DWF Labs Research: Deep Dive into the Economic Models of On-Chain Derivatives Exchanges

TechFlow Selected TechFlow Selected

DWF Labs Research: Deep Dive into the Economic Models of On-Chain Derivatives Exchanges

Tokenomics is a core component of crypto protocols, and there is no definitive formula for determining successful tokenomics.

Author: DWF Labs Research

Translation: TechFlow

Introduction

In our previous article, we explored the evolving landscape of decentralized derivatives exchanges (or derivative Dexes) and examined the evolution and potential developments of existing derivative DEXs. This article will delve into the current tokenomics of decentralized derivatives exchanges, analyze the different mechanisms adopted by various protocols, and discuss potential future directions.

Why Tokenomics Matters?

Tokenomics is crucial for a protocol's growth and stability. After the "DeFi Summer," liquidity mining successfully provided initial funding for protocols in their early stages, but long-term, this mechanism proved ultimately unsustainable. It attracted mercenary capital, creating a vicious cycle of "mining and dumping," where funded investors constantly chase the next protocol offering higher yields, while abandoned protocols suffer as a result.

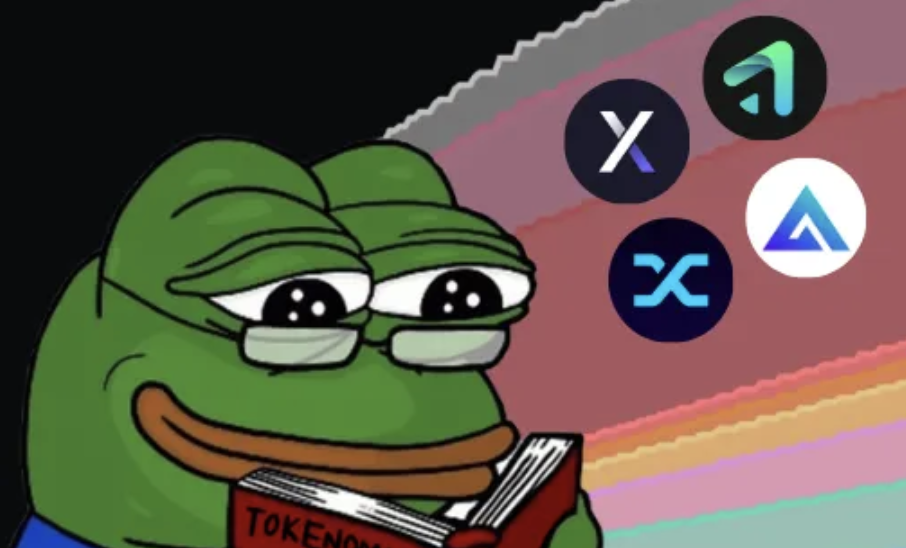

One example is Sushiswap’s vampire attack on Uniswap—initially successful in attracting significant TVL, but ultimately unsustainable. Meanwhile, protocols like Aave and Uniswap, which prioritized product development, successfully attracted and retained users, with sustainable tokenomics helping solidify their positions as market leaders—a lead they still maintain today.

While product-led growth is important, tokenomics also plays a key role in enabling derivative DEXs to stand out in a competitive market. Tokens represent users’ valuation of a protocol based on its activity, similar to how stocks reflect expectations of corporate performance. Unlike traditional markets, token prices often precede broad recognition and growth of crypto projects.

Therefore, it's important to have tokenomics that accumulate value from protocol growth. Ensuring a sustainable token economy that provides sufficient incentives for new user adoption is also critical. Overall, sound tokenomics are key to achieving long-term growth and retaining protocol value.

Current State of Derivative DEXs

In our previous Hindsight Series article, we broadly covered the evolution and mechanics of derivative DEXs. Now, we dive deeper into the tokenomics of these protocols. dYdX was one of the first projects to launch perpetual contracts on-chain in 2020 and launched its token in September 2021. However, it offered limited utility to holders beyond trading fee discounts, and the token has generally been considered highly inflationary due to emissions from staking, liquidity providers (LPs), and trading rewards.

GMX entered the market in September 2021 aiming to address the unsustainability of emission models. GMX was among the first to introduce a peer-to-pool model and a user fee-sharing mechanism, distributing revenue from trading fees in both major cryptocurrencies and the project’s native token. Its success inspired more peer-to-pool systems like Gains Network, which differs in staking models and revenue-sharing parameters, posing lower risk to users but generating lower returns.

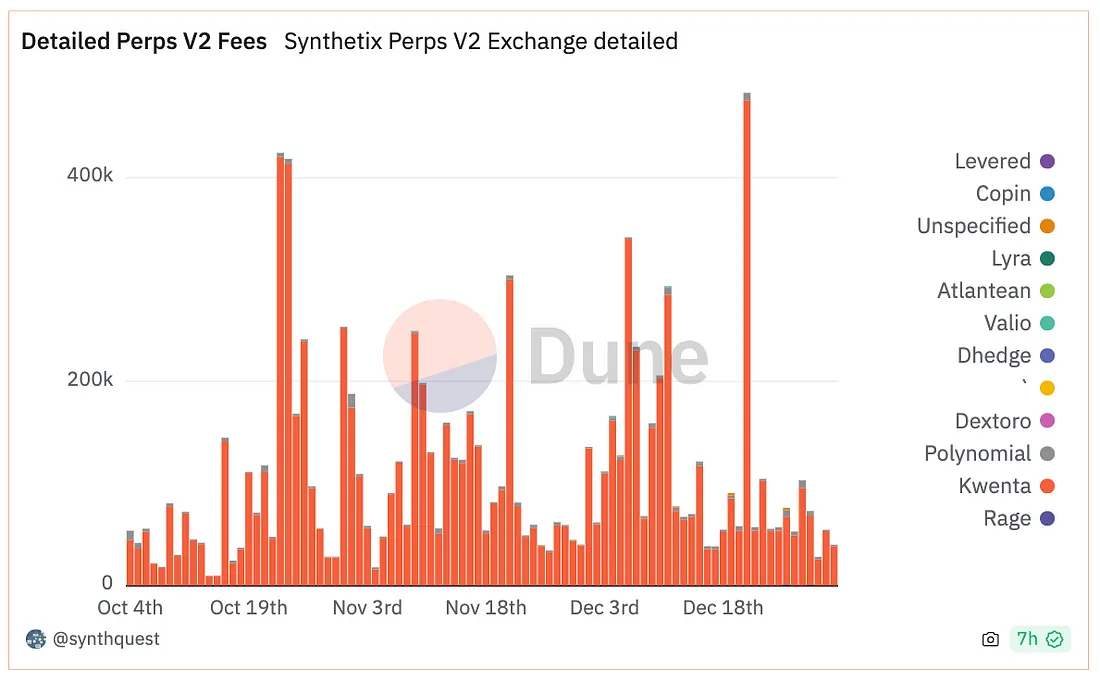

Synthetix is another DeFi protocol in this space, supporting multiple perpetual and options exchanges such as Kwenta, Polynomial, Lyra, and dHEDGE as front-ends. It uses a synthetic model where users must stake SNX tokens to borrow sUSD for trading and earn sUSD fees from all front-end transactions.

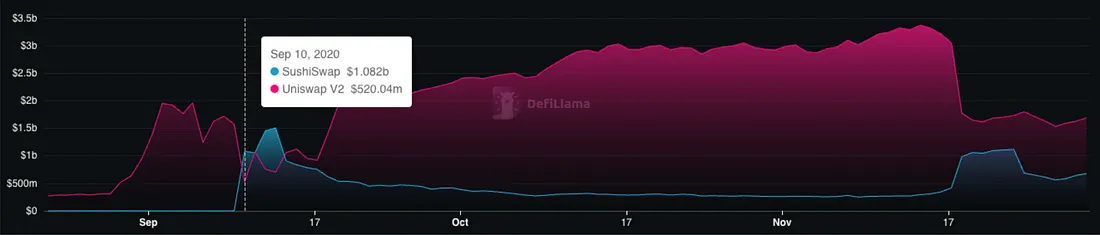

Comparison of Derivative DEX Tokenomics

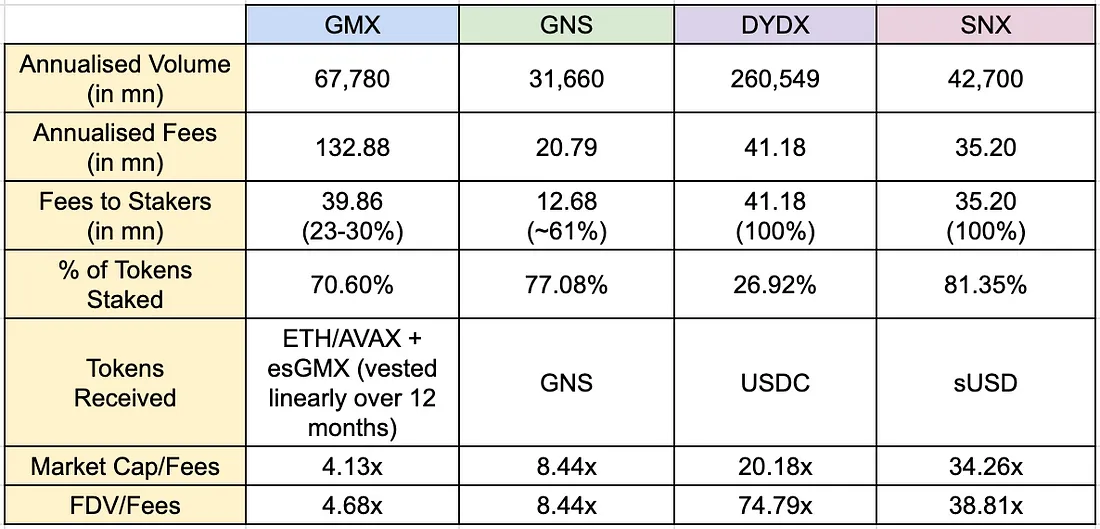

The table below compares different protocols across key aspects of tokenomics:

Key Factors in Designing Effective Tokenomics

Designing effective tokenomics requires careful consideration of various factors to create a system that aligns participant incentives and ensures long-term token sustainability. We discuss the following factors based on the current landscape of derivative DEX tokenomics.

1. Incentives and Rewards

Incentives and rewards play a vital role in encouraging user behavior, including staking, trading, or other mechanisms that encourage contributions to the protocol.

Staking

Staking is a mechanism where users deposit native tokens into the protocol in exchange for yield. The yield can come from a share of transaction fees—paid in mainstream coins or stablecoins—or through issuance of the native token. Among the protocols we analyzed, there are three main types of staking:

-

Fee sharing in mainstream coins or stablecoins

-

Fee sharing in native tokens

-

Earning inflationary releases of the native token

As shown in the table, fee sharing has proven effective in incentivizing users to stake their tokens. The table reflects recent changes in tokenomics for dYdX and Synthetix, including introducing 100% fee sharing for dYdX v4 and eliminating inflationary SNX emissions.

Previously, dYdX v3 had a security and liquidity staking pool that issued inflationary DYDX rewards, as these pools did not directly benefit from platform trading volume. After community votes in September and November 2022, both pools were deprecated because they failed to achieve their intended purpose and were inefficient for the DYDX token. With v4, fees generated from trading volume are returned to stakers, incentivizing users to stake for yield.

GMX uses two types of staking to distribute rewards—both in major tokens (ETH/AVAX) and its native token. High staking ratios for GMX, Gains Network, and Synthetix indicate that rewards are sufficient to motivate users to provide upfront capital and keep it staked within the protocol. Determining the ideal incentive mechanism is difficult, but so far, partially paying fees in major tokens/stablecoins and introducing inflationary native token rewards has proven effective.

Overall, staking offers the following benefits:

-

(1) Reduced circulating supply (and selling pressure)

-

This works only if generated yields aren't purely inflationary to ensure sustainability

-

If yields are paid in major tokens or stablecoins, selling pressure is reduced because users don’t need to sell tokens to realize gains

-

-

(2) Value appreciation of staked tokens

-

As the protocol grows and fees per token increase, token value can grow indirectly

-

Offering stable yield on tokens can attract non-traders who participate solely to earn returns

-

However, several considerations must be made when implementing staking, depending on the protocol’s goals:

-

(1) Durability and type of rewards

-

Stable returns are important, especially for risk-averse users who don’t need to sell tokens to “realize” gains

-

Release rates matter too, ensuring users receive stable and sustained rewards over time

-

-

(2) Rewarding the right users

-

Low barriers to entry and easy access to rewards (no upfront capital, no redemption requirements, etc.) may attract mercenary users, diluting rewards for active users (active traders, long-term holders, etc.)

-

Our view: Staking is a common method across most protocols to reduce circulating supply. It’s an effective way to align incentives, especially if the native token is required as collateral (e.g., SNX), reducing volatility for users' positions through yield. If rewards are distributed via partial fees in major coins/stablecoins, staking becomes even more positive and long-term, likely suitable for most derivative DEXs with solid trading volumes.

Liquidity Providers (LPs)

Liquidity providers (LPs) are particularly important for derivative DEXs, especially under the peer-to-pool model, as they enable support for greater trading volume. In peer-to-pool models, LPs become counterparties to traders on the platform. Therefore, fee-sharing revenues must sufficiently offset risks from losses to traders.

For orderbook models like dYdX, being an LP is a way for users to earn rewards. However, most TVL still comes from market makers, and DYDX-issued rewards were purely inflationary. As a result, the LP module was deprecated in October 2022. Synthetix is an exception—stakers act as LPs on integrated platforms like Kwenta, Polynomial, and dHEDGE, earning fees from trading volume.

Both GMX and Gains Network use peer-to-pool models requiring LPs to serve as counterparties for executed trades. Comparing the two:

-

GLP’s TVL is significantly higher than gDAI, likely due to higher yields

-

gDAI users face lower risk since trader profits are backed by GNS minting, whereas GMX pays users directly from GLP funds

-

More risk-averse users might be drawn to GLP’s high yields, while less risk-averse users may prefer gDAI despite lower returns

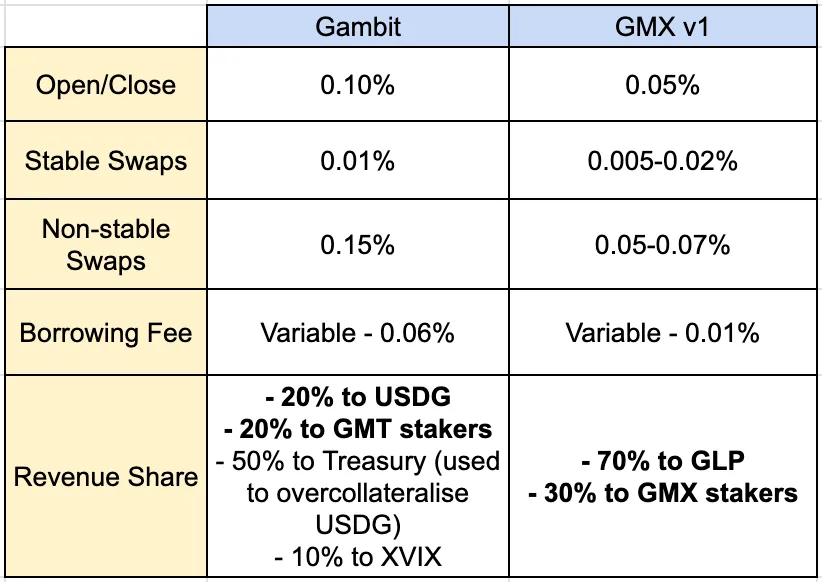

Gains Network’s mechanism resembles that of GMX’s predecessor, Gambit Financial on BNB. Gambit generated substantial trading volume and TVL after launch. While Gambit and GMX share similarities in peer-to-pool design and revenue sharing, their parameters differ.

Although Gambit gained traction, GMX saw a surge in Arbitrum trading volume and user count after modifying its tokenomics and structure. Key changes include:

-

Allocating most revenue to stakers/LPs

-

Gambit allocated only 40% of revenue (20% to USDG + 20% to Gambit stakers) to holders/stakers, while GMX v1 allocated 100% (70% to GLP + 30% to GMX stakers)

-

Increasing rewards to stakers/LPs created a compelling narrative appealing beyond pure traders

-

Shifting risk to LPs as direct counterparties

-

Gambit allocated only 20% of revenue to USDG, while GMX allocated 70% to GLP

-

Both USDG and GLP are formed by depositing whitelisted assets to provide platform liquidity. Gambit offered lower LP yields because USDG is a stablecoin, and the platform reserved 50% of revenue for staking to ensure LP redemption. In contrast, GMX shifted risk to LPs, who bear the brunt of trader profits or losses

From case studies of Gains Network, Gambit, and GMX, increasing LP rewards relative to protocol risk absorption can drive more liquidity. In GMX v2, tokenomics saw minor adjustments, reducing fee shares to stakers and GLP holders by 10%. Details:

-

GMX V1: 30% to GMX stakers, 70% to GLP providers

-

GMX V2: 27% to GMX stakers, 63% to GLP providers, 8.2% to protocol treasury, 1.2% to Chainlink—approved by community vote

Community members largely supported the vote and continued TVL growth under GMX v2, indicating a positive impact.

Rewarding LPs offers many benefits, especially for peer-to-pool models, as they are key stakeholders:

-

(1) Enhanced loyalty through stable returns

-

Reduces risk of LPs losing initial capital

-

Combined with stable yields, reduces inertia to rebalance positions, as users don’t need to sell tokens to realize gains

-

This mechanism didn’t apply to dYdX v3 due to volatility introduced at issuance of its native token

-

-

(2) Native token value accrual

-

For GMX, GLP growth and platform trading volume indirectly boost GMX value—fees per token—which drives significant token demand

-

Considerations:

-

(1) Adjusting LP risk exposure to the protocol

-

Without adjusting parameters based on risk and market conditions, LPs may face risks in both peer-to-pool and orderbook models

-

Recently, SNX stakers lost $2 million due to a TRB price manipulation event, as OI limits were set in TRB tokens rather than USD amounts

-

Historically, GLP holders mostly benefited from trader losses, but questions remain about sustainability. With changing tokenomics, any major trader wins may now be backed by the protocol treasury

-

Our view: This mechanism is crucial for peer-to-pool models, as growth depends on incentivizing liquidity. Over time, GMX effectively achieved this through high revenue sharing and capturing trader losses. While trader wins pose LP risks, we believe medium-sized protocol earnings can significantly offset them. Thus, adequately incentivizing LPs is vital for building a strong user base.

Trading

Trading rewards primarily incentivize trading volume and are typically distributed in the protocol’s native token. Rewards are usually calculated as a percentage of total planned rewards during a specific period, based on trading volume or fees.

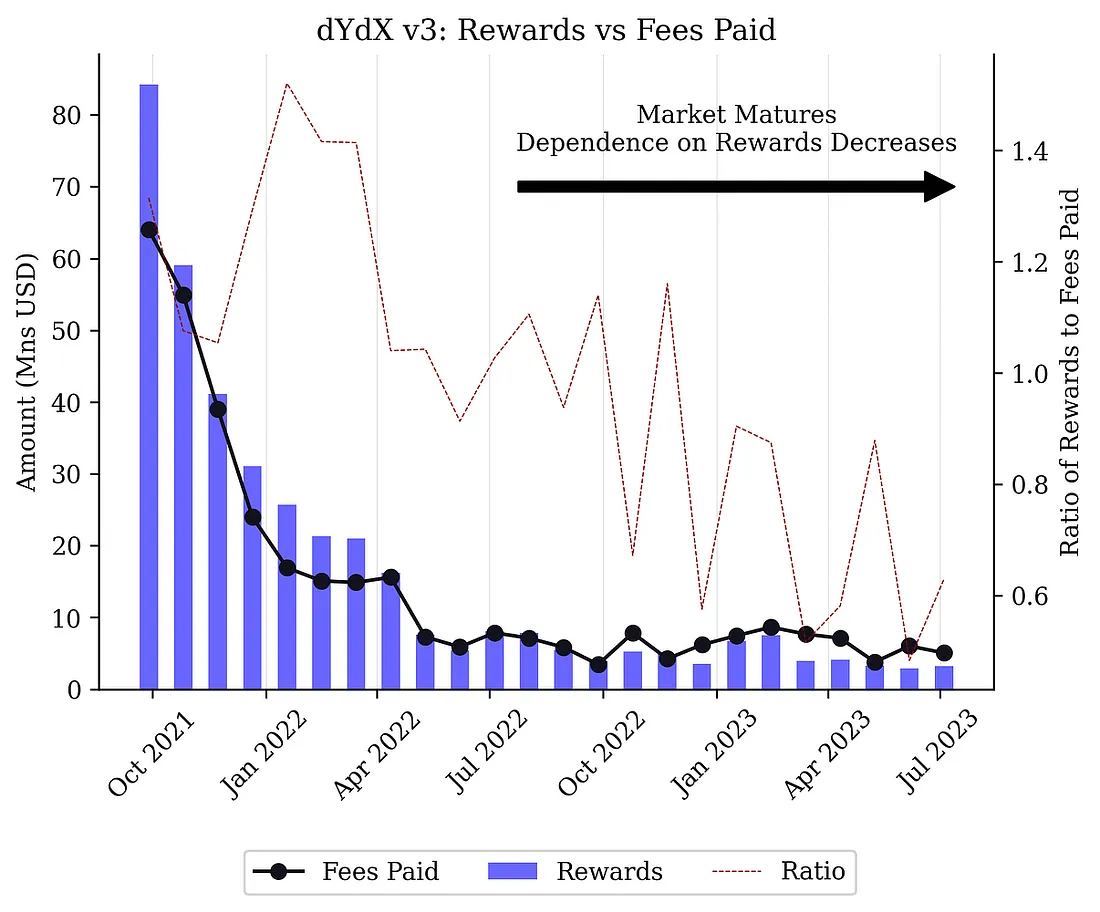

For dYdX v3, 25% of the total supply was allocated to trading rewards, making it the primary source of emissions in the first two years. Often, reward amounts exceeded fees paid by traders, meaning token emissions were highly inflationary. With little holding incentive (mainly trading fee discounts), this led to significant selling pressure on DYDX over time. This changed with dYdX v4, discussed below.

Kwenta also offers trading rewards capped at 5% of total supply. Users must stake KWENTA and trade on the platform to qualify. Rewards are determined by multiplying staked KWENTA and a percentage of trading fees, ensuring rewards don’t exceed users’ upfront costs (staking capital + trading fees). Rewards are locked for 12 months, with up to 90% reduction if claimed early.

Overall, clear benefits of introducing trading rewards include:

-

Incentivizing trading volume short-term: Through dYdX v3 rewards, traders were essentially paid to trade, boosting volume.

Considerations:

-

Type of users the protocol wants to attract

-

For dYdX, easy qualification and no lock-up may attract many short-term users, diluting rewards for genuine users.

-

For Kwenta, upfront capital and lock-up requirements may deter short-term users, reducing dilution of rewards for long-term users

-

Our view: Trading rewards may be effective for bootstrapping a protocol initially but should not be used indefinitely, as continuous token issuance devalues the token. They also shouldn’t dominate monthly supply and inflation. Lock-ups are important for protocols to disperse sales pressure.

Value Accrual to the Chain

Case Study: dYdX

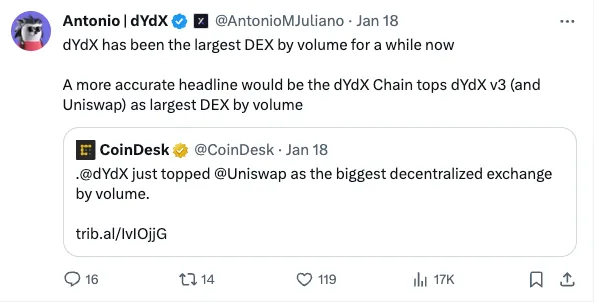

The launch of the dYdX chain marks a new milestone for the protocol. On January 18, the dYdX chain briefly surpassed Uniswap as the highest-volume DEX.

In the future, we may see more derivative DEXs follow suit. Key tokenomic changes post-dYdX chain update include:

-

Staking supports chain security, not just yield generation

-

In v3: Rewards in the security pool were issued in DYDX tokens, but eventually disabled after community approval of DIP 17

-

In v4: The dYdX chain requires validators to stake dYdX tokens to run and secure the chain. Delegation (staking) is a key process—stakers delegate validators to perform network validation and block production

-

100% of trading fees distributed to delegators and validators

-

In v3: All generated fees were collected by the dYdX team, a concern for some in the community

-

In v4: All fees—including trading and gas fees—are distributed to delegators (stakers) and validators. This new mechanism is more decentralized and better aligns incentives with network participants

-

PoS stakers (delegators) can choose validators to stake their dYdX tokens with and earn a share of validator income. Commission rates range from 5% minimum to 100% maximum. Currently, according to Mintscan data, the average validator commission rate on the dYdX chain is 6.82%.

Beyond these changes, new trading incentives ensure rewards do not exceed paid fees. This is critical, as many concerns around v3 centered on inflationary and unsustainable tokenomics—despite later updates, impacts on token performance were minimal. Xenophon Labs and other community members raised questions about whether rewards could be “gamed,” a topic previously debated.

In v4, users can receive trading rewards up to 90% of net trading fees paid by the network. This improves demand (fees) vs. supply (rewards) balance and controls token inflation. Reward cap: 50,000 DYDX daily for six months, ensuring inflation remains insignificant.

Our view: The dYdX chain is at the forefront of industry moves toward greater decentralization. The validation process plays a key role on the new chain: securing the network, voting on on-chain proposals, and distributing staking rewards. Combined with 100% fee distribution to stakers and validators, it ensures rewards align with network participants’ interests.

Value Accrual at Liquidity Hubs

Case Study: Synthetix

Synthetix serves as a liquidity hub for multiple perpetual and options exchange front-ends like Kwenta, Polynomial, Lyra, and dHEDGE. These integrators have developed custom features, built communities, and provided trading interfaces.

Among all integrators, Kwenta is the primary derivatives exchange driving most volume and fees to the broader Synthetix platform. Synthetix captures value from Kwenta and others thanks to its tokenomic model. Key reasons:

-

Staking SNX is the first step to trading on integrators

-

Even with its own governance token, Kwenta quotes prices only in sUSD, which can only be minted by staking SNX

-

Besides Kwenta, other integrators like Lyra, 1inch, and Curve (Atomic Swaps) also use sUSD, requiring SNX. Thus, Synthetix’s front-end integrations allow value to accrue to the SNX token

-

Liquidity hub rewards distributed to integrators

-

In April 2023, Synthetix announced allocating a large portion of its Optimism tokens to traders. For 20 weeks, Synthetix distributed 300,000 OP weekly, while Kwenta got 30,000 OP weekly

-

From Q2 to Q3 2023, Synthetix attracted higher trading volume and fees, significantly contributing to SNX price growth

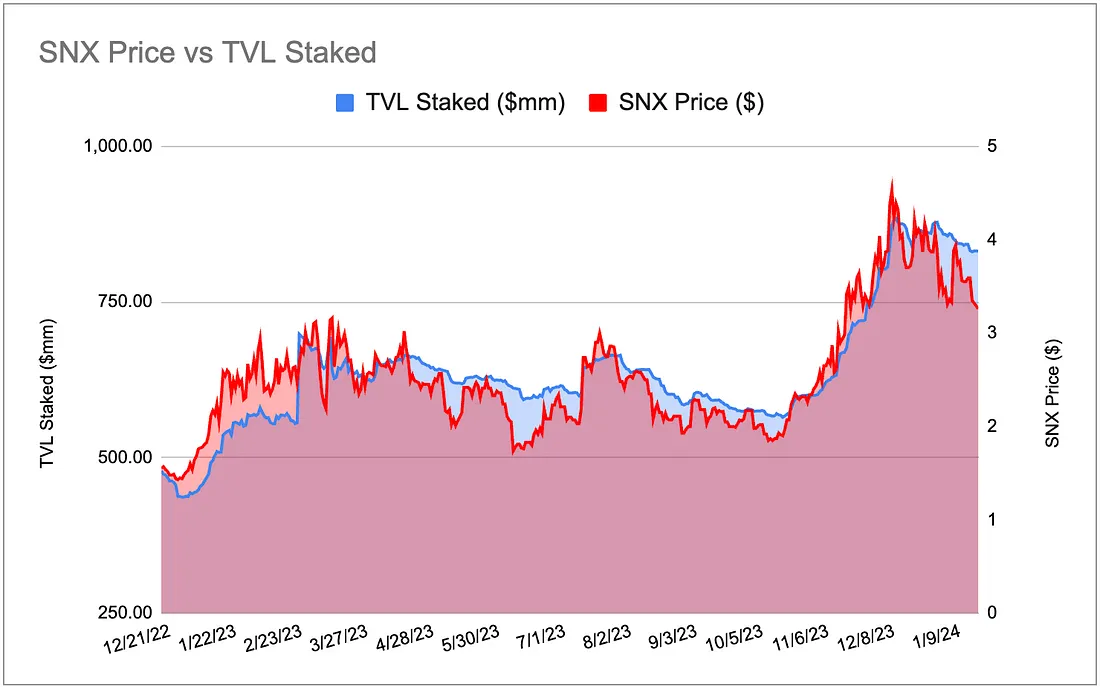

The chart also shows that total value staked in SNX is highly correlated with SNX price performance. As of January 22, 2022, Synthetix’s staked TVL was approximately $832 million. It has the highest staking ratio (81.35%) compared to dYdX, GMX, and Gains Network.

Our view: For a liquidity hub, the relationship should be mutually beneficial. While Synthetix provides liquidity to these integrators, it also earns fees from them, indirectly driving Synthetix TVL through trading volume. Increased trading demand on integrators leads to higher SNX demand, reducing sell pressure and indirectly boosting token value. Therefore, partnering with more front-end integrators benefits both Synthetix and its token holders.

2. Buybacks and Burns

Buybacks involve using a portion of revenue to purchase tokens on the market to directly push up price or burn them to reduce circulating supply. This lowers circulating supply, potentially increasing future prices.

Gains Network has a buyback and burn program where a portion of trader losses can be used to buy back and burn GNS based on gDAI staking rates. This mechanism has burned over 606,000 GNS tokens—about 1.78% of current supply. Because GNS supply is dynamic via minting and burning, it’s hard to determine if buybacks significantly impacted token price. Still, it’s a way to offset GNS inflation, which kept supply between 30–33 million over the past year.

Synthetix recently voted to introduce a buyback and burn mechanism in its Andromeda upgrade. This proposal may rekindle interest in SNX, as holders are doubly affected—through staking rewards and holding a deflationary asset. This reduces pure staking risk, as buyback and burn allocations can act as a backstop during events (e.g., what happened with TRB).

Key advantages of the mechanism:

-

Ability to control/reduce supply: Ensures token holders aren’t gradually diluted by rewards or other holders’ token issuance

-

Encourages token holding: Holders/stakers gain additional utility from holding a “deflationary” asset

However, buyback effectiveness heavily depends on:

-

Protocol revenue to sustain burns: Without stable revenue, the mechanism cannot be maintained, and reduced impact may discourage holding.

Our view: Burn mechanisms may not directly affect price but can promote the concept of buying a deflationary token. Most effective for protocols with strong revenue and large portions of total supply already circulating (e.g., RLB). Thus, suitable for established protocols like Synthetix with low inflation.

3. Token Distribution and Vesting Schedule

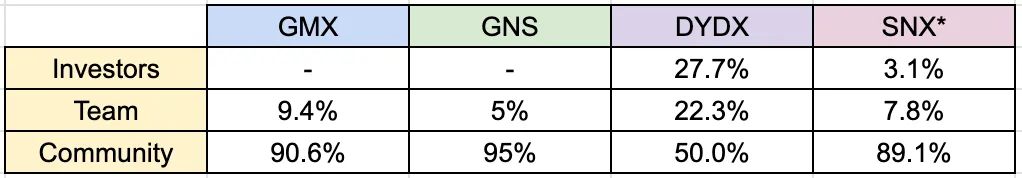

Documenting token distribution and vesting schedules across stakeholders is important to ensure parameters don’t favor certain groups. For most protocols, major allocations include investors, teams, and communities. For community tokens, this includes airdrops, public sales, rewards, and DAO tokens.

SNX distribution is calculated based on increased token supply from rewards issued under the February 2019 monetary policy change

Reviewing these protocols’ distribution and vesting schedules, we draw several conclusions:

-

GMX and Gains Network are exceptions, having raised funds only through public token sales. “Community-owned” protocols can reduce user concerns about investors, incentivizing holding and participation

-

dYdX and Synthetix reserved large supplies for investors—27.7% and 50% respectively (pre-supply change). However, dYdX had ~2-year long lockups, while Synthetix had a 3-month lockup post-TGE followed by quarterly unlocks

-

GMX and Gains Network migrated from previous tokens, meaning most supply was unlocked at launch. Future reward emissions thus represent a small fraction of circulating supply

-

dYdX and Synthetix both reserved large supplies for rewards (>=50%). However, dYdX rewards were purely inflationary, while Synthetix distributed part fees + rewards, unlocking over 12 months—reducing SNX inflation compared to DYDX

Due to vast differences in holder composition and mechanisms, there’s no definitive formula for token distribution or vesting. Nevertheless, we believe the following factors generally benefit all stakeholders:

-

Community should receive the largest allocation

-

Team allocation should not be excessive, with longer vesting than most holders, signaling commitment

-

Investors should receive minimal allocation with long unlock periods

-

Token releases should be spread over time with lock-ups to prevent sharp inflation at any point

4. Governance and Voting

Governance is crucial for derivative DEXs, granting token holders power to participate in decision-making and influence protocol direction. Examples of governance decisions include:

-

Protocol upgrades and maintenance

-

Derivative DEXs often require upgrades to improve functionality, scalability, and growth, keeping the protocol updated and competitive

-

For example, GMX’s recent snapshot passed proposals to create a BNB market on GMX V2 (Arbitrum) and adjust GMX v2 fee distribution

-

-

Risk management and security

-

Token holders can collectively decide on collateral requirements, liquidation mechanisms, bug bounties, or emergency actions during breaches. This protects user funds and builds trust

-

Recently, Synthetix lost $2M due to TRB price volatility, highlighting the need for ongoing parameter review—adding volatility circuit breakers and increasing sensitivity to pricing skew during peaks

-

-

Liquidity and user incentives

-

Holders can propose and vote on strategies to incentivize LPs, adjust fee structures, or introduce mechanisms to enhance liquidity provision

-

For example, dYdX governance approved the v4 launch incentive proposal

-

-

Transparent, decentralized community

-

Governance should foster transparency and accountability. Publicly accessible processes and on-chain voting ensure transparent decision-making

-

For example, DEXs like dYdX, Synthetix, and GMX use on-chain voting to promote decentralization

-

Our view: Governance helps build a strong, inclusive community for stakeholders in derivative DEXs. On-chain voting and transparent decision-making foster trust between stakeholders and the protocol, ensuring fairness and public accountability. Thus, governance is a key feature of most crypto protocols.

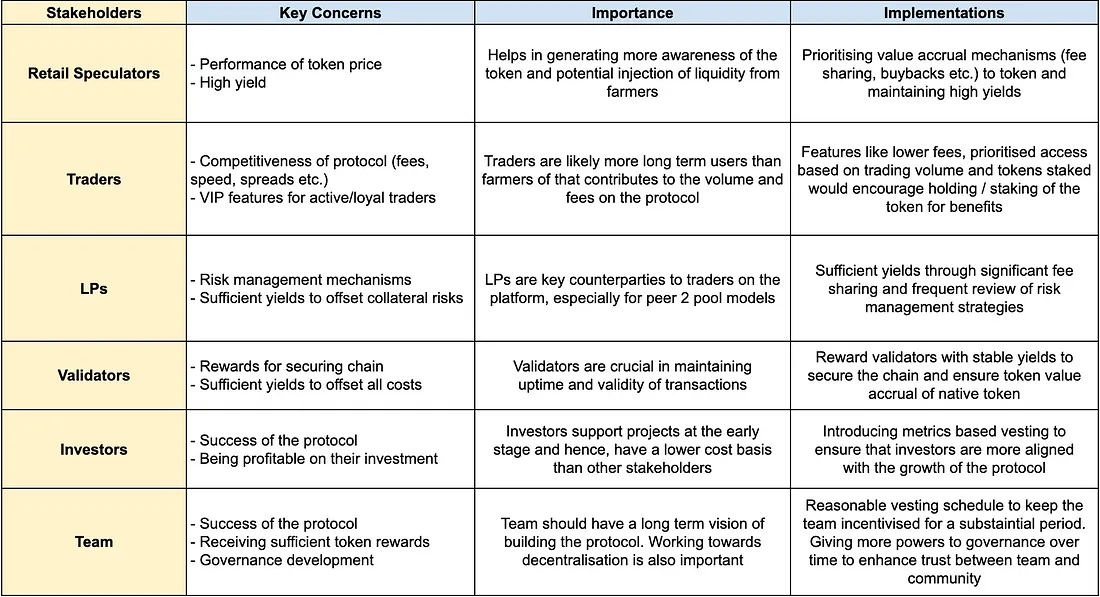

Exploring New Mechanisms

Beyond the above, we believe there are innovative ways to introduce additional utility and stimulate token demand. Protocols must prioritize new mechanisms based on their target stakeholders and what matters most to them. The table below outlines key stakeholders and their primary concerns:

Given the wide range of concerns, it’s impossible to satisfy all stakeholders. Therefore, it’s crucial for a protocol to reward the right user groups to ensure sustained growth. We believe there’s room to introduce new mechanisms that better balance the interests of different stakeholders.

Conclusion

In conclusion, tokenomics is a core component of crypto protocols. There is no definitive formula for successful tokenomics, as many factors affect performance—including uncontrollable external elements. Nonetheless, the fast-changing nature of crypto markets highlights the importance of adaptability and responsiveness to market conditions. From the examples above, experimenting with new mechanisms can be highly effective for achieving exponential growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News