Understanding Sanctum: The Solana Liquid Staking Aggregator Led by Dragonfly That Unlocks Fragmented SOL Liquidity

TechFlow Selected TechFlow Selected

Understanding Sanctum: The Solana Liquid Staking Aggregator Led by Dragonfly That Unlocks Fragmented SOL Liquidity

Sanctum connects large and small LSTs through a routing mechanism, unlocking a unified liquidity network.

Author: TechFlow

Solana today seems to have successfully earned the label of a "Meme playground."

Thousands of low-quality meme tokens emerge daily, capturing all market attention on memes. Meanwhile, the once-popular narrative of liquid staking that thrived in Ethereum's ecosystem has made little impact within Solana’s ecosystem.

While chasing high-risk meme token gains can be thrilling, some capital still seeks more stable and consistent returns. Liquid staking is precisely one key avenue for generating relatively steady yields—here, Solana clearly lags behind.

Thus, projects targeting this gap in Solana’s liquid staking demand are beginning to emerge—and may become the next source of alpha.

Sanctum is one such project, offering a liquid staking aggregation service on Solana that enables users staking SOL natively or using liquid staking tokens (LSTs) to leverage a powerful unified liquidity layer.

If you're wondering why such a project is needed, the answer is simple:

SOL can certainly be used to chase meme tokens, but users also want to use their SOL across the economy for various purposes: DeFi, NFTs, payments, etc. They want to use LSTs in layered strategies to explore additional yield opportunities.

Yet in Solana’s current ecosystem, attempting these layered operations with LSTs is extremely difficult to execute effectively.

Fragmented Liquid Staking Pools and PvP Competition

What is the current state of liquid staking on Solana?

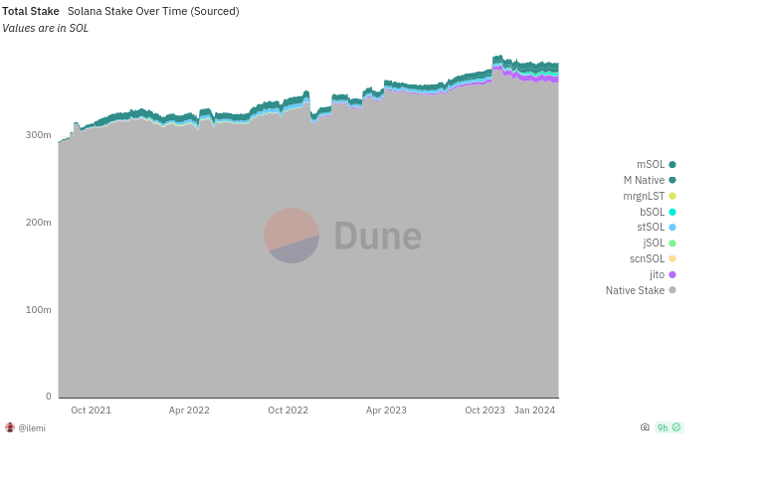

Despite the many advantages of liquid staking, nearly three years after Solana’s launch, less than 5% of staked SOL is in liquid form.

If everyone agrees liquid staking is beneficial, why hasn’t it taken off on Solana?

It succeeds by liquidity, yet fails due to liquidity.

Liquid staking on Ethereum follows an intense PvP mindset: a few giants like Lido dominate, each liquid staking pool operates independently, competing fiercely for liquidity and attention, each trying to use liquidity as a moat to eliminate rivals.

Given Ethereum’s early start, large user base, and high adoption, this winner-takes-all environment doesn't appear problematic; users can simply choose top providers like Lido, while smaller ones face natural selection.

However, for newer up-and-coming chains like Solana, if liquid staking providers adopt the same PvP approach—fighting independently without collaboration—they will only further fragment already limited liquidity.

For example, Sabre has a stSOL-SOL pool, Raydium has an mSOL-SOL pool, Orca has a scnSOL-SOL pool—these pools are entirely isolated.

Under these conditions, smaller projects struggle to survive, and new minor LSTs stand no chance at all.

To establish their own stake pool, operators must contribute millions of dollars in liquidity just to enter the game; otherwise, their LST risks depegging due to insufficient liquidity.

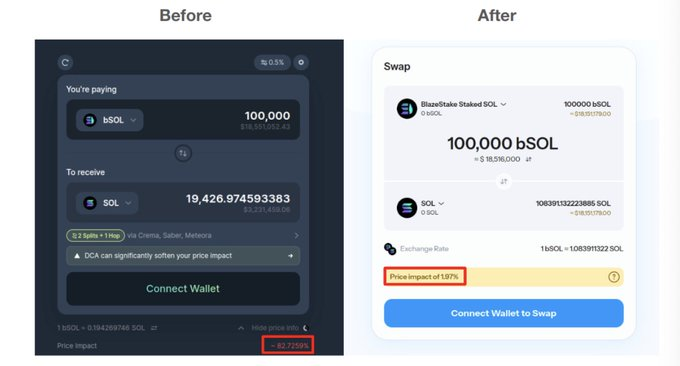

As a result, on Solana, liquid staking pools are fragmented, attention is scattered. Users suffer from shallow liquidity in smaller LST pools, facing extremely high slippage when swapping assets—leading to potential losses and constrained asset movement and trade execution.

The chart below illustrates the awkward situation faced by LST holders on Jupiter when exchanging for SOL: poor liquidity causes severe price impact when swapping larger amounts, discouraging users from trading altogether—further limiting asset circulation...

Over time, users naturally develop a sense of insecurity toward LSTs on Solana—you never know whether converting your LST back to SOL will incur a loss, let alone build any complex layered applications on top of LSTs.

Therefore, Sanctum’s core idea is to shift from PvP to PvE—not letting one liquid staking project win, but helping all liquid staking services across the Solana ecosystem collaborate, revitalizing fragmented SOL staking liquidity so that every LST holds value.

Understanding Sanctum’s Mechanism

So how exactly does Sanctum achieve this?

Broadly speaking, it partners with Jupiter to bring aggregation into the realm of liquid staking. Specifically, Sanctum’s product consists of several components.

-

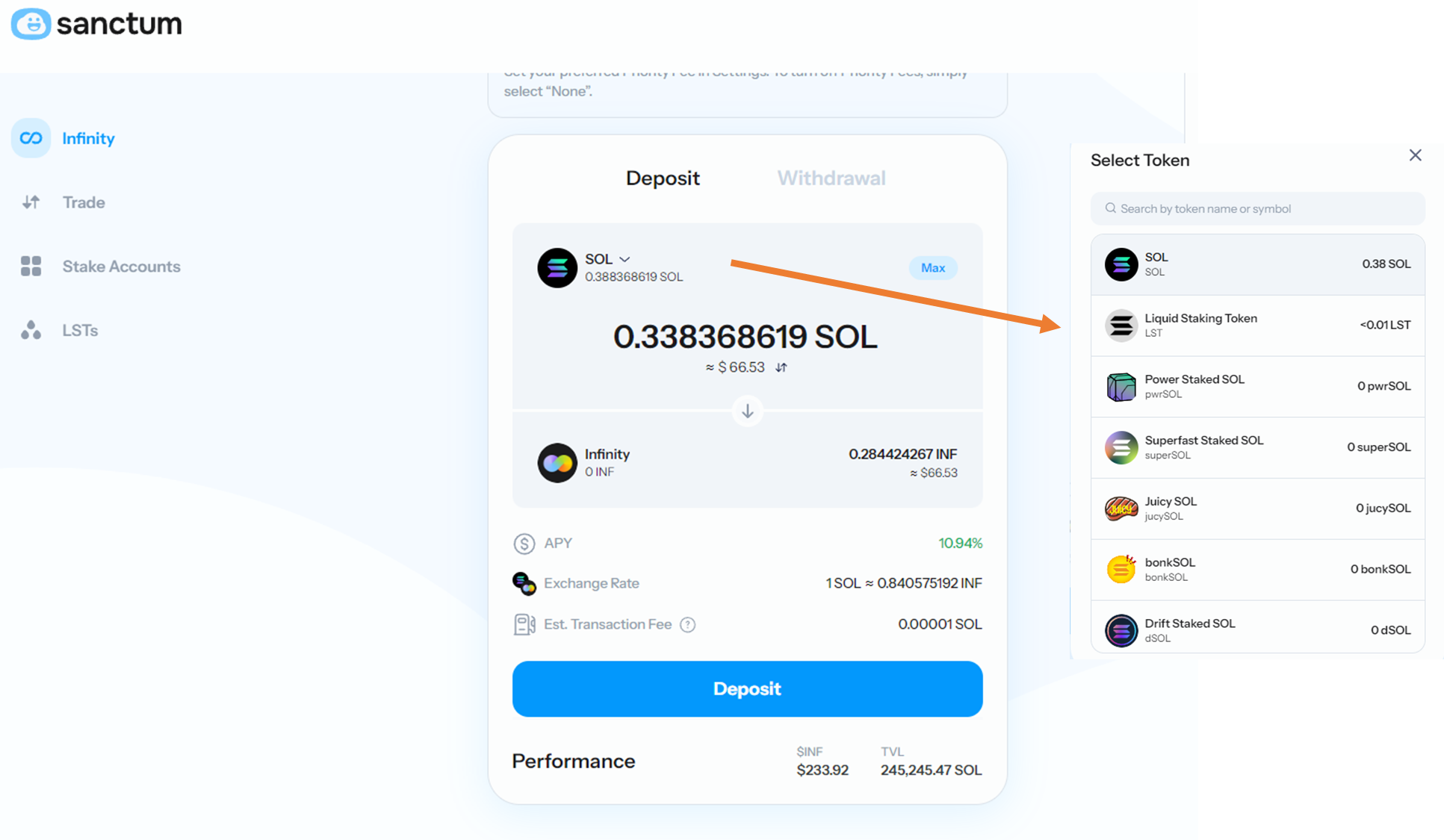

Infinity: A multi-LST liquidity pool that aggregates fragmented liquidity

Typically, LP pools consist of only two assets (e.g., USDC-SOL). Some pools, like Curve’s stablecoin swaps, support three to four assets (e.g., USDC-USDT-DAI).

Sanctum created Infinity, a multi-LST liquidity pool designed to aggregate liquidity across different trading pairs.

Currently, Infinity supports all whitelisted LSTs (e.g., SOL-bSOL-bonkSOL-cgntSOL-compassSOL-driftSOL-...).

Thus, Infinity is the only liquidity pool on Solana capable of natively supporting millions of different LSTs. Since all LSTs can be traced back to staking accounts, the fair price of each LST can be calculated based on the amount of SOL in its underlying staking account. This allows Infinity to enable swaps between any two LSTs of any size without relying on constant product formulas.

In other words, there is no limit to the number of LSTs Infinity can support—that’s where its name comes from.

-

Validator LSTs: Enhancing native SOL staking experience

Solana has so many individual staking accounts that the network temporarily halts at the start of each epoch to calculate staking rewards for each account.

(Note: An epoch is a fixed time period on the Solana blockchain used to re-select validators, update network state, and distribute rewards—it is a fundamental unit of its consensus mechanism and network maintenance.)

The existence of LSTs significantly reduces the number of staking accounts, thereby improving Solana’s speed.

With LSTs, projects can run multiple validators under a single LST (e.g., Bonk1 and Bonk2 validators), enhancing security and decentralization without fragmenting or confusing their staker base.

Validators can run incentive or loyalty programs. For instance, validator Laine airdrops block rewards and priority fees to laineSOL holders, resulting in annual returns exceeding 100% for laineSOL holders. With LSTs, validators can easily airdrop tokens or NFTs to users holding sufficient LST balances.

LSTs offer a superior user experience compared to native staking accounts. Users can easily convert instantly between any token and SVT via Sanctum or Jupiter (USDC ↔ xSOL).

Crucially, you don’t need to deactivate your stake account, wait an entire epoch, or remember to manually claim rewards.

-

Reserve: A “reserve requirement” buffer for unstaking

Reserve, also known as the Sanctum Reserve Pool, functions as a pool of idle SOL that provides deep liquidity for all liquid staking tokens on Solana.

This pool accepts staked SOL and offers SOL from its reserves in return. Currently, the pool holds over 210,000 SOL.

The reserve differs from any other LST-SOL liquidity pool. Every LST—whether a large one like jitoSOL or bSOL with substantial deposits, or a small emerging LST—can utilize the liquidity in this reserve pool.

From a business perspective, average users may not directly interact with the reserve, which is not open to public deposits. It primarily serves liquid staking providers. This reserve forms the foundation for providing deep, instant liquidity for staked SOL.

You can think of it as analogous to the "reserve requirement system" in traditional finance.

When you want to "unstake," thanks to this reserve system, the process becomes seamless—no waiting or extra steps. The SOL in the reserve pool satisfies your withdrawal request immediately, regardless of the current liquidity condition of the LST. There’s always reserve liquidity available for you to withdraw.

-

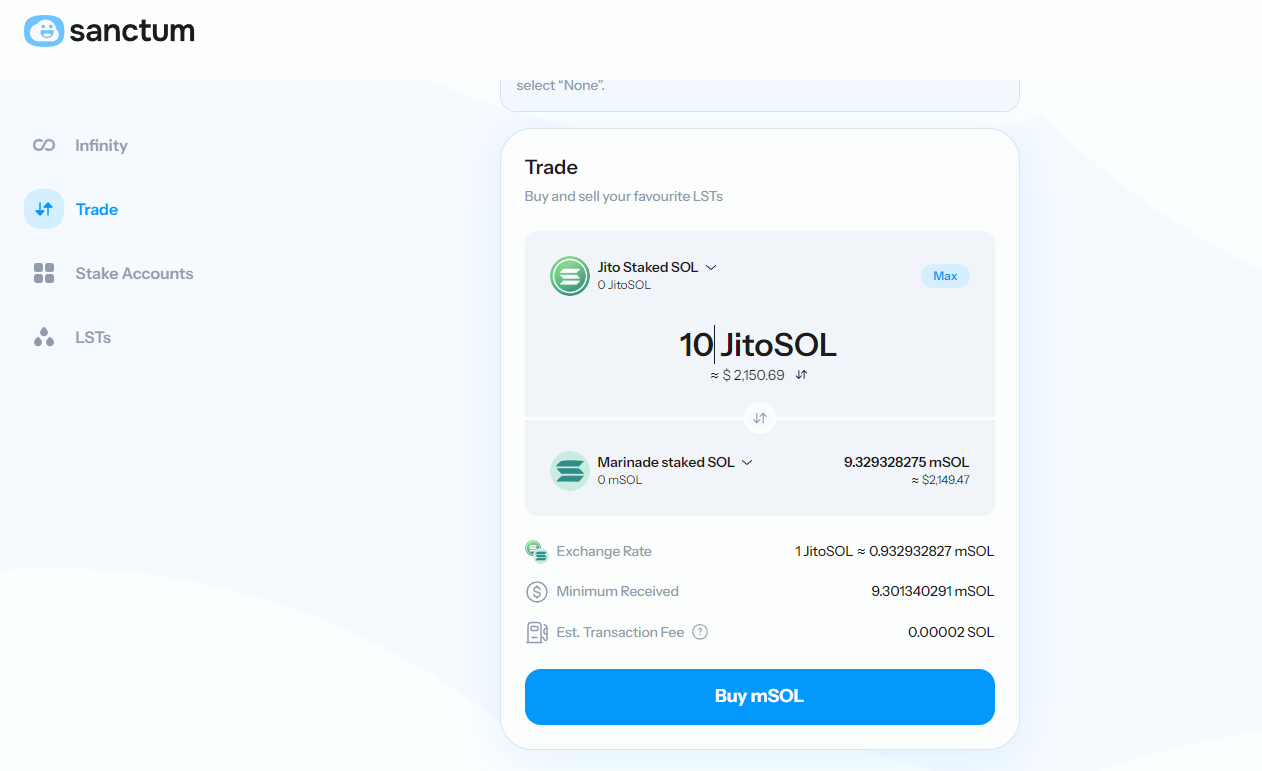

Router: The pathway for any LST exchange

The Router enables conversion between two LSTs that normally lack a direct trading path. By allowing smaller LSTs to access the liquidity of larger ones, it unifies LST liquidity.

Previously, each LST’s usability was limited by how much liquidity they could raise in Orca/Raydium pools (i.e., xSOL/SOL pools). If the pool was too shallow, their liquidity (i.e., the ability to instantly convert LST to SOL) would be too weak, rendering them ineffective as LSTs. Other DeFi protocols would hesitate to integrate such LSTs because, at the fundamental level, their LSTs cannot safely liquidate assets.

This is exactly why earlier mentioned layered strategies fail to take off—if your LST’s redeemability is questionable, how can you build businesses on top of it?

But Sanctum connects large and small LSTs through its routing mechanism, unlocking a unified liquidity network. Like claws, Sanctum’s router can tear off and wrap different liquidity wrappers (whether it’s aSOL or bSOL), depositing and withdrawing staking accounts into different LSTs.

For example:

-

A user deposits SOL and receives 1 jitoSOL—this is essentially a liquidity wrapper for their own staking account;

-

When the user swaps via Sanctum Router, what happens in the backend is that the staking account is withdrawn from jitoSOL and deposited into the jSOL pool, giving them JuicySOL.

This means liquidity is no longer a real barrier for new LSTs. If an LST needs to be converted to SOL, Sanctum Router can quickly extract your staking account from that LST and deposit it into any other LST with deep liquidity.

All LST liquidity is now unlocked and shared by all.

According to data shared on Sanctum’s official Twitter, by the end of March, transaction volume generated by its routing service had reached $500 million—clear evidence of strong demand for swapping between different LSTs on Solana.

Overall, Sanctum is effectively optimizing the fragmented state of liquid staking in Solana’s ecosystem, connecting large and small liquid staking pools so that every LST in the ecosystem benefits from deeper liquidity—enabling more advanced use cases for various LSTs.

Insufficient liquidity is no longer a psychological burden undermining LST reliability. Layered strategies involving LSTs can now proceed with greater confidence.

From Native Staking to LST

In fact, Sanctum didn’t emerge out of nowhere. Its predecessor traces back to Socean Finance, a native staking protocol on Solana.

Socean Finance is a decentralized algorithmic staking project aimed at enhancing Solana’s network security and providing users with risk-free returns. The project launched on mainnet as early as September 2021 and secured a $5.75M seed round that same year, led by Dragonfly with participation from Sequoia and Jump.

At that time, however, Solana wasn’t enjoying its current spotlight—the collapse of the FTX empire left Solana neglected for quite some time.

With market recovery and Solana’s resurgence, narratives evolved and new trends emerged.

Socean Finance naturally realized that merely operating a simple Solana staking pool could no longer adequately address the current liquidity pain points in Solana’s ecosystem.

Therefore, over the past year and a half, Socean has been dedicated to developing Sanctum—from native staking to liquid staking aggregation—pursuing the vision of making all SOL more liquid in a new way.

For some projects, switching tracks whenever a new trend emerges reflects short-term opportunism.

But Sanctum’s evolution feels more like a continuous accumulation of expertise. Having already operated native SOL staking, moving into liquid staking aggregation is both a natural progression and a response to clear market demand.

Given that no similar project currently exists in Solana’s ecosystem to aggregate LST liquidity, Sanctum remains a non-consensus gem worth watching—even amidst the noise of AI, DePIN, and meme coins.

Yet how far Sanctum itself can go depends heavily on broader market conditions and risk dynamics.

In a bull market, liquidity aggregation acts as lubricant for countless applications—everyone wants better liquidity. But in a bear market, as liquidity dries up, even the best aggregation systems may become hollow shells.

Whether Sanctum can endure across cycles and catch favorable winds remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News