Analyzing Sanctum: The Innovative Solana LST Protocol Incubated by Solana Labs

TechFlow Selected TechFlow Selected

Analyzing Sanctum: The Innovative Solana LST Protocol Incubated by Solana Labs

By providing liquidity support, Sanctum unlocks staked SOL within the Solana ecosystem and ensures DeFi lending protocols remain solvent by offering a safe haven for SOL to facilitate flash loans and close LST collateral positions.

Project Background:

Sanctum is an on-chain stability protocol incubated by Solana Labs and led by Dragonfly, with participation from Sequoia Capital (India/Southeast Asia), Jump Crypto, and Solana Ventures.

The core team consists of veteran developers from the Solana ecosystem who began building liquid staking solutions on Solana as early as 2021. To date, Sanctum has secured over $1 billion in assets under management, with a total value locked (TVL) exceeding $85 million.

In short, Sanctum provides liquidity support to unlock staked SOL within the Solana ecosystem. By offering a safe harbor for SOL, it enables flash loans and the closure of LST collateral positions, ensuring DeFi lending protocols remain solvent.

Problem Statement:

For a long time, Solana has faced a major challenge: once SOL is staked, users earn rewards and help secure the network, but that staked SOL becomes illiquid—difficult to trade or transfer. In essence, after staking, you lose control over your SOL.

Liquid Staking Tokens (LSTs) emerged to solve this issue. A simple analogy: staked SOL is like a gold bar stored in a bank vault, while an LST is like paper money—freely spendable at any time and redeemable for the underlying gold. Thus, liquidity is critical for LSTs; without it, the "paper money" becomes worthless.

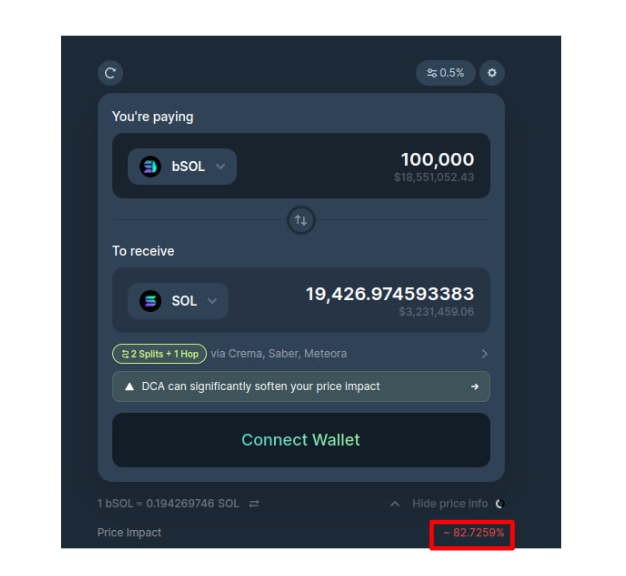

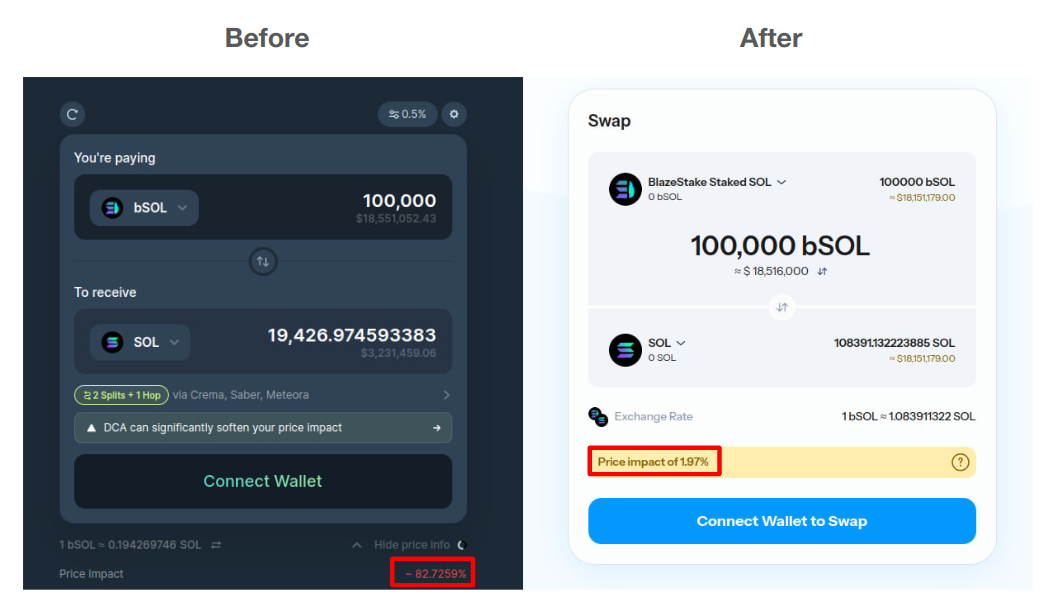

Insufficient liquidity can directly harm user interests. The image below illustrates an example: swapping an LST (bSOL) back to SOL in a poorly liquid pool could result in an 82% loss if executed.

All LST users may suffer such losses, and achieving healthy liquidity typically requires multi-million dollar capital thresholds—an inherent barrier for most LSTs.

Sanctum reduces the price impact of liquidity provision from 82% to less than 2%. The following comparison highlights this dramatic improvement.

Products & Services:

Sanctum Router, Reserve, and Infinity. Collectively, Sanctum functions as a unified liquidity aggregation layer, enabling near-zero-cost swaps between any LSTs and providing deep, unified liquidity for all users.

Reserve: An SOL liquidity pool that offers instant unstaking services for all LSTs. Regardless of validator size, any LST can be immediately converted into SOL.

Router: A key infrastructure component in Solana’s LST ecosystem. It enables conversions between two LSTs even when no direct trading path exists. By allowing smaller LSTs to tap into the liquidity of larger ones, it unifies LST liquidity across the board.

Infinity: A liquidity pool for Infinity-LSTs that supports seamless conversion among all included LSTs. While most pools only support two-asset swaps (e.g., jitoSOL–bSOL), Sanctum supports thousands. This allows small LSTs to first swap into large LSTs and then freely convert further (e.g., bonkSOL → bSOL → USDC).

Sanctum LST Program: Sanctum helps other projects launch and promote their own LSTs. Within one month, the total value locked (TVL) of these LSTs grew from zero to nearly $50 million.

Sanctum's goal is to enable zero-slippage swaps among millions of LSTs.

Below are some key metrics:

- Over $450 million in USDC trading volume on Router.

- Instant unstaking of over 1.8 million SOL via Reserve.

- Over 175,000 SOL deposited into the Infinity-LST liquidity pool.

- 14 different LSTs launched on the Sanctum platform (with more added daily).

Vision:

A future where LSTs have infinite possibilities—a more innovative Solana. When anyone can create an LST, when there are no liquidity moats, and switching costs are negligible, the potential for LSTs becomes boundless. Diverse LSTs mean exponential innovation. At that point, even those with the deepest pockets will yield to those who deliver real value.

This not only fosters stronger competition but also enables creative models such as micro-payments or subscriptions (e.g., coffeeSOL), influence-based LSTs, and “non-fraudulent NFTs.” Below are some examples:

How to Use:

Just follow a few simple steps to easily enjoy the benefits offered by Sanctum.

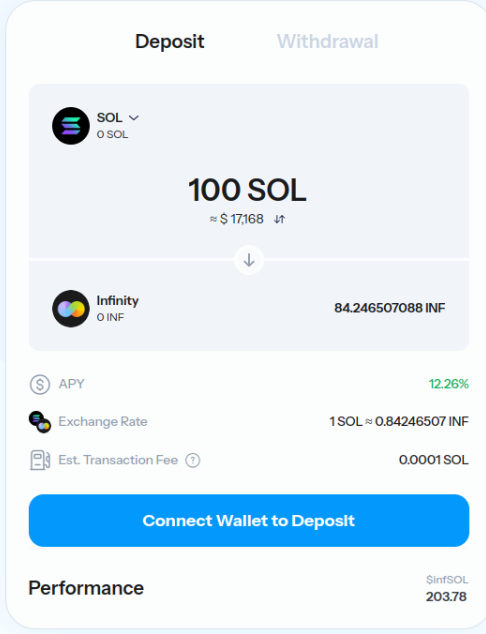

1/Go to app.sanctum.so/infinity and prepare to deposit SOL or any LST into Infinity.

2/ Confirm the transaction on the website.

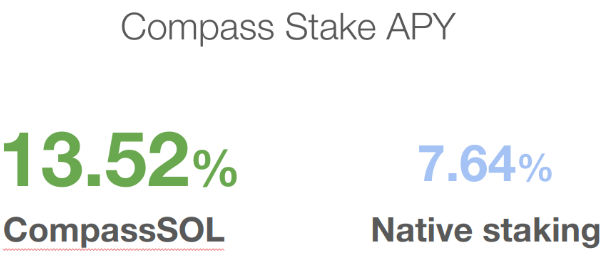

3/ Once deposited, your SOL will earn staking rewards and trading fees (currently around 12% APY).

4/ Additionally, visit app.sanctum.so/swap to trade with all of Sanctum’s partners.

Narrative:

1. Ethereum is destined to fail in terms of liquidity equity. Solana still has its chance.

2. LSTs inherently possess monetary properties. But monetary utility depends on liquidity, which inevitably leads to centralization—resulting in monopolies (like LDO) and the suppression of innovation.

3. Sanctum stands for building unified liquidity for staked SOL—ensuring all LSTs, regardless of size, can trade freely if they hold sufficient value—thereby resisting centralization and enabling fair competition.

4. Staking will ultimately be decentralized. With Sanctum, users don’t need millions of dollars to launch their own LST. This opens up possibilities for innovation and collaboration, allowing builders to share in the rewards without fear of their success being monopolized.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News