Folius Ventures Report: Matr1x, the Perfect Combination of Strategic FPS Mobile Game, Cryptocurrency Recursive Growth Strategy, and a Mature In-Game Cosmetic Business Model

TechFlow Selected TechFlow Selected

Folius Ventures Report: Matr1x, the Perfect Combination of Strategic FPS Mobile Game, Cryptocurrency Recursive Growth Strategy, and a Mature In-Game Cosmetic Business Model

The production quality of Matr1x Fire is top-tier among Web3 games and remains solid even compared to Web2 games.

Author: Folius Ventures

Folius Ventures believes the Matr1x ecosystem and its first product—the strategic mobile shooter “Matr1xFire”—has the potential to further advance Web3-powered gaming after Axie Infinity and StepN. Led by former Tencent executives, the Matr1x team brings extensive experience in managing daily active users (DAU) and large-scale go-to-market (GTM) strategies, placing them among the top 10–20% of teams. In our view, Matr1x can achieve an elegant balance—potentially reaching critical mass, attracting mainstream audiences, sustaining profitability, and entirely avoiding the death spiral often seen in Web3:

Right Team & Market Fit: A mobile FPS with a sizable TAM and an experienced team that has successfully delivered similar projects.

Product Risk De-risked: Strong production quality demonstrated in early builds and enthusiastic player feedback.

Unfair Web3 Advantage for Reaching Critical Mass: Leveraging recursive viral loops at low cash cost within a highly popular category (validating the recursive loop and wealth effect proven by Axie and StepN).

Sustainability via Mature Cosmetic Economy Model: Separation of ROI from consumer assets, a solid precedent set by CS:GO’s skin market, and strong cashflow-driven buybacks collectively reinforce "growth debt."

Assuming the team maintains strong GTM execution—as evidenced by the strength of their NFT traction—they could achieve viral growth within 12 months, generate meaningful profits through loot box sales and NFT marketplace fees, and successfully launch a governance token by 2024. If executed well, we believe Matr1x has the potential to set a new standard for the next phase of Web3 gaming.

Folius led Matr1x’s Series A2 round, and Folius Ventures looks forward to partnering with the team to realize their vision.

The mobile tactical FPS category is highly scalable, typically achieving DAUs between 500k–5mm—making it an ideal target for Matr1xFire

A mature, high-quality mobile tactical FPS typically achieves 500k–5 million DAUs, a reasonable target for Matr1xFire. Hitting this user scale would place Matr1x near the top of today's Web3 engagement rankings.

Source: SensorTower, company disclosures, on-chain data

Vertical axis: Average 2022 DAU*

Horizontal axis: FPS/TPS shooting genres + cryptocurrency** | Bubble size represents estimated annual revenue

- Strategy = primarily skill-based, no progression or special abilities; Progression = gear, levels, special abilities, etc.; Battle Royale = game genre

We believe Matr1x ranks among the top 10–20% of teams in China’s Web2 gaming industry

We believe the Matr1x team stands out in China’s Web2 gaming landscape and is one of the few teams today capable of delivering a top-tier Web3 mobile FPS.

The Matr1x team consists of seasoned engineers with long-standing collaboration at Tencent, bringing deep expertise in high-throughput, mass-market mobile FPS games:

-

CrossFire Mobile (generated $600–800M in revenue, previously achieved >20M DAU)

-

T-Game (a mobile FPS with 2M DAU but no monetization, generating $200M in exposure)

-

CoDM (involved in technical integration, GTM, and distribution for the Chinese market)

Former colleague: "I mainly collaborated with him on technical and creative implementation. Even within [the company], he was exceptionally sharp. He’s arguably a leader—top 10–20%, possibly even top 5% depending on the metric. He’s an extremely strong technical resource."

Former manager: "He excels at identifying key issues, remains calm and mature, and receives positive feedback from most colleagues... They’re deeply passionate about Web3 and are thoughtful long-term thinkers.... It’s a stable, long-term team, not overly aggressive. Even in the Web2 space, I’d rank them in the top 20%."

Former team lead / builder: "Compared to all the Web2 teams I’ve encountered, I’d rank them in the top 15% across domains. They’ve worked together for a long time... The team has great chemistry and extensive FPS development experience. If there were a Web2 opportunity, I’d gladly join them."

Investor: "They have technically skilled, rock-solid co-founders. We also discussed their product extensively. After conversations, they clearly stand out compared to other Web2/Web3 teams we’ve met. I can confidently say peer reviews are excellent—no red flags."

Based on current gameplay, Matr1xFire’s production quality is top-tier among Web3 games and competitive even within Web2

Results from two prior closed beta tests confirm that the game delivers top-tier production quality within today’s Web3 landscape and is competitive with Web2 counterparts.

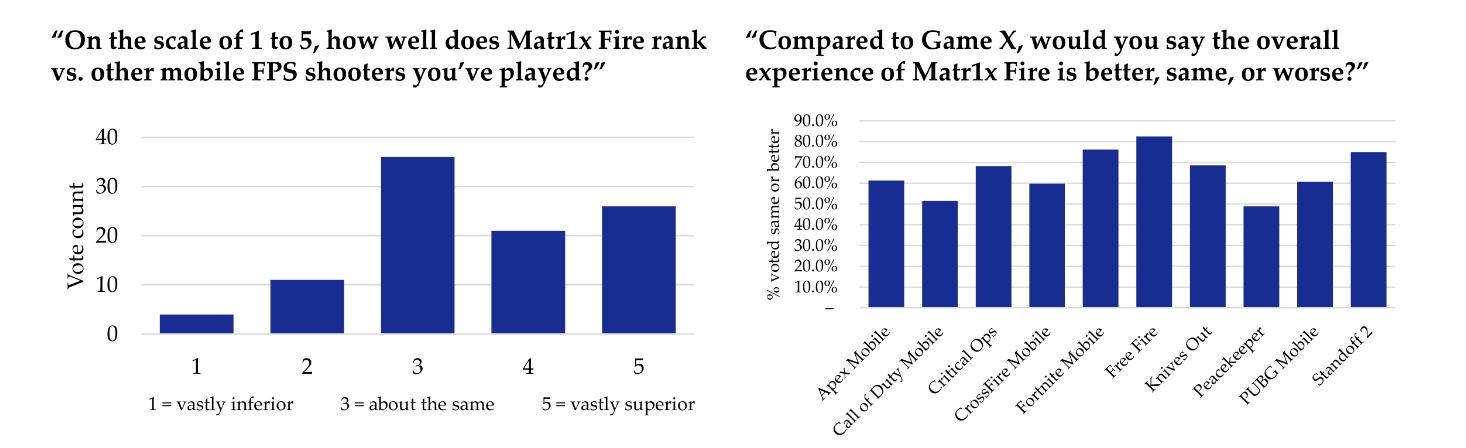

User surveys confirm players generally agree with the “on par with Web2” assessment

Survey results from the recent closed beta indicate that the game’s production quality positions it as a top Web3 title and allows it to compete meaningfully with Web2 games.

Source: Folius survey based on feedback from ~100 testers in the recent closed test. Respondents self-identified as regular FPS players.

Left: “On a scale of 1 to 5, how does Matr1xFire compare to other mobile FPS games you’ve played?”

-

Vertical axis: Number of votes

-

1 = Much worse; 3 = About the same; 5 = Much better

-

Independent average score: 3.55/5

- The average score suggests testers perceive Matr1xFire’s production quality as slightly above the industry average for mobile FPS games in Web2, making it a strong standalone Web2 product.

- However, bias in this direct question may be significant—especially given respondents were airdrop recipients with vested interests—highlighting the importance of benchmarking against actual gameplay (see right chart).

Right: “Compared to Game X, do you think Matr1xFire’s overall experience is better, the same, or worse?”

-

Vertical axis: % responding “same or better”

-

% saying “Matr1xFire same or better”: 66

-

Average benchmark score: 2.72/5

- On average, 66% of respondents rated Matr1xFire as “same or better” compared to specific reference titles.

- Further quantification yields an average score of approximately 2.72—indicating that “Matr1xFire is slightly inferior when compared to broader top-tier Web2 games.”

- We are encouraged that the comparison benchmarks are major Web2 hits. The fact that such comparisons are even possible means Matr1xFire has passed the bar.

Achieving network effects/scale in Web2 FPS is costly and highly challenging

- More players

- Better matchmaking + stronger social dynamics + better streaming content = more fun

- Increased social/emotional needs drive higher cosmetic/skin spending

- Higher revenue = larger marketing/user acquisition budget

The economies of scale and network effects in PvP social games like mobile FPS mean the flywheel is both risky and dominant—even for Web2 giants.

1. More players improve player experience (faster, fairer matchmaking and a more vibrant community), attracting more players and streamers—achieving the network effect seen in leading FPS games.

2. Spending and valuation of cosmetics grow exponentially with popularity, as demand is inherently tied to social proof/self-expression; sunk costs and muscle memory reinforce retention.

3. Current CAC for an FPS player ranges from $1–100. Higher profitability enables larger marketing budgets for user acquisition and retention—a cost barrier for new entrants.

4. Therefore, new Web2 entrants must commit substantial cash CAC expenses (often multiples of R&D costs) to reach critical mass until (a) gameplay is compelling enough and (b) cosmetic spending is sufficiently high. Scale barriers and network effects make this investment highly risky.

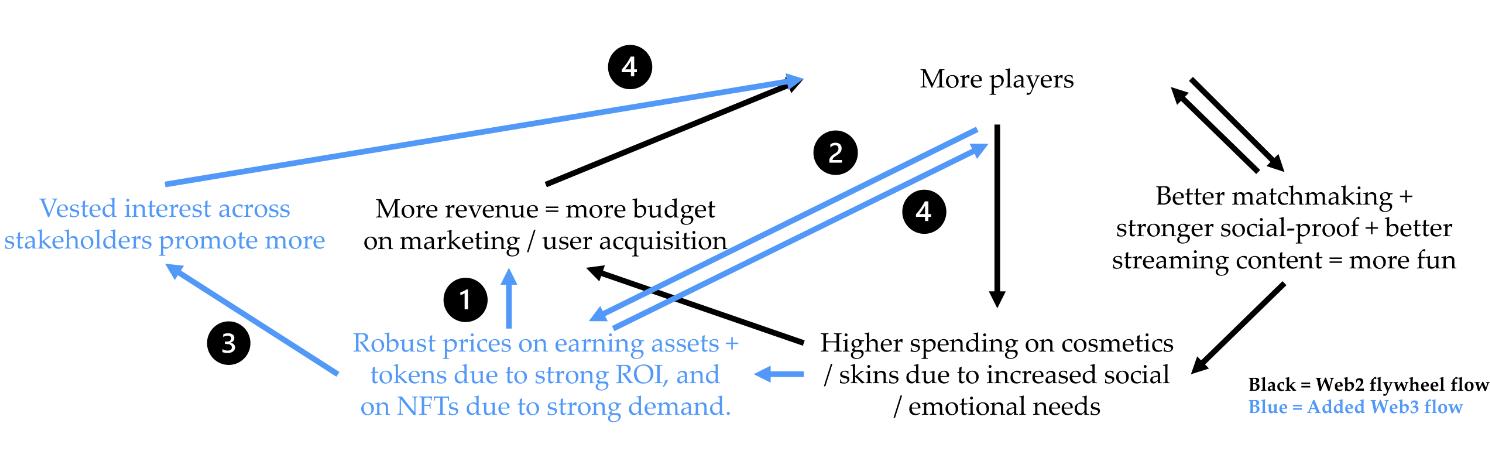

We believe Web3 user acquisition offers an elegant, low-cost path to critical scale

We believe the Web3 user acquisition strategy—leveraging recursive wealth effects (no cash outlay) + yield from investments—is Matr1x’s only viable path to achieving network effects amid intense Web2 competition.

(Black text)

-

More players

-

Better matchmaking + stronger social dynamics + better streaming content = more fun

-

Increased social/emotional needs drive higher cosmetic/skin spending

-

Higher revenue = larger marketing/user acquisition budget

(Blue text)

-

Stakeholder incentives attract more participants

-

High ROI supports profitable assets and stable token prices; strong demand supports stable NFT pricing.

-

Black = Web2 flywheel

-

Blue = Web3 added flow

In a Web3 design like Matr1xFire, cosmetic NFTs and tokens (FIRE + MAX) are generated through gameplay by players owning productive assets (characters), requiring tokens to upgrade/create more characters:

1. Strong demand for cosmetics not only creates sustainable, non-ROI-driven revenue for characters but also strengthens character and token prices as player count and demand grow—generating a wealth effect.

2. This wealth effect naturally attracts profit-motivated players without any CAC expenditure.

3. Additionally, profit motives and wealth effects naturally turn all NFT and token holders into stakeholders who actively promote the project. Even if purely self-interested, this will...

4. ...spontaneously create powerful non-cash acquisition momentum, accelerating the FPS flywheel. Assuming fiat on/off ramps, user journey, output value, and consumption conversion are all above threshold, achieving network effects becomes not only possible but cheaper and faster.

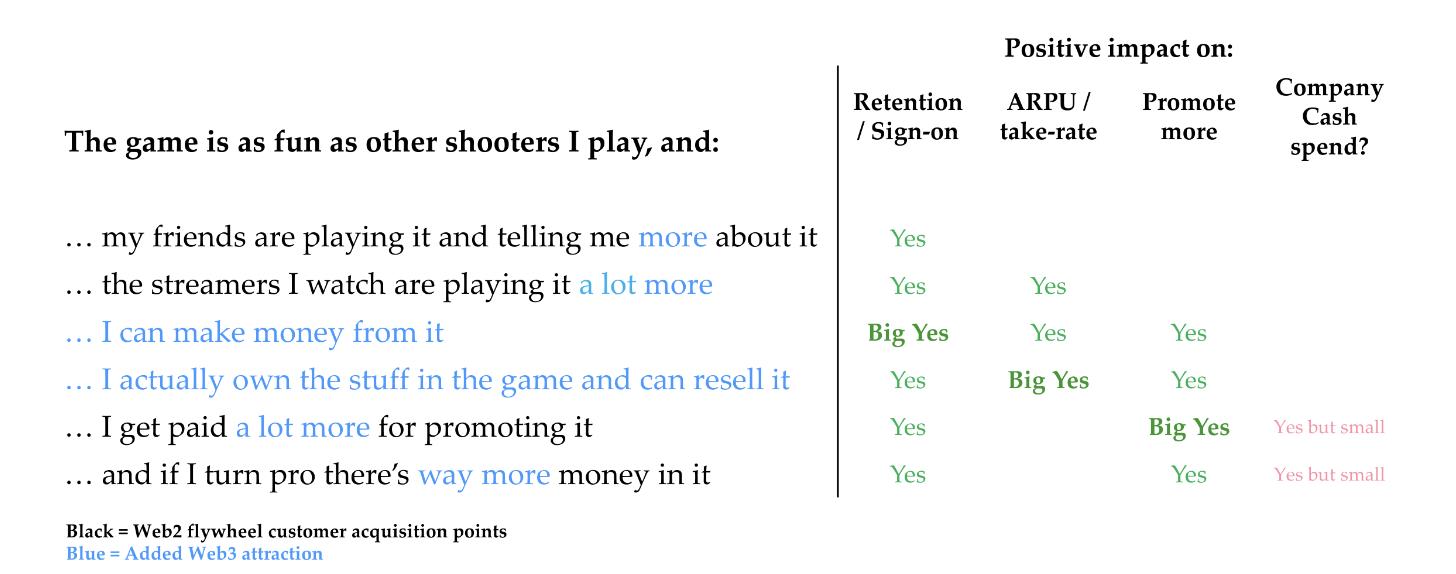

The Web3-added effect should increase the game’s virality by an order of magnitude

For a typical player/KOL, the Web3-added effect should amplify the game’s virality by an order of magnitude; yet for the company, the increase in cash cost is negligible.

Black = Web2 flywheel acquisition points; Blue = Web3 added highlights

This game is as fun as other shooters I play, AND:

-

- My friends are playing it and telling me more about it

-

- The streamers I follow are playing it more often

-

- I can earn money from it

-

- The in-game items are truly mine—I can sell them

-

- I can earn more by promoting the game

-

- If I become a pro player, I’ll earn even more

Positive impact on:

-

- Retention / login rates

-

- ARPU / take rate

-

- Promotion / word-of-mouth

-

- Company cash outlay?

-

Yes: Yes

-

Big yes: Strongly positive

-

Yes but small: Yes, but minimal

-

A favorable factor for Matr1x is that shooter games are already among the most popular genres on promotional channels like Twitch, YouTube, and TikTok. These games offer thrilling viewing experiences even for audiences who haven’t played them. We believe that once Matr1x integrates Web3 elements into this popular genre, its market appeal and influence will be further amplified, accelerating its path to virality.

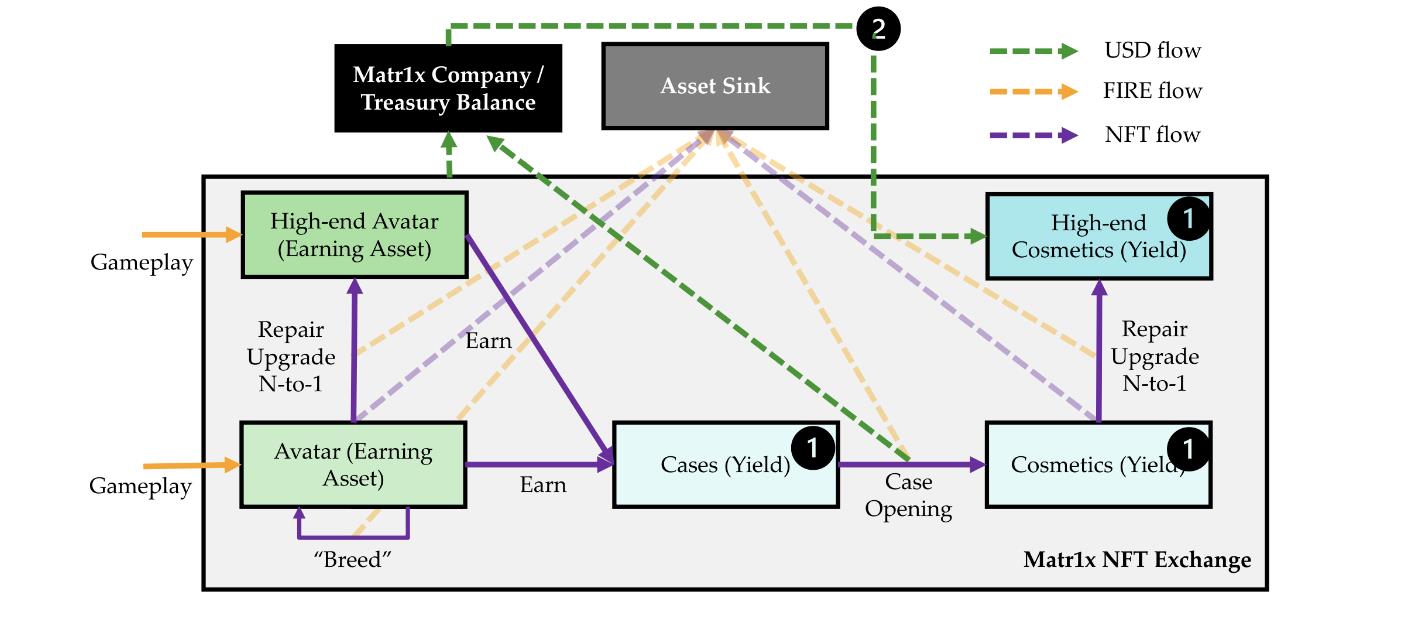

Addressing the death spiral via separation of ROI/consumption-driven assets, CS:GO precedent, and USD buybacks

We believe Matr1x’s approach to avoiding the Web3 death spiral is elegant—through separation of ROI and consumption-driven assets, a solid precedent established by CS:GO’s non-ROI-driven market, and USD buybacks of cosmetics.

Boxes:

-

Matr1x Company / Treasury Balance: Matr1x / treasury balance

-

Asset Sink: Asset reduction

-

High-end Avatar (Earning Asset): High-end avatar (earning asset)

-

Avatar (Earning Asset): Avatar (earning asset)

-

Cases (Yield): Cases (yield)

-

Cosmetics (Yield): Cosmetics (yield)

-

High-end Cosmetics (Yield): High-end cosmetics (yield)

Relationship descriptions (left to right):

-

Gameplay

-

Repair Upgrade N-to-1

-

“Breed”

-

Earn

-

Case Opening

-

Matr1x NFT Exchange

1. Separating earning assets (green boxes) from cosmetics (blue boxes, as yield) decouples ROI-driven and consumption-driven demand. CS:GO has already demonstrated the TAM for pure cosmetics.

2. Because USD revenue + organic user demand fuels purchases of premium cosmetics (obtainable only via upgrades/N-to-1 synthesis), this top-down demand drives prices of lower-tier cosmetics (as raw materials for high-end ones), thereby boosting valuations of tokens (materials) and yield assets.

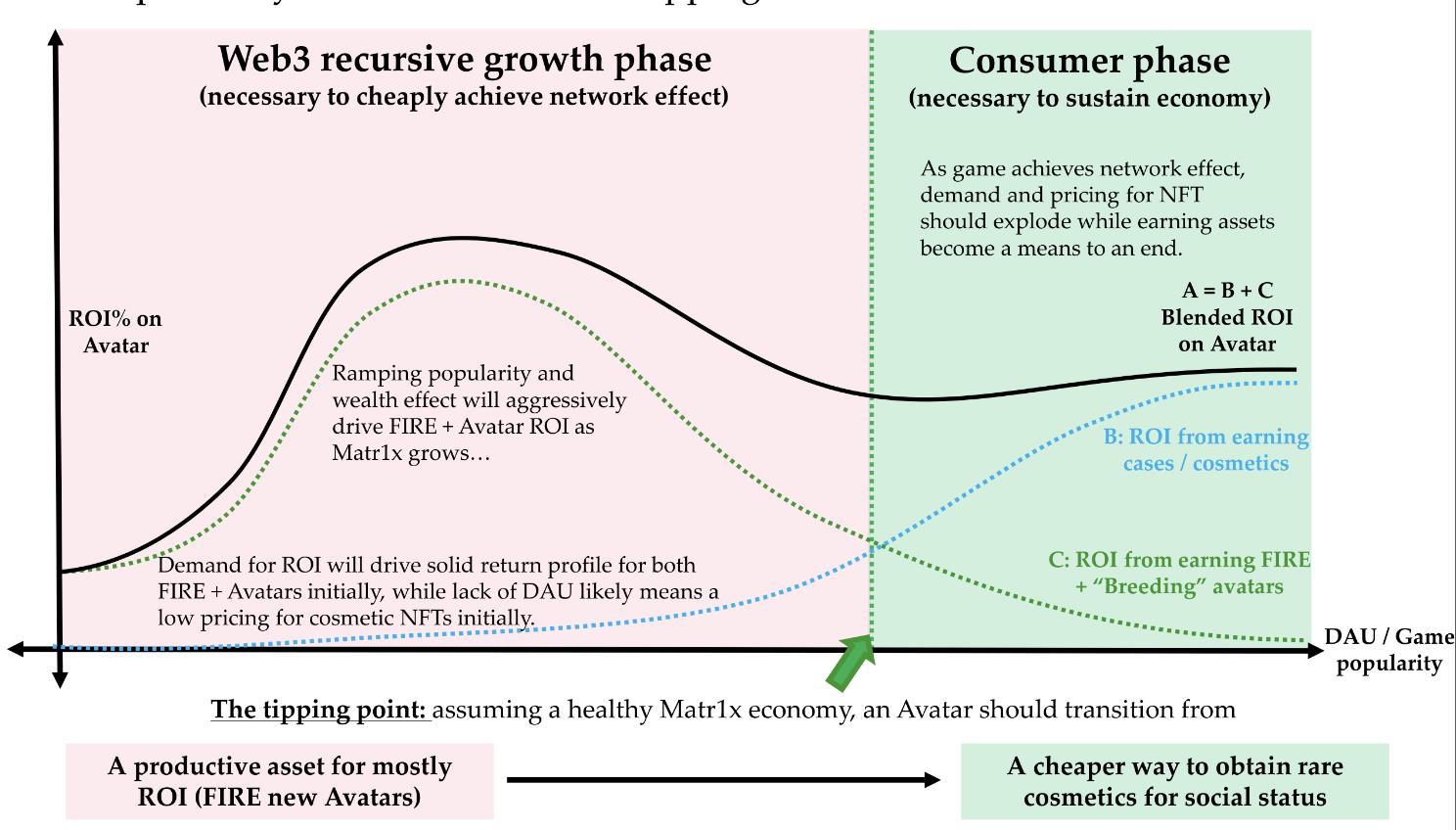

In other words, Matr1x’s leap toward economic sustainability ultimately hinges on its cosmetic marketplace reaching critical scale

Therefore, if Matr1x achieves recursive network effects via Web3, its economic sustainability leap will ultimately be driven by its cosmetic marketplace reaching critical mass.

Vertical axis: Avatar ROI%

Horizontal axis: DAU / game popularity

Web3 Recursive Growth Phase

(Essential for low-cost network effects)

As Matr1x grows, rising popularity and wealth effects will positively drive FIRE + avatar ROI...

Initial ROI demand will support robust returns for "FIRE + avatars," while suboptimal DAU may mean lower initial pricing for cosmetic NFTs.

Consumer Phase

(Essential for maintaining the economy)

As the game achieves network effects, demand and pricing for NFTs will explode, and earning assets will transition into a secondary role. A=B+C

Hybrid Avatar ROI

B: ROI from case/cosmetic drops

C: ROI from earning FIRE + "breeding" avatars

Tipping point: Assuming healthy economic development, avatars should transition from

productive assets focused on ROI (FIRE/new avatars)

to tools for acquiring rare cosmetics more affordably and enhancing social status

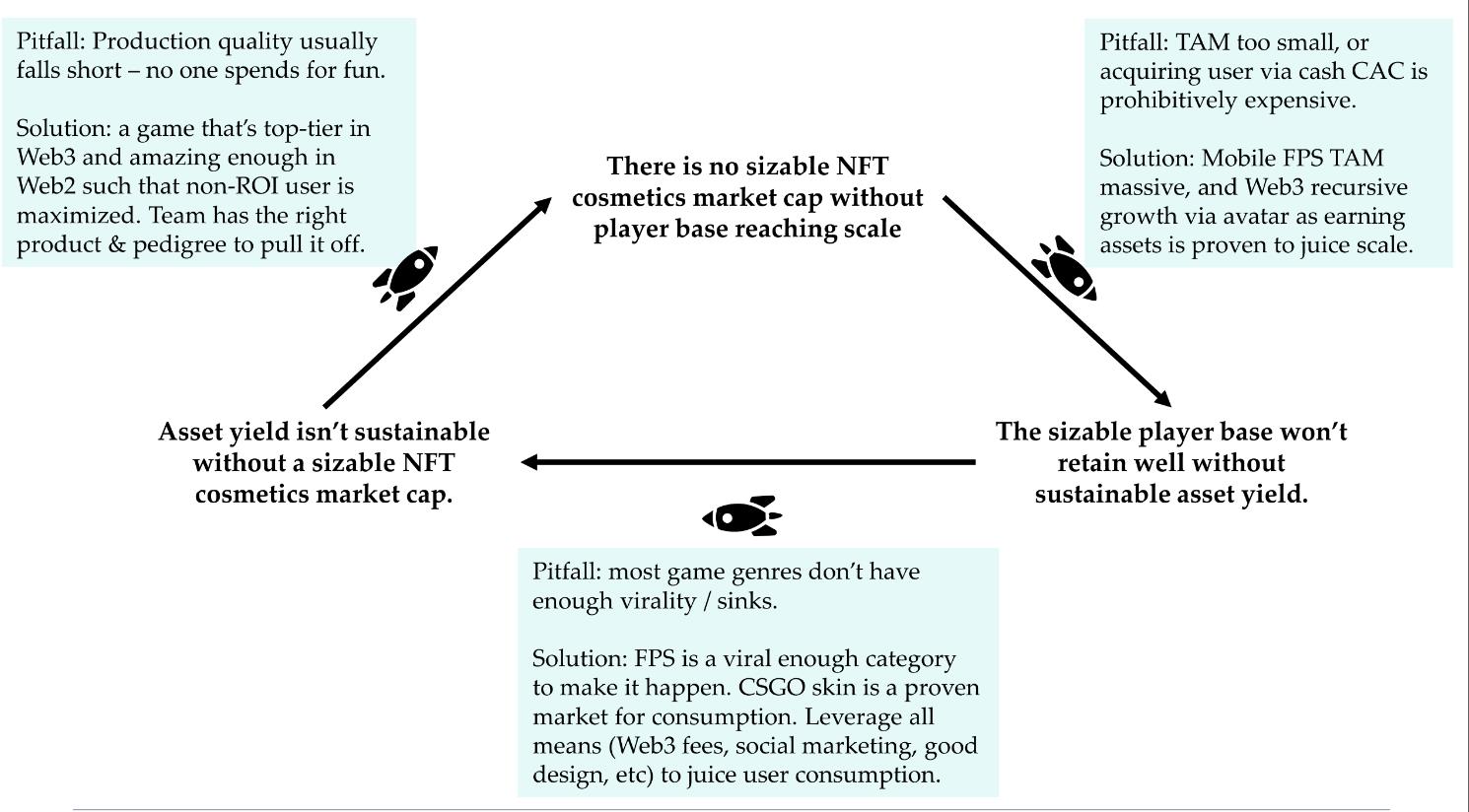

Summary of challenging flywheels + Matr1x’s strategic choices

Breaking the flywheel will be challenging, but we believe Matr1x’s design philosophy and production quality give it a chance to pioneer this category in Web3.

Left colored box

Trap: Production quality is usually subpar; no one pays just for fun.

Solution: Deliver a top-tier Web3 game that impresses even by Web2 standards—maximizing non-ROI users. The team has the right product and foundation to achieve this.

Right colored box

Trap: TAM too small, or user acquisition via cash CAC too expensive.

Solution: Mobile FPS has massive TAM, and Web3 recursive growth via avatars as earning assets has been validated at scale.

Bottom colored box

Trap: Most game genres lack sufficient virality or gradually sink.

Solution: FPS is a genre capable of going viral. CSGO skins represent a proven consumer market. Leverage every tool (Web3 fees, social marketing, superior design, etc.) to stimulate spending.

Top: If player count doesn’t reach critical mass, cosmetic NFTs won’t achieve meaningful market cap.

Bottom left: Without meaningful cosmetic NFT market cap, asset ROI becomes unsustainable.

Bottom right: Without sustainable asset ROI, retaining a meaningful player base becomes impossible.

Matr1x’s GTM performance to date is encouraging and reflected in strong NFT metrics

Timely roadmap delivery, steady hype building, and sustained appreciation of their NFTs strongly demonstrate Matr1x’s GTM capability, and we expect this trend to continue.

1H23

-

September 2022: Pre-registration launched

-

Demo + gameplay released

-

January 2023: YATC – Genesis NFT giveaway

-

February 2023: Matr1x 2061 NFT mint

-

February 2023: First beta test reached 1.5–2k DAU + 700 PCU

-

Roadmap + ongoing content releases

3Q23

-

New website

-

Staking launched

-

Whitepaper release

-

August 2023: Second beta test reached 15k DAU + 4k PCU

4Q23e

-

Launch new NFTs

-

Launch Matr1xFire

-

NFT marketplace

-

Offline GTM

-

Streamer/KOL onboarding

-

Distribute FIRE

-

Genesis avatar mint

1Q24e

-

Matr1xFire version update + content pack

-

Possibility of PC mode

-

Launch esports events

-

Release PUBGM brand expansion advisory

-

Offline GTM

-

Streamer/KOL onboarding

-

MAX listing & possibility of token rewards

2Q24e+

-

Matr1xFire version update + content pack

-

Possibility of PC mode

-

Ongoing esports operations

-

Integrate PUBGM gameplay into FIRE

-

Offline GTM

-

Streamer/KOL onboarding

-

MAX listing & possibility of token rewards

-

Matr1x has achieved solid NFT performance amidst industry turbulence, demonstrating not only product quality but also the team’s GTM expertise.

-

Their rhythm around social media, Weibo, offline events, content rollouts, and expectation-setting has reached textbook-level execution, surpassing most native Web3 teams.

Their consistent strong performance combined with Web2 GTM foundations gives us continued confidence in roadmap execution and outlook toward key DAU milestones.

We believe the Matr1x ecosystem will generate meaningful revenue as it develops

We estimate that, assuming moderate success, Matr1xFire could generate $50–150M in ecosystem revenue. If it follows trajectories like StepN or Axie, revenues could be multiples higher.

Analysis of Axie, StepN, Thetan Arena, etc., shows that adding Web3 components typically increases ARPDAU by 15–25x. Under moderate success, a typical tactical shooter averages $10–30 ARPDAU → $150–750 ARPDAU.

StepN peak DAU = 1.2M; Axie = 2.5M; Thetan = 2M. Web3 games generate $250–500 per peak DAU.

CSGO took years to reach $200–400 ARPDAU ($500M–$1B revenue at 2.5M DAU).

Triangulating these data points, under base case assumptions, Matr1x should generate $50–150M in revenue within the first 12–24 months, with upside potential toward $500M. In a downside scenario, the company should still cover production costs.

Risk Factors

As an entertainment app, Matr1x’s DAU potential may be limited and face competition from other entertainment-driven products (e.g., casual games, social apps)

We believe Matr1x’s viral potential and earning mechanics are sufficient to sustain multiple hype cycles; although challenges exist in GTM execution and DAU ceiling, we believe: (a) the team’s deep Web2 marketing experience reduces adoption risk; (b) profits generated through these hype cycles will enable further growth via additional products.

Once initiated, Web3’s recursive growth may become uncontrollable and burdensome for the team

Web3 infrastructure still faces limitations on mobile policy, fiat gateways, and UI/UX, which could pose execution risks during the recursive growth phase. However, we believe the team’s experience managing high-DAU FPS products, along with precedents set by Axie and StepN at 1–2M peak DAUs, will help push industry boundaries. We assess that industry infrastructure has improved significantly compared to 1.5 years ago and can now support higher peak DAUs.

Bugs, cheating, hacks, ROI-maxing, gold farming, etc., could be devastating to the game

We believe the team has extensive experience addressing such FPS-specific issues, and increased Web3 incentives—particularly around confiscating assets from users violating TOS—can effectively deter known problems prevalent in Web2 FPS games.

Cosmetic NFT-driven ROI may prove unsustainable and/or overly backend-dependent for various reasons

This is a bet we are willing to make: assuming Matr1x reaches critical DAU scale, we believe social proof and the permanence/security of ownership will generate real demand. We accept the risk that the business may fail to reach critical scale.

Earning assets and tokens require deeper liquidity, especially during downturns

We believe the team is fully aware of this risk and will remain closely engaged in discussions. Moreover, liquidity issues are also linked to slowing user growth, which we hope will not become a threat in the short term.

MAX token may fail to properly incentivize user behavior

We believe the key to governance tokens lies in rewarding users who continuously add value to the Matr1x ecosystem. This requires continuity + value creation. The former demands sustained effort; the latter requires measurable metrics (likely around activity, spending patterns, referrals, and new user acquisition). We fully recognize the risks of merely distributing tokens to users who bring only temporary benefits, and we will maintain close collaboration with the team on this front.

Future product-related risks

Brand expansion always carries risks. We believe the team’s FPS expertise will help them navigate adjacent categories effectively. We remain cautious about non-FPS genres but believe Matr1x will likely evolve into a publisher model over time.

Mobile platform risks: iOS and Android policies

We believe policies are trending positively. For Web3 to achieve mass adoption, it must enter mobile platforms (eventually Apple and Google will need to cooperate). We believe Matr1x may eventually need to share revenue with Apple via Spark, similar to StepN, but this is not a risk we feel compelled to avoid.

Challenges with team internationalization and English proficiency

We acknowledge the team is highly China-centric, but we believe they can strengthen overseas operations. As the business scales, the company will be able to hire top-tier talent and recruit from the global community.

Regulatory risks related to token and NFT issuance

We acknowledge that platforms integrating Web3 features face heightened regulatory risks, particularly concerning U.S. and mainland Chinese users. We advise the team to implement strong safeguards and, if necessary, avoid high-risk jurisdictions even at potential cost to the business. Furthermore, sound token design and distribution mechanisms will help ensure compliance with legal frameworks across jurisdictions, which may require significant legal investment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News