Platform Coin LBP Approaching: Learn About the History and Data of LBP Launch Platform Fjord Foundry

TechFlow Selected TechFlow Selected

Platform Coin LBP Approaching: Learn About the History and Data of LBP Launch Platform Fjord Foundry

We need fair launches, better and more carefully curated launches.

Author: hitesh.eth

Translation: TechFlow

LBP fair launches are the IDO of this cycle—here’s my take on Fjord Foundry’s LBP.

Back in 2016–2018, during crypto’s biggest bull run, we had fair launches; venture capital hadn’t flooded into crypto yet—they were watching from the sidelines—while we won through fair launches and ICOs.

However, in that environment of fair launches, scammers outperformed investors.

As retail investors, we ended up investing in the wrong tokens, failed to take profits when they 10x’d at listing, decided to HODL—and then lost money.

I personally lost seven figures on ICO tokens that were once the hottest things in crypto.

IDO was another wave of fair launches in crypto—with lower entry barriers and some VC participation—but the game was still rigged.

IDOs were essentially rigged ICOs by design, and they failed within two years.

We’re now in a new bull cycle, and we need better designs—at least better than Dutch auctions, where whales buy up all the token supply in seconds.

We need fair launches—better-designed, well-curated launches—and launches where we can bet with more data and information.

Fair launches are needed now, and their scale is growing every day.

In just a few months, everyone will start participating in fair launches. Now might be a good time to start researching the ongoing fair launches on Fjord Foundry.

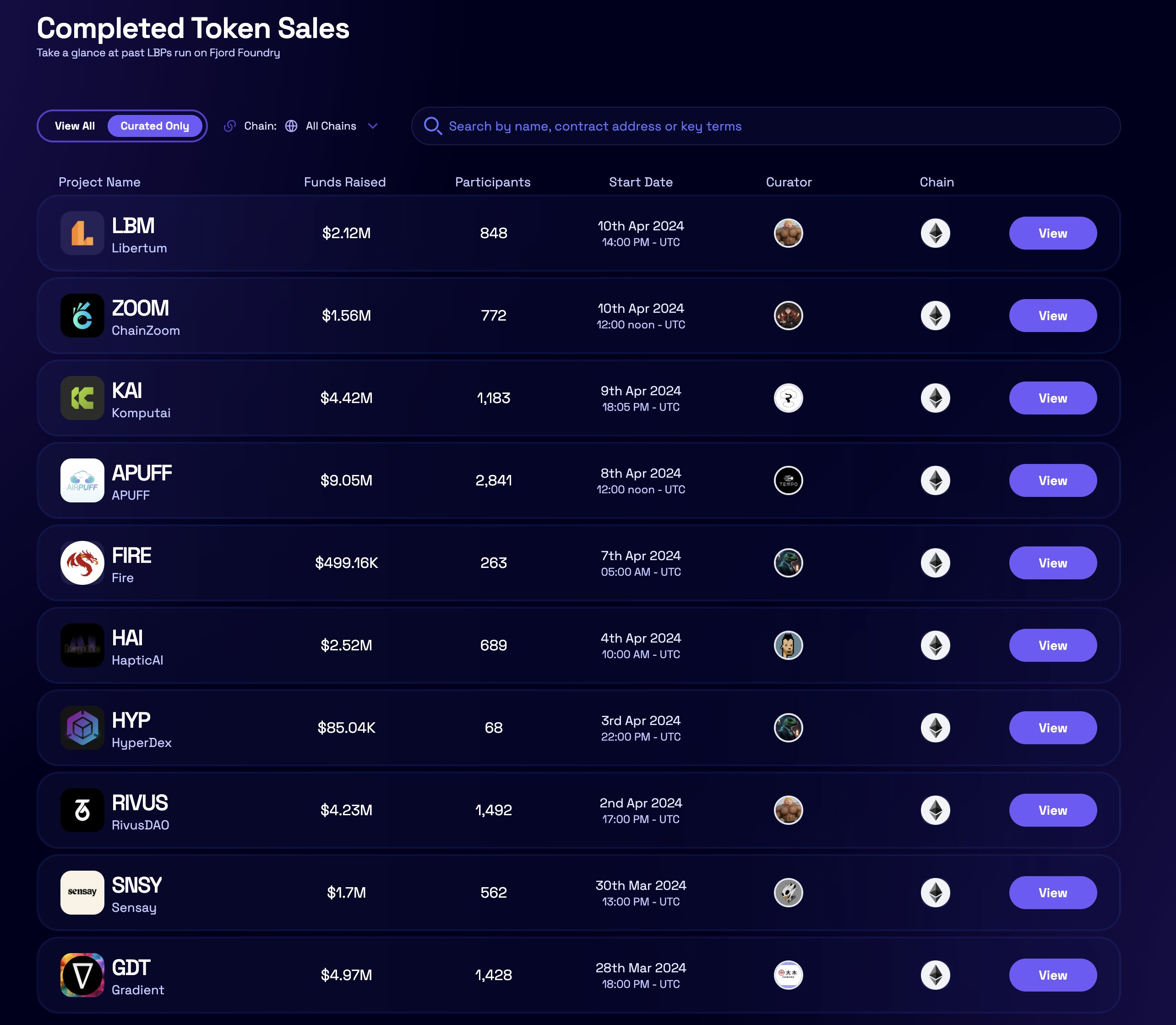

Fjord Foundry was formerly known as Cooper Launch. During the previous bull market peak, Merit Circle raised $105 million on Copper Launch.

At the time, it used a Dutch auction mechanism, where whales and bots snatched up most of the tokens, drawing criticism from the community.

Cooper rebranded to Fjord Foundry and shifted from Dutch auctions to Liquidity Bootstrapping Pools (LBPs).

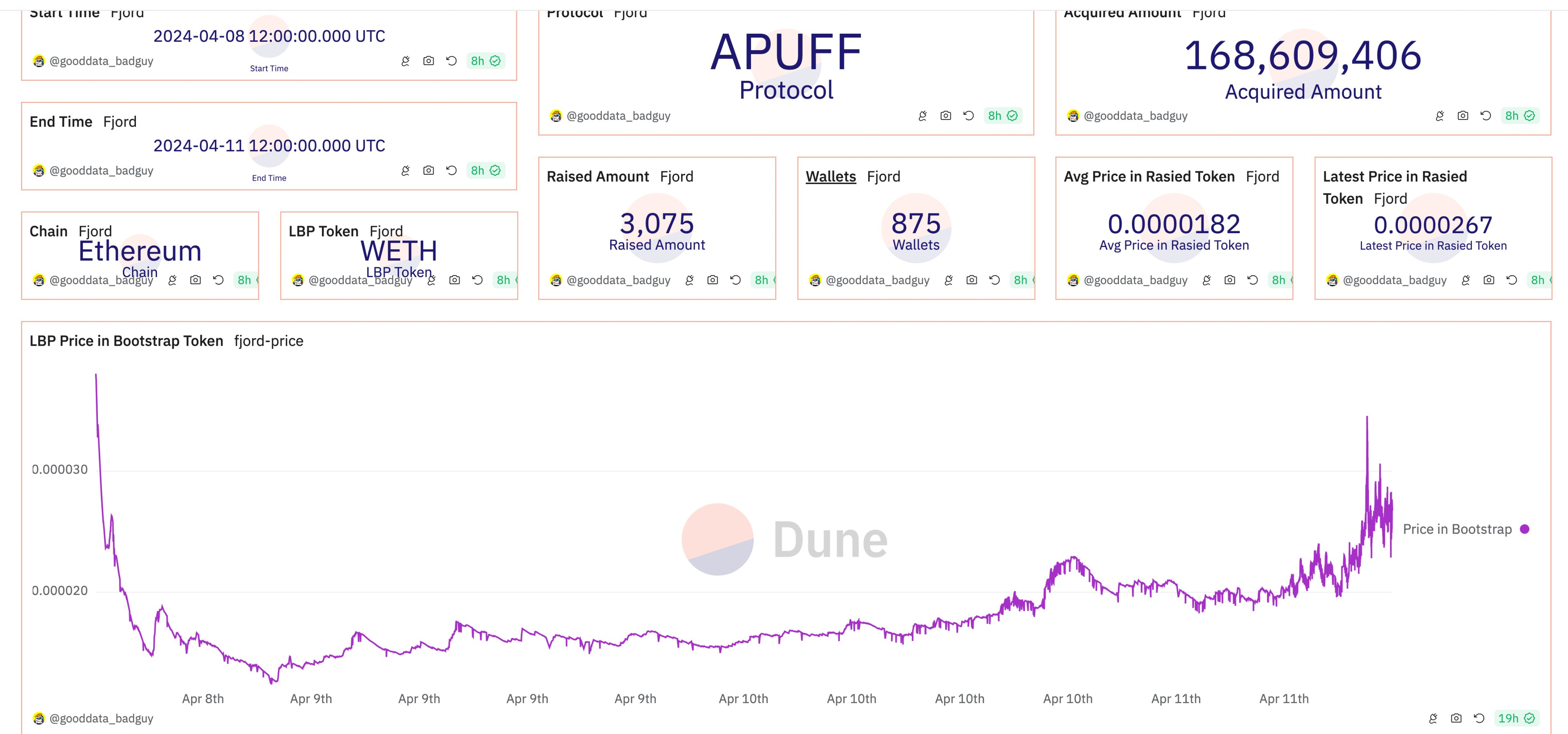

Unlike Dutch auctions, in an LBP, prices start high and gradually decrease, allowing demand from participants to determine a fair valuation.

LBPs typically run for several days, though some projects may hit their hard cap faster than others—this depends entirely on curation, hype, and narrative.

We live inside a narrative bubble. Artificial intelligence is the biggest one you’ve heard about, followed by Bitcoin L2s and runes, which are emerging narratives. You’ll see many fair launches built around these themes.

The harsh reality is that even scammers can use AI to create fake websites, set up documentation, and launch an LBP in under two hours. They can easily pull off multi-million dollar scams because people in crypto want to get in first and research later.

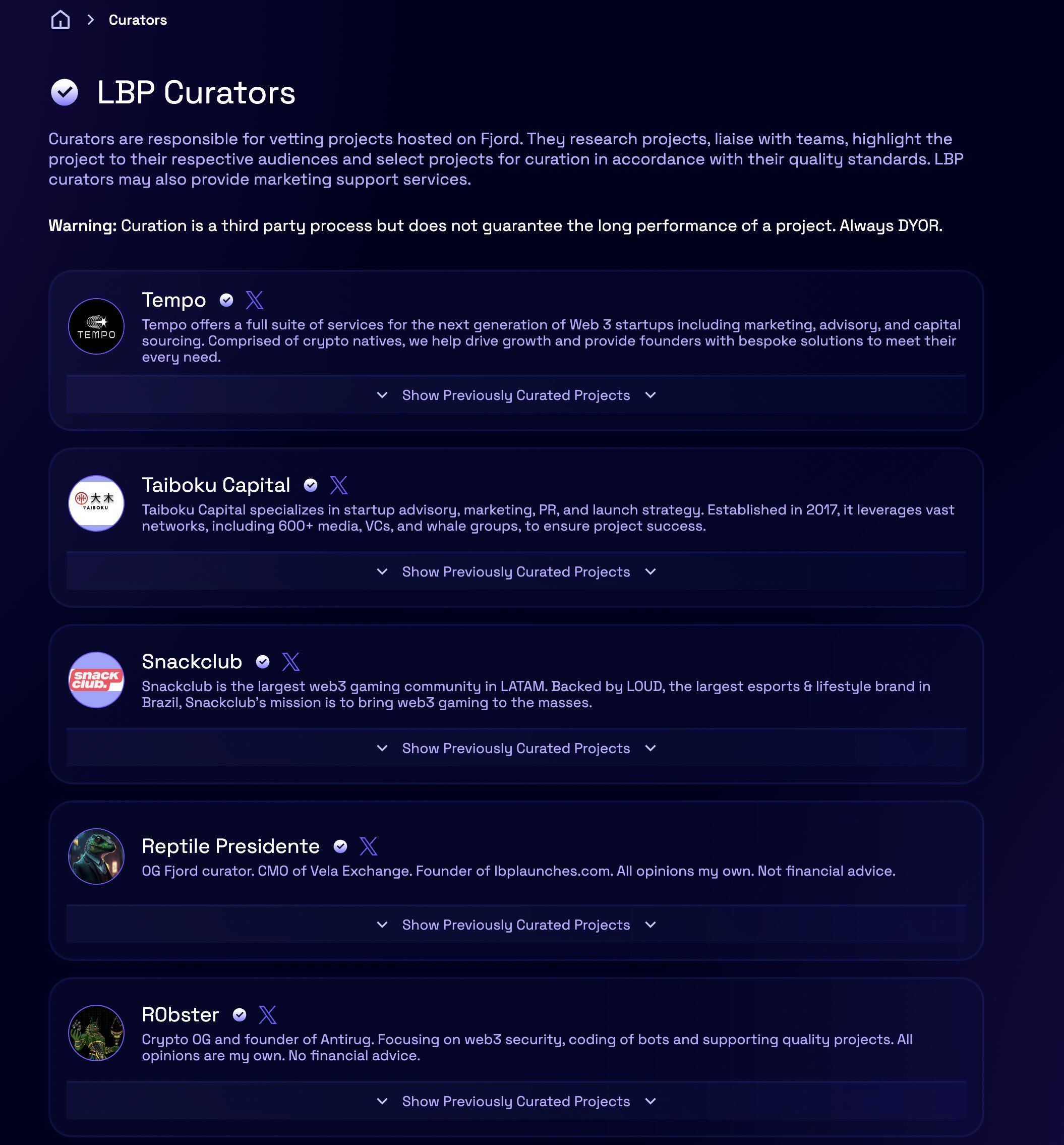

That’s why curation matters—and Fjord Foundry already has curators. But they really need to bring in some geniuses for curation. Personally, I don’t find the current batch of curators impressive, despite some having backed great projects in the past. They could also bring in more technically focused curators.

Editor’s note: Curators are responsible for vetting projects on Fjord. They research projects, communicate with teams, introduce them to their audiences, and select projects for curation based on quality standards.

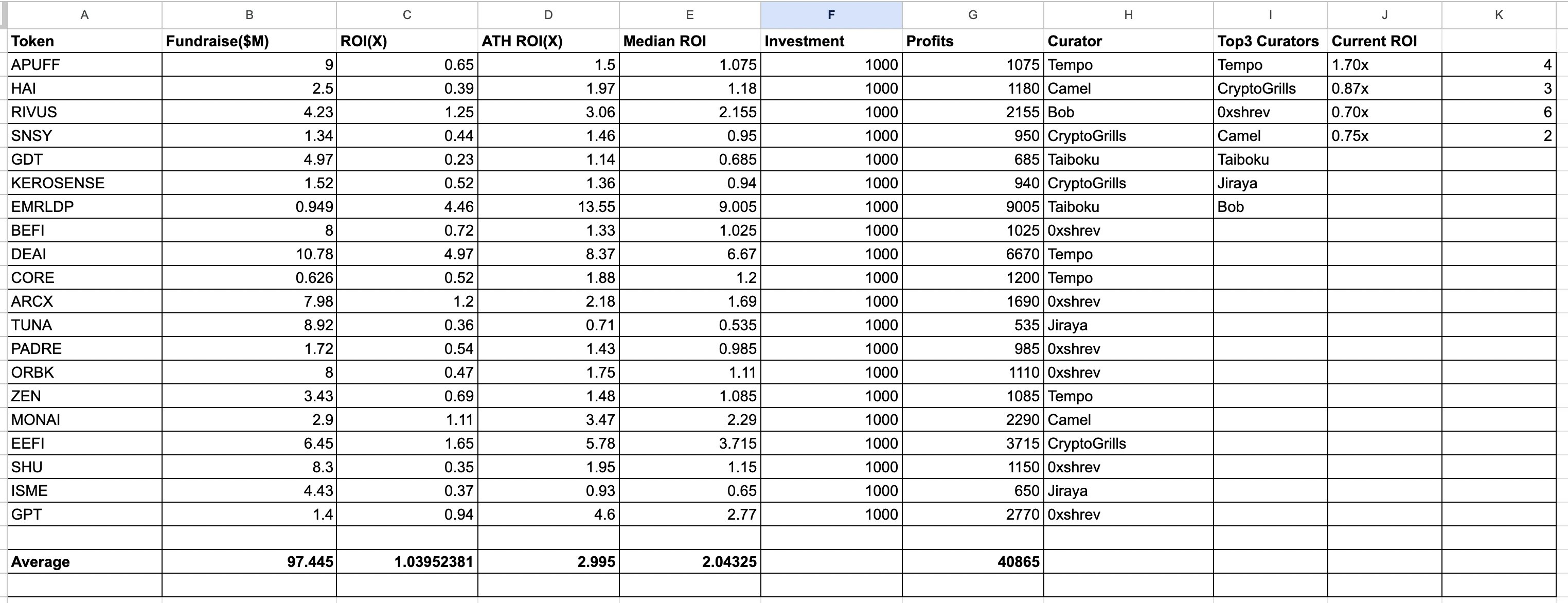

Based on ROI from the ATH of 20 past projects, here are the top 3 curators:

-

Tempo: Their best return came from Zero1 Labs, achieving an 8.37x ROI.

-

Taiboku Capital: Their highest return was from Emerald, with a 13.55x ROI.

-

Grills: Their best performance was from EeFi Finance, returning 5.7x.

Additionally, they had a project called AxonDAO; it raised less than $120,000 but reached an ATH price 500x higher.

That was extremely lucky—something that typically doesn’t happen for 99% of crypto investors. So, don’t get too excited about ROI.

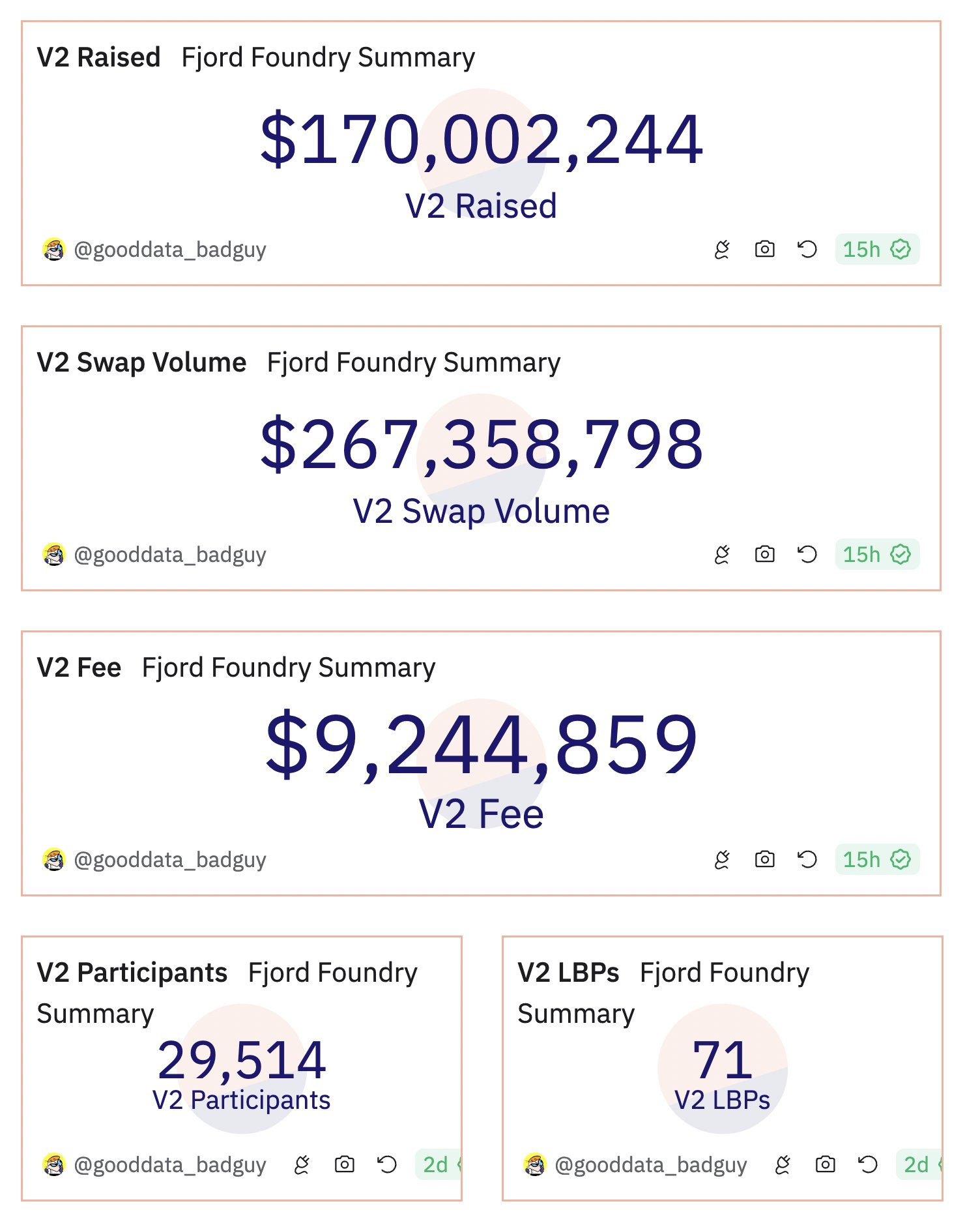

Fjord recently launched some strong projects like Autonolas, which is now trading at 100x its issuance price.

Technically speaking, Autonolas and AxonDAO are the only two LBPs in the past 12 months to achieve over 100x growth. The third-highest was Ordiswap at 5.96x.

There have also been problematic projects on Fjord, such as Voddo Trade, so you need to be very cautious with these.

Research the curators before researching the projects. Curators are the foundation of investor trust. That’s why we need better Fjord curators—I clearly see mediocre project returns.

For retail investors, blindly investing on Fjord isn’t suitable. However, if you can deploy your capital wisely on good deals, you can easily make 100% profits, and with proper execution, even achieve 40x returns.

Also, price is crucial, especially when deciding to invest.

Here’s a tip: Wait at least 8 hours before participating in an LBP, and always withdraw 50% of your profits at listing. Always check token vesting schedules and all available project data.

Also, keep an eye on 1intro launches on Solana. They might spark a wave of fair launches,

but again, be careful—around 90% of these projects involve technical manipulation.

You need to adapt quickly and act—until you eventually identify clear winners after spending countless hours researching.

Special thanks to Good Data Bad Guy for creating the dashboard to track LBPs on Fjord Foundry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News