Everything is ready except the east wind: Exploring the possibilities of decentralized options

TechFlow Selected TechFlow Selected

Everything is ready except the east wind: Exploring the possibilities of decentralized options

We're long past the DeFi summer of "decentralized is good by default." Every decentralization will now be questioned: WHY!

Author: armonio

Introduction

An option is a type of right—a contractual agreement between two parties specifying the conditions and terms for delivery. The emergence of smart contracts has enabled these agreements to execute autonomously on-chain without human intervention, with transparent and clearly defined execution conditions and processes, creating an ideal environment for options trading. Since the DeFi summer of 2020, numerous teams and projects have ventured into decentralized options. Over the past three years, the industry has flourished with diverse innovations in accounting infrastructure, option types, and market-making algorithms.

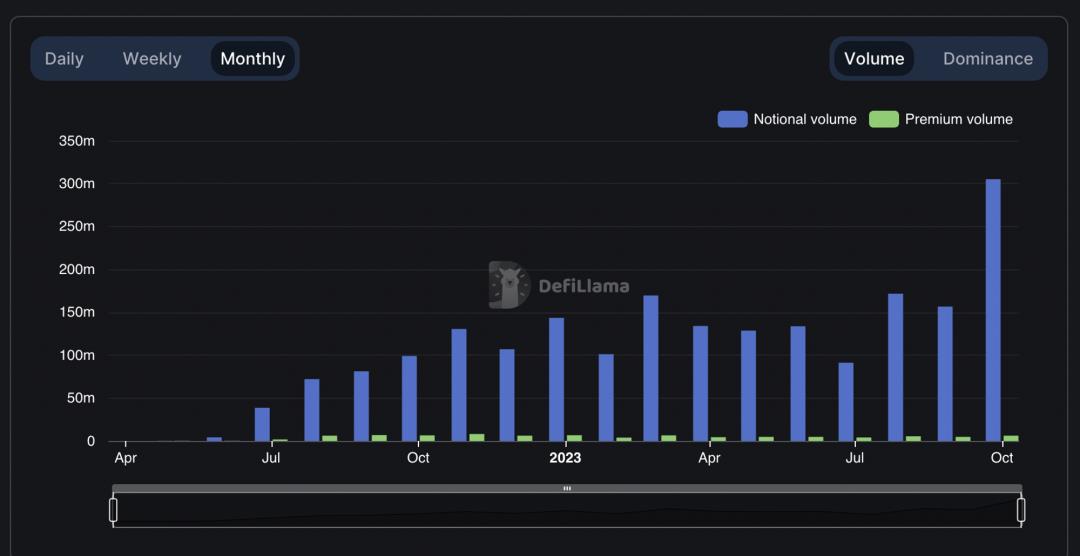

As the market entered a bear phase, token incentive costs rose significantly. The artificially inflated activity in decentralized options began to decline. Beyond a few standout projects, innovation has largely been limited to minor financial product tweaks. The market rewards disruptive innovations that align with blockchain architecture and decentralized environments—projects like Lyra, building upon predecessors, have formed DeFi ecosystems with unique algorithmic pricing systems. Despite shrinking market size, Aevo and Lyra now dominate the sector by capturing a clear majority of trading volume.

Compared to off-chain options markets with hundreds of billions in trading volume, current on-chain options remain negligible. In traditional finance, nominal options volumes are roughly on par with futures. This data suggests that on-chain options are still in their infancy. In the second half of 2023, Layer 2 networks matured technologically, enabling low-cost infrastructure for orderbook-style options markets—sparking renewed growth in on-chain options.

We’ve long moved past the naive “decentralized is better” ethos of DeFi summer—every decentralized system must now answer one critical question: WHY!

01 Background of Decentralized Options

What Are Options?

To understand decentralized options, we must first address two fundamental questions: what are options, and why decentralize them?

At its core, an option is a choice—the buyer gains the right (but not the obligation) to buy or sell an asset at a predetermined price and time. The holder can exercise this right according to the contract’s terms.

An option is both a special financial contract and a volatility-linked instrument. Beyond reflecting the underlying asset's price movement, it also captures the rate of change, time decay, and other nuanced factors.

Options are risk-pricing tools. Their price dynamics reveal attributes invisible in spot or futures markets, offering investors additional dimensions for hedging risks and constructing portfolios.

Moreover, options serve multiple purposes. Understanding these helps identify precise user segments. In traditional finance, beyond leverage, options are used for:

1. Risk Management Tool

Options help manage risk across operational and compliance dimensions. Businesses face constant price fluctuations in raw materials and products. Besides using futures to lock in costs or revenues, they can purchase options to secure buying/selling rights at fixed prices within a timeframe—effectively capping expenses and income, guaranteeing minimum profits. For financial institutions, derivatives are complex and often fall into regulatory gray areas where options can offer unexpected advantages. Traders holding large positions may face high slippage when liquidating under margin calls; holding corresponding options during low-volatility periods converts potential liquidity loss into a fixed cost.

2. Financing Tool

Options are vital financing instruments. Beyond convertible bonds (a mix of bond + option), companies have historically raised capital by selling options. In October 2022, Tesla sold 5 million call options to raise $2.2 billion, granting buyers the right to purchase Tesla stock at $1,100 per share by January 2024.

3. Organizational Incentive Tool

Large organizations often use options to incentivize mid-to-senior management—a common practice in traditional finance, extensively studied in academic literature.

4. Leverage and Speculation Tool

Many investors use options to speculate—amplifying small capital into large returns, betting on time decay or volatility shifts—capabilities unmatched by most other financial instruments.

In 2020, as DeFi gained traction in spot markets, decentralized derivatives emerged via analogies from traditional finance. Users sought to capture value from centralized institutions' options businesses on open platforms. But how do we define decentralized options?

In traditional finance, options trade across various venues including exchange-traded and OTC markets.

What Are Decentralized Options?

Decentralized options are smart contracts on blockchains that possess option-like properties. Compared to traditional options, they are permissionless, transparent, default-risk-free, and highly composable with other DeFi products. Unlike centralized exchange or OTC options, execution is guaranteed by blockchain-based smart contracts—this is the only key difference.

Decentralized options originated as mappings of centralized markets. In traditional finance, the derivatives market dwarfs the spot market, with options volumes comparable to spot. After successes like Uniswap and Curve demonstrated smart contracts’ potential in finance, many teams saw opportunities in decentralized futures and options. During DeFi summer, the flaws of decentralization were overlooked, fueling a wave of innovation in decentralized options.

Why Are Decentralized Options Important?

Decentralized options offer three main advantages over centralized ones: 1) elimination of counterparty risk; 2) greater fairness; 3) deeper capital collaboration.

Unlike centralized options, decentralized options eliminate counterparty risk. Risk stems from uncertainty. On-chain execution environments are fully transparent—clearing rules and outcomes are deterministic and visible. With no ambiguity in settlement, there is no counterparty risk.

Traditional finance imposes strict准入门槛 to prevent malpractice, protecting users but excluding others. In contrast, all participants—including creators—operate under the same smart contract rules without privileges, making decentralized options more equitable.

Decentralized options are essential to DeFi. Their inclusivity, accessibility, and reduced regulatory burden give them potential to replace centralized options while serving the growing needs of the decentralized world.

For the decentralized options market to thrive, demand for such instruments must grow. Currently, on-chain options are mostly seen as gambling tools—used simply for leverage or volatility exposure, or as components in structured investment strategies.

02 The Market for Decentralized Options

New technologies differ fundamentally from traditional systems—not just in assets and users, but in distribution channels. Decentralized options diverge from traditional markets, enabling differentiated competition.

DeFi operates entirely on-chain. Ideal underlying assets are native digital assets. Handling off-chain assets inevitably involves centralization—falling under RWA (Real World Assets), constrained by compliance and inheriting centralization’s drawbacks.

Additionally, user bases differ.

First, traditional options have well-defined users, whereas decentralized options lack clarity. In traditional markets, industrial capital plays a major role—hedging raw material costs or locking in product revenues. These entities influence price discovery. Financial markets are bilateral risk-exchange platforms where industrial players supply risk and premium capital. In contrast, decentralized markets lack substantial real-world business activity. Only a few sectors—blockchains, oracles, data indexing, and select DeFi protocols—constitute meaningful on-chain industries. Take BTC: annual production is under 400,000 coins, representing less than $10 billion in hedgeable value. Without robust on-chain economic activity, genuine hedging demand remains weak—preventing the formation of a solid user base for decentralized options.

On-chain options favor programmatic over manual interaction. Their design should emphasize smart contract interoperability rather than direct user engagement.

Second, differing compliance preferences. Centralized options operate under full risk and compliance frameworks, serving legally defined qualified investors. Decentralized options lack robust compliance controls, attracting users indifferent to regulation.

Third, broader range of underlying assets. Cryptocurrencies exhibit extreme volatility, leading to high option premiums. Many lack regulatory oversight and suffer from concentrated holdings and price manipulation risks. Thus, centralized exchanges struggle to expand offerings beyond stablecoins, ETH, and BTC. Some decentralized exchanges introduce “private pools,” allowing market makers to independently assume exercise risk—enabling differentiation from centralized competitors.

Fourth, despite marketing tactics like token airdrops and trading rewards, participation remains sparse due to high complexity, entry barriers, and compliance concerns. Low activity leads to poor liquidity. To mitigate this, DEXs reduce available strike prices and expiration dates. Opyn even introduced perpetual options to further concentrate liquidity.

Fifth, while smart contracts eliminate default risk, this requires collateral value to exceed potential losses—meaning funds are typically over-collateralized. Capital efficiency suffers as a result.

03 Bottlenecks in Decentralized Options Market Development

Decentralized options represent an exciting new asset class—but remain in early development. Several bottlenecks must be overcome before reaching full potential.

High Costs

One major bottleneck is the high cost of using decentralized options. Multiple factors contribute: operational fees, risk costs, and education costs.

Operational fees refer to gas paid to miners for on-chain transaction processing. On popular chains like Ethereum, gas fees can be prohibitively high. Some projects require oracle feeds, adding further expense—making decentralized options inaccessible to many users.

Risk cost is another contributor. As a relatively new sector, decentralized options lack extensive historical data. From both technical and design perspectives, we cannot yet prove the system’s safety through induction. This perceived risk hinders mass adoption.

Finally, education costs add to the barrier. Decentralized options are complex and difficult to grasp. Users need deep understanding to use them effectively—an obstacle for many.

Immature Market

Another bottleneck is market immaturity—not only higher risk compared to traditional markets, but also a lack of stable, essential demand. This makes finding counterparties difficult, limiting liquidity. Poor liquidity forces platforms to restrict choices to concentrate trading activity, reducing convenience.

Market immaturity also shows in usage. Traditional options serve multiple roles: compliance-driven hedging (e.g., regulatory arbitrage), corporate financing, employee incentives, and operational risk mitigation. None of these uses are well-developed in decentralized options.

Low Capital Efficiency

Another bottleneck is low capital utilization in margin requirements. In traditional finance, platforms allow some margin risk exposure based on centralized credit. They hold user data and can pursue recourse in case of shortfall. But in decentralized options, users are semi-anonymous and platforms lack enforcement power. If margin fails to cover losses, the platform bears the cost.

On centralized exchanges, all user assets are managed centrally, allowing non-cash assets as collateral. In contrast, decentralized platforms require ownership transfer before assets can be pledged.

Without recourse mechanisms, decentralized platforms must minimize shortfall risk—leading to higher margin ratios or elevated risk premiums, a suboptimal compromise.

Immature Infrastructure

Decentralized options rely on immature infrastructure—wallets, exchanges, etc. These tools are often complex, unreliable, or insecure. Private key management is challenging; wallets get hacked. Exchange interfaces are clunky, lacking analytical tools and user support.

Despite these challenges, significant progress has been made. New projects are tackling these issues head-on, and the market is growing rapidly. As it matures, we can expect solutions to emerge, making decentralized options more accessible and user-friendly.

04 Landscape of the Decentralized Options Sector

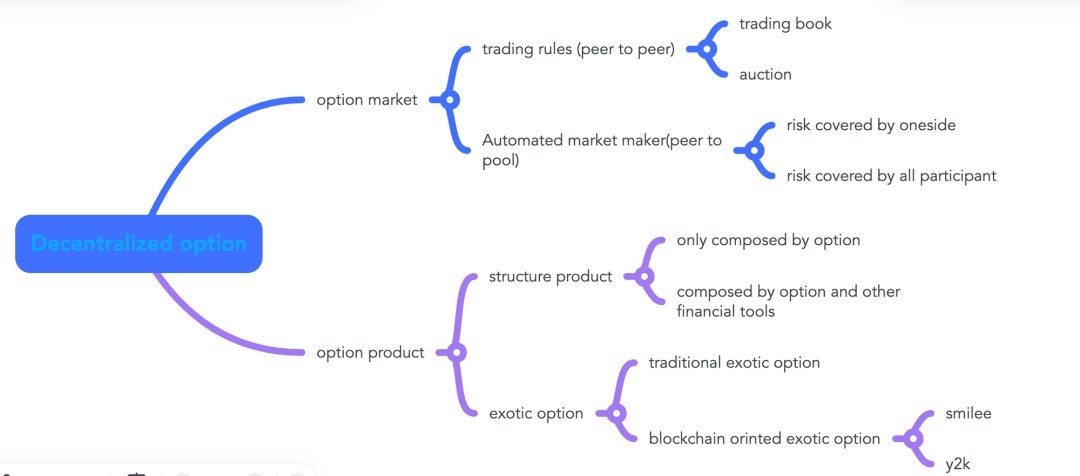

The decentralized options space can be segmented by problem focus: option issuance, market making, and structured products built atop options.

Decentralized options vary along multiple dimensions.

From a pricing mechanism perspective, models include algorithm-driven "pool-based" (peer-to-pool) and counterparty-quoted "peer-to-peer" systems. Pool-based models split into public pools (uniform algorithmic pricing) and private pools (each pool runs its own pricing logic; market price aggregates across pools). Peer-to-peer models differ in execution—order books vs auctions.

By option type: standard vs exotic options. To address liquidity constraints, perpetual options emerged—no expiry date. However, they lose sensitivity to time decay.

By margin structure: some projects require full collateral, others allow partial. Partial-margin models increase flexibility. In my view, undercollateralized options resemble option spread strategies. Cross-margin designs improve capital efficiency. Smart contracts handle liquidations—even if repayment is incomplete, profit/loss outcomes remain transparent.

Automated Classic Option Market Making

Asset pricing lies at the heart of finance. How to price options—and establish a pricing mechanism—is the crown jewel of on-chain models. Prices closer to equilibrium stimulate trading, enhance capital efficiency, and generate higher returns. Market-making mechanisms solve this pricing challenge. Years of experience show exchanges and market makers enjoy lucrative businesses—naturally attracting capital and talent.

Automated market makers (AMMs) are a DeFi innovation. From spot to futures, the evolution continues into options. Leading this trend is Lyra.

Lyra

Lyra’s market-making model builds on lessons from Synthetix, GMX, and other DeFi pioneers. It uses liquidity pools as counterparties to all traders, pooling capital to absorb risk. Lyra decomposes option risk into Delta (from underlying price moves) and Vega (from volatility changes). Delta risk is hedged via futures pools; Vega risk is absorbed by the pool, compensated by fees. Ultimately, Lyra’s quote = Black-Scholes base price + risk premium adjustment. This risk premium fluctuates with the pool’s net risk exposure.

This approach works well for high-liquidity assets—those dominating the market. BTC alone accounts for over 75% of fungible token market cap. Whoever captures the top-tier assets dominates the entire options market. However, these major assets are already heavily covered by centralized exchanges. The downsides of centralization only surface during crises, but entrenched habits favor convenient, user-friendly centralized platforms.

Deri

Deri is a comprehensive financial platform acting as a market maker. It uses DPMM (Dynamic Pricing Market Maker), similar to Lyra: start with a BS-model baseline, then adjust based on platform position size, guiding net exposure toward zero.

Optix

Optix adopts a market-maker-plus-trader structure, emphasizing independent pools with self-directed P&L and fair competition. The platform hosts multiple pools, each linked to oracles and responsible for pricing specific products. One pool can back multiple assets. Thus, Optix delegates pricing authority to autonomous strategy pools—each functioning as a market maker. Optix acts more like an asset management tool for option collateral, handling fee collection and payout logistics.

Because pools bear their own risks, Optix tolerates higher risk. It supports not only high-decentralization, high-liquidity assets like BTC and ETH, but also other ERC20 tokens. If Lyra uses math to unlock liquidity in mainstream markets, Optix uses game theory to activate long-tail trading. While mainstream pricing matters, supporting long-tail assets ensures options fulfill their functional purpose.

Still, observing Optix’s listed assets, many small-cap tokens remain absent—due to lack of incentive for market makers.

Premia

Premia emphasizes equal treatment for all traders. It uses an order book model for quoting and trading. It offers automated market-making algorithms for retail investors and dedicated pool services for institutions and professionals.

I believe accurate market maker quotes are essential for efficient liquidity creation. Hence, AMM pricing algorithms are core assets. Though Optix and Premia contain centralized elements (e.g., oracle data possibly sourced privately), we cannot conclude hybrid models fail to generate efficient liquidity.

Panopic

Panopic treats Uniswap LP shares as synthetic options. To create an option, provide liquidity to a pool; to hold an option, withdraw liquidity.

Panopic also employs partial-margin systems. Unlike closed centralized options, where shortfall risk is unknown until liquidation, on-chain data combined with liquidation logic allows traders to assess counterparty risk. In other words, option prices can better reflect counterparty risk. These experiments are nascent—let’s wait and see.

Hegic

Founded in 2020, Hegic was a pioneer in decentralized options. Born in an era of high on-chain costs and strong anti-centralization ideology, Hegic simplified complex option pricing (dependent on time, strike, volatility) into a model based only on market price and interest rates—the longer the term, the higher the rate. Clearly, this design has severe limitations. When volatility rises, fair option prices should exceed Hegic’s quotes; when low, vice versa. Its pricing ignores supply and demand.

Regarding risk dilution, Hegic pits buyers against sellers—the liquidity providers bear all losses.

Aevo

Aevo replicates traditional centralized options exchanges on Layer 2, following the principle of performing complex computations off-chain and recording final results on-chain. Thus, Aevo is a hybrid exchange. As a Layer 2 order-book-based options exchange, it supports cross-margin functionality, with liquidation mechanics similar to centralized exchanges: first auto-deleverage, then close profitable positions if undercollateralized, with any remaining deficit covered by an insurance fund. Note: Aevo is a multi-product platform offering not just options, but also perpetual futures and lending. Building on core services, it offers structured products—like Lyra, forming a DeFi matrix.

After more than three years, we’ve seen decentralized pricing systems become increasingly sophisticated and efficient. Coupled with maturing infrastructure, the on-chain options sector is gradually reaching maturity. Like most current on-chain projects, the goal isn’t merely matching centralized platforms—it’s doing things centralized platforms cannot. We’re nearly there—we now need to identify demands that centralized systems can’t meet.

Structured Products

As decentralized options evolve, so do structured products built on them. However, current innovations have little connection to decentralization or blockchain architecture—many have counterparts in centralized options tools.

Structured products use smart contracts or programs to automate interactions with decentralized options.

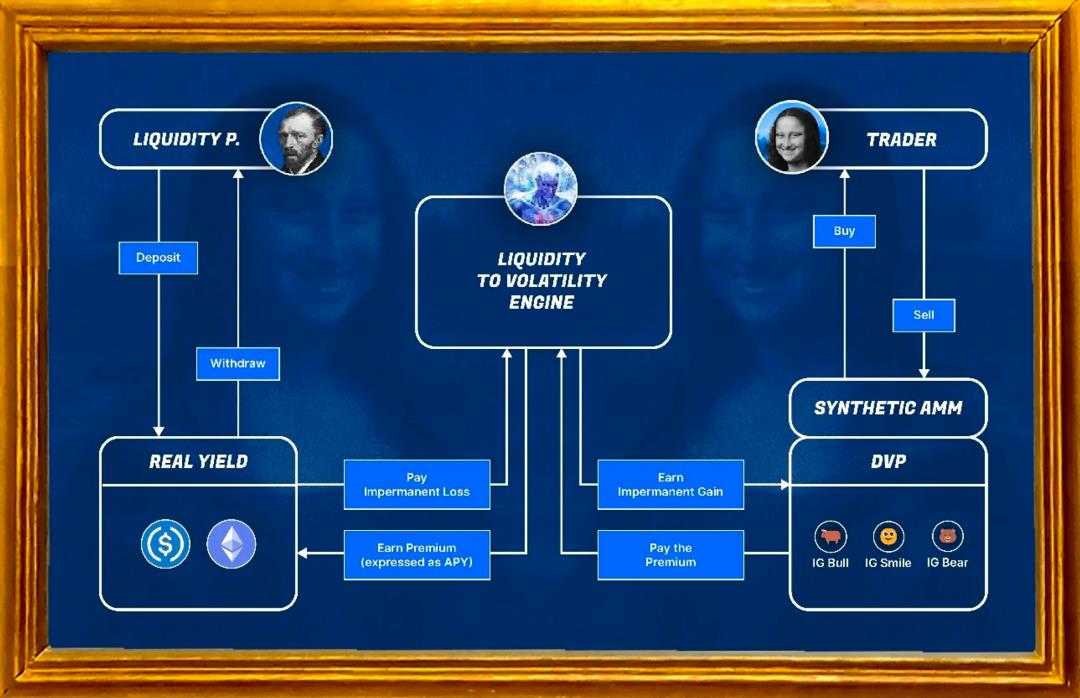

We know options hold significant value as hedging tools—like insurance, users pay premiums to mitigate risk. But only if product design addresses real risks. For example, someone earning ~20% APY in AMM liquidity provision faces impermanent loss despite hedging directional risk via futures. Paying a premium to hedge impermanent loss—ensuring residual yield exceeds U.S. Treasury rates—creates a risk-free arbitrage mechanism. Such mechanisms could provide sustainable profits for option sellers, moving beyond zero-sum speculation.

Ribbon Finance and Theanuts Finance focus on raising funds for simple covered call/put-selling strategies—mirroring centralized exchanges’ yield-enhancement products. By selling short-dated out-of-the-money options (rarely exercised), they aim for steady positive cash flow. If designed carefully, consistent profitability is possible. Reality check: Ribbon relies on external institutions for auction-based pricing, losing control over valuation—most of its structured products are currently unprofitable.

Cega offers structured wealth products: if a basket of assets doesn’t hit an extreme price (e.g., drop 50%) within 27 days, investors earn yield; otherwise, payouts go to counterparties. Essentially, it’s bond + out-of-the-money put option.

BracketX offers short-term (2-day) volatility range betting products—whether the underlying hits predefined price boundaries. Outcome determines payment direction. This combines basic options into accessible instruments, lowering complexity.

Others like Hegic offer frontends for one-click deployment of option combination strategies.

The proliferation of structured products highlights DeFi’s trustless, regulation-light nature—breaking monopolies and lowering barriers to derivative issuance. Yet, their designs aren’t inherently tied to decentralization or blockchain. Twin products exist on centralized exchanges. True intelligence in structured products remains underdeveloped.

Exotic Option Design

Most options platforms support native option issuance. However, focused on high-traffic assets, they often neglect niche markets like exotic options—giving rise to specialized projects.

Exotic options mainly serve on-chain ecosystems—the standout being Y2K Finance. It offers binary options betting on stablecoin depeg events, with pricing determined by bid-ask distribution. Y2K’s flaw: unclear yields. Prices adjust dynamically based on wager sizes, meaning users enter bets with uncertain odds.

Some projects, aiming to consolidate liquidity and simplify options, created perpetual options. This represents a radical exploration of expiration timing. If American options extend European options’ exercise window, perpetual options remove the wall entirely—exercisable anytime. In return, they sacrifice sensitivity to time decay. Perpetual options aren't suitable for speculating on time-value fluctuations. A novel product, they avoid direct competition with centralized exchanges but suffer from scarce pricing tools and high learning curves. So far, user onboarding has been poor. Without sufficient incentives, users lack motivation to learn. Among perpetual options, Opyn and Deri stand out. Opyn pioneered the concept, backed by Paradigm, gaining first-mover advantage. Deri expanded from perpetual futures to perpetual options using a Synthetix-like strategy, offering “comprehensive” financial services.

Smilee Finance focuses on impermanent loss risk, aiming to price and tradable IL risk. It uses perpetual option design, pricing via BS model. The product divides the volatility smile into bull, bear, and full segments—allowing amplified leverage when selecting directional exposures.

Opyn enhances hedging tools via options. While Smilee directly targets impermanent loss, Opyn attempts to replicate it using Squeeth + traditional financial instruments. Squeeth offers convex returns. Like other novel financial tools, Squeeth struggles with high learning barriers and slow adoption.

05 Ecological Positioning of Decentralized Options

Decentralized options lack user visibility. For ecosystem builders, success means either traffic or cashflow. Traffic belongs to social and gaming apps, enhanced by wallet UX. Traditional options users are high-net-worth individuals, constituting only ~1% of spot traders. Thus, options can’t drive user acquisition. Cashflow comes from trading or lending. Trading-wise, decentralized perpetuals already offer 200x leverage—leaving little room for options-based leverage.

Does this mean options have no role in ecosystem growth? Not necessarily.

As previously noted, options uniquely price volatility and enable risk management. Today’s blockchain market remains primitive—far from fine-grained risk control.

When decentralized options achieve capital efficiency on par with centralized platforms, and as traditional capital increasingly integrates with blockchain—RWA transitioning from vision to reality—investor profiles will shift. Preferences will evolve from high-risk/high-return to low-risk/moderate-return. Perhaps we’re at a pivotal moment of transformation.

We’re in the midst of the Layer 2 wars. Standing out via traditional successful apps is extremely hard. Controlling risk and building financial systems with varied risk appetites may be the key to winning the DeFi battle within the Layer 2 war. Who remembers UST’s contribution to Luna? Not all investors enjoy wild swings.

Spot succeeded. Futures succeeded. Is the spring for options far behind?

06 Conclusion

Post-DeFi summer, the decentralized derivatives sector has grown rapidly, forming a landscape centered on classic BTC/ETH options, flanked by various ERC20 and exotic options. Projects remain siloed—with no option aggregator emerging. Few synergies exist with other blockchain sectors. Some aim to bridge liquidity between spot, futures, and options. In an era of expensive traffic, operating a DeFi matrix significantly reduces costs.

In option pricing, I believe the future lies in pool-based, automated market-making models—platforms pitting users against each other, sharing extreme risks collectively. Structured products continue evolving—the key to success lies in creating low-risk, moderate-return on-chain instruments.

Current usage of decentralized options lacks distinctive on-chain advantages. On-chain players lag far behind centralized exchanges. Without clear benefits, users lack incentive to learn decentralized systems. On-chain industries haven’t scaled, nor shown urgent need for risk management. Traditional functions like option-based financing and incentives remain absent in on-chain operations—one sign of DAOs’ immaturity.

Compared to decentralized spot exchanges enabling low-cost token trading, or decentralized futures allowing 100x+ leverage without borrowing, options don’t occupy a core demand position in today’s Layer 2 competition. Battles are fought over capital flows and user traffic. Credit creation is currently more critical. Yet, we shouldn’t underestimate options—the ultimate risk tool. They offer us a chance to redefine the very attributes of on-chain assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News