What Sets Derivatives DEX Vertex Apart, Which Quickly Rose to the Top via Trading Mining?

TechFlow Selected TechFlow Selected

What Sets Derivatives DEX Vertex Apart, Which Quickly Rose to the Top via Trading Mining?

Vertex combines the order book model used by centralized exchanges with the AMM model commonly adopted by DEXs, bridging the operational gap between DEXs and CEXs.

Written by: TechFlow

In the competitive derivatives DEX arena, a dark horse is swiftly leaping forward.

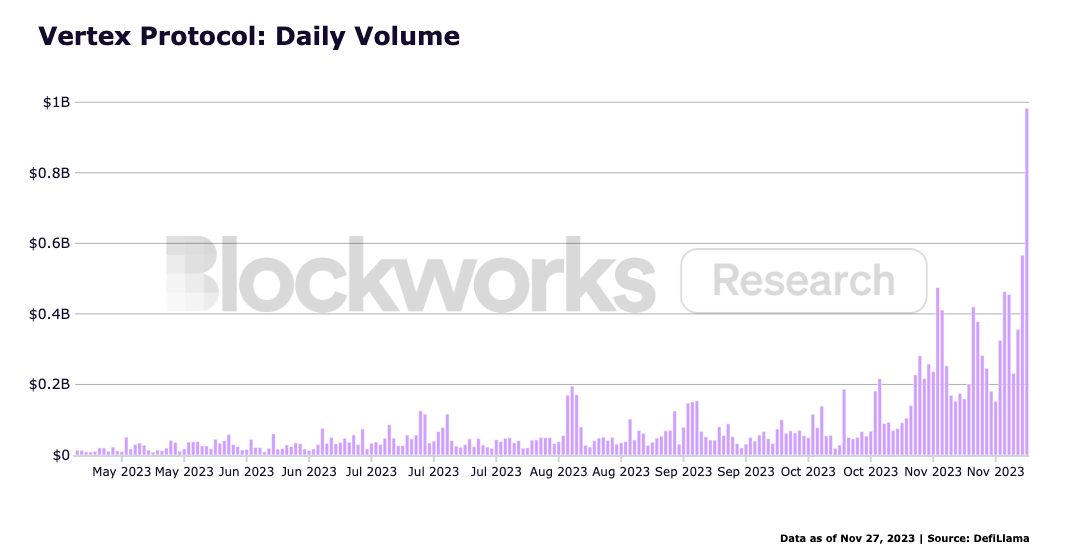

On November 28, the derivatives trading platform Vertex achieved a daily trading volume of $1.63 billion, surpassing established platforms like dYdX and GMX to become the largest derivatives DEX.

How did it accomplish this feat so quickly?

On November 23, Vertex announced an incentive campaign: traders who conduct transactions on the platform would receive token rewards—not only its native token VRTX but also ARB, sourced from over 3 million ARB previously awarded through STIP by the Arbitrum DAO. It’s the familiar “trade-to-earn” model, and this time it’s dual mining with one click.

According to the rules disclosed in the official blog, traders can earn ARB rewards in two ways:

1.Trade on Vertex: Trading on Vertex earns both ARB and VRTX rewards. ARB rewards are distributed based on the taker fees paid by traders, up to 75% of the taker fees paid. ARB rewards are settled and distributed weekly. Total ARB trading rewards will range between 1.35 million and 2.55 million ARB (450K–850K ARB per 28-day cycle).

This means users effectively pay only 25% of their fee to earn VRTX.

2. Deposit as an LP in Elixir Fusion Pools: Users who provide liquidity to Elixir Fusion Pools can also earn ARB and VRTX rewards, allocated based on the amount of liquidity provided. The maximum ARB reward for Fusion Pools is 450,000 ARB (up to 150,000 ARB per 28-day cycle).

Additionally, during the 12-week ARB rewards program, sequencer fees for all trading pairs are reduced to 0 USDC.

Fueled by the dual incentives of ARB and VRTX, a large influx of traders arrived, increasing daily trading volume by 546% compared to the previous week.

What Makes Vertex Special?

As another derivatives trading platform, what distinguishes Vertex from veteran DEXs like dYdX and GMX?

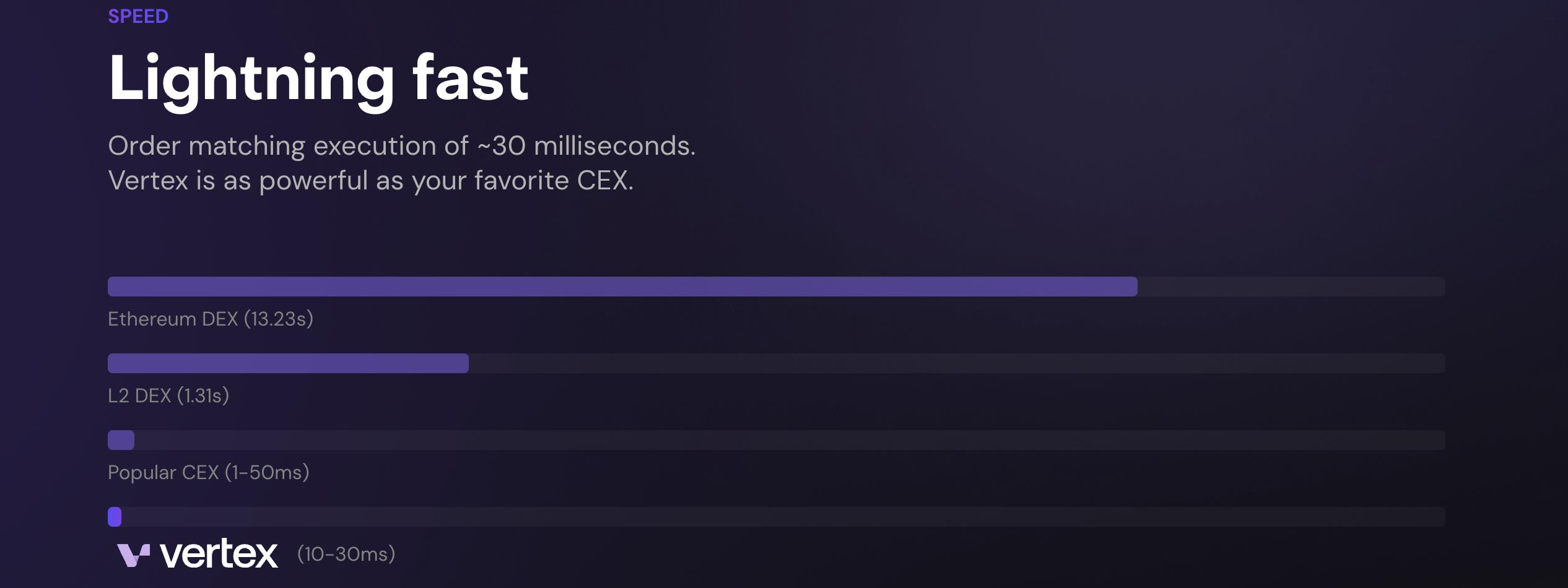

The biggest differentiator is that Vertex uniquely combines the order book model used by centralized exchanges (CEX) with the AMM model commonly adopted by DEXs, bridging the operational gap between DEXs and CEXs.

Vertex employs a hybrid order book-AMM model, meaning the platform maintains two types of liquidity simultaneously: order book liquidity provided by market makers via API, and LP capital supplied through smart contracts.

AMM liquidity resides on-chain, while order book liquidity operates off-chain. These two liquidity sources are combined via a sequencer, presenting traders with a unified liquidity pool at the front end, enabling trades to be executed at the best available price. This integration of on-chain and off-chain liquidity significantly enhances trading efficiency.

Secondly, to improve capital efficiency, Vertex introduced the concept of "Universal Cross Margin," essentially a cross-margin mode that expands the scope of margin usage.

All funds held by a user on the platform—deposits, positions, and investment gains or losses—can serve as margin. For example, if a user is providing liquidity to a spot pool, they not only earn fees but can also use their LP position as collateral for derivative trading.

To further enhance the user experience to match that of CEXs, Vertex implemented a one-click trading (1CT) feature.

Users need only sign one approval transaction before starting; after that, any action within Vertex requires no further confirmations—just like logging into a CEX account and immediately beginning to trade.

Tokenomics

On November 20, 2023, Vertex officially launched its native token—VRTX.

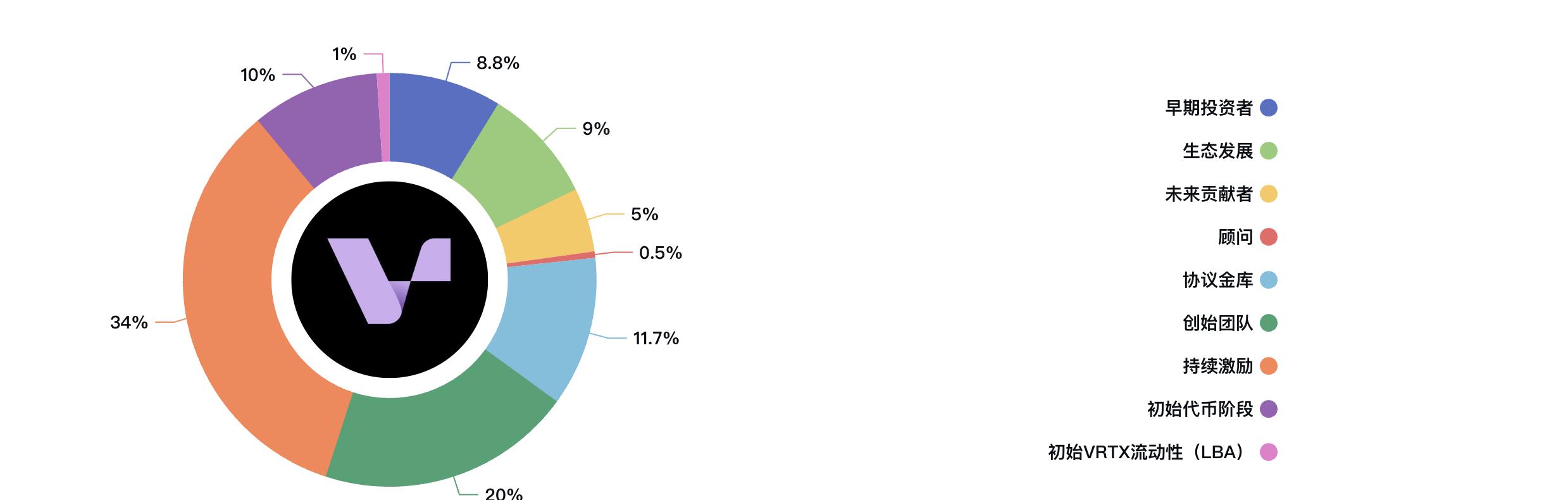

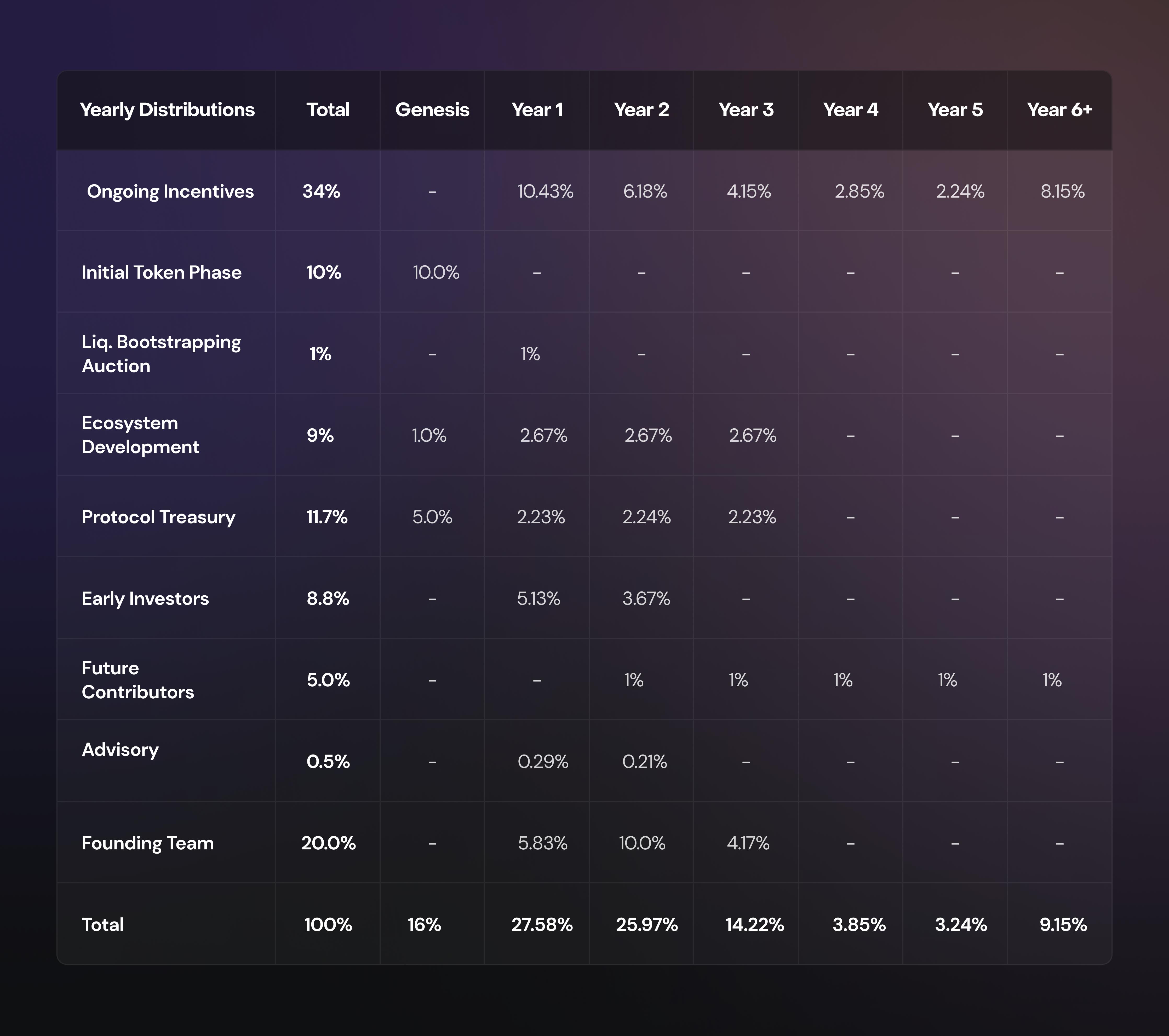

VRTX has a total supply of 1 billion tokens, with 34% allocated to ongoing incentives, 20% to the founding team, 10% to the Initial Token Phase (the first stage of the Trade & Earn program), 11.7% to the treasury, 9% to the ecosystem, 8.8% to early investors, 5% to future contributors, 1% to LBA (liquidity bootstrapping auction), and 0.5% to advisors.

In 2022, Vertex Protocol raised $8.5 million in seed funding led by Hack VC, Dexterity Capital, Jane Street, and Hudson River Trading. For early investors, the VRTX allocation is 8.8% (88 million VRTX), with vesting occurring roughly 2–3 years after project launch.

In June this year, Vertex Protocol secured strategic investment from Wintermute Ventures, though the amount remains undisclosed.

Approximately 90.85% of VRTX tokens will be distributed over a period exceeding five years, as shown in the chart below.

According to the above chart, current token distribution accounts for only 16% of the total supply, and within this 16%, only 10% is truly circulating.

According to official documentation, the VRTX token is primarily designed to incentivize the Vertex community and facilitate mutually beneficial relationships among contributors. Currently, it serves two main purposes:

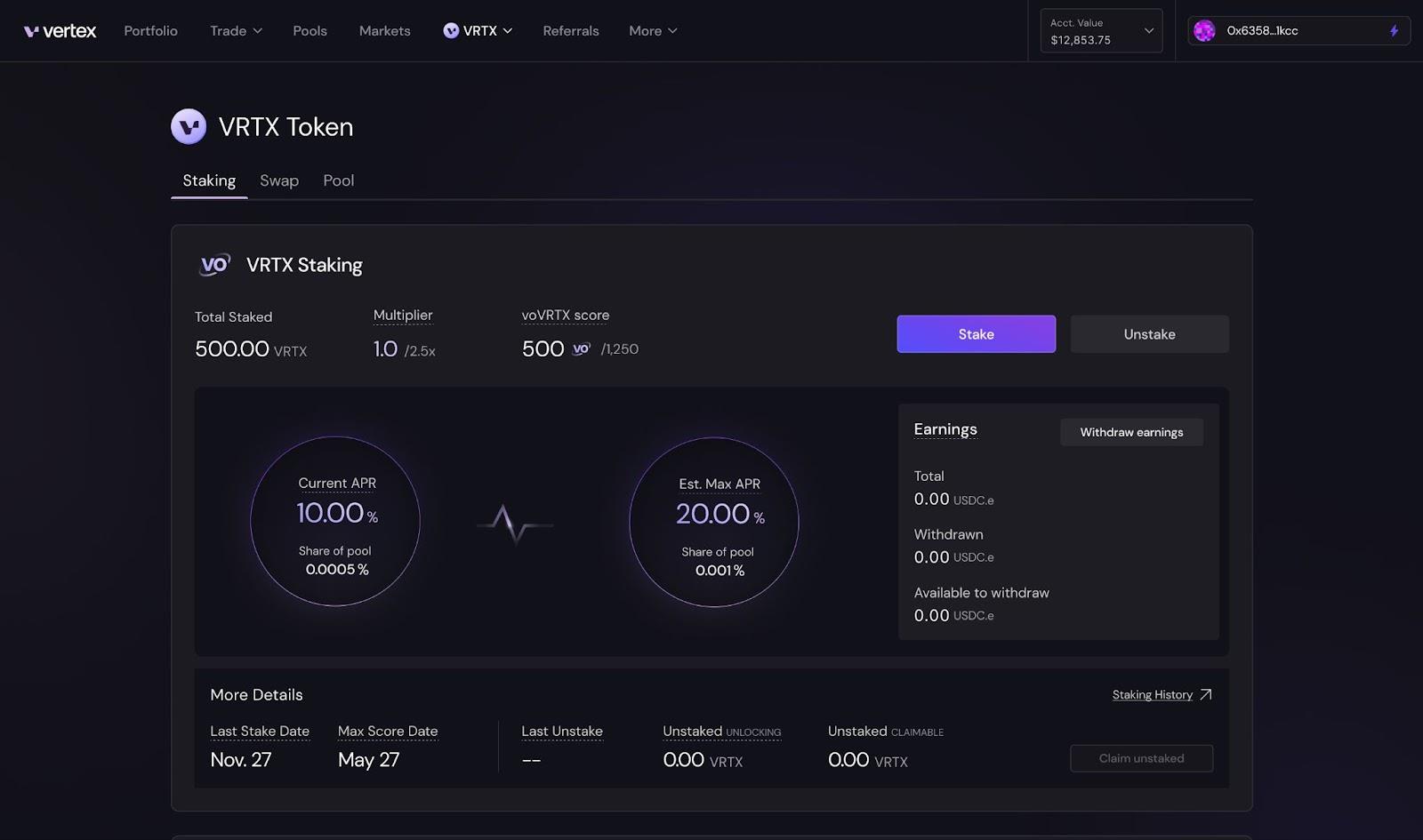

(1) Staking: VRTX can be staked to contribute to the security of the Vertex ecosystem. Vertex also introduced a "ve" model, generating voVRTX points proportional to the duration of VRTX staking—the longer the stake, the greater the rewards.

(2) Long-term rewards for varying levels of contribution to the protocol.

Despite fierce competition in the derivatives DEX space, "trade-to-earn" still appears to be an effective cold-start strategy. However, whether Vertex can sustain momentum and cultivate a loyal user base after the incentive phase ends remains an open question. That said, in terms of innovation, Vertex certainly stands out.

Currently, over 97% of derivatives trading volume still occurs on CEXs, while derivatives DEXs account for just 2.72% of total volume. Any breakthrough in the derivatives DEX space could trigger a massive transformation in trading activity, which is why many investors are betting heavily on this sector—some even believe it will drive the core narrative of the next bull market.

The赛道 is still in its early stages. The outcome remains uncertain—we’ll continue to monitor developments closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News