Even MicroStrategy has no ammunition left to buy the BTC dip—how is your DAT stock doing?

TechFlow Selected TechFlow Selected

Even MicroStrategy has no ammunition left to buy the BTC dip—how is your DAT stock doing?

Are you buying them for crypto exposure, or for that illusory premium which no longer exists?

Author: David, TechFlow

Over the past month, BTC has fallen from its all-time high of $126,000 to below $90,000. A 25% pullback has triggered market panic, with fear levels dropping into single digits.

But that man is still buying.

On November 17, Michael Saylor posted his usual update on X: "Big Week".

Subsequently, it was announced that MSTR purchased another 8,178 BTC for $835.6 million, bringing its total Bitcoin holdings to over 649,000 BTC.

Don't panic—the biggest bull is still in. But is that really true?

While Saylor's comment sections are filled with celebration, some have uncovered a critical data point:

MSTR's mNAV is about to fall below 1.

mNAV, or market net asset value multiple, is the key metric measuring the premium of MSTR's stock price relative to its BTC assets.

Simplistically, an mNAV of 2 means the market is willing to pay $2 for $1 worth of BTC assets; mNAV = 1 means no premium; mNAV < 1 means trading at a discount.

This metric is the linchpin of Saylor’s entire business model.

For comparison, when was the last time BTC dropped 25%? The answer is March this year.

At that time, Trump announced tariffs on multiple countries, markets plunged, Nasdaq fell 3% in a day, and crypto followed suit.

BTC dropped from $105K to $78K, more than 25%. But back then, MSTR was in a completely different state.

mNAV remained around 2, and Saylor had a full suite of financing tools—convertible bonds, preferred shares, ATM offerings—ready to raise capital to buy the dip.

Now? mNAV has fallen below 1.

This means issuing stock to buy Bitcoin is becoming unsustainable. For example, raising $1 through stock issuance might only let investors acquire $0.97 worth of BTC. That’s not buying the dip—it’s subsidizing losses.

According to MSTR’s Q3 financial report, the company now holds only $54.3M in cash.

In other words, Saylor may not be able to buy aggressively—not because he doesn’t want to, but because he physically can’t.

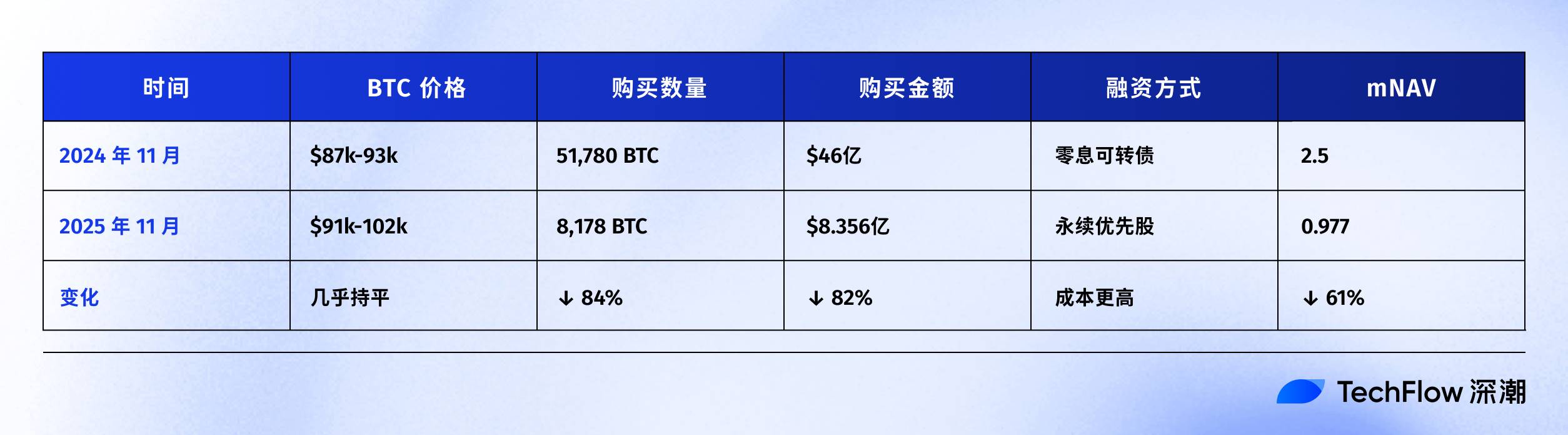

Last November vs This November

Don’t believe Saylor is running out of firepower? Let’s look at the books from exactly a year ago.

In November 2024, after Trump won the election, BTC surged from $75K to $96K.

What was Saylor doing? Buying heavily.

Where did the money come from? Debt. A $3 billion convertible bond due in 2029—with zero interest payments.

A year later, the situation has dramatically changed.

Beyond price changes, shifts in funding methods are also significant.

Last year, Saylor borrowed $3 billion to buy BTC—interest-free, repayable in 2029. Effectively free capital.

This year, Saylor can only issue a special class of stock (perpetual preferred shares), requiring MSTR to pay out 9–10% annually to shareholders.

The terms have worsened. The market may have lost confidence in MSTR, unwilling to lend freely anymore.

But mNAV falling below 1 triggers a real danger: a downward spiral.

mNAV drops → weaker fundraising ability → forced to issue more shares → further equity dilution → stock price declines → mNAV drops further.

This vicious cycle is already underway.

Since the beginning of the year, BTC has only declined 4.75%, but MSTR’s stock price has dropped 32.53%.

On November 17, MSTR hit a 52-week low of $194.54, declining for six consecutive days. From its yearly peak, the stock has lost 49.19%.

MSTR has underperformed BTC by 27 percentage points. The market is voting with its feet—investors would rather buy BTC directly than hold MSTR.

Moreover, in 2025, more and more companies are adopting Bitcoin and other token treasury strategies. MSTR is no longer the only option.

With increasing competition and a worsening crypto market, why should investors pay a premium for MSTR?

The logic behind MicroStrategy’s model is clear: continuously raise capital to buy BTC, use BTC’s appreciation to support share prices, and leverage stock premiums to fund further purchases.

But when BTC plunges and mNAV falls below 1, this loop becomes far less sustainable.

In November, Saylor is still buying—but clearly running low on ammunition.

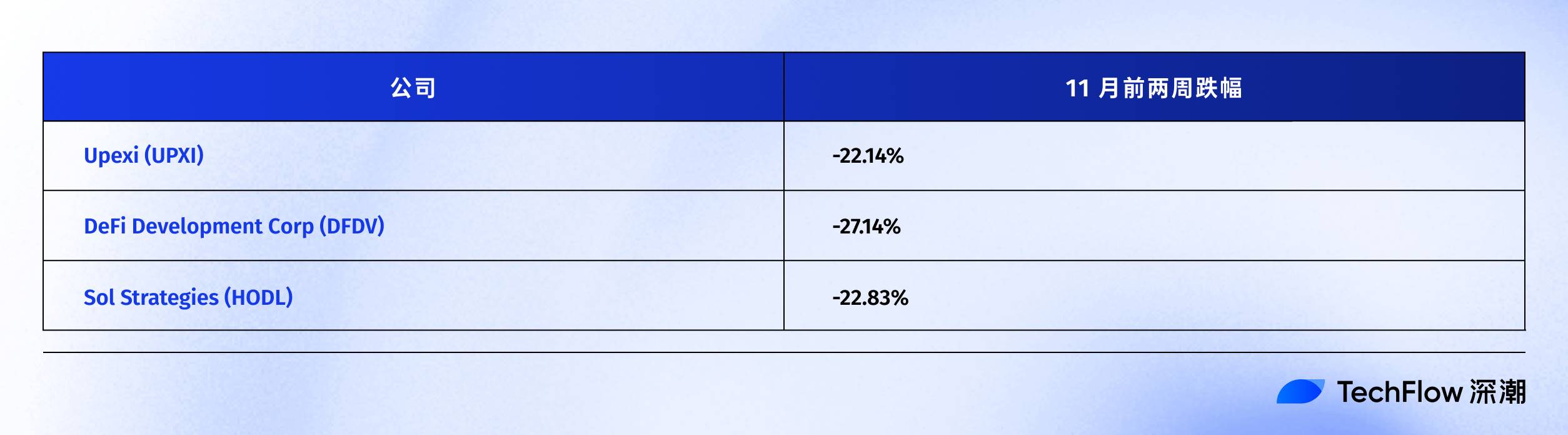

Other DAT companies are struggling too

MSTR’s troubles are not isolated.

The entire Digital Asset Treasury (DAT) sector suffered heavy losses in November.

First, companies holding BTC:

These firms follow a Bitcoin mining + treasury model. In the first two weeks of November, BTC dropped ~15%, yet their stock prices fell over 30%.

But worse off are those holding altcoins.

Companies holding ETH:

These firms hold ETH as their primary treasury asset. In early November, ETH dropped from $3,639 to $3,120 (-14.3%), but their stocks fell 17–20%.

Companies holding SOL:

The most dramatic case is DFDV, which saw its stock surge 24,506% in early 2025 due to its SOL treasury strategy. By November 17, however, it had crashed from a high of $187.99 to around $6.74.

Companies holding BNB:

Why do altcoin treasury firms suffer steeper declines?

The logic is simple:

In this market correction, BTC fell 25%, but altcoins like ETH, SOL, and BNB declined much more sharply.

When treasury assets are more volatile, stock prices amplify the losses. Additionally, altcoin treasury firms face a bigger problem: liquidity risk.

BTC is the deepest liquidity market among crypto assets. Even with hundreds of thousands of BTC, MSTR can slowly sell via OTC desks or exchanges.

But ETH, SOL, and BNB have far lower liquidity. During market fear, dumping millions of ETH could collapse prices further, creating a death spiral.

This November selloff served as a full stress test.

The results are clear: whether holding BTC or altcoins, DAT companies’ stock prices fell far more than their underlying treasury assets.

And for altcoin holders, the pain is even greater.

When the printing press breaks down

Back to the question posed at the start: if even Saylor can’t buy anymore, how safe are your DAT stocks?

The answer is now obvious.

November’s market has stripped away the final layer of illusion surrounding DAT stocks. According to the latest SaylorTracker data, MSTR’s Bitcoin holdings have dropped below $60 billion in market value, and its unrealized gains on 649,870 BTC are nearing a drop below $10 billion.

With mNAV below 1, MSTR’s “BTC printing press” model is breaking down. Raising capital through stock issuance no longer works smoothly. Soaring financing costs and dwindling funds are realities Saylor must now face.

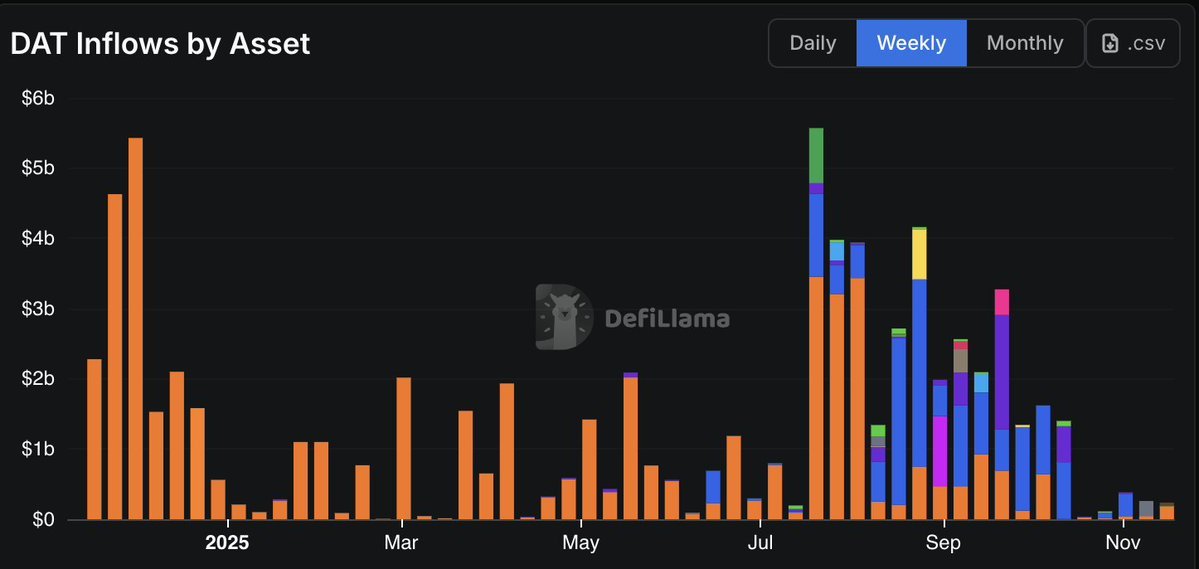

Data confirms this trend: inflows into DAT companies are declining, with October marking the lowest capital inflow since the 2024 election.

BTC miner stocks are down roughly 30%, ETH treasury firms down 20%, while SOL and BNB treasury stocks have collapsed to soul-crushing lows. Regardless of which company you favor, their stock declines have far exceeded the performance of their treasury assets.

Certainly, broader macro conditions—such as U.S. equity investors selling to seek safety—play a role. But structural flaws inherent in the DAT model are becoming increasingly apparent during downturns:

During crypto corrections, DAT stocks act as leveraged instruments that magnify downside moves. You thought you were buying “premium BTC exposure,” but in reality, you’re holding a leveraged vehicle accelerating losses.

If you still hold these stocks, perhaps ask yourself:

Are you holding them for crypto exposure—or for a premium that no longer exists?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News