On-Chain Analysis of the Liquid Staking Sector: TechFlow, Lido, Marinade, Tonstakers, and Stader

TechFlow Selected TechFlow Selected

On-Chain Analysis of the Liquid Staking Sector: TechFlow, Lido, Marinade, Tonstakers, and Stader

The total value locked (TVL) in the liquid staking market has exceeded $50 billion.

Author: OurNetwork

Compiled by: TechFlow

Liquid Staking

Sanctum, Lido, Marinade, Tonstakers, and Stader

Over $50 billion locked in liquid staking protocols

-

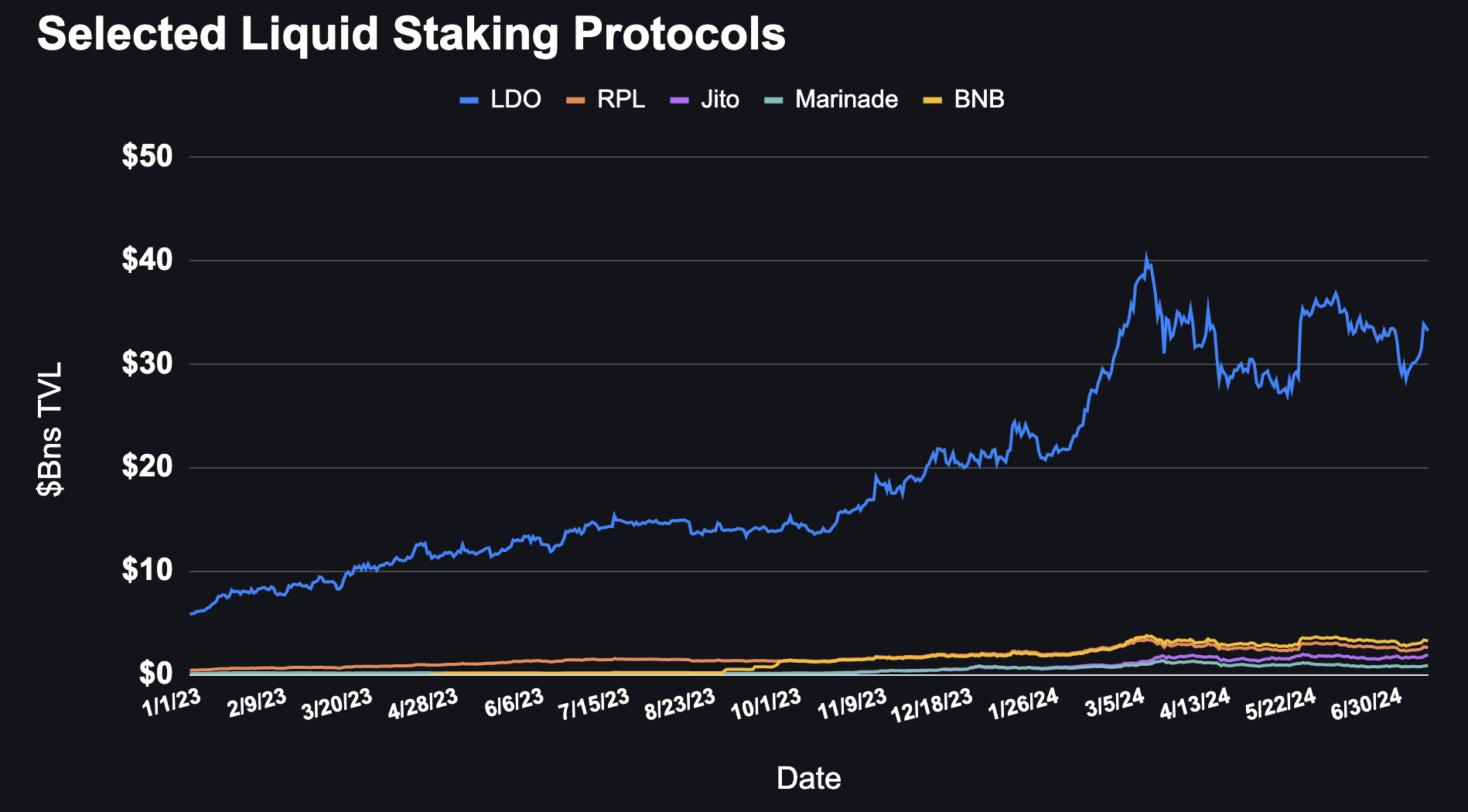

Liquid staking is one of the most widely used features in crypto, enabling DeFi opportunities for users. As more Proof-of-Stake blockchains launch, liquid staking solutions emerge almost immediately, offering users flexibility in how they stake. Driven by new chain launches, rising ETH prices, and increasing adoption of liquid staking tokens (LSTs), the total value locked (TVL) in liquid staking has surpassed $50 billion. Over the past year, liquid staking activity has surged significantly on Solana, TON, and Ethereum.

DeFi Llama

-

Lido remains the dominant liquid staking protocol with an impressive TVL of $33 billion—over eight times larger than the second-largest protocol, Rocket Pool. The liquid staking market continues to exhibit a power-law distribution. Two Solana-based protocols made the top ten: Jito accumulated $1.8 billion in TVL, while Marinade Finance reached approximately $850 million.

Artemis Analytics & DeFi Llama

-

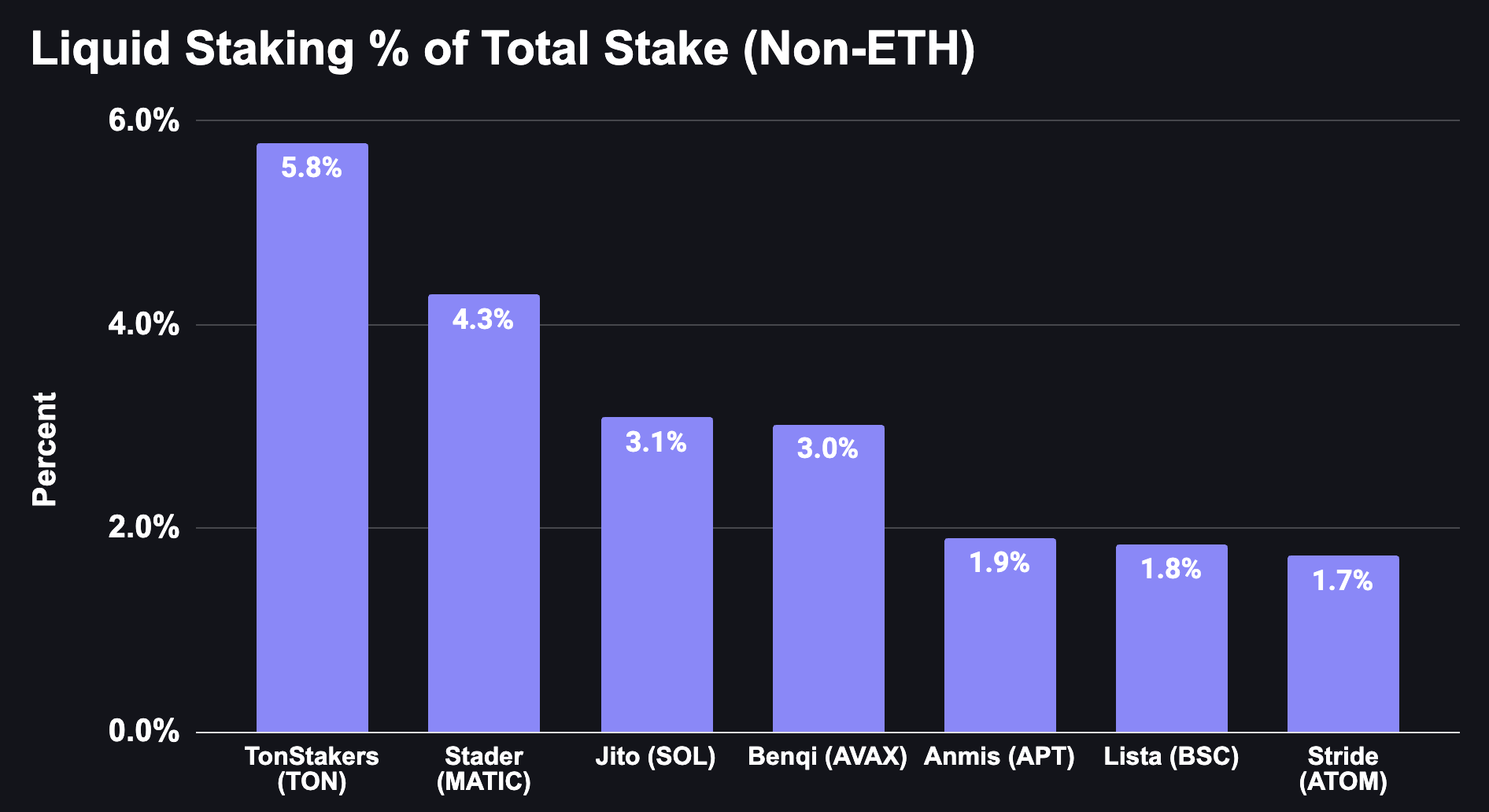

Outside of Ethereum, penetration of liquid staking providers remains low, indicating significant room for growth. Tonstakers has staked nearly 6% of all TON, signaling strong demand for TON staking products. While Solana staking products have seen notable inflows over the past year, the overall staking ratio remains relatively low.

stakingrewards.com

① Sanctum

Sanctum's Wonderland increased LST trading volume on Solana by 25%, now exceeding 25 million SOL

-

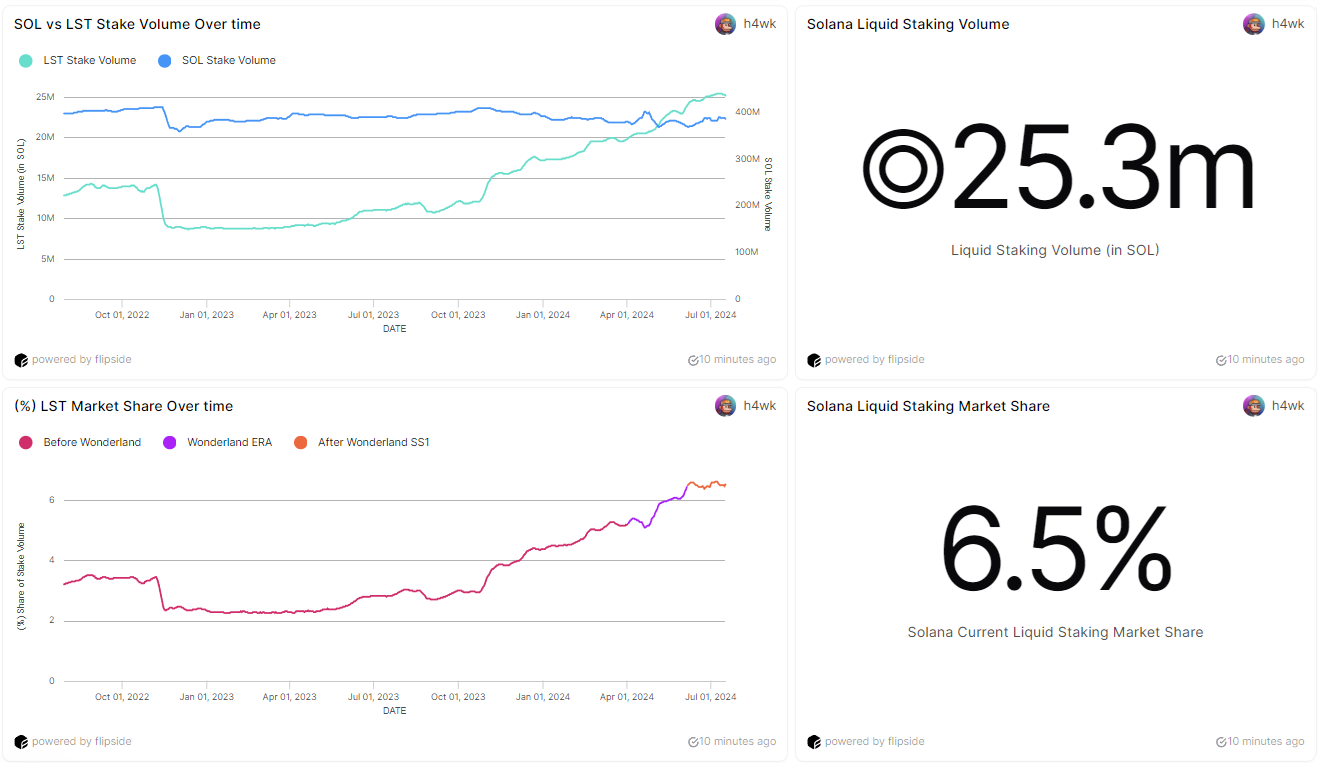

Sanctum Infinity is the only liquidity pool capable of natively supporting millions of different LSTs. Wonderland allowed users to hold LSTs to earn pet experience points (XP) and contribute to the CLOUD airdrop campaign as of July 18, 2024. This event boosted LST trading volume on Solana, increasing its share from 5.2% to 6.5%, with total volume surpassing 25 million SOL.

Flipside - @h4wk

-

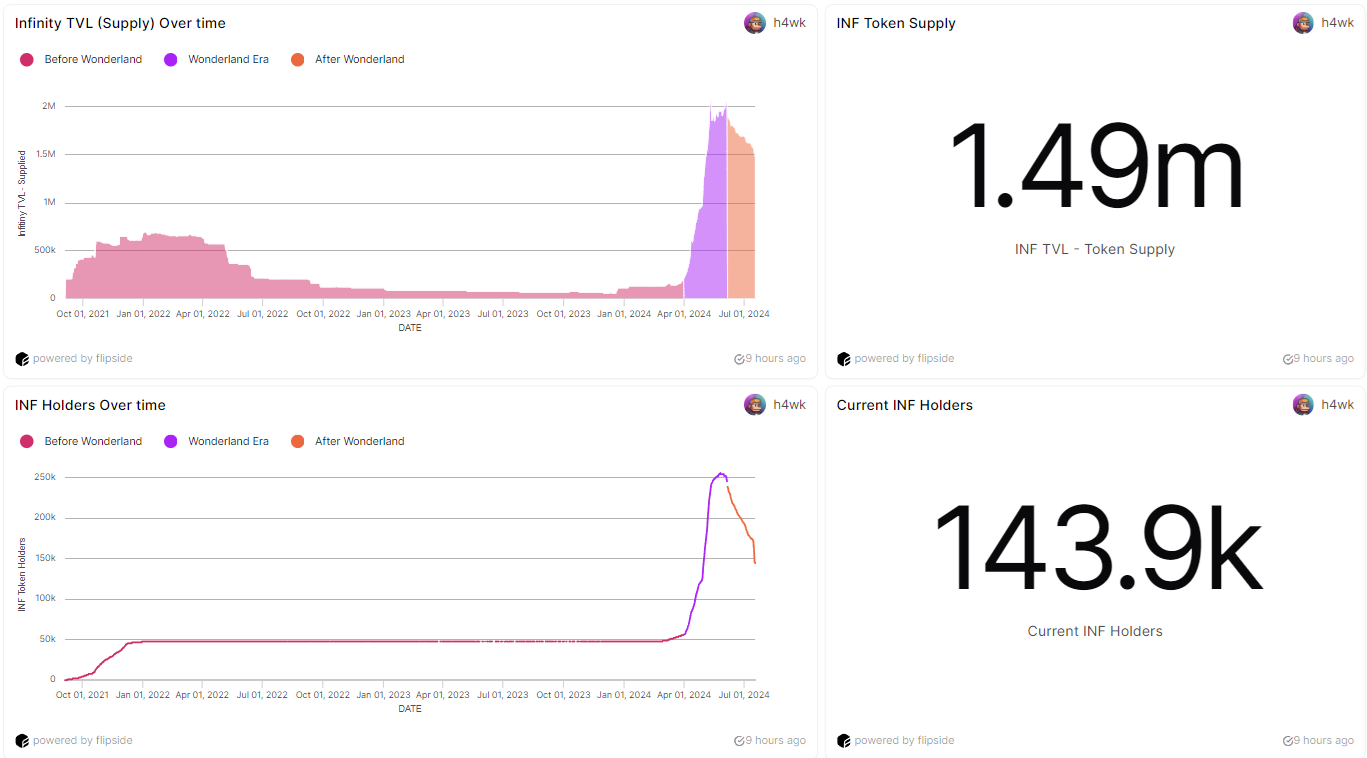

Even after the campaign ended, the INF token remains popular among Sanctum users. Currently, INF supply remains around 1.5 million, with over 140,000 holders. Both figures declined slightly after Season One concluded. Announcement of Wonderland Season Two indicates it will launch later this year.

Flipside - @h4wk

-

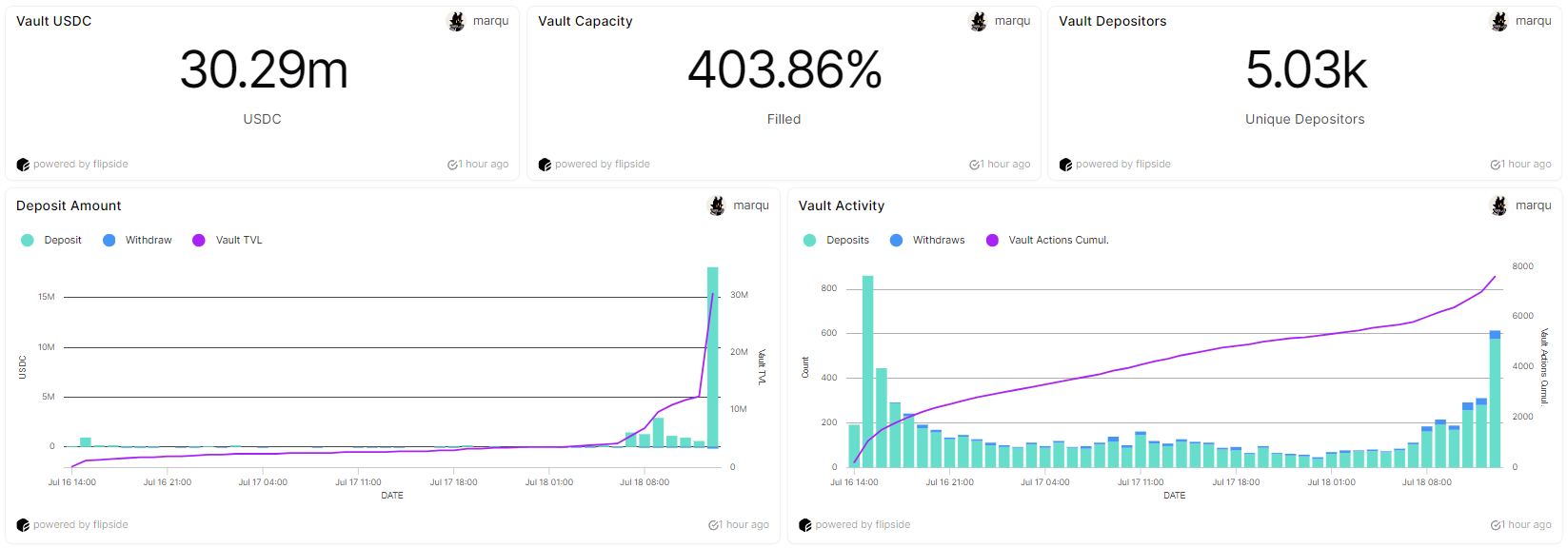

Prior to CLOUD’s launch, 5,000 investors committed 30 million USDC into the CLOUD Alpha Vault, oversubscribing by 400%. 60% of the volume came in the final hour, highlighting strong project popularity and trader anticipation.

Flipside - @marqu

② Lido

Steakhouse Financial | Website | Dashboard

stETH price highly correlated with CME ETH futures

-

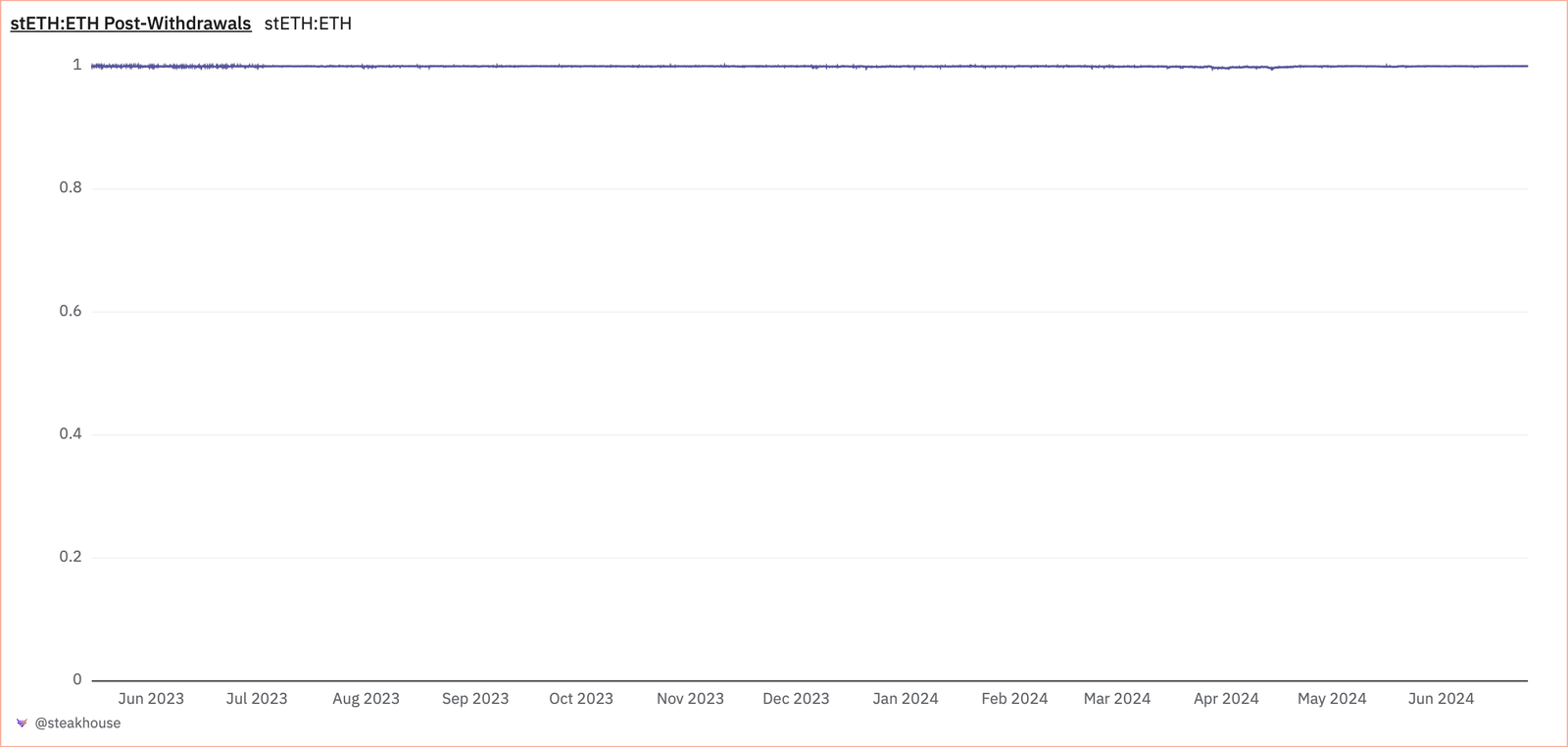

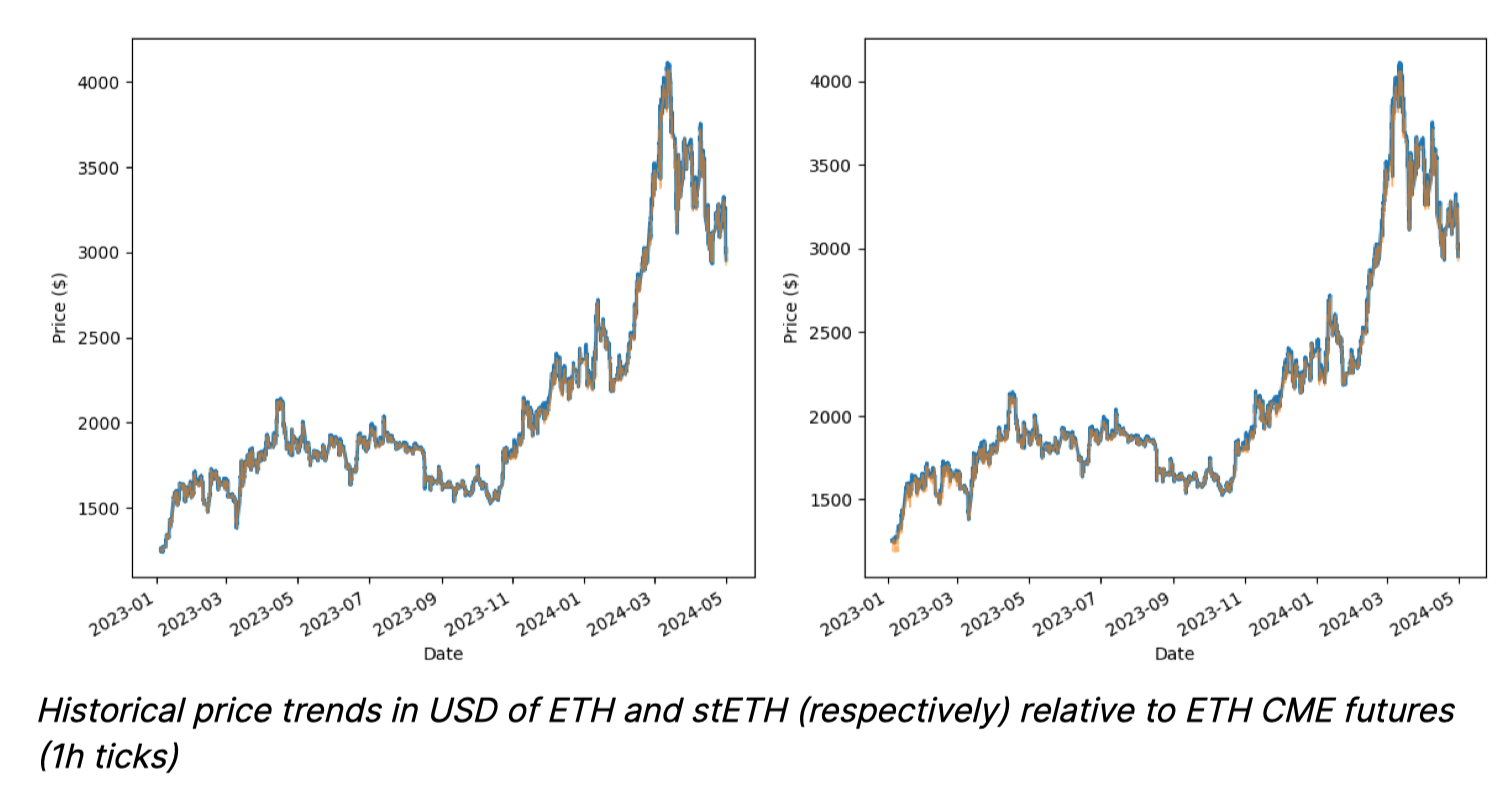

Steakhouse analyzed stETH’s suitability as underlying collateral for Ethereum staking ETFs and found that stETH price is highly correlated with CME ETH futures, with relatively tight bid-ask spreads relative to market cap. We examined three questions: Can stETH trade fairly and support efficient redemption and subscription markets? Can stETH be traded without control by a small number of individuals or entities? What is the total return profile offered by stETH as an ETP underlying asset?

Dune Analytics - @steakhouse

-

For stETH data, Steakhouse used TradingView’s API to obtain centralized exchange (CEX) pair data for stETH/USD. For ETH commodity futures data, we relied on CME tick-level historical data. For ETH spot price, we used Coinbase data delivered via TradingView API. Our Python notebooks are available on GitHub. We explored long-term correlation trends, the timeframe since withdrawals opened, and short-term detailed market reactions.

Steakhouse Financial’s economic analysis of stETH performance in ETFs

③ Marinade

Marinade | Website | Dashboard

Marinade’s total staked amount up 26% year-on-year

-

The Stake Auction Marketplace (SAM) is a key feature of Marinade v2, creating a public auction platform for stake among validators. This allows Marinade stakers to access priority fees such as MEV tips and transaction fees, which were previously accessible only to validators.

Twitter - @MarinadeFinan

-

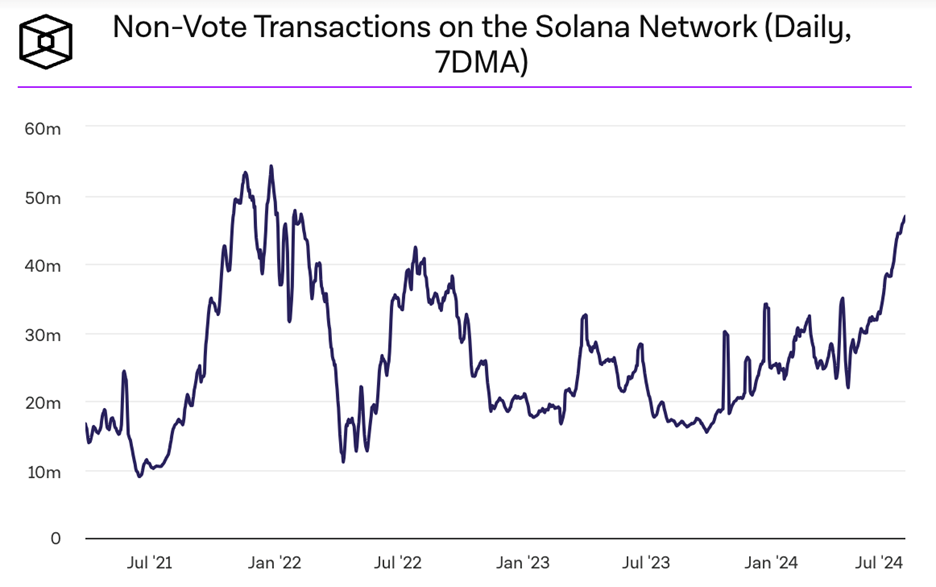

Solana’s network growth is accelerating. As usage increases, validators earn more revenue from MEV and transaction fees. This makes staking more valuable and enables Marinade to create an on-chain marketplace to redistribute maximum rewards back to stakers.

The Block

-

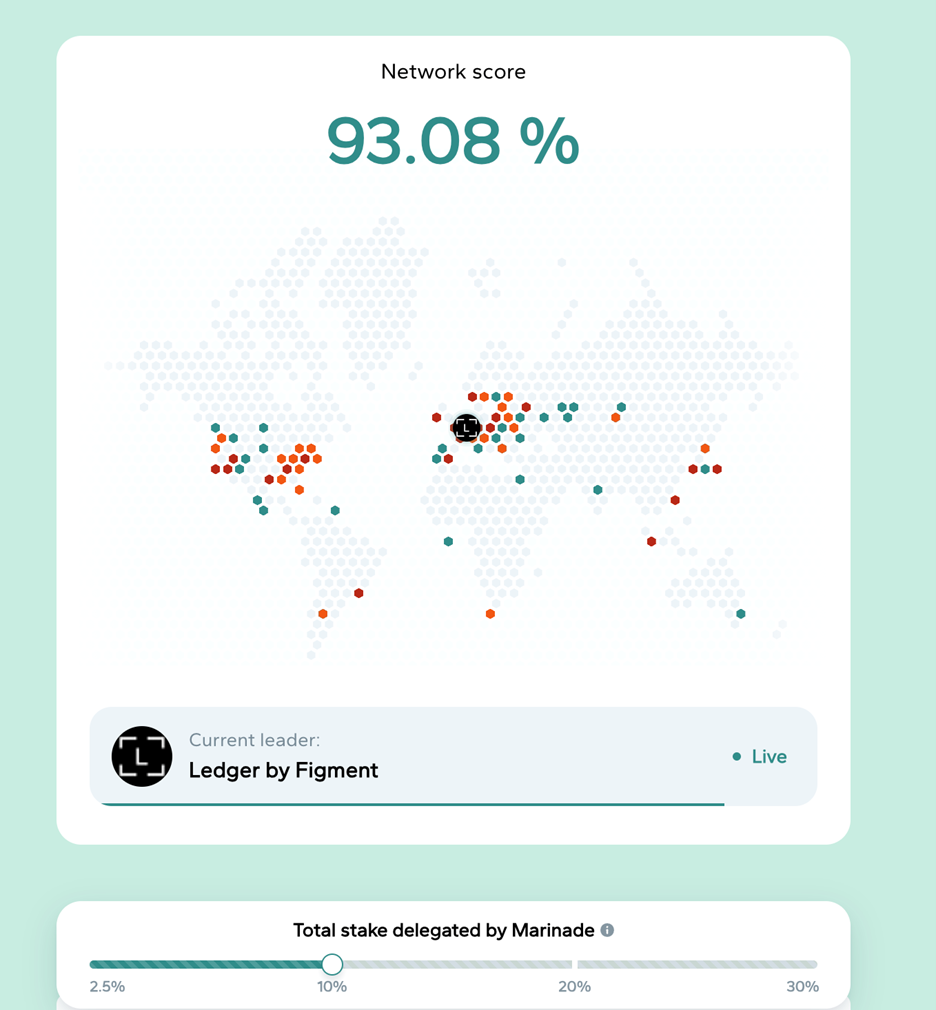

Marinade will soon update its delegation strategy to enhance decentralization of Solana’s security. Starting August 14, 90% of stake will be delegated based on SAM results, 10% based on MNDE voting, and the rebalancing cap per epoch will increase from 2% to 5%. Currently, about 2% of SOL staked is delegated through Marinade. If this rises to 10%, validator performance would improve from 72% to 93%, positively impacting decentralization.

-

Trade-level Alpha: Last month, a user deposited 30,000 SOL (worth over $4.1 million at the time) into Marinade’s liquid staking in a single transaction. Overall, Marinade’s staked SOL has increased by approximately 2.85 million over the past 15 months, representing a 57% growth.

④ Tonstakers

Maksim Ratnikov | Website | Dashboard

First liquid staking protocol on TON, TVL exceeds $250 million, DAU surpasses 70,000

-

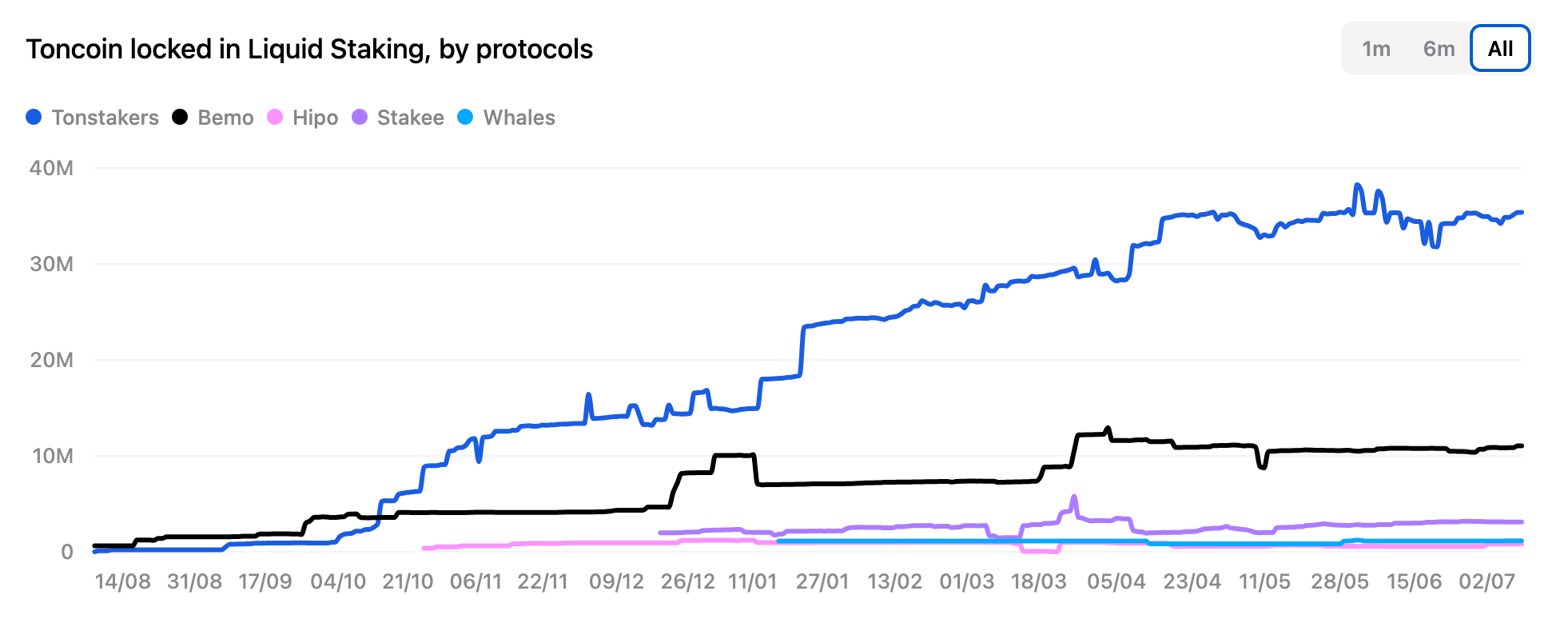

Tonstakers accounts for 69% of the total value locked (TVL) in liquid staking tokens (LSTs) on TON. Tonstakers is a liquid staking protocol within The Open Network (TON) ecosystem. It employs a clever compounding mechanism, reinvesting yields approximately every 18 hours to maximize annual percentage yield (APY), while protecting users from slashing penalties. Yearly USD-denominated deposit value grew 12,400% year-over-year (from $2 million to over $250 million). In 2024, Tonstakers reached 1 million subscribers on its Telegram channel, with daily active users (DAU) growing from around 20,000 to over 75,000—a 700% YoY increase.

TON Stat

-

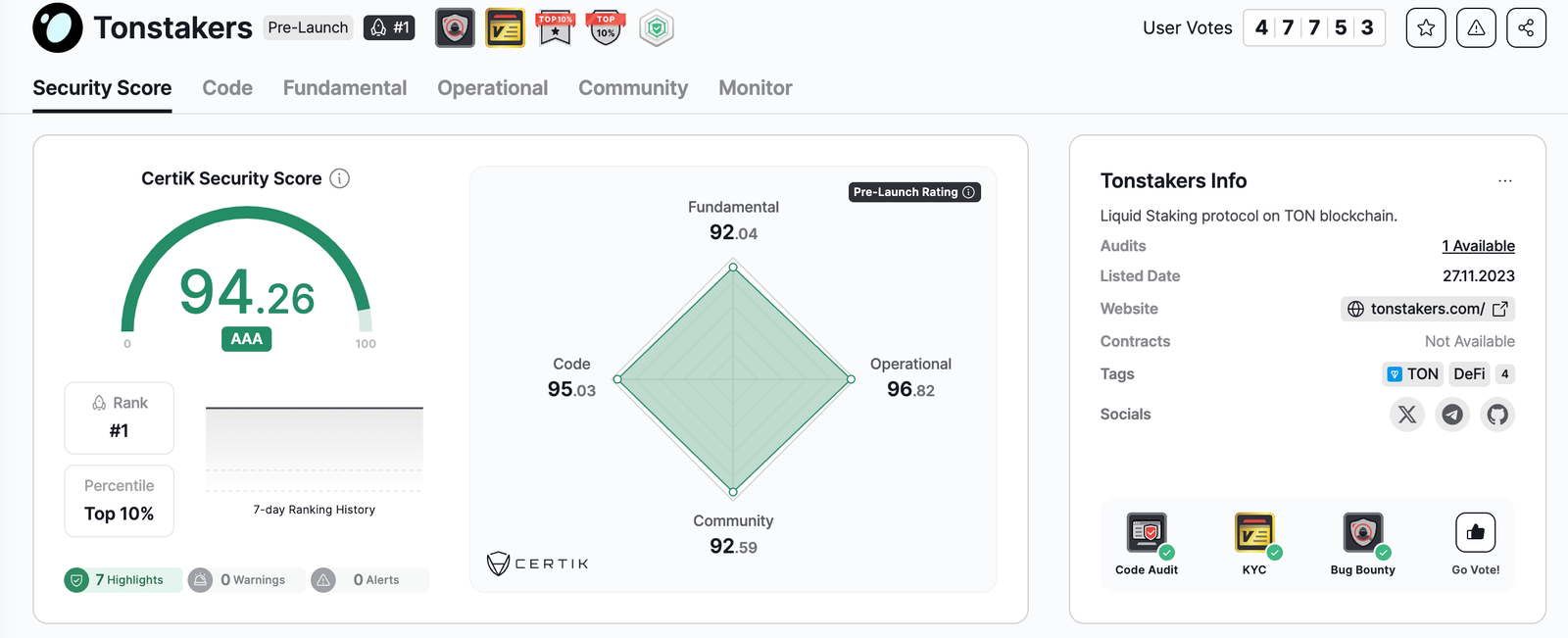

At the beginning of 2024, Tonstakers passed a comprehensive security audit by Certik, scoring 94 out of 100 (AAA rating). This makes Tonstakers the most secure project on the TON blockchain and maintains a clean record with no security incidents during operations.

skynet.certik.com

-

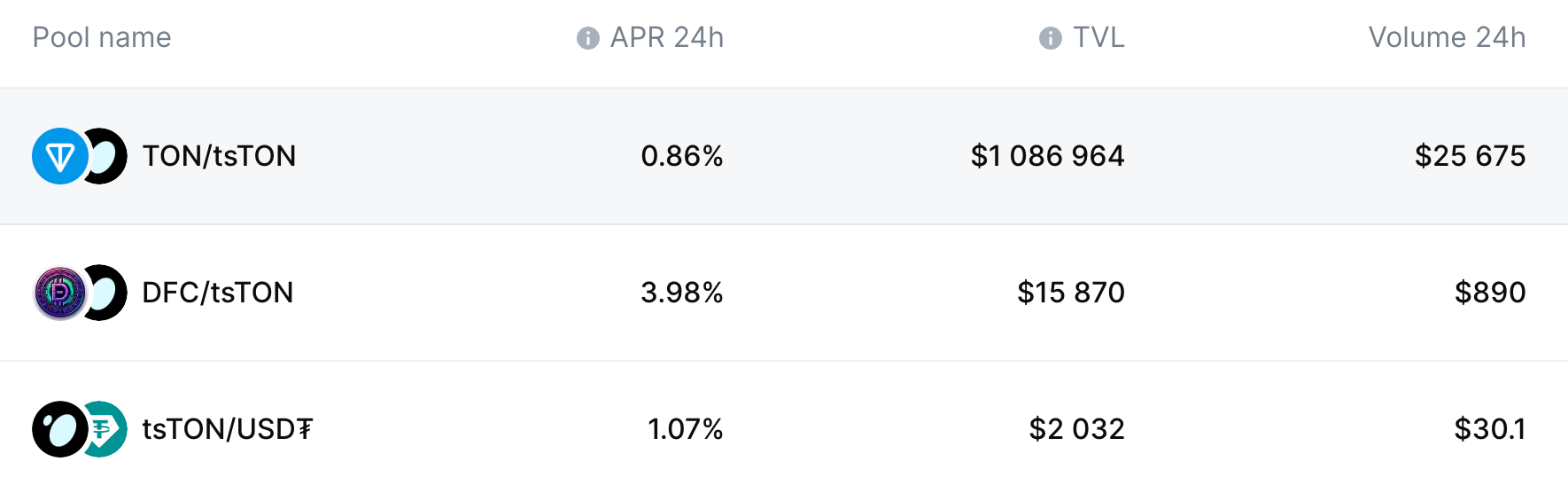

Tonstakers users understand how the protocol’s LST, tsTON, unlocks liquidity: using tsTON in EVAA loans, earning higher rewards via DFC, minting stablecoins on Aqua Protocol, and more. Additionally, Tonstakers is developing a unique jetton staking mechanism, enabling risk-free fungible token staking for both users and projects.

app.ston.fi

⑤ Stader

Mayhem10r | Website | Dashboard

TVL exceeds $600 million across ETHx, Polygon, BSC, and Hedera, with over $25 million in rewards distributed

-

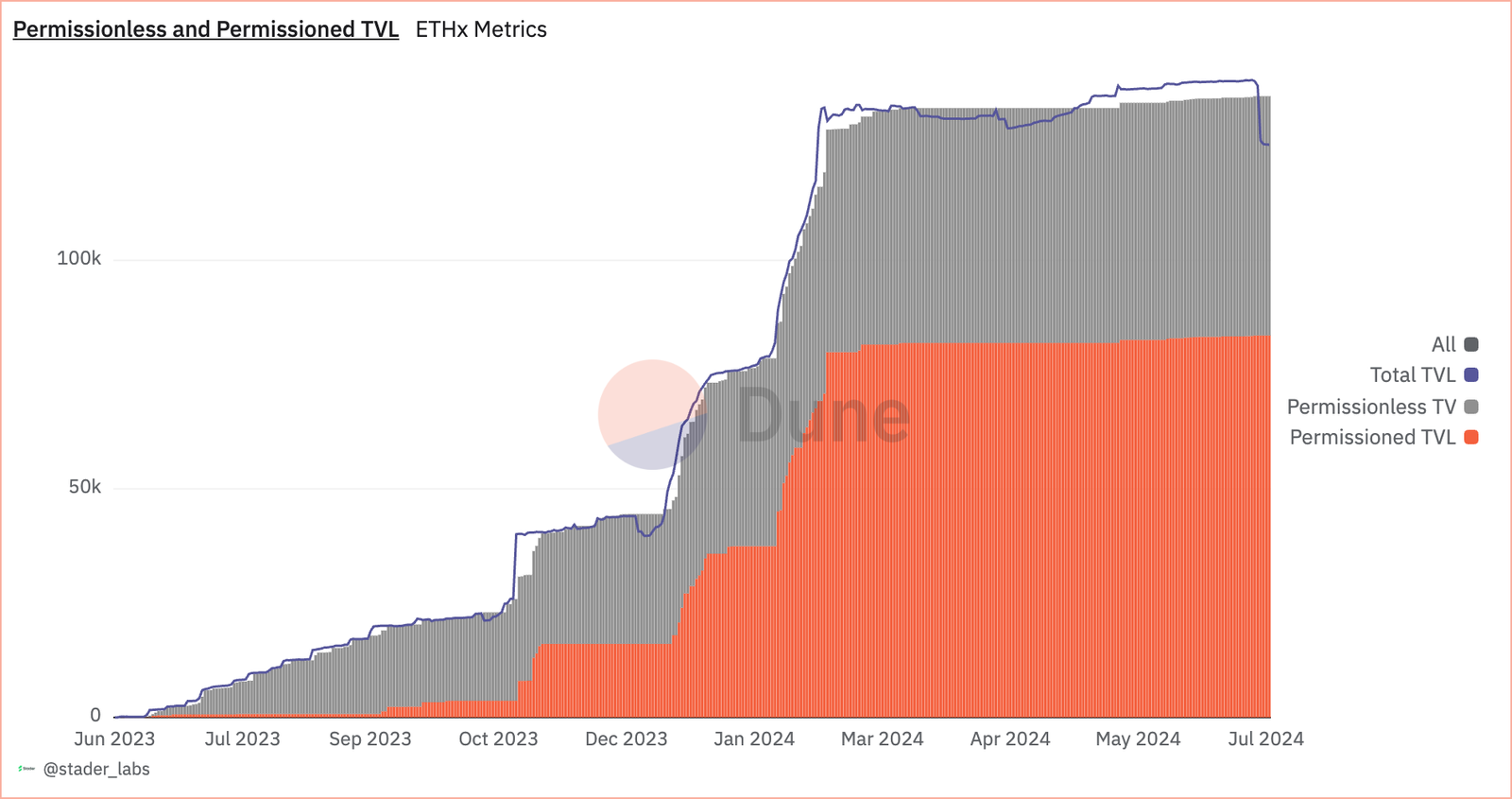

ETHx TVL and Deposits: Stader Labs is a non-custodial staking platform providing liquidity and security for users across multiple Proof-of-Stake networks. Stader Labs’ total TVL on ETHx stands at Ξ125,293 (~$386 million), with Ξ135,872 deposited on the beacon chain—including over 9,000 ETH in node operator collateral. This large-scale participation reflects strong institutional and user confidence in Stader’s staking solutions, driven by a mix of permissionless and permissioned TVL.

Dune - Stader Labs

-

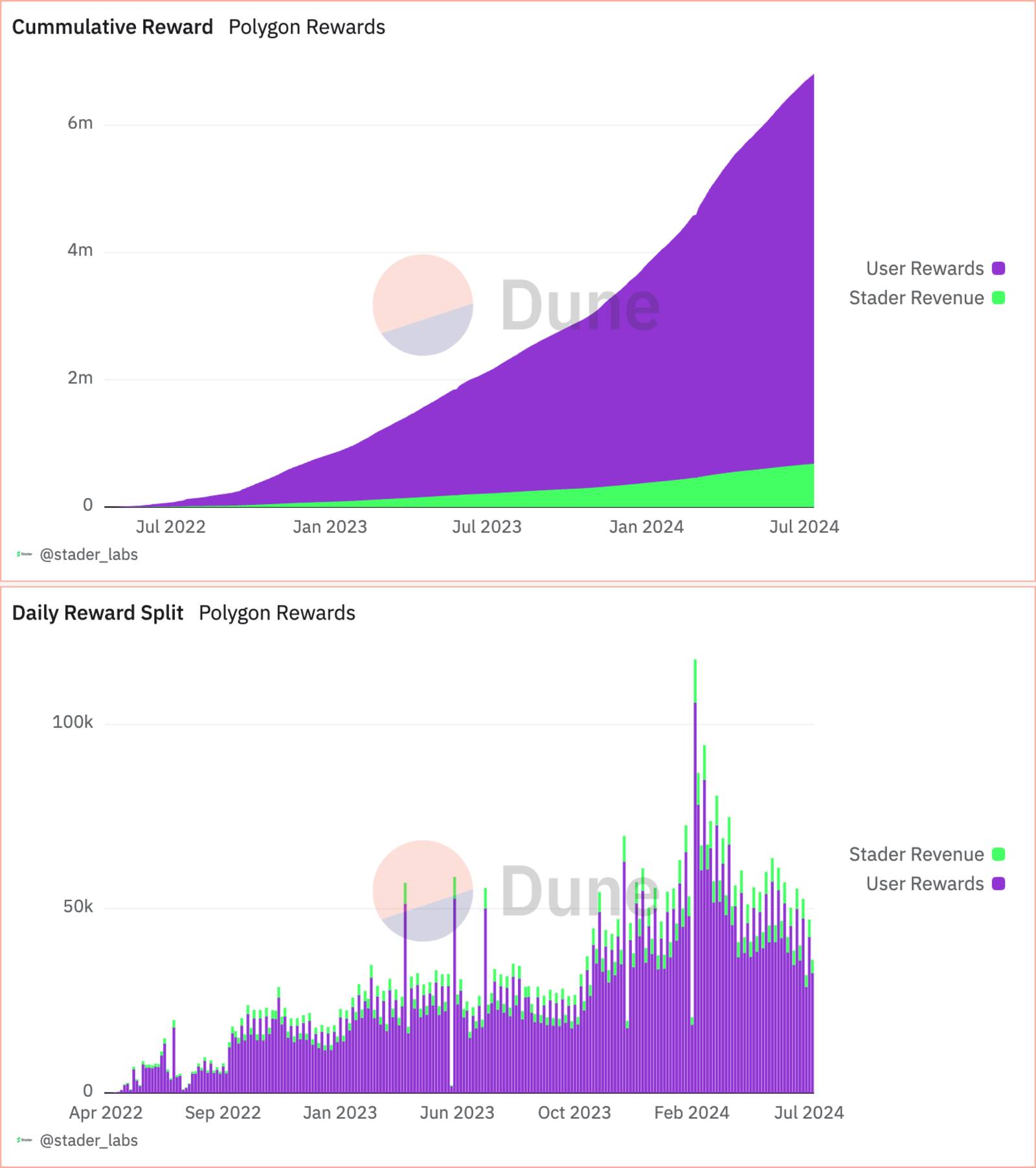

MaticX TVL, Rewards, and Revenue: Stader Labs is the leading liquid staking token (LST) on Polygon, with TVL exceeding 154 million Matic. It has distributed $6,128,781 in rewards to users. These rewards are managed via ETH contracts, with Stader retaining a 10% share ($680,976). Since July 2022, Stader has demonstrated consistent growth.

Dune - Stader Labs

-

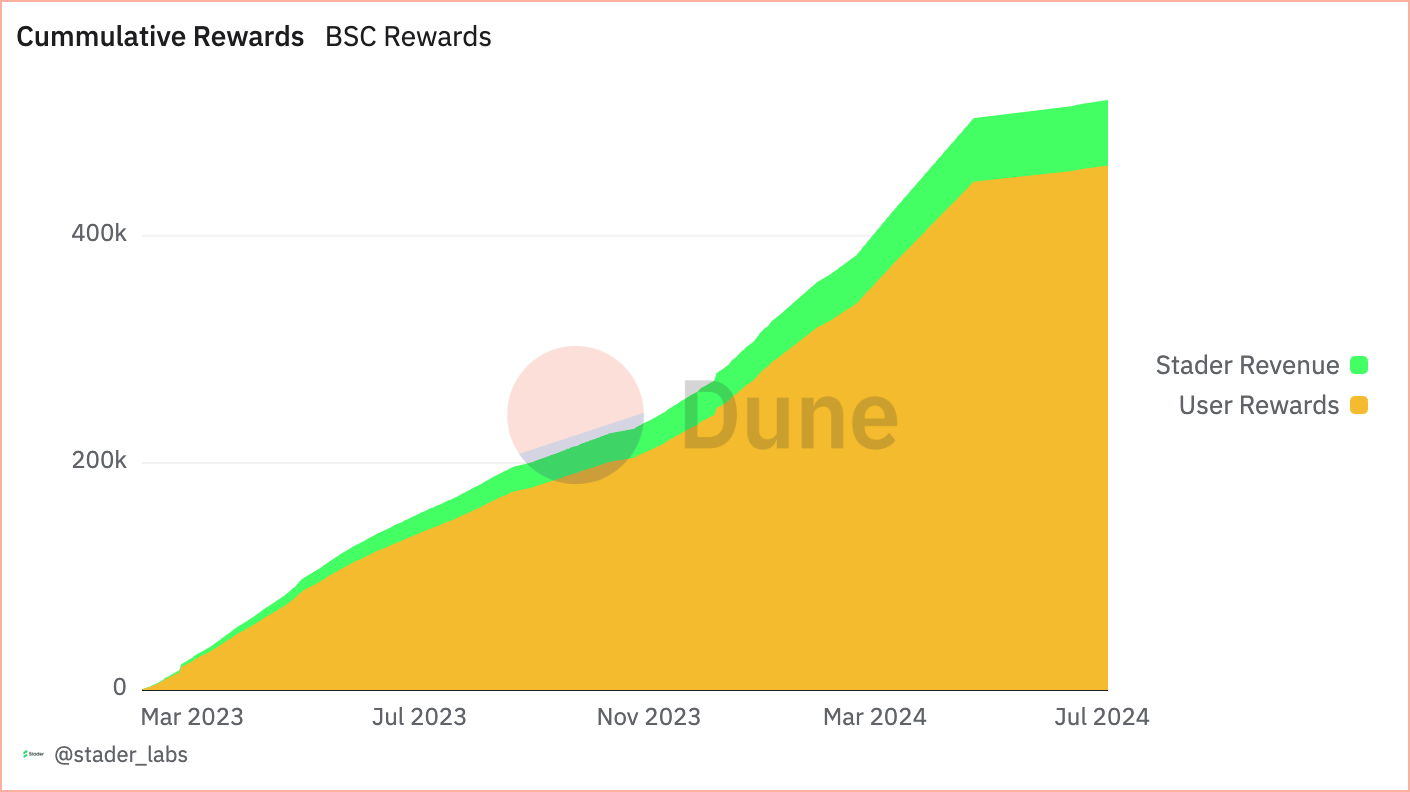

BNBx Rewards and Revenue: On the BNB Chain, Stader Labs has distributed $461,818 in rewards and generated $57,727 in revenue. Rewards are automatically distributed with each auto-compounding event, ensuring sustained growth and user engagement in the staking ecosystem.

Dune - Stader Labs

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News