The WLFI game is too competitive—how to find arbitrage opportunities to make money?

TechFlow Selected TechFlow Selected

The WLFI game is too competitive—how to find arbitrage opportunities to make money?

Trading might be noisy, but arbitrage is stable.

Author: Jaleel

TechFlow's core project WLFI, half a year in the making by the Trump family, has launched and is drawing global attention. Some are betting on price swings, others are chasing hot meme coins. Beyond simply "betting up or down" through real trading, can we profit from this hype wave in a more certain way? The answer is arbitrage. In this article, BlockBeats compiles several actionable arbitrage opportunities for WLFI:

Spread Arbitrage

1. CEX-to-CEX Spread Arbitrage

Due to differences in matching rules, launch times, bid density, fees, and deposit/withdrawal arrangements across exchanges, short-term price discrepancies naturally emerge for WLFI—creating arbitrage opportunities.

For example, WLFI spot trading starts tonight at 9 PM on Binance, but withdrawals won't open until 9 PM tomorrow. This means that before withdrawals are enabled, funds can only "flow into Binance and be sold to on-platform buyers," but cannot temporarily "flow out." This one-way flow makes internal pricing more likely to run high.

The practical strategy is quite straightforward. Select two or three manageable platforms as your "arbitrage triangle"—typically one top-tier CEX (likely Binance today due to its strongest order book and media attention), one secondary CEX that supports withdrawals (preferably with low fees to preserve margins during entry and exit), plus an on-chain monitoring post (e.g., the WLFI pool on Uniswap, to gauge the strength of marginal on-chain demand).

Open the order books and recent trades on both exchanges simultaneously and monitor the WLFI price spread. As soon as you see Binance's price significantly higher than the other exchange—and after accounting for taker fees, bid-ask spread, and potential slippage—the net difference remains positive—you can buy on the cheaper exchange and sell on Binance.

The challenge isn't in the logic, but in execution speed. Cross-exchange arbitrage is essentially a race against latency: delayed deposits/withdrawals, risk control pop-ups, blockchain confirmations, or even your own reaction time when clicking "confirm" can determine whether that 0.x% to 1.x% margin actually lands in your pocket. Therefore, the safest approach is to first run through the entire process with a very small amount, measure the time and costs at each step, and only then scale up.

2. Triangular Arbitrage

Triangular arbitrage can be seen as an upgraded version of the above CEX-to-CEX spread arbitrage, involving more on-chain routing paths and sometimes stablecoin conversions. Thus, it offers more opportunities—but also greater friction.

A common early-stage "sandwich spread" pattern looks like this: WLFI price on BNB Chain ≈ Solana Chain > Ethereum mainnet > CEX spot price. Since pools on BNB and Solana chains are typically smaller and bot-dense, prices can spike quickly from just a few trades; Ethereum, with higher fees and fewer bots, sees relatively conservative trading and thus lower prices; centralized exchanges, controlled by market makers who often restrict deposits/withdrawals or impose limits, prevent spreads from being instantly arbitraged away, resulting in the lowest spot price. Given that WLFI is deployed across multiple chains, such arbitrage opportunities exist.

Additionally, minor de-pegging between the new stablecoin USD1 and USDT/USDC, or fee differences, may further amplify loop profits.

However, triangular arbitrage is more complex than simple CEX arbitrage. Beginners should avoid it unless they have already mastered cross-chain mechanisms, routing paths, slippage, and fee structures.

3. Spot–Perpetual Basis / Funding Rate Arbitrage

This type of "spot–perpetual basis / funding rate" arbitrage is commonly used by market makers, market-neutral funds, quant traders, and arbitrageurs. Retail investors can participate too, but due to smaller size, higher rates, and borrowing costs, their edge is less pronounced.

There are only two fundamental sources of profit here. First is funding rate. When perpetual price exceeds spot and funding is positive, longs pay periodic "interest" to shorts—you go "long spot + short perpetual" and collect this interest regularly. Conversely, when funding is negative, go "short spot + long perpetual," collecting payments from shorts to longs. This way, your net exposure approaches zero. The funding rate acts like interest income, settling periodically—capturing cash flows from "sentiment premium / pessimism discount."

Second is basis convergence. At launch or during emotional swings, perpetual contracts may exhibit temporary premiums or discounts relative to spot. As sentiment cools and market makers restore equilibrium, the perpetual price converges back toward spot/index price. Within a hedged structure, you capture this one-time gain from narrowing spreads. Combined, this creates an "interest + convergence" return stream, which, minus borrowing costs, fees, and slippage, yields net profit.

Be sure to understand various platform-specific details such as liquidation mechanisms, slippage, fees, funding settlement schedules, and market depth to avoid events like XPL short squeezes.

Also, for the common "long spot + short perpetual" strategy, high-yield vaults such as those offered by StakeStone and Lista DAO currently offer over 40% APY post-subsidies.

4. LP Positioning + Short Hedge Arbitrage

Simply providing liquidity (LP) is not arbitrage—it's more like "exchanging directional risk for fees." But when combined with a short hedge, leaving only the net yield curve of "fees − funding/borrowing cost − rebalancing cost," it becomes a solid hedging strategy.

The most common setup involves supplying concentrated liquidity on-chain (e.g., in WLFI/USDC or WLFI/ETH pools), while simultaneously shorting an equivalent notional value of WLFI perpetuals on exchanges. If no perpetual exists, you could borrow and short spot via margin accounts, though this increases friction. The goal is to avoid betting on price direction and instead focus entirely on capturing "higher volume → thicker fees."

In execution, treat the LP position as a "fee-charging market-making range." Choose a fee tier and price band you can monitor—such as 0.3% or 1% during initial phases—with a "moderately wide" range close to the current price. After deployment, part of your LP position will be in WLFI tokens, part in stablecoins. Use the dollar-equivalent value of the WLFI portion to short the perpetual, initially balancing the dollar value of both legs. As price oscillates within the range, the on-chain leg earns fees from turnover and slight rebalancing gains; directional exposure is offset by the short leg, keeping overall exposure near neutral. If funding is positive, your short leg earns additional yield; if negative, wider ranges, lower leverage, and infrequent re-hedging help sustain net profitability.

Different from basis arbitrage—which captures convergence between perpetual and spot prices—this strategy profits from on-chain trading volume and associated fees. Unlike pure LP—whose P&L heavily depends on price direction and impermanent loss—this approach isolates fee income.

ALTS Stock vs. WLFI Token Hedging

ALT5 Sigma (Nasdaq: ALTS) raised approximately $1.5 billion via stock issuance and private placements, using part of the proceeds to directly acquire WLFI tokens and another portion to allocate to WLFI in secondary markets—effectively turning itself into a WLFI "treasury / proxy exposure." For more on the WLFI-linked stock ALT5 Sigma (Nasdaq: ALTS), read: Can You Still Profit from the WLFI Stock if You Won’t Buy the Token?

By monitoring the relative performance of ALTS and WLFI, one can logically short the stronger asset and go long the weaker, then close the hedge when normalization occurs. For instance, WLFI might surge early due to exchange listings and narrative momentum, while ALTS lags due to U.S. market hours or high borrowing costs, creating a divergence. Once U.S. markets open and capital fills the "proxy gap" in ALTS, this spread converges.

If using WLFI perpetuals to hedge, you might additionally collect funding fees, but the primary return still comes from the spread itself—not directional moves.

This differs from prior "basis/funding arbitrage": there's no fixed "spot–perpetual" anchor here. Instead, the stock acts as a "shadow" for WLFI—a concept similar to the classic BTC/MSTR dynamic. However, execution challenges stem from friction and timing mismatches. Crypto markets trade 24/7, WLFI unlocks at 8 PM, but Nasdaq opens at 9:30 AM. Trading before market open falls under pre-market rules, where order matching differs from regular sessions, and halts or circuit breakers must also be considered.

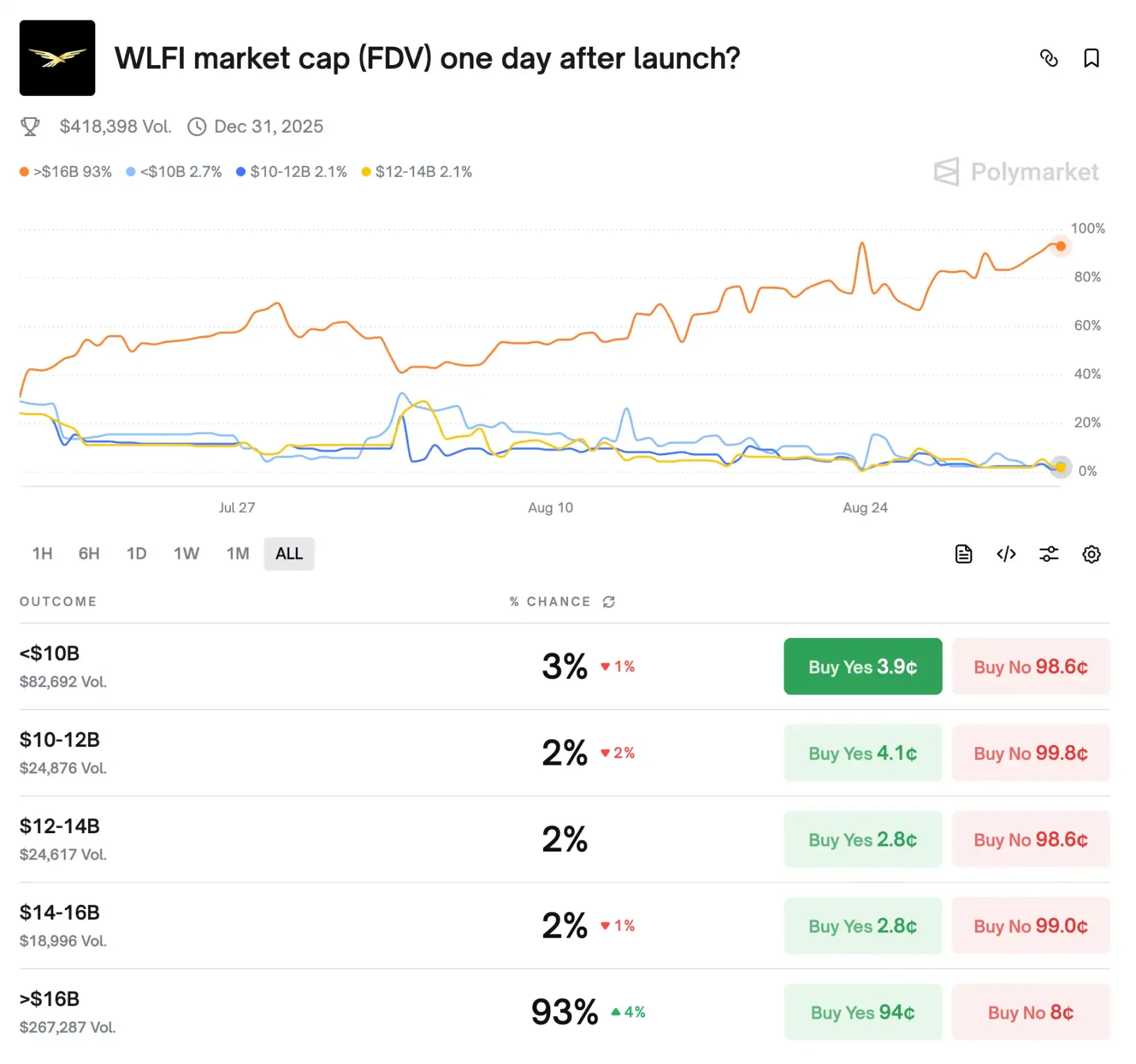

WLFI Market Cap Wagers on Polymarket

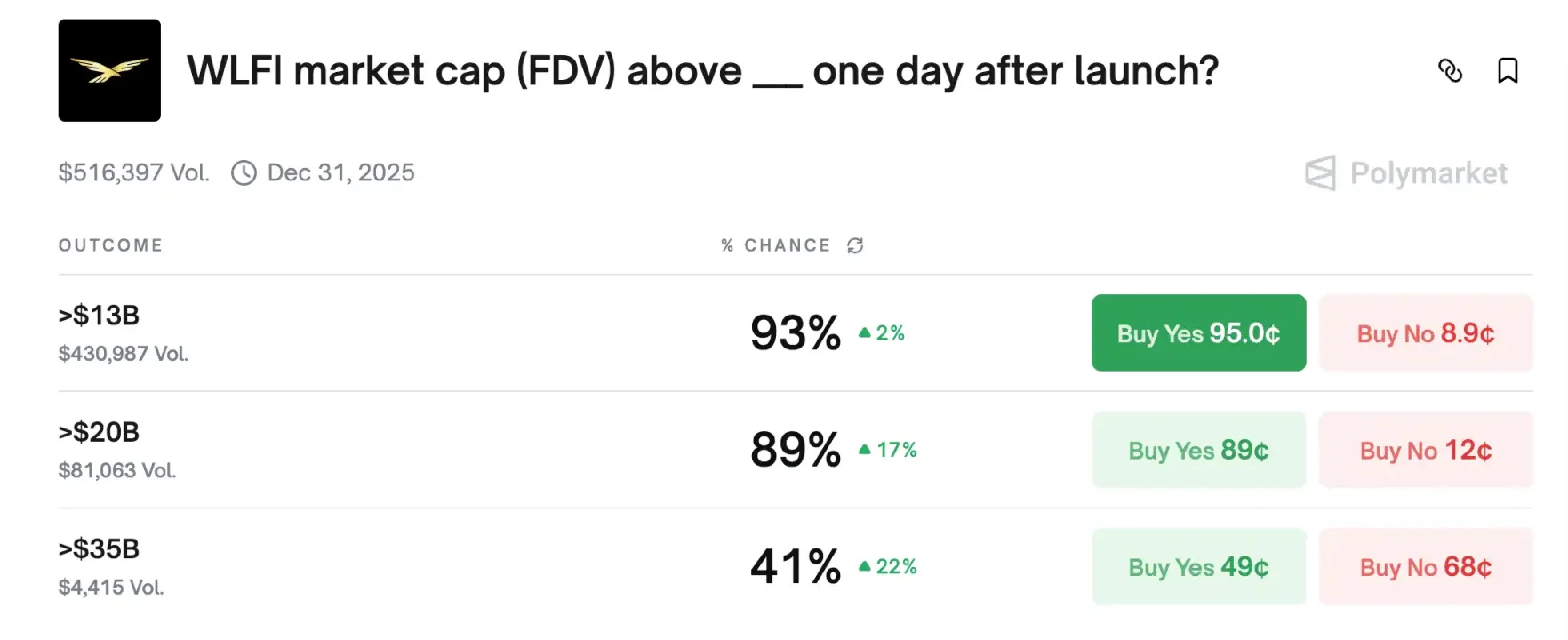

Currently, Polymarket features two WLFI-related prediction markets, both asking about WLFI’s market cap on its listing day—one is a bracketed market (<$10B, $10–12B…, >$16B, five options), the other a threshold market (>$13B, >$20B, >$35B, three binary outcomes).

Since both ask about "WLFI FDV 24 hours after launch," their prices must align consistently: the sum of probabilities across the five brackets must equal 100%. Therefore, the price of the "> $16B" bracket in the first market must match P(>16B) in the second.

Similarly, the sum of prices in the complementary four brackets (<$10B, 10–12B, 12–14B, 14–16B) must equal 1 − P(>16B) in the threshold market. If you detect mispricing—for example, if "> $16B" is priced too high while the sum of the other four is also high, causing total implied probability to exceed 100%—sell the overpriced side or hedge with "No" shares, while buying up the undervalued side to create a basket that guarantees $1 payout for less than $1 cost. If total probability sums below 100%, simply buy all outcomes to lock in the difference.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News