After officiating international e-sports events, I'm extremely bullish on gaming on the blockchain

TechFlow Selected TechFlow Selected

After officiating international e-sports events, I'm extremely bullish on gaming on the blockchain

Stop being an NPC in the game; become a creator player of a new civilization.

Author: msfew

From Gaming Addict to Esports Referee

I'm msfew, a hardcore gaming addict. Since elementary school, I've been immersed in video games—playing League of Legends with friends on a sub-20-fps laptop.

Whether during my undergraduate classes, interning as a programmer at Google, or later joining ORA (ora.io, World Intelligent Network) as part of an AI startup, I never stopped spending several hours every day gaming—even sacrificing sleep for it.

As my understanding of the gaming industry deepened, I recently had an epiphany and obtained an "esports referee certification." After applying to a few events, I leveraged my narrative skills cultivated in the crypto space and multilingual advantage to secure a role as an operations referee for the top-tier international tournament—"Overwatch Champions Series."

I officiated matches at the same venue used for the Hangzhou Asian Games, ensuring fairness and smooth execution in front of players, coaches from North America and Europe, and tens of millions of online and offline viewers. (The person looking at the camera in the photo is me)

(This article mainly discusses on-chain gaming assets. If you're interested in the esports referee part, feel free to skip to the end.)

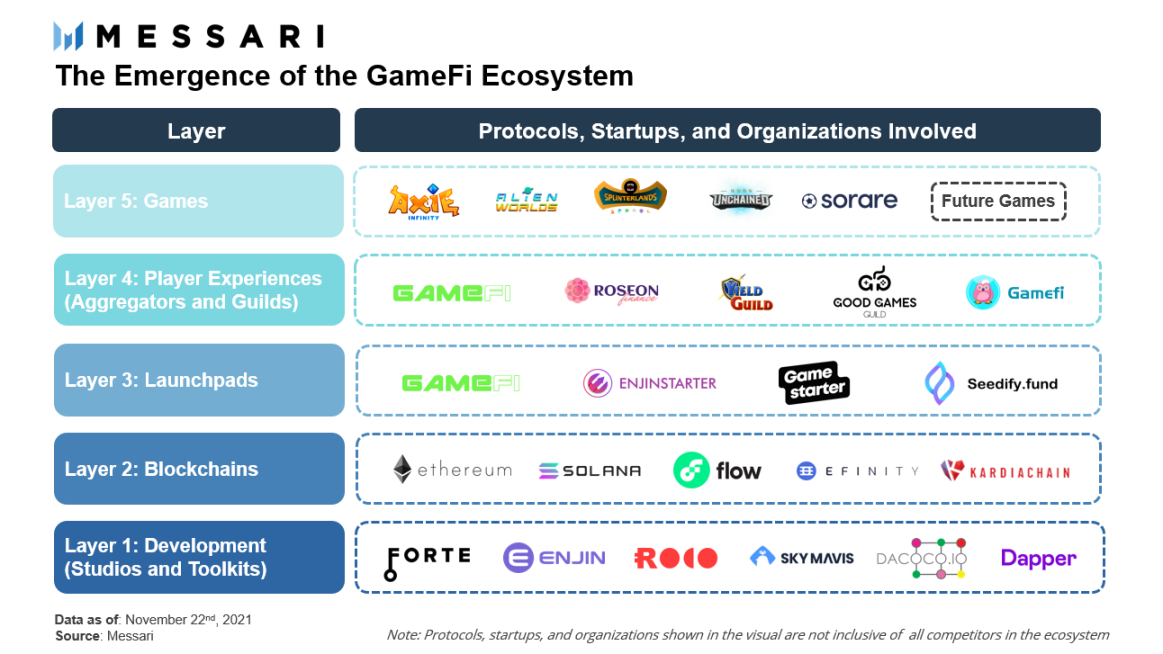

Forgotten Version: Blockchain Games

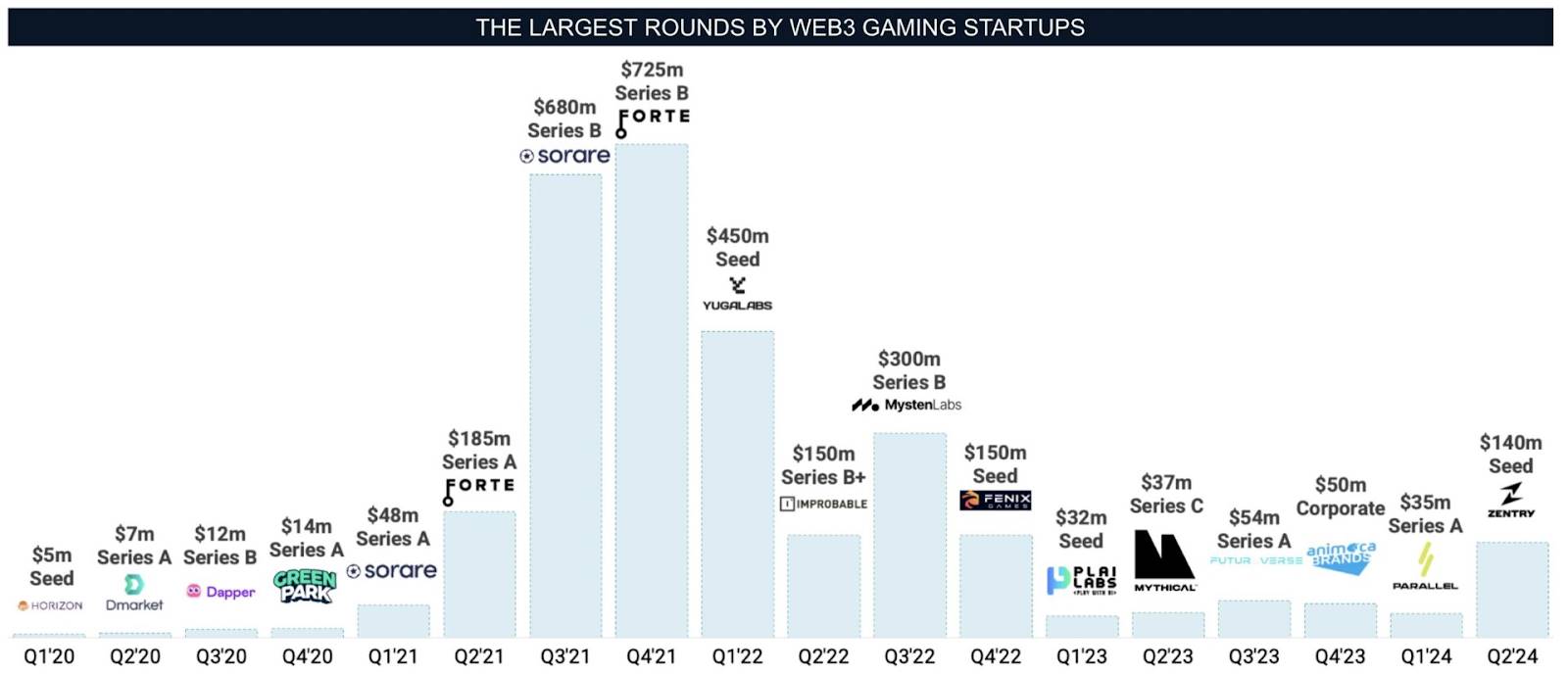

2021–2022 marked the peak of blockchain gaming. Since then, we’ve hardly heard any news about blockchain games or new major projects—only occasional mentions, such as narratives around fully on-chain games.

Many analyses have explored why GameFi failed (e.g., from the perspective of gameplay, or data metrics). While successful narratives and sectors vary, failures share the same root: the narrative/product/new traffic can no longer support the price ("debt issuance < debt resolution"). GameFi has always relied on "Play-to-Earn," "rural encirclement of cities," "new economic systems," and "influx of new users," but failed to create or keep pace with a sustainable cycle.

Capital began voting with its feet. Less funding flowed into GameFi, leading to fewer participants, declining project quality, failure of well-funded projects to deliver as promised, and the bursting of inflated narrative bubbles—creating a vicious cycle.

What’s Next for Gaming + Blockchain?

How do we save blockchain gaming? I believe there are three main approaches:

-

Tokenization: Abandon attempts at creating low-quality games. Drop the pretense and instead explore integrating blockchain with existing popular games.

-

Fully On-Chain Games: Continue pursuing fully on-chain games—not necessarily for gameplay, but to drive infrastructure development through application demands.

-

Incorporate New Technologies: For example, integrate AI to make games more engaging.

Game Asset Tokenization

After this market cycle, 100% of crypto natives are now comfortable tokenizing anything. This cycle isn’t lacking in strong narratives—games just got overlooked.

But in reality, traditional Web2 games with genuine community consensus have been ignored. These are the truly popular ones.

"Native Web3 games" struggle to compete with established game studios (like Riot, whose new shooter instantly garnered massive attention years ago) or traditional distribution channels. Or rather, these games aren't willing to take the "hard path." Of course, if a game has native crypto mechanics, then selling tokens as a product is perfectly reasonable.

Rather than trying to embellish shit, it's better to start with high-quality content.

Great Games, Great Assets

The in-game assets of popular games themselves are excellent candidates for tokenization, due to three key advantages:

-

-

Speed of trend formation + scarcity and irreproducibility: Once a great game launches a token, it’s a one-time event. There are only so many great games—and each launch reduces that number.

-

Broad consensus: Most in the crypto market recognize and value high-quality games.

-

Financial capacity of the audience: Gamers and traders alike are willing to spend heavily on on-chain game assets.

-

Additionally, games’ attention mechanisms differ from memes—each with pros and cons. Memes spread fast but fade quickly; few survive years. Game attention, however, is sustained—more like an initial spike followed by long-term engagement.

-

-

Shared Mental Model:

-

Game assets already align closely with crypto assets mentally. Take CSGO: Play-to-Earn (crate drops), randomness (getting a golden skin), and cosmetic series/items (NFTs) are highly similar. Traders often adopt a "gambler mindset," aware they’re speculating. Of course, many gamers also spend heavily on cosmetics purely as luxury items.

-

-

Loser Business:

-

A controversial idea: Invest in "loser businesses"—games being a prime example of a growing one. Fresh blood will keep entering. You might avoid trading coins, but not playing games? That’d be odd.

-

Didn’t people know this before? Why act now? Because things have changed—the infrastructure is ready (exchanges, various "brokerages"), and acceptance of tokens and on-chain assets has grown.

Having discussed the advantages, one issue remains: game assets are capped by the game’s ceiling (though high), and can’t spread infinitely like pure memes (e.g., your grandparents may know Trump but resist learning about games). Regulatory and IP constraints also exist.

Finally, back to the original point: in gaming, we should tokenize great games/great assets—not create garbage assets to tokenize. This echoes the lesson from the last AI and gaming cycle we’ve learned (everyone building launchpads, which mint more junk assets—that doesn’t work).

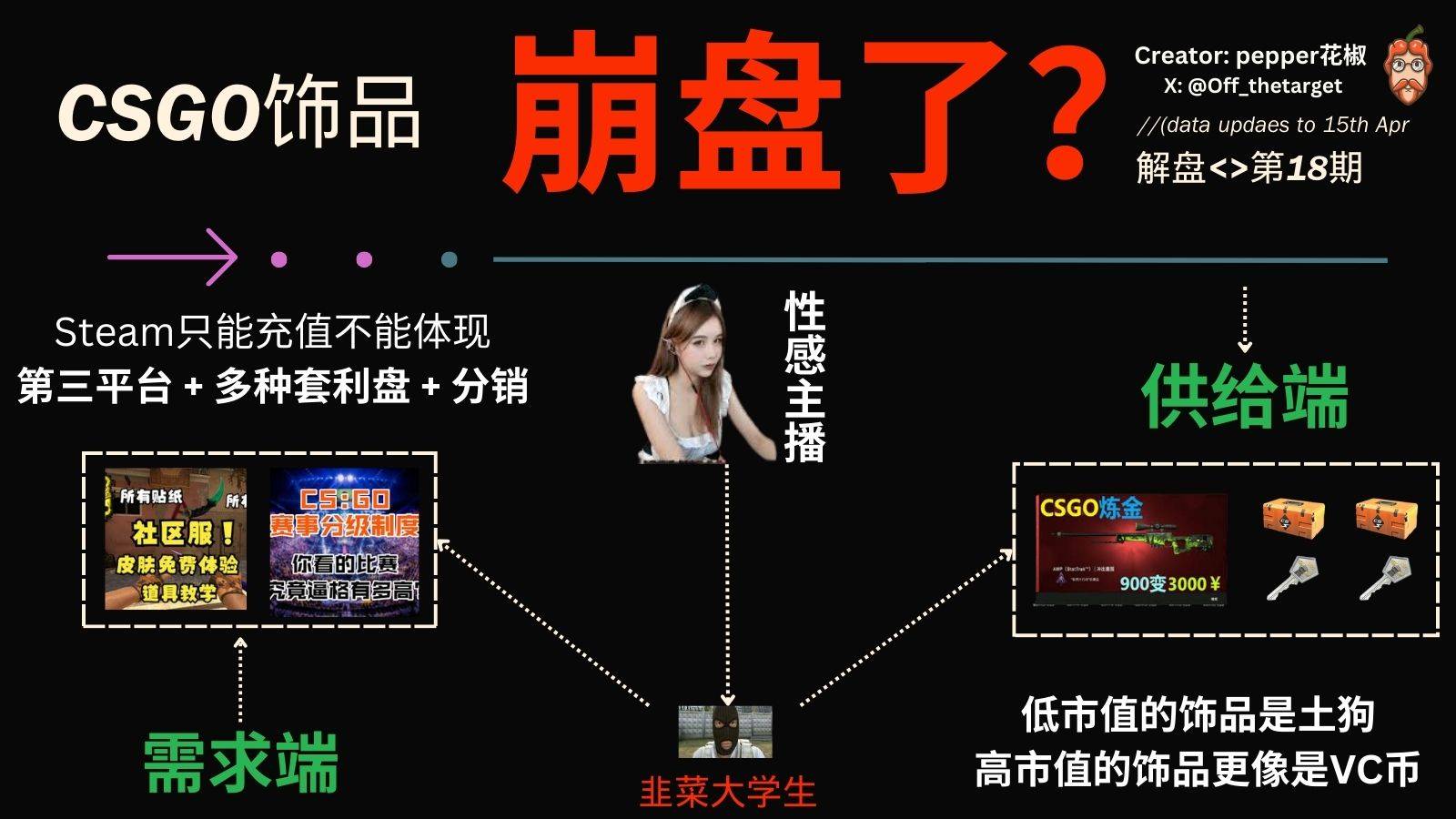

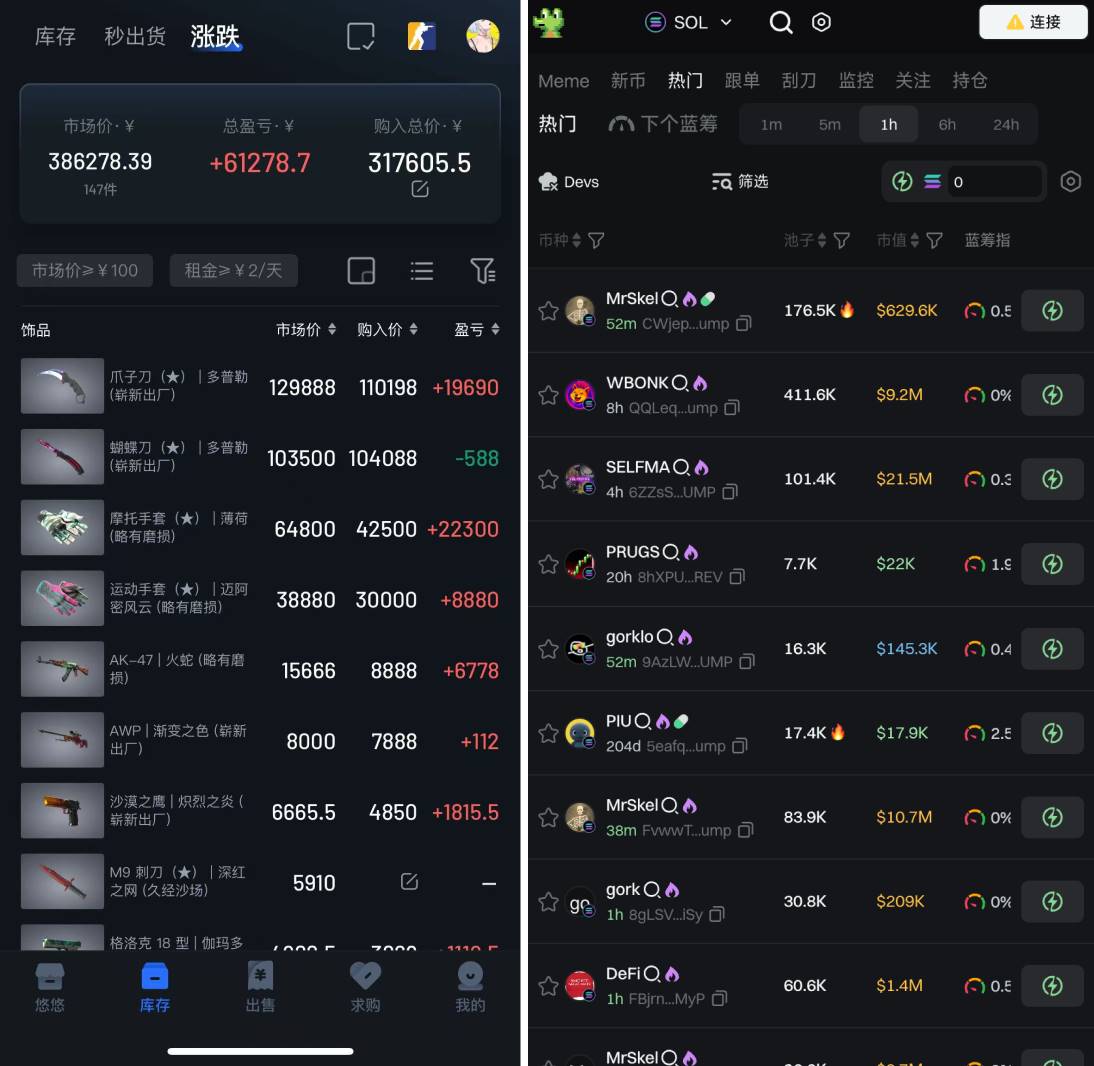

CSGO Skins as an Example

CSGO skins are a classic example of game assets—simple in model (much simpler than the Dream Xiyu games everyone loved in the last GameFi cycle) and highly popular.

Previously, off_thetarget, Gink5814, and I have all published content on CSGO skins.

In short, CSGO skins:

-

CSGO is a shooter game with many weapons (AK, M4, pistols, knives, gloves)—and extremely high popularity.

-

Base skins are ugly (compared to custom ones); players obtain cosmetic skins via crates or secondary markets.

-

Skins map directly to → weapon type (primary? knife? gloves?) → specific model (AK, M4, butterfly knife) → wear level and pattern—perfectly mirroring NFT categories (PFP? U-card?) → specific series (Punks, BAYC) → individual images.

-

Player demand for skins is extremely high, with even official platform bans acting as a built-in burn mechanism.

I believe the current risk with CSGO skins is that prices have run far ahead of intrinsic value. The game’s actual user growth is likely declining, but narratives like "being a landlord" and "skin arbitrage" attract speculative capital and hype:

-

"Being a landlord"—buying skins and renting them out—is attractive if prices rise (though even then, buyout default risk exists). But if prices fall, returns may underperform余额宝… So gains aren’t guaranteed either way.

-

"Skin arbitrage" seems to rely on finding dumb money as exit liquidity—calculating exchange rate differences, buying cheap USD cards. But given card sources and the 7-day hold requirement, concerns arise: what if a crash happens? Will they be the last ones holding?

-

Marketing is overly aggressive—often via QQ and WeChat groups, where a "mentor" commands everyone to raise listing prices simultaneously…

Overall, CSGO perfectly fits our narrative of "popular Web2 games going on-chain." Two directions can link CSGO skins with blockchain—making game assets "on-chain": 1) Build tools; 2) CSGO on-chain funds.

1. Pickaxe Seller: Building CSGO Skin Trading Tools with Crypto Thinking

In any trading domain, those selling picks and shovels profit risk-free across bull and bear markets. Bloomberg, Uniswap, law firms, audit companies—all stand tall regardless of market conditions.

In crypto, assets and narratives evolve (ICO → VC coins → DeFi → GameFi → pure memes), and trading methods change too (CEX → AMM → NFT → TG Bot → on-chain scanning terminals). But the need for better, more comprehensive, faster trading tools remains constant.

Both crypto and CSGO skins face technical limitations:

-

Crypto: On-chain trading mostly follows AMM models; off-chain faces regulatory hurdles.

-

CSGO Skins: Trade cooldowns exist; platforms use order-book systems like NFT markets.

Though both are constrained, they’ve achieved decent trading experiences. Crypto’s tooling evolved faster, iterating multiple times: aggregators like 1inch solved AMM fragmentation; platforms like Blur addressed NFT marketplace splits; DEX wallets and TG bots bridged trading-wallet gaps…

Current CSGO skin trading can improve via:

-

"On-chain scanners": KOL-style analytics and pro player holdings analysis

-

"Aggregators": All-in-one brokerage for buying (compare lowest prices across platforms) and selling (analyze volume-price listings across all platforms + prevent overselling + consider exchange rates and lockup)

-

"Exchanges": AMM-like mechanisms (selling to platform/pool instead of buyers) enabling instant buy/sell

-

"Derivatives": Leverage trading, long/short positions, rentals, lending, and other financial instruments

As an industry born and raised on trading, crypto has rich experience building tools under technical constraints—this would be a game-changer for CSGO skin platforms.

Strong players don’t complain about the environment. With more mature trading platforms and UX, portfolio diversification would increase, leading to healthier volume-price dynamics.

2. New Asset: On-Chain ETFs for CSGO Skins

The narrative around RWA and cross-platform crypto stock integration is heating up again. The biggest issue with traditional assets going on-chain today is their lack of appeal—they’re middling, unexciting assets:

-

Lower yields than stablecoins, less safety (if we exclude stablecoins and US Treasury RWA from RWA)

-

Complex purchase processes requiring KYC (fails to achieve ideal geographic bypass and arbitrage)

-

Less appealing than memes or other assets (few in crypto want corn or soybean funds—these are usually junk assets packaged for exit liquidity)

CSGO skins, however, have something interesting: categorized indices—skin index, base skin index, agent index, etc. They naturally divide into clear categories, with potential for further细分 by specific weapon lines. CSGO is ideal for creating attractive RWA.

Advantages of CSGO skin funds:

-

On-chain fund benefits: Well-known advantages—transparent data and flows, low operational cost via single contract, unrestricted on-chain transferability.

-

Capture index performance: Avoid single-item risks, gain exposure to entire sector returns. CSGO already has indices—but they’re not tradable, leaving many able to watch but not participate.

-

Bring in gaming traffic: Mass adoption logic. Gamers may enter crypto through such index funds, creating strong crossover effects and high ceilings.

-

Pricing consensus among young audiences: Young people, especially in crypto, often ignore traditional RWA and instead chase assets they care about. CSGO skins are a perfect example. Young people play games daily—they naturally feel connected.

How could a CSGO skin fund work? A simple concept for a knife base-skin index fund:

-

80% of fund allocated to various knife types, 20% in stablecoins for yield farming.

-

Make crypto invisible—despite being on-chain, allow direct fiat in/out.

-

If users find passive returns insufficient (many buy skins purely as luxury items), holding a certain amount of fund shares grants free borrowing of fund-held skins; additionally, a portion of skin holdings can be rented out on platforms.

-

To comply with regulations, use token standards like ERC-7641 RevShare Token to transform the fund into a revenue-sharing token, distributing value growth and rental income from underlying assets.

Other Directions

Beyond asset tokenization, two smaller paths exist: fully on-chain games and AI integration.

Fully on-chain games aren’t about putting games on-chain per se, but using applications to push infrastructure development. Like how demand for better graphics drove GPU advances, which later fueled AI and other frontiers. A recent crypto example is MegaETH’s Crossy Fluffle—it’s not about the game, but using app demands to strengthen underlying infra, driving progress through necessity.

AI integration allows AI to act as a neutral agent, objectively executing tasks—perfect for roles like my esports referee job. AI can also generate stories, infinite maps, and game assets…

Conclusion: GG, But Not WP

This is why, after serving as an international tournament referee, I’m bullish on game asset tokenization and gaming + crypto.

Not because it’s trendy now, but because we may finally have figured out how to play the game right.

The GameFi wave had winners and losers, but this time crypto has reset—with more mature strategies, stronger asset models, and deeper understanding.

Stop being NPCs in the game—become founding players of a new civilization.

Small Reflections as an Esports Referee

Some bonus thoughts—unrelated to main content, just for fun:

-

Esports referees aren’t like traditional sports refs—no need to judge wins/losses. Mainly assist players with device setup and resource coordination.

-

The essence of an esports referee is being a liaison—communicating internally (with players and coaches) and externally (with head referees and production teams).

-

Entering esports refereeing or the scene overall is actually very easy—easier than climbing ranks in games. The hard part is securing individual event opportunities. Once you get the first, it becomes much easier.

-

There’s a shortage of people fluent in English and Korean—those with translation skills are especially rare.

-

Esports events must be held offline—players’ physical locations must be unified to ensure relative fairness.

-

Like Web3, esports operates at night or late into the night—better aligned with young people’s biological clocks.

-

Esports will replace traditional sports—new generations will increasingly participate in and watch esports over traditional sports.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News