Aura Finance: A New Strategy to Drive LST Liquidity Growth on Optimism

TechFlow Selected TechFlow Selected

Aura Finance: A New Strategy to Drive LST Liquidity Growth on Optimism

Aura has played an indispensable role in driving the growth of the Balancer ecosystem on Ethereum.

Author: Beethoven X

Compiled by: TechFlow

What is Aura?

Aura Finance is a liquidity layer that connects to and builds upon the Balancer protocol. Much like Convex does for Curve, Aura Finance acquires Balancer’s native governance token veBAL and plays a crucial role in providing an additional layer for network participants to build and incentivize liquidity.

Liquidity providers can stake Balancer pool tokens (BPT) to earn incentives in AURA and BAL; AURA holders can stake and participate in the veBAL voting market, while protocols can offer vote-boosting incentives to effectively direct BAL (and AURA) emissions to specific pools. To date, Aura has hosted over 30% of veBAL governance power, enabling it to maximize LP rewards and direct the majority of BAL emissions. Undoubtedly, Aura is a key player within the Balancer ecosystem.

Aura Finance currently manages nearly $500 million in total value locked (TVL) on mainnet and has established and nurtured interconnected partnerships across a range of protocols. From liquid staking tokens and cross-chain infrastructure providers to lending markets and enhanced integrations, Aura has played an indispensable role in driving the growth of the Balancer ecosystem on Ethereum—and now, Aura is preparing to drive growth on Optimism.

Why Optimism?

Optimism is currently the second-largest scaling solution for Ethereum, with over $835 million in total value locked. With the recent Bedrock upgrade, the Superchain vision has become a reality. Combined with the upcoming launch of Base, opBNB chains, and continued development of the OP Stack, Optimism appears poised to attract even greater attention and liquidity. The introduction of Aura now creates an opportunity to establish Balancer and Beethoven X as core technological and liquidity hubs on the network.

In particular, over the past year, the liquid staking market has rapidly grown into the largest DeFi liquidity category, reaching $20.75 billion in TVL. Migrating liquid staking tokens (LSTs) to Layer 2 networks offers higher speeds and minimal fees—an exemplar of capital efficiency with strong potential for continued growth. By offering simplified liquidity and incentive mechanisms atop the most efficient liquid staking technologies in DeFi, Aura is now ready to accelerate LST growth on Optimism.

The Optimism DEX launched in 2022 as a unique DeFi partnership through the joint deployment of Balancer and Beethoven X. Beethoven X handles the frontend, while the underlying “native” incentive contracts are governed by veBAL and controlled by BAL. Subsequently, Beethoven X’s DAO governance adopted an additional incentive proposal, committing 50% of its protocol fees to be converted into OP, matched with Beethoven X’s OP grants, and distributed back to pools as liquidity mining or gauge incentives.

Since its launch in July 2022, the joint deployment of Balancer and Beethoven X on Optimism has demonstrated innovation, emerging as a major provider of LST liquidity—accumulating $60 million in TVL by April 2023 and generating approximately $370,000 in protocol revenue. While these metrics are commendable, there remains room for improvement. With the recent introduction of L2 veBAL Boost, there is now an opportunity to leverage the upcoming launch of Aura to significantly increase market share.

As a central hub, Beethoven X, Balancer, and Aura aim to play a pivotal role in advancing liquidity growth on Optimism. Through a new liquidity layer designed to ignite growth and implement efficient flywheel incentive programs, users will soon realize the benefits of this synergistic collaboration.

Incentive Structure and Funding

This unique collaborative effort between Beethoven X, Balancer, and Aura ensures that Optimism liquidity pools are incentivized in the most efficient and sustainable manner. Currently, Beethoven X employs a protocol fee-matching structure to incentivize liquidity pools. Beethoven X converts 50% of its protocol fees into OP, matches it 1:1 with OP grant funds, and redistributes it to liquidity pools as liquidity mining incentives. This approach aims to significantly boost reward distributions while maintaining sustainability.

With the anticipated launch of Aura and cross-chain veBAL boosting, Beethoven X will provide an additional liquidity layer for the Balancer ecosystem, enabling an efficient voting market. As a result, Beethoven X’s current OP grant matching program could evolve into a voting incentive mechanism using BAL and AURA emissions to grow protocol TVL. If the voting market proves inefficient, the incentive program can continue distributing liquidity mining rewards directly to pools.

Aura has also proposed an OP grant program that would distribute additional LP incentives or match rewards on the Aura voting market. Protocols can use their grants in one of two ways. The first method involves matching OP tokens with voting incentives provided by the protocol to vlAURA holders, thereby increasing participation in Aura’s Optimism voting market and directing a larger share of BAL emissions to Optimism pools. The second method involves directly distributing OP grants to LPs, matched 1:1 with BAL and AURA incentives. The chosen method will depend on efficiency at the time. If approved, this grant program has the potential to return 100% of protocol fees as user rewards.

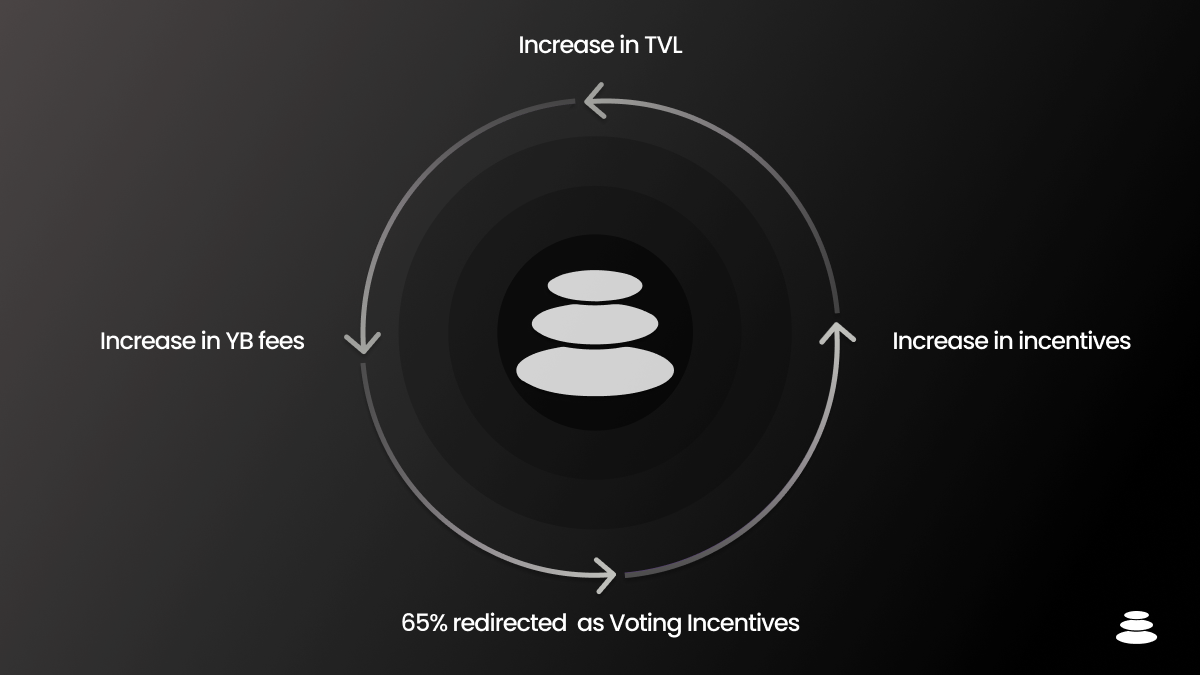

Balancer pools also implement an effective liquidity flywheel designed to promote pool growth. Pools that generate more than 50% of protocol yield—or 8020 pools—are eligible for core pool status. From these pools, 65% of Balancer protocol fees are automatically allocated as voting incentives to their respective gauges. More incentives naturally lead to higher TVL, and thanks to Balancer’s innovative fee collection mechanism—which draws fees directly from yield-generating assets—higher TVL now directly translates into higher fees. This closes the loop and ignites a self-sustaining growth flywheel within the Balancer ecosystem.

Currently, only 25% of protocol fees are recycled on the Optimism DEX, but a restructuring of Balancer’s incentive program is under discussion. If Aura’s OP grant is approved, the proposal could enable a staggering 260% of protocol fees to be returned as liquidity mining incentives (compared to 130% without Aura’s grant), combining fee recycling, OP grant matching, and efficient voting market strategies.

Future Potential

High performance on Layer 2, the potential of the Superchain, an efficient liquidity flywheel, generous incentive structures, and a thriving community—all signs indicate that Aura is ready for expansion on Optimism. All initial pools will focus on LSTs or enhanced pools, combining some of the most powerful features of the Balancer ecosystem with Aura’s enhanced liquidity layer to create core infrastructure capable of driving liquidity growth on Optimism.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News