Detailed Explanation 1intro: Solana's First LBP Platform, a New Opportunity Filling the Ecosystem Gap

TechFlow Selected TechFlow Selected

Detailed Explanation 1intro: Solana's First LBP Platform, a New Opportunity Filling the Ecosystem Gap

1Intro focuses on solving liquidity issues within the ecosystem while ensuring everyone can access secure LBPs.

Author: Ash

Translation: TechFlow

LBP stands for Liquid Bootstrap Pool, also known as a liquidity bootstrapping pool or Dutch auction (also called a descending-price auction).

However, there has never been a dedicated Liquidity Bootstrapping Pool (LBP) launch platform on Solana, and we've recently seen the impact of many rug pulls during Solana's meme coin frenzy.

Recent meme presales have made one thing clear: if Solana wants to solidify its position, it needs a better way to crowdfund liquidity in a fair, transparent, and secure manner.

LBP Recap

An LBP is essentially a variant of a Dutch auction, where the price starts high and gradually decreases over time.

This allows the community to discover and acquire tokens at prices deemed fair by participants, while minimizing interference from snipers and whales.

Multiple scenarios can occur during an LBP:

-

Scenario A: Buying immediately after launch, willing to pay a higher price considered fair (starting price/FDV is typically set by the team).

-

Scenario B: Buying midway through the LBP, where prices may be lower or higher than Scenario A depending on demand.

From my observation, successful LBPs follow a similar cycle: starting high → dropping after initial surge → gradually rising as the LBP nears completion. Personally, I only participate during the last quarter of an LBP schedule, after the initial hype has subsided.

Some projects that successfully launched in the past two weeks include $DEAI and $ARCX.

Introduction and Product-Market Fit

The Solana ecosystem has seen significant recovery over the past six months, with TVL, volume, and price all increasing more than tenfold.

Below are statistics comparing March 2023 to March 2024:

-

TVL: $270 million → $6 billion

-

Trading Volume (Daily): $27 million → $820 million

-

$SOL Price: $22 → $180

Yet among the numerous dApps on SOL (covering staking, lending, etc.), it surprises me that there is still no LBP platform on Solana.

Chains with much lower TVL and trading volumes already have multiple LBP launch platforms, making @1intro's proposition even more compelling.

1Intro will be the first platform to bring fairness to Solana via an LBP model, focusing on solving the ecosystem’s liquidity challenges while ensuring safe and accessible LBPs for everyone.

Put simply, 1Intro’s vision is to act as a bridge connecting developers and investors in a fair, transparent, and secure way, driving innovation at the forefront of the Solana ecosystem.

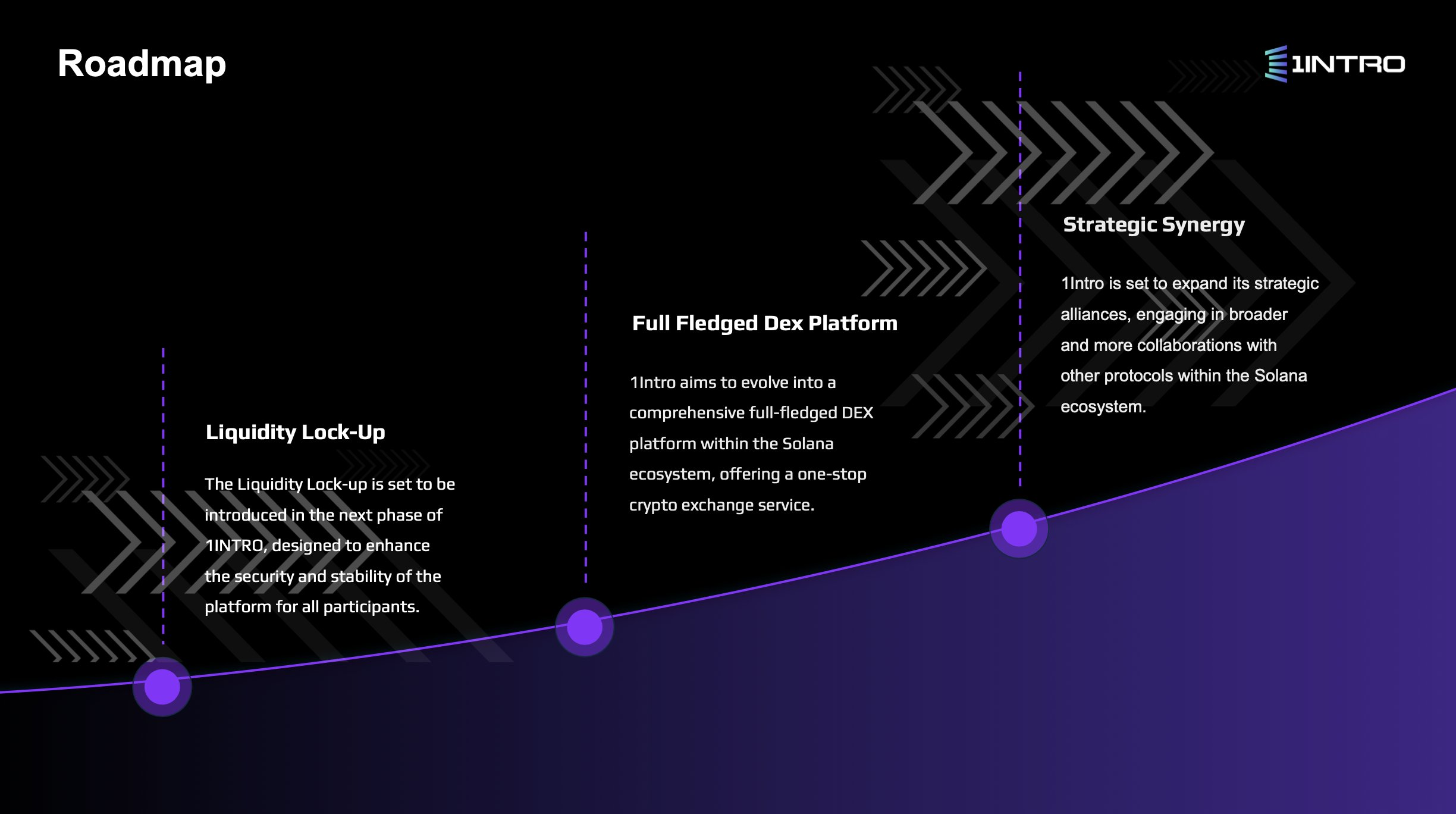

1Intro Roadmap

The 1Intro team has outlined several key strategic initiatives planned for the platform, to be delivered in multiple phases.

Regardless, development focus will center on enhancing security, functionality, and enabling deeper ecosystem collaboration.

Roadmap:

-

Phase 1: Implement liquidity locking to further protect retail investors and improve platform security and stability

-

Phase 2: Evolve into a comprehensive DEX platform offering one-stop exchange services through various tools and features

-

Phase 3: Expand strategic partnerships to cultivate and build a stronger, more interconnected ecosystem

Competitive Comparison

There are two main categories: general-purpose launchpads (cross-chain) and ecosystem-specific launchpads (single-chain only).

General-purpose launchpads include: MOBY, Fjord Foundry, ChainGPT Pad

Ecosystem-specific launchpads include: ZAP (Blast), Thala (Aptos), Tonstarter (Ton)

To fairly assess 1Intro’s valuation, let's examine four projects of varying scale:

-

$DAO (DAO Maker): $510 million FDV

-

$CGPT (ChainGPT): $416 million FDV

-

$XAVA (Avalaunch): $177 million FDV

-

$MOBY (Moby): $108 million FDV

In my view, under bear market conditions, 1Intro would likely launch with an FDV around half that of $MOBY—approximately $50–60 million. Given recent activity on Solana, I estimate its actual value could range between $100 million and $200 million.

The detailed tokenomics for $1INTRO are not yet live, so the per-token price cannot currently be estimated. However, FDV estimates remain relevant.

Personal Thoughts

1Intro is definitely an interesting project, especially given Solana's urgent need for an LBP platform.

It fills a clear market gap, and a well-known LBP platform is crucial for further advancing the Solana ecosystem.

In my opinion, 1Intro will eventually become a blue-chip project within the Solana ecosystem, standing alongside projects like Jupiter and Drift.

Below are the links related to 1Intro:

-

Twitter: https://twitter.com/1intro

-

Website: https://1intro.com

-

Documentation: https://docs.1intro.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News