Vertex Protocol: A One-Stop Decentralized Trading Platform, a New Direction for the DEX Sector

TechFlow Selected TechFlow Selected

Vertex Protocol: A One-Stop Decentralized Trading Platform, a New Direction for the DEX Sector

In today's mainstream DEX赛道, Vertex Protocol brings a new direction for development.

Preface

Vertex Protocol is a vertically integrated application built on Arbitrum—a decentralized exchange (DEX) protocol across contracts that offers users spot trading, perpetual futures, and an integrated money market in one unified platform. Vertex aims to create a new generation of vertically integrated exchanges that combine the security advantages of DeFi with the convenience of centralized exchanges (CEX). Vertex's mission is to make decentralized trading simple and accessible for everyone. In today’s mainstream DEX landscape, Vertex Protocol introduces a fresh direction.

Product Mechanism

Vertex is powered by a hybrid unified central limit order book (CLOB) and an integrated automated market maker (AMM). As paired LP markets fill the order book, Vertex significantly enhances its liquidity.

Vertex Protocol leverages Arbitrum's Layer 2 rollup technology and optimistic rollup model, effectively addressing network performance and gas fee issues. Additionally, Vertex adopts a non-custodial design, allowing users to maintain continuous on-chain control over their assets.

With its hybrid order book-AMM architecture, Vertex delivers ultra-low latency trading and more efficient DeFi asset utilization. Its off-chain sequencing architecture also helps minimize miner extractable value (MEV) inherent in Ethereum L1, enabling lightning-fast transaction speeds.

To empower developers within the community to build high-quality integrations and composable DApps, Vertex provides the Vertex SDK developer toolkit. Combined with seamless UX integration, users can effortlessly switch between platforms and applications.

Vertex thus offers a robust, scalable infrastructure along with fully functional APIs and SDKs, supporting high-frequency and automated trading for both users and developers. It also optimizes trading efficiency, enabling transactions to operate across EVM-compatible chains.

On Vertex, a user’s entire portfolio serves as collateral. Trading accounts use default cross-margining to manage a single account that offsets margin requirements across open positions, maximizing capital efficiency. Vertex delivers a powerful yet simplified trading experience for DeFi users while preserving self-custody, transparency, and autonomy—making it an unparalleled, user-preferred decentralized trading platform.

Trading Engine

At the core of Vertex’s technology is an optimal architecture for a vertically integrated product stack, encompassing three fundamental DeFi products:

▪️Spot Market

▪️Perpetual Market

▪️Money Market

On Arbitrum, these three most popular DeFi products are bundled into a single DEX, enabling users to access all three financial primitives from a unified interface. Users no longer need to switch between isolated DeFi applications—such as AMMs, perpetual DEXs, and money markets—to use the most sought-after DeFi functionalities.

▪️Buy and sell assets

▪️Use leverage to go long or short derivative contracts

▪️Borrow from or lend into asset pools

Vertical product integration offers unmatched advantages in capital efficiency, reduced user costs, and improved overall user experience.

Unified Margin

By default, Vertex uses cross-margining, meaning a user’s trading account aggregates liabilities to offset margin requirements across positions. A user’s portfolio then acts as collateral for multiple open positions. On Vertex, your portfolio *is* your margin.

Universal cross-margin accounts are rare in DeFi. Therefore, it's important to distinguish between two types of margin systems:

▪️Isolated margin = Account liability is limited to the initial margin posted for a single position.

▪️Cross-margin = Liabilities across multiple positions are shared within the account to offset margin requirements between positions.

Isolated margin is typically used for volatile, speculative positions and limits risk exposure to the account balance. It is popular for long-term trading on both DEXs and CEXs.

Cross-margin allows users to reduce margin requirements by calculating the overall portfolio risk across multiple positions. Open positions share capital to offset individual margin needs, requiring lower initial margin per position. While common in TradFi and widely available on many CEXs, cross-margin remains limited in DeFi.

On Vertex, users can utilize all funds—deposits, positions, and PnL—as margin.

This means open positions in spot, perpetual, and money markets all contribute to the portfolio’s margin capacity. With reduced risks of margin calls and forced liquidations on single positions, users can trade more flexibly and efficiently.

Vertex’s cross-margin design also supports portfolio margining. Similar to standard cross-margin, portfolio margining allows unrealized profits to offset unrealized losses, serve as margin for existing positions, or open new ones. All related settlements are automatically calculated in Vertex’s backend and clearly displayed in the app, showing the health of the trading portfolio at a glance.

Integrated Money Market

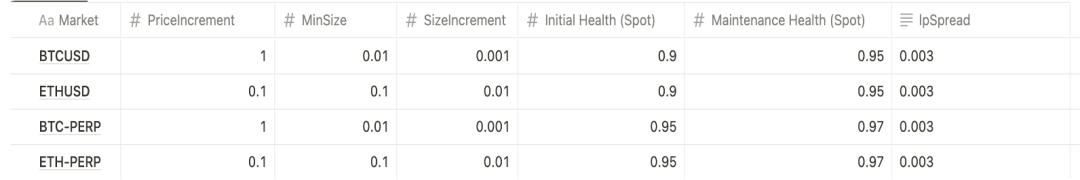

Specifications for Perpetual and Spot Markets

▪️PriceIncrement = The smallest price unit for a given market.

▪️MinSize = The minimum trade amount for a given market.

▪️SizeIncrement = The smallest increment for trade size in a given market.

▪️lpSpread = LP-related bid/ask spread

(commonly referred to as LP trading fees on other non-orderbook exchanges)

▪️Initial and Maintenance Health (Margin) = Health represents the amount of capital (in $USD) available for trading before liquidation.

Hybrid Orderbook-AMM

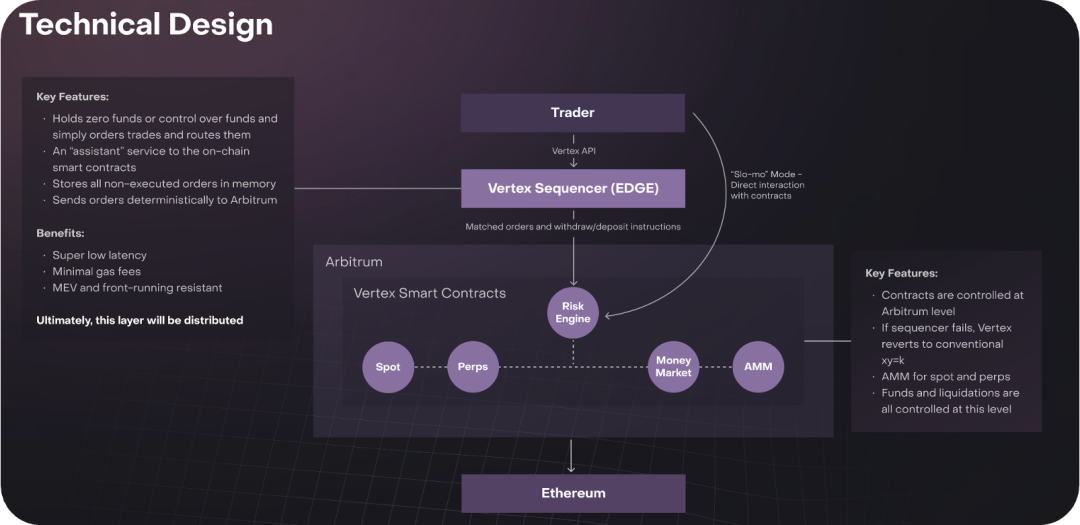

Vertex integrates a fully on-chain trading venue and risk engine at the protocol layer, topped with an off-chain sequencer, forming a hybrid orderbook-AMM DEX. The on-chain trading and risk engine hosts Vertex’s core products—spot, perpetual, and money markets—controlled by Vertex Protocol smart contracts on the Arbitrum layer.

The sequencer functions as a high-performance order book, matching incoming orders at the protocol layer with extremely low latency. Vertex’s on-chain clearinghouse acts as a hub, integrating perpetual and spot markets, collateral, and risk calculations into a single, unified system. The fusion of AMM and orderbook forms the foundation of a unified trading stack, making vertically integrated DeFi primitives the core on-chain offerings.

Each component of the Vertex trading stack combines into a powerful on-chain trading platform. Thus, the hybrid orderbook-AMM DEX excels uniquely in performance, liquidity expression, and diversified product offerings.

To accurately illustrate Vertex DEX’s specific design and resulting advantages, the hybrid orderbook-AMM model consists of three core pillars:

▪️An off-chain order book tracking limit orders sent to Vertex

▪️An on-chain AMM supporting the long tail of crypto assets, allowing users to provide passive liquidity

▪️An on-chain risk engine routing orders to the cheaper of the above liquidity sources without custodying funds

Conceptual Overview of Vertex Tech Stack

API & SDK

API

1. WebSocket/REST API supporting write (execution) and polling (query) operations.

2. WebSocket API enabling subscription to real-time data feeds.

SDK

Vertex provides a high-quality Vertex SDK developer toolkit, enabling anyone—other protocols or large traders—to seamlessly interact with Vertex smart contracts. This empowers community developers to build deeper integrations and composable dApps, while allowing users to quickly transfer assets in and out of the platform without relying on standalone transfer services or external apps.

Tokenomics

VRTX is the governance token of Vertex Protocol, designed to enable stakeholders within Vertex DAO to participate in the decentralized governance of the protocol. VRTX promotes decentralized participation and enables the creation of xVRTX (a liquid staking token) and voVRTX (a non-transferable voting share token for the protocol).

Users who stake VRTX receive xVRTX and voVRTX

▪️xVRTX is a transferable staking token representing a single voting right for governance and eligibility to receive a proportional share of protocol revenue and emissions.

▪️voVRTX represents the holder’s “user score.” voVRTX unlocks enhanced voting power and access to specific ecosystem rewards, acting as a rating system that incentivizes staking xVRTX. Staking xVRTX increases the score; unstaked voVRTX resets to zero.

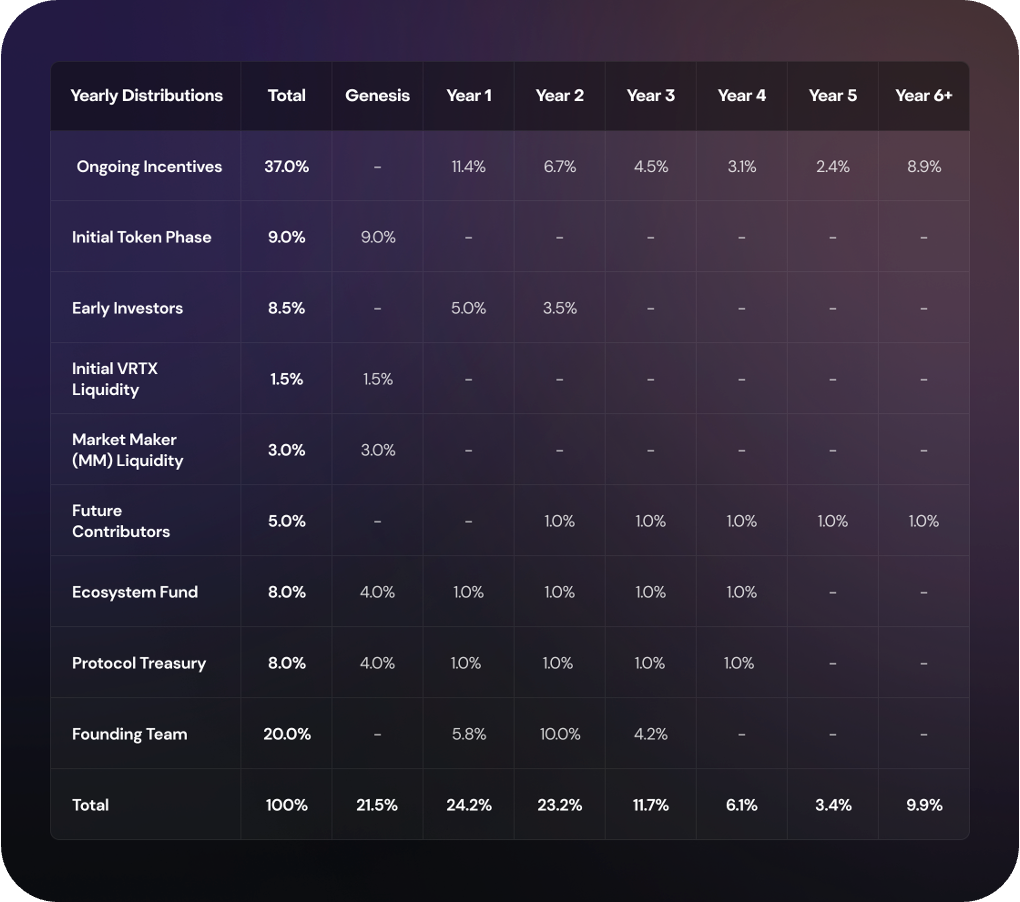

VRTX Token Supply and Distribution

The total supply of VRTX is 1 billion tokens, with 90.08% distributed over five years. Once the full 1 billion VRTX tokens are allocated, no additional supply will be introduced.

VRTX Total Token Allocation Chart

VRTX Annual Distribution Timeline

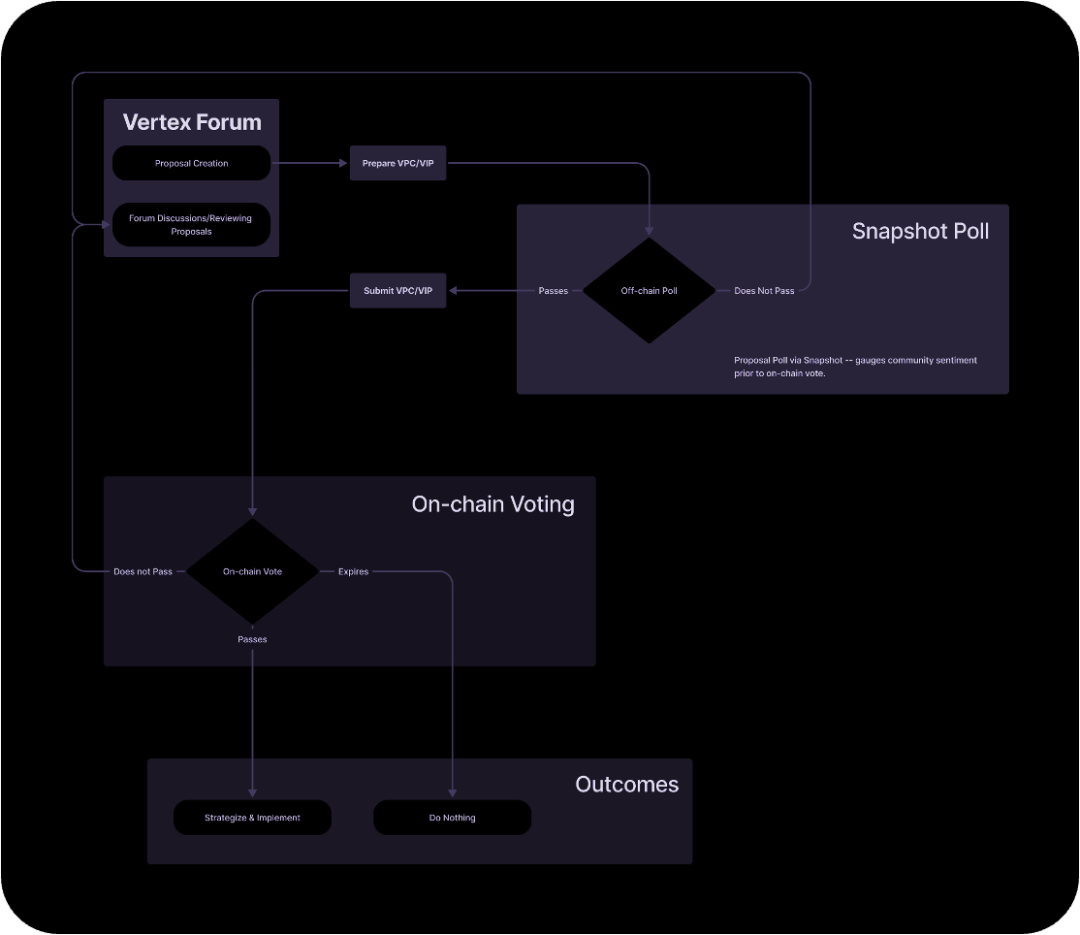

Governance

Vertex introduces Vertex DAO as its decentralized governance framework, innovatively designing a roadmap to maximize protocol decentralization over time.

Governance participants decide on new features and directions for the Vertex Protocol, such as integrating new functionalities, protocol upgrades, and adjusting risk parameters. Governance engages VRTX holders through a phased approach, starting with Version 1 and transitioning to Version 2.

Version 1

Vertex Governance Version 1 marks the first on-chain governance iteration of the protocol. This governance format allows anyone to participate in discussions about protocol evolution, giving VRTX holders a path to govern the protocol based on community votes.

Vertex DAO Governance Process

Version 2:

Vertex DAO’s update introduces a new governance model composed of multiple sub-committees formed by selecting core contributors to the protocol.

▪️Core Contributors: Individuals who deliver valuable general and technical work, implementing features and driving protocol changes.

▪️Sub-Councils: Community-elected working groups responsible for overseeing, managing, and prioritizing Vertex governance.

▪️Election [Nominees]: Sub-council elections are public and roll every three months. Councils have the power to vote out uncommitted members during their term.

VRTX stakers (> 0.01 VRTX) can nominate themselves for a (single) council position, submitting proof of governance involvement along with relevant experience.

▪️Election [Voters]: VRTX stakers participate in electing sub-council members. Wallets must hold and stake VRTX tokens to gain voting rights.

Votes are counted quadratically; at the end of the election period, nominees with the highest weighted vote counts are elected to their respective sub-council roles.

Comparison with Mainstream DEXs

Most mainstream DEX platforms fail to offer Web2-native users a smooth transition into Web3. For beginners, using MetaMask and navigating complex protocols for hedging or leveraged trading is cumbersome, and complicated workflows deter many native users. Compared to traditional DEXs, Vertex’s hybrid orderbook-AMM design supports low-fee trading and simplifies the orderbook experience. Additionally, since AMMs are ideal for illiquid assets, combining AMM with an orderbook gives Vertex the best of both worlds.

Investors and Partners

In April 2022, Vertex Protocol raised $8.5 million in a seed round led by Hack VC, Dexterity Capital, Jane Street, and Hudson River Trading, with participation from Collab Currency, GSR, Lunatic Capital, Big Brain Holdings, Huobi Ventures, and JST Capital.

Summary

Vertex is a vertically integrated DEX that bundles spot trading, perpetual contracts, and an integrated money market into a single, unified trading platform. Trade with lightning speed, universal cross-margining, and a customizable, user-friendly interface. No more switching between dApps—trade, earn, and borrow all within one DEX. Vertex’s unique design merges the strengths of DEXs and CEXs, offering self-custody like a DEX and trading speed akin to a CEX. In short, Vertex is pushing DEXs toward a new level of sophistication.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News