Echo Protocol: The Cross-Chain Staking Protocol That Brings BTC to Life

TechFlow Selected TechFlow Selected

Echo Protocol: The Cross-Chain Staking Protocol That Brings BTC to Life

Whether you're a long-term holder looking to put your BTC to work or a DeFi enthusiast chasing high yields, Echo offers a one-stop solution.

Written by: TechFlow

Global instability persists, and asset speculation continues in full swing. As a financial asset under worldwide spotlight, cryptocurrencies have emerged as the dominant force in today's turbulent era. Beyond diamond-handed holders quietly accumulating coins and major institutions steadily entering the space, for public companies, "buying Bitcoin" has become a key strategy to join the global trend and unlock wealth creation.

As more people gradually recognize BTC’s value, BTC has entered its own sustained bull market—remaining resilient amid market turbulence, once again rewarding BTC holders. However, simply holding BTC is like locking gold bars in a safe—secure, but lacking dynamism. BTC holders now face a growing need: how can BTC generate yield without selling?

The answer lies within the constantly evolving landscape of BTC staking protocols. Echo Protocol, a standout BTCFi protocol in the Aptos ecosystem, revitalizes BTC through cross-chain staking and diversified yield mechanisms. It seamlessly integrates BTC into a multi-chain environment while offering users accessible, high-return DeFi experiences through intelligent design.

In this article, we’ll explore the core technological strengths of Echo Protocol and understand how it leverages multiple layers of value in BTC staking to “ride the waves” of innovation.

Top-Tier Ecosystem Metrics Speak Volumes—Strength Beyond Words

Echo is a multifunctional BTCFi protocol focused on the Move-language-based ecosystem, primarily offering cross-chain capabilities, liquid staking, and restaking services. Its goal is to bring BTC liquidity into the Move ecosystem and introduce innovative restaking solutions for BTC assets. At the same time, Echo achieves seamless integration with the native BTC ecosystem, supporting all native BTC Layer 2 solutions such as Babylon.

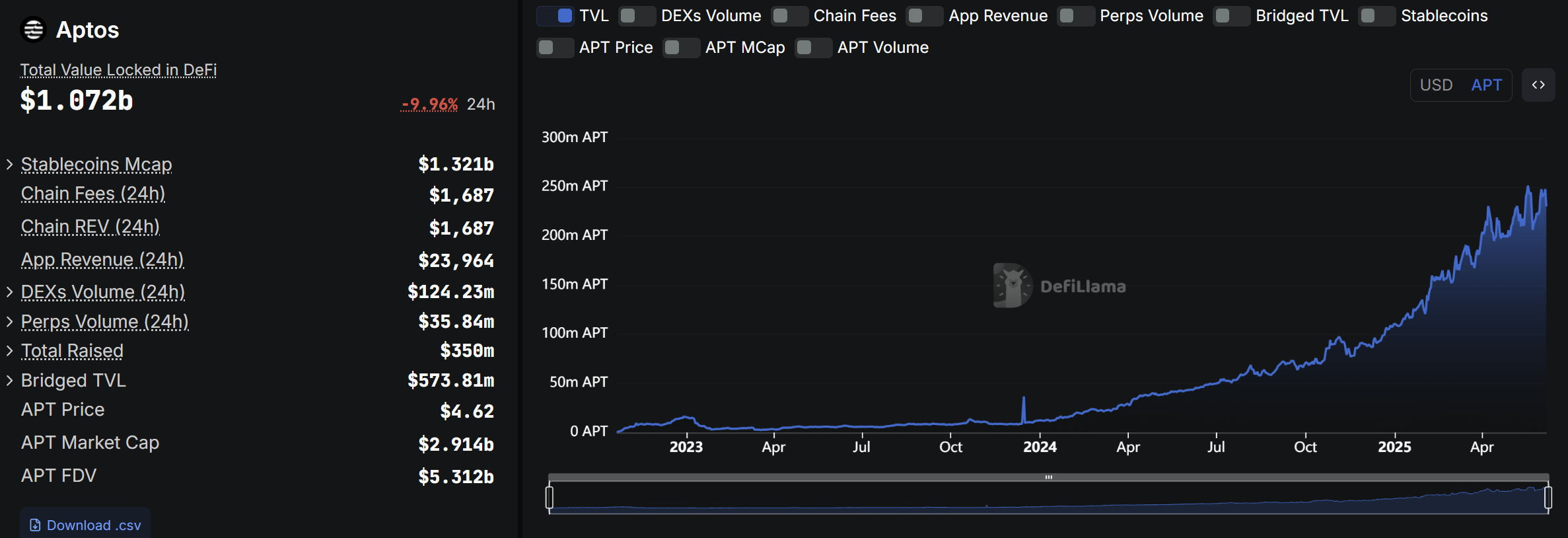

Data: Aptos Keeps Growing, and Echo Is a Core Driver

While APT’s price performance remains debated, the data tells a compelling story—Aptos’ ecosystem TVL continues climbing, surpassing $1 billion in total value locked (TVL).

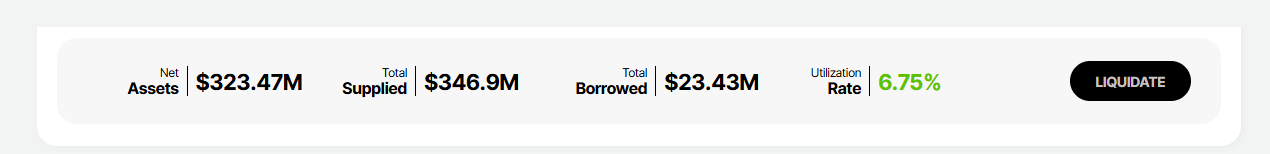

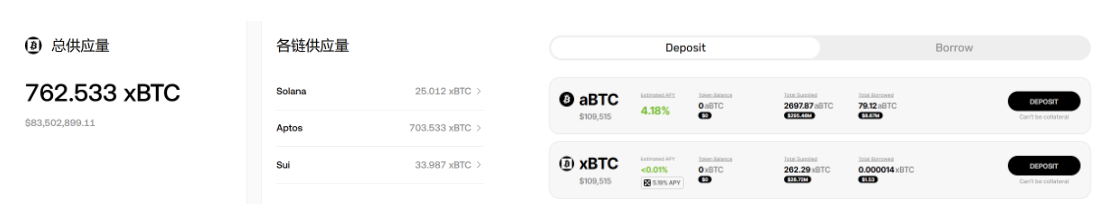

As one of the key contributors to Aptos' TVL growth, Echo generated $147 million in TVL within just one month of launch. Today, with $375 million in TVL, it accounts for nearly 40% of Aptos’ total. This reflects strong user trust in Echo’s staking mechanism. Whether you’re a long-term holder seeking stable returns or a DeFi enthusiast looking to explore new frontiers, Echo offers a platform that meets diverse needs. Its success stems not only from technical innovation but also from understanding BTC holders’ dual demands: security and yield.

Team Background

Behind Echo is a low-key yet powerful team. Core members bring deep expertise in blockchain technology, DeFi product design, and financial engineering. Their mission is clear: to ensure BTC is no longer an outsider in the DeFi world. While specific member details remain partially undisclosed, the team’s professional background ensures rapid iteration and development, backed by leading investors including Spartan Group, ABCDE Capital’s ecosystem fund, and multiple top-tier venture capital firms.

Security is the lifeblood of any DeFi project, and Echo takes it seriously. The protocol has undergone audits by leading firms such as Zellic, Cyfrin, OtterSec, and Certik. Certik has completed part of its audit, assigning Echo a Skynet score of 80.47 and awarding both team verification and audit badges. This security-first approach sends a clear message: your BTC is in safe hands with Echo.

With solid team credentials and impressive metrics, Echo has achieved remarkable results in less than a year since launch. Clearly, Echo aims for far more than being just another “small and beautiful” protocol.

But what truly wins market adoption isn’t surface-level appeal—Echo’s innovative tech architecture and flexible yield strategies are the real reasons behind its growing attention.

Three-Layer Architecture: Bringing Assets to Life

Echo Protocol’s yield solution follows a three-step process, delivering efficient and secure staking options uniquely tailored for BTC holders—transforming BTC from a static asset into dynamic productive capital.

Through its interconnected three-layer structure—the Permissionless Liquidity Layer, the Yield Amplifier, and the BTC LST Infrastructure Hub—Echo enables BTC holders to easily participate in DeFi activities across the Move ecosystem and beyond, balancing security, liquidity, and yield.

-

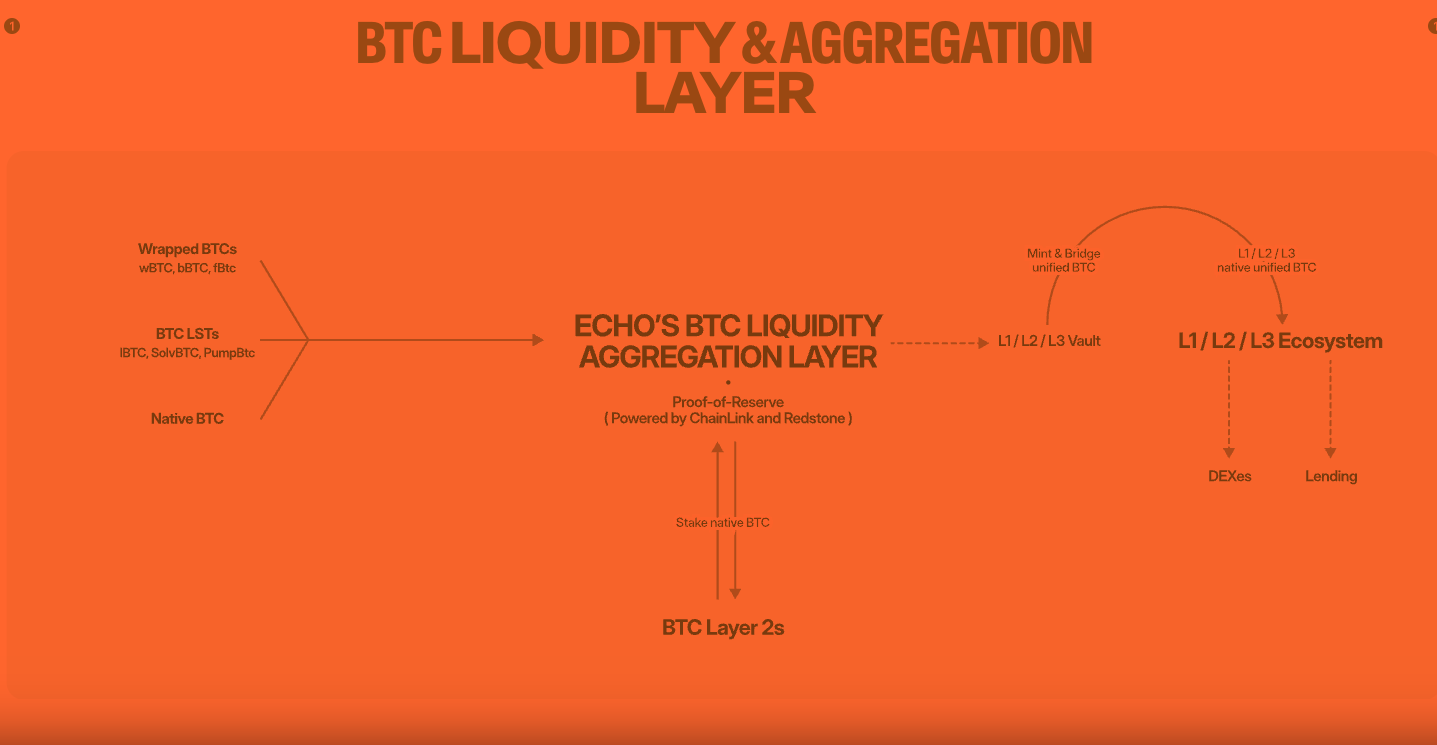

Permissionless Liquidity Layer

Due to network isolation, BTC has long struggled to directly engage in cross-chain DeFi. Different forms of BTC (LSTs, wBTC, etc.) are incompatible across chains, resulting in fragmented liquidity. Echo’s Permissionless Liquidity Layer acts like a “universal converter,” wrapping various BTC assets into a unified standard and enabling efficient cross-chain movement on Aptos—with near-zero latency thanks to Aptos’ high performance.

In simple terms, Echo issues a universal pass for different BTC variants—native BTC, liquid staking tokens (LSTs) like uBTC from B², wrapped BTC such as OKX’s xBTC, BitGO’s wBTC, and Mantle’s fBTC—standardizing them into “Echo Unified BTC Assets.”

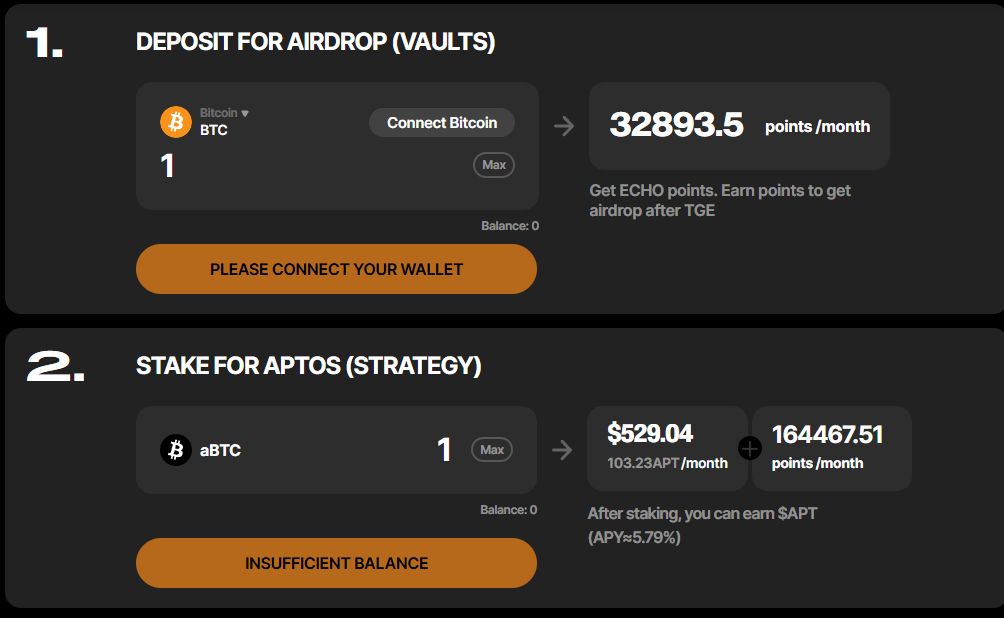

Echo’s Vault solution allows users to deposit various BTC assets and receive standardized tokens, enabling direct participation in DeFi without relying on traditional BTC staking protocols. Additionally, Echo channels Aptos ecosystem liquidity into its aggregation layer: users can deposit aBTC to exchange for APT or borrow APT via Echo Lend. By staking borrowed or exchanged APT on Echo LST, users earn staking rewards and receive eAPT, which can be used to secure other MoveVM chains or integrated into Move DeFi protocols.

To ensure safety, Echo partners with PoR (Proof of Reserves) providers like Chainlink and Redstone. Every BTC deposit into the Vault undergoes rigorous due diligence (DD) and real-time PoR monitoring, ensuring 1:1 backing and eliminating depegging risks.

-

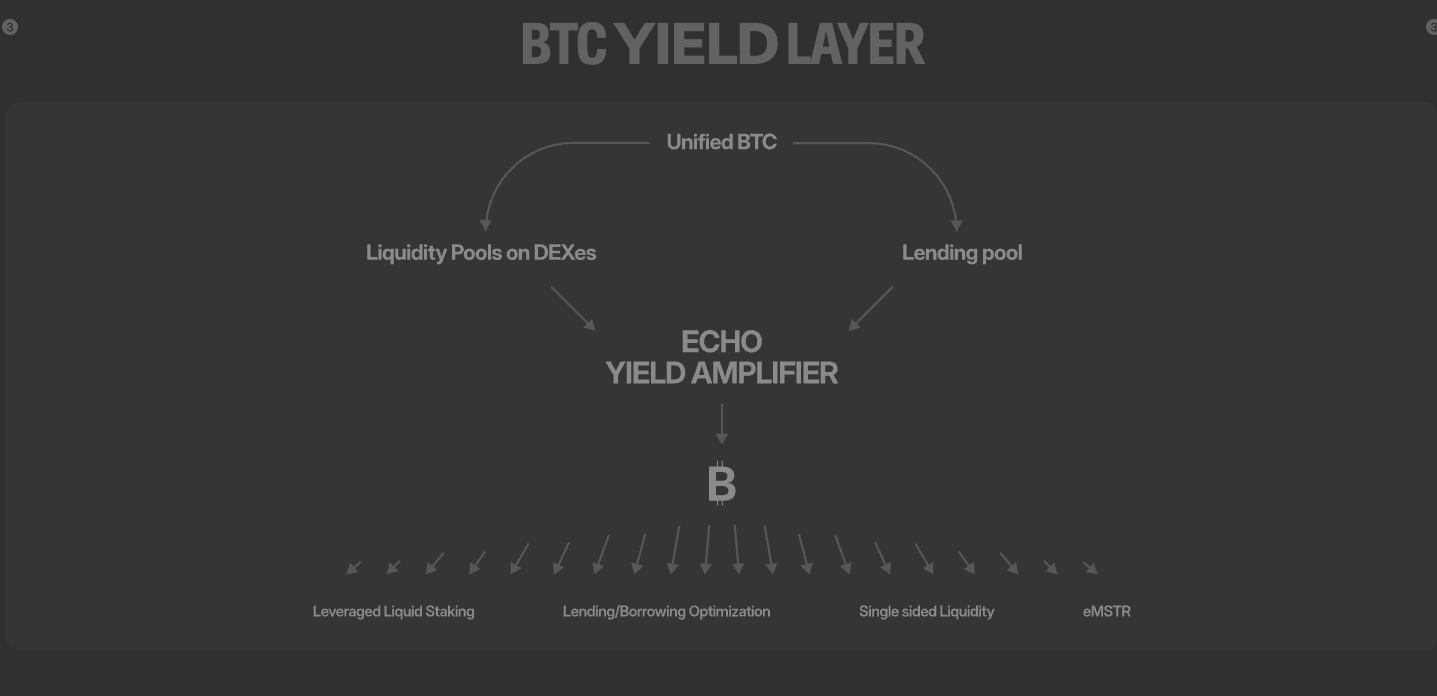

Yield Amplifier

Traditional BTC holding generates zero additional yield, while DeFi offers attractive annualized returns. Echo’s Yield Amplifier uses smart algorithms and risk management to allocate users’ BTC (or aBTC) into optimal yield-generating opportunities—allowing them to benefit from both BTC appreciation and DeFi yields.

This layer serves as Echo’s “money tree,” maximizing BTC returns through diversified strategies. With features like eMSTR’s non-liquidatable leverage and CeDeFi’s secure custody, it caters to users across the risk spectrum—from conservative to aggressive.

-

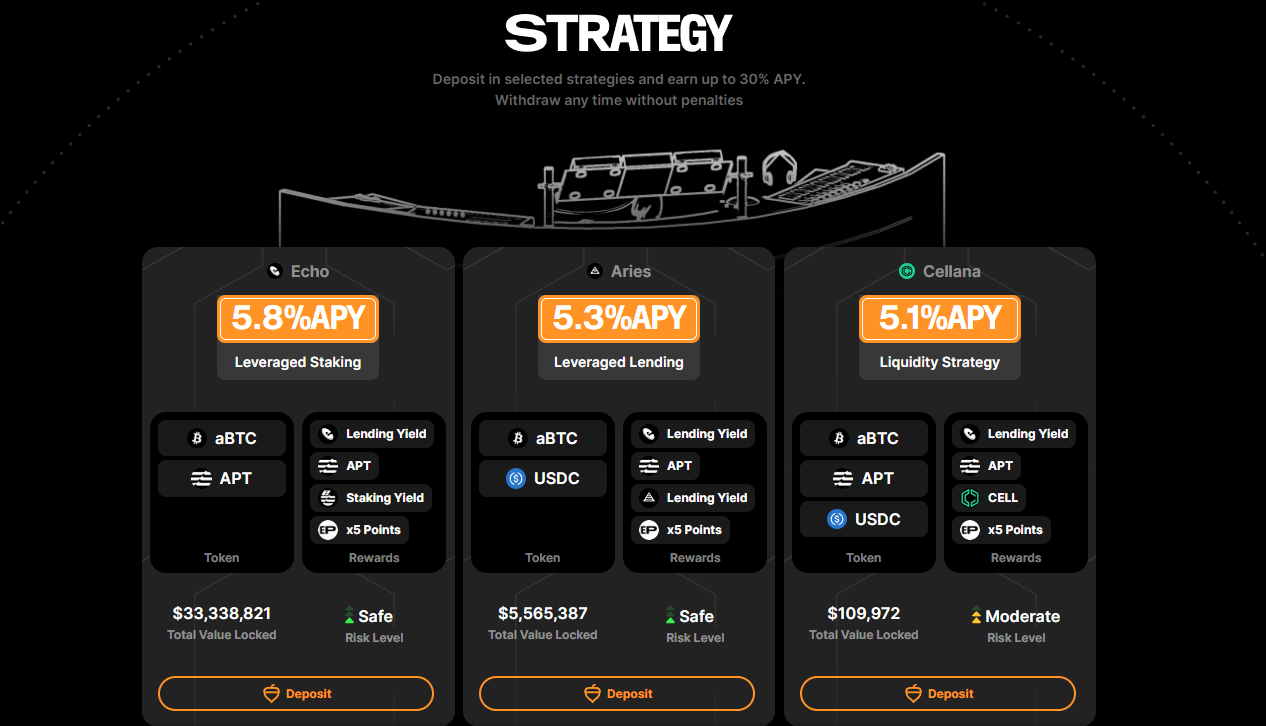

Echo Strategy: This strategy aggregates multiple DeFi protocols (such as lending platforms and liquidity pools), dynamically adjusting asset allocation to offer high-yield opportunities like leveraged staking and borrowing optimization. In essence, it automatically deploys user funds into the highest-yielding protocols based on market conditions—an always-on investment assistant that earns passively on your behalf.

-

eMSTR: Through low-cost convertible notes, eMSTR allows users to gain at least 2.5x leveraged exposure to BTC with zero liquidation risk. By integrating Web3 lending protocols, it reduces capital costs (WACC), amplifying returns without requiring users to sell their BTC. Simply put, eMSTR lets you use the capital of 1 BTC to enjoy the upside of 2.5 BTC—without fear of forced liquidation.

-

CeDeFi: Leveraging Ceffu’s custodial infrastructure, CeDeFi supports neutral trading strategies that balance safety and yield, enabling users to earn more with unified BTC assets on-chain.

Whether it’s stable lending income or high-risk vault investments, Echo provides suitable options for every type of user. Plus, participants in the Yield Layer can earn Echo Points—redeemable for future tokens—adding multiple streams of “passive income.”

-

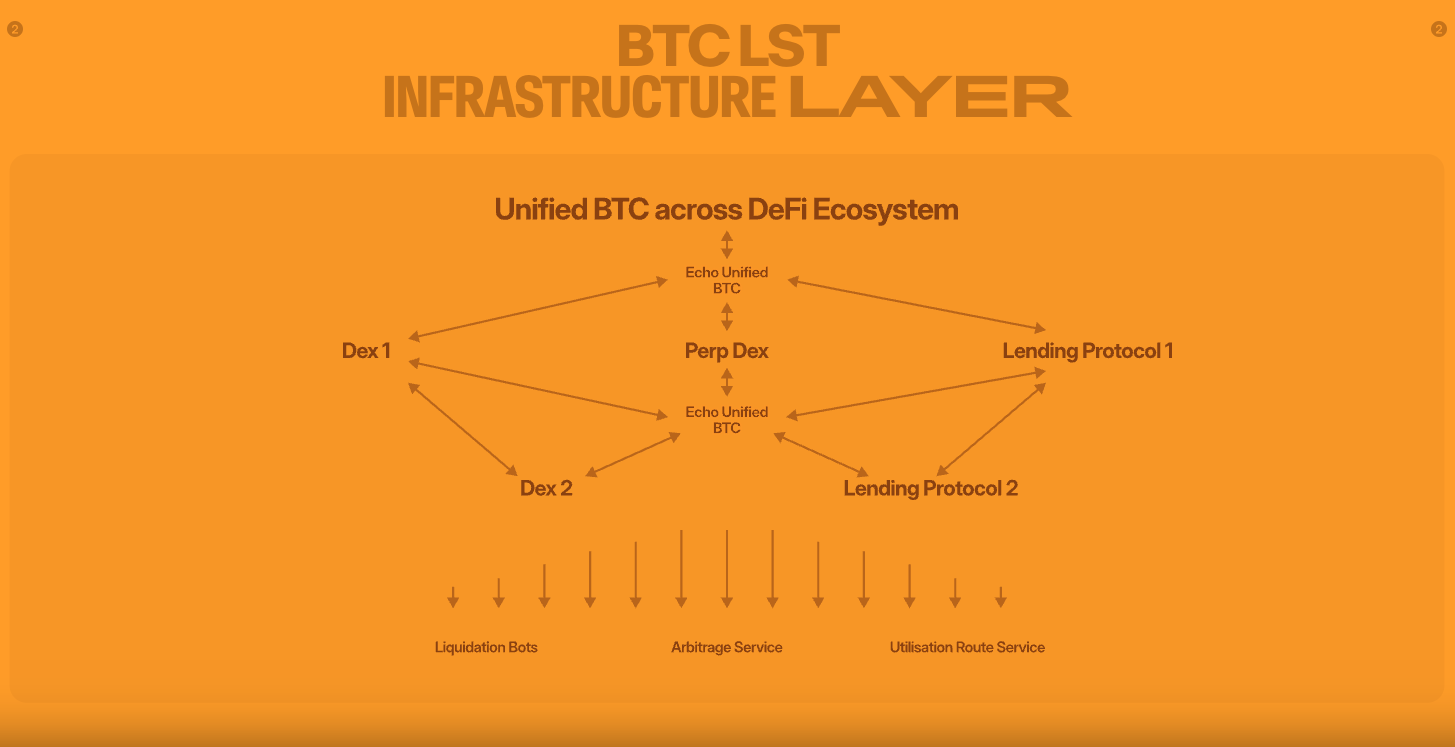

BTC LST Infrastructure Hub

DeFi’s power lies in composability—assets and protocols that function like Lego blocks, freely combinable. But if BTC’s LST tokens cannot interoperate with other protocols, their potential remains untapped.

The BTC LST Infrastructure Hub connects liquid staking tokens (LSTs) to various DeFi applications. Whether for lending, trading, or providing liquidity, Echo’s hub ensures seamless integration between LSTs and protocols.

After staking BTC, the LST token acts as your receipt—proof of ownership—that can then be used elsewhere, such as for borrowing or trading. Echo’s hub functions like a DeFi control center, ensuring your LSTs (like aBTC) flow smoothly across protocols. This universal infrastructure makes Echo an essential bridge across multiple ecosystems.

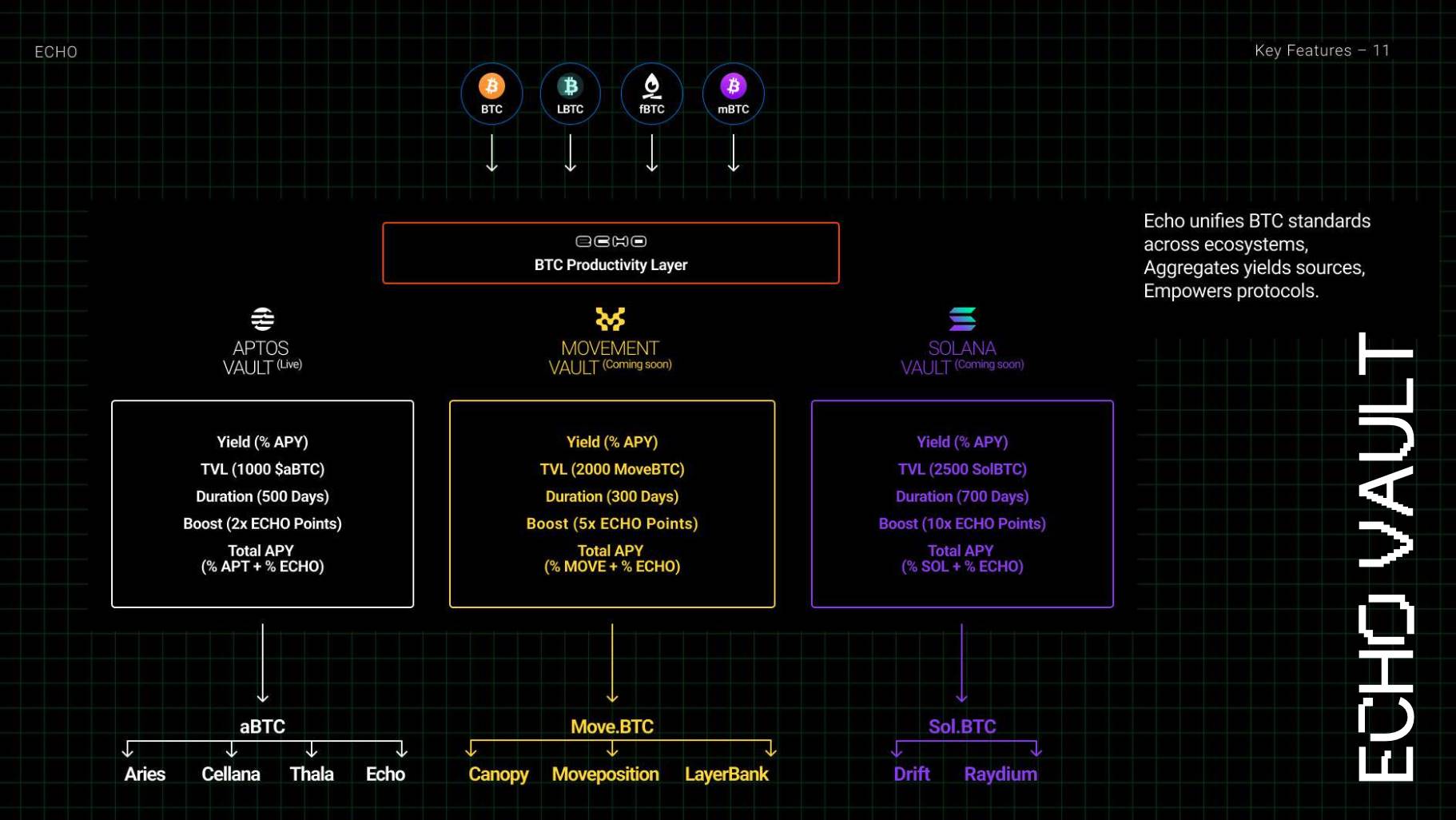

For example, suppose a user stakes 1 uBTC via Echo and receives 1 aBTC. They want to earn interest in the Aptos ecosystem. By depositing aBTC into Echo Vault, they earn 6% APY. A few days later, a DEX liquidity pool on Solana offers higher yields. The user can directly swap aBTC into SolBTC via Echo’s Solana Vault and provide liquidity on Solana-DEX for a higher APY.

Unlike simple staking platforms, Echo Protocol functions more like a “BTC value unlocking layer”—a claim well justified. Through its unique three-layer architecture and cross-chain capabilities, Echo offers comprehensive support for BTC in DeFi.

Looking back at the entire architecture, Echo’s cross-chain design stands out as a consistent highlight. Traditional staking protocols are often confined to single networks, whereas Echo enables BTC to move freely across chains. Users bridge LSTs generated via BTC Layer 2s like Babylon into Echo’s Vault, converting them into standardized assets. This process supports not only Aptos but also other Move-based ecosystems like Movement, and even extends to Solana.

Take Aptos as an example: the high performance of the Move language enhances Echo’s staking experience. Transactions confirm in seconds, and gas fees are extremely low. On Movement, Echo similarly leverages Move’s efficiency to offer cost-effective, highly flexible staking options. Users can freely switch networks based on market conditions—sending their BTC wherever yields are highest. This level of freedom sets Echo apart in the cross-chain staking space.

Diverse Yield Mechanisms: Practicality Meets Versatility

Echo’s yield mechanisms are both practical and richly layered, thoughtfully designed to meet the varied needs of BTC holders. On Aptos, users can bridge BTC into aBTC and participate in lending or vault investments to earn multiple income streams.

ECHO LENDING is ideal for conservative users. By lending aBTC or other assets, users can earn stable annualized interest between 5%–8%, with manageable risk.

Multi-Chain Vaults cater to yield seekers, using automated investment strategies to allocate funds into top-tier DeFi protocols, offering up to 30% APY.

In addition, users earn Echo Points by participating in staking, lending, and other activities. These points can be redeemed in the future for tokens or other ecosystem benefits.

Ecosystem Synergy: Strong Partnerships Pave the Way

As Echo’s cross-chain ecosystem expands, so does its network of strategic collaborations.

-

Echo x xBTC x Aptos

Anchored in the Aptos ecosystem, Echo’s collaboration with xBTC and Aptos is a key highlight. xBTC is a wrapped BTC issued by OKX, pegged 1:1 to BTC. Integrated into Echo Protocol, it seamlessly connects with Echo’s LST mechanism, allowing users to stake and lend xBTC on Aptos. Within three weeks of launch, over $70 million worth of xBTC was bridged to Aptos, with nearly $30 million staked in Echo—accounting for almost half of the total.

-

Solana Vault x Kamino

Additionally, Echo collaborates with Kamino in the Solana ecosystem. Through the Solana Vault, Echo bridges BTC to Solana, minting solBTC and enabling users to participate in Solana’s DeFi activities. Kamino’s optimized yield strategies further enhance vault returns. This cross-chain synergy not only broadens Echo’s application scope but also validates its multi-chain expansion capabilities.

Riding the Waves: A Bright Future Ahead

With $375 million in TVL, leading on-chain activity, and an ever-expanding partnership map, Echo Protocol has clearly established itself within the Move ecosystem and emerged as a frontrunner in the BTCFi sector.

Although the Aptos ecosystem—which currently hosts Echo’s primary focus—maintains a relatively low profile in the broader market, its unique high-performance advantages and Echo’s consistent growth trajectory suggest its full potential remains largely untapped. Whether you're a long-term holder wanting to make BTC “work,” or a yield-chasing DeFi player, Echo delivers a one-stop experience.

Echo Protocol is more than just a staking platform—it’s a pioneer redefining BTC’s value proposition. By making BTC more versatile, Echo shows the market that BTC’s potential extends far beyond “digital gold.” Backed by Aptos and the wider Move ecosystem’s high performance, BTC is poised to become a preferred engine of DeFi innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News