A Brief Analysis of the Differences Among Three Stablecoin Protocols Built on Ethereum LST Assets

TechFlow Selected TechFlow Selected

A Brief Analysis of the Differences Among Three Stablecoin Protocols Built on Ethereum LST Assets

This article introduces three stablecoin protocols based on Ethereum LST and their differences.

Author: Sleeping Deeply in the Rain

There are currently three stablecoin protocols on the market built on Ethereum LSTs. What differentiates them?

First and foremost, all of their models are based on yield generation from Ethereum.

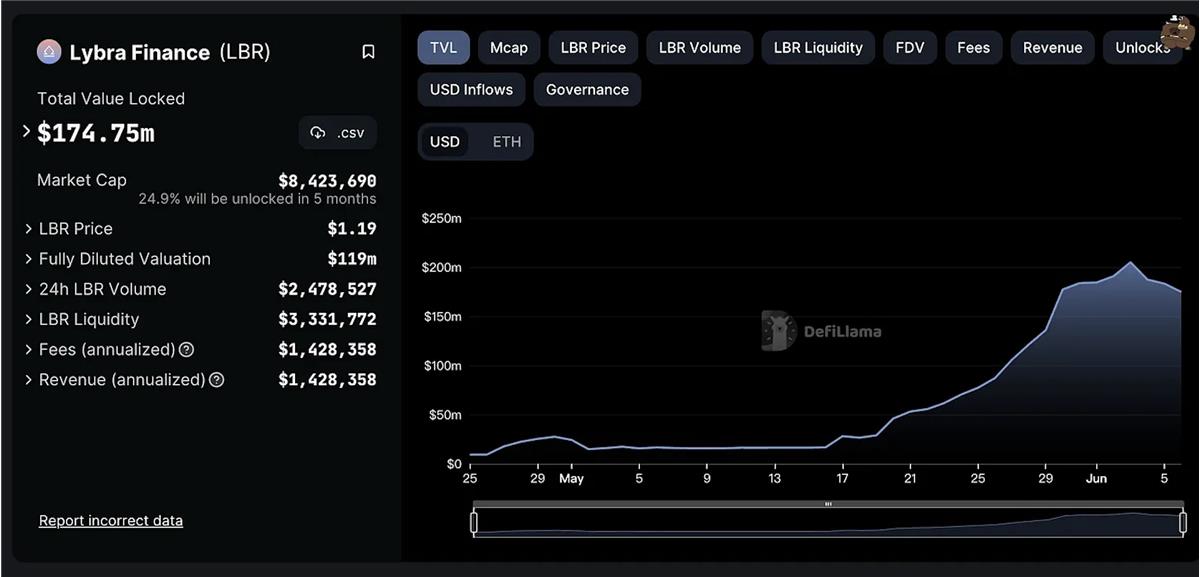

Lybra uses debt-based yield rebasing—meaning the debt you mint automatically earns rebase rewards, paid to you in stablecoin form.

Prisma automatically repays debt—meaning the protocol uses interest generated from your collateral to automatically repay the debt you've minted.

Raft implements collateral rebasing—your debt remains unchanged, but the quantity of your collateral increases over time, without affecting the debt itself.

In terms of aggressiveness, Lybra is the most aggressive, Prisma sits in the middle, while Raft differs little from traditional over-collateralized lending.

In terms of advantages, Lybra incentivizes liquidity with its native token and is also pushing for cross-chain adoption and use of eUSD. Prisma’s specific incentive model isn’t clear yet, but given its backing by Frax, Curve, and Convex, it’s likely to be deeply integrated into the Frax and Curve ecosystems. Raft also has strong backers, mostly market makers such as Wintermute, GSR, and Jump, with lead investment from Lemniscap—a mature VC firm that previously invested in Avalanche, Aurora, Kava, and Liquity—and should bring significant resources and partnerships. Raft's method of incentivizing liquidity involves offering high-mining-reward LP pairs for its stablecoin $R.

From a liquidity incentive perspective, it’s clear that Lybra resembles a group of DeFi degens setting up a game—they敏锐ly identified the LSDFi trend and rapidly launched a product to attract liquidity. However, due to cold-start constraints, they could only rely on token incentives initially, which invited some FUD (fear, uncertainty, doubt), primarily around whether the token’s LP liquidity can sustain the token emission schedule.

But what else could they have done?

Without incentives at launch, user participation would have been minimal. Additionally, eUSD lacks deep liquidity—which was inevitable, given the team consists of DeFi degens who couldn’t quickly establish a deep v1 pool on Curve or accumulate significant veCRV voting power.

Ultimately, Lybra had to demonstrate results to attract potential partners and secure long-term growth—such as their current collaboration with LayerZero.

Prisma, on the other hand, was founded by a group of DeFi OGs and thus had access to support from major DeFi protocols from day one, significantly lowering cold-start difficulty. I suspect Prisma’s token may follow a ve-token model. As @leslienomad mentioned, he previously avoided public presence intentionally—to keep early stages private and exclude outside participants.

Raft was assembled by VCs and market makers, bringing excellent resources—for example, launching high-APY pools on Beefy right from the start, using others’ capital to fund liquidity incentives, thereby avoiding risks of its own token depreciation. I believe Raft’s token will lean more toward governance functionality, with VCs and market makers likely receiving tokens at lower costs.

From a risk perspective, Lybra and Prisma operate similarly, but Prisma’s automatic repayment mechanism helps reduce borrowers’ LTV ratios. Raft achieves similar LTV reduction through growing collateral value, though less effectively than Prisma. Lybra’s eUSD rebase requires manual repayment actions, making it riskier. Nevertheless, I still hope to see more protocols like Lybra emerge, particularly in terms of innovative design and product execution.

I’m personally very bullish on the LSDFi stablecoin sector, as it can effectively reduce liquidation risks in lending and improve users’ capital efficiency. Competition among the three is currently intense—it remains to be seen who will break through and claim dominance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News