Aave Umbrella Officially Approved: The Fall of the "God Mine" for Stablecoins with 13% stkGHO APY?

TechFlow Selected TechFlow Selected

Aave Umbrella Officially Approved: The Fall of the "God Mine" for Stablecoins with 13% stkGHO APY?

Following this update, the AAVE team may reposition GHO's competitiveness by focusing more on real-world use cases of decentralized stablecoins—such as payment mediums, censorship resistance, and improving capital efficiency within lending protocols.

Author: @Web3Mario

Summary: This week, the AAVE ecosystem passed a key proposal—the long-anticipated AAVE Umbrella module has gained community approval and will go live on June 5, 2025.

With this upgrade, the AAVE Umbrella module will officially replace the existing Safety Module, taking over the role of bad debt protection within the AAVE ecosystem.

Prior to this change, I personally enjoyed the stkGHO yield opportunity offered by the original Safety Module, which delivered a stablecoin-denominated annualized return of around 13% under manageable risk—an extremely attractive offering.

However, the approval of this proposal marks a significant shift in AAVE’s yield paradigm. This article aims to summarize and share the concrete implications of the Aave Umbrella implementation.

In summary, Aave Umbrella improves AAVE tokenomics by reducing supply-side pressure and enhancing capital efficiency from the protocol's perspective. However, we must monitor potential disruptions during the transition for existing incentive participants. For stkGHO stakers specifically, alternative yield opportunities may now need to be sought.

What Problems Does the Aave Umbrella Module Solve?

First, let’s understand the purpose of the Aave Umbrella module. As a decentralized lending protocol relying on over-collateralization, AAVE’s greatest risk lies in extreme market volatility—sharp declines in collateral value or liquidity could lead to delayed liquidations and ultimately, bad debt. Before Aave Umbrella, AAVE primarily mitigated this risk through its Safety Module: essentially a reserve fund that covers losses when bad debt occurs. To incentivize users to provide this risk-bearing capital, AAVE distributed generous rewards.

The Safety Module accepted three types of assets: AAVE, BPT (liquidity tokens from the Balancer AAVE/wstETH pool), and GHO. Users could stake these tokens and earn official AAVE token incentives. When bad debt occurred, these staked funds would be partially slashed to cover losses. The maximum slashing rate was 30% for AAVE and ABPT, but up to 99% for GHO. Additionally, unstaking required a 20-day cooldown period followed by a 2-day withdrawal window; failure to complete withdrawal within this time would result in automatic restaking.

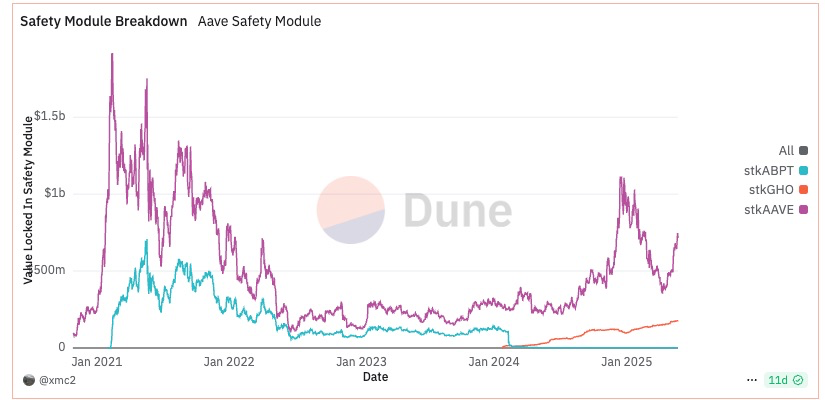

This mechanism had two major benefits: it reduced protocol-level bad debt risk, while simultaneously creating yield use cases for AAVE and GHO, thereby generating demand for both tokens. As of now, the total value locked (TVL) in the Safety Module stands at $1.14B—$744M in AAVE, $222M in ABPT, and $170M in GHO.

Nevertheless, this design presented two core issues:

- Excessively high operational costs;

- Low capital efficiency.

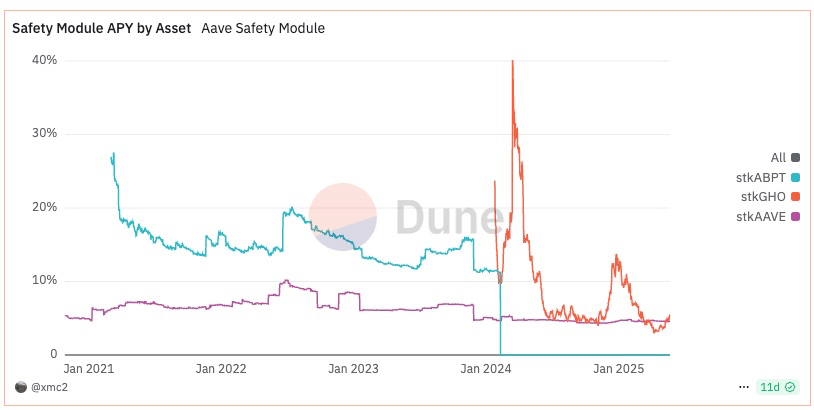

Firstly, the cost paid by AAVE to attract such capital was substantial. At current rates, the staking APRs are approximately: 4.57% for stkAAVE, 5.55% for stkGHO, and 10.18% for stkABPT. Based on TVL, the estimated annual incentive expenditure is around $66 million—all funded through AAVE emissions—placing notable downward pressure on AAVE’s market cap.

Secondly, since only AAVE and GHO-related assets were eligible, there was a structural mismatch. Given AAVE’s position as a blue-chip lending protocol, most borrowing—and thus potential bad debt—involves assets like USDT and ETH. Yet, when covering losses, the protocol must sell off AAVE or GHO holdings to obtain the defaulted assets. This creates additional selling pressure and liquidity strain on AAVE and GHO. In essence, despite the high rewards, the capital deployed via the Safety Module is inefficient in addressing actual bad debt risks.

To address these shortcomings, the AAVE team introduced Aave Umbrella as a successor to the Safety Module. It brings three main improvements:

- Asset Selection: Instead of relying solely on AAVE and GHO, Aave Umbrella uses aTokens more directly tied to borrowing activity. Each aToken backs only its underlying asset, eliminating cross-asset dependency. In this upgrade, three new staked assets are introduced: stkwaUSDC (staked wrapped aUSDC), stkwaUSDT, and stkwaETH.

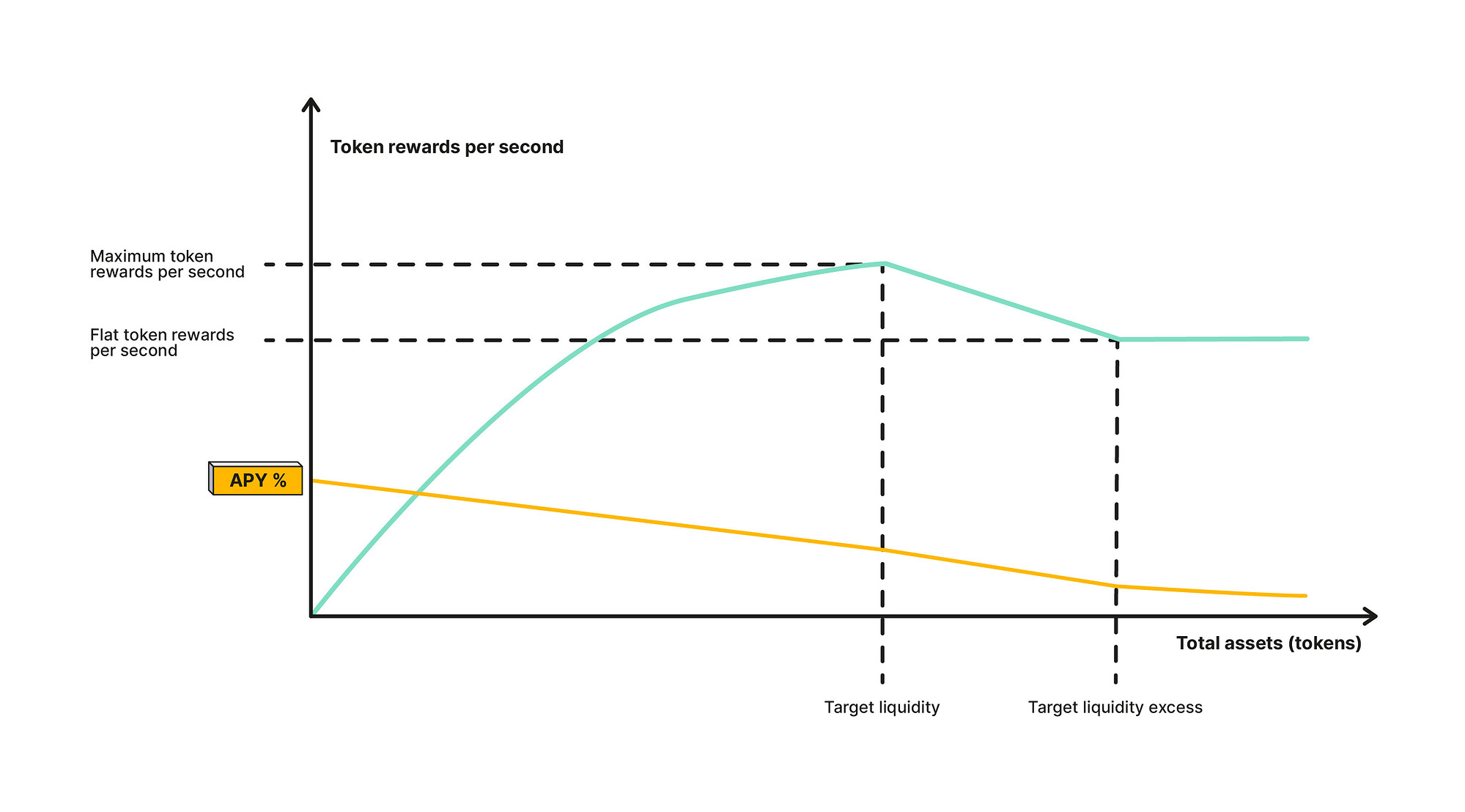

- Reward Distribution: A dynamic emission curve determines final staking yields based on three parameters: target liquidity, current staked amount, and maxEmission. The emission curve functions as a piecewise function:

- (1) When staked amount is below target liquidity, per-unit AAVE rewards increase—but with diminishing returns—as the threshold approaches, peaking at maxEmission;

- (2) When staked amount is between target liquidity and an over-collateralization threshold (e.g., 20%), per-unit rewards decrease linearly;

- (3) Once beyond the threshold, per-unit rewards remain constant.

The overall APY follows the yellow line—a segmented curve. The primary benefit is improved capital efficiency: interest rate adjustments help maintain optimal security funding levels without over-subsidizing. Below are the system parameters for this update (values denominated in base tokens):

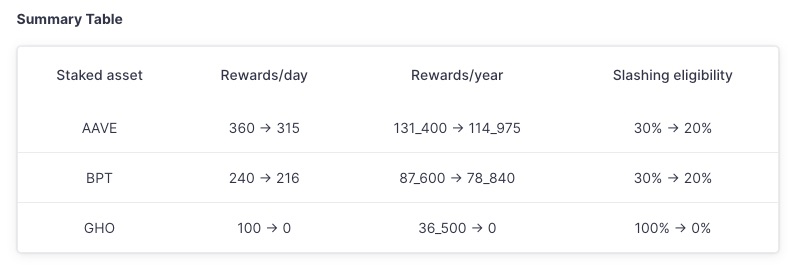

AAVE emission adjustments for the original three assets are shown below:

- Slashing Mechanism: Slashing transitions from DAO-governed manual activation to automatic execution at the smart contract level.

The first two changes are most impactful for DeFi users, as both the yield medium and APR have shifted. Since AAVE and ABPT incentive adjustments are phased gradually, we’ll focus next on how stkGHO stakers are affected by Aave Umbrella.

From 13% to 7.7%: Structural Shift in Risk-Reward Profile for GHO Stakers

Following the upgrade, stkAAVE and stkABPT receive transitional reward adjustments with minimal immediate impact—clearly intended to stabilize AAVE demand and liquidity. However, stkGHO sees a dramatic reduction in risk compensation rewards under the new Umbrella model.

Using the updated rate model and preset parameters:

- (1) Target Liquidity: $12M

- (2) maxEmissionPerYear: $1.2M

- (3) Current total stkGHO staked: $170M

If all stkGHO holders migrate fully to the Umbrella module, their base holding yield drops to just 0.56%, far below the current 5.55%. However, factoring in the Merit module’s 7.14% yield allocation for GHO users, the total effective return may fall from today’s ~13% to approximately 7.7%. This assumes full migration; actual yields may be slightly higher due to expected outflows. See Desmos link for detailed calculations.

That said, lower yield also means lower risk: stkGHO stakers will now only bear default risk associated with GHO loans, rather than systemic risk across the entire protocol.

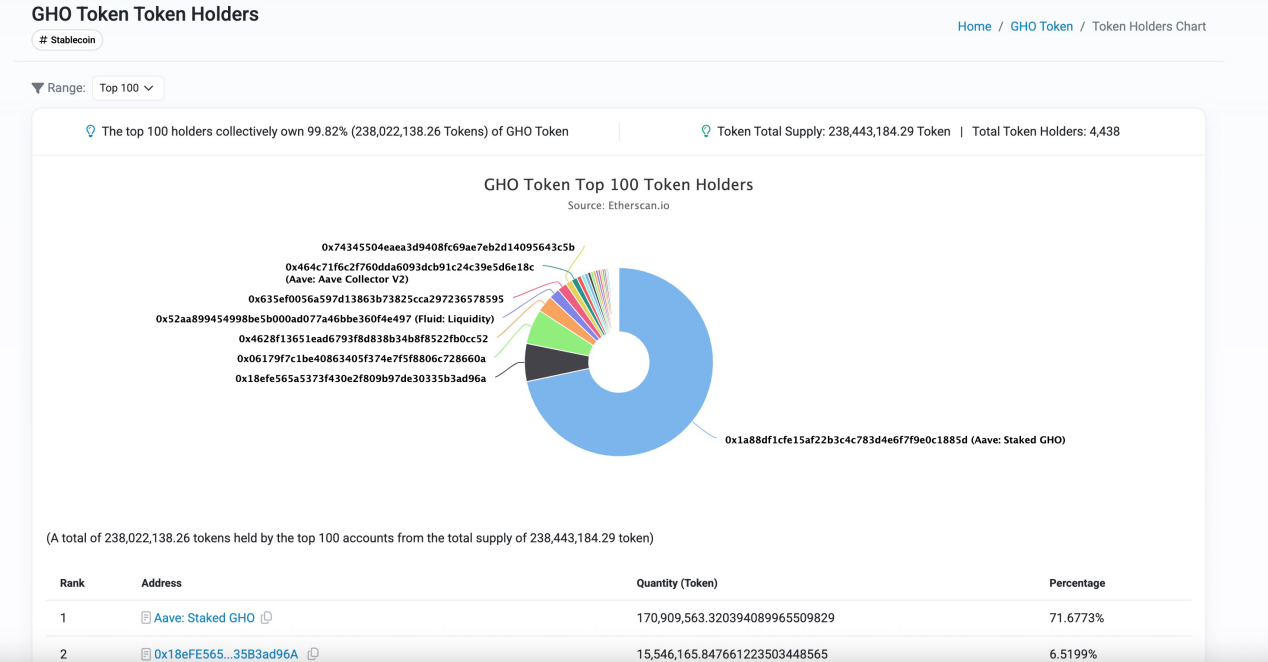

So what are the likely consequences? GHO issuance is expected to shrink significantly. Currently, GHO’s total supply is 238M, with 170M participating in stkGHO staking—about 71%. This high staking ratio indicates that much of GHO’s current demand stems directly from Safety Module incentives. With yields dropping sharply, demand will inevitably decline until a new equilibrium forms. That said, a full-scale run on GHO isn’t likely—the protocol’s total collateral backing exceeds 245%, placing it in a healthy state.

From AAVE’s standpoint, this update represents a necessary correction of GHO’s previously unsustainable growth model. Historically, GHO demand relied heavily on token subsidies rather than organic, sustainable utility.

Going forward, the AAVE team may refocus on building real-world use cases for GHO as a decentralized stablecoin—such as payments, censorship resistance, and improving capital efficiency across lending protocols. Alas, one might say: the era of a legendary yield farm has come to an end.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News