WLFI Launch Countdown: Early Investors Including Justin Sun Profit Over 10x, Aave Revenue Share Proposal Sparks Controversy

TechFlow Selected TechFlow Selected

WLFI Launch Countdown: Early Investors Including Justin Sun Profit Over 10x, Aave Revenue Share Proposal Sparks Controversy

The total supply of WLFI tokens is 100 billion, with 25% of the public offering completed. Justin Sun is the largest individual investor, and institutions such as DWF Labs are participating in market making.

Author: Nancy, PANews

Another top-tier project is about to launch—World Liberty Financial (WLFI), a cryptocurrency initiative backed by the Trump family, is set to go live on the Ethereum mainnet, quickly becoming a hot topic in the crypto space due to its sky-high market valuation and staggering early returns. However, WLFI has also been caught in a public controversy over a disputed revenue-sharing proposal with Aave, sparking broader market discussion and reflection.

WLFI to launch on Ethereum, early investors could see up to 14x returns

On August 23, WLFI announced it will launch on the Ethereum mainnet on September 1, enabling users to claim and trade tokens. Early supporters (those who invested at $0.015 and $0.05) will unlock 20%, while the remaining 80% will be determined by community voting. Tokens allocated to the founding team, advisors, and partners will not be unlocked at launch.

Following the announcement, exchanges including Binance, OKX, and Hyperliquid launched pre-market trading for WLFI/USDT perpetual contracts. The contract price briefly surged to $0.55, implying a fully diluted valuation of approximately $55 billion. However, prices quickly retreated, with pre-market trading falling over 60% from peak levels to around $0.20.

Announced by the Trump family in September 2024, WLFI has publicly conducted two funding rounds to date. The first private sale began on October 15, 2024, offering 20 billion tokens at $0.015 each to whitelisted investors. Initial response was lukewarm, with only about 610 million WLFI sold on day one (leaving 19.4 billion unsold), generating just $9.15 million in sales. Due to weak demand, WLFI filed an application the following month to slash its fundraising target by 90%, revising the goal down to just $30 million.

However, after Donald Trump won the U.S. presidential election, WLFI token sales accelerated, ultimately selling out all 20 billion tokens before January 20, 2025, raising roughly $300 million in total. During this period, Justin Sun, founder of TRON, made two investments totaling $75 million ($30 million and $45 million), becoming the largest individual investor in this round and joining as a WLFI advisor.

On January 20, 2025—inauguration day for Trump—WLFI launched its second private sale, opening another 5% of the token supply at an increased price of $0.05. Compared to the first round, demand was strong, and the entire allocation sold out by March 14, successfully meeting its $250 million fundraising target within just two months.

According to WLFI’s tokenomics, the total supply is 100 billion tokens: 35% allocated to token sales, 32.5% to community growth and incentives, 30% to initial supporters, and the remaining 2.5% to the team and advisors. Based on current public sale progress, WLFI has completed 25% of its total supply distribution, with 10% still available for sale.

At the current pre-market price of $0.21, investors who bought at $0.015 have seen unrealized gains of approximately 14x, while those who invested at $0.05 have gained about 4.2x. According to on-chain analyst Ai Auntie, the top 10 WLFI addresses from the public sale collectively invested $73.08 million and hold 4.63% of the total supply—4.64 billion tokens. At current prices, these investors will unlock tokens worth over $190 million at TGE.

WLFI’s market maker arrangements have also been revealed. As analyzed by Ai Auntie, DWF Labs is almost certainly WLFI’s market maker, and other market makers are likely involved. Data shows Web3Port received 200 million WLFI tokens at $0.05 during the strategic round, DWF Labs received 250 million at $0.10, and ALT5 Sigma Corporation acquired 7.5 billion tokens at $0.20 through an equity purchase.

Notably, DT Marks DEFI LLC, linked to the Trump family, holds rights to 75% of the protocol’s net revenue distribution without bearing any responsibilities. During the public fundraising process, DT Marks DEFI LLC reduced its stake from an initial 75% to approximately 40%.

Dispute over 7% token allocation: WLFI and Aave offer conflicting statements

As excitement grows over WLFI's high returns for early investors, controversy has emerged around rumors that Aave might receive 7% of WLFI’s total token supply. WLFI denies this, but Aave maintains the agreement remains valid—leaving both parties at odds.

The roots of this dispute trace back to before WLFI’s official launch. At the time, WLFI indicated plans to offer crypto lending services on the Ethereum blockchain and stated in its official Telegram channel that it was collaborating with Aave—not as a hostile fork, but to build an innovative platform advancing the DeFi industry.

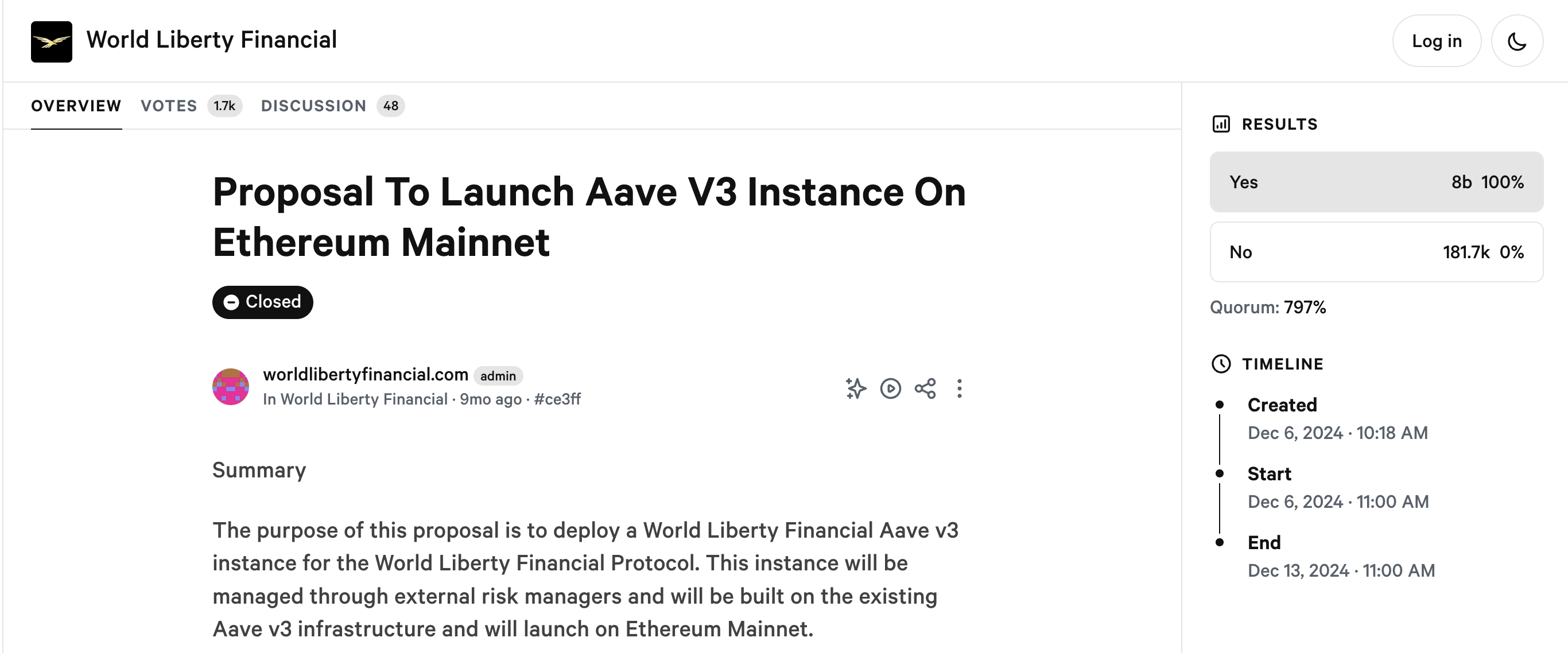

In early December 2024, WLFI submitted its first community proposal to deploy a WLFI-powered Aave v3 lending instance on the Ethereum mainnet, initially supporting USDC, USDT, ETH, and WBTC, managed by Aave’s risk team. The primary goal was to attract new DeFi users and enhance brand visibility for both WLFI and Aave. In return, the proposal specified that AaveDAO would receive 20% of protocol fees generated by the WLFI Aave v3 instance and approximately 7% of the total WLFI supply (7 billion tokens), to be used for future governance participation, liquidity mining, and decentralization efforts. The revenue distribution would be executed via trustless smart contracts, proportionally allocated to AaveDAO and WLFI treasury addresses. The proposal passed on December 13, 2024, with 100% support.

With WLFI’s imminent launch, this proposal has recently resurfaced in the community, directly contributing to a rise in AAVE’s price. Based on current market valuations, Aave’s treasury could receive billions of dollars worth of WLFI tokens, potentially making it one of the biggest beneficiaries of this cycle.

However, this positive development was denied by someone believed to be a member of the WLFI Wallet team. The WLFI team also told Wu Blockchain the claims were false and labeled them “fake news.” In contrast, Aave founder Stani.eth insists the agreement remains valid, emphasizing that the proposal was created and formally approved by the WLFI team itself.

As the story unfolds, debate within the crypto community continues, with diverging opinions. Crypto influencer @0x_Todd pointed out that this was WLFI’s genesis proposal—the very first—and passed with voter turnout exceeding the quorum by seven times, with over 99% support. If even the founding proposal isn’t honored, he argued, it fundamentally contradicts DeFi principles. Centralized governance is no longer DeFi, and breaking governance agreements should result in expulsion from the DeFi ecosystem.

KOL @Luyaoyuan1 warned of potential default risks, citing past cases like SPK where promised returns were drastically cut, and noted Aave has been deceived multiple times before. He expressed support for Aave taking legal action if WLFI defaults.

dForce founder Mindao believes the original terms—"20% revenue share + 7% token allocation"—were poorly designed and misaligned with WLFI’s actual brand value and market position. He speculated that WLFI may now completely abandon Aave integration, rendering the prior agreement null. Meanwhile, WLFI could significantly reduce token allocations and redirect those resources toward incentivizing USD1 borrowing and minting—a circular strategy that benefits WLFI internally, effectively treating it as targeted subsidy for stablecoin operations.

“Initially, WLFI struggled in its public sale and faced accusations of rug-pulling, putting Aave in a stronger negotiating position. But now, with surging market enthusiasm, passage of the 'Genius Stablecoin Bill,' and Trump’s personal financial disclosure revealing holdings of 15.7 billion WLFI tokens, WLFI’s perceived value has risen sharply—making it less willing to give Aave such a large share as before,” @wenser2010 analyzed. He suggested Aave may need to compromise by reducing its share, or WLFI might propose a new plan to renegotiate revenue splits. How long this takes depends on behind-the-scenes negotiations.

Yet Mint Ventures research partner Alex Xu noted that WLFI originally intended to build a lending market based on Aave—with a formal proposal outlining token and profit distribution—but later shifted focus to launching a stablecoin instead, deeming lending less appealing. If so, the basis for collaboration no longer exists, especially since WLFI’s official “Golden Paper” makes no mention of Aave.

Despite the unresolved dispute between WLFI and Aave, this incident highlights the limitations of on-chain governance. While on-chain governance offers transparency and decentralization, even proposals approved by community votes may ultimately depend on the willingness and negotiation outcomes among involved parties.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News