Aave Joins Dividend Trend: Over $100 Million Cash Reserves to Fund Buybacks, Potentially Boosted by DeFi Regulatory Tailwinds

TechFlow Selected TechFlow Selected

Aave Joins Dividend Trend: Over $100 Million Cash Reserves to Fund Buybacks, Potentially Boosted by DeFi Regulatory Tailwinds

On March 4, the Aave community proposed a new initiative to update its token economic model, strengthening its competitive edge in the liquidity wars and accelerating DeFi's transition toward sustainable value capture models.

Author: Nancy, PANews

Following Sky, Uniswap, Ether.Fi, Synthetix, and Ethena, which have adopted or proposed token buyback strategies, Aave—the leading decentralized lending protocol—is also poised to join the growing ranks of DeFi protocols offering dividends.

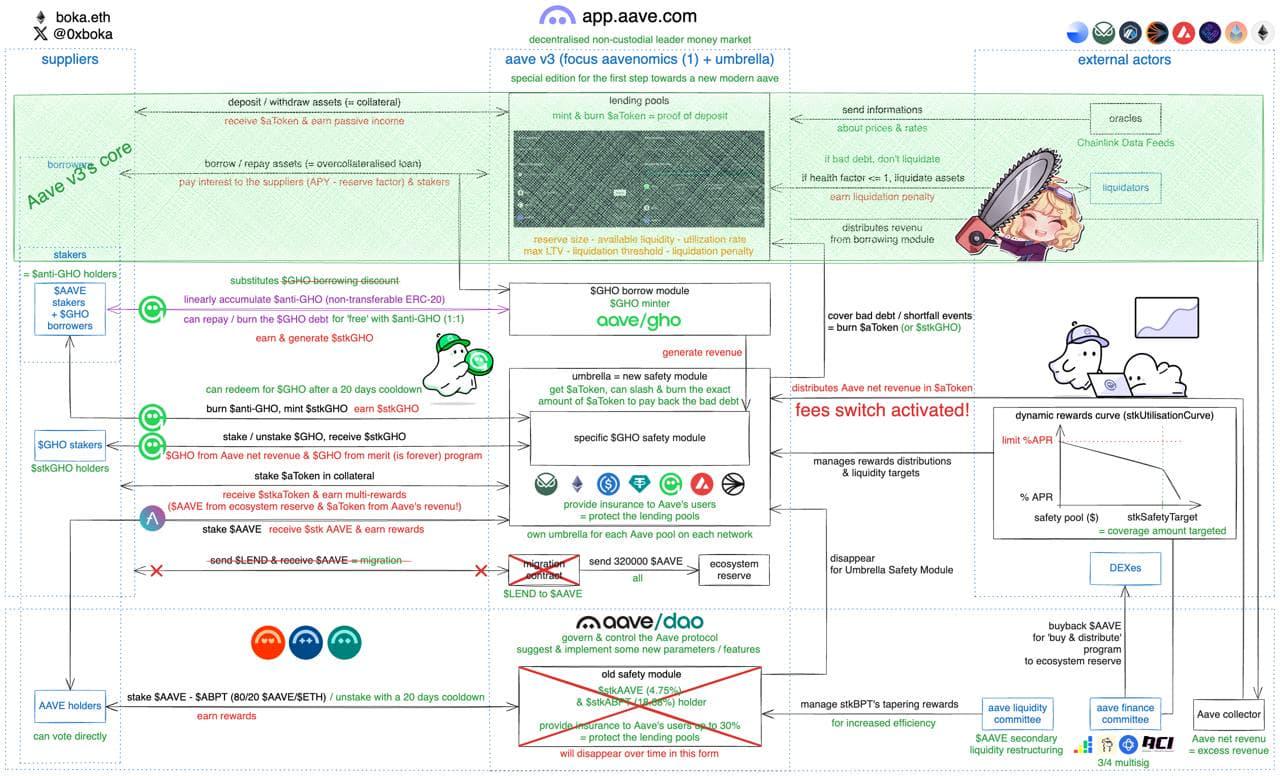

On March 4, the Aave community introduced a major new proposal to revamp its tokenomics, including initiating AAVE buybacks, redistributing protocol surplus revenue, ending the LEND token migration, and upgrading secondary liquidity management. Boosted by this news, CoinGecko data shows that AAVE surged 21.3% over the past 24 hours.

Aave Plans to Launch Dividend Model; Proposal Still in Feedback Phase

In the competitive landscape of DeFi liquidity, Aave has maintained its leadership in decentralized lending through strong cash flows and continuous innovation.

The new Aavenomics (Aave economics) proposal reveals that Aave’s market share and revenue have steadily increased over the past two years. GHO stablecoin supply has surpassed $200 million, while Aave DAO’s cash reserves now stand at $115 million. This growth stems from Aave’s near-monopoly position in lending protocol revenues and sustained investment in innovation—such as the recent upgrade to Aave 3.3 and the upcoming launch of the Umbrella self-protection system. Notably, Aave expects its 2025 revenue to grow significantly due to SVR (volatility shielding mechanism), potentially exceeding $10 million annually, providing solid financial backing for Aavenomics implementation.

As investors increasingly focus on value capture mechanisms in DeFi protocols, many projects are shifting toward dividend or buyback models to enhance tokenholder returns. Aave’s buyback proposal demonstrates several strengths, including robust cash reserves, diversified income streams, high-quality asset rewards, and efficient governance and execution.

The proposal outlines the following key initiatives:

· Token Buyback and Distribution: Aave plans to launch a "Buy and Distribute" program, using excess protocol revenue to repurchase AAVE tokens on the open market or via market maker partners, then allocating them to the ecosystem reserve. The initial phase would execute at a rate of $1 million per week for six months—totaling $24 million in buybacks—with adjustments based on overall protocol budget thereafter. This mechanism aims to reduce circulating supply, increase token value, and provide a sustainable source of AAVE funding for the DAO.

· Umbrella and AFC Establishment: The proposal identifies Umbrella as a user protection and growth tool for Aave users, recommending reallocating part of Aave DAO's surplus revenue to Umbrella aToken stakers. To implement this, it proposes forming an Aave Financial Committee (AFC), composed of Chaos Labs, Tokenlogic, Llamarisk, and ACI, with a 3/4 multi-sig threshold. The AFC would manage collector contract assets, define liquidity targets for Umbrella, and execute monthly budget allocations via Tokenlogic-managed AIPs.

· Protocol Revenue Redistribution: The proposal suggests creating an ERC20 token called Anti-GHO to enhance rewards for Aave ecosystem stakers—generated by both AAVE and StkBPT stakers. Initial Anti-GHO issuance would be set at 50% of GHO revenue, with 80% allocated to StkAAVE holders and 20% to StkBPT holders. Based on current GHO borrowing rates and supply, this would distribute approximately $12 million annually in protocol revenue to GHO stakers.

· End of LEND Migration: After nearly five years of operation, Aave will close the LEND-to-AAVE migration channel and reclaim the remaining 320,000 AAVE tokens (worth about $65 million), injecting them into the ecosystem reserve to support future growth and security.

· Secondary Liquidity Management Optimization: Aave DAO currently allocates around $27 million annually (based on current AAVE valuation) from ecosystem reserves toward secondary market liquidity incentives. The proposal recommends adopting a hybrid model combining StkBPT staking with direct oversight by the Aave Liquidity Committee (ALC), aiming to achieve greater liquidity at lower cost.

However, the proposal remains in the feedback phase. If consensus is reached, it will advance to Snapshot voting. Upon approval, Aave will authorize the formation of the AFC and begin phased implementation via AIPs.

DeFi May Gain Policy Relief as White House Backs Repeal of “DeFi Broker Rule”

At the time of the Aave proposal, the DeFi sector may be entering a window of regulatory relief and potential growth.

According to the Office of Management and Budget (OMB)’s Statement of Administration Policy, the U.S. government supports S.J. Res. 3—a bill led by Senator Ted Cruz aimed at overturning the IRS rule on “digital asset sales broker total proceeds reporting.”

The rule was originally introduced by the Biden administration in late 2024, expanding the definition of brokers to include software related to DeFi protocols and requiring certain DeFi users to report gross proceeds from crypto transactions along with taxpayer information. The White House argues that this rule imposes undue compliance burdens on U.S.-based DeFi enterprises, hampers innovation, and raises privacy concerns. The statement explicitly says that if S.J. Res. 3 reaches the President, senior advisors will recommend signing it into law, thereby repealing the IRS rule.

Senator Lummis commented: “The IRS rules targeting DeFi fundamentally misunderstand how decentralized technology works. I’ve seen firsthand how regulatory clarity—not overregulation—fuels innovation. These heavy-handed federal mandates risk pushing American crypto entrepreneurs overseas at a time when we should be nurturing this industry domestically. I’m proud to stand with Senator Ted Cruz in rolling back this attack on the crypto community.”

The White House’s endorsement signals a potential shift in crypto policy direction. For the DeFi industry, repeal of the rule could relieve projects like Aave from burdensome reporting obligations, lower compliance costs, preserve decentralization, and potentially attract talent and capital back to the U.S., further fueling American DeFi innovation.

With DeFi potentially facing a more favorable regulatory environment, Aave’s tokenomic overhaul not only strengthens its competitive edge in the liquidity battle but also accelerates the broader transition of DeFi toward sustainable value-capture models. Real revenue is no longer just a financial metric—it is becoming the foundation for building enduring ecosystems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News