Understanding IP Capital Markets: How City Protocol and Mocaverse's "IP Micro-Strategy" Brings IP into the Cash Flow Era?

TechFlow Selected TechFlow Selected

Understanding IP Capital Markets: How City Protocol and Mocaverse's "IP Micro-Strategy" Brings IP into the Cash Flow Era?

The significance of MOCASTR lies not in its current price, but in the fact that it has enabled NFTs to have their own "treasury strategy" for the first time.

1. A New Turning Point for Web3: From Narrative to Asset Management

If the keyword for Web3 in 2021 was "innovation," 2022 was "speculation," and 2023 was "adjustment," then 2025 clearly belongs to "assetization." Whether it's the on-chain representation of real-world assets (RWA) or the re-financialization of blue-chip NFTs, after a full market cycle, the industry has returned to the most fundamental logic—how to generate sustainable returns on-chain.

At this pivotal moment, Mocaverse from the Animoca Brands ecosystem and City Protocol have launched a structurally innovative joint project: $MOCASTR (Moca Strategy Token).

This is a mechanistic token centered around high-value intellectual property (IP) assets from Mocaverse, driven by an on-chain strategy treasury (Tokenised Strategy) to enable a revenue loop. It’s not merely a "coin," but more like a digital asset strategy engine capable of autonomous operation and perpetual appreciation.

City Protocol has given this experiment an ambitious definition: "Bringing cultural IP into a programmable financial physical cycle." From an investment perspective, this represents a structural innovation attempt within the NFT market.

2. Mechanism Breakdown: A "Self-Compounding" On-Chain Strategy System

City Protocol's IP Strategy module is an on-chain strategy framework (Tokenised Strategy Module) specifically designed for IP ecosystems. The core logic is straightforward: drive community funds into the treasury through tokenomics, then use on-chain strategies to support long-term value building of the IP. In other words, it is not a "passive asset pool," but rather a tokenized execution layer for IP strategies.

MOCASTR is the first token under this module and the starting point of the entire flywheel.

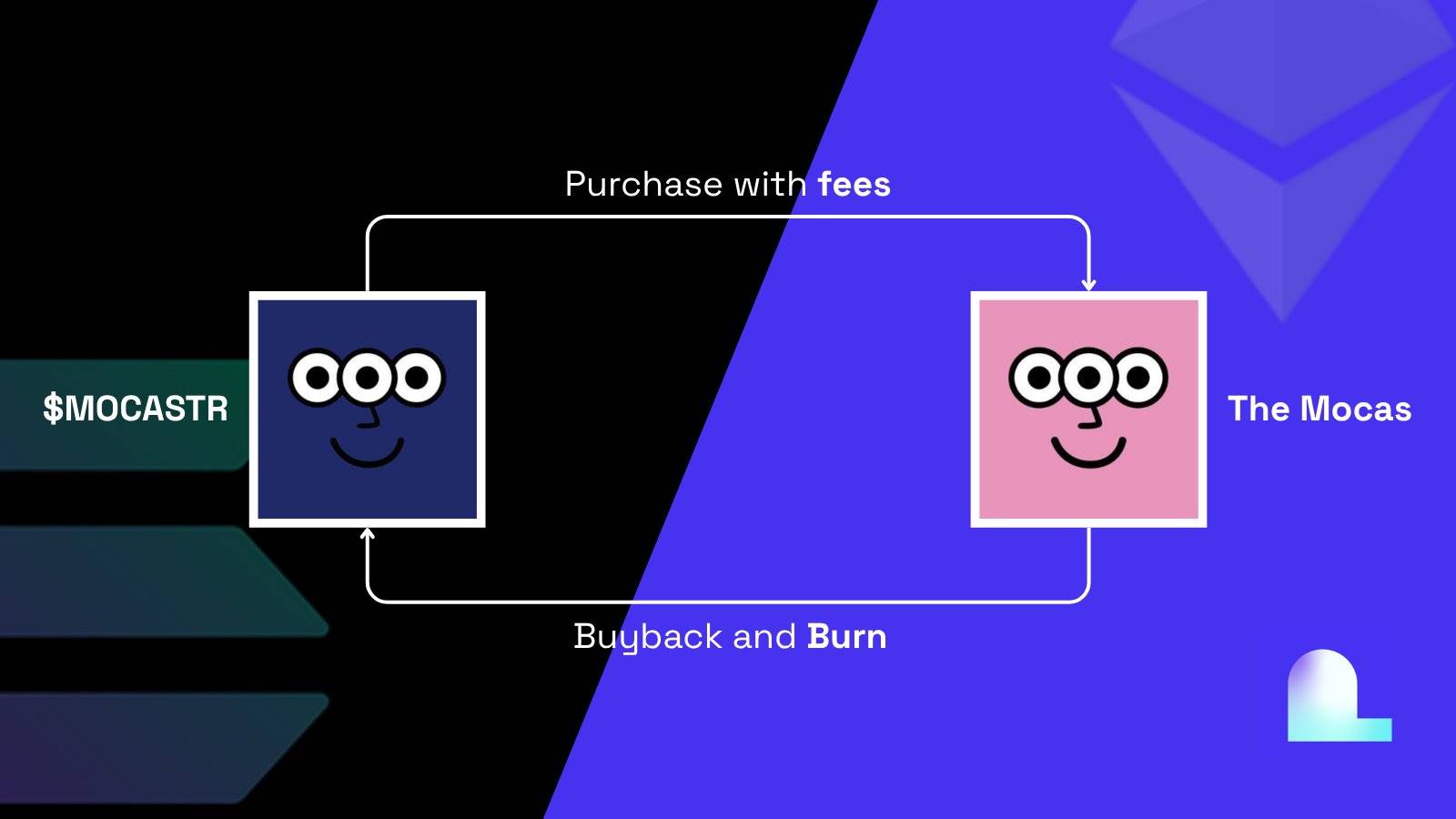

The design of MOCASTR can be summarized into three components: fee injection, treasury strategy execution, and profit reinvestment.

Each transaction generates a 2.5% fee, with 80% automatically injected into the treasury. The treasury uses on-chain data interfaces to continuously monitor the market performance of Mocaverse NFTs, including floor price, trading depth, and volatility range. When the system detects an undervalued range, the IP Strategy executes NFT buybacks; these assets are then relisted for sale at approximately a 1.2x premium over the floor price.

After completing a "buy low, sell high" cycle, the generated profits are split into two parts: one portion is used to repurchase and burn $MOCASTR tokens, creating a deflationary effect; the other remains in the treasury to further expand its operational capacity and fuel the next cycle.

The entire system thus forms a self-sustaining closed loop: Fee Injection → NFT Buyback → Premium Sale → Profit Recycling → Token Burn → Treasury Expansion. This logic resembles an automated market maker (AMM), except the underlying asset shifts from trading pairs to value conversion between NFTs and tokens.

The key innovation lies in enabling users to share in the overall returns of the Mocaverse ecosystem simply by holding $MOCASTR, without needing direct participation in NFT trading. NFTs evolve from static collectibles into income-generating assets, while the token becomes the vehicle for sharing in this value creation process.

This structure closely mirrors MicroStrategy’s "hold-and-grow flywheel," but MOCASTR establishes not a corporate financial loop, but a collective treasury model at the token level. It transforms "IP valuation management" from a single-brand action into a shared, participatory, and tokenized on-chain logic.

3. Flywheel Activation: Resonance Among Token, Treasury, IP, and Market

The MOCASTR flywheel consists of a four-layered cycle:

1. Token Layer: Transaction fees from all trades continuously fund the treasury, serving as the base fuel.

2. Treasury Layer: City Protocol's IP Strategy takes control of the funds, executing transparent on-chain strategic actions related to the IP, such as maintaining market depth for Mocaverse NFTs, supporting collaborative events, or funding ecosystem proposals.

3. IP Layer: Mocaverse enhances its influence through branding, community engagement, and cross-ecosystem collaborations, increasing expectations for IP value and amplifying the market impact of treasury activities.

4. Market Layer: As Mocaverse's value grows, market recognition of $MOCASTR rises in tandem, attracting new liquidity and increasing trading frequency, which feeds back into higher transaction fees and further strengthens the treasury.

The essence of this cycle is using market volatility to drive IP appreciation in reverse. The treasury acts as an energy storage unit; the token functions as a transmission shaft; the IP serves as the growth core; and the market provides the feedback mechanism. These four elements interlock to form a transparent, self-driven growth system.

In past NFT markets, IP value often remained in the "collectible era"—held, admired, and socialized;

In the MOCASTR model, IP enters the "treasury era"—managed, utilized, and compounded.

4. Mocaverse & City Protocol: A Combined Force of Narrative and Execution

$MOCASTR officially launched on the Solana mainnet on October 29. Thanks to its buyback strategy and high-speed execution architecture, the project demonstrated market performance exceeding expectations. Within 48 hours of launch, the treasury completed buybacks of 40 Mocaverse NFTs, driving the series' floor price up by approximately 15%.

Meanwhile, the first strategy cycle delivered an annualized yield of about 20%, providing direct cash flow support for the token's value. Raydium and Jupiter liquidity pools achieved over $300,000 in initial depth on day one, and the project's market cap reached $2–3 million within hours.

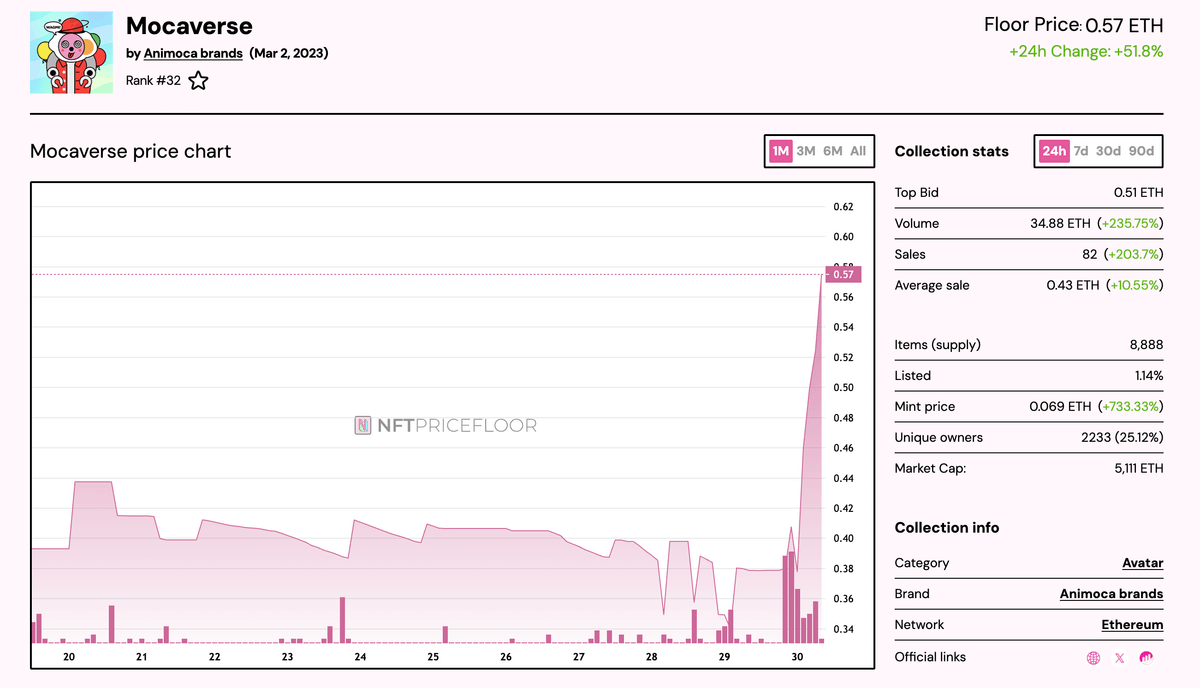

Mocaverse is Animoca Brands’ flagship identity and cultural ecosystem, integrating over 540 projects and 700 million on-chain wallets since 2023. Its 8,888 Moca NFTs form four archetypes—Dreamers, Builders, Angels, and Connectors—not only carrying cultural symbolism but also governance, reputation, and points systems.

These NFTs reflect Animoca’s long-term positioning in social, gaming, and identity layers, providing MOCASTR with solid asset and community foundations.

Since receiving investments from institutions such as Jump Crypto, Dragonfly, and CMT Digital in 2024, City Protocol has focused on "on-chain IP financialization," introducing the DAT architecture (Digital Asset Treasury) to support sustainable asset growth. With its treasury system, Mocaverse’s ecosystem energy is translated into direct cash flows and market momentum.

The launch of MOCASTR marks the first official resonance between Mocaverse and City Protocol—culture and finance, narrative and execution, IP and capital, truly converging within a smart contract.

The collaboration creates a clear division of labor: Mocaverse owns the core assets and cultural moat, while City Protocol builds the algorithmic engine and financial management infrastructure. In this model, MOCASTR becomes the bridge between them—and a template for future on-chain IP financialization.

This combination reveals a new ecosystem structure to the market:

IP strategy is no longer abstract, but becomes a tradable, governable tokenized entity.

More notably, Yat Siu, founder of Animoca Brands, personally purchased Mocaverse NFTs that were bought back and resold by the City Protocol treasury after the project's launch. The market widely interprets this not as a symbolic gesture, but as validation of the mechanism itself—a consensus forming between IP owners and DeFi protocols, creating a new type of "liquidity agreement."

5. Why Is This Model Needed by the Market?

The NFT market has entered a prolonged "post-hype phase." Blue-chip IP prices show reduced volatility, new capital inflows are weak, and attempts to integrate with DeFi frequently fail. The ecosystem’s biggest issue is not a lack of narrative, but a lack of structural momentum.

Shortly after its late-October launch, MOCASTR quickly became a focal point on-chain. Within 48 hours, the treasury executed multiple operations, significantly boosting both the floor price and trading depth of Mocaverse NFTs. At the same time, Animoca founder Yat Siu's community engagement provided a strong external signal of trust in the flywheel.

More importantly, it didn’t just bring numerical growth—it triggered a concentrated return of market sentiment.

A large number of crypto KOLs, NFT investors, and on-chain researchers began discussing MOCASTR’s mechanism on social media—how it gives NFTs a "compoundable financial logic," and how cultural assets are finally resonating with DeFi growth models.

This phenomenon acted as a catalyst, reawakening the dormant NFT investment community—shifting focus from surface-level art and trading to how to build revenue structures and endogenous financial cycles for IP.

What City Protocol’s IP Strategy module offers is precisely this kind of momentum—not mere financial manipulation, but a sustainable growth architecture.

It enables IP projects to move beyond reliance on one-time issuance revenue, instead gaining continuous support via a strategic treasury;

It transforms token holders from mere speculators into active participants and beneficiaries of IP growth.

The long-term potential of this structure lies in:

● IP value being bounded by brand and culture;

● The treasury providing cash flow and market support;

● Tokens connecting users to the mechanism, turning the community into a source of growth;

● The entire system achieving sustained symbiosis of "culture × capital."

The success of MOCASTR means the NFT market now possesses its first "strategy-driven growth engine," moving beyond being merely an "emotion-driven gambling arena."

6. Future Outlook: The "Programmability" of IP Assets

City Protocol has hinted that this collaboration is only the beginning of a "series of strategies." The team is currently still focused on refining the IP Strategy module. Future directions will center on optimizing treasury execution parameters, enhancing cross-IP collaboration capabilities, and involving more on-chain governance participants.

But one thing is certain: MOCASTR has already proven that:

1. IPs can adopt treasury management logic similar to corporate assets;

2. Cultural assets can enter on-chain capital cycles through tokenization;

3. The market can generate new returns and consensus by participating in such cycles.

No matter which asset class the IP Strategy module expands into next, its "tokenized strategy treasury" model has become one of the most promising new narratives in the NFT space since GameFi and RWA.

8. Conclusion: The True Value of IP Returns to Cash Flow

The emergence of MOCASTR may signal an important inflection point for NFT economic models.

For the past two years, the debate over NFT "value" has centered on whether they possess intrinsic yield; now, MOCASTR offers a verifiable answer.

The NFT micro-strategy model represented by MOCASTR grants cultural assets their first financial operating logic;

The IP Strategy module from City Protocol systematizes and standardizes this logic—marking a crucial step for the NFT market to emerge from stagnation and rebuild growth.

As cultural assets, IPs are being written into on-chain economics. Tokens are no longer just mediums of exchange, but governance units and value levers. When treasuries can generate revenue, IPs can grow, and tokens can feed back into the system, the flywheel will keep spinning.

The significance of MOCASTR lies not in its current price, but in being the first to give NFTs their own "treasury strategy." This may well mark the beginning of Web3 cultural assets achieving autonomy and financial sustainability.

For Mocaverse, this means its ecosystem’s long-term value is now quantifiable and amplifiable; for the DeFi world, it offers a completely new strategic template—IP-driven, self-sustaining yields, transparent treasury execution.

When holders are no longer just collectors, but shareholders of the treasury;

When animated characters and fictional worlds generate steady cash flows;

Then perhaps the door to a "cultural capital market" is truly opening—in cryptographic form.

Project Information

● City Protocol Website:https://cityprotocol.co/ipstrategy/token?id=7

● City Protocol Twitter:@cityprotocolHQ

● Moca Strategy Twitter:@Moca_Network

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News