In-Depth Analysis of Vertex Edge: Synchronized Multi-Chain Liquidity is the Future of DEX

TechFlow Selected TechFlow Selected

In-Depth Analysis of Vertex Edge: Synchronized Multi-Chain Liquidity is the Future of DEX

Edge unlocks the potential of Vertex's high-performance trading engine, ushering in a multi-chain future.

Author: Vertex Edge

Translation: TechFlow

Introduction

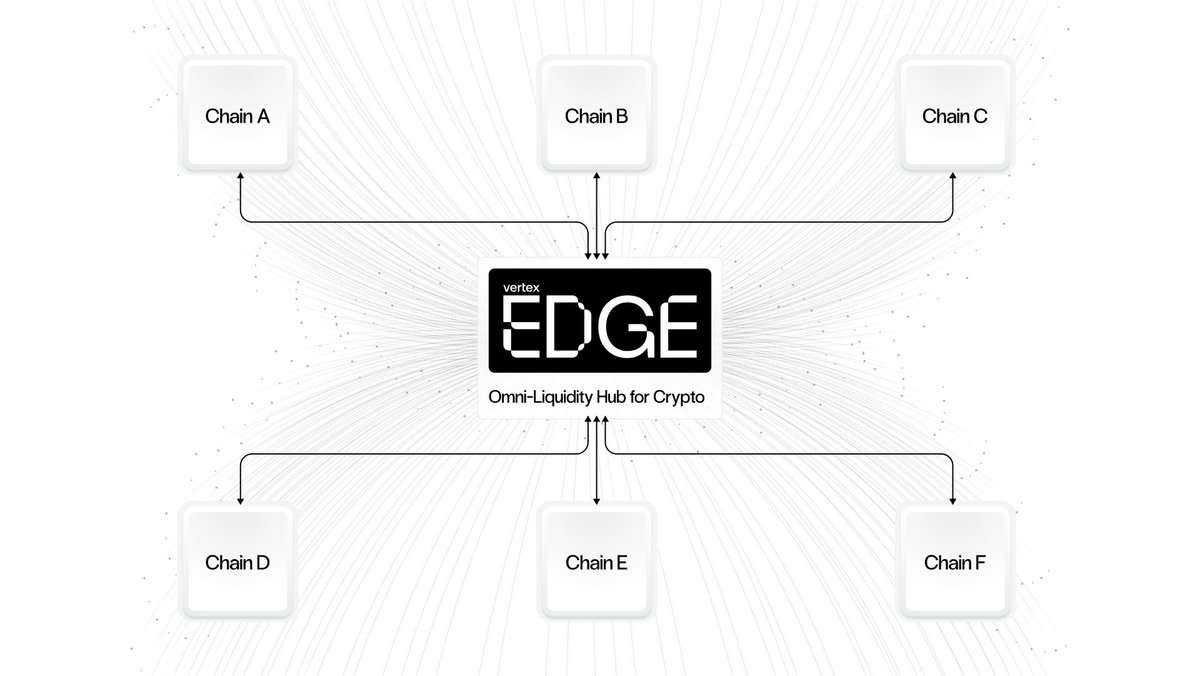

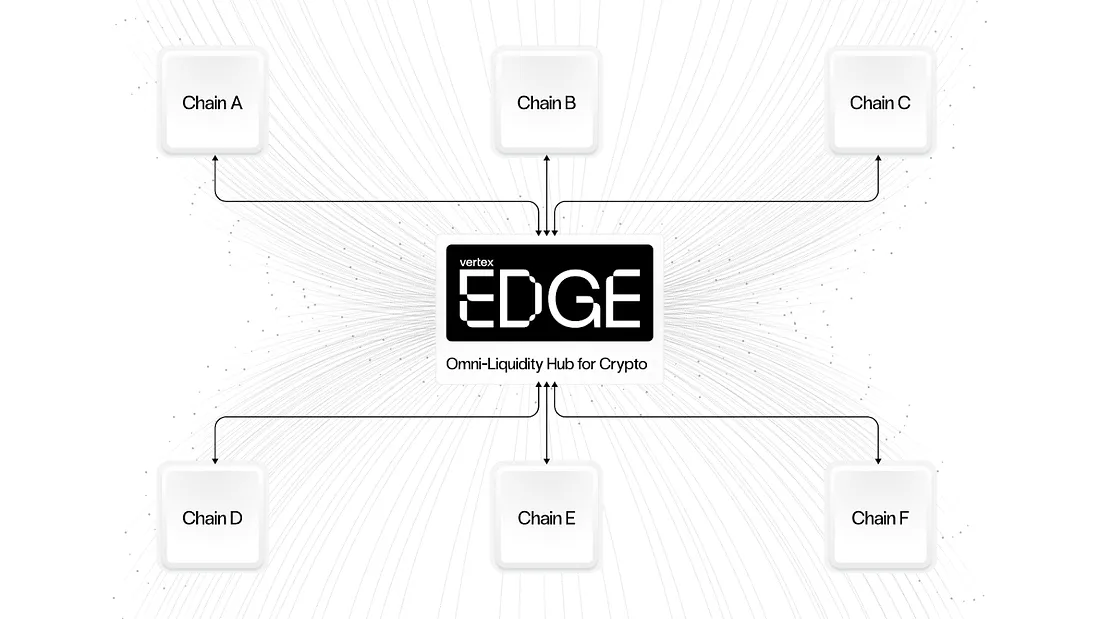

Vertex Edge is a revolutionary synchronized order book liquidity layer designed to unify cross-chain liquidity in decentralized finance (DeFi). Leveraging Vertex’s high-performance trading engine, Edge unlocks the full potential of a multi-chain future by aggregating liquidity from supported Edge chains and settling transactions natively on-chain through the Vertex sequencer, thereby unifying liquidity.

Main Content

Vertex Edge is an innovative synchronized order book liquidity layer designed to unify cross-chain liquidity in DeFi.

Edge fully leverages the potential of Vertex's high-performance trading engine to unlock a multi-chain future where inter-chain liquidity is no longer fragmented. Instead, liquidity from supported Edge chains is fused together, aggregated at the Vertex sequencer level, and settled natively on-chain across the underlying base layers of interconnected Vertex instances.

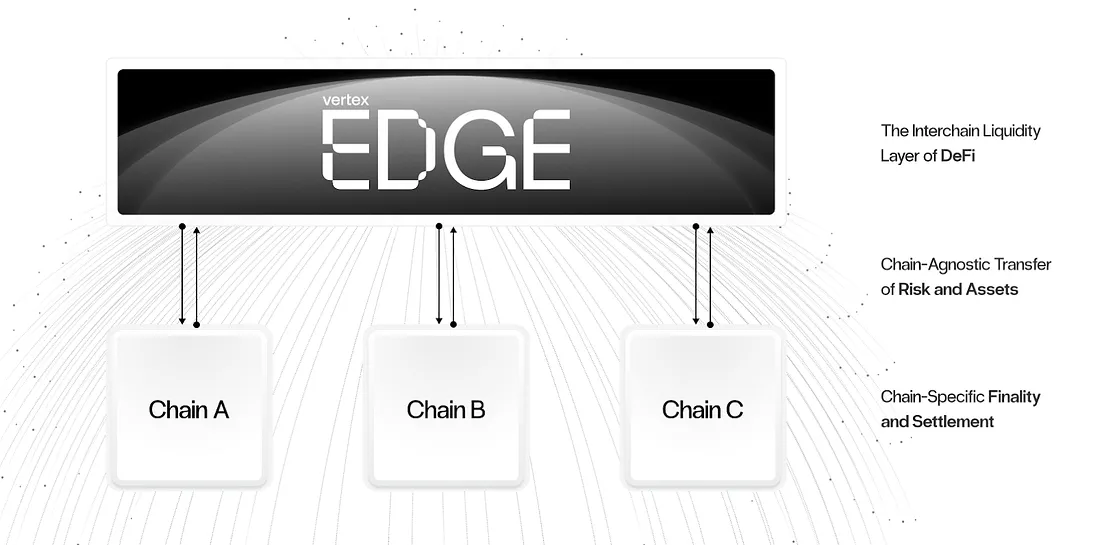

At its core, Edge represents a major upgrade to the Vertex sequencer: a custom parallel EVM implementation built in Rust for off-chain order books and trading engines.

Edge expands the functional scope of the sequencer, extending it cross-chain to any supported base layer ecosystem.

Conceptually, Edge acts as a virtual market maker between trading venues on different chains.

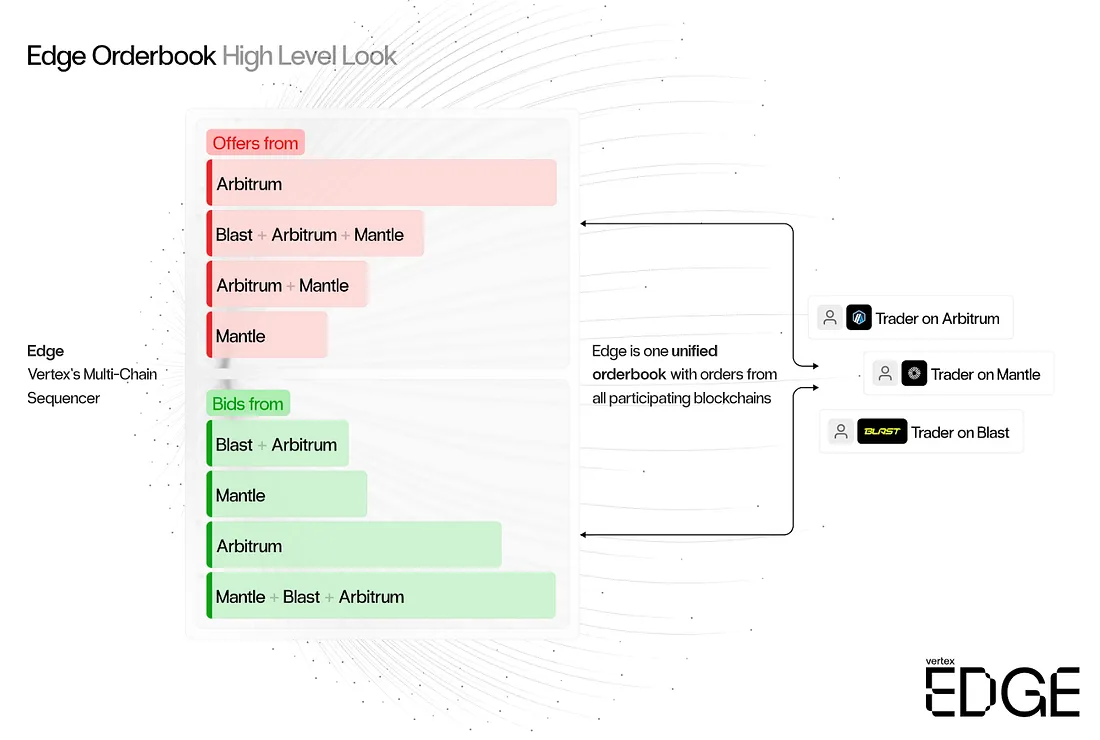

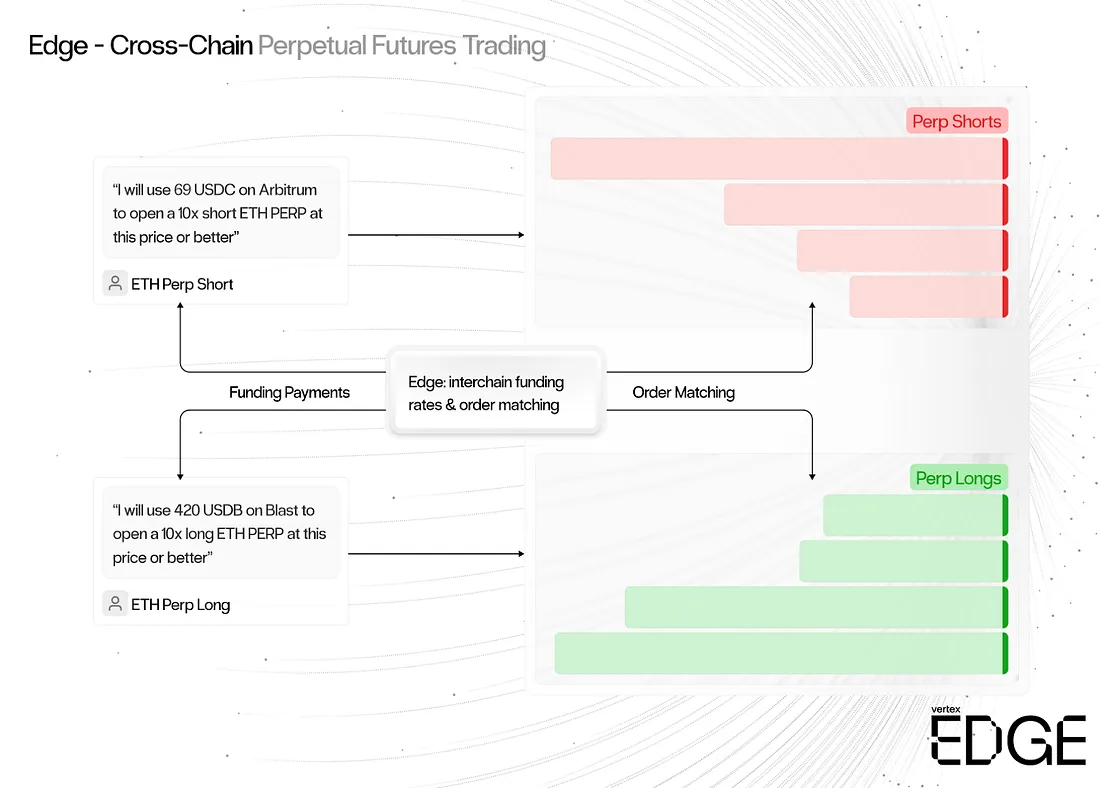

The state of the sequencer is sharded across simultaneously supported chains, receiving and cloning incoming orders from each chain. Then, individual orders from one chain are matched against liquidity pooled from multiple chains.

For every trade, the sequencer (Edge) handles the counter-side transaction in the background—automatically hedging and rebalancing liquidity across chains.

Notably, the sequencer only reflects static liquidity (e.g., market maker orders) from the sharded states of Vertex instances on different base layers. Taker orders remain unchanged and are submitted directly from independent Vertex instances (such as DEX Blitz) to Edge—the unified liquidity layer of the sequencer.

Order matching occurs simultaneously across chains, with the combined liquidity profile of the sequencer across all supported base layers being sharded and propagated to each Vertex instance.

As a result, Edge can match incoming orders from one chain against the consolidated order book liquidity inserted into the Vertex sequencer across all base layers.

Edge paves the way for the sequencer to operate concurrently across multiple (non-Arbitrum) chains without fragmenting liquidity between them.

You can view each incoming order from a Vertex instance as a request to modify balances on-chain. Therefore, settlement occurs only on the specific chain where corresponding balance changes are required (e.g., Vertex on Arbitrum).

More intuitively, you can think of Vertex Edge as a highway network connecting isolated islands of liquidity.

This liquidity superhighway not only connects these islands but merges them into a shared continental pool of liquidity. Thanks to this interconnected liquidity network, orders from different blockchains are matched with unprecedented efficiency.

Synchronized liquidity across multiple chains eliminates bottlenecks and fragmentation that plague isolated liquidity pools. By weaving together liquidity profiles across chains, Edge enables users to trade unified cross-chain liquidity through a single DEX interface—without needing to move from Chain A to Chain B.

Traditional cross-chain solutions often divide and dilute liquidity across platforms. In contrast, Vertex Edge unifies inter-chain liquidity instead of splitting it into isolated silos.

As Vertex instances proliferate and usage grows within the ecosystem, reciprocal scale effects in liquidity emerge. For example, using a new Vertex instance on a non-Arbitrum chain generates positive order flow and improves the liquidity efficiency of Vertex on Arbitrum.

Order book liquidity from non-Arbitrum instances is injected into a synchronized order book, merging liquidity from Vertex on Arbitrum with that from Vertex on non-Arbitrum instances.

Liquidity aggregated via Edge is accessible to users of any cross-chain Vertex instance, displayed on their respective application interfaces as a single, synchronized order book.

Settlement of matched orders still occurs on the user’s original chain, resulting in a net positive impact on block space demand for the native chain.

Example:

-

Suppose there are two Vertex instances (Arbitrum and Blast)

-

Alice submits a market order (taker) on Blitz to go long ETH-PERP at price X

-

After checking the aggregated order books of both Vertex instances on Arbitrum and Blast, the sequencer (Edge) matches the order with the best available liquidity

-

The best quote comes from John trading on Arbitrum

-

John now holds a short position on Arbitrum, while Alice holds a long position on Blast

-

In the middle, the sequencer (Edge) takes offsetting positions on each chain. Edge now holds a short position on Blast and a long position on Arbitrum

-

Edge injects Alice’s matched order into the sequencer’s batch queue to be rendered and settled on the Blast chain, while sending John’s order to be settled on Arbitrum

-

Over time, Edge will accumulate long and short positions locally on each chain

-

Edge periodically aggregates cross-chain liquidity and settles imbalances in the background

The steps described above are executed with Vertex’s characteristic low-latency performance. As such, expanding across multiple chains has minimal impact on Edge’s performance—it continues to match incoming orders within 5–15 milliseconds before batching and settling matched trades on-chain.

In summary, Edge is an upgraded version of the Vertex sequencer—a powerful matching engine combined with on-chain settlement. Edge simply extends settlement from a single chain to multiple chains.

The result is that fragmented cross-chain liquidity is replaced by additive, order-book-based liquidity across a single unified layer spanning multiple chains.

Launching Vertex Edge—Blitz on Blast

Vertex Edge is the flagship cross-chain product, paving the way for ecosystems to contribute their liquidity into a shared, synchronized, cross-chain order book liquidity layer.

The expansion of the Vertex Edge network will begin with the first cross-chain Vertex Edge instance: Blitz on Blast.

What is a Vertex Edge Instance?

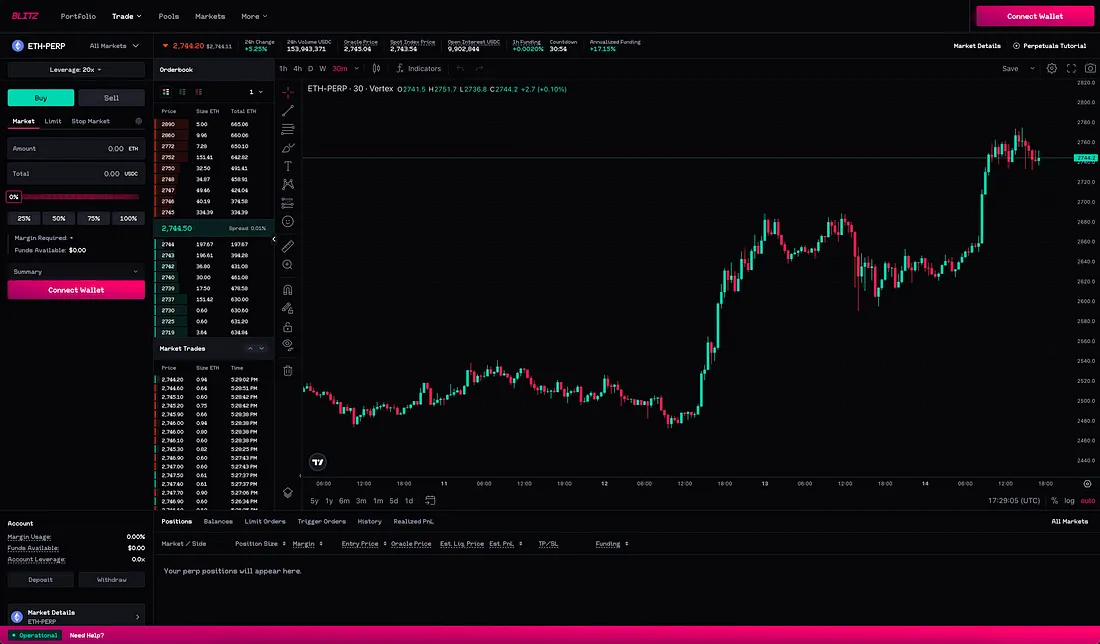

Any deployment of Vertex smart contracts on an independent base layer (L1/L2) constitutes a Vertex Edge instance. For example, Vertex (Arbitrum) and Blitz (Blast) are the first Vertex instances on different L2s.

A Vertex Edge instance on any base layer includes the following key attributes:

-

Liquidity on Edge-supported chains (e.g., Blitz on Blast) is aggregated and unified at the sequencer level with all other Vertex Edge instances (Arbitrum, Blast, Mantle) into a single synchronized order book liquidity layer

-

Application interfaces use the same UI toolkit and backend as the Vertex app on Arbitrum, but with modified design features and other user-facing elements across different-chain Vertex Edge instances

-

Any base layer connected to Edge (Arbitrum, Blast, Mantle) gains access to shared liquidity

-

Each Vertex instance displays combined order book liquidity from all connected chains on its trading interface (e.g., order book). For example, Blitz will show residual liquidity from both Arbitrum and Blitz order books

Blitz is a native on-chain deployment of Vertex smart contracts onto the Blast L2 network.

Blitz DEX uses the same architecture as Vertex on Arbitrum, and the Blitz app will be a near-identical version of the current Vertex app on Arbitrum. The main differences between Vertex (Arbitrum) and Blitz (Blast) are primarily in design.

However, behind the scenes, the same lightning-fast performance and hybrid on-chain/off-chain model powering Vertex on Arbitrum also powers Blitz.

So what’s the key difference? Edge.

Vertex Edge will officially launch alongside the Blitz application on Blast, meaning the first two chains plugged into Vertex Edge will be the original Vertex application on Arbitrum and the Blitz application on Blast.

Yes, Blitz users will be able to trade unified cross-chain liquidity pools from day one—meaning Blitz users instantly gain access to Vertex’s liquidity on Arbitrum. For users, aside from specific design changes and a separate points system, Blitz will retain the intuitive feel of the Vertex app on Arbitrum.

But the magic lies in what happens behind the scenes—the synchronized order book liquidity.

In short, increased usage of Blitz adds value to Vertex on Arbitrum—unified liquidity creates synergies rather than simple subtraction. This is a different paradigm in blockchain trading.

Blitz will also roll out all of Vertex’s signature features, including:

-

Spot, perpetuals, and integrated money markets

-

Unified cross-margining across all products

-

Order matching latency of 5–15 milliseconds

-

30+ spot and perpetual trading pairs

-

Embedded AMM

-

Zero trading fees for market makers

-

2 basis point taker fee across all markets

-

Ability to leverage liquidity beyond TVL

-

HFT-friendly API and SDKs (Typescript, Python, and Rust)

-

Synchronized access to unified cross-chain order book liquidity

Edge doesn’t end with Blitz—more Vertex cross-chain instances will be supported by Edge throughout 2024.

The Edge Triangle—Unique Product Features

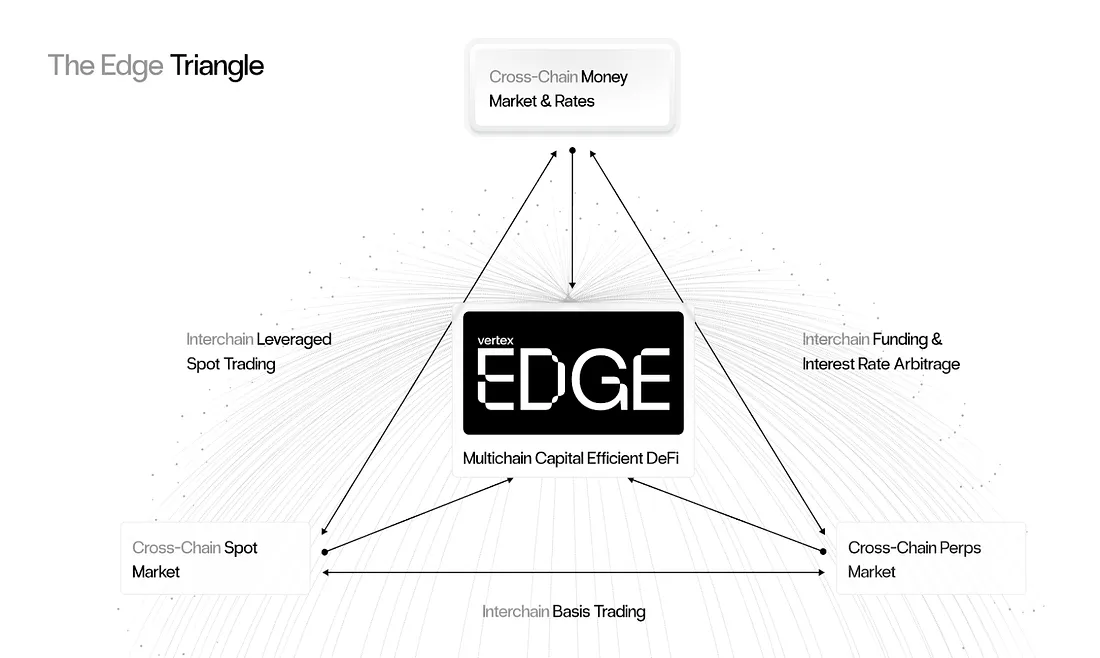

The ability of Vertex Edge to expand the scope of the sequencer is unique, enabling multi-chain liquidity to be shared on a single synchronized order book under unified standards.

This design brings several advantages for users and for the underlying networks supported by Edge.

However, it’s important first to understand how Edge uniquely unlocks functionality related to unified cross-margin trading across Vertex’s core products, including:

-

Spot Markets

-

Perpetual Markets

-

Money Markets

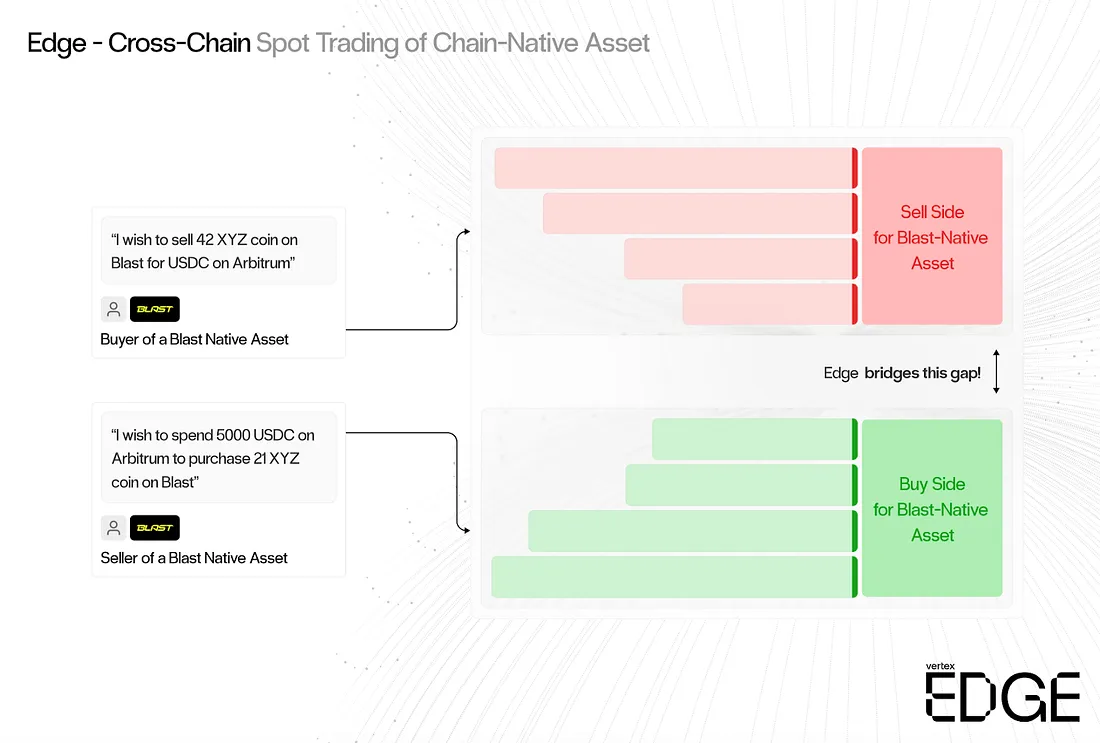

Spot Trading—Cross-Chain Native Assets: Vertex Edge enables users to trade native spot assets across chains without directly needing access to the underlying base layer of the native asset they wish to trade.

-

For example, if Alice on the Blast network using Blitz wants to sell XYZ tokens on Arbitrum for USDC, her order will be matched against resting buy-side liquidity in USDC from both Blast and Arbitrum

-

Vertex Edge acts as a conduit bridging the gap between these two counterparts, facilitating a transaction that feels lightning-fast and seamless despite occurring on two different blockchain networks

-

This synchronized order book is a significant advantage because it aggregates liquidity—meaning a seller on one chain can access buyers across multiple chains, and vice versa—optimizing market depth and potentially reducing slippage

An intuitive analogy is an airport duty-free shop serving international travelers—all passengers, regardless of flight origin or destination, can transact in one location using a unified currency exchange system.

This enhances the shopping experience by offering broader choices and consistent pricing, similar to how Vertex Edge aims to deliver seamless trading across different blockchain networks.

Perpetual Contracts—Cross-Chain Funding Rates and Basis Trading: Cross-chain liquidity for perpetual contracts brings the most capital-efficient trading opportunities for traders and risk-takers across the ecosystem, optimizing overall market efficiency.

-

As Vertex Edge adds more native spot and perpetual markets across multiple ecosystems, more basis trading opportunities will emerge

-

Vertex Edge will feature unified funding rates, making trading more efficient compared to current alternatives—where the same protocol on different chains often has divergent funding rates due to fragmented liquidity

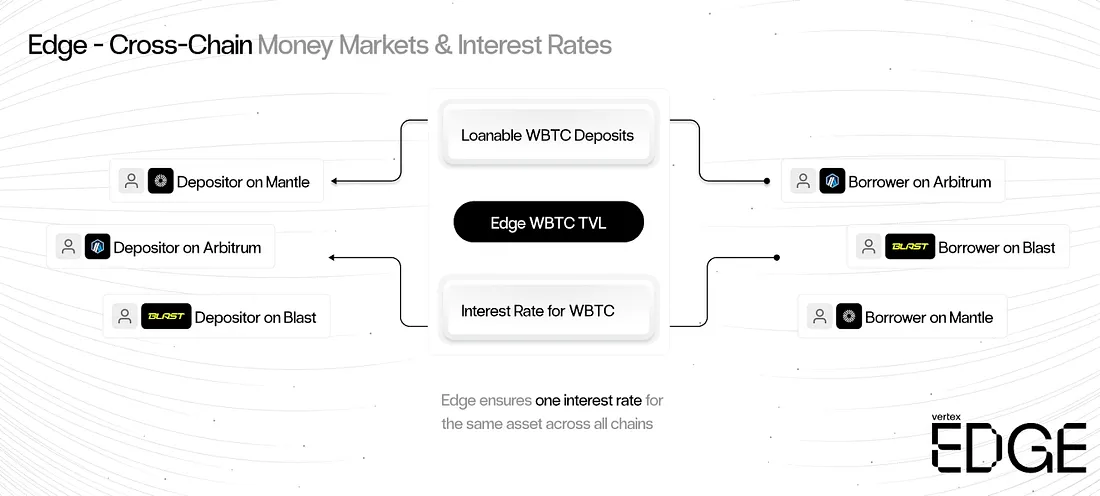

Money Markets—Multi-Chain Collateral and Unified Interest Rates: Storing collateral natively across multiple chains—without bridging assets—enables Vertex Edge to offer more collateral options, increasing liquidity and trading efficiency.

-

By allowing users to store collateral natively on different chains, Edge reduces many of the existing cross-chain friction points in money markets, potentially increasing market participation

-

For example, on DeFi platforms like MakerDAO or Compound, users deposit various types of collateral to mint stablecoins or borrow. If these platforms support multi-chain collateral without requiring asset movement across chains, it simplifies the cross-chain borrowing/lending experience, offering greater flexibility and choice

-

More collateral types generally mean deeper liquidity, as users from various chains contribute to the total collateral pool, improving efficiency by streamlining the process of posting collateral and borrowing.

The synchronized order book layer applied to Vertex Edge preserves Vertex’s embedded money market and links it to the user’s entire trading portfolio via unified cross-margining.

This is a key distinction between any Edge instance and existing money markets in DeFi—interest rates for a given money market pool remain consistent across Edge instances on different chains.

More specifically, Vertex Edge makes it possible to have a single USDC deposit rate across all Vertex Edge instances, enabling capital to flow freely across ecosystems and actively deploy where it can be most effectively utilized. This generates cost-effective loans for the most active traders and ensures passive capital providers receive optimized yields.

Consistent interest rate curves are a critical catalyst for enabling cross-chain spot trading. They allow traders easier access to assets across different ecosystems without needing to bridge stablecoins between chains.

Without this capability, the overall effect would fall short of optimal. Tokens would remain isolated within their native ecosystems.

The ultimate vision is to generate additive, synergistic liquidity effects across multiple chains—powered by Vertex.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News