Vertex: The Rising Star DEX in Derivatives – With Around 10% Daily Trading Volume Market Share, Why It Matters?

TechFlow Selected TechFlow Selected

Vertex: The Rising Star DEX in Derivatives – With Around 10% Daily Trading Volume Market Share, Why It Matters?

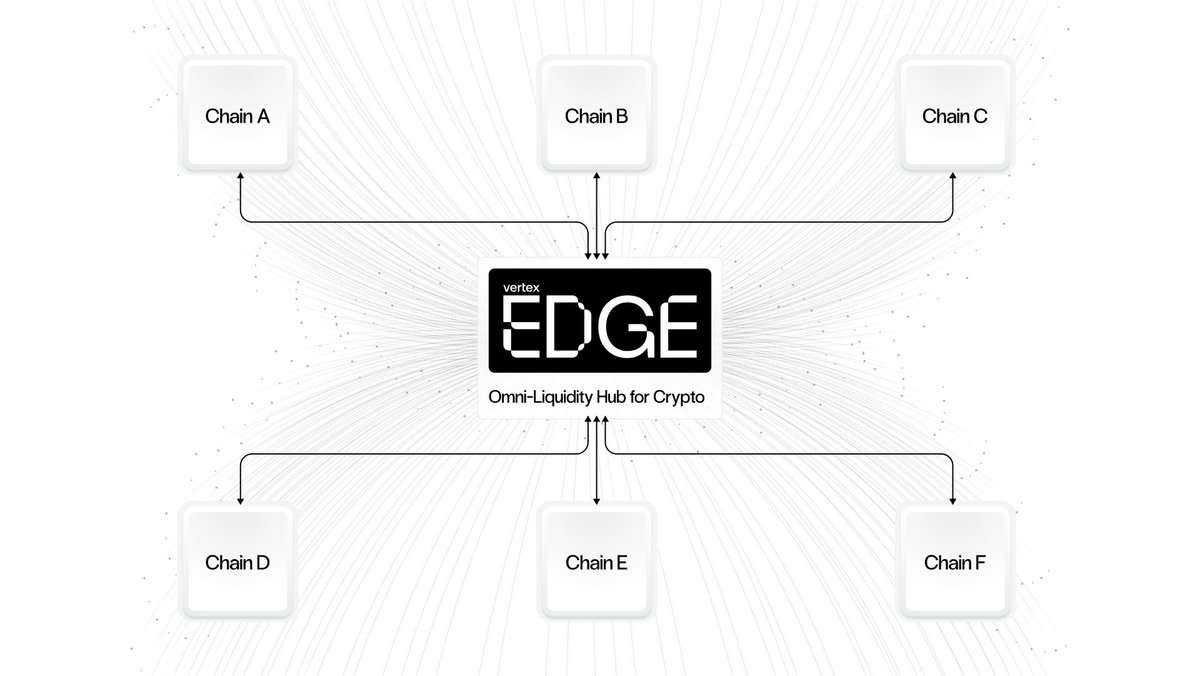

Vertex introduces some mechanistic innovations aiming to create better liquidity and higher capital efficiency.

Author: duoduo, LD Capital

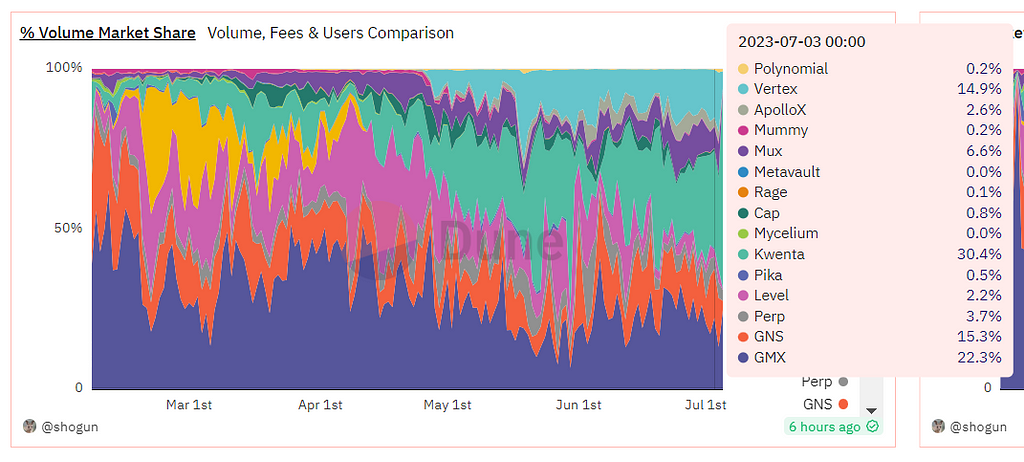

The derivatives DEX space is fiercely competitive, with top-tier protocols such as GMX, DYDX, and SNX; second-tier players including Gains, MUX, Level, and ApolloX; and a steady stream of new protocols launching.

Vertex is a recently launched derivatives DEX that has shown strong performance. Since its launch in late April 2023, it has captured approximately 10% to 15% of daily trading volume within the pool-based derivatives DEX market and secured a strategic investment from Wintermute in June 2023.

Source: dune

Note: This chart excludes DYDX data and compares only pool-based derivatives DEXs.

1. Business Metrics

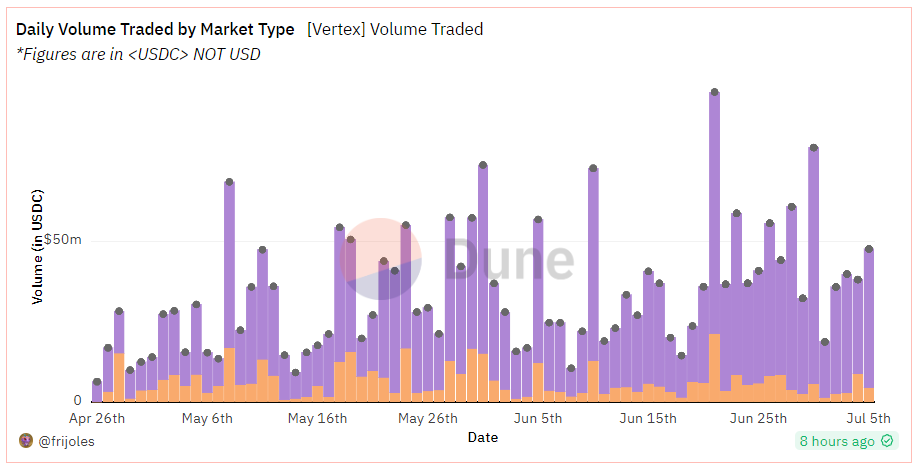

Trading Volume: Primarily driven by trading incentives, Vertex has achieved high trading volumes, with an average daily trading volume of around $40 million over the past seven days. The purple portion represents derivatives, while the yellow represents spot trading, indicating a focus on derivatives trading.

This daily volume is lower than leading derivatives DEXs (DYDX/GMX/SNX), but comparable to other second-tier derivatives DEXs. Based on the last seven days’ volume, Vertex has entered the top ten.

Source: dune

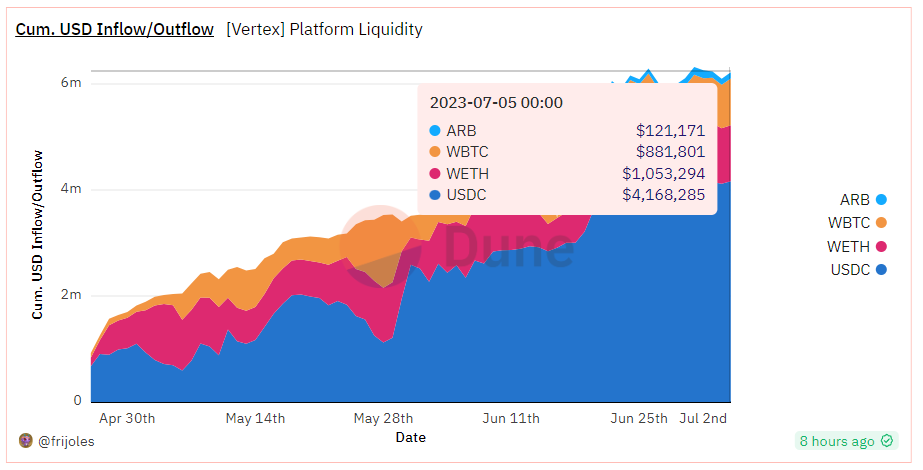

TVL: $6.22 million, which remains relatively small. It includes four tokens, with the specific composition shown below:

Source: dune

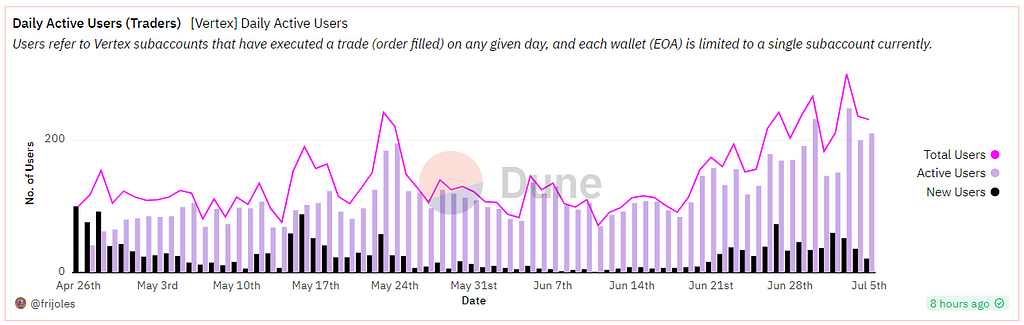

DAU: Cumulative users total 1,842, with approximately 200 daily active users in the past seven days. For comparison, GMX has over 1,000 daily active users, DYDX around 700, and SNX about 500.

Source: dune

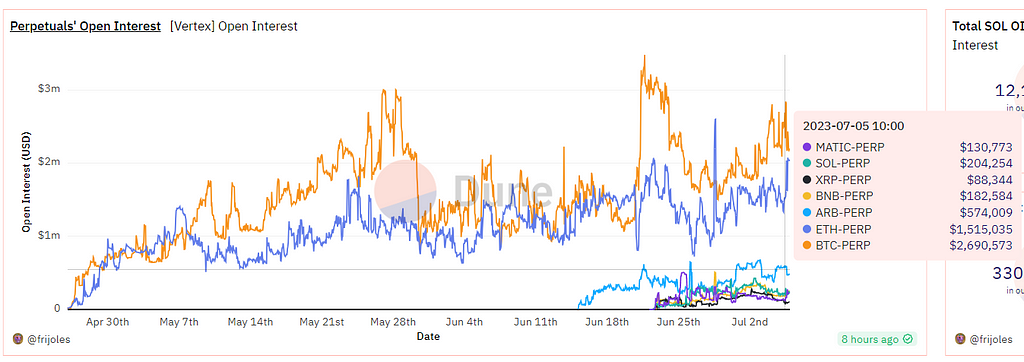

Open Interest: There are seven trading pairs in total, with BTC and ETH dominating. Current open interest stands at approximately $5.37 million, which is also relatively low.

For context, DYDX’s open interest is around $300 million, GMX’s between $150–200 million, Gain Network’s between $30–50 million, and Mux’s between $20–50 million.

Source: dune

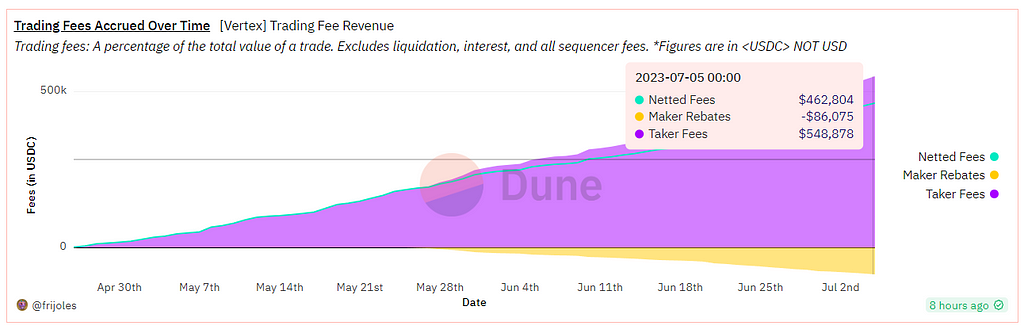

Fee Revenue: Cumulative gross revenue is approximately $540,000. After deducting $86,000 in rebates to makers, net revenue amounts to $460,000.

Source: dune

2. Team and Investors

Co-founder Darius primarily oversees external marketing activities.

Co-founder Alwin Peng previously worked at Jump Trading as a blockchain engineer.

In June 2023, Vertex received a strategic investment from Wintermute Ventures, the venture arm of crypto market maker Wintermute. Wintermute provides market-making services for multiple well-known projects including Arb, OP, and Blur.

When announcing the investment, Wintermute stated: "Vertex is led by a strong team of traders and engineers with proven track records in both TradFi and DeFi markets, positioning it at the forefront of smart contract and market innovation."

Earlier, in April 2022, Vertex raised an $8.5 million seed round, led by Hack VC and Dexterity Capital, with participation from Collab+Currency, GSR, Jane St., Hudson River Trading, Huobi, JST Capital, Big Brain, Lunatic Capital, among others. Early investors received 8.5% of the tokens, implying a seed valuation of $100 million for Vertex.

Vertex was originally built on Terra, but after Terra's collapse, the protocol migrated to Arbitrum.

3. Product

Vertex offers a one-stop DeFi platform featuring spot trading, perpetual contracts, and lending markets. Its core operations revolve around derivatives, particularly perpetual contracts, with spot and lending services mainly supporting derivatives trading—thus classifying it as a derivatives DEX.

Liquidity Provision Model: Hybrid Orderbook-AMM Design

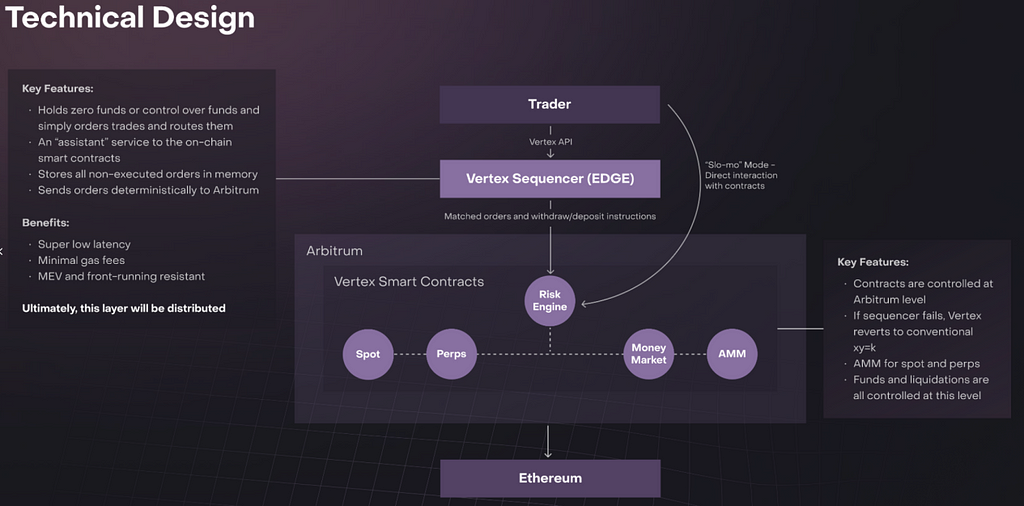

The liquidity model is the key differentiator for Vertex compared to other derivatives DEXs. Vertex argues that off-chain orderbooks processed via FIFO (first-in, first-out) reduce MEV attacks and improve execution speed. Meanwhile, on-chain AMMs provide permissionless liquidity, allowing traders to force trades and ensuring transaction viability even when orderbook liquidity is insufficient.

Vertex implements this hybrid model through three core components:

- On-chain trading venue (AMM)

- On-chain risk engine for rapid liquidations

- Off-chain sequencer for order matching

Figure: Core Architecture of Vertex

Source: Vertex

This means two types of liquidity coexist on Vertex: orderbook liquidity provided by market makers via API, and LP capital supplied through smart contracts.

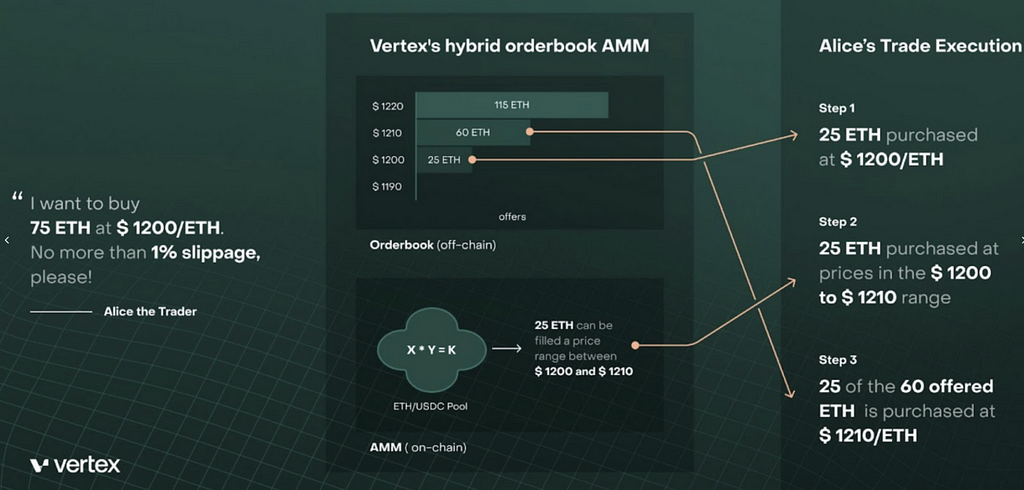

These two liquidity sources are combined via the sequencer, presenting a unified liquidity pool on the frontend interface, enabling trades at the best available price. The diagram below illustrates how the sequencer utilizes both orderbook and LP liquidity to fulfill trades.

Source: Vertex

Process Example:

The current trading price for ETH-USDC is $1,200.

Alice wants to buy 75 ETH and sets her maximum slippage at 1%.

There are sell orders worth 25 ETH on the orderbook priced at $1,200, so one-third of the trade executes at $1,200.

The next set of orderbook sell orders (totaling 60 ETH) are priced at $1,210.

However, there is an LP position of 25 ETH with a price range between $1,200 and $1,210. Therefore, the next third of the trade is filled from the LP position at prices ranging between $1,200 and $1,210.

The final third of the trade executes at $1,210.

Capital Efficiency: Universal Cross Margin Expands Collateral Scope

To enhance capital efficiency, Vertex introduced the concept of “Universal Cross Margin,” significantly expanding the scope of acceptable collateral.

Currently, two margin models dominate derivatives trading. The first is Isolated Margin, where each trading pair operates as a separate account. Only assets related to that specific trading pair can be deposited, held, or borrowed within the isolated account. Risk ratios are calculated independently based on the assets and liabilities of each isolated position, ensuring isolation—if one position is liquidated, it does not affect others.

The second is Cross Margin, where typically a single cross-margin account allows trading across all supported assets. All assets within the account serve as mutual collateral and share usage. The risk ratio is calculated based on the entire portfolio’s assets and liabilities. If liquidation occurs, all assets in the account may be sold off.

Clearly, cross-margin offers higher capital efficiency than isolated margin. Building upon this, Vertex introduces Universal Cross Margin.

All user funds on the platform—deposits, positions, and PnL—from spot, perpetual, and money markets can be used as margin. For example, users providing liquidity to spot pools earn fees while simultaneously using their LP position as margin for derivatives trading, thereby increasing capital efficiency.

Universal Cross Margin also enables portfolio margining, allowing unrealized profits to offset unrealized losses or serve as margin for existing or new positions.

To help users better manage risk, Vertex provides real-time account health indicators directly visible on the interface.

Accounts fall into two states: Initial and Maintenance. Within the Initial state, accounts are further categorized into low, medium, or high risk based on the margin-to-liability ratio. The Maintenance state indicates initial margin usage exceeds 100%, meaning no new positions can be opened and additional margin must be added promptly to avoid liquidation.

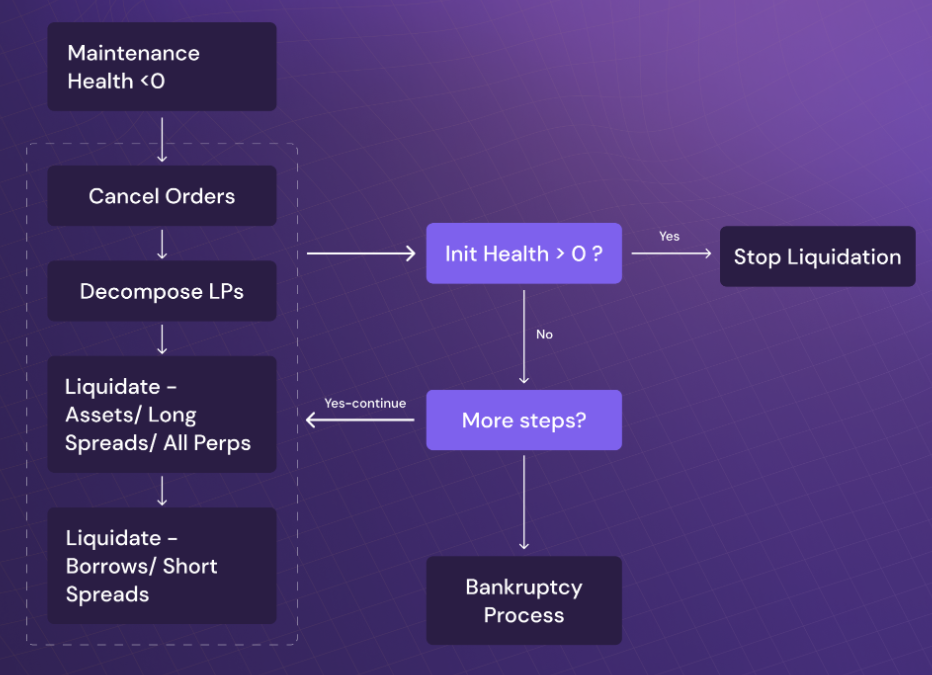

Due to Universal Cross Margin, liquidations occur under full cross-margin mode, following this sequence:

- Orders are canceled, releasing order funds;

- LP assets are withdrawn and sold;

- Assets are liquidated (spot balances / derivative positions);

- Liabilities are settled (borrowed funds).

If during liquidation the account’s initial health factor recovers above zero, the process stops.

Source: Vertex

Low Trading Fees

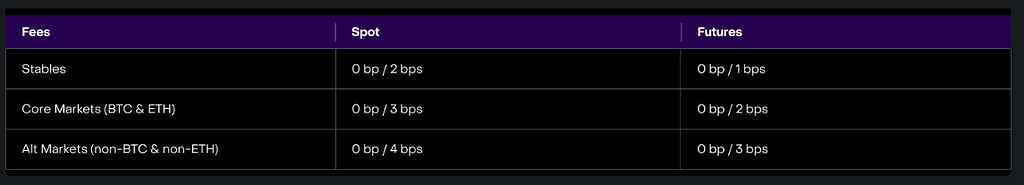

Vertex offers some of the lowest trading fees in the market. Currently, maker fees are 0% for both spot and derivatives, while taker fees range from 0.01% to 0.04%.

Source: Vertex

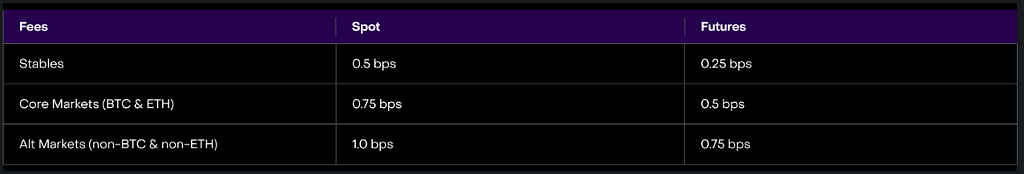

To incentivize makers, those whose trading volume exceeds 0.25% of the total maker volume during a given epoch (28 days) receive rebates. The rebate structure is as follows:

Source: Vertex

Compared to major derivatives DEXs: GMX charges relatively high fees (0.1% for opening and closing positions); DYDX’s fee ranges from 0.02% to 0.05%, decreasing with volume; Kwenta charges 0.02% to 0.06%.

4. Tokenomics

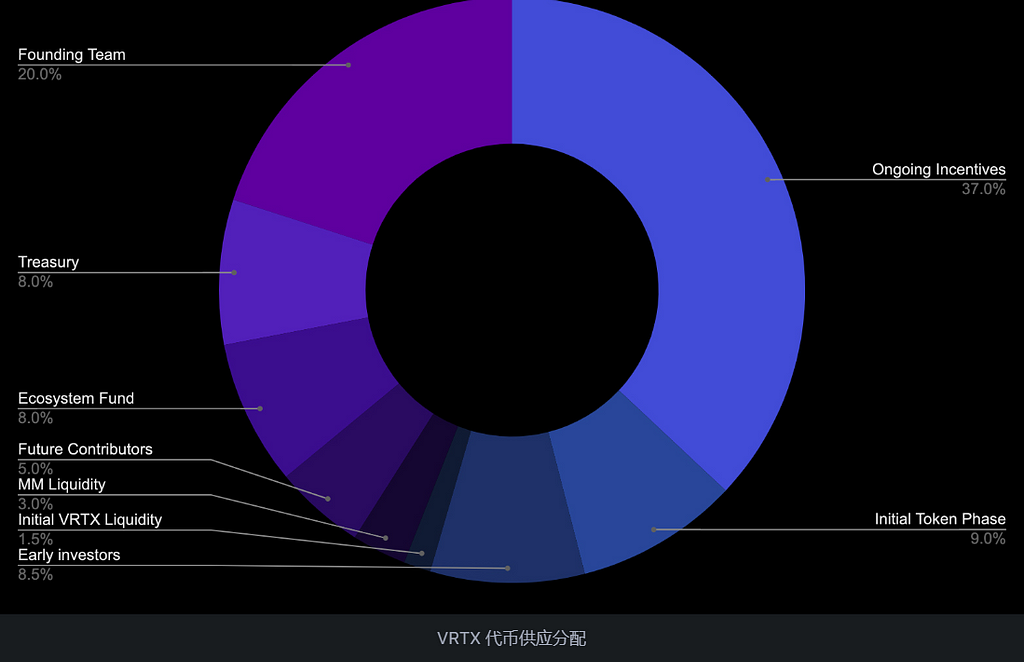

VRTX is the governance token of Vertex Protocol, with a total supply of 1 billion tokens, of which 90.08% will be distributed over five years.

Token distribution is illustrated below: 46% allocated to community incentives (9% for initial incentives, 37% for ongoing rewards); 41% reserved for team, treasury, ecosystem fund, and future contributors; 8.5% for early investors; and 4.5% for liquidity. Note: This allocation was disclosed in early June 2022 and does not include the Wintermute investment, which would likely come from the treasury.

Source: Vertex

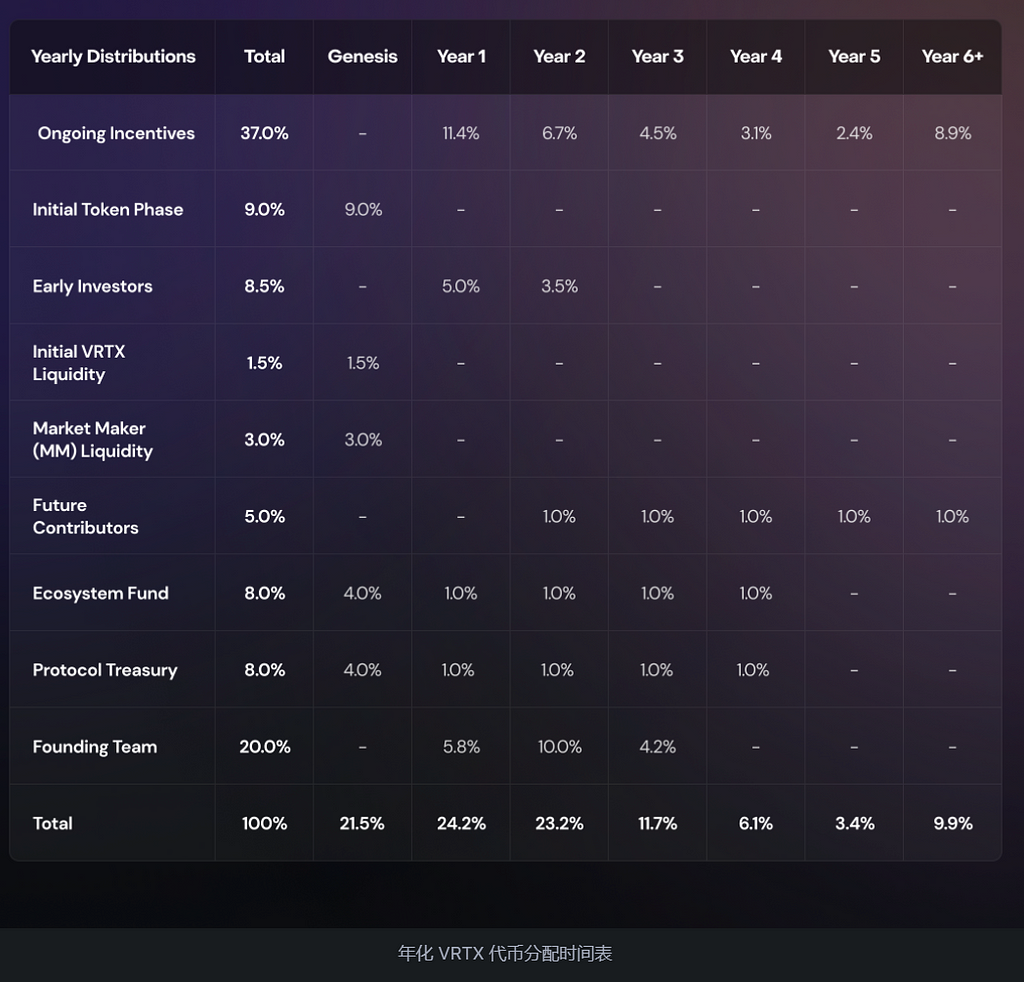

VRTX tokens will be distributed six months after mainnet launch, expected around October 2023. The release schedule is as follows:

Source: Vertex

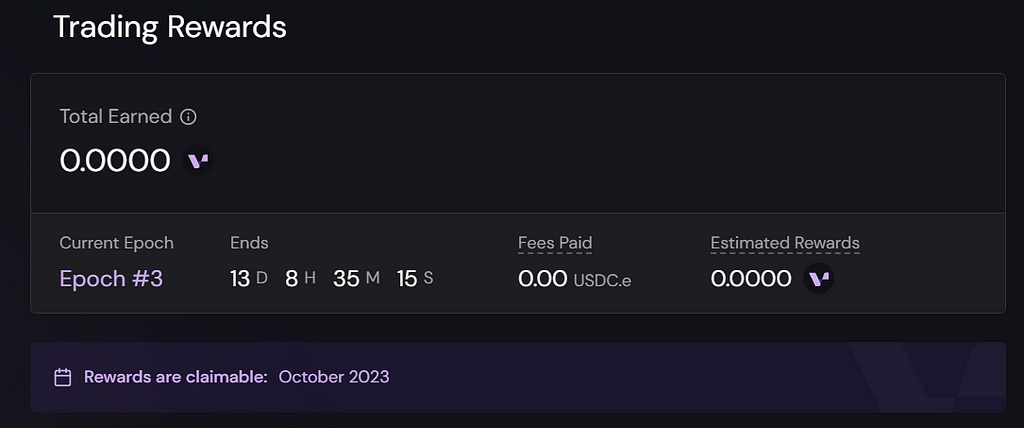

The Initial Token Phase allocates tokens for pre-launch trading incentives. Users can track these rewards on the Rewards page within the Vertex app, with official confirmation that these incentives can be claimed starting October 2023.

Source: Vertex

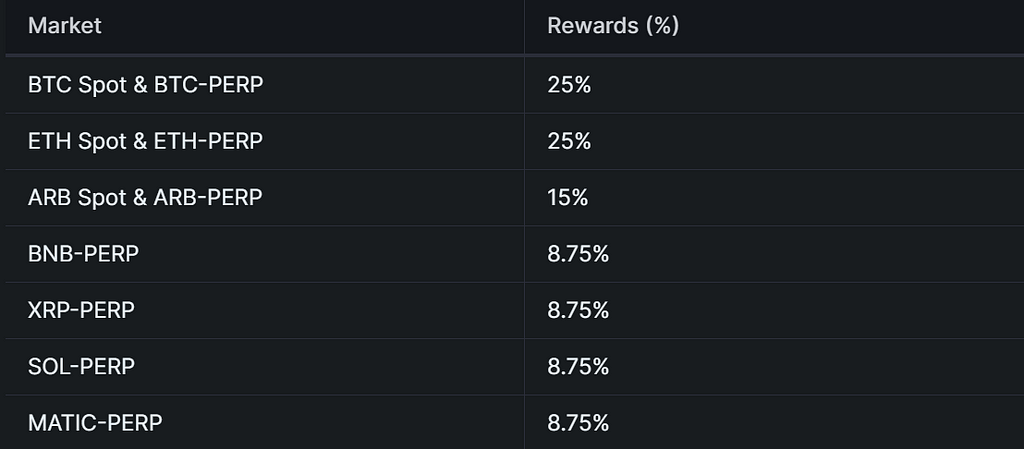

The Initial Token Phase consists of six epochs, each lasting 28 days, with 15 million tokens awarded per epoch—currently in the third epoch. Incentive allocations are weighted primarily by trading fees. Additionally, different trading pairs have varying reward weights, detailed below:

Source: Vertex

Vertex’s token has not yet launched. Given the presence of trading incentives, some degree of wash trading is inevitable. Most derivatives DEXs rely on trading incentives at launch—such as Vela, which ran incentives during its beta phase to boost volume. Many protocols maintain incentives post-launch, including DYDX and Kwenta. Vertex’s current traction suggests positive market sentiment toward its upcoming token.

5. Conclusion

The derivatives DEX landscape is already saturated. Many projects fork GMX’s model, deploying on new chains or L2s with high APRs to attract capital and yield. In contrast, Vertex introduces several innovative mechanisms aimed at improving liquidity quality and capital efficiency—making it a project worth watching.

A notable risk, however, is that Universal Cross Margin increases users’ risk exposure despite enhancing capital efficiency. Traders must exercise appropriate risk management.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News