Backed by a16z and Tiger Global, Volt Capital, which focuses on contrarian investments, has invested in which projects?

TechFlow Selected TechFlow Selected

Backed by a16z and Tiger Global, Volt Capital, which focuses on contrarian investments, has invested in which projects?

Volt Capital focuses its investments on infrastructure and tools, NFTs, and digital assets.

Author: Zen, PANews

According to a report by Swiss investment advisory firm 21e6 Capital AG, as of August this year, 97 out of more than 700 global cryptocurrency funds have shut down. The firm noted: "Most funds have delivered positive returns, but in many cases, that hasn't been enough to attract capital." This current "capital winter" inevitably brings nostalgia for the former "glory days" of crypto funds. For instance, during the first half of last year, according to PANews data, a total of 107 Web3-related funds were launched globally, raising nearly $40 billion in aggregate. This included top-tier venture capital firms like Tiger Global and a16z, which raised over $10 billion and $4.5 billion respectively—both of which also backed a rising VC firm called Volt Capital.

In May last year, Volt Capital announced it had raised $50 million for its second crypto fund, with backing from a16z general partners Marc Andreessen and Chris Dixon. Other supporters of the fund include Tiger Global, angel investor Elad Gil, and others. As an early-stage venture capital firm focused on startups, Volt Capital has made over 30 investments since 2020 in early-stage crypto companies and protocols such as Magic Eden, Nansen, LayerZero, Magic, Coinshift, Thirdweb, and Sound.

01 Soona Amhaz, Millennial Founder, Shifts from Crypto Community to Investing

Volt Capital’s founder and general partner, Soona Amhaz, graduated from the University of Michigan College of Engineering. During college, she spent significant time on Reddit, where Bitcoin—an emerging topic at the time—was her main area of discussion. However, back then, Soona felt the crypto industry wasn’t mature enough and worried about long-term career prospects. Thus, after graduating in 2015, she joined Alation, a data intelligence solutions provider, becoming the company's 20th employee. At that time, Alation had just completed a Series A round led by a16z and DCVC, positioning it as a highly promising startup (in November last year, Alation raised $123 million at a $1.7 billion valuation).

Even after starting her job, Soona remained closely engaged with the crypto industry. Since people primarily relied on Reddit, Coindesk, and Twitter for news—sources often fragmented and disorganized—she envisioned creating a vibrant, high-quality, trustworthy community. In 2017, she co-founded the crypto community Token Daily, which organically grew to over 16,000 readers without any marketing efforts. The community actively hosted events with builders from Bitcoin, Ethereum, and other niche sectors.

Over time, many projects began reaching out to her before launch. Some sought feedback on product strategy and talent referrals from her and her community prior to fundraising, while others requested help with distribution and outreach via newsletters. Gradually, Token Daily’s information network evolved into Soona’s personal professional network. She connected with numerous talented teams building promising crypto projects and gained early insights into their progress. As she observed large amounts of capital flowing into the crypto space and saw projects she knew were promising secure funding, she realized she held a distinct advantage. After making several personal investments, Soona ultimately decided to launch her own fund, Volt Capital, in 2019.

Notably, the same year Volt Capital was founded, Lebanon experienced a financial crisis, with cumulative inflation reaching 4,667% by August this year. Soona’s family in Lebanon lost significant assets. She advised them to convert their remaining holdings into Bitcoin to protect against further currency devaluation and capital controls, deepening her understanding of cryptocurrency’s value proposition.

02 Backed by Top-Tier Institutions and Investors

In April 2021, Soona Amhaz—fresh off being named to Forbes’ 30 Under 30 list in venture capital the previous year—announced that Volt Capital had launched its first fund and raised $10 million. The fund received support from prominent investors and institutions including Web3 venture firm CMT Digital, Balaji Srinivasan (former CTO of Coinbase and former a16z GP), Albert Wenger (managing partner at Union Square Ventures), and Brian Singerman (partner at Founders Fund). The capital was allocated toward investing in crypto data, infrastructure, and DeFi startups.

In the first half of 2022, major investment firms continued announcing new crypto funds, with giants like a16z launching a $4.5 billion “Crypto Fund IV.” That May, Volt Capital announced it had raised $50 million for its second crypto fund, backed by a16z GPs Marc Andreessen and Chris Dixon. Additional supporters included Tiger Global, angel investor Elad Gil, hedge fund manager Brevan Howard, and Albert Wenger. The fund targets investments in crypto infrastructure, DeFi, NFTs, and DAO-related projects, focusing on early-stage equity financing such as pre-seed, seed, and Series A rounds.

03 A Look at Volt Capital’s Portfolio

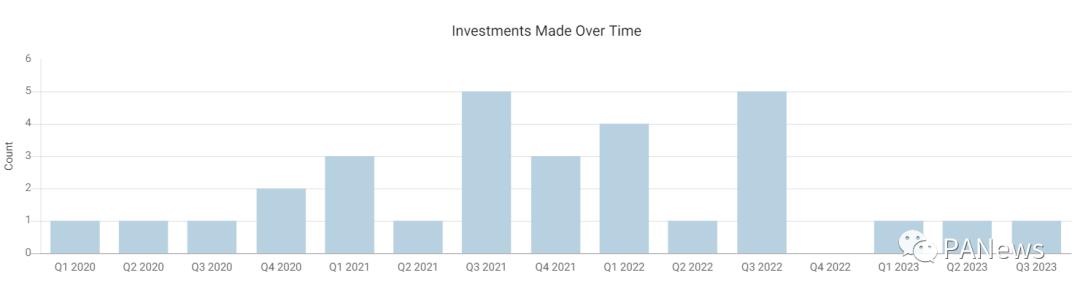

Reflecting its fund launches, most of Volt Capital’s investments occurred between Q1 2021 and Q3 2022. Its most recent investment was announced in August this year—Spearbit, a Web3 security company that raised $7 million in a round led by Framework Ventures. Additionally, in May, Magic, a wallet-as-a-service (WaaS) provider, announced a $52 million strategic funding round led by PayPal Ventures. As an initial seed investor, Volt Capital participated again in this round.

Based on public information from Volt Capital’s official website and collected by PANews, Volt Capital has invested in at least 30 crypto projects. As mentioned above, its focus lies in infrastructure and tools, NFTs, and digital asset sectors—including crypto wallets, DeFi, infrastructure layers, software development, data storage, and privacy and security subfields. Except for leading the seed round of Yakoa, an NFT fraud detection startup, all its other investments have been follow-on participations.

Below is a brief overview of Volt Capital’s portfolio:

Infrastructure & Tools

-

Nansen: Blockchain analytics platform. Announced a $1.2 million seed round in October 2020, led by Mechanism Capital and Skyfall Ventures, with participation from Robot Ventures and Fabric Ventures.

-

Magic: Wallet-as-a-Service (WaaS) provider. Raised $4 million in a seed round led by Placeholder in June 2020, with Lightspeed Ventures and Volt Capital among participants. In May 2023, it raised $52 million in a strategic round led by PayPal Ventures, with Cherubic, Synchrony, KX, Northzone, and Volt Capital participating.

-

Cashmere: Solana-based enterprise wallet management company. Closed a $3 million seed round in August 2022, with Coinbase Ventures and Y Combinator participating.

-

Liquality: Multi-chain wallet. Its Liquality SDK aims to provide users with seamless experiences. Raised $7 million in August 2021, with Hashed and Coinbase participating.

-

Thirdweb: Web3 software development company. Announced a $5 million raise in May 2021, with Mark Cuban and Soona Amhaz (founder of Volt Capital) participating. In August 2022, it raised $24 million at a $160 million valuation, led by Haun Ventures, with Coinbase Ventures among others.

-

LayerZero: Omnichain interoperability protocol.

-

Koop: Web3 protocol focused on the creator economy. Announced a $5 million raise in August 2022, led by 1confirmation and Variant Fund, with Defi Alliance participating.

-

Penumbra Labs: Privacy-focused Layer 1 network in the Cosmos ecosystem. Announced a $4.75 million seed round in November 2021, led by Dragonfly Capital, with Robot Ventures participating.

-

Spearbit: Web3 security company. Announced a $7 million raise in August 2023, led by Framework Ventures, with Breed VC and Robot Ventures participating.

-

Squads: DAO infrastructure project. Announced a $5 million strategic round in February 2022, led by Multicoin Capital, with Jump Capital and Delphi Digital participating.

-

KYVE: Decentralized data storage solution. Completed a $1 million pre-seed round in June 2021, with Solana Foundation participating.

-

Cozy Finance: Permissioned peer-to-peer protection solution enabling users to invest in DeFi while guarding against hacks and exploits. Closed a $2 million seed round in September 2020, with Dragonfly and Electric Capital participating.

NFTs

-

Magic Eden: NFT marketplace.

-

Sound: Decentralized music streaming platform.

-

Center: NFT tools company offering products like NFT rendering API and cross-chain interoperability tools.

-

Metahood: Metaverse startup. Announced a $3 million seed round in January 2023, led by 1confirmation, with Neon DAO and The Sandbox co-founder Sébastien Borget participating.

-

Pinata: Web3 infrastructure provider focused on NFTs. Announced a $21.5 million raise in August 2022, comprising an $18 million Series A and a previously raised $3.5 million seed round. Greylock co-led both rounds with Pantera (Series A) and Offline Ventures (seed), with participation from Volt Capital, OpenSea, and Alchemy.

-

MetaStreet: Liquidity provider for NFT-backed lending, offering liquidity and scaling solutions for NFT collateral platforms. Announced a $14 million raise in February 2022, including $3 million in seed funding and $11 million in initial liquidity, led by Dragonfly Capital, with Ethereal Ventures, Sfermion, Nascent Capital, Delphi INFINFT, and Alliance participating.

-

Yakoa: NFT fraud detection startup. Announced a $4.8 million seed round in November 2022, co-led by Brevan Howard Digital, Volt Capital, and Collab+Currency.

-

Recur: NFT brand experience company. Announced a $5 million seed round in April 2021, led by DeFi Alliance, with IOSG Ventures, Delphi Digital, and Volt Capital participating. In September 2021, it raised $50 million in a Series A at a $333 million valuation, with Volt Capital again participating. Recently, RECUR announced it will fully shut down on November 16, 2023.

Digital Assets

-

Slingshot: Decentralized exchange (formerly DEX.AG).

-

Parsec Finance: DeFi and analytics platform providing technical analysis tools for traders and data-focused users. Closed a $1.2 million seed round in January 2021, with Polychain participating.

-

Giving Block: Crypto donation marketplace, founded in 2018. Acquired in March 2022 by Shift4, a U.S.-listed payments company, but continues to operate independently.

-

Coinshift: Funds management and infrastructure platform offering financial tools for DAOs and Web3 companies. Raised $2.5 million in a seed round in October 2021, with investors including Sequoia Capital India, Fintech Collective, Consensys Mesh, Defi Alliance, and Volt Capital. In May 2022, it raised $15 million in a Series A led by Tiger Global, with Sequoia Capital India and Volt Capital participating again.

-

CoinLedger: Crypto tax reporting platform. Closed a $6 million raise in February 2022, with CMT Digital participating.

-

Parcel: Indian startup helping DAOs manage finances. Closed a $500,000 pre-seed round in January 2021, with Consensys participating.

Others:

-

Lines: Web3 social platform. Announced a $4 million seed round in July 2022, led by former Twitter VP Elad Gil, with Scalar Capital participating.

-

Merkle Manufactory: Developer of Farcaster, a decentralized social networking protocol, founded by former Coinbase executive Dan Romero. Announced a $30 million raise in July 2022, led by a16z, with 1confirmation, Scalar Capital, and Coinbase Ventures participating.

-

Matrix: Protocol enabling creators to launch cryptocurrencies, gamifying fan engagement and digital branding. Closed a $470,000 pre-seed round in June 2020.

-

BAYZ: Web3 gaming guild. Closed a $4 million raise in December 2021, led by Yield Guild Games, with BITKRAFT participating.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News