Aave Bets on RWA: Will Horizon Be the Next Growth Engine?

TechFlow Selected TechFlow Selected

Aave Bets on RWA: Will Horizon Be the Next Growth Engine?

Horizon is a lending market专门 serving RWA.

Author: ChandlerZ, Foresight News

On August 28, Aave Labs announced the official launch of Horizon, an Ethereum-based RWA market. Institutional and qualified users can borrow stablecoins by pledging RWAs as collateral, with support for collateral from Circle, Superstate, and Centrifuge. Partner organizations include Ant Digital Technologies, Chainlink, Ethena, KAIO, OpenEden, Ripple, Securitize, VanEck, and WisdomTree.

The proposal for this project was first introduced in March. The company stated its goal is to create a new revenue stream for Aave DAO and enhance the utility of GHO within DeFi.

However, the proposal page also indicated that if a token were created, Aave DAO might receive a 15% allocation along with revenue-sharing arrangements. Many opposing users argued that a new token could dilute the value of the existing AAVE token and undermine AAVE's status as the sole governance and utility token. Following heated discussions, Aave founder Stani Kulechov ultimately confirmed that no new token would be created for Horizon, the product developed by Aave.

What is Horizon? Can it bring new growth to Aave?

What is Horizon?

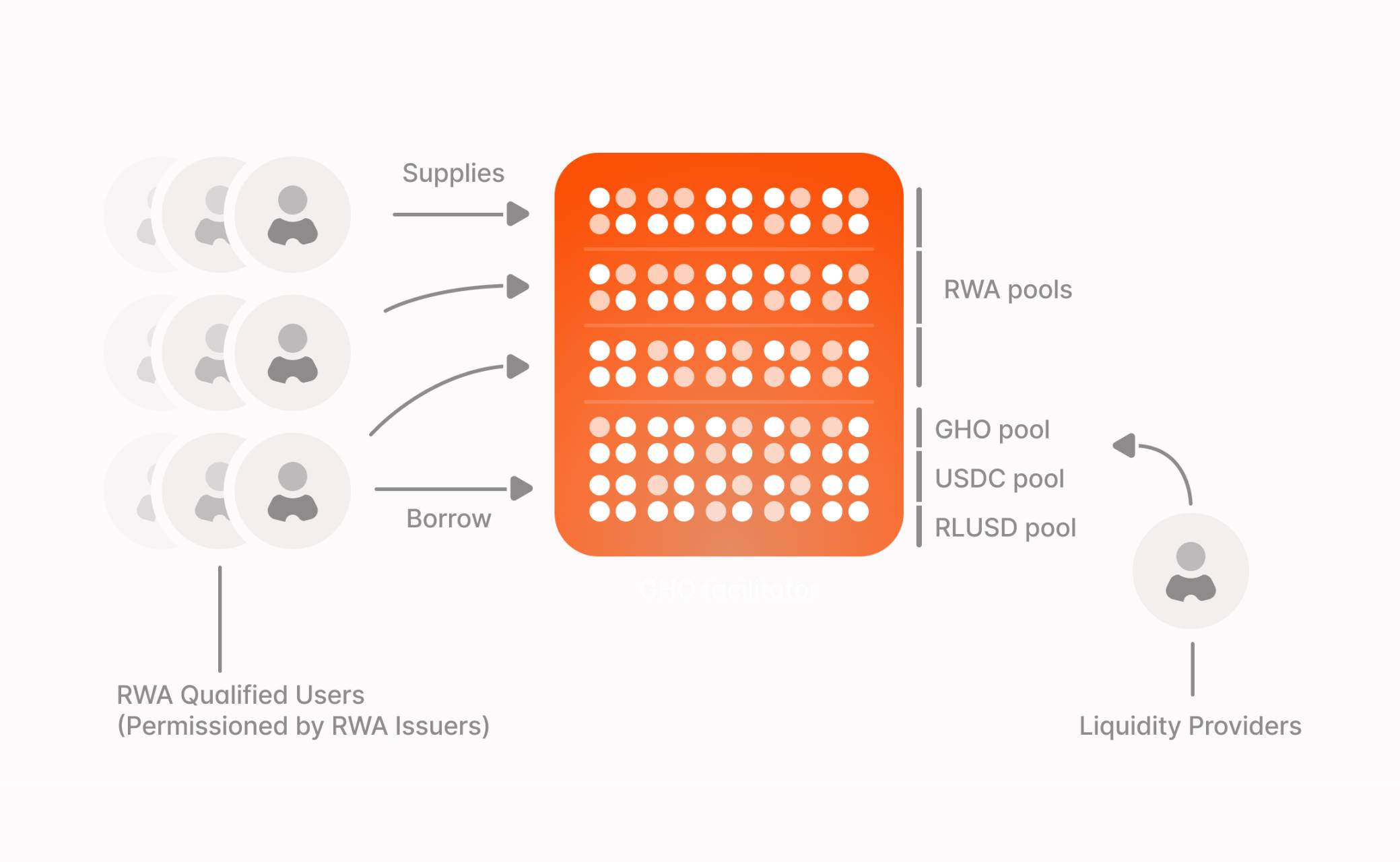

According to Aave Labs, Horizon is a lending market dedicated to RWAs. Institutional investors can pledge tokenized U.S. Treasuries, money market funds, or even AAA-rated loan bonds to borrow stablecoins and maintain liquidity. Ordinary users can participate without barriers by depositing stablecoins to earn interest.

Technically, Horizon is still built on Aave Protocol v3.3, maintaining a non-custodial, automated architecture. Chainlink’s NAVLink provides net asset value data for collateral, while Llama Risk and Chaos Labs handle risk assessment. It sounds institution-friendly yet preserves DeFi’s transparency and automated execution.

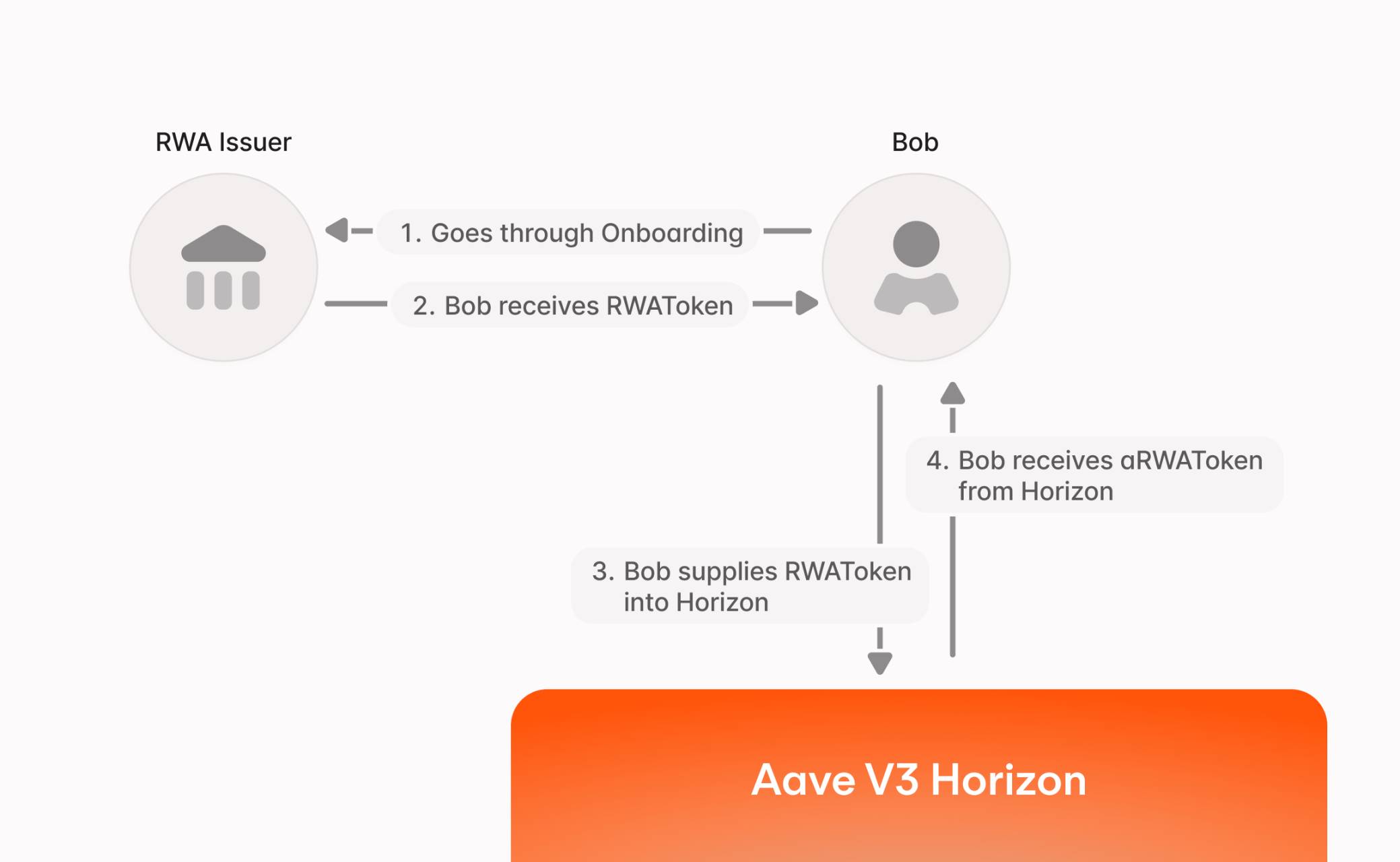

Qualified investors meeting RWA issuer requirements can deposit RWAs as collateral on Horizon. Each issuer sets its own criteria and manages access permissions for tokenized assets.

Once RWA tokens are supplied, Horizon issues a non-transferable aToken representing the collateral position. Users can borrow stablecoins up to a certain percentage of their collateral value, with each collateral type having its own predefined loan-to-value (LTV) ratio.

Providing stablecoins to Horizon requires no permission. Anyone can supply RLUSD, USDC, or GHO for lending to institutions. Users who provide their chosen stablecoin receive an aToken representing their deposit. These aTokens earn yield and can be withdrawn at any time.

Launch Partners and Assets

The project has attracted several partners from the start. At launch, Horizon includes RWA collateral options from Superstate (USTB and USCC) and Centrifuge (JRTSY and JAAA). Circle’s USYC will also be coming soon. Stablecoin lenders can provide GHO, RLUSD, and USDC.

-

Circle’s USYC offers the opportunity to earn USD yields through diversified investments in high-quality short-term U.S. Treasury portfolios.

-

Superstate’s USTB and USCC offer yield opportunities through short-term U.S. government securities and cryptocurrency arbitrage strategies.

-

Centrifuge’s JRTSY and JAAA offer yield opportunities through tokenized investments in U.S. Treasury bills and AAA-rated mortgage debt.

Other institutions in the Horizon network include Ant Digital Technologies, Ethena, KAIO (formerly Libre), OpenEden, Securitize, VanEck, and WisdomTree.

Why is Aave doing this?

For the past few years, Aave has been one of the leading players in DeFi lending. However, a real challenge is that growth in the crypto-native market has hit a bottleneck. Lending volumes for familiar assets like ETH, USDC, and DAI have largely stabilized. While long-tail assets exist, they carry higher risks and cannot sustain significant new growth.

Meanwhile, RWAs have become a new industry trend. The size of tokenized Treasuries has multiplied over the past two years, with traditional giants like BlackRock and Franklin Templeton entering the space. Aave believes that although there are already over $25 billion worth of RWA assets on-chain, most remain fragmented across traditional infrastructure. Horizon enables these assets to serve as real-time collateral for stablecoin loans, unlocking greater utility. For Aave, this is an opportunity too big to miss. Bringing in RWAs could attract new capital and provide a stronger use case for its own stablecoin, GHO.

When Aave first unveiled the Horizon plan in March, the intention was to bring RWAs into DeFi and offer institutions a compliant entry point for collateralized lending. However, one proposed design quickly sparked controversy within the DAO: whether to issue a new token for Horizon.

Initially, if Horizon launched a standalone token, Aave DAO would receive approximately 15% of the allocation and a share of revenues. But this proposal immediately faced strong opposition. Many community members feared the new token would dilute AAVE’s value and compromise AAVE’s role as the sole governance and utility token. Marc Zeller from Aave Chan Initiative publicly stated he would not support such a proposal.

As debate intensified, Aave founder Stani Kulechov personally clarified in mid-March that no new token would be created for Horizon. He emphasized that the development team would respect the DAO’s consensus, stating, “The overall consensus is that the DAO has no interest in introducing a new token, and that consensus will be respected. AaveDAO is a true DAO.” This statement reassured many community members, who saw it as protecting AAVE’s value and governance integrity. The tokenization controversy around Horizon thus came to an end.

Horizon’s launch marks Aave’s evolution from a crypto-native lending protocol toward a more ambitious direction. Of course, challenges remain. Horizon isn’t the first attempt at RWAs, and its debut places Aave into an increasingly competitive landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News