Lending + LST Dual Engine, Native USDC Empowerment: How is NAVI, the Leading DeFi Project in Sui's Ecosystem, Rising to Prominence?

TechFlow Selected TechFlow Selected

Lending + LST Dual Engine, Native USDC Empowerment: How is NAVI, the Leading DeFi Project in Sui's Ecosystem, Rising to Prominence?

Native USDC is即将上线 Sui, and NAVI may rise again on this momentum.

Author: TechFlow

Frankly speaking, we are going through a cycle that hasn't been particularly positive. Whether it's the mutual refusal to "bag-hold" or the MEME resistance movement, beneath the apparent excitement lies a subtle sense of self-mockery from the community. However, with rate cuts now taking effect, the market has finally reunited with long-missed optimism.

At the beginning of the highly anticipated fourth quarter, Sui has captured the community’s attention with its standout price surge.

According to data from DeFi Llama, Sui's TVL has surpassed $1 billion, rising over 250% in the past two months. Its token price has broken through $1.72, posting a 30-day gain of over 109%.

Beyond the numbers, Sui has also announced major ecosystem developments such as the Grayscale SUI Trust and the upcoming launch of native USDC. These moves have not only heightened expectations for Sui's future but also ignited community enthusiasm for building within the Sui ecosystem:

After all, during the last bull market, Solana’s ecosystem produced high-return applications like Raydium. With the Sui ecosystem heating up rapidly, which project will rise to the occasion and reignite passion across Sui and the broader crypto industry? As the lending protocol NAVI surpasses $400 million in TVL—solidifying its position as the leading DeFi player in the Sui ecosystem—it has become many investors’ top choice for capturing Sui’s wealth-generating potential.

This article aims to offer readers better insights into participating in the Sui ecosystem by analyzing NAVI’s ecological positioning, on-chain data comparisons, and recent catalysts.

Sui TVL Surpasses $1 Billion—NAVI Plays a Key Role

Over the past few months, anyone paying even slight attention to the market couldn’t have missed Sui’s impressive on-chain performance.

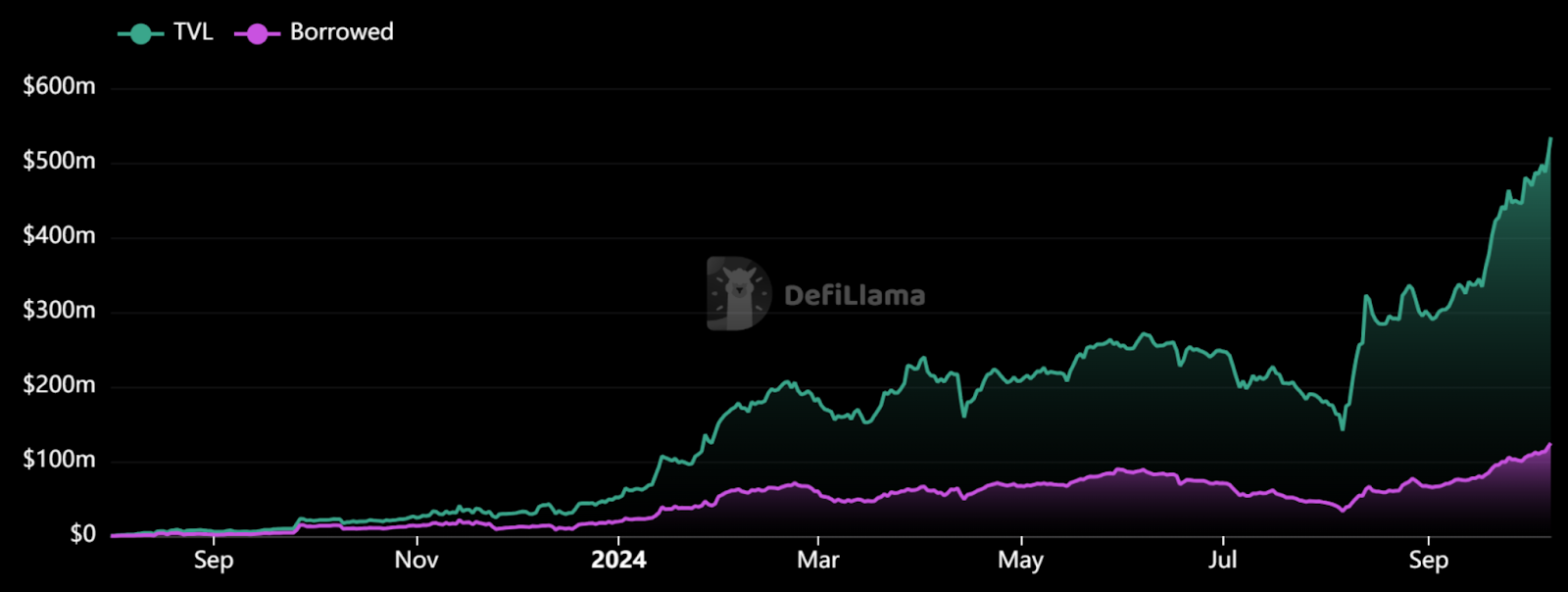

According to DeFi Llama, on August 5, 2024—just two months ago—Sui’s TVL hovered around $500 million. Today, it has surged past $1.3 billion, ranking among the top ten public blockchains (currently eighth), marking a growth of over 250% in just two months.

In fact, since the start of 2024, Sui has demonstrated consistent and robust growth, climbing from nearly zero to a peak of $1.3 billion in TVL—an unprecedented “vertical takeoff” among layer-1 chains in this current cycle.

We know that on-chain activity thrives on ecosystem vitality, with DeFi being a primary driver. Therefore, when analyzing the forces behind Sui’s growth, DeFi stands out as a critical area worthy of deep exploration.

Within DeFi, DEXs, lending protocols, and stablecoins have long been considered the three pillars driving development—indispensable components for healthy ecosystem growth. Particularly, lending protocols, as a core use case in decentralized finance, have already surpassed DEXs in total value locked (TVL), becoming the largest capital-absorbing segment in DeFi.

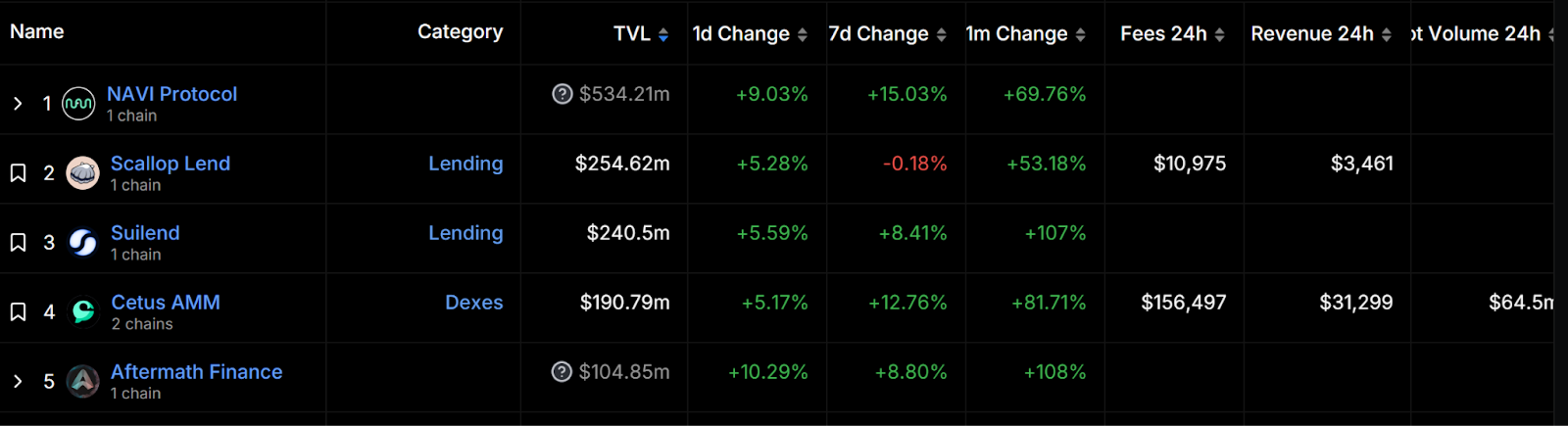

Data from DeFi Llama confirms this trend: the top five projects by TVL in the Sui ecosystem are all DeFi protocols.

From a TVL perspective, NAVI Protocol leads the Sui ecosystem with an overwhelming TVL exceeding $530 million; Scallop Lend ranks second at around $250 million; Suilend follows closely in third with over $240 million in TVL—the gap between second and third is minimal.

Notably, NAVI alone contributes nearly 40% of the entire Sui ecosystem’s TVL, more than double that of the second-place protocol. This highlights NAVI’s competitive edge and solidifies its dominant position within the Sui ecosystem.

Of course, while TVL is an intuitive metric, it can be somewhat broad. For lending protocols, a more meaningful comparison lies in borrowing volume—the total amount of assets users have borrowed through the protocol—which better reflects actual usage and liquidity depth.

In terms of borrowing volume, NAVI’s borrowing volume exceeds $120 million; Scallop surpasses $88 million; Suilend exceeds $57 million. Compared to other lending platforms, NAVI continues to lead in real-world lending activity.

More importantly, according to NAVI’s official website, the platform boasts over 850,000 active users, a massive user base that further reflects strong demand and trust in NAVI’s lending platform.

Historically, a strong lending protocol plays a crucial role in any blockchain ecosystem. It serves not only as a key gateway for capital and traffic but also as a foundational source of liquidity, enhancing capital efficiency and overall liquidity across the ecosystem.

DeFi Llama data shows that the top three TVL projects in the Sui ecosystem are all lending protocols—highlighting the fierce competition within this sector.

Despite intense rivalry, NAVI stands out due to its leadership across multiple metrics—TVL, borrowing volume, and active users. It is widely seen not only as the strongest engine behind Sui’s rapid growth but also as an essential pick for users seeking opportunities within the Sui ecosystem.

Looking beyond surface-level data, let’s dive into the technological innovations and fundamentals behind NAVI’s success. We’ll also examine upcoming milestones for both NAVI and the Sui ecosystem to assess the project’s future growth potential.

Lending + LST: Becoming the One-Stop Liquidity Hub for Sui and Move Ecosystems

Specifically, NAVI’s business consists of two main components:

-

NAVI Lending: The core offering, allowing users to participate as liquidity providers or borrowers in the Sui ecosystem;

-

Volo LST: Through acquiring Volo—the leading liquid staking protocol in the Sui ecosystem—NAVI expands deeply into LST, enabling users to stake SUI tokens and earn vSUI, a liquid staking derivative, to generate additional yield.

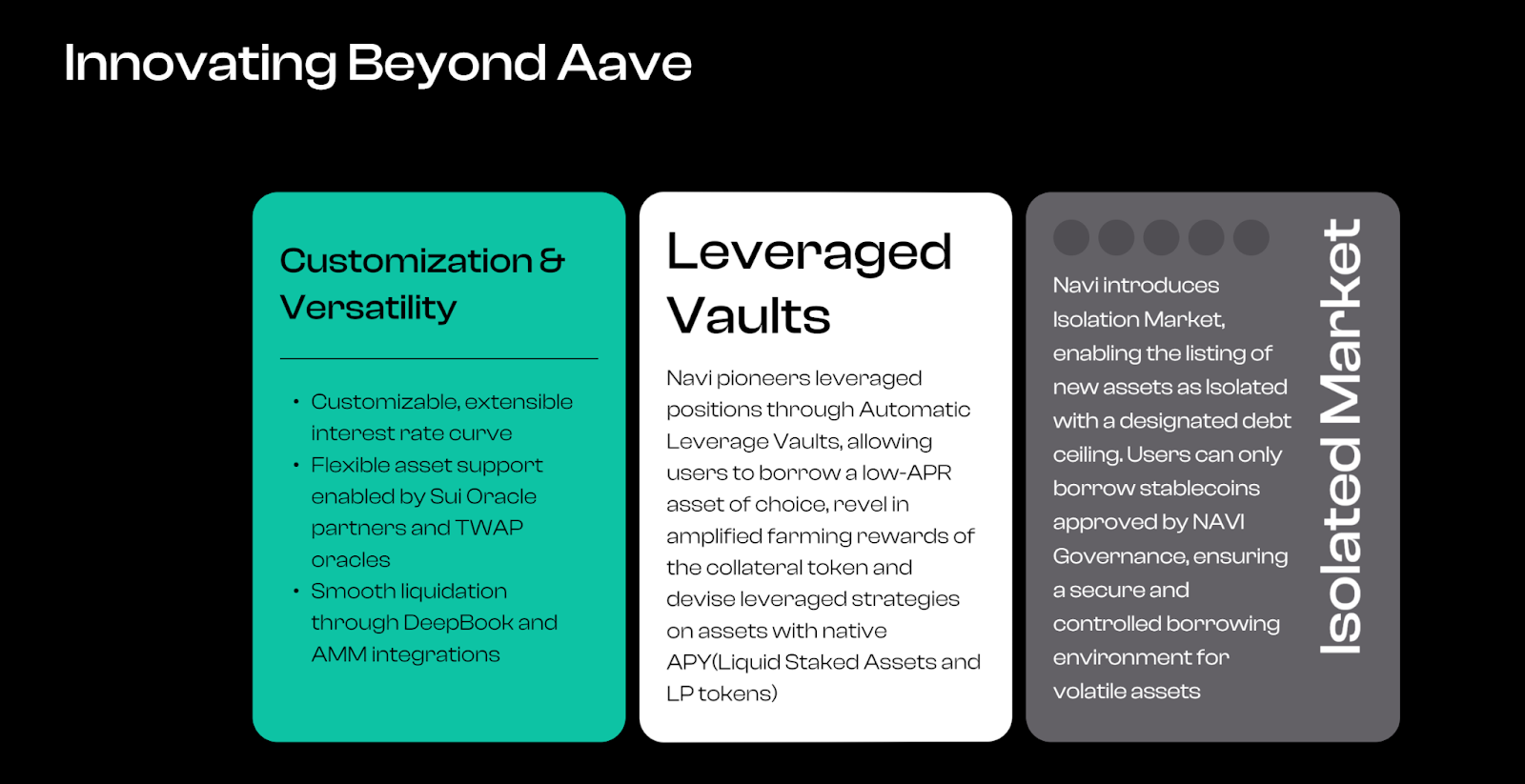

In lending, NAVI has long stood out for higher capital efficiency, stronger security, and superior user experience thanks to innovations like the “Leverage Vault” and “Isolation Mode.”

The “Leverage Vault” offers several features: automated leverage simplifies repeated borrowing to maximize capital utilization; low-interest-rate asset borrowing, high-yield farming returns, and leveraged strategies on native APY assets (such as liquid staking tokens and LP tokens) further enhance capital efficiency and user profits.

The “Isolation Mode” enhances trading safety: new assets must go through NAVI governance approval before they can be used as collateral, allowing users to safely explore new opportunities with minimal risk.

Additionally, NAVI excels in UI design and product functionality: the introduction of the Health Factor (Hf) clearly visualizes users’ borrowing risks; a 24-hour alert system helps users monitor market fluctuations and act promptly; the transaction history feature allows users to easily review all interactions with the NAVI protocol with just a few clicks. Through continuous iterations, NAVI has earned consistent praise from the community for its user experience, enabling it to quickly rise as a top lending protocol in the Sui ecosystem since its launch in 2023.

On the LST front, acquiring and integrating Volo is a clever differentiator that sets NAVI apart from other lending protocols.

We know liquidity is the lifeblood of DeFi, and LSTs exist to unlock it. Since Ethereum’s shift from PoW to PoS sparked the staking narrative, LSTFi has gained significant traction and is now viewed as the next billion-dollar sector.

According to Defillama, Volo currently holds a TVL of $83.7 million, with a single-day record of 891 new stakers in September. By both TVL and number of stakers, Volo leads all LST protocols in the Sui ecosystem.

By acquiring Volo, NAVI integrates both upstream and downstream liquidity, aiming to deliver deeper liquidity, greater composability, and richer yield structures. This allows NAVI users and stakeholders to access larger markets and benefit from cross-vertical synergies.

From a market positioning standpoint, integrating Volo enables NAVI to capture over 30% of Sui’s LST market overnight. This not only expands NAVI’s service footprint but, combined with its lending strength, accelerates NAVI’s path toward becoming a central marketplace for efficient capital flow—marking a breakthrough step toward realizing its vision of becoming the “one-stop liquidity hub” for Sui and the broader Move ecosystem.

Beyond core business logic, several feature upgrades in Q3 2024 further enhanced NAVI’s functionality and user experience, contributing to significant growth in on-chain metrics.

In September, NAVI launched its leverage strategy feature, enabling users to easily apply leverage via one-click operations based on Sui PTB, making participation simpler and returns more attractive.

Earlier in August, NAVI announced “NAVI Pro,” a DApp powered by Mysticeti and Sui’s new consensus algorithm. The product includes a customizable UI, advanced DeFi strategies, improved liquidity management tools, community-building features, and developer onboarding guides—all designed to lower the barrier to entry for Sui DeFi and offer users richer, more sophisticated strategy options.

Since launching these features, NAVI has seen clear growth in new users, transaction activity, and TVL, earning widespread acclaim across the DeFi community.

Beyond product strengths, NAVI has also won favor in the capital markets:

Earlier this year, NAVI announced a $2 million funding round to expand its innovative integrated lending, borrowing, and LSDeFi platform.

The round was co-led by OKX Ventures, dao5, and Hashed, with participation from Mysten Labs, Comma3 Ventures, Mechanism Capital, Coin98 Ventures, Gate.io, and LBank Labs, among others.

Support from renowned VCs not only validates NAVI’s narrative and future prospects but also provides stronger financial and strategic backing, laying a firmer foundation for sustained growth.

Notably, the inclusion of Mysten Labs and OKX Ventures in NAVI’s funding round has generated significant discussion:

On one hand, as the developer behind Sui, Mysten Labs investing in NAVI serves as a strong endorsement of NAVI’s potential within the Sui ecosystem. This support brings not just capital but also technical advantages, enabling better product execution and deeper integration with Sui.

On the other hand, NAVI’s token NAVX is already listed on several tier-2 exchanges and recently announced its launch on Bybit Launchpool and spot trading on October 7. The campaign includes a 2.5 million NAVX reward pool targeted at SUI holders, who can earn rewards by staking NAVX, SUI, or USDC.

Will NAVX make its way to top-tier exchanges next? The community is watching closely. With OKX Ventures’ backing, expectations are high that NAVX could soon list on OKX, unlocking access to OKX’s vast ecosystem resources.

In reality, both Sui and NAVI have maintained strong momentum for months. Yet, in the much-anticipated Q4 of 2024, both are set to achieve several key milestones. Beyond exchange listings, community sentiment remains overwhelmingly bullish, expecting continued rapid growth in the next phase.

Native USDC Coming to Sui—NAVI Poised to Rise Again

One of NAVI’s most anticipated milestones in Q4 is the launch of native USDC on Sui—a key reason the community believes NAVI will maintain its upward trajectory.

At the recently concluded Sui Builder House event in September, Sui announced the upcoming rollout of Circle’s native USDC on its network. Simultaneously, the Cross-Chain Transfer Protocol (CCTP) will launch on Sui—a permissionless on-chain utility that enables verifiable and secure transfers of USDC across blockchains, offering safer and more capital-efficient transactions.

Through this collaboration, Sui becomes the first Move-based chain to support native USDC. As the largest regulated, dollar-backed stablecoin in crypto, USDC’s integration will immediately boost Sui’s utility and interoperability for users and developers alike, significantly improving UX for dApps in DeFi, gaming, DePin, cross-border payments, and enterprise solutions.

As the leading DeFi protocol on Sui, NAVI stands to gain immense benefits from USDC. Most directly, once native USDC launches, major exchanges will enable deposits and withdrawals of USDC on Sui, injecting substantial liquidity into the network. As the dominant liquidity hub in the Sui ecosystem, NAVI will be the go-to platform for users looking to leverage their positions. It will be the first to capture this incoming liquidity, and NAVI’s native token NAVX is expected to receive new utility features to capture revenue generated from this influx.

Beyond USDC, according to its roadmap, NAVI plans to complete full integration with Volo in Q4 2024—another strong catalyst fueling confidence in NAVI’s continued growth.

Given Sui’s remarkable recent growth, many now see Sui as the “next Solana,” expecting it to follow a similar trajectory and produce breakout projects that bring traffic, attention, and wealth effects.

After acquiring LST protocol Volo, NAVI has successfully upgraded its narrative—from a simple lending protocol to a “one-stop liquidity solution” combining lending and LSTFi within the Sui ecosystem. This combination inevitably draws comparisons to Solana’s Kamino + Jito.

Kamino is a lending, liquidity, and leverage protocol built on Solana, while Jito is Solana’s first liquid staking protocol offering both MEV and staking rewards. Both played pivotal roles in Solana’s late-2023 revival, becoming major contributors to Solana’s TVL. Currently, Jito leads with $1.9 billion in TVL, followed by Kamino at $1.6 billion.

For the Sui ecosystem, NAVI + Volo occupy a similar strategic position as Kamino + Jito did for Solana. The synergistic benefits of this model have already been proven on Solana, and given Kamino and Jito’s success, the community now expects multi-fold growth potential for NAVI and Volo.

Notably, according to Volo’s whitepaper, the protocol plans to issue a governance token in the future, currently in a “blind mining” phase. Long-term SUI holders can deposit into Volo to qualify for potential airdrops—adding further incentive for users to engage with NAVI and Volo.

Of course, with NAVX (NAVI’s native token) already surging 211.5% over the past 30 days, some may wonder: Is it still a good time to get in?

On-chain data may largely answer this concern.

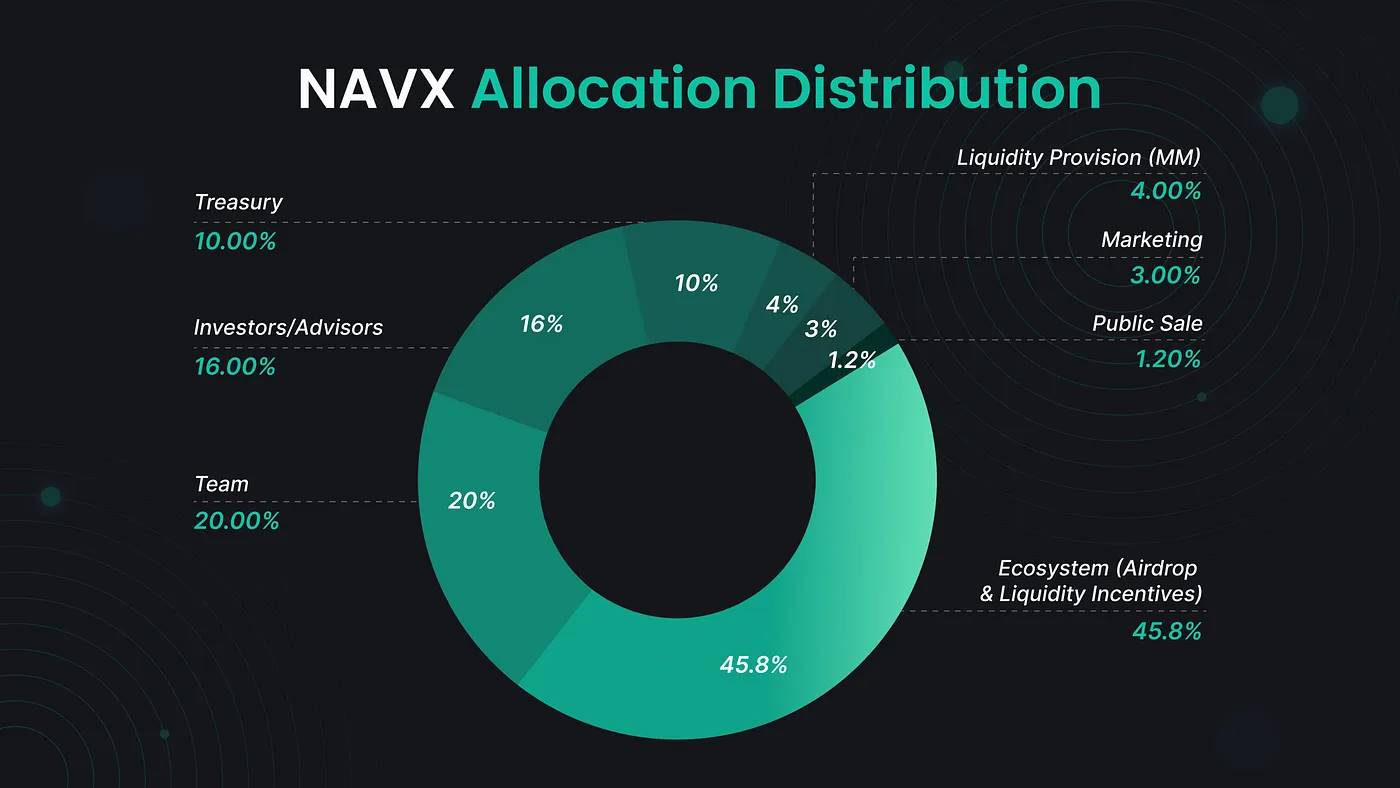

As NAVI’s native token, NAVX has a total supply of 1 billion, with use cases in governance, incentives, and protocol fee sharing. Its allocation is as follows:

According to Coingecko, despite NAVX’s 211.5% gain over the past month, consider this:

Take Cetus, the top TVL DEX in the Sui ecosystem. NAVI’s TVL is around $530 million, while Cetus sits at $190 million—a nearly threefold difference.

Yet, in terms of market cap, NAVX stands at ~$42 million, compared to Cetus’ ~$55 million.

This misalignment suggests strong upside potential for NAVI, reinforcing its status as a top choice for Sui ecosystem exposure.

Conclusion

On October 7—the day this article was written—Sui’s token price surged another 20%, now trading at $2.10. Sui’s continued upward momentum is evident, raising community expectations for top projects within its ecosystem. On the same day, NAVI’s native token NAVX rose 14.3%, showcasing early signs of its wealth-generation potential as the undisputed leader in the Sui ecosystem.

Through smart product design, the narrative upgrade from acquiring Volo, and strong ecosystem dominance, NAVI’s ambition is clear: it does not aim to merely ride Sui’s growth wave, but to become a key driver of Sui’s high-speed expansion through innovation, growing on-chain metrics, and strong market performance.

With native USDC coming to Sui, full Volo integration underway, and more milestones on the horizon, NAVI’s vision of becoming the go-to liquidity hub for Sui and the Move ecosystem is increasingly within reach.

Faced with such a vibrant Sui and NAVI, are you still lamenting this cycle as dull and uneventful?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News