Will Animoca's potential US listing save GameFi?

TechFlow Selected TechFlow Selected

Will Animoca's potential US listing save GameFi?

An optimistic interpretation of Animoca's performance is that the company has found a way to operate profitably before the next GameFi wave arrives.

Author: Steven Ehrlich

Translation: TechFlow

Crypto gaming once failed to live up to its massive market expectations, but today, one of the early pioneers in this space is finding its financial footing in this challenging industry.

Animoca's crypto gaming business is becoming increasingly profitable

Image source: Shutterstock

The crypto industry is having another moment. Bitcoin has hit a new high at $111,814; Coinbase has become the first crypto company to enter the S&P 500; and more industry firms are planning to go public in this suddenly heated crypto market.

In this context, Hong Kong-based Web3 company Animoca Brands is joining the trend. The privately traded firm operates in NFTs, crypto gaming, and an investment platform with stakes in over 500 companies, including crypto exchange Kraken and Ethereum development studio ConsenSys.

Animoca delisted from the Australian Securities Exchange in 2020 due to its ties to the crypto sector, but during the pandemic, its valuation surged from $100 million to $5.9 billion, marking its peak. However, the company gradually faded from public view amid the crypto winter, the collapse of the NFT market, and the subsequent meme coin frenzy. Compounding matters, the GameFi boom failed to capture significant attention from the global gaming market, which Oppenheimer estimates at $180 billion.

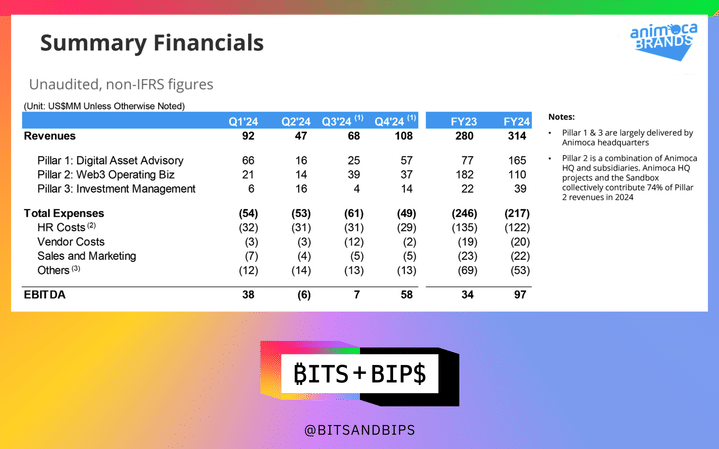

Nevertheless, under CEO Yat Siu’s leadership, Animoca has continued moving steadily forward, carving out a profitable business strategy. According to unaudited financial data published on the company’s website, Animoca generated a profit of $97 million last year, an 185% increase from 2023.

Today, the company is exploring deeper commercial ties with the U.S. market alongside many other global firms, thanks to the Trump administration’s pro-crypto stance, including potential listings on major exchanges such as Nasdaq or the New York Stock Exchange. “We believe the U.S. will become the largest crypto market globally, so it would be foolish not to try entering it,” Siu told Unchained. Still, he noted that a U.S. listing is just one of many opportunities the company is currently exploring.

How will the market respond to Animoca? That will depend on whether GameFi and NFTs can re-engage users and whether investors embrace Animoca’s narrative as a “tool provider” in the GameFi space.

Game Pause

Although the global gaming industry is largely unaffected by specific tariffs from the Trump administration, it remains highly dependent on shifting macroeconomic conditions. “Overall, performance has been okay, but nowhere near as strong as during the pandemic,” said Martin Yang, senior analyst at Oppenheimer. “We had two very strong years of growth, but now overall annual growth may only be 3–6%.”

The mobile gaming market is even more concerning—and this is precisely where GameFi primarily exists. To outside observers, this might seem counterintuitive, as the “freemium” model and relatively low costs of mobile games appear more resilient. Yet this phenomenon reveals an important nuance in the gaming industry and explains why crypto gaming has struggled to gain traction.

“People thought, ‘Oh, either players don’t pay at all or they pay very little,’ so they assumed [the mobile gaming model] could withstand challenging macro environments,” said Mike Hickey, senior analyst at The Benchmark Company, in an interview. “But in fact, starting a few years ago, we found mobile gaming to be the most vulnerable.” He added that even many major independent mobile game studios, such as Zynga, have been acquired or faced layoffs.

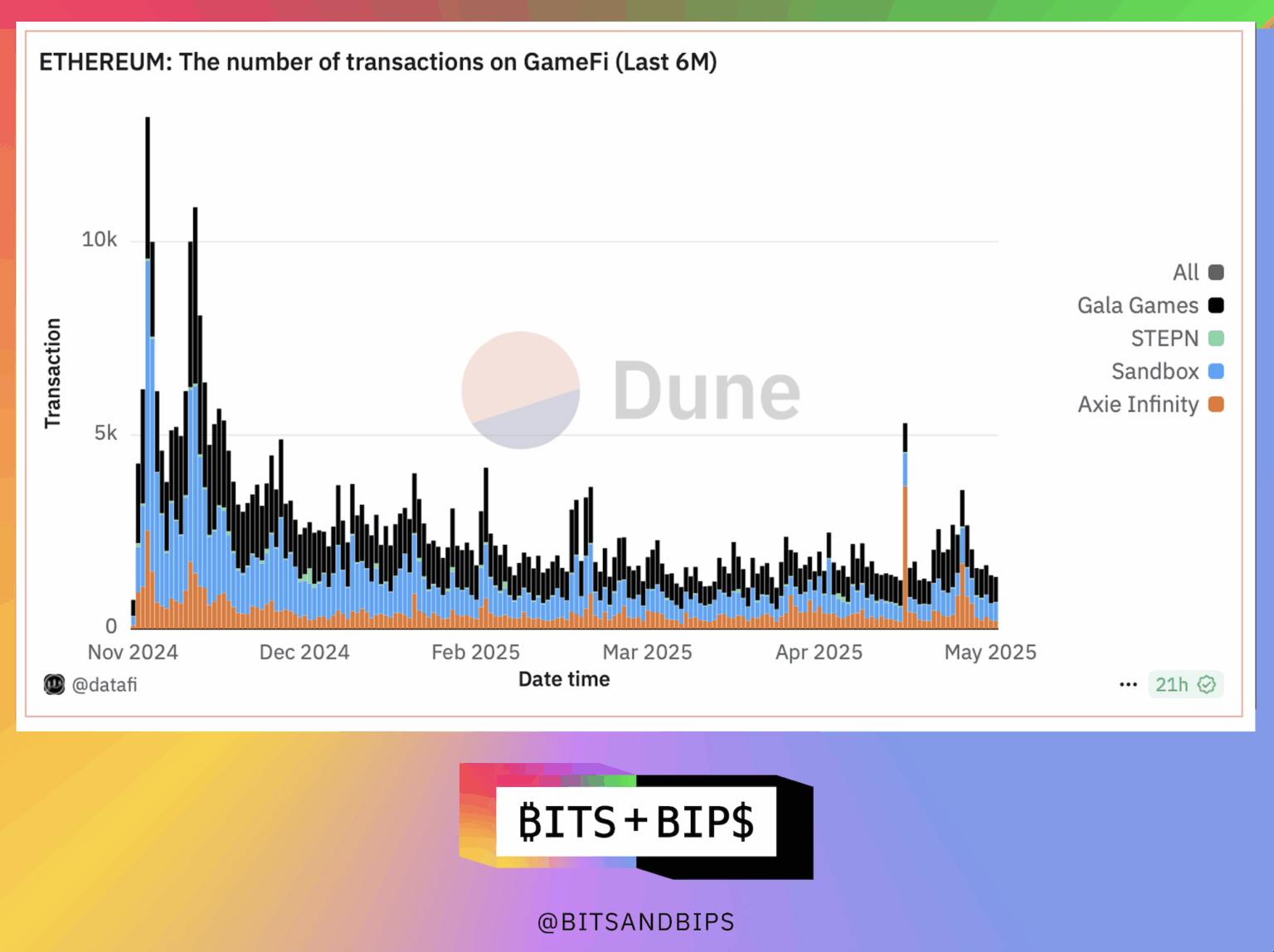

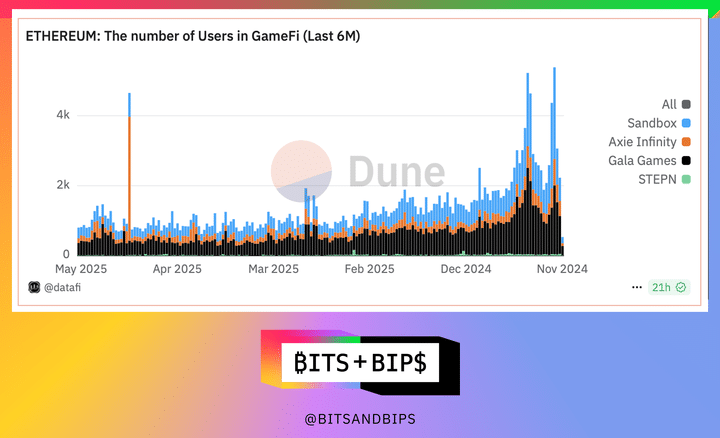

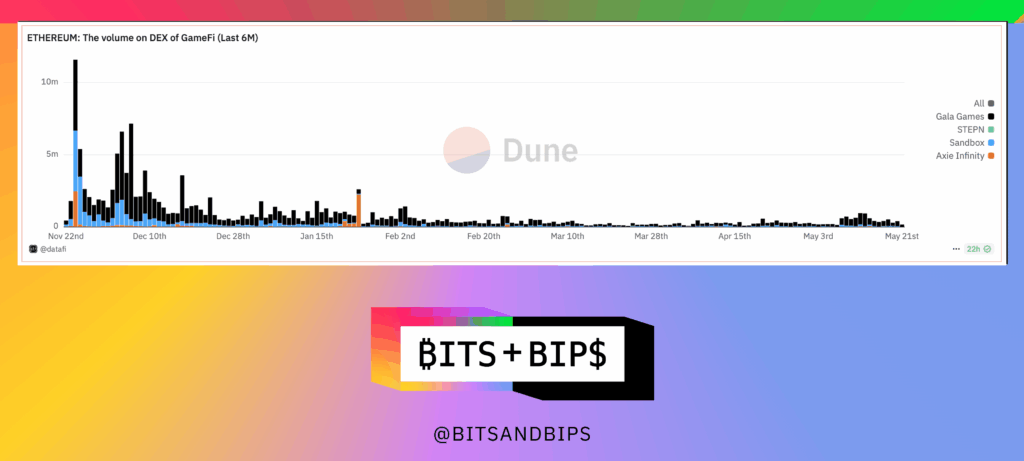

How does this relate to the crypto industry? Data shows GameFi is struggling, partly because its user base is much smaller than the broader gaming market. Take Ethereum—the dominant blockchain in the space—as an example: key metrics like transaction volume and number of users have sharply declined, a trend clearly visible in the chart below (note: the second chart should be read from right to left).

Animoca’s B2B Strategy: Becoming the Market Engine for GameFi

In the current market environment, Animoca nearly tripling its profitability within a year seems surprising—but that’s exactly what it has achieved. How did it do it? By becoming the primary liquidity engine or market maker for GameFi. Yat Siu realized that providing financial back-end support to these companies was a more stable, safer, and potentially more profitable approach than launching yet more games into an already crowded market. “That’s how the business evolved,” Siu said. “We know many small companies lack the financial infrastructure or experience when launching their games. We buy their tokens and provide capital markets support, such as OTC trading. It sounds very financialized, but it’s actually just an extension of what we call our publishing business.”

What impact has this had on its business? In 2023, most of the company’s revenue came from its Web3 operations, including wholly owned projects such as virtual worlds, chess games, and online education platforms. However, from 2023 to 2024—a particularly active year for the crypto industry—this revenue dropped by 39.5%. Yet the company’s profits grew 185% year-on-year. How was this possible? Its digital asset advisory business grew by 114%, which is precisely where all the capital markets activity resides.

Can This Growth Last?

Delta-neutral strategies like market making can be profitable both inside and outside the crypto industry, and data suggests Animoca has found a product-market fit in this niche. But investors need confidence that the company can continue expanding this revenue stream, especially as key GameFi metrics remain weak.

This is hard to answer. One telling data point is GameFi token trading volume on decentralized exchanges (DEX). As shown in the chart below, even when looking only at Ethereum-based tokens, the trend remains negative, despite daily volumes still reaching hundreds of thousands of dollars. The same pattern holds for other blockchains like Polygon and BNB.

This matters because DEX volume more accurately reflects actual user demand for specific tokens, whereas centralized exchange (CEX) volume tends to be more speculative. It’s currently unclear how much of this volume stems from trades executed by Animoca on behalf of clients—an important blind spot for investors.

Supplement

An optimistic interpretation of Animoca’s performance is that the company has found a way to operate profitably ahead of the next GameFi wave—if such a wave ever arrives. On this point, Yat Siu emphasized that the Trump administration’s support for crypto markets is particularly significant, as unfavorable U.S. regulation has deterred major American gaming companies from entering the space.

“We work with large institutions, essentially bringing them into crypto,” he said. “There’s a certain level of comfort doing this globally, but in the U.S., conversations with [major game companies] may be more difficult. They do talk to us regularly, saying, ‘Hey, tokens are interesting—we should look into them.’ But… when something’s legality [like token classification] isn’t 100% clear, you’re relying on legal opinions.” Siu implied such efforts could be rejected.

If—albeit a big if—Siu and Animoca manage to bring in a major player like EA Sports, it could address another core problem in crypto gaming: the lack of fun in games and players’ negative reactions to excessive financialization in the industry. “When you try to attach something to a normal gaming experience that’s purely a monetization mechanism without enhancing gameplay, players push back against these company-driven monetization strategies,” Hickey said.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News