Meme coin H surges again—what story is it telling this time?

TechFlow Selected TechFlow Selected

Meme coin H surges again—what story is it telling this time?

Early airdrop events exposed trust flaws due to bot attacks, causing severe market volatility.

By Oliver, Mars Finance

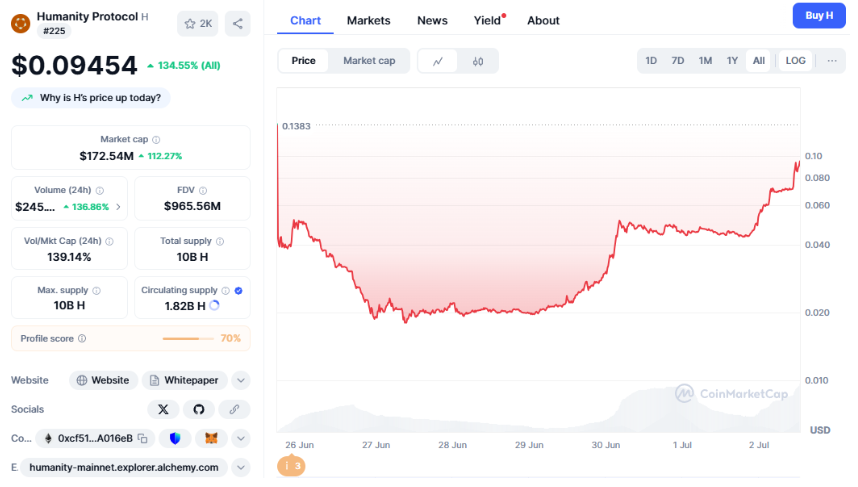

When the $H chart once again drew that heart-stopping green spike—surging 95.2% within 24 hours—two intertwined sounds seemed to echo across the entire cryptocurrency market: one, the euphoric shouts of those boarding a wealth express; the other, the blaring alarms over the project’s immense controversy. This asset dubbed a "rogue coin" by the market, Humanity Protocol, has a story far more complex than a simple rags-to-riches myth. It rose triumphantly onto top-tier exchanges like Bitget, achieving a single-day gain of 125%; yet it also plunged over 61% amid a catastrophic trust crisis at birth.

This extreme volatility isn't mere market speculation. It reflects real-time odds in a grand gamble—with the stakes being nothing less than how we prove “I am human” in an age where artificial intelligence (AI) increasingly blurs the line between humans and machines.

The story of $H is an epic about a "flawed savior" attempting to answer this ultimate question. It carries two diametrically opposed yet coexisting narratives: one, the "bright narrative" backed by a $1.1 billion valuation and leading investments from elite VCs such as Pantera Capital and Jump Crypto; the other, the "dark narrative" marked by the founder's own admission that the network was overrun by bots and its airdrop turned into disaster. It is precisely this tension between opposing forces that gives $H its "rogue" nature.

Vision: Forging a 'Human Layer' Amidst the Fog of AI

The tale of $H begins with a pressing anxiety of our time. As nearly half of internet traffic now comes from bots and deepfake technology becomes indistinguishable from reality, the foundation of digital trust is crumbling. “Sybil attacks”—where a single entity manipulates networks through numerous fake identities—are spreading like a plague across every corner of Web3.

Humanity Protocol was born to confront this crisis. Its vision is breathtakingly ambitious: to build a global foundational "trust layer," or "Human Layer," with the goal of “onboarding the first billion humans into Web3.”

To achieve this seemingly impossible mission, it devised an elegant technical framework:

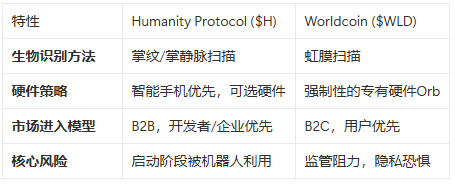

A gentler Proof of Humanity: At its core lies “Proof of Humanity” (PoH). Unlike its controversial rival Worldcoin, which uses iris-scanning orbs, $H opts for palm-vein recognition—a less invasive and more publicly acceptable method. In phase one, users can complete verification using just their smartphone cameras, drastically lowering the barrier to entry.

Privacy-first zero-knowledge proofs: To address fears of biometric data leakage, the protocol employs zero-knowledge proofs (ZKPs). Palm-vein data is converted into encrypted mathematical noise directly on the user’s device, enabling verification of “humanness” without exposing any raw information.

Robust underlying architecture: Built on Polygon CDK as an Ethereum-compatible Layer 2 network, ensuring scalability and developer-friendliness.

This perfect “dragon-slaying” narrative attracted top-tier capital—and planted the seeds for its future price surge.

The Original Sin: A Protocol Designed to Resist 'Witches,' Conquered by Them

Yet, at the very peak moment when the dragon slayer was about to draw his sword, he was viciously bitten by the very monster he vowed to destroy. This forms the ineradicable “original sin” at the heart of $H’s story.

During its token airdrop event named “Fairdrop,” disaster struck. A protocol founded on resisting Sybil attacks ironically saw its first token distribution overwhelmed by an army of bots.

The crisis erupted when founder Terrance Kwok candidly admitted during a community discussion that among the 9 million “human IDs” previously touted by the team, “a significant portion are actually bots,” while genuine human users were “approaching only one million.”

This implied up to 88% of early user data might be fraudulent—a fatal blow to a project built on proving humanity. Upon release of the news, community trust collapsed instantly, and the token price plummeted. What was meant to be the fairest airdrop became a feast for “scientists” (script-savvy profiteers) and a tragedy for authentic users.

This failure exposed a critical flaw: the project opened its treasury to poorly protected early accounts before fully deploying and enforcing its strongest weapon—the palm-vein scanner. It was akin to distributing treasure before the castle walls were even built.

The Mirror War With Worldcoin, and Philosophical Dialogue With Vitalik

$H did not emerge in isolation. From day one, it has been embroiled in a sovereignty battle over the future of digital identity. To understand its position, we must place it alongside its main rival, Worldcoin, and view it through the philosophical lens of Ethereum co-founder Vitalik Buterin.

$H’s strategic intent is crystal clear: it exists almost as a mirror image of Worldcoin, systematically addressing every pain point the latter has exposed. Where Worldcoin relies on centralized, unsettling Orb hardware, $H champions lightweight mobile scanning. Where Worldcoin’s iris data collection triggered global regulatory backlash, $H chooses the “less invasive” palm-vein approach. It acts as a nimble “fast follower,” leveraging the pioneer’s mistakes to offer what appears to be a superior alternative.

Yet, despite their tactical rivalry, both may fall into the same “single system trap” warned against by Vitalik Buterin. Vitalik repeatedly cautions that any singular identity system, no matter how well-designed, risks eroding the internet’s valuable culture of pseudonymity if it achieves dominance—and could ultimately become a tool of surveillance. He advocates instead for a pluralistic identity ecosystem. Viewed this way, the war between $H and Worldcoin may not hinge on who wins—but whether a decisive victory by either side poses a greater threat.

VCs, Genomics, and Cross-Domain Ambition

The confidence of $H stems not only from its technological narrative but also from powerful financial backing and strategic alliances. Over $50 million in funding from top-tier VCs like Pantera Capital and Jump Crypto—referred to as a “war chest”—forms the bedrock of its high-stakes gamble. These investors are betting that reliably verifying “humanness” in the AI era will become a trillion-dollar necessity.

If VC funding provides ammunition, then its series of strategic partnerships constitute its frontline troops—revealing ambitions far beyond simply proving you’re human.

The most striking and controversial move is its collaboration with Prenetics, a Nasdaq-listed genomics company. Under the agreement, Prenetics will use its flagship product, CircleDNA, to issue “Proof of Humanity” credentials via DNA testing.

This pushes biometric identity to its logical extreme—DNA being the most unique and hardest-to-forge personal identifier known today. If successful, this would erect an unparalleled competitive moat for $H. However, it also thrusts the project into an even more complex and sensitive minefield of ethics and regulation than iris scanning ever posed. Combining genomic data—even if only its encrypted hash—with an immutable blockchain crosses a bioethical Rubicon.

A Necessary Gamble, or a Faustian Bargain?

Examining the full arc of $H, we see a contradictory composite. It seeks to solve a real and urgent problem, backed by grand technological vision and formidable capital. Yet its launch stumbled due to self-inflicted errors, and its core technical path places it squarely in the crosshairs of ethical and legal storms.

The story of $H mirrors the broader Web3 experiment. It reveals the immense potential of decentralized technologies to rebuild social infrastructure, while also exposing the governance chaos, misaligned incentives, and violent friction with real-world regulations inherent in its journey toward maturity.

So what story does the rogue coin $H tell with its latest surge?

It tells the story of a “flawed savior” struggling to survive in the age of AI. It surges to proclaim the value of its vision, and crashes to pay for its “original sin.” Every price fluctuation is the market casting a new vote on this grand experiment.

Supporting or participating in $H is not merely an investment—it is a statement about a future paradigm of digital identity. The final outcome of this gamble remains unknown: Will we achieve a fairer, more authentic internet? Or, in pursuit of a technical fix, will we inadvertently strike a Faustian bargain—trading ultimate privacy for proof of our humanity?

The answer still hangs in the wind. But regardless of success or failure, $H will remain an unavoidable character in this defining drama of our era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News