Vertex Liquidity Auction Recap: Initial Token Liquidity in Place, Incentive Program May Spark Trading Enthusiasm

TechFlow Selected TechFlow Selected

Vertex Liquidity Auction Recap: Initial Token Liquidity in Place, Incentive Program May Spark Trading Enthusiasm

Vertex not only aims to challenge existing DEXs, but also CEXs.

Author: Leah Callon-Butler

Compiled by: TechFlow

Vertex is a decentralized exchange (DEX) that has recently gained attention for its Liquidity Bootstrapping Auction (LBA), successfully creating the initial liquidity pool for its $VRTX token.

In this article, we will review Vertex's recent Liquidity Bootstrapping Auction (LBA), which ran from November 13 to November 20, as well as the subsequent incentive programs.

(Editor’s Note: A Liquidity Bootstrapping Auction (LBA) is a mechanism designed to generate initial liquidity, specifically applied for the VRTX token. It is structured to be fair, less sensitive to price volatility, and accessible in terms of capital requirements. The LBA operates through an LP contract containing a dual pool of USDC and VRTX, with one-sided liquidity provision. This auction uses an extended price discovery period to improve accuracy, gradually reaching the market-driven price of VRTX over seven days.)

The purpose of this auction was to create the initial liquidity pool for $VRTX and achieve a fair launch price for the $VRTX token by relying on supply-demand dynamics and free-market mechanisms to avoid price volatility.

Conducting a liquidity auction typically involves the following steps:

-

Prepare tokens and funds: Select the token you want to auction and prepare a certain amount of funds (e.g., USDC) as liquidity.

-

Set auction parameters: Determine the duration of the auction, starting price, and ending price.

-

Launch the auction: Initiate the liquidity auction on the platform.

-

Bidding by participants: Buyers place bids to purchase tokens during the auction period.

-

End the auction: At the conclusion of the auction, tokens are allocated to bidders based on the final price.

Now that the LBA has concluded, liquidity has been locked and vested, and the $VRTX and $USDC.e pools have merged into a single pool integrated into Vertex AMM. The $VRTX token officially launched at a price of $0.3133.

One-third of the LP liquidity will unlock on January 19, 2024, with the remainder unlocking on April 20, 2024.

LBA Statistics

At the end of the issuance, 13.7 million $VRTX and 4.29 million $USDC.e were contributed and locked by participants.

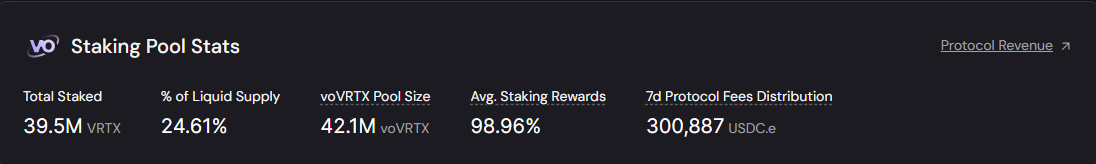

Just six hours after the VRTX token launch, 25 million VRTX were staked. As of November 28, the number of staked $VRTX tokens had risen to 37 million, with a total of $300,887 in $USDC.e distributed to stakers.

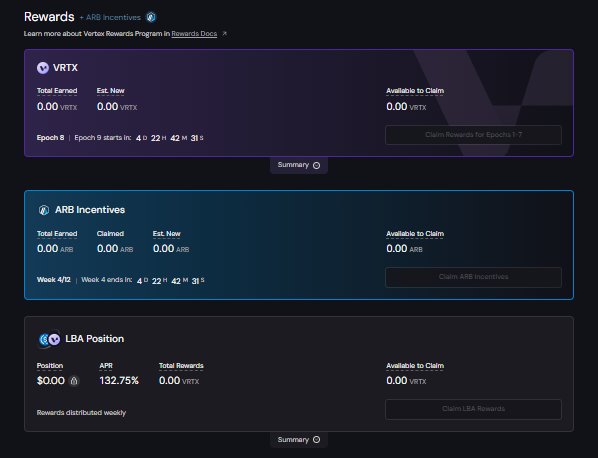

Current staking statistics are as follows:

-

39.5 million $VRTX staked

-

Generated 42.1 million $voVRTX

-

$300,887 in $USDC.e distributed weekly as rewards

-

Average staking reward rate of 98.96%

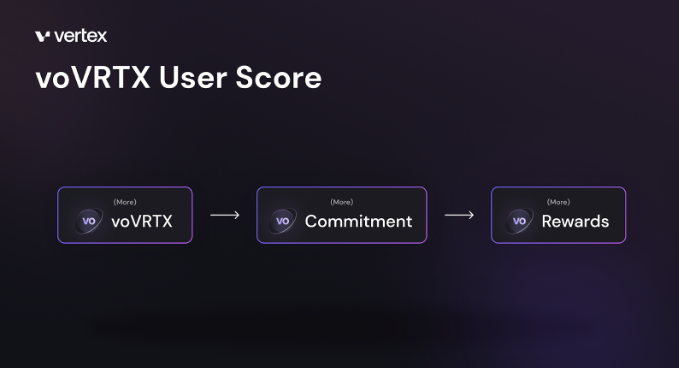

Staking $VRTX generates a "user score" in the form of voVRTX, a non-transferable subtype of the $VRTX token that exists as an incentive layer controlling multiplier effects for $VRTX stakers. The longer a user stakes, the more this multiplier compounds, increasing their voVRTX rewards.

Like all other exchanges, Vertex generates revenue from trading fees. Currently, 50% of revenue is allocated to the protocol treasury. The remaining portion is distributed weekly in $USDC.e based on users' long-term commitment to the protocol (measured by their voVRTX score). The percentage of revenue allocated between the treasury and users will be determined period by period according to the protocol’s needs.

For complete details on staking rewards, how to stake/unstake, and all other staking-related information, click here to view this document.

Vertex Incentive Program

Next, we introduce Vertex's trading incentive program, designed to reward user activity on the protocol, with rewards paid in $VRTX tokens. The distribution of $VRTX tokens as rewards is divided into an Initial Token Phase and a Sustained Incentive Phase. Out of a total supply of 1 billion $VRTX tokens, 10% was allocated to the Initial Token Phase and 34% to the Sustained Incentive Phase. The Initial Token Phase ended on November 8, 2023. The Sustained Incentive Phase is currently ongoing, with $VRTX rewards claimable within three days after the end of each phase (each phase lasting 28 days). Reward caps have been removed, meaning there is no upper limit on reward value, and vesting periods are no longer applicable.

The trading incentive program has performed exceptionally well! So far, total trading volume has reached $221.2 billion, with $52.3 billion executed just last week. The total number of platform users continues to grow steadily, currently around 15,820. These users have generated nearly $5 million in total fees for the protocol, exceeding $1 million in fees over the past seven days (as of writing).

Short-Term Incentive Program (STIP)

In addition to the trading incentive program, Vertex Protocol’s proposal for Arbitrum’s Short-Term Incentive Program (STIP) received support of 160 million votes. As a result, Vertex was allocated 3 million $ARB tokens to distribute as incentives to platform users. This means that not only will you earn $VRTX rewards when trading on Vertex, but you will also receive $ARB rewards! These $ARB rewards will be distributed until January 31, 2024, awarded weekly, and can be earned by trading on the platform or providing liquidity to Elixir Fusion Pools.

To learn all details about Vertex’s $ARB trading incentive program, click here to view this document. For a comprehensive understanding of the trading incentive program, click here to view this document.

Since $VRTX is still relatively new to the market, here is an overview of $VRTX tokenomics. As previously mentioned, the total supply of $VRTX tokens will be capped at 1 billion, with 90.85% distributed over the next five-plus years. In the chart below, we can see the allocation of $VRTX tokens.

In the chart below, we can see the timeline of $VRTX token distribution.

If you're interested in token supply and distribution schedules, Vertex provides a detailed spreadsheet here. For a comprehensive overview of $VRTX tokenomics, refer to Vertex's documentation.

Conclusion

The DEX space is highly competitive. Vertex aims not only to challenge existing DEXs but also CEXs. It offers the best of both worlds.

This means that on Vertex, you get the speed, high liquidity, and low fees of a CEX, along with the self-custody benefits of a DEX. Users no longer need to compromise between high performance and asset security.

Vertex’s initial goal was to attract professional traders to build liquidity and trading volume on the platform. Then, they will begin targeting retail investors. Given how well-designed the product is, it's easy to imagine Vertex rapidly capturing market share.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News