The Breakthrough Moment for DeFi: Financial Transformation by ether.fi, Aave, Sky, and Lido

TechFlow Selected TechFlow Selected

The Breakthrough Moment for DeFi: Financial Transformation by ether.fi, Aave, Sky, and Lido

After years of liquidity guidance and moat building, we are now witnessing some protocols transitioning toward sustainable profitability.

Author: Kairos Research

Translation: Luffy, Foresight News

Executive Summary

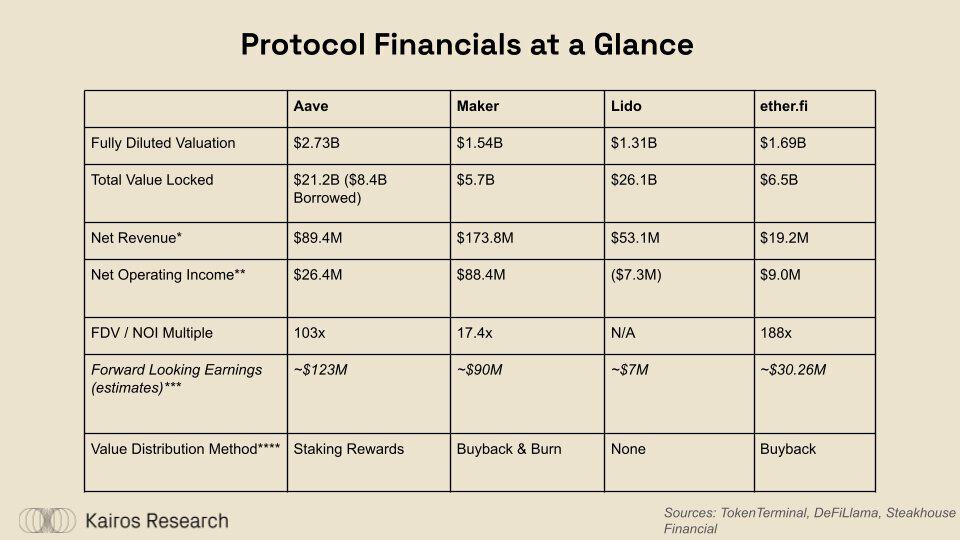

This report aims to explore some of the most influential DeFi protocols from a financial perspective, including a brief technical overview of each protocol and an in-depth analysis of their revenue, expenses, and token economics. Given the lack of regularly audited financial statements, we use on-chain data, open-source reports, governance forums, and conversations with project teams to estimate Aave, Maker (Sky), Lido, and ether.fi. The table below highlights key conclusions drawn throughout our research, providing readers with a comprehensive view of each protocol’s current state. While price-to-earnings ratios are commonly used to assess overvaluation or undervaluation, critical factors such as dilution, new product lines, and future profit potential offer a more complete picture.

Note: 1. DAI Savings Rate is included in revenue costs but not within Aave's safety module; 2. Excludes ether.fi token incentives as they were distributed via airdrops; 3. This is a rough estimate based on growth rates from new products (GHO, Cash, etc.), interest rates, ETH price appreciation, and margins—should not be considered investment advice; 4. Aave is currently exploring improvements to its tokenomics, including AAVE buybacks and distribution

The analysis shows that after years of liquidity bootstrapping and moat-building, several protocols are transitioning toward sustainable profitability. For example, Aave has reached a turning point, achieving profitability for consecutive months and rapidly expanding into a new, higher-margin lending product through GHO. ether.fi is still early-stage but has already accumulated over $6 billion in total value locked (TVL), securing its position among the top five largest DeFi protocols by scale. As a leader in liquid restaking, it has also learned from some of Lido’s shortcomings, launching numerous high-yield ancillary products to maximize returns across its multi-billion-dollar deposit base.

Problem Statement and Definitions

Since DeFi’s emergence in 2020, tools for on-chain data and analytics have steadily improved, with companies like Dune, Nansen, DefiLlama, TokenTerminal, and Steakhouse Financial playing a crucial role in building real-time dashboards reflecting the health of crypto protocols. At Kairos Research, we believe one important way to build credibility within the industry is by promoting standardization across protocols and DAOs to showcase financial performance, sustainability, and overall health. In crypto, profitability is often overlooked, yet value creation remains the only sustainable method to align all participants—users, developers, governance actors, and communities—within a protocol.

Below are terms we will use throughout this research to standardize approximations of each protocol’s costs:

-

Total Revenue / Fees: All income generated by the protocol, whether paid to users or retained by the protocol itself.

-

Take Rate: The percentage of fees the protocol charges users.

-

Net Revenue: Protocol income remaining after paying out user rewards and deducting revenue-related costs.

-

Operating Expenses: Various protocol expenditures, including salaries, contractors, legal and accounting, audits, gas costs, grants, and potential token incentives.

-

Net Operating Income: Net dollar amount after subtracting all costs incurred by the protocol and token holders, including token incentives tied to operations.

-

Adjusted Earnings: One-time expenses added back into earnings to better forecast future profitability, minus known future costs not yet reflected in revenue.

Protocol Overview

We provide a detailed analysis of the core products offered by each highlighted protocol in this report—representing some of the most mature players across various crypto sectors.

Aave

Aave is a "decentralized, non-custodial liquidity protocol where users can participate as suppliers, borrowers, or liquidators." Suppliers deposit crypto assets to earn yield on loans and gain borrowing power, enabling them to leverage or hedge their positions. Borrowers are either overcollateralized users seeking leverage or hedging, or those utilizing atomic flash loans. Borrowers must pay fixed or variable interest rates on the specific assets they borrow. Aave’s protocol fee consists of the total interest paid on outstanding (unrealized), closed, or liquidated positions, which is then split between lenders/suppliers (90%) and the Aave DAO treasury (10%). Additionally, when a position breaches its loan-to-value ratio threshold, Aave allows “liquidators” to close it. Each asset carries its own liquidation penalty, split between the liquidator (90%) and the Aave DAO treasury (10%). Aave’s new product, GHO, is an overcollateralized, crypto-backed stablecoin. The introduction of GHO enables Aave to originate loans without relying on third-party stablecoin providers, giving it greater flexibility in setting interest rates. Furthermore, GHO eliminates intermediaries, allowing Aave to capture all interest income from outstanding GHO loans.

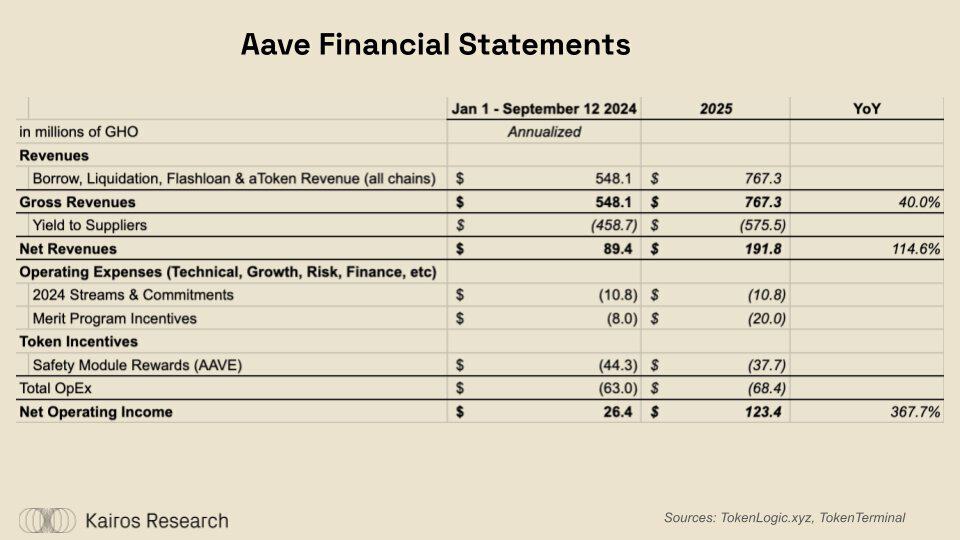

Aave transparently displays all DAO-level revenue and expense data via the Tokenlogic dashboard. We extracted “fiscal revenue” data from August 1 to September 12 and annualized these figures, arriving at $89.4 million in net revenue. To estimate total revenue, we relied on TokenTerminal’s P&L data to approximate margins. Our 2025 projections are primarily based on assumptions, including rising crypto asset prices leading to increased borrowing capacity. Moreover, in our model, Aave’s net profit margin increases due to GHO potentially replacing third-party stablecoins and improvements in the protocol’s security module, explained further later.

The leading crypto lending market is poised to see Aave achieve its first profitable year in 2024. Multiple signals indicate Aave’s profit potential: supplier incentives have dried up, active loans continue to trend upward, and outstanding borrowings exceed $6 billion. Aave clearly benefits significantly from the liquid staking and restaking markets, as users deposit LSTs/LRTs, borrow ETH, swap ETH for liquid staking tokens, and repeat the cycle. This loop allows Aave users to earn net interest spreads (APY from LST/LRT deposits minus Aave borrowing interest) without significant price risk. As of September 12, 2024, ETH is Aave’s largest outstanding borrowed asset, with over $2.7 billion in active loans across all chains. We believe this trend driven by proof-of-stake and restaking concepts has fundamentally reshaped the on-chain lending landscape, sustainably increasing utilization for protocols like Aave. Before restaking-driven recursive borrowing became popular, these lending markets were primarily dominated by leveraged users who typically borrowed only stablecoins.

The launch of GHO creates a new, higher-margin lending product for Aave. It is a synthetic stablecoin where borrowing fees do not need to be shared with suppliers. It also allows the DAO to offer slightly below-market interest rates, stimulating borrowing demand. From a financial standpoint, GHO is undoubtedly one of the most critical aspects of Aave’s future because the product offers:

-

High upfront costs (technical, risk, and liquidity)

-

Gradually decreasing costs over the next few years related to audits, development, and liquidity incentives

-

Relatively large upside potential

-

$141 million in outstanding GHO supply, representing just 2.35% of Aave’s total outstanding loans and 2.7% of DAI supply

-

Nearly $3 billion in non-GHO stablecoins (USDC, USDT, DAI) currently lent out on Aave

-

Higher margins than Aave’s traditional lending market

-

Although issuing stablecoins involves additional costs, it should still be cheaper than paying third-party stablecoin providers

-

MakerDAO’s net income margin is 57%, compared to Aave’s 16.31%

Aave’s native token AAVE has a fully diluted valuation (FDV) of $2.7 billion, equivalent to approximately 103x its annual earnings (projected at $26.4 million). However, we expect this multiple to shift in the coming months. As outlined above, favorable market conditions increase borrowing capacity, stimulate new demand for leverage, and may lead to higher liquidation income. Finally, even if GHO’s market share growth merely cannibalizes Aave’s traditional lending business, it should still have a direct positive impact on margins.

MakerDAO

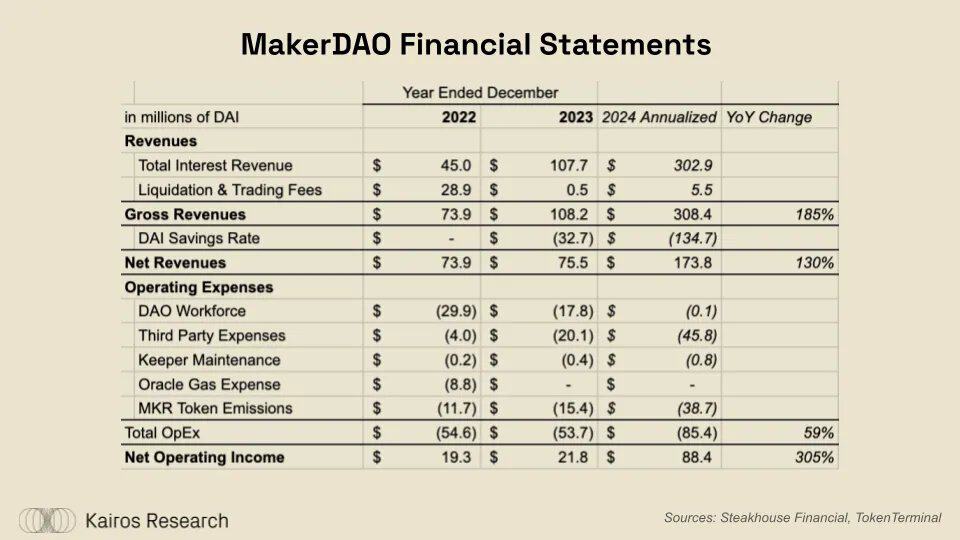

MakerDAO (recently rebranded as Sky) is a decentralized organization supporting the issuance of a stablecoin (DAI) backed by various cryptocurrencies and real-world assets, enabling users to utilize their holdings while providing the crypto economy with a “decentralized” store of stable value. Maker’s protocol fees consist of “stability fees,” composed of interest paid by borrowers and returns generated from yield-bearing assets allocated by the protocol. These fees are distributed between MakerDAO and depositors who place DAI into the DAI Savings Rate (DSR) contract. Like Aave, MakerDAO also collects liquidation fees. When a user’s position falls below the required collateral value, assets are settled through an auction process.

MakerDAO experienced strong growth over the past few years, fueled by liquidations during speculative volatility in 2021. However, as global interest rates rose, MakerDAO also developed more sustainable, lower-risk business lines, introducing new collateral types such as U.S. Treasuries, enabling higher asset efficiency and returns exceeding standard DAI lending rates. In examining the DAO’s expenses, we clearly observe two points:

-

DAI is deeply embedded across the crypto ecosystem (CEXs, DeFi), allowing Maker to avoid spending millions on liquidity incentives.

-

The DAO has done exceptionally well prioritizing sustainability.

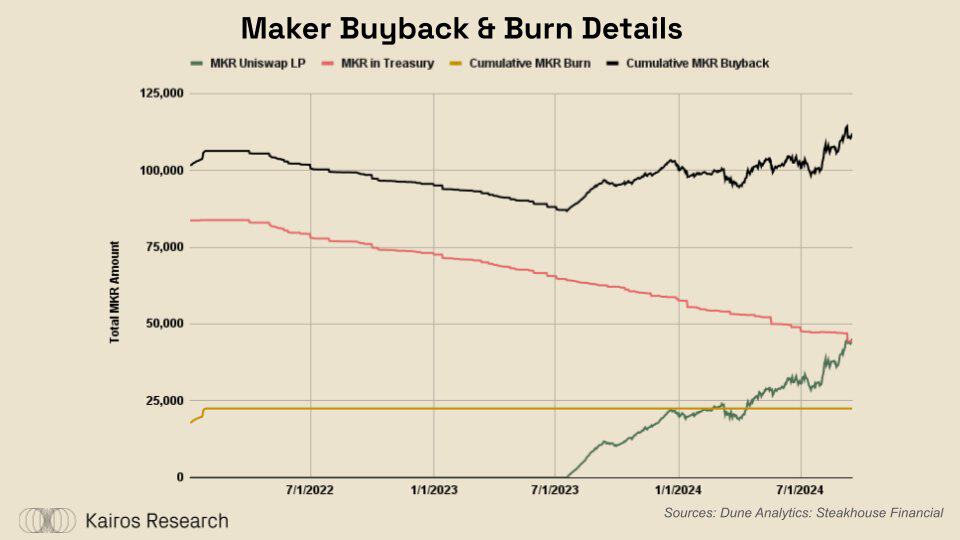

Throughout 2024, Maker is expected to generate around $88.4 million in net protocol income. MKR is valued at $1.6 billion, only 18x net income. In 2023, the DAO voted to revise its tokenomics to return a portion of earnings to MKR holders. As DAI continues accumulating stability fees into the protocol, Maker builds system surplus, aiming to maintain it around $50 million. Maker introduced a smart burn engine that uses surplus funds to repurchase MKR on the open market. According to Maker Burn, 11% of the MKR supply has been repurchased and used for burning, protocol-owned liquidity, or treasury building.

Lido

Lido is the largest liquid staking service provider on Ethereum. When users stake ETH via Lido, they receive “liquid staking tokens,” allowing them to bypass withdrawal queue delays and avoid the opportunity cost of being unable to use staked ETH in DeFi. Lido’s protocol fee comes from ETH staking rewards generated by validating the network, distributed to stakers (90%), node operators (5%), and the Lido DAO treasury (5%).

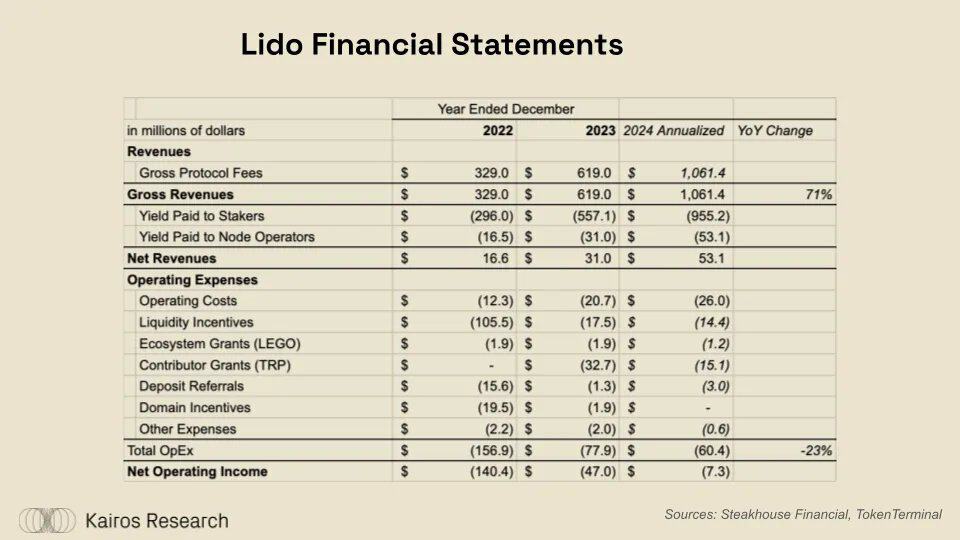

Lido presents an interesting case study among DeFi protocols. As of September 10, 2024, they had 9.67 million ETH staked through their protocol, approximately 8% of the total ETH supply and over 19% of the staking market share, with a TVL of $22 billion. However, Lido still lacks profitability. What changes could enable Lido to generate cash flow in the near term?

Over the past two years alone, Lido has made significant progress in cost reduction. Liquidity incentives were crucial in bootstrapping stETH adoption, with advanced users naturally gravitating toward LSTs due to their superior liquidity across the ecosystem. We believe that with stETH now possessing a strong moat, the Lido DAO will be able to further reduce liquidity incentives. Even so, a $7 million profit may still not justify an FDV exceeding $1 billion for LDO.

In the coming years, Lido must seek revenue expansion or deeper cost cuts to match its valuation. We see several potential growth paths: either the ETH-wide staking rate continues rising from 28.3%, or Lido expands beyond the Ethereum ecosystem. We consider the former highly likely over a long enough time horizon. By comparison, Solana’s staking rate is 65.5%, Sui’s is 79.5%, Avalanche’s is 49.2%, and Cosmos Hub’s is 61%. By doubling ETH staking volume while maintaining market share, Lido could generate over $50 million in additional net income. This assumption is overly simplistic and does not account for compressed ETH issuance rewards as staking rates rise. While increased market share for Lido is possible, we observed serious skepticism from Ethereum’s social consensus about Lido’s dominance in 2023, signaling that its growth pace may have peaked.

ether.fi

Like Lido, ether.fi is a decentralized, non-custodial staking and restaking platform that issues liquid receipt tokens for user deposits. ether.fi’s protocol fees include ETH staking rewards and Active Validator Service (AVS) income earned by providing economic security across the Eigenlayer ecosystem. ETH staking rewards are split among stakers (90%), node operators (5%), and the ether.fi DAO (5%). Restaking rewards (via Eigenlayer) are allocated to stakers (80%), node operators (10%), and the ether.fi DAO (10%). ether.fi offers several other revenue-generating auxiliary products, including “Liquid,” a suite of restaking and DeFi strategy vaults designed to maximize depositor yields. Liquid charges a 1–2% management fee on all deposits, which flows directly to the ether.fi protocol. Additionally, ether.fi recently launched a Cash debit/credit card product, allowing users to spend restaked ETH in real-life transactions.

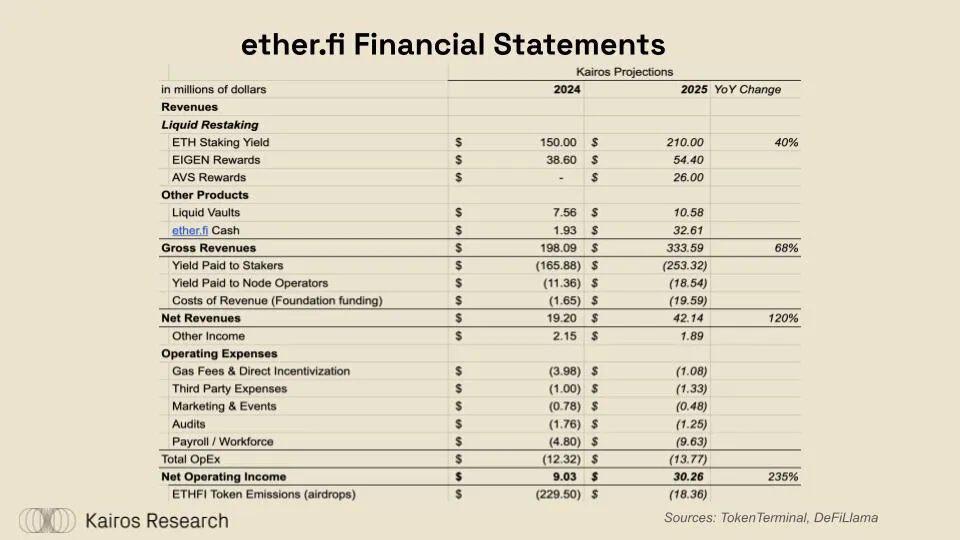

As of September 2024, ether.fi is the undisputed market leader in liquid restaking, with $6.5 billion in TVL across its restaking and yield products. We attempt to simulate potential protocol revenue for each product using the following assumptions in the financial model above:

-

Assuming ether.fi’s current staking volume remains constant for the remainder of the year, average staking TVL in 2024 would be ~$4 billion

-

Average ETH staking yield declines by ~3.75% this year

-

Prior to listing, EIGEN’s FDV is estimated at ~$5.5 billion, with restaking reward allocations of 1.66% in 2024 and 2.34% in 2025, implying direct ether.fi income from EIGEN: ~$38.6 million in 2024 and ~$54.4 million in 2025

-

Based on EigenDA, Omni, and other AVS reward programs, we estimate ~$35–45 million in total rewards paid to Eigenlayer restakers annually (~0.4% APY)

Cash is the hardest revenue stream to model due to its recent launch and lack of transparent precedents in the space. We collaborated with the ether.fi team to make our best 2025 estimates based on booking demand and revenue-cost structures of major credit card providers—we will monitor this closely over the next year.

While we recognize ETHFI token incentives as a protocol cost, we chose to exclude them from the bottom line for the following reasons: these expenses were heavily front-loaded via airdrops and liquidity bootstrapping, are not essential for ongoing operations, and we believe EIGEN + AVS rewards are sufficient to offset ETHFI incentive costs. With withdrawals enabled for some time now, ether.fi has experienced notable net outflows, suggesting the protocol is closer to achieving long-term sustainable TVL targets.

Token Value Accrual and Scoring System

Beyond simply assessing protocol profitability, it’s worth exploring where each protocol’s earnings ultimately flow. Regulatory uncertainty has historically driven innovation in revenue distribution mechanisms. Dividends to token stakers, buybacks, token burns, treasury accumulation, and many other unique methods have been adopted in attempts to involve token holders in protocol growth and incentivize governance participation. In an industry where token holder rights do not equate to shareholder rights, market participants must thoroughly understand their token’s role within the protocol. We are not lawyers nor do we take any stance on the legality of any distribution method—only exploring market reactions to each approach.

Stablecoin / ETH Dividends:

-

Pros: Measurable benefit, higher-quality returns

-

Cons: Taxable events, gas costs, etc.

Token Buybacks:

-

Pros: Tax-efficient, sustained buying pressure, growing war chest

-

Cons: Susceptible to slippage and front-running, no guaranteed returns, concentration in native token

Buybacks and Burns:

-

Pros: Same as above, plus increased per-token earnings

-

Cons: Same as above + no capital growth

Treasury Accumulation:

-

Pros: Expands operational runway, enables diversification, remains under DAO control

-

Cons: No direct benefit to token holders

Tokenomics is clearly an art, not a science, and it’s difficult to determine whether distributing earnings to holders is more beneficial than reinvesting them. For simplicity, in a hypothetical world where a protocol has maximized growth, tokens that redistribute earnings would enhance holders’ internal rate of return and eliminate risks upon receiving payouts. Below, we explore the design and potential value accrual of ETHFI and AAVE, both currently undergoing tokenomic improvements.

Looking Ahead

Aave

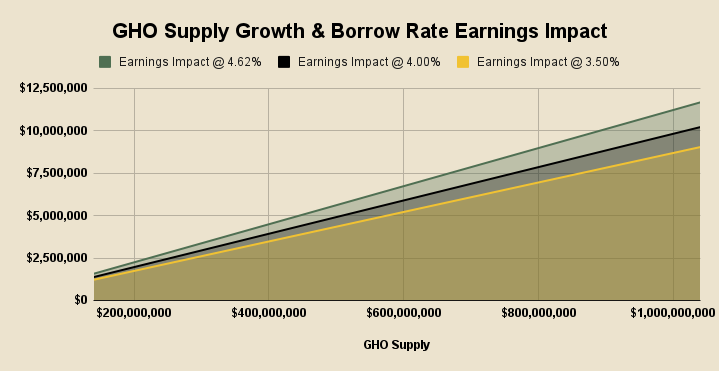

Currently, GHO supply stands at $142 million, with a weighted average borrowing rate of 4.62% and a weighted average stkGHO incentive cost of 4.52%, of which 77.38% of total GHO supply is staked in the safety module. Thus, Aave earns 10 basis points on $110 million in GHO and 4.62% on the unstaked $32 million. Considering global interest rate trends and the stkAAVE discount, there is clear room for GHO borrowing rates to fall below 4.62%, so we’ve included forecasts at 4% and 3.5%. In the coming years, Aave has ample opportunities to drive GHO growth—the chart below projects how reaching $1 billion in outstanding GHO loans could impact protocol revenue.

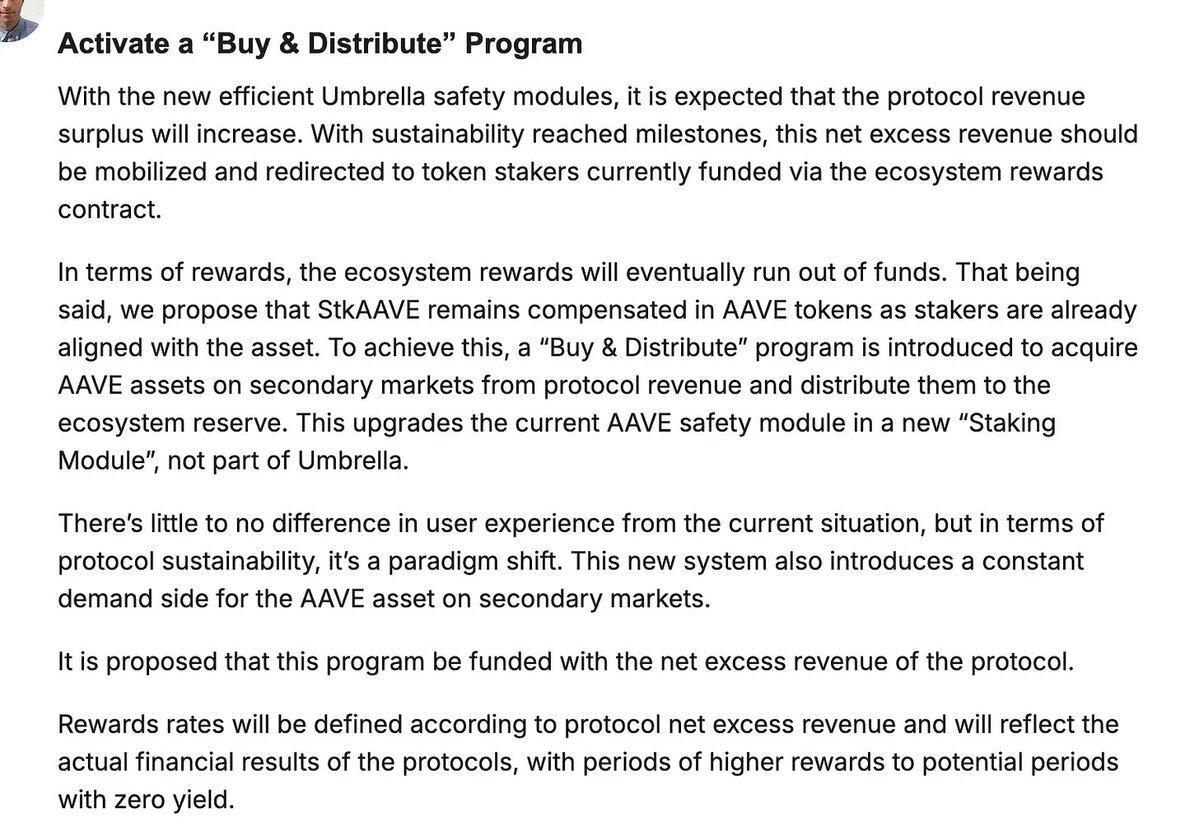

While Aave has growth potential, Marc Zeller has also proposed a temperature check within Aave’s governance forum to improve the protocol’s spending and native token AAVE. The proposal stems from Aave rapidly becoming a profitable protocol but currently overpaying for an imperfect safety module. As of July 25, $424 million was held in Aave’s safety module, primarily consisting of stkAAVE and stkGHO—both imperfect assets unable to cover bad debt caused by slippage or depeg risks. Additionally, the protocol incentivizes secondary AAVE liquidity via token emissions to minimize slippage if stkAAVE must be used to cover losses.

If the DAO votes to accept aTokens like awETH and aUSDC into the safety module while isolating stkGHO solely for GHO debt repayment, this concept could undergo a radical transformation. stkGHO would never need to be sold to cover bad debt—only seized and burned. The aforementioned aTokens are highly liquid and constitute most of the protocol’s liabilities. If undercollateralized, these staked aTokens could be seized and burned to cover losses. The goal of this proposal is to reduce spending on the safety module and liquidity incentives. Zeller further explains stkAAVE’s role under the new plan in the diagram below.

If approved, this proposal should positively impact the AAVE token by creating more stable demand while allowing holders to earn rewards without risking stkAAVE seizure to cover losses. We’re uncertain about tax implications of staking contracts, but it strongly benefits long-term AAVE holders through sustained buying pressure and redistribution of tokens to stakers.

ether.fi

Given ether.fi’s success in quickly building a sustainable business model, launching multiple profit initiatives is appealing. For instance, the protocol’s development team and DAO acted swiftly, proposing that 25–50% of revenue from Restaking & Liquid products be used to buy back ETHFI for liquidity provisioning and treasury reserves. However, given the absence of AVS rewards, high initial startup costs, and the novelty of most of its product suite, using 2024 revenue data to calculate fair valuation may be futile and complex.

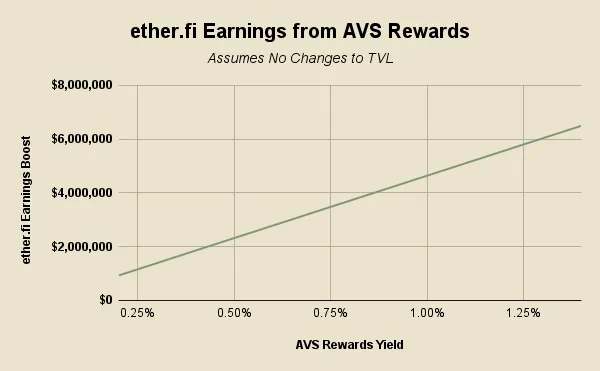

ETHFI token has an FDV of $1.34 billion and is expected to achieve modest profitability this year (excluding liquidity incentives), making it quite similar to Lido’s LDO. Of course, ether.fi must prove its longevity, but it has faster profitability potential than Lido and, given continued success across its broader product set, a higher revenue ceiling. Below is a conservative analysis showing how AVS rewards could contribute to protocol revenue. AVS reward income refers to rewards restakers receive solely from AVS payouts.

As seen with Lido, liquid staking/restaking is a competitive industry with relatively thin margins. ether.fi fully recognizes this limitation and is actively exploring broader yield-enhancing ancillary products while capturing market share. Below are reasons why we believe these additional products align with its wider restaking and yield-generation thesis:

-

Liquid: We firmly believe advanced LRT users are familiar with DeFi Lego blocks and seek maximum yield, making them ideal candidates for products that automate their DeFi strategies. Once AVS rewards go live, dozens of new risk/reward strategies and a novel native yield stream will emerge in the crypto economy.

-

Cash: Similar to LSTs, LRTs are a superior form of collateral compared to plain ETH, offering sufficient liquidity. Users can treat liquid restaking as an interest-bearing checking account or borrow assets at near-zero cost for daily spending.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News