Vertex Protocol: A Leading Derivatives Protocol on Arbitrum, Re-Emerging with Renewed Value in the New Cycle

TechFlow Selected TechFlow Selected

Vertex Protocol: A Leading Derivatives Protocol on Arbitrum, Re-Emerging with Renewed Value in the New Cycle

This article will provide an in-depth analysis of Vertex's current data, token yields, comparisons with other projects, and future development plans.

Written by: TechFlow

After the approval of Bitcoin spot ETFs, market attention has shifted back to the Ethereum ecosystem.

BlackRock's CEO recently stated he sees an opportunity in launching an Ethereum ETF. Meanwhile, expectations around Ethereum’s Q1 Cancun upgrade—which promises lower fees—have renewed interest in Layer 2 (L2) performance.

With all these positive catalysts, we’ve seen a collective rally across L2 projects, with Arbitrum entering its moment in the spotlight:

The ARB token hit an all-time high, and Total Value Locked (TVL) continues to climb, suggesting capital is flowing into Arbitrum. As such, it’s crucial to identify under-the-radar alpha opportunities within this growing ecosystem.

The competition among on-chain derivatives DEXs remains a compelling narrative—and far from over. Thanks to Arbitrum’s low gas fees and its recent STIP incentive program, derivatives DEXs built on Arbitrum deserve renewed attention.

Last year, Vertex Protocol, a derivatives exchange on Arbitrum, briefly surpassed GMX in daily trading volume, emerging as a dark horse largely overlooked by mainstream attention.

Now, as Ethereum L2s gain momentum and Arbitrum hits new highs, can this former dark horse—Vertex—shine again in a new cycle?

In this article, we’ll dive deep into Vertex by analyzing its current data, token economics, comparisons with other projects, and future development plans.

Vertex: The Late-Mover That Leaps Ahead in Derivatives

The on-chain derivatives space is crowded. How did Vertex manage to rise despite being late?

Launched on mainnet just nine months ago in April last year, Vertex integrates spot trading, derivatives (futures), and lending into a single platform, aiming to deliver a one-stop DEX experience.

However, more features don’t always mean better outcomes. In fact, more functionality and a later launch often mean broader comparisons and fiercer competition.

To leap ahead despite starting late, Vertex needed to excel in two areas: superior user experience and higher returns.

The former determines whether traders stay after joining; the latter influences why they come in the first place. Let’s start by reviewing the trading experience.

-

Better Liquidity Matching

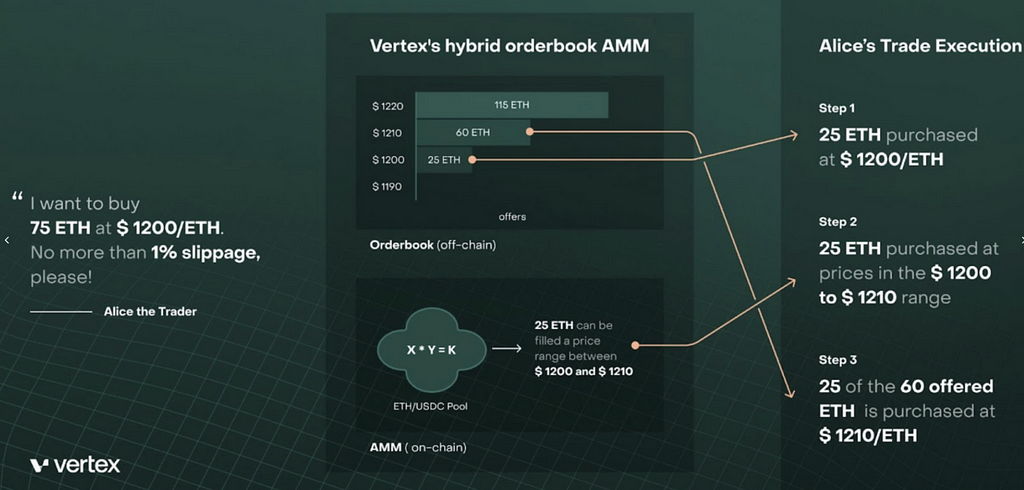

Unlike typical DEXs that rely solely on AMM models, Vertex combines two liquidity mechanisms: a unified Central Limit Order Book (CLOB) and integrated Automated Market Makers (AMM).

This hybrid model brings a key advantage: the platform hosts two types of liquidity—order book liquidity provided off-chain by market makers via API, and LP funds provided on-chain through smart contracts.

AMM liquidity exists on-chain, while order book liquidity operates off-chain. These are combined via sequencers, presenting traders with a unified liquidity pool at the front end, enabling trades at the best available prices. By merging on- and off-chain liquidity, Vertex significantly improves trading efficiency.

-

Higher Capital Efficiency

Vertex employs a global margin model where all funds—deposits, positions, and PnL—are usable as collateral, including open positions across spot, perpetuals, and money markets.

This allows unrealized profits to offset unrealized losses or serve as margin for existing or new positions, maximizing capital utilization for traders.

-

Lower Fees

Given that on-chain degens often suffer from slippage, MEV, and network congestion, Vertex benefits from Arbitrum L2’s batch transactions and rollup technology, resulting in significantly lower gas costs compared to Ethereum mainnet.

Additionally, Vertex has built its own smart contract risk control engine to minimize MEV impact.

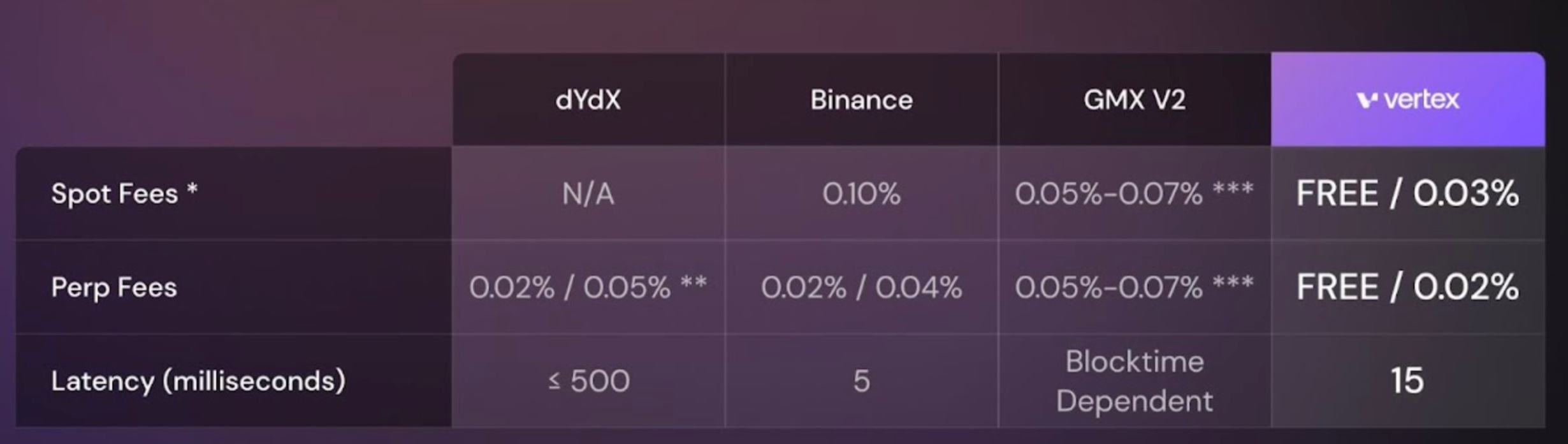

The chart below compares Vertex’s fees with leading exchanges as of last year-end, clearly showing Vertex’s rates are substantially lower than top players like GMX and dYdX for both spot and futures trading.

Looking back at Vertex’s 2023 performance, multiple data sources confirm it has become a major force within the Arbitrum ecosystem—and holds its own against derivatives DEXs across other ecosystems.

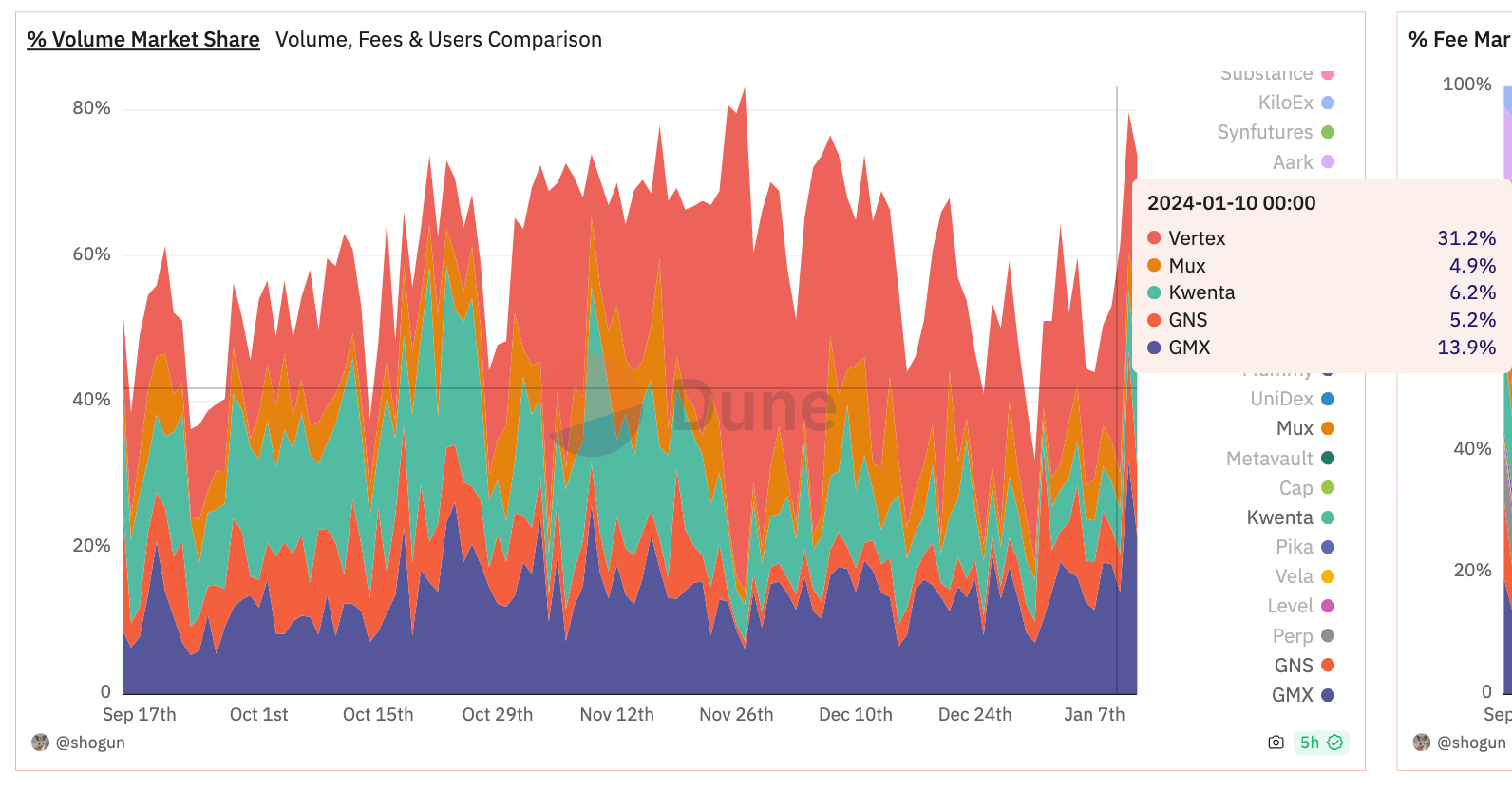

First, according to the official Dune dashboard, Vertex holds a meaningful share of trading volume among all derivatives exchanges in the entire crypto market.

At the time of writing, Vertex accounts for 30% of daily trading volume across all derivatives platforms (the red area at the top of the chart below). This market share has been steadily rising since October last year.

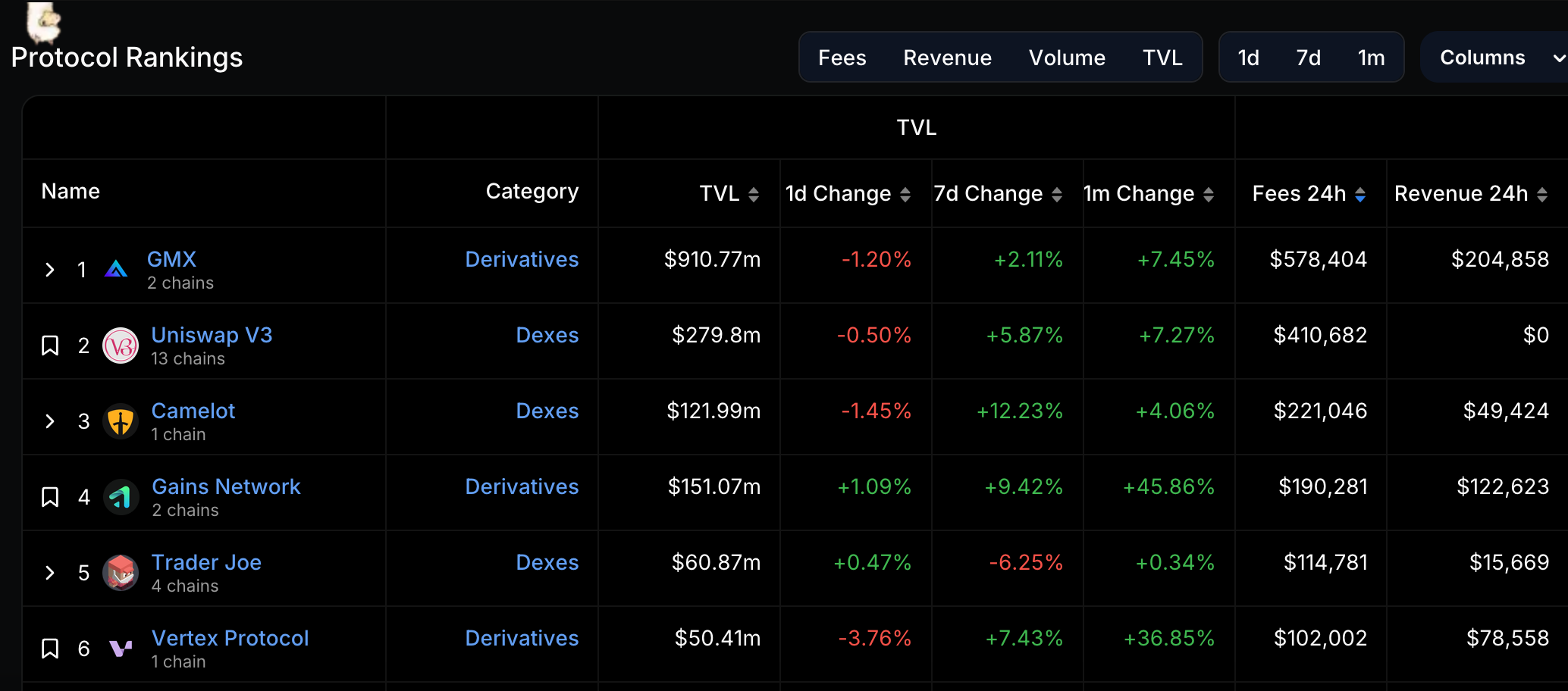

Second, DefiLlama’s cross-protocol comparison shows Vertex ranks highly in daily revenue generated on Arbitrum. If we consider only native Arbitrum protocols (excluding cross-chain projects), Vertex is already the top fee-generating native protocol on Arbitrum.

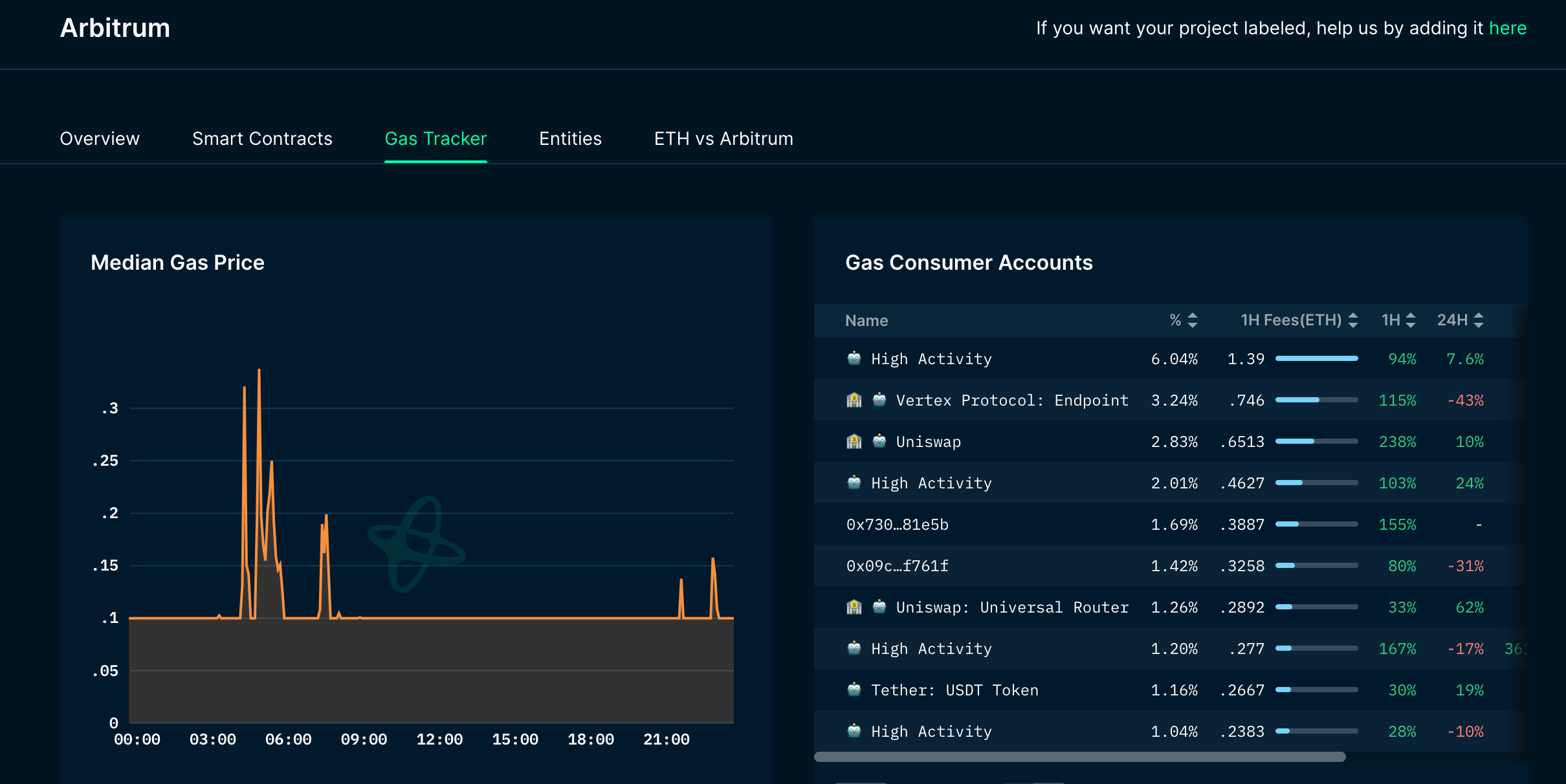

Moreover, Messari’s data on gas consumption across ecosystems shows Vertex ranks second on Arbitrum—even ahead of Uniswap.

These metrics point to one clear reality: a large number of users are actively trading on Vertex.

The logic is straightforward: trading activity generates gas usage, which translates into measurable trading volume and fee revenue for the protocol.

Vertex itself published an annual recap, showing concurrent growth in user count and TVL—a natural outcome as more users join the platform.

More importantly, over 45% of VRTX tokens are currently locked in staking, reducing circulating supply and alleviating selling pressure.

Beyond product improvements, another direct factor attracting traders is:

Vertex currently offers higher returns for LPs and traders—liquidity naturally flows to the most profitable venues.

Dual-Token Incentives Kickstart Growth, Real Revenue Takes Over

Using the classic “liquidity mining” playbook, Vertex successfully captured market attention last year.

Under previous incentive programs, users were encouraged to trade and share in protocol revenues. Beyond native VRTX rewards, participants also earned ARB tokens thanks to Arbitrum’s ecosystem incentives. With dual rewards, the influx of users was entirely predictable.

But old tricks bring old problems.

While token incentives boosted volume, relying solely on emissions isn’t sustainable. Continuous VRTX issuance creates long-term downward pressure on the secondary market. Moreover, incentives are essentially marketing spend—once the budget runs out, a vacuum often follows.

Vertex’s solution? Let real revenue take over from liquidity mining-driven traffic.

Users were initially drawn in by liquidity mining, but their trading activity generated genuine volume. As volume grew, so did transaction fees and real revenue.

This income stems from actual economic activity—not just new token emissions.

Combined with strong user experience and low gas fees on Arbitrum, a portion of users incentivized by rewards will naturally develop lasting trading habits on Vertex. As expected, Vertex saw rapid user and volume growth early on, followed by stabilization as real revenue matured.

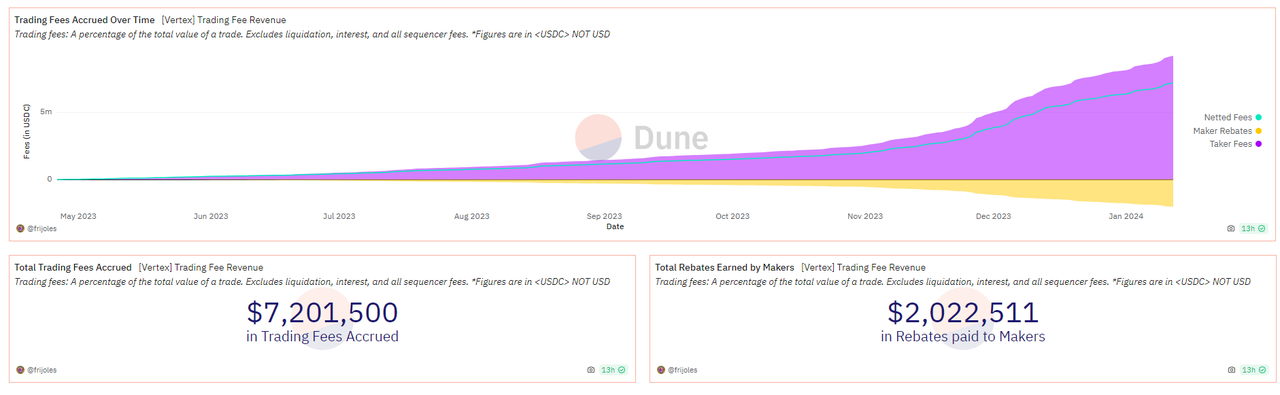

Real-world data confirms this trend.

As shown above, platform revenue (purple) has grown over time, along with payouts to liquidity providers (LPs, yellow). This means LPs earn ongoing returns from real protocol income.

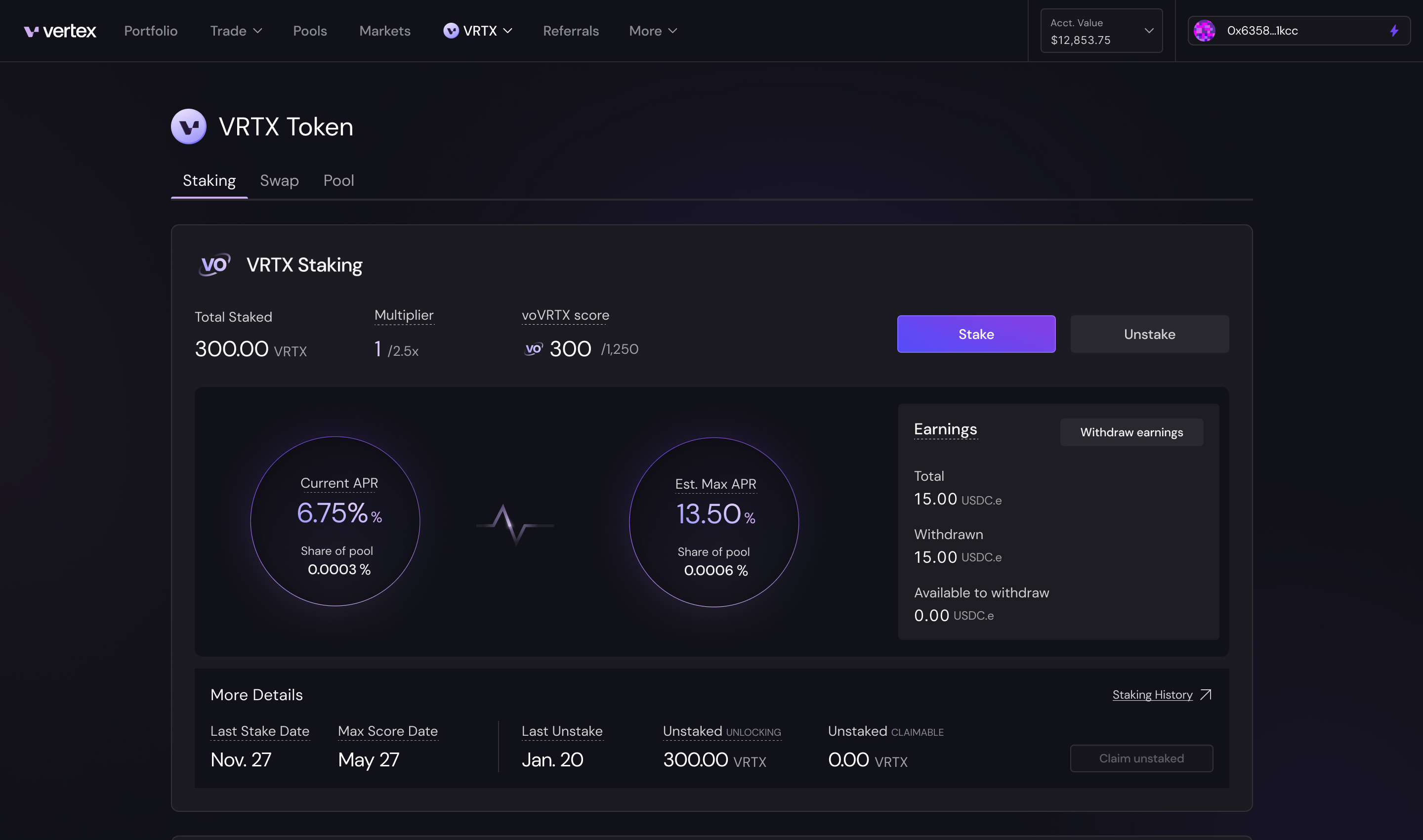

For traders, returns come through staking.

By combining incentives for trading and liquidity provision with VRTX staking, Vertex encourages users to reinvest earned tokens back into the protocol. This not only delivers staking rewards funded by real revenue but also helps stabilize the token price by reducing VRTX’s market supply.

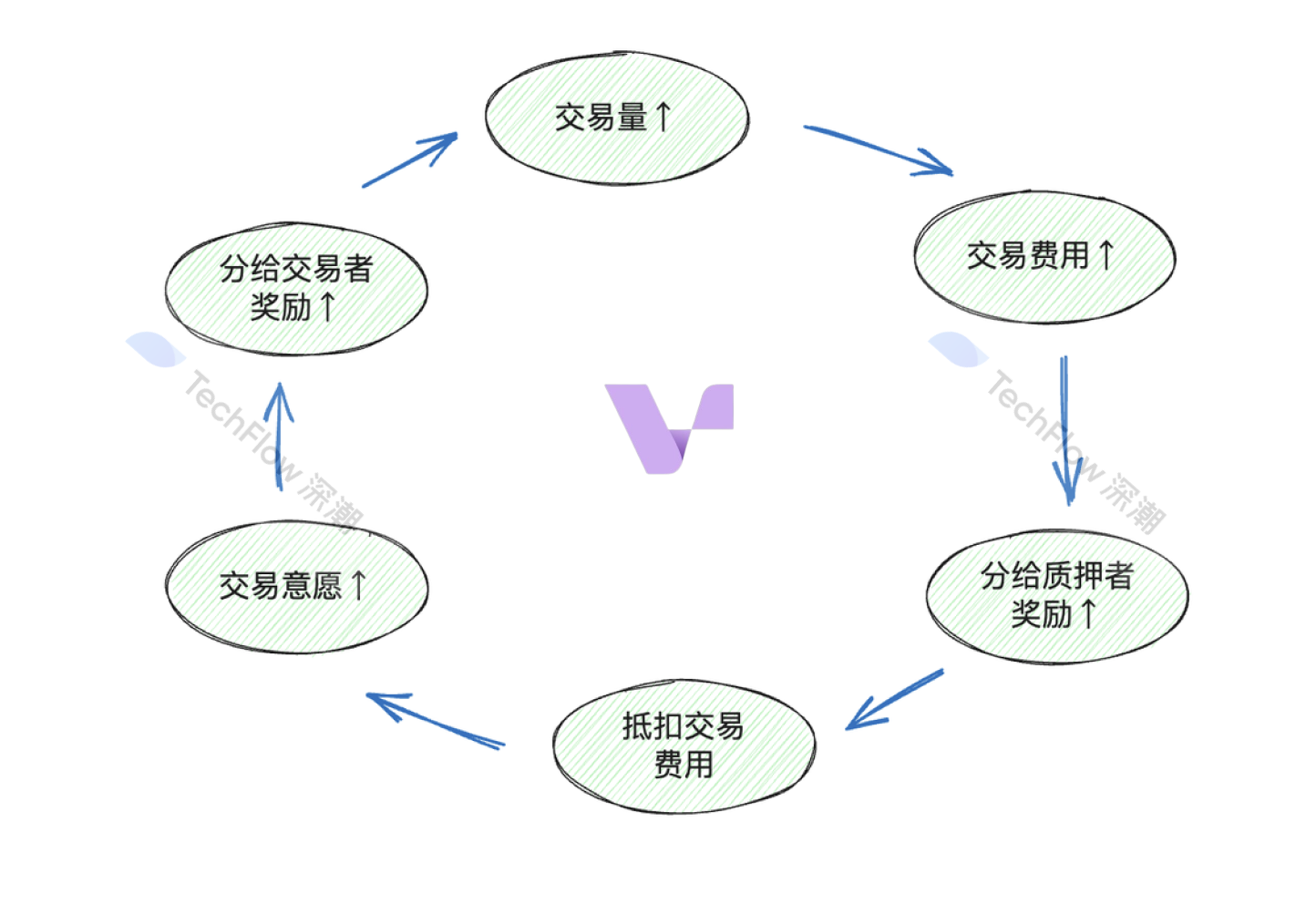

Kickstarted by liquidity mining, sustained by real revenue—we can now summarize Vertex’s full positive feedback loop:

-

Increasing trading volume leads to higher fees—i.e., more real income distributed to LPs, stakers, and traders;

-

Stakers can receive up to 50% of fee revenue (in ARB + VRTX);

-

Traders who stake get fee discounts, further encouraging trading activity;

-

More trading generates more fees, which fund additional rewards (in VRTX)—the larger the volume, the greater the reward;

-

Rewards are then restaked, restarting the cycle.

Thus, liquidity mining acts as the initial catalyst, driving volume growth. Once habits form, a robust staking mechanism ensures users keep earning from trading and staking, while reduced token circulation indirectly supports price stability.

Currently, Arbitrum’s ecosystem incentives continue, allowing users on Vertex to earn dual rewards. We can't precisely predict whether users will leave once incentives end—but assuming competitive conditions remain stable and no alternative platforms offer comparable yields, some users may stay due to established habits.

Ultimately, success will depend on whether the protocol can expand utility for its token and add more trading pairs to attract degens. Overall, however, shifting toward real revenue remains the right path—pure incentives won’t survive the second half of the derivatives race.

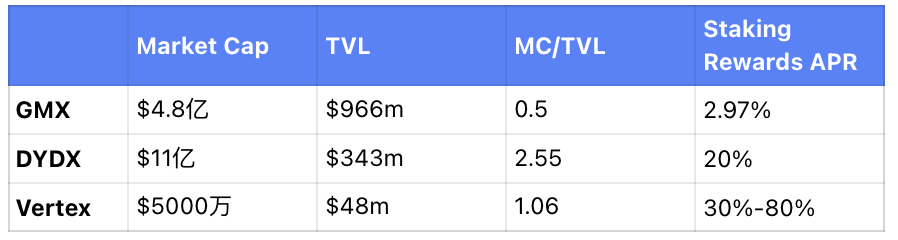

We’ve also conducted a comparative analysis of Vertex, GMX, and dYdX across market cap, TVL, and staking yields.

Though Vertex has smaller absolute values in market cap and TVL, it currently offers higher staking yields and supports relatively higher TVL per unit of market cap—making it a more cost-effective option for capturing alpha.

Future Catalyst: V2 Launching Soon, Cross-Chain to Aggregate Multi-Ecosystem Liquidity

Beyond historical data, what future catalysts could drive Vertex?

First, as part of its 2024 roadmap, Vertex plans to launch V2 in Q1, featuring significant UX improvements. Key upgrades include:

-

Long-tail trading pairs: More assets will be tradable, including “long-tail asset perps.” Essentially, smaller tokens not listed on major CEXs/DEXs will become available—great for attracting degens and enabling speculation on trending assets.

-

Heterogeneous collateral: Expand acceptable margin types beyond crypto. While details remain scarce, this could eventually support bonds, RWA, or even gold as collateral, broadening appeal and attracting diverse liquidity.

-

Isolated margin perps: Previously, the global margin model increased capital efficiency but also interconnected risk. Isolated margin serves as a risk management tool, allowing users to isolate collateral for specific positions, limiting exposure.

Additionally, in February, a more immediate bullish catalyst is Vertex’s upcoming multi-chain product.

Why is this a stronger catalyst? Because this isn’t conventional multi-chain expansion.

Traditionally, a DEX on one chain can only access that chain’s liquidity. Expansion requires deploying identical versions on other chains—an approach akin to “reinventing the wheel” across ecosystems, which we previously understood as multi-chain.

But this approach has major drawbacks:

First, multi-chain deployment requires bridging tokens—an inconvenient process familiar to any experienced trader;

Second, building on a new chain isn’t just copying code—it involves adapting to different technical standards, which can be costly in time and resources;

Third, liquidity becomes extremely fragmented. Each deployment creates a separate liquidity pool, diluting depth across chains;

Finally, the more chains involved, the higher the interaction and technical risks.

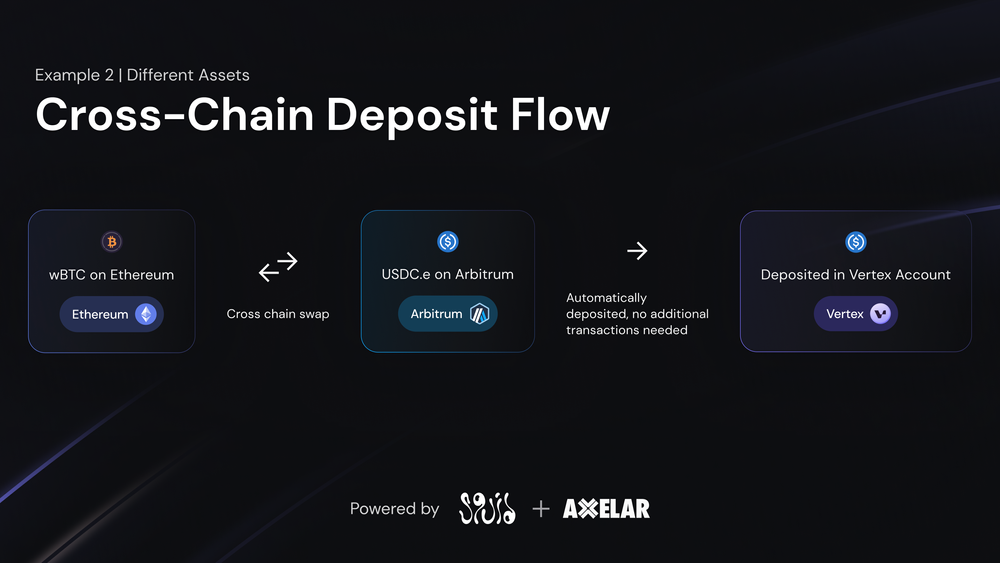

To address these issues, Vertex offers a different answer: instead of expanding into other ecosystems, bring multi-chain liquidity to one place.

Think of Vertex’s upcoming update as enabling multiple chains to share a single liquidity order book: users interact with one unified Vertex, without leaving the interface. Regardless of which chain your assets reside on, you can deposit them directly to trade or provide liquidity (LP).

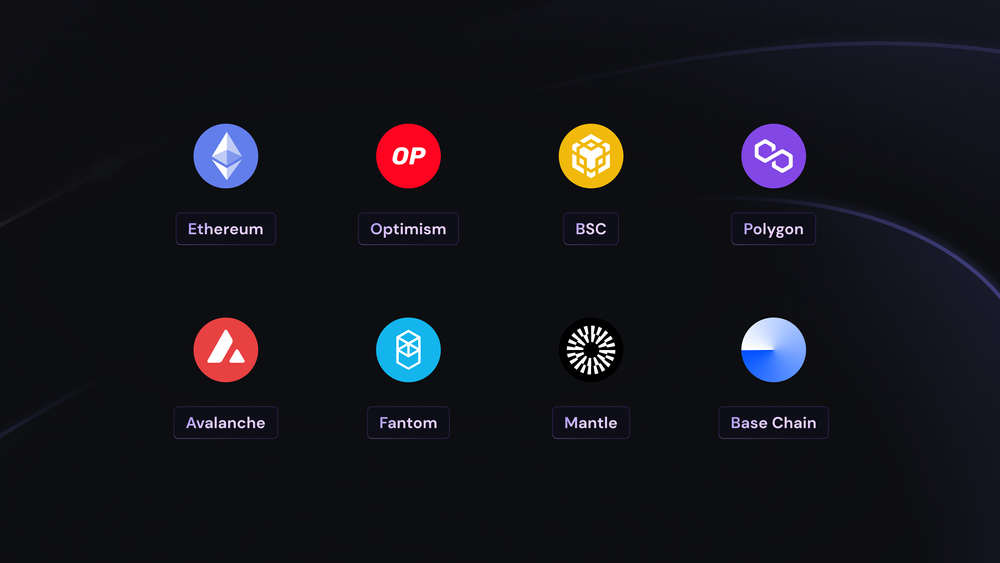

Based on current information, Vertex will support assets from multiple EVM-compatible L1s and L2s, including Ethereum, OP, BSC, Polygon, Avalanche, Fantom, Mantle, and Base.

Due to space constraints, we won’t detail the technical implementation here. Conceptually, it involves technically processing assets from different chains and depositing them into a single Vertex instance for trading.

The user experience improvement will be dramatic: connect your wallet, see assets on any supported chain, and trade directly—no bridging required.

To sum up, Vertex’s upcoming tailwinds include:

-

Instead of chasing liquidity, liquidity comes to you—much more convenient;

-

Multi-chain design enables easier collaboration—other projects across ecosystems can integrate derivatives via Vertex, bringing their liquidity to the exchange and helping bootstrap liquidity for new tokens;

-

Arbitrum’s STIP incentive program launches in February, adding momentum to the L2 narrative and drawing more attention to high-performing derivatives DEXs like Vertex.

Lastly, in a bull market, rising on-chain trading demand and increased volatility naturally benefit the derivatives sector.

Vertex used liquidity mining to spike trading volume but didn’t stop there. With real revenue materializing and a forward-looking multi-chain liquidity aggregation design, last year’s dark horse may have much further to run.

Across all narratives, platforms that simplify liquidity access and enable seamless trading will always win user favor.

The battle among crypto derivatives exchanges is far from over. Who will ultimately win users’ hearts through superior experience and yield? Stay tuned.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News