Will Radiant Capital dethrone Aave and Compound to become the new king?

TechFlow Selected TechFlow Selected

Will Radiant Capital dethrone Aave and Compound to become the new king?

Andrew Kang believes Radiant Capital could become the strongest competitor to Aave and Compound, and explains why.

Written by: Andrew Kang

Translated by: TechFlow

Andrew Kang, co-founder of Mechanism Capital, believes Radiant Capital could become the top contender to Aave and Compound, and outlines in this article why he thinks so.

Note: The views expressed herein are solely those of the author and do not constitute financial advice. Do your own research (DYOR).

Aave and Compound are currently the largest money markets in crypto, with TVLs of $5 billion and $2 billion respectively. Through innovation, Radiant Capital has emerged as a leading challenger to their dominance and holds the potential to become the new king of crypto money markets.

Radiant Overview:

-

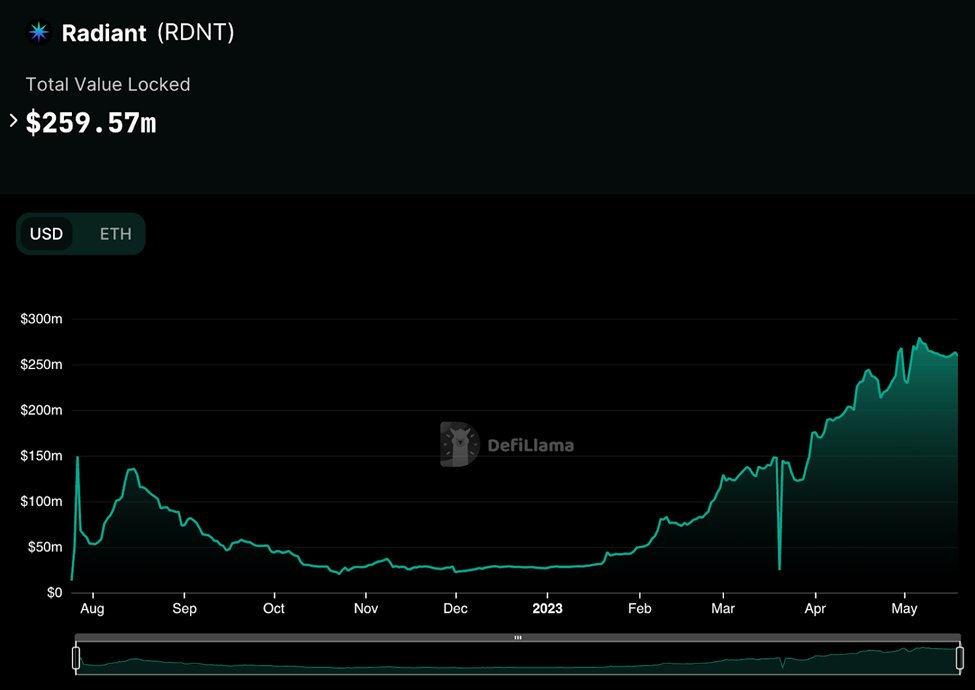

TVL of $260 million on Arbitrum and BSC;

-

First functional cross-chain MM (lend on chain X, borrow on chain Y);

-

Upcoming launches on Ethereum and zkSync;

-

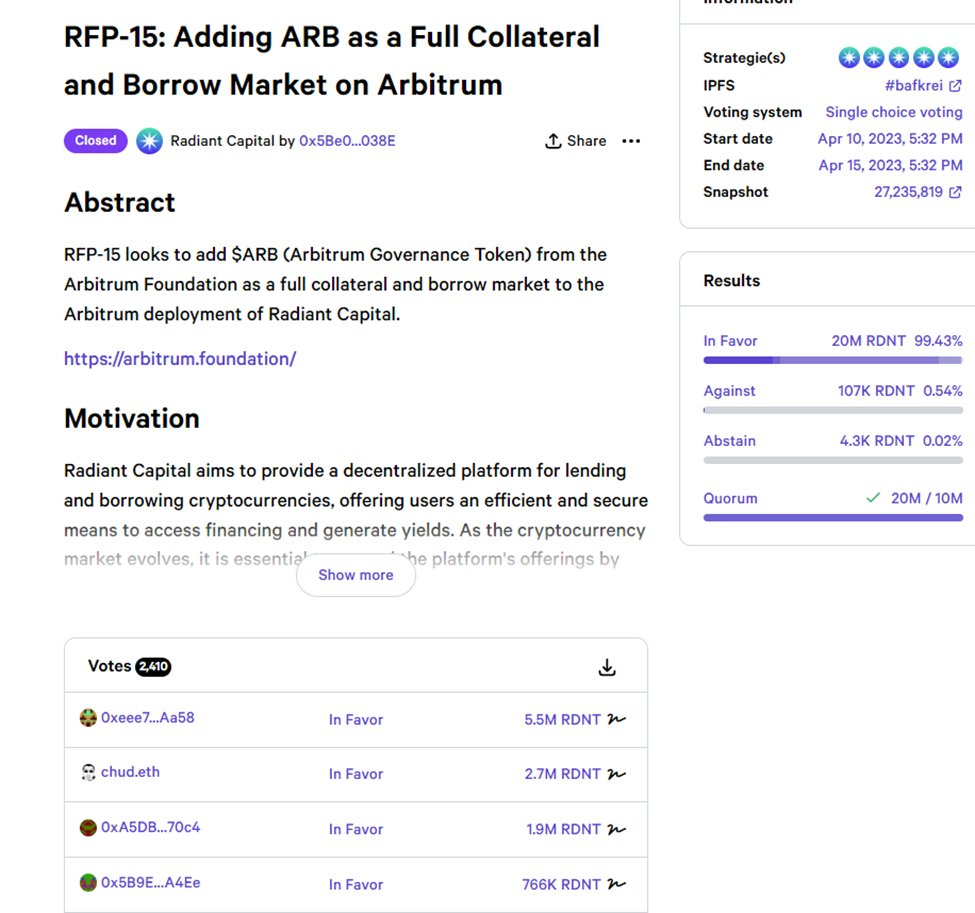

Adding more secure collateral such as $ARB (other money markets are slow-moving);

-

Token design optimized for demand and protocol growth.

Aave and Compound offer only 1-2% yields on stablecoins—lower than U.S. Treasury rates. With stablecoin market cap exceeding $100 billion, over $10 billion worth of stablecoins previously used in market-making now sit idle. This untapped liquidity represents a massive opportunity. As awareness grows about this audited, one-year-old protocol offering 10–40% stablecoin yields, TVL is expected to rise.

The second-largest opportunity lies in ETH + LSDs. While Compound and Aave have $4 billion combined exposure here, Radiant’s sustainable and incentivized yields can capture market share. Additionally, many multi-billion dollar non-stETH LSDs lack dedicated money markets—Radiant can become their preferred platform.

Flywheel

Radiant is one of the biggest beneficiaries of ARB, as no other money market currently lists ARB. We expect continued capital inflows, giving the $2 billion ARB supply a productive outlet for single-sided yield.

A key driver behind RDNT growth is the V2 Tokenomics flywheel upgrade, which increases the value of its incentive reserves while directing more sustainable emissions toward long-term, protocol-aligned users.

-

User deposits $1M and qualifies for 5% of “Locked LP” emissions.

-

RDNT price drops → user now falls below the 5% threshold.

-

User is incentivized to buy RDNT and re-lock additional LP to stay above 5%.

With the rising narratives around LayerZero and zkSync, Radiant stands to benefit significantly as users engage with the platform to farm potential airdrops.

Total TVL, measured in USD and ETH, has been growing steadily throughout the year.

Yield

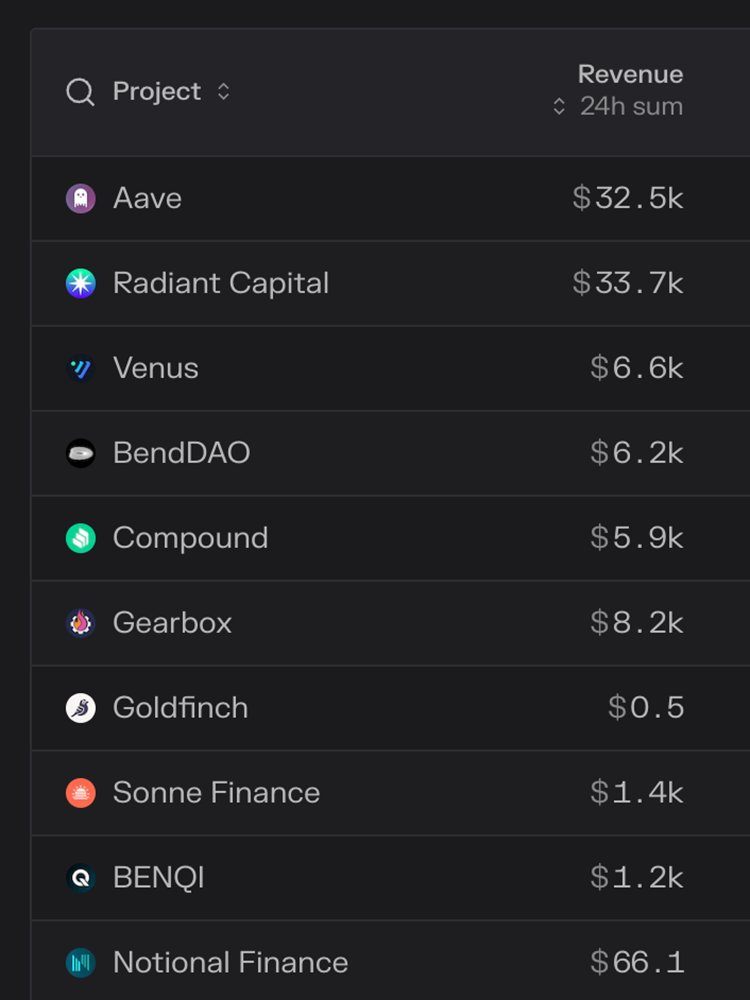

Over a 90-day horizon, Radiant has already outperformed Aave, Compound, and even Solana. Judging by 90-day trends, it is among the fastest-growing protocols in the sector.

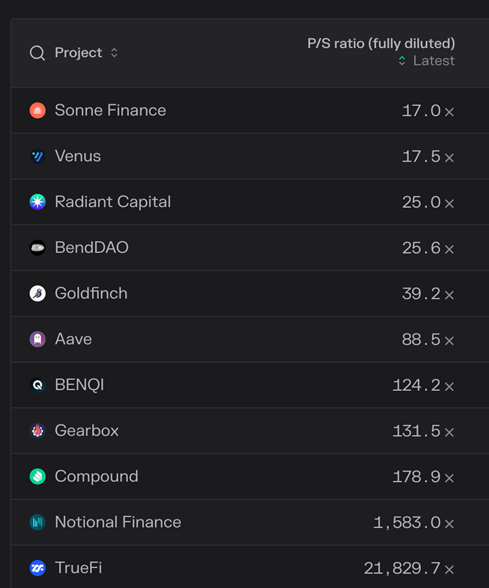

Valuation

Radiant trades at a modest valuation but aligns with other blue-chip projects on price-to-earnings metrics.

Community Engagement

The community is highly active. DAO governance proposals receive an average of over 2,000 votes, with one-third of token holders registered on Snapshot.

Over the past few weeks, more than $10 million in dLP has been unlocked. Comparing total dLP tokens (locked + unlocked) on May 31st versus May 10th, the dollar value of dLP increased by approximately $5.2 million—indicating that despite unlocks, Radiant continues attracting new stakers.

Within two weeks of implementing RFP-17 and RFP-18, 71% of staking users opted for 6-month or 1-year lockups, compared to only 40% last month.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News