Analyzing Vertex Protocol: Filling the Business Gap Between DEXs and CEXs

TechFlow Selected TechFlow Selected

Analyzing Vertex Protocol: Filling the Business Gap Between DEXs and CEXs

Vertex has unparalleled product-market fit and is fully positioned to become a top-tier decentralized exchange and a leading cryptocurrency exchange.

Author: Metaverse Guy

Compiled by: TechFlow

From the collapse of FTX and the loss of billions in customer funds to the recent SEC actions against Binance and Coinbase, the advantages of on-chain transparency and self-custody offered by decentralized exchanges have become increasingly evident.

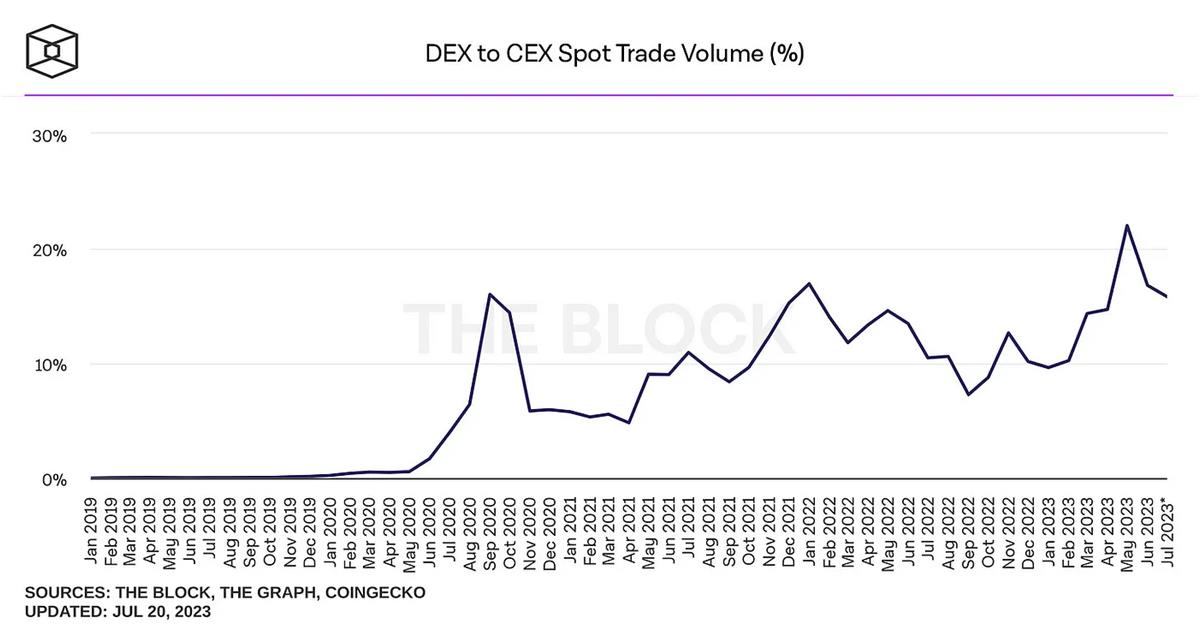

However, despite some progress in spot trading, 80–90% of spot volume still flows through centralized exchanges. Over 97% of perpetual contract trading volume is still executed via centralized platforms.

The inherent risks of custodial centralized platforms are clear—why do most investors, traders, and institutions still use them?

For retail investors, it’s simple: DeFi functionality and products are scattered across multiple platforms, making the entire process complex and time-consuming.

This lack of vertical product integration also affects advanced traders and institutions, making it difficult to execute sophisticated strategies—especially when execution speed is significantly slower compared to centralized platforms.

Most decentralized exchanges aim only to compete with other DEXs, not solve the core issues keeping the majority of trading volume on centralized exchanges. As a result, they attract only existing DeFi users from other platforms—not new users into the on-chain ecosystem.

But one new platform aims to address both latency and functionality challenges while preserving DeFi’s core benefits: transparency and self-custody.

What Is Vertex Protocol?

Vertex is an Arbitrum-based decentralized exchange offering integrated spot, perpetual contracts, and money markets with execution speeds comparable to centralized exchanges. Its vertically integrated architecture and high-speed execution, combined with unique features like universal cross-margining, make it appealing to both retail and institutional users.

Thus, Vertex combines the performance and functionality of centralized exchanges with on-chain transparency and user self-custody, positioning itself to compete with both decentralized and centralized platforms.

How Does Vertex Compare to CEXs?

Like top-tier centralized exchanges, Vertex offers a vertically integrated suite of core crypto trading products: spot, perpetuals, lending, and more. This integration enables a universal cross-margin feature—even Binance doesn’t offer this.

Cross-margining allows using collateral from one or more profitable positions to support underperforming trades, reducing required margin per position and improving capital efficiency. While common on centralized platforms, cross-margining is rare in DeFi—and typically limited to one product type (e.g., only spot or only perpetuals). You can’t use funds across product types or collateralize with money market deposits or liquidity pool tokens. Vertex’s universal cross-margin enables exactly that.

Vertex’s universal cross-margin makes advanced strategies like basis and pairs trading far more viable, setting it apart from both other DEXs and centralized platforms like Binance.

By consolidating all core trading products on one platform, Vertex becomes as easy to use for retail users as a centralized exchange. Meanwhile, universal cross-margin gives advanced traders unique capabilities.

But Vertex goes further: slow transaction speeds in DeFi make time-sensitive trading nearly impossible—another reason institutions and large traders stick with centralized exchanges. To solve this, Vertex built an off-chain orderbook within its Edge sequencer, operating in parallel with on-chain AMMs to achieve sub-30ms execution times—rivaling the fastest exchanges in crypto.

The Edge sequencer automatically selects the best price between the orderbook and AMM, with the AMM effectively acting as another market maker. The orderbook delivers CEX-level speed and optimal pricing while solving another major DEX issue: price impact.

AMMs also allow Vertex to list low-liquidity assets that might be unviable with an orderbook-only model.

In practice, the orderbook provides CEX-like execution speed, while AMMs enable listing assets even centralized exchanges can’t support. All trades settle on-chain, ensuring critical DeFi benefits: transparency and self-custody.

The only downside compared to centralized exchanges is the inability to trade non-ERC20 tokens—for example, you must trade wBTC instead of BTC. Undoubtedly, this may concern supporters of Bitcoin, Cardano, and Solana.

Centralized exchanges generate massive revenue from fees and liquidations, capturing most crypto trading volume without sharing any with users. Vertex, however, appears poised to capture a portion of that volume and share revenue via its VRTX token.

How Does Vertex Compare to Other DEXs?

Decentralization purists may argue that Vertex, with its off-chain orderbook, doesn’t qualify as a true DEX. Yet the same applies to dYdX—which hasn’t stopped it from becoming the largest on-chain perpetuals exchange by volume, running only an orderbook, not a hybrid AMM/orderbook model.

The whitelisting mechanism on the user interface is also highly centralized, meaning projects cannot list automatically on Vertex—so you’re unlikely to see the latest degens tokens. While Vertex can list more tokens than the average centralized exchange, it hosts far fewer than the largest DEXs. But is that really a bad thing?

To compete with centralized exchanges, Vertex had to make compromises—especially when on-Ethereum DEX executions take over 13 seconds, and L2 DEXs over 1.3 seconds. The hybrid AMM/orderbook model delivers centralized performance with on-chain finality, transparency, and self-custody.

Regarding whitelisting, there’s an argument that investors—especially those migrating from centralized exchanges—need protection from high-risk projects and potential scams. Plenty of other venues exist for those wanting to buy degens tokens.

Vertex does not replace other DEXs—it fills the gap between them and centralized exchanges.

VRTX Token

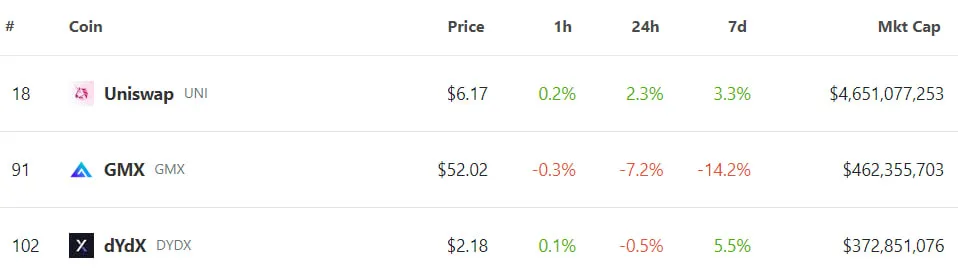

Most native protocol tokens lack real buy pressure. For example, UNI is merely a governance token with no intrinsic value; dYdX offers governance and reduced fees, but unless you trade heavily, it holds little appeal.

However, revenue-sharing or real yield has steadily gained traction, propelling tokens like GMX into the top 100 by market cap. Despite dYdX having 10x the trading volume of GMX, GMX’s market cap is 1.3x larger—such is the power of real yield.

Imagine a protocol matching dYdX’s performance, surpassing it in functionality, and rewarding token holders with revenue shares—what would such a token be worth? We’ll soon find out when VRTX launches.

How to Get VRTX?

Before the VRTX token launch, the only way to gain exposure is by trading spot or perpetuals on the Vertex platform.

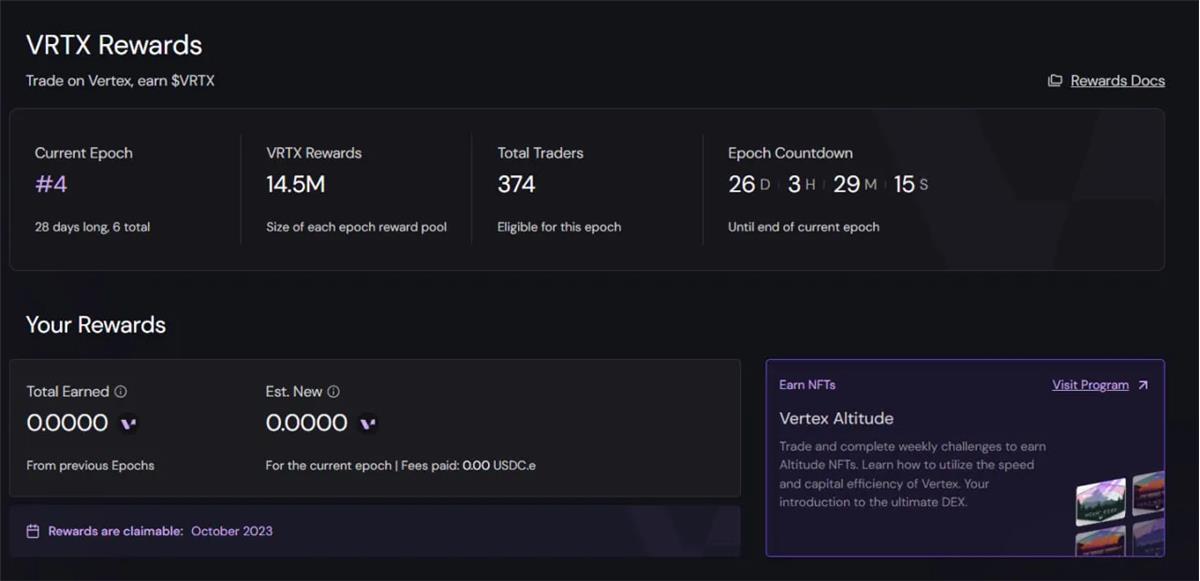

To incentivize platform usage, Vertex established a rewards system. VRTX rewards are distributed proportionally based on each trader’s fee contribution during a given period. During the genesis phase, 9% of total VRTX supply is available, ending in October, followed by a continuous issuance phase distributing the next 37% over five years.

So far, the reward system has been highly successful, with Vertex briefly surpassing GMX and nearly all other on-chain perpetual platforms in recent days.

Upside Potential

CEXs control 80–90% of spot volume and over 97% of derivatives volume. Thus, the potential for a platform that competes with—and potentially surpasses—them in vertical integration, functionality, and performance is enormous.

Uniswap handles just one-tenth of Binance’s spot volume, yet its UNI token has a $4.6 billion market cap. dYdX, the largest on-chain perpetuals platform, captures only 3% of Binance’s volume, yet its token is valued at $376 million—and neither shares revenue with holders.

In contrast, GMX shares revenue and boasts a nearly $500 million market cap. Yet, as discussed, Vertex has already reached competitive volumes within less than four months.

Therefore, VRTX is destined for a substantial market cap. How much upside early holders will capture depends on whether they earn it through rewards or buy at launch—and on the initial listing price.

To me, Vertex seems almost too good to be true, so I suspect the starting market cap will be very high.

Nevertheless, Vertex demonstrates unparalleled product-market fit and is well-positioned to become a leading decentralized exchange—and one of the top crypto exchanges overall. In a bull market, as volumes and revenues surge, VRTX may face no real competitors.

Advantages:

-

Exchange-grade trading speed;

-

Zero price impact;

-

On-chain transparency and self-custody;

-

All core crypto trading products—spot, perpetuals, and money markets—vertically integrated;

-

Universal cross-margin trading;

-

User-friendly interface;

-

Integrated fiat on/off ramps;

-

Low trading fees;

-

Trading rewards program;

-

VRTX token receives revenue share;

-

API access for institutional trading software;

-

Supports low-liquidity tokens;

-

Whitelisting protects users from high-risk assets;

-

Backed by major institutions like Jane Street and Wintermute;

-

Already achieved significant perpetual trading volume.

Disadvantages:

-

The sequencer and orderbook represent centralized compromises;

-

Whitelisting is a centralized element;

-

Whitelisting limits the number of available tokens;

-

Only ERC20 tokens can be traded, unlike centralized exchanges;

-

Currently limited selection of spot and perpetual pairs;

-

No announcement yet on VRTX listing price.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News