Beyond VCs and Meme Coins, Why You Should Pay Attention to $MAX?

TechFlow Selected TechFlow Selected

Beyond VCs and Meme Coins, Why You Should Pay Attention to $MAX?

There must be usage and development for a token to have a future.

Author: TechFlow

Recently, the crypto market has warmed up—Bitcoin has reclaimed $70,000 and Trump delivered an impassioned speech at the Bitcoin Conference. In this favorable environment, it's time to look for new assets.

Yet too many infrastructure giants are still in vesting periods, while meme coins sporadically mint "gold dogs" that are hard to catch.

Meanwhile, application-focused projects seem absent from this atypical bull run.

Investing is a game of uncovering non-consensus opportunities. Amid the crowded waves of infrastructure and memes, seeking out contrarian plays in the application space might offer greater potential.

Clues to such opportunities can even be found in CEX listing trends—on July 29, OKX’s Jumpstart launched Matr1x, a gaming project, with its token $MAX; trading will go live on August 5 across multiple CEXs including OKX and BingX.

The secondary market certainly needs fresh assets, but capital and users have become more discerning.

For new application or gaming projects, success now demands solid value capture mechanisms and robust product development. The previous cycles’ death spirals and crude pay-to-win models no longer stand out—either narratively or functionally.

So, could Matr1x’s $MAX become a market-favored asset?

Betting on a token is fundamentally betting on the long-term trajectory of a crypto project. With MAX即将上市 (about to launch), let’s examine Matr1x’s current product matrix and ecosystem to assess whether MAX can redefine success for Web3 gaming projects.

$MAX Emerges: Value Tied to Web3’s “People, Goods, Scene”

Let’s get straight to the point—here’s a look at the basics of $MAX:

As the governance token for the entire Matr1x platform, $MAX had no public fundraising or private sale. It has a total supply of 1 billion tokens, designed to support applications and services within the ecosystem.

Currently circulating $MAX tokens were primarily generated through Matr1x’s loot box campaigns. The overall token allocation is as follows:

-

Platform Incentives: 27.6% (276,000,000 tokens)

-

Ecosystem: 16% (160,000,000 tokens)

-

Community: 10% (100,000,000 tokens)

-

NFT Airdrop: 9.4% (94,000,000 tokens)

-

Early-Bird Campaigns: 5.5% (55,000,000 tokens)

-

Team & Investors: 30% (300,000,000 tokens)

-

Advisors: 1.5% (15,000,000 tokens)

Before diving into the utility and supply-demand dynamics of MAX, how should someone unfamiliar with Matr1x evaluate its value? And how can one judge whether it’s worth holding?

Since betting on a token means betting on the project’s future, answering these questions requires a deep dive into Matr1x’s products and ecosystem.

But before we begin, let’s establish a framework.

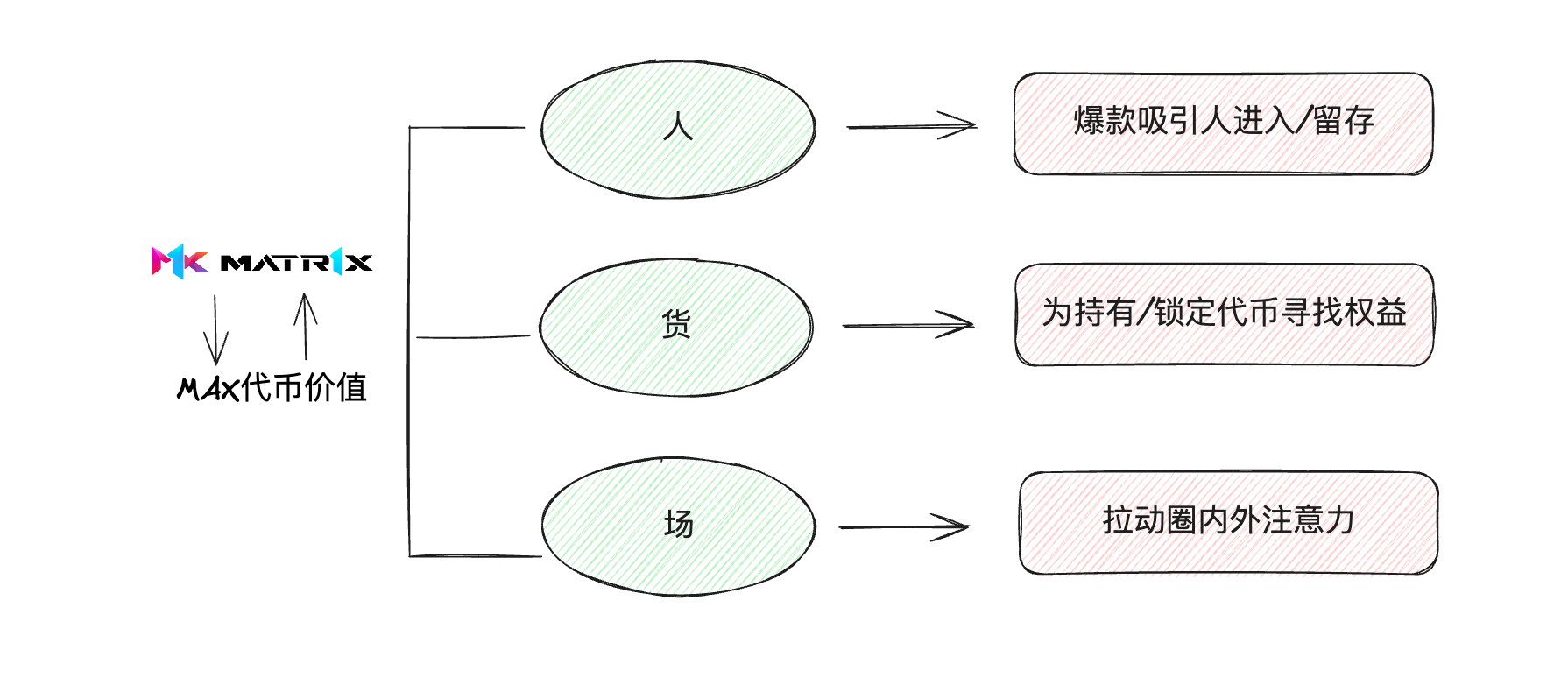

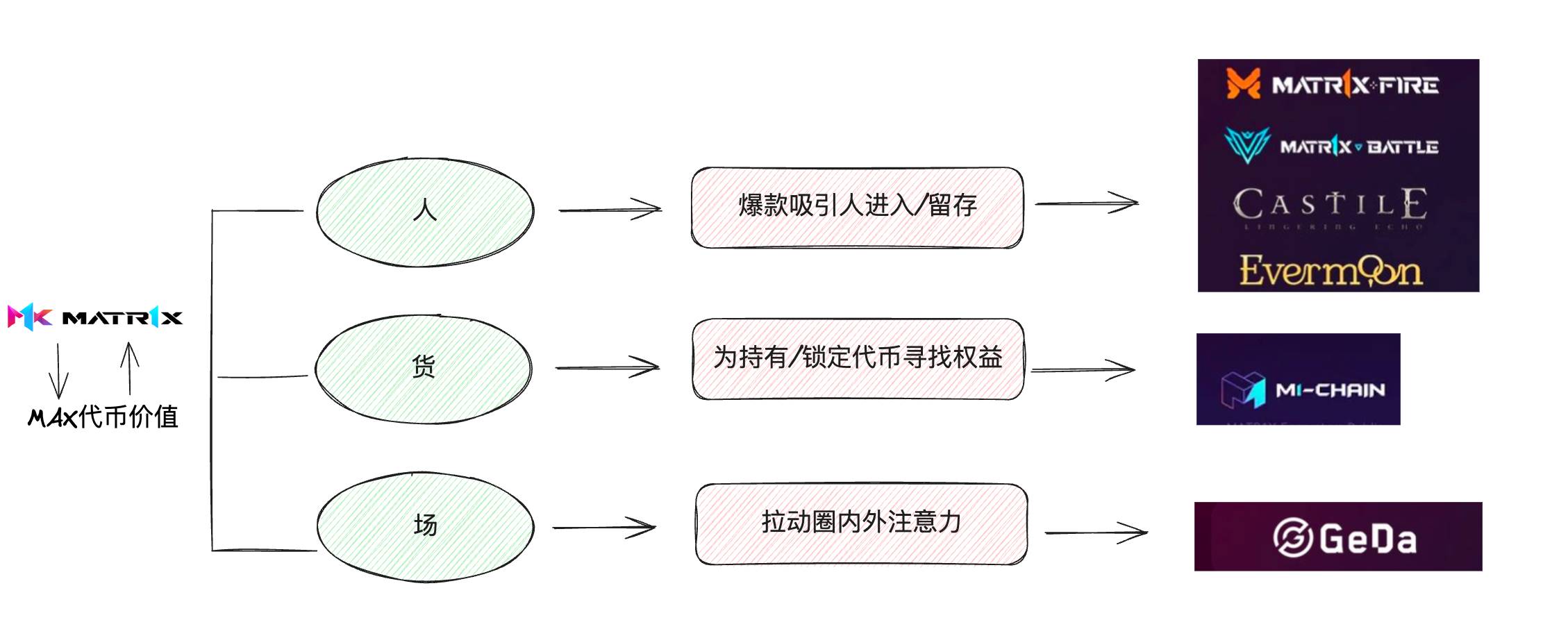

For gaming projects, whether a token holds value and whether the business is sustainable ultimately hinges on the logic of “people, goods, scene”:

-

People: Are there hit products and follow-ups that continuously attract and retain players?

-

Goods: Is there a coherent design that delivers value to token holders or lockers?

-

Scene: Is there a sustained ecosystem that draws attention from inside and outside the crypto world?

After one full market cycle, investors, users, and speculative capital clearly understand that pure P2E “mine-and-dump” models no longer work. Without real substance, application projects cannot prove their worth.

So, how well does Matr1x perform on “people, goods, scene,” and can it sustainably deliver value to MAX?

Hits and Coherence: MATR1X FIRE Builds the Fan Base

On the “people” front, initial user acquisition is crucial—it establishes the foundational base for MAX.

MATR1X FIRE clearly serves this role.

As a well-known 5v5 FPS shooter, players familiar with CS can easily grasp its rules and maps.

Moreover, FPS games are among the most popular genres globally—one only needs to check CS2’s concurrent player count to gauge the genre’s appeal.

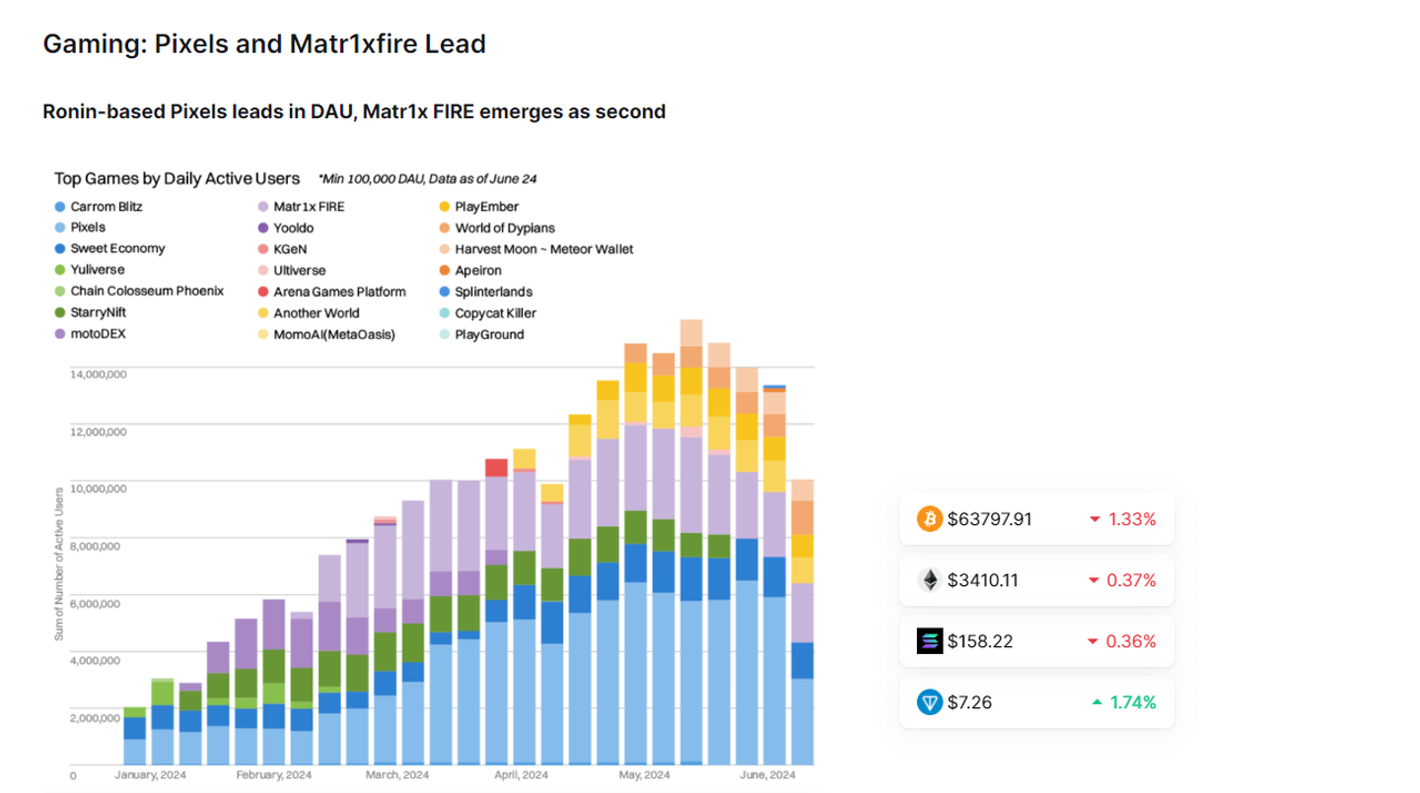

To date, MATR1X FIRE has surpassed 2.5 million downloads across major app stores (download here). According to CoinmarketCap’s 2024 industry report, it ranks as the #2 Web3 game.

Many friends in the crypto industry I know casually play a few rounds of MATR1X FIRE during downtime. The team also regularly hosts offline tournaments.

For those unfamiliar, check out this video.

Ask yourself: How many Web3 games are you still actively playing? How many of last cycle’s hyped titles remain?

In gaming, it’s not just survival of the fittest—it’s the strong who endure. Hit products always have self-consistent mechanics:

-

First, the product must be engaging. The longevity of PC-based CS and mobile PUBG proves that repeated gameplay doesn’t equate to diminishing fun;

-

Second, the business model of stable gameplay plus cosmetic variety has been validated. Take CS’s skin market or League of Legends’ skins—transplanting similar designs to Web3 avoids the gold-farming death spiral. Your rewards are randomized rather than directly transactional. Cosmetic drops enhance gameplay experience, and their prices fluctuate based on market demand.

You may ask: What does this have to do with $MAX?

Imagine this: What if MAX holders could share in the revenue generated by the MATR1X FIRE cosmetics marketplace and in-game items?

With a hit game anchoring the foundation, the floor for MAX’s value is secured.

Platform and Ecosystem: Game Publishing + Esports + Blockchain Revive the Industry Chain

A hit game solves the problem of attracting users, but players inevitably churn if confined to a single title. If a Web3 gaming project only offers one game, the value of MAX will inevitably dilute over time.

Therefore, MAX’s upside depends on richer “goods” and “scenes” that expand value capture and utility.

For Matr1x, this means building a broader product matrix and ecosystem beyond the success of MATR1X FIRE.

In entertainment, there’s a saying: “Act well, then sing.” Artists often build complementary skills around a core strength.

Similarly in crypto, successful apps often evolve into platforms—leveraging their hit product to connect to broader ecosystems and value streams.

Examples include Axie with Ronin, or Immutable X and Gala.

How is Matr1x doing it? (This video gives a good overview of the platform’s operations.)

-

From One Hit Game to a Game Portfolio:

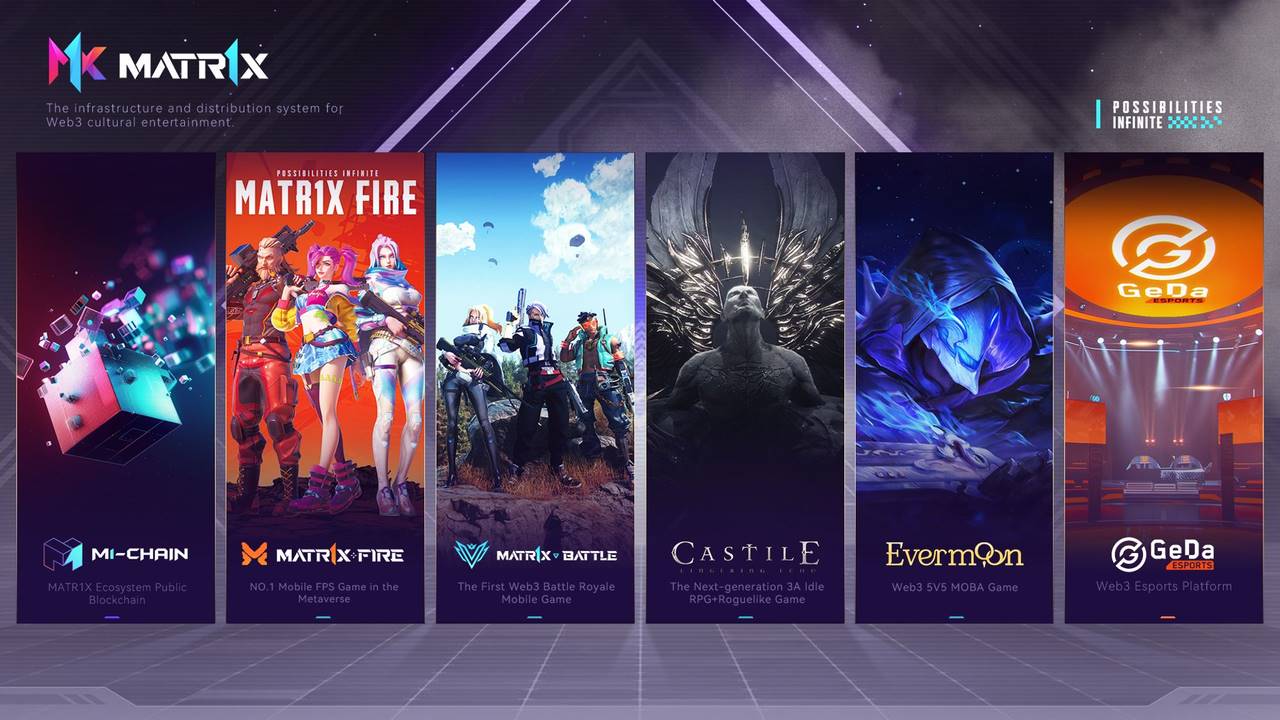

Matr1x now features four AAA-level games: MATR1X FIRE, MATR1X BATTLE, Castile, and Evermoon—covering FPS, battle royale, card, and MOBA genres. These represent the most proven and profitable mobile game categories.

-

From In-House Development to Game Publishing:

If one game builds the base and multiple games strengthen it, helping other games launch ensures a continuous influx of new content—“I always have new games and assets to play.” Given the limited selection of Web3 games today, wouldn’t you join?

Launching high-quality Web3 games is a business with massive potential. Projects on BNB Launchpool draw huge crowds; Valve’s Steam earns $9 billion annually from game publishing.

So what about a Web3 game launchpad? The future looks promising.

-

From Playing Games to Watching Esports:

Core players are on the field—but how do outsiders participate?

Competitive games may be too demanding for many casual players, but they can still enjoy the thrill through spectating.

Thus, GEDA, Matr1x’s esports platform, hosts various tournaments to attract more participants via “Watch to Earn,” expanding the user base beyond core players (more details here).

The power of attention economics is undeniable. Drawing external interest and amplifying visibility are prerequisites for partnerships and business expansion.

-

From Application to Gaming Chain:

Matr1x isn’t just building apps—it’s launching M1-Chain, an OP-stack-based public chain dedicated to supporting the trading and transfer of all gaming assets within its ecosystem. Independent from other chains, it enables specialized infrastructure. Having its own chain dramatically elevates valuation potential.

So, what exactly is Matr1x?

A portfolio of hit games + a gaming public chain + a Web3 game launchpad + a Web3 esports platform.

By building games, launching them, enabling esports viewing, and running its own chain, Matr1x significantly raises expectations for MAX utility:

Not good at playing? What if watching matches also earned you MAX?

Involved in game publishing? What if holding MAX granted access to assets from every new launch?

Running a game chain? What about staking rewards from the chain itself?

Clearly, a larger platform and ecosystem bring more “goods” and “scenes,” pushing MAX’s value ceiling higher.

Comparing to similar crypto projects may help benchmark MAX’s value:

AXS and RON together have a market cap of ~$4 billion; IMX along with ILV and GODS (tokens of its two games) also reach ~$4 billion.

In comparison, MAX is doing something similar to Axie and Immutable X. Thus, its theoretical valuation could also approach $4 billion.

The Golden Shovel and Dividend Rights: $MAX Leverages the Entire Matr1x Universe

Having integrated the “people, goods, scene” analysis above, we now understand the potential sources of value capture for MAX:

-

Floor: Tied to asset value and revenue sharing from a single hit game;

-

Ceiling: Governance, asset issuance, game launches, revenue dividends, chain staking across the entire Matr1x ecosystem.

Looking at the official MAX token utilities, our analysis aligns closely:

-

Governance: Participate in MATR1X community proposals and voting

-

Ecosystem Value Capture: Access treasury distributions, participate in MATR1X Launchpool, receive airdrops from partner projects

-

Exclusive Privileges: Unlock special rights such as publishing games on the MATR1X platform or securing club seats

-

Staking & Rewards: Stake $MAX to become an ecosystem node, earn rewards, and participate in governance decisions on the MATR1X blockchain—including revenue distribution

In short, MAX is the golden shovel of the entire ecosystem—granting dividend rights across multiple connected assets.

From a value-capture perspective, MAX offers diverse and coherent use cases—its demand-side design is rich and self-sustaining.

But what about supply? Will there be constant selling pressure from VC unlocks?

According to the latest official information, MAX tokens held by VCs and the team will have a 1-year lock-up period and a 4-year linear unlock schedule—demonstrating investor confidence and Matr1x’s long-term vision.

Additionally, past performance suggests strong supply management: FIRE, the in-game token of Matr1x FIRE, maintained price stability post-launch through careful vesting design.

During the recent bear market, while most gaming tokens plummeted, FIRE’s price actually rose and remained above $1.

Likewise, NFTs linked to MATR1X didn’t suffer significant devaluation. This reflects the team’s expertise in market cap management and supply design—and, more importantly, their genuine concern for asset pricing.

Clearly, Matr1x understands that asset price is key to maintaining project confidence and momentum—a sign of respect toward its crypto-native community.

As the universe expands with more games and users, demand for MAX will grow (e.g., via loot boxes). If the team introduces a token burn mechanism, it could further balance supply effectively.

Overall, MAX’s fundamentals are solid, with proven experience in market cap management and economic controls. However, how MAX performs post-listing will test the team’s ongoing execution and strategic wisdom.

Calling the Contrarians, Rewarding the Committed

Crypto applications need users. Web3 games need players. Unfortunately, that’s not the prevailing sentiment in today’s market.

Few projects have real substance, while many chase hollow narratives. That’s why we need contrarians like Matr1x—swimming against the tide of speculative infrastructure and fleeting meme hype toward the shores of practical utility.

From classical economics, a product’s value stems from its utility.

If people use it and it grows, the token has a future.

Those who walk alongside contrarians—the right kind of holders—may be the ones to achieve sustainable, long-term returns.

In the vast casino of crypto, the call for real utility should echo back.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News