Web3 Gaming's Great Collapse: How Can We Escape the "Cyber Graveyard"?

TechFlow Selected TechFlow Selected

Web3 Gaming's Great Collapse: How Can We Escape the "Cyber Graveyard"?

Why do blockchain game investors feel more pain despite paying for games like everyone else?

Author: Zen, PANews

MapleStory N, a Web3 blockchain game adapted by South Korean gaming giant Nexon from its classic IP "MapleStory," recently launched officially. With the strong performance of its NXPC token, the long-silent Web3 gaming sector has regained widespread attention. Many are once again speculating about a potential revival of GameFi.

However, it's heaven on one side and hell on the other.

Since 2025, the Web3 (blockchain) gaming space has seen a large-scale halt in project development. Numerous projects once highly praised by the market have successively "died."

Projects including the blockchain ARPG Tatsumeeko, NFT game Nyan Heroes, blockchain FPS Blast Royale, and Rumble Kong League backed by NBA star Stephen Curry have all gradually announced termination of development. Even the once highly anticipated MMORPG project Ember Sword abruptly shut down after raising over $200 million, shocking the player community.

Why Can't Web3 Games Sustain?

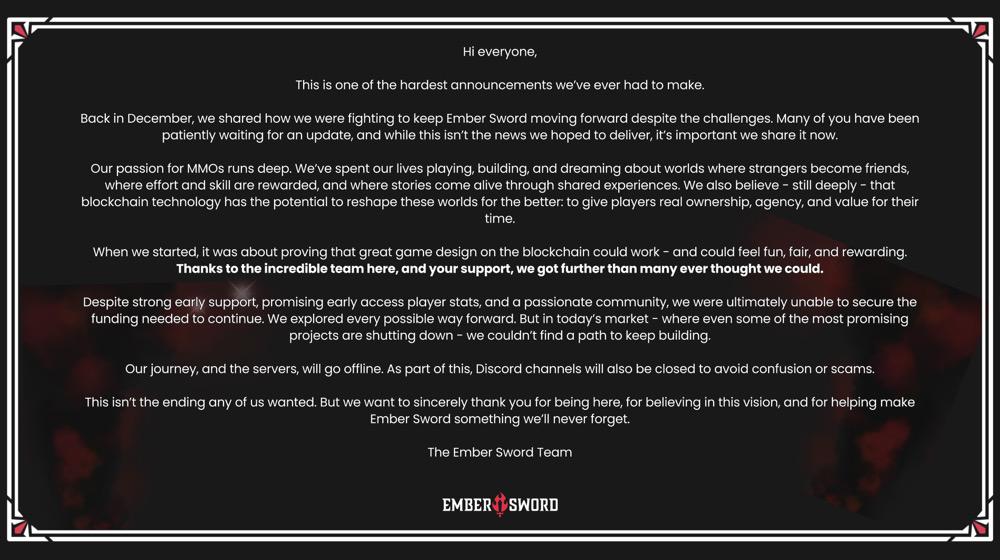

"We explored every possible path forward. But in today’s market environment, even some of the most promising projects have shut down—we simply couldn’t find a way to continue development," said Bright Star Studios, developer of the social sandbox game Ember Sword, announcing its closure on May 21. Beyond PR rhetoric, the clearest explanation was: "Ultimately, we were unable to secure the funding needed to continue development"—a reason echoed by nearly all developers who’ve paused their games.

Ember Sword official homepage

Ember Sword official homepage

Among recent shutdowns, the most surprising was the cat-themed shooter Nyan Heroes. This well-known Solana-based game attracted over a million players across four test phases, with more than 250,000 adding it to their wishlists on Epic Games Store and Steam. "Despite these achievements, and despite discussions around publishing, new investments, grants, and acquisition, we still failed to secure the funding required to complete the game," stated 9 Lives Interactive, developer of Nyan Heroes, in a post on X on May 17, noting regretfully that due to the industry’s current hardships, the game would be shutting down.

"The past few months have been tough. We're currently exploring acquisition opportunities for both the studio and IP. Some talks are underway, but I expect final decisions may take time," said Max Fu, CEO and Creative Director of 9 Lives, expressing cautious hope for Nyan Heroes’ future, though short-term outcomes seem unlikely.

Another highly anticipated fantasy MMORPG shut down this week—Tatsumeeko: Lumina Fates. Its developer, Tatsu Works, raised $7.5 million in 2022, backed by prominent investors including Binance Labs, BITKRAFT Ventures, Delphi Digital, and Animoca Brands.

Tatsu Works expressed itself more diplomatically in its official announcement, stating that the project had grown too complex during development, failing to meet internal standards for sustainability, thus forcing a return to lightweight, community-driven experiences. The team now aims to shift focus to a new project called "Project: Wander," integrating gameplay directly into digital "third spaces" like Discord servers, abandoning the large-scale development model of Tatsumeeko.

According to PANews' report titled *Reviewing 17 Discontinued Web3 Games in 2025: Behind the Blockchain Gaming Retreat Lies Funding Crisis and Loss of Confidence*, 17 Web3 games have ceased operations in 2025. In addition to the commonly cited lack of funding, factors such as "deteriorating market conditions" and "player attrition making operations unsustainable" have also critically undermined numerous blockchain gaming projects.

High Mortality Has Always Been the Industry’s Chronic Illness

The sudden deaths of several high-profile blockchain games recently give the impression that Web3 gaming has entered a death cycle—but this perception is likely amplified by the visibility of these particular failures. In reality, high failure rates in Web3 gaming are nothing new.

CoinGecko published a report on Web3 gaming in December 2023, showing that since the emergence of GameFi in 2017, failure rates in the sector have remained consistently high. The study evaluated 2,817 web3 games launched between 2018 and 2023 and, using data from blockchain analytics platform Footprint Analytics, identified active projects as of November 27, 2023. It found that approximately 2,127 of these games had failed—an average annual failure rate of 80.8%.

A late-2024 report from ChainPlay was even more alarming: analyzing 3,279 projects in its database, ChainPlay defined a game as "dead" if its token price had dropped over 90% from its all-time high and daily active users fell below 100. By this measure, 93% of Web3 games were already dead, with GameFi projects lasting an average of just four months.

In fact, extremely high project failure rates have always been common in the gaming industry—it's not unique to blockchain gaming.

A 2022 study by independent research and consulting firm ICT Institute analyzed 100 successfully funded video game projects and found that only 25% were completed and delivered either on time or within acceptable delay limits, while 40% failed to deliver any promised content.

The competitive mobile gaming space also sees exceptionally high attrition. A November 2023 study by SuperScale, a games-focused business analytics company, showed that mobile games face an 83% mortality rate within three years. Among 500 game developers studied, SuperScale found that 43% of games died during development.

An academic paper on the gaming industry published via DiVA Portal points out that in creative industries, game projects fail at higher rates than other software ventures. Because games require constant innovation and high-quality delivery, they are particularly prone to development delays and budget overruns—often leading to cancellation.

Stage-Based Financing Meets Deteriorating Macro Environment

Game development typically follows a "stage-based financing" model: initial seed or angel funding is secured early, and as development progresses, further rounds (Series A, B, etc.) are raised based on demonstrated progress and new content.

For example, last year’s hit *Black Myth: Wukong* gained massive attention shortly after releasing its first gameplay trailer in August 2020, laying the foundation for subsequent fundraising and talent recruitment—eventually leading to Tencent investing as a strategic investor in 2021.

This model relies on a project’s hard capabilities—each stage must demonstrate sufficient progress and potential to attract new investment. However, in the current blockchain gaming landscape, this model appears ineffective: according to ChainPlay, GameFi project tokens have, on average, fallen 95% from their all-time highs. Moreover, among venture capital firms investing in GameFi, 58% have experienced losses ranging from 2.5% to 99%.

In today’s Web3 gaming space, airdrops and token incentives have become fundamental tools for user acquisition. Especially in early stages, projects can rapidly expand their user base and boost community engagement by promising future rewards. However, this strategy often fails to sustain long-term user retention. Once tokens are issued and airdrops completed, players leave en masse as expectations for future rewards diminish, causing game activity to plummet—a major obstacle to sustainable growth. As users exit, token prices fall, triggering a negative spiral. Market skepticism toward the sustainability of “Play-to-Earn” models grows, exacerbating token volatility and weakening investor confidence.

For risk-averse investors slowing down deployments and adopting wait-and-see stances, underperforming blockchain games are far from ideal investments. According to a DappRadar report, Web3 gaming projects raised approximately $91 million in Q1 2025—down 68% year-on-year and 71% quarter-on-quarter. This sharp decline reflects waning investor enthusiasm, partly due to rising interest in artificial intelligence and real-world assets (RWA), which are diverting investment away from Web3 gaming.

A project’s user count and appeal directly affect its ability to secure funding and resources. If user growth stalls or market response is lukewarm, even capable development teams may exhaust time and money before delivering a final product. Based on the number of games shut down in recent years, this scenario is likely not uncommon.

Scams, Exit Scams, and 'Garbage' Creators

The financial health and efficiency of failed projects cannot be reduced to simple binaries like “lack of funds” or “too much money,” but rather reflect deeper issues of capital allocation and operational efficiency.

Among the wave of discontinued games, some evoke genuine regret—developers who showed sincerity in creation, yet failed to deliver a complete or better product, perhaps due to bad timing. Others, however, entered the space purely for hype and profit, making their eventual exit scams and production of “cyber junk” entirely predictable.

Nowhere is this more evident than with Ember Sword, whose development team exhibited astonishing negligence.

In 2021, riding the metaverse wave, Ember Sword gained broader recognition, attracting 35,000 players to whom it sold NFT virtual land worth a total of $203 million. The project also completed multiple funding rounds, with investors including gaming streamer Dr. Disrespect, The Sandbox co-founder Sebastien Borget, and Twitch co-founder Kevin Lin.

Last July, Ember Sword announced closed beta testing and released gameplay footage. Yet the visuals were shockingly crude, simplistic, and cheap-looking, leaving players deeply disappointed. One commented: "If this came out in 1995, the 11-year-old me would’ve been thrilled." Others angrily labeled it a scam, pointing out that its graphics were inferior even to RuneScape, an MMORPG launched back in 2001. Ember Sword’s inevitable shutdown was foreshadowed long before it happened.

Ember Sword gameplay test footage

Ember Sword gameplay test footage

With Ember Sword permanently closed, its servers are offline and Discord access restricted. Its EMBER token has crashed to near-worthlessness, with a market cap now just $80,000. The developer issued a lofty statement: "This is not the outcome anyone wanted"—which is certainly true, but many community members call Ember Sword a "scam." Player and YouTuber CAGYJAN claimed on X that he lost at least $30,000 on the project between 2021 and 2025, with many users in the replies sharing similar stories.

The Illusion of Player Ownership Shattered

What dies along with these discontinued Web3 games is the dream of truly owning in-game assets.

Branded as the "future of gaming," Web3 games have long touted promises that "players will truly own their in-game assets." In theory, when characters, items, and land are built using NFT technology, players become true owners—these assets exist on-chain, independent of game developers’ servers, meaning players could retain and trade them even after a game shuts down.

But in practice, so-called "decentralized assets" remain heavily dependent on centralized game servers and developer support. When a project ends or developers withdraw, players’ NFTs and tokens lose practical utility and their value plummets instantly. After Nyan Heroes announced its shutdown, its NYAN token crashed about 40% that day, falling below a $900,000 circulating market cap. As of May 23, it trades at $0.006—down 98.5% from its all-time high of $0.45 set in May 2024.

Industry observers argue that if players cannot use their digital assets across different platforms and games, they don’t truly own them. Yet even if the Web3 gaming industry achieves technical standardization, the idea of "interoperability" faces a deeper structural challenge: the vast differences between game genres make cross-platform asset transfer practically unfeasible.

Imagine an NFT character, weapon, or mount from an RPG—what practical use would it have in an FPS shooter? How could it carry value in a simulation management game? Game assets embody specific systems of abilities and attributes, usually designed uniquely per title, rendering cross-game compatibility virtually nonexistent.

Moreover, for developers, integrating external NFT assets into their own game worlds means exponentially increased development complexity and maintenance costs. They’d need to design new models, animations, UI interactions, and ensure these foreign assets don’t disrupt game balance—all impractical fantasies. No commercial game developer would voluntarily take on such burdens for the sake of player "ownership."

Therefore, when discussing player ownership, we must recognize that the core issue isn't about on-chain verification or provenance—it's fundamentally about whether assets remain compatible with a living game ecosystem. From this perspective, today’s Web3 games are no different from traditional ones.

Why Do Web3 Gamers Feel the Pain More Acutely?

Supporters funding ongoing development isn’t unique to blockchain. Traditional game crowdfunding has operated for over a decade. Since the early 2010s, platforms like Kickstarter have provided independent developers with funding channels. In this model, players typically participate through pre-orders, merchandise, or developer updates.

A University of Cologne survey found that crowdfunding backers generally fall into three categories: supporters who want to help specific developers create games free from external constraints, buyers expecting a finished product, and influencers hoping to impact the gaming industry. The study noted that the first two groups tend to view their contributions as support rather than pure transactions.

Dubbed the "sell-ship cult" by fans, *Star Citizen* began crowdfunding on Kickstarter in October 2012. Over thirteen years, its developer Cloud Imperium Games has raised over $800 million through paid alpha access, subscriptions, merchandise, microtransactions, and selling ships worth hundreds of dollars. While controversial, the community has rarely collectively protested over paid content.

When traditional crowdfunding games fail, most backers have typically only spent small amounts on game copies or merchandise. Even if a project fails, financial losses are limited, and psychologically, supporters often see their contribution as backing creativity rather than a financial investment. Even if unfinished, they accept it as supporting innovation—not speculative loss.

In contrast, in the Web3 model, players and speculators directly spend significant real money buying in-game assets or tokens. When projects fail, they face real financial losses, resulting in stronger feelings of loss and betrayal.

Where Should Web3 Gaming Go From Here?

"What are the best-designed, economically sustainable Web3 games? Right now, the answer is simple—almost none," said Duncan Matthes, researcher at Delphi Digital. Game development is lengthy and capital-intensive. Most high-quality games require 2 to 5+ years of development and deep expertise.

Besides, development budgets range from millions for mobile titles to hundreds of millions for console and PC games—far exceeding typical Web3 game funding. These factors make it difficult for game tokens to grow steadily amid markets driven by attention and shifting narratives.

Given this context, industry experts widely agree that Web3 game developers must first ensure game quality and playability. Carlos Pereira, partner at Bitkraft Ventures, recently told Blockworks that Web3 game development should prioritize game quality over prematurely introducing tokens or NFTs for monetization—because the latter raises expectations that, if unmet due to failed exits or plan adjustments, trap studios in crisis.

For many Web3 game developers, in their pursuit of NFT-driven ownership and economic incentives, they often neglect core game elements like characters, storytelling, gameplay experience, and community interaction. Shiti Manghani, COO of Find Satoshi Lab, once said players care more about whether a game is fun than about in-game asset ownership mechanisms.

In reality, the wave of Web3 game shutdowns stems from a confluence of factors: the gaming industry’s inherently high failure rate, difficulty retaining players under the Web3 model, flawed funding distribution and financing structures, and worsening macro investment conditions.

Facing these challenges, Web3 gaming must break free by returning to value-driven development and technological fundamentals—by going back to basics and first making Web3 games actually enjoyable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News