The Long-Tail Effect of Solana's Liquid Staking, Seen Through Sanctum

TechFlow Selected TechFlow Selected

The Long-Tail Effect of Solana's Liquid Staking, Seen Through Sanctum

Sanctum drives LST adoption on Solana through a unique approach that is markedly different from Ethereum.

Author: Sonya Kim

Translation: TechFlow

Background (LSTs on Solana vs. Ethereum)

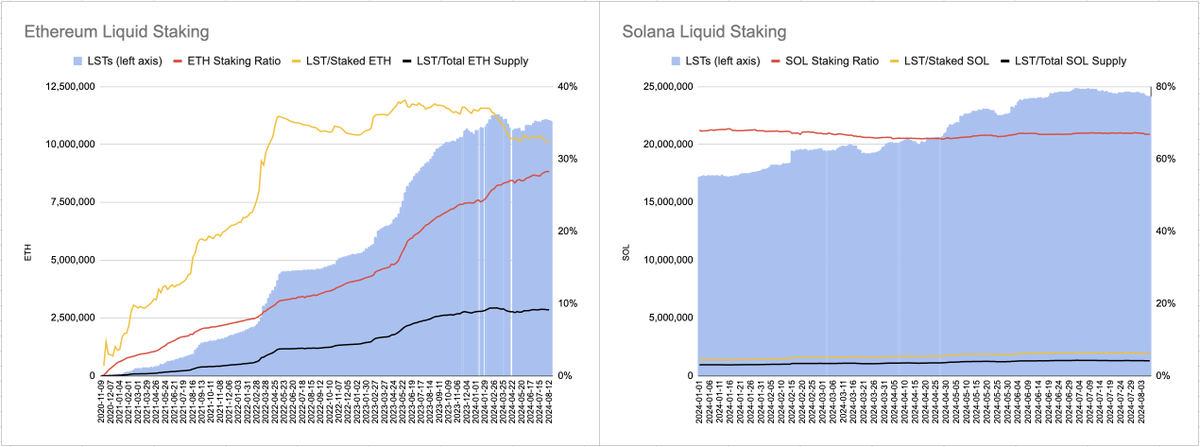

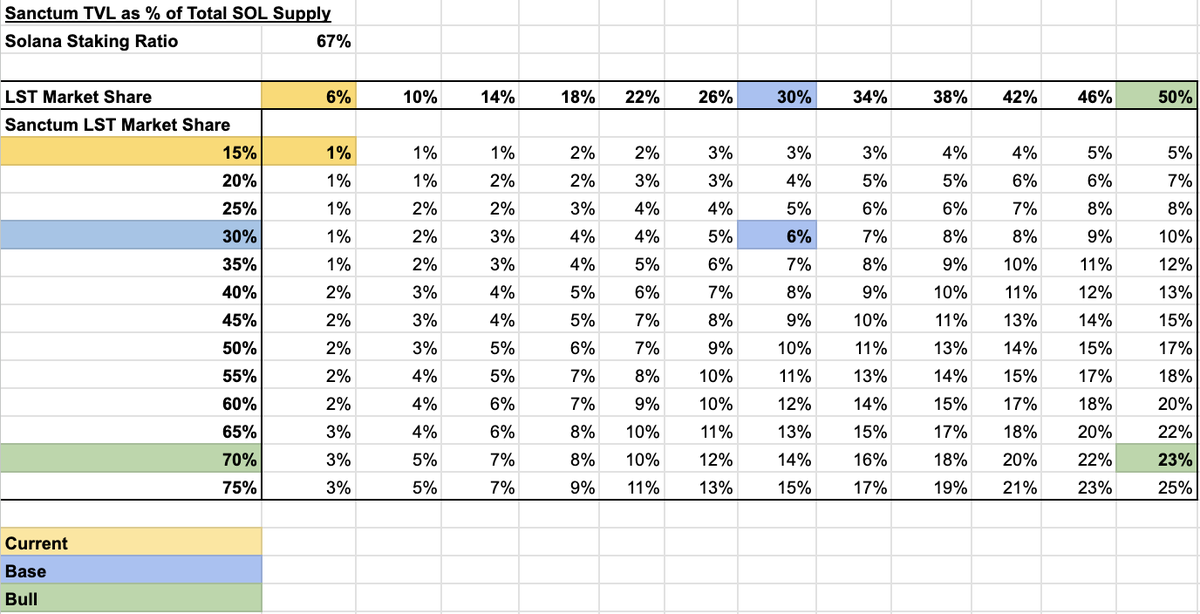

Historically, liquid staking tokens (LSTs) on Solana have been less successful than those on Ethereum. For example, Lido attempted to expand onto Solana but exited in October 2023 due to lack of user traction. On Ethereum, LSTs hold a higher market share, accounting for 32% of all ETH staked. With about 28% of ETH supply staked, LSTs represent less than 10% of ETH's total market cap. In contrast, while Solana has a much higher staking ratio—reaching 67%—LSTs only account for around 6% of staked SOL, representing just over 4% of the total SOL market cap.

Source: Dune Analytics (hildobby_, andrewhong5297, 21shares)

The relatively low market share of LSTs on Solana may be attributed to several factors:

-

Lower friction in native staking on Solana: On Ethereum, the presence of queuing mechanisms for staking and unstaking makes liquidity and LSTs highly valuable, as entry and exit times are uncertain. In contrast, Solana’s native staking features a ~2.5-day activation/deactivation cycle, resulting in lower friction. This reduces the relative advantage of LSTs compared to regular staking.

-

Less mature lending markets on Solana: While Ethereum’s market cap is 3.8x that of Solana, Aave—the largest lending protocol on Ethereum—has 8.5x the total value locked (TVL) of Kamino, Solana’s largest lending protocol. The relative immaturity of lending protocols on Solana means leveraged staking via LSTs is not as widely adopted as it is on Ethereum.

LSTs on Solana

-

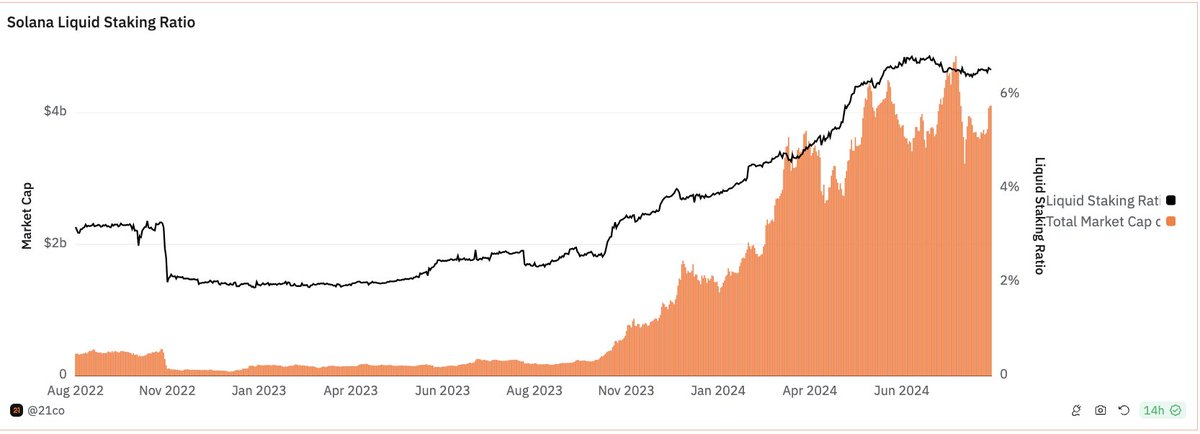

Despite lagging behind Ethereum in LST development, Solana’s LST ecosystem is growing from a smaller base.

-

Since Q1 2023, LSTs’ market share has increased from under 2% of total staked SOL to over 6.5% today.

-

This growth has been largely driven by Jito, whose market share has surged from zero two years ago to nearly 50% today. In comparison, mSOL (Marinade), once the market leader, has lost some ground.

Source: Dune Analytics (21shares)

Source: Dune Analytics (21shares)

-

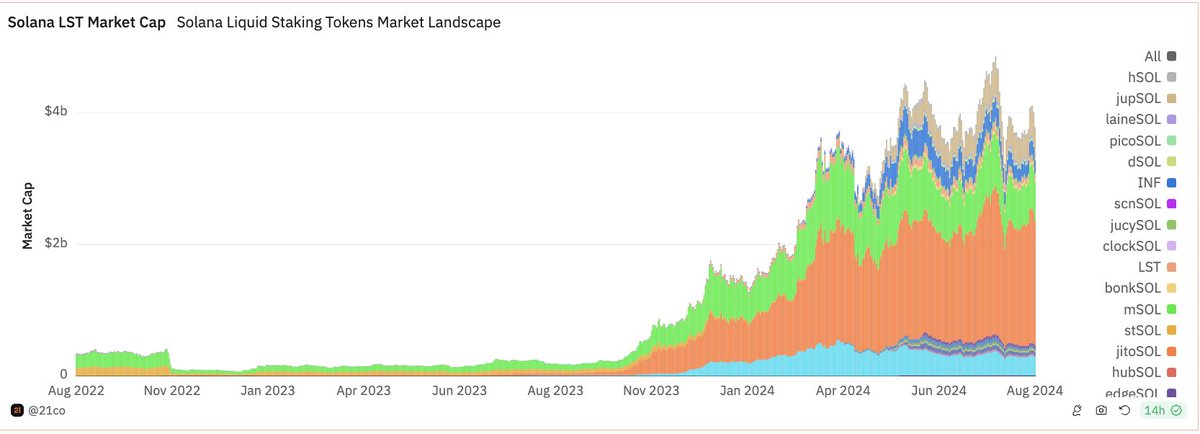

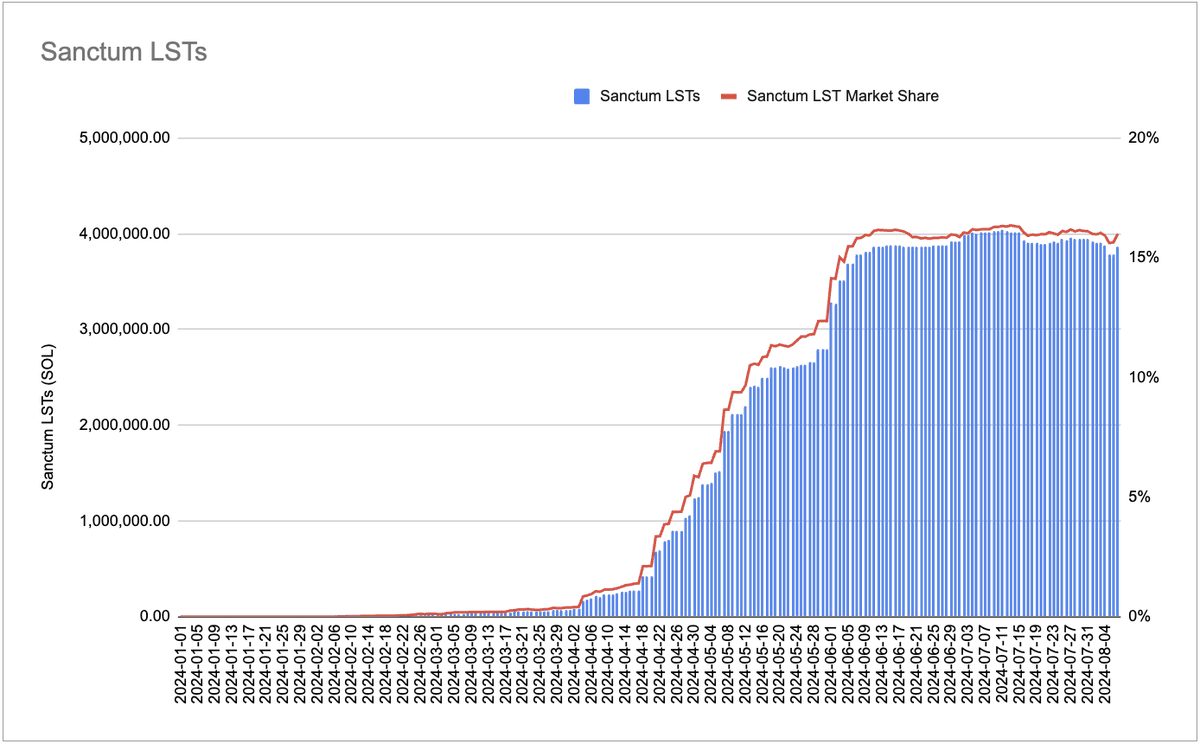

What isn't immediately visible from the charts above is that Sanctum has grown its LST market share from 0 to over 16% since launching its protocol in Q1 2024. Sanctum is a liquid staking protocol enabling the creation, trading, and management of LSTs.

-

To date, Sanctum has launched approximately 20 LSTs, including those linked to major Solana projects such as Jupiter (jupSOL), Helius (hSOL), Bonk (bonkSOL), and dogwif (wifSOL). This week, Binance (BNSOL), Bybit (BBSOL), and Bitget (BGSOL) announced plans to launch their own SOL LSTs through Sanctum.

-

According to DefiLlama, Sanctum ranks among the top six protocols on Solana with over $700 million in total value locked (TVL). With upcoming LST launches from top centralized exchanges (CEXs), I expect TVL to continue rising. Notably, Binance is the fourth-largest staking provider on Ethereum (after Lido, Coinbase, and EtherFi), holding around 4% market share.

Source: Dune Analytics (21shares)

What is Sanctum?

Sanctum is a protocol designed to simplify the launch of LSTs on Solana. It envisions an “infinite LST future” with thousands of possible LSTs.

Through three distinct products, Sanctum addresses liquidity challenges faced by LSTs, enabling any LST—regardless of size—to interact with other LSTs or SOL with minimal friction.

-

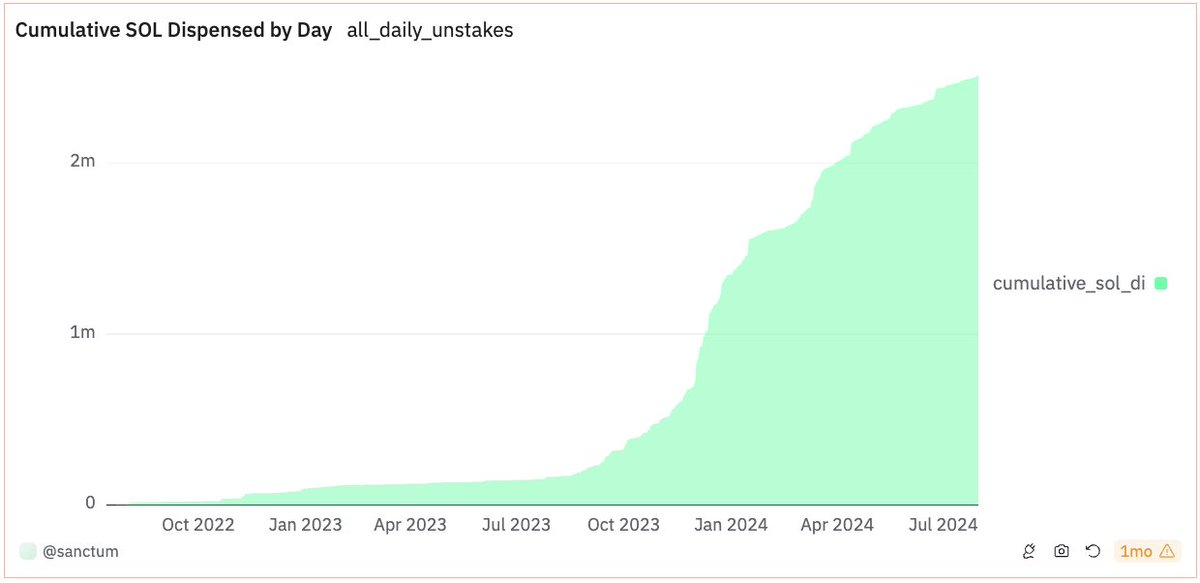

Reserve: A pool of approximately 400,000 idle SOL that allows users to instantly swap LSTs for SOL at a small fee, bypassing the one-epoch waiting period. This acts as a safety net for DeFi protocols integrating any LST (large or small) as collateral. Since July 2022, a total of 2.5M SOL has been unstaked via the Reserve, with average daily usage below 1%.

Source: https://dune.com/sanctum/sanctum

-

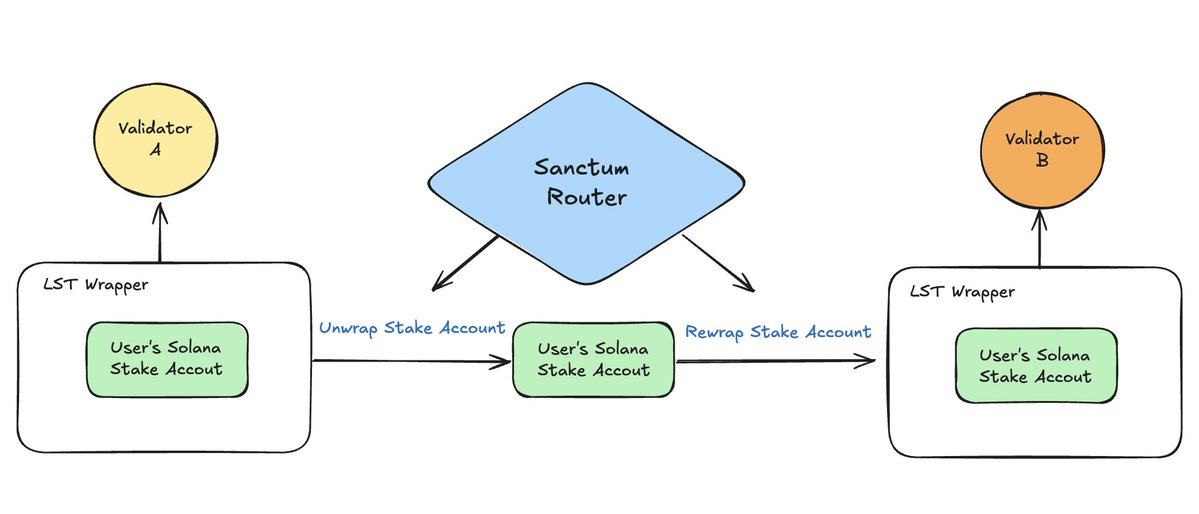

Router: A tool enabling zero-slippage LST-to-LST swaps, leveraging Solana’s Stake Account design. When users stake, a Stake Account is created and delegated to a validator to earn rewards. Solana LSTs are essentially SPL token wrappers around these Stake Accounts. Behind the scenes, when a user swaps from one LST to another, the Sanctum Router automatically undelegates and unwraps an active Stake Account, then re-wraps it and re-delegates it to a new validator. This mechanism enables LST-to-LST swaps without requiring liquidity pools. The Sanctum Router is integrated into Jupiter.

Solana’s LSTs are effectively liquid versions of users’ staking accounts. This means LSTs on Solana are semi-fungible.

-

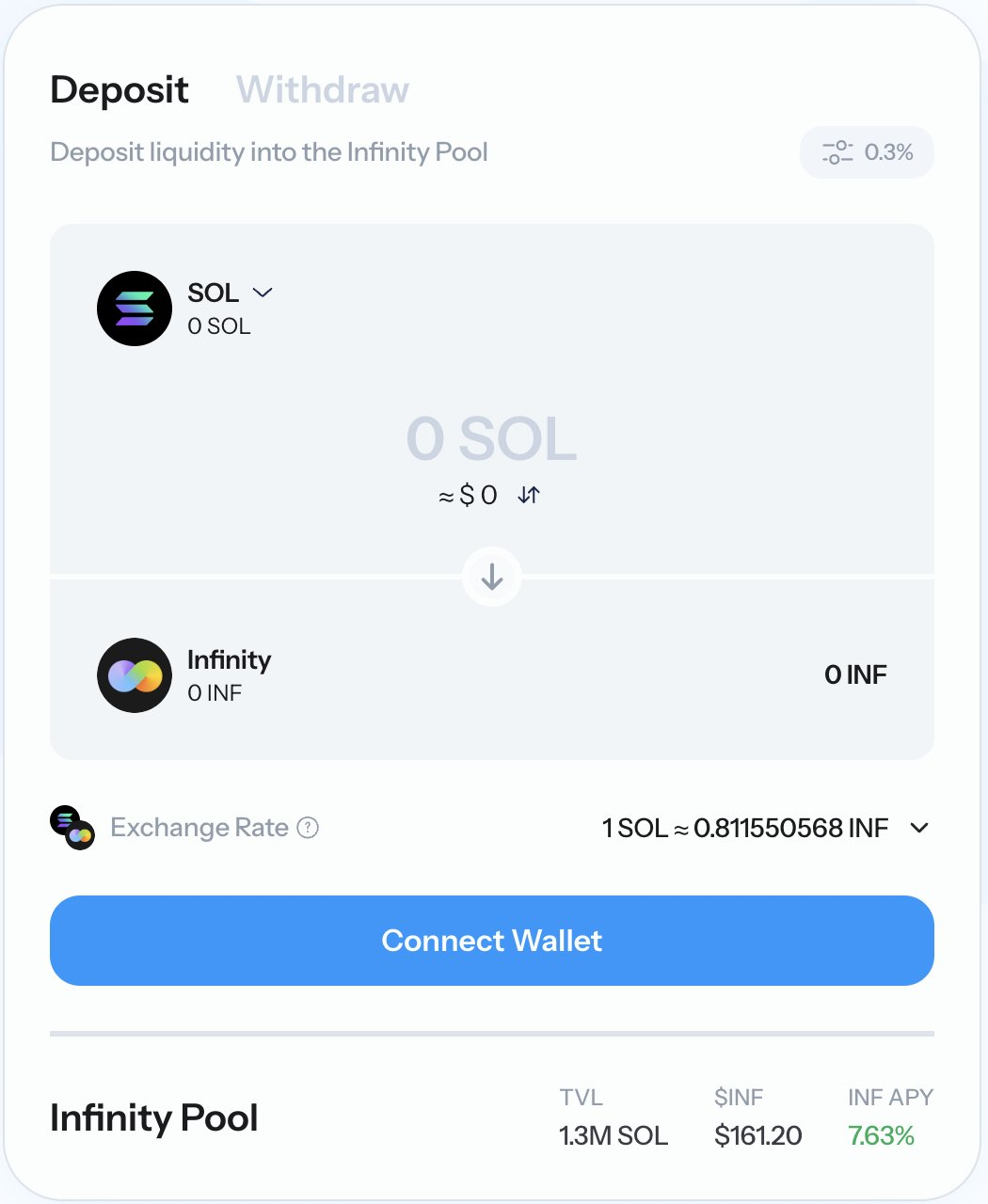

Infinity is a liquidity pool composed of Sanctum-approved LSTs, allowing swaps between any included tokens within the pool. Liquidity providers deposit LSTs into the pool in exchange for INF Tokens. The INF Token itself is also an LST, meaning it can be used across DeFi and earns both underlying LST staking rewards and pool trading fees. Currently, INF offers an annual percentage yield (APY) of 7.63%, slightly higher than JitoSOL’s 7.59% and the estimated network-wide APY of 7.34%.

Source: Sanctum

Why Launch a Sanctum LST?

Through Reserve, Router, and Infinity, Sanctum has built a unified liquidity layer that lowers liquidity barriers for long-tail LSTs. So why would someone want to launch a Sanctum LST?

Potential motivations include:

-

Revenue generation: LSTs can choose to charge a fee on total value locked (TVL) or on staking rewards.

-

Stake-weighted Quality of Service (SwQoS): SwQoS is an anti-Sybil mechanism currently being discussed in the Solana ecosystem. It ties stake weight to transaction priority. If implemented, a validator with 1% of staked supply would be allowed to send up to 1% of packets to leaders, giving high-stake validators greater inclusion chances. This model incentivizes high-volume projects (e.g., Jupiter) to accumulate more stake via LSTs to improve service quality for their users.

-

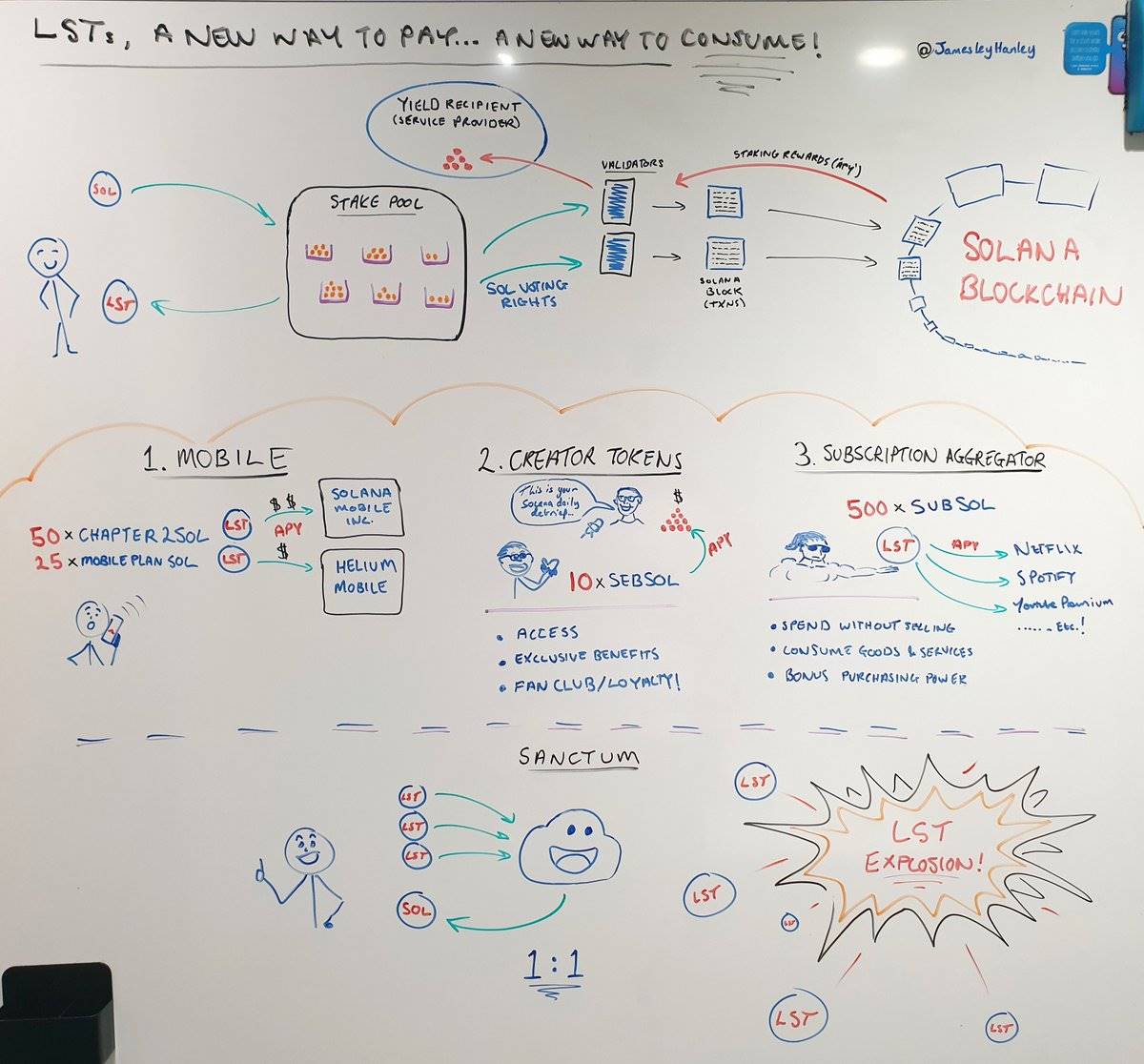

Identifying communities, users, and fans: Sanctum is developing a second version called Sanctum Profiles, aiming to build a "composable social and loyalty layer" on Solana. The vision is for anyone—individuals, projects, or enterprises—to launch personalized LSTs. These LSTs function similarly to NFTs (or social tokens), granting access to exclusive features, rewards, or subscriptions. The design space is vast. As JamesleyHanley noted in a post, staking rewards could be redirected to the LST issuer to fund specific services or products for holders.

Source: JamesleyHanley

Sanctum ($CLOUD) Value Accrual Path

-

The project is still in early stages, primarily focused on increasing TVL of Sanctum LSTs. Recent partnerships with Tier-1 centralized exchanges (CEXs) suggest strong product-market fit across both DeFi and CeFi.

-

Intuitively, future monetization strategies may include: 1) turning on fee switches to monetize liquidity interactions (including Reserve, Router, and Infinity), and/or 2) charging a small fee on LSTs. The first strategy depends on interaction volume (potentially unlimited upside), while the second relies on total TVL of Sanctum LSTs (capped by SOL’s market cap).

-

TVL Model: If Solana’s LST market share reaches Ethereum’s level and Sanctum captures a share comparable to Lido’s, Sanctum’s TVL could grow from ~1% of SOL supply today to 6%—a 6x increase. If V2’s concept of personalized LSTs as a social and loyalty layer gains broader adoption, the upside potential could be even greater.

-

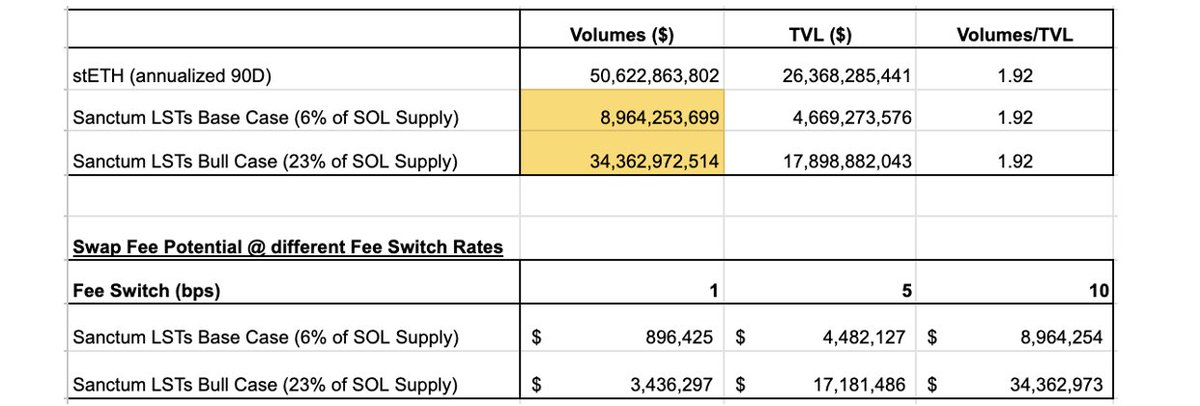

Interaction Volume Model: While LST interaction volumes are hard to model precisely, we can draw insights from Lido’s stETH. Annualized 90-day on-chain volume for stETH is $50.6B, roughly 1.9x its current TVL. Using this ratio, Sanctum’s annualized transaction volume could reach ~$9B in a base case and ~$34B in a bull case. From there, we can estimate potential protocol revenue by assuming Sanctum charges 1, 5, or 10 basis points on LST-to-SOL or LST-to-LST interactions.

Source: Artemis.xyz, Dune Analytics

-

$CLOUD currently trades at $0.265, implying a $48M market cap (MC) or $265M fully diluted valuation (FDV). Given anticipated TVL growth from recently announced Tier-1 CEX LSTs and clear paths to monetization via DEX maturity, I believe Sanctum represents a compelling liquidity investment opportunity at current valuations.

Conclusion

-

Sanctum is driving LST adoption on Solana through a unique approach fundamentally different from Ethereum. By leveraging Solana’s stake account architecture, Sanctum integrates liquidity for long-tail LSTs—a stark contrast to Ethereum’s winner-takes-all LST market dominated by liquidity moats from leaders like Lido.

-

Recent partnerships with top-tier CEXs suggest significant potential for TVL growth in both Sanctum and the broader Solana LST market.

-

The upcoming V2 launch of Sanctum Profiles will further expand the application potential of LSTs. The use cases for personalized LSTs are broad, especially regarding customizable staking rewards.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News