The Mysterious Trader Buying 1.76 Billion USDT in 50 Days to Manipulate the Bitcoin Market

TechFlow Selected TechFlow Selected

The Mysterious Trader Buying 1.76 Billion USDT in 50 Days to Manipulate the Bitcoin Market

The Story Behind the Mysterious Address and Bitcoin's Surge

Author: Xiaohe River

On October 16, Bitcoin surged past the previous high reached before the "August 18" sharp drop, launching a new uptrend cycle. The price climbed from 27,000 USDT to a peak of 44,000 USDT, marking a maximum increase of over 60%.

Meanwhile, a mysterious on-chain address (0x1dbbbc3fdb2c4fabd28fd9b84ed99ceb84bfbec5) started receiving 1.81 billion USDT via Tether minting from October 20, transferring these funds into regulated exchanges such as Kraken, Coinbase, and OKX. The timing of these operations perfectly aligned with the rise in this market cycle, leading many to consider it one of the potential catalysts behind this bullish rally.

Meanwhile, a mysterious on-chain address (0x1dbbbc3fdb2c4fabd28fd9b84ed99ceb84bfbec5) started receiving 1.81 billion USDT via Tether minting from October 20, transferring these funds into regulated exchanges such as Kraken, Coinbase, and OKX. The timing of these operations perfectly aligned with the rise in this market cycle, leading many to consider it one of the potential catalysts behind this bullish rally.

So, what exactly did this mysterious address do? What are its trading patterns and underlying logic? Who might be operating behind it? This article aims to conduct an in-depth investigation using blockchain analytics tools like OKLink (Blockchain Eye) and Arkham to uncover the truth behind this address.

17.6 Billion USDT Over 50 Days

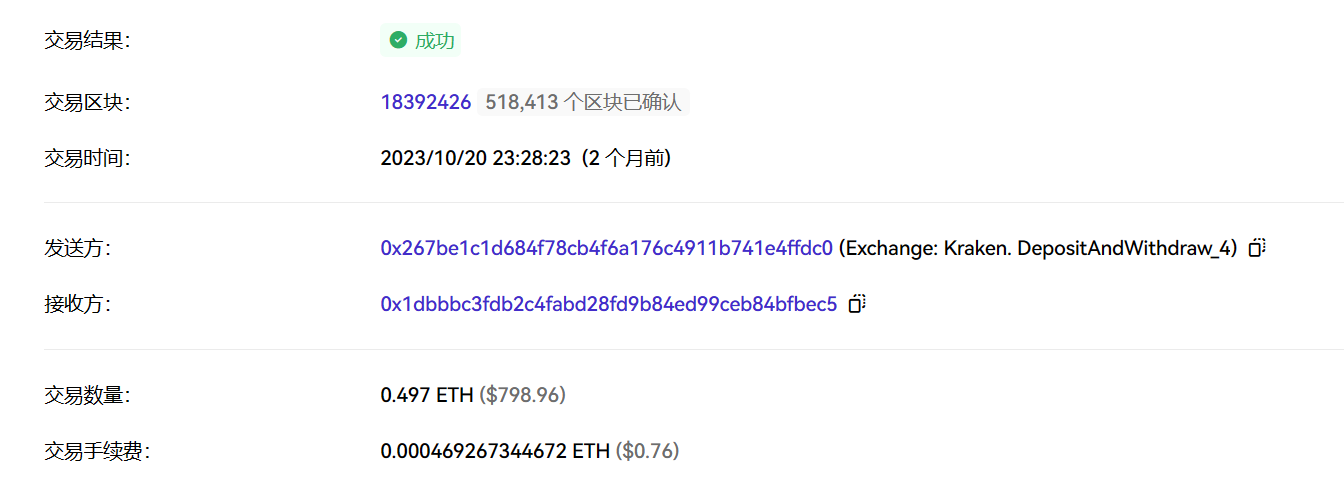

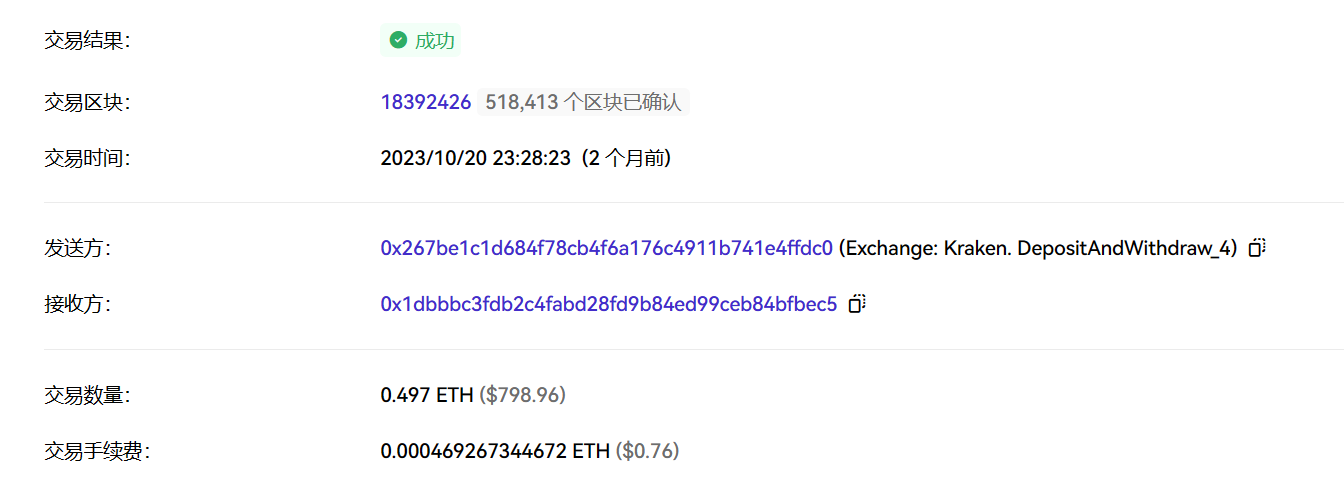

Firstly, data from OKLink’s blockchain explorer shows that the initial gas funding for this address came from 0.497 ETH transferred at 23:28:23 on October 20, 2023, originating from a Kraken deposit address.

According to OKLink's Blockchain Eye data, just 22 minutes after this gas transfer, the original Kraken deposit address called the Tether USDT minting contract and sent 20 USDT to this mysterious address for the first time.

Theoretically, this small 20 USDT mint was likely a test transaction to confirm the usability of the mysterious address before larger transfers.

Then, from October 20 to December 9, this address received a total of 1.76 billion USDT from Tether in 38 separate minting events, which were then distributed across 298 transactions to centralized exchanges including Kraken, Coinbase, OKX, and Huobi.

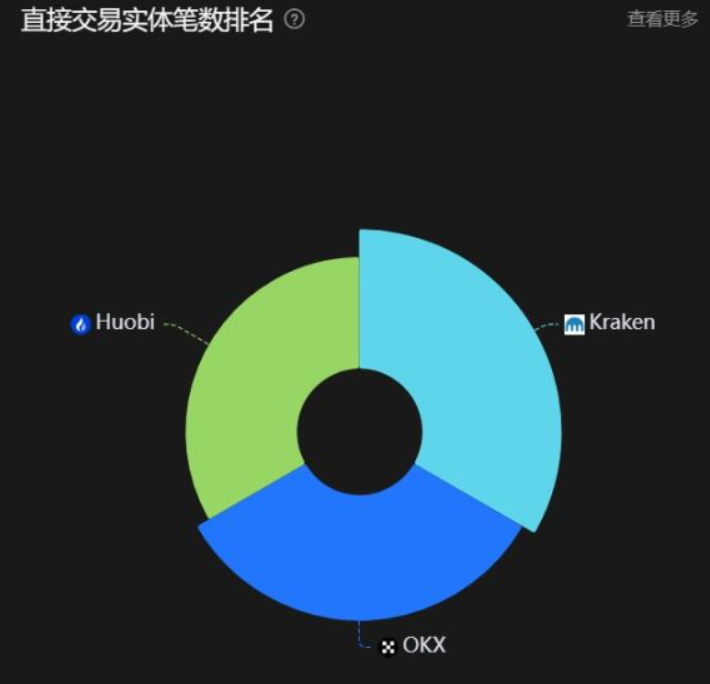

According to OKLink Blockchain Eye’s “Direct Transaction Entity Count Ranking,” Kraken leads with 51 transactions, followed by OKX (25 transactions) and Huobi (2 transactions).

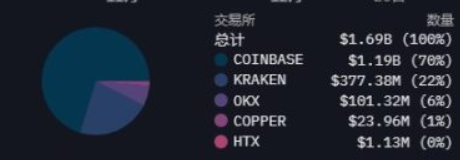

Supplemental data from Arkham reveals that in terms of deposited amounts, Coinbase ranks first:

- The mysterious address deposited approximately $1.19 billion into Coinbase, accounting for nearly 70%;

- It deposited $377 million into Kraken, about 20%;

- It deposited $101 million into OKX, around 6%;

Uncovering Trading Patterns Behind the Transactions

Next, we use OKLink Blockchain Eye and Arkham to dig deeper into the hidden information within this address’s transaction data.

Operating During North American Business Hours, Focused on Weekdays

OKLink Blockchain Eye’s “24-Hour Address Transaction Statistics” chart shows that the address is most active between 21:00 and 05:00 Beijing time, with peak activity concentrated between 22:00 and 01:00.

This aligns perfectly with U.S. market trading hours—during winter time (early November to early March), U.S. stock markets operate from 22:30 to 05:00 Beijing time.

From this perspective, the entity behind this address is highly likely to follow North American financial market working hours.

Moreover, when analyzing transaction dates under North American time zones, all transactions fall precisely within weekdays (Monday to Friday), further supporting this hypothesis:

Out of 347 total transactions, only 21 occurred on weekends (Saturday and Sunday), while 326 took place from Monday to Friday (weekend transactions may correspond to timing overlaps with late Friday or early Monday activities).

Likely Purchasing BTC During This Period

Between October 20 and December 9, this address transferred a total of 1.76 billion USDT into exchanges, perfectly coinciding with the market upswing—during which BTC rose from 27,000 USDT to a high of 44,000 USDT.

Whenever this mysterious address made frequent deposits into exchanges, BTC saw clear upward movements in the following days:

- For example, on November 7–8, the address made 30 USDT deposits into exchanges. BTC subsequently rose for four consecutive days, climbing from 35,000 USDT to 37,300 USDT;

- On November 28 to December 1, the address made 55 USDT deposits, followed by five straight days of gains, pushing BTC from 37,700 USDT to 44,000 USDT;

In contrast, ETH remained relatively weak during this period, with the ETH/BTC exchange rate fluctuating broadly between 0.051 and 0.055.

Overall, the activity of this mysterious address closely matches the market’s upward momentum. After ceasing operations on December 9, the market dropped sharply on December 11 and has since been consolidating near highs.

Comparatively speaking, this address can be considered one of the key spot market drivers of this rally—market prices rose when the address was active and entered consolidation or decline phases when inactive.

Considering that its initial gas originated from Kraken, its only counterparties are compliant institutions like Coinbase, OKX, and Kraken, and given the scale of billions in purchases, it is unlikely to be a crypto-native firm but rather a traditional institution headquartered in North America, likely with offices in Hong Kong or similar locations.

Reactivation on December 28

Notably, on December 28, after 20 days of dormancy, the mysterious address reactivated, acquiring 50 million USDT from Tether, with only three counterparties involved: Kraken, Bitgo, and Coinbase.

Specifically:

- Kraken transferred funds in three batches totaling 13 million USDT;

- Bitgo transferred 10 million USDT in three batches;

- Coinbase transferred 27 million USDT in three batches;

Is It Cumberland DRW?

Arkham has tagged this mysterious address with the AI-generated label “Cumberland DRW.” Who is Cumberland DRW?

Based in Chicago, Cumberland DRW is a wholly-owned subsidiary of DRW Trading Group, with offices in Chicago, London, Singapore, and Hong Kong—consistent with the clues pointing to North American operations and interactions with exchanges like OKX and Huobi.

Specializing in derivatives trading—including futures, options, and other structured products—it is also highly active in cryptocurrency markets, offering institutional clients trading, research, and custody services. According to Cumberland DRW’s website, the company managed approximately $10 billion in assets in 2022.

Regardless of the true identity behind this address, a purchase worth 1.81 billion US dollars sends a powerful signal—especially considering the proximity to the anticipated approval of spot Bitcoin ETFs. Its future moves will undoubtedly carry significant implications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News