Trend Research: Bullish ETH forecast of $10,000 in the new cycle, long-term capture of ETH ecosystem opportunities

TechFlow Selected TechFlow Selected

Trend Research: Bullish ETH forecast of $10,000 in the new cycle, long-term capture of ETH ecosystem opportunities

Our current forecast for ETH is a long-term突破 above $5,000. In optimistic scenarios, if BTC reaches over $300,000 in this cycle, ETH could rise to $10,000 and we will continue to capture opportunities within the ETH ecosystem over the long term.

Since TrendResearch's full report was released online on April 24, 2025, ETH has risen from $1,800 to around $2,400, achieving an approximately 30% gain within one month. The forecast made prior to the report’s publication started at $1,450. As a multi-billion-dollar asset class, this represents a rare opportunity for large capital pools to achieve high short-term returns. The main reasons we firmly held a bullish view at that time included: ETH still maintains solid financial metrics and its status as critical crypto infrastructure remains unchanged; it experienced a significant short-term correction (over 60% decline in four months); the derivatives market had built up massive short positions; spot trading volume surged at the bottom and climbed into a key support/resistance flip zone; traditional finance continued strategic positioning with gradual ETF inflows. Our current outlook for ETH is that long-term prices could surpass $5,000, and under optimistic scenarios—should BTC reach over $300,000 in this cycle—ETH may rise to $10,000, and we will continue capturing opportunities within the ETH ecosystem.

1. ETH Valuation Forecast

A key backdrop to the new valuation framework for ETH is identifying the trend of convergence between major digital assets and traditional finance. We observe that BTC, as the most important digital asset, after approval of spot ETFs, has begun being incorporated into strategic reserve assets by various U.S. states, gradually serving as both an expansion and partial strategic alternative to dollar-denominated assets. It currently ranks as the 6th largest asset by market cap globally. U.S. spot Bitcoin ETFs now manage approximately $118.6 billion in assets, representing about 6% of Bitcoin’s total market cap. The integration trend between crypto assets and traditional finance is beyond dispute. In a May interview in Dubai, CZ stated that Bitcoin’s price in this market cycle could reach between $500,000 and $1 million.

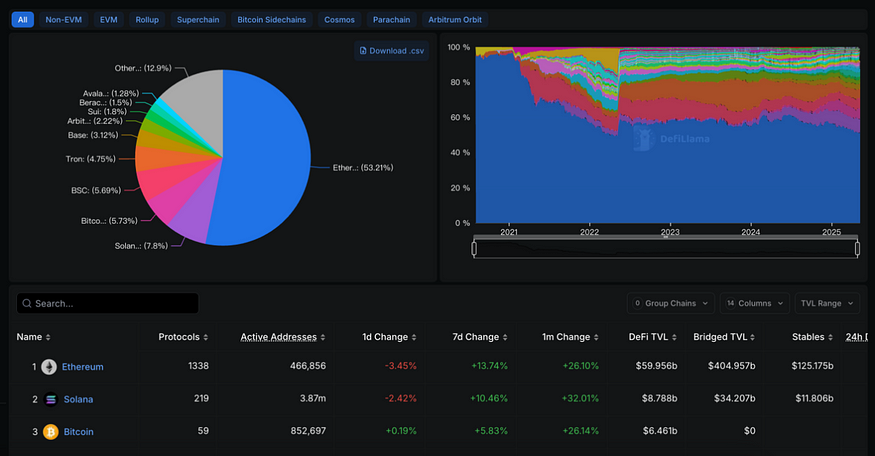

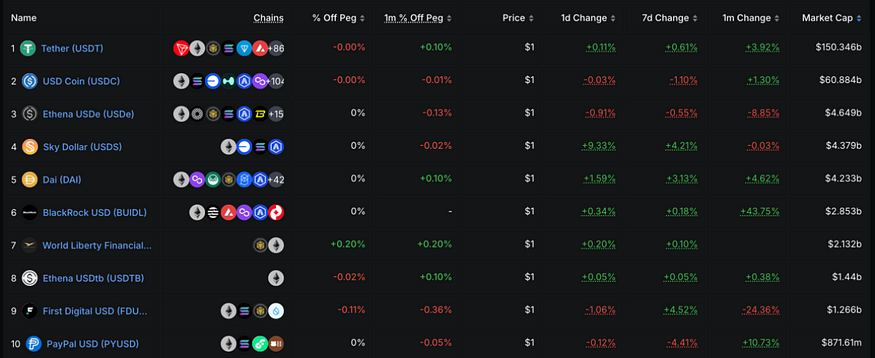

ETH continues to demonstrate strong financial data, and its position as the most important infrastructure in crypto finance remains unchanged. Ethereum’s DeFi total TVL is approximately $60 billion, accounting for over 53% of the global DeFi market. Stablecoin market cap stands at $124 billion, representing over 50% of the global stablecoin market. Total AUM of Ethereum ETFs is $7.2 billion. BlackRock’s tokenized money market fund BUIDL has invested about $2.7 billion within the Ethereum ecosystem, making up 92% of its total assets.

After forming three tops near $4,000 in 2024, ETH rapidly declined to around $1,300, with an all-time high above $4,800. Based on the following potential factors, we forecast ETH will reach $5,000 in this cycle:

l Imminent end of U.S. QT and further rate cuts ahead

l A new SEC chair may advance on-chain tokenization and staking-related legislation for ETH

l ETH Foundation governance and roadmap recovery, maintaining moderate infrastructure innovation

l Continued steady growth of on-chain financial ecosystem

In long-term optimistic projections, ETH could target $10,000 in the new cycle, contingent upon meeting the following conditions:

l BTC rises above $300,000

l ETH delivers notable infrastructure innovations beneficial to DeFi

l U.S. institutions promote ETH as a primary native platform for asset tokenization

l Demonstration effect drives global asset tokenization

2. Three Notable Projects in the ETH Ecosystem

1. UNI (Uniswap): Largest DEX Protocol in Crypto

Uniswap is the earliest and largest Dex protocol in the crypto market, with a TVL of $4.7 billion and daily trading volumes exceeding $2 billion, generating $900 million in annual revenue. UNI is fully circulating, with around 40% locked for governance purposes. Its current circulating market cap is $4 billion and FDV is $6.6 billion.

Currently, there is a certain degree of disconnect between UNI’s token economics design and protocol income—the protocol earnings are not automatically distributed to UNI holders. UNI primarily functions as a governance token, enabling voting control over treasury usage, and can indirectly influence the UNI price through governance proposals—for example, in 2024, the DAO voted to repurchase 10 million UNI tokens.

The decoupling between protocol revenue and token distribution was primarily due to earlier regulatory risks from the SEC regarding securities classification. As U.S. crypto regulation gradually becomes more relaxed and structured, UNI’s revenue-sharing mechanism may be upgraded in the future.

Recent developments at Uniswap include Uniswap V4 and Unichain expansion, as well as preliminary activation of the “Fee Switch” mechanism.

2. AAVE (Aave): Largest Lending Protocol in Crypto

AAVE is the largest lending protocol in the crypto market, with $23 billion in TVL and $450 million in annual revenue. The token is 100% circulating, with a current market cap of $3.3 billion.

Similar to UNI, AAVE does not have a direct dividend link to protocol income but influences value indirectly through governance.

Recent progress at Aave includes development of Aave V4, cross-chain expansion of its native stablecoin GHO, and advancing the Horizon project for RWA exploration.

3. ENA (Ethena): Largest Synthetic Stablecoin Protocol in Crypto

From 2025 to date, Ethena’s synthetic dollar USDe has become the third-largest USD-pegged asset in the crypto market, ranked only behind USDT and USDC, and is the only synthetic stablecoin among them. In terms of yield, Ethena is also a highly profitable DeFi protocol, generating $315 million in annual revenue. ENA currently has a market cap of $2.18 billion and an FDV of $5.6 billion.

Recent comprehensive business developments at Ethena include: Ethena partnering with Securitize to launch the "Converge" blockchain network aimed at bridging traditional finance and DeFi; planning to introduce iUSDe, a stablecoin product targeting traditional financial institutions; integrating its stablecoin sUSDe into Telegram; and building an ecosystem based on sUSDe, including Ethereal—a perpetual and spot exchange on its own application chain—and Derive, an on-chain options and structured products protocol.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News