Stay away from $WLFI, or you'll become unlucky

TechFlow Selected TechFlow Selected

Stay away from $WLFI, or you'll become unlucky

Its sole purpose is to make the already wealthy even richer.

Author: The Smart Ape

Translator: AididiaoJP

Everyone in the crypto ecosystem has a terrible memory. Remember how we got wrecked by the TRUMP meme coin? If you forgot, this WLFI looks exactly like TRUMP all over again.

But compared to what they’re doing with WLFI, that was nothing. I’ve seen too many red flags—here are just a few that should be enough to tell you to stay far away from this project.

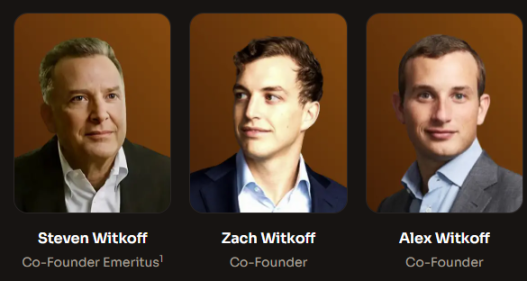

Team

When I saw that image, my first thought was: why are there nine co-founders? The marketing is way too obvious.

Not a single person on this team inspires confidence. It’s clear the Trump family is here purely for marketing. There’s no indication they’re involved in operations or providing technical support. Clearly, they don’t actually understand any of this—but they definitely know how to profit from it.

Zach Witkoff has drawn scrutiny due to his political connections; his company helped orchestrate a $2 billion deal with MGX via the USD1 stablecoin. This raises concerns about "pay-to-play" privileges.

Chase Herro is better known in the crypto space. He calls himself an “internet scumbag,” did time for drug charges, launched multiple rug-pull or zero-value crypto projects, and sold “get rich quick” courses. This is not the kind of co-founder you want on your project.

Then there’s Zach Folkman, whose background is very similar to Herro’s. He was involved with Dough Finance, a protocol linked to a major DeFi exploit. Overall, he's a controversial entrepreneur who even once hosted dating “pickup” workshops.

Out of the nine co-founders, seven are sons of billionaires, and the other two have questionable histories. This is absolutely not a crypto dream team.

Lies

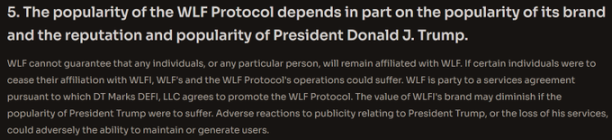

Worst of all, they make you believe this is a project designed and operated by the Trump family. But that’s not true. They’re just marketing figures meant to make you feel safe. Their own disclosures basically admit as much.

Even worse: the Trump family bears no legal responsibility in the contracts. Legally, they’re not liable for anything. If someone pulls a rug tomorrow, the Trump family can legally disassociate themselves, and you can’t hold them accountable.

So who is responsible?

Unsurprisingly, it’s Chase Herro and Zak Folkman, who directly control WLFI through their Puerto Rico-based entity Axiom.

Despite having no legal liability, the Trump family holds 22.5% of the token supply and 75% of the revenue. The Witkoff family gets 7.5% of the supply and 25% of the revenue.

Herro and Folkman also get a portion of the supply (but no direct revenue share). This is essentially a deal between two people who know how to extract value and the Trump family. The Trumps take the biggest slice, while these two get smaller pieces—but those pieces are still massive amounts to them.

WLFI Token

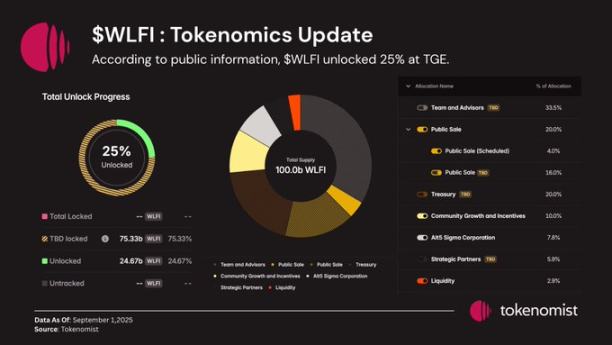

To be honest, this token is a joke. Six people hold 40% of the supply—that’s blatant centralization. Over 60% of tokens are held by fewer than 10 wallets, often via multisig wallets.

At launch, only 25% of the supply was circulating. Combined with extreme concentration, this leads to extreme volatility and fragility.

In the first few hours, there were massive liquidations as insiders dumped heavily, cashing out hundreds of millions of dollars within hours.

There’s zero transparency around allocations. Most tokens were immediately available at launch, giving insiders complete freedom to dump at any time.

Utility? Almost none. It’s a “governance token,” but beyond that, nothing concrete: no revenue share, no fee discounts, no yield—nothing. They even explicitly state on their website that they can temporarily or permanently restrict your governance rights if they choose, so it’s not even real governance.

Some of you might say, “Well, there’s a proposal to use 100% of protocol fees for buybacks.” If you’re cheering for that, remember: 60% of the supply is controlled by insiders. Either way, they win—if WLFI goes up, their tokens appreciate in value, and they can dump at higher prices.

USD1 Token

USD1 is WLFI’s stablecoin, and one look at its logo tells you it’s a joke.

Seriously, couldn’t they spend a little more effort? It looks like something made by a 7-year-old.

USD1 has a market cap of $2.7 billion, making it one of the largest stablecoins, but this comes from large institutional allocations—not real user demand. 93% of its value sits on Binance, meaning there’s no real organic adoption yet.

What shocks me most is that the wallet used to deploy USD1 on Solana also deployed a bunch of other poorly made tokens with almost no trading volume. They didn’t even bother deploying USD1 cleanly with a new address—they used an address already associated with junk tokens.

Website

If you still have doubts, the easiest way to resolve them is to read the disclosures on their website. That’s the only place they’re somewhat honest. You’ll quickly realize they’re trying to shift blame. Basically, they’re telling you this project is unstable, and you shouldn’t be surprised if things go wrong.

The site is also full of errors, broken links, typos, poor image formatting… The UI is bad, unprofessional, and reflects a careless attitude.

Conclusion

WLFI is basically TRUMP 2.0—a highly centralized, utility-less, innovation-free meme coin. Its sole purpose is to make the already wealthy even richer. In just one day of research, I found about twenty red flags.

My advice: stay away. If you’ve made profits, take them and leave.

The only reason this thing has trading volume is because Trump is endorsing it. But honestly, I’m pretty sure if you asked Trump to explain what his own project actually does, he wouldn’t be able to answer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News