Pantera Open Letter: BTC to Rise to $35,000 Before Next Halving, Then Reach $148,000 After Halving

TechFlow Selected TechFlow Selected

Pantera Open Letter: BTC to Rise to $35,000 Before Next Halving, Then Reach $148,000 After Halving

Even if we assume that everyone knows something, it doesn't mean there isn't a significant profit to be made.

Author: Panteracapital

Translation: TechFlow

This article is from Panteracapital's August open letter titled "Positive Black Swans."

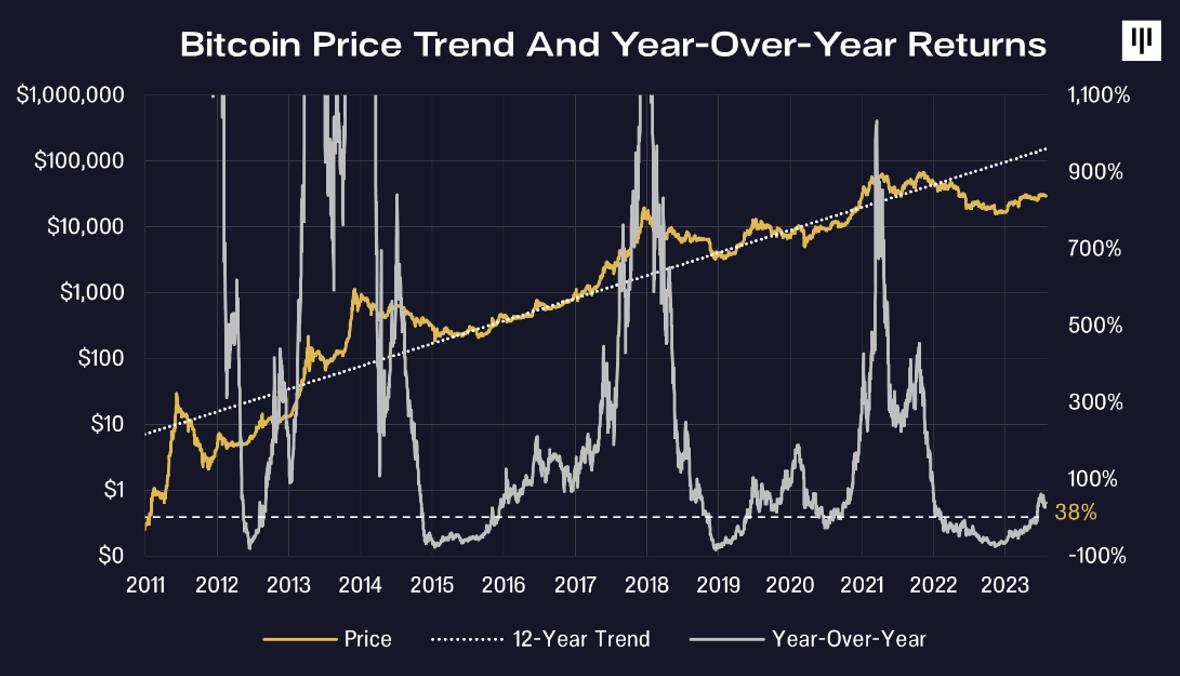

Bitcoin has experienced its longest-ever period of negative year-over-year returns, lasting 15 months (from February 8, 2022, to June 12, 2023). The previous longest stretch was less than a year (from November 14, 2014, to October 31, 2015).

We believe we've seen enough—the market cannot keep falling indefinitely.

We believe that recent developments—such as the XRP ruling and institutional endorsements like BlackRock—combined with the anticipated Bitcoin halving in April 2024, will strongly position digital assets for the next bull market.

Bitcoin Halving: Background

Bitcoin’s monetary supply mechanism is the exact opposite of quantitative easing. The Bitcoin protocol stipulates that only 21 million coins will ever be issued, and new coin issuance decreases over time.

Currently, 6.25 bitcoins are issued every ten minutes. Every four years, the “block reward” is cut in half—hence the term “halving.” This process will continue until the year 2140, when all 21 million bitcoins will have been fully mined.

Bitcoin’s supply and coin distribution rules are entirely based on mathematics, designed to be predictable and transparent.

“The total circulation will be 21 million. Coins will be distributed to network nodes when they generate blocks, halving every four years. First four years: 10.5 million coins. Next four years: 5.25 million coins. Following four years: 2.625 million coins. Then four more years: 1.3125 million coins. And so on.”

—Satoshi Nakamoto, Cryptography Mailing List, January 8, 2009

Next Year’s Halving

The next halving is expected to occur on April 20, 2024. The mining reward per block will decrease from 6.25 BTC to 3.125 BTC.

The efficient market theory suggests that if we all know it’s coming, then it’s already priced in. As Warren Buffett once said, “Markets are almost always efficient, but the difference between markets is, to me, almost always $80 billion.” Thus, even if we think everyone knows something, it doesn’t mean there isn’t massive profit potential remaining.

“Investing in a market where people believe in market efficiency is like playing bridge with someone who’s been told it’s useless to look at the cards.”

—Buffett, 1984, quoted in Davis, 1990

If demand for newly minted bitcoins remains stable while the supply is halved, prices will be forced upward. Historically, demand for Bitcoin increases before halvings as people anticipate price rises.

For years, we’ve emphasized that the halving is a major event, but one that unfolds over multiple years.

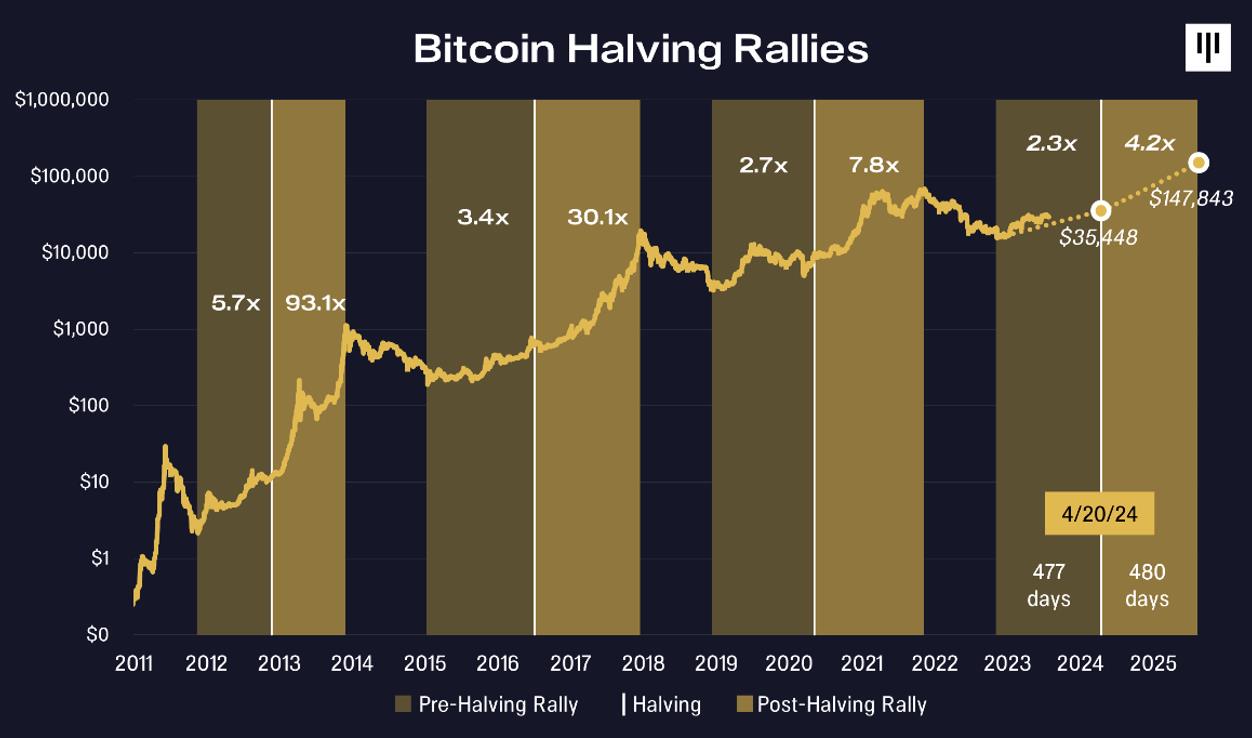

Historically, Bitcoin has bottomed around 477 days before the halving, then climbed into and through the halving event, followed by explosive growth. On average, the post-halving rally lasts about 480 days from the halving to the peak of the next bull cycle.

If history repeats itself, Bitcoin’s price should have bottomed on December 30, 2022.

The actual low occurred on November 9, 2022—during the FTX collapse—over a month earlier than expected.

We would then expect a rebound in early 2024, followed by a strong surge after the actual halving. The chart below shows what might happen if Bitcoin repeats its historical performance around past halvings.

Bitcoin’s current price has already surpassed our pre-halving forecast of $35,500/BTC, now trading 7% above that projected level.

Price Forecast Based on Stock-to-Flow Model

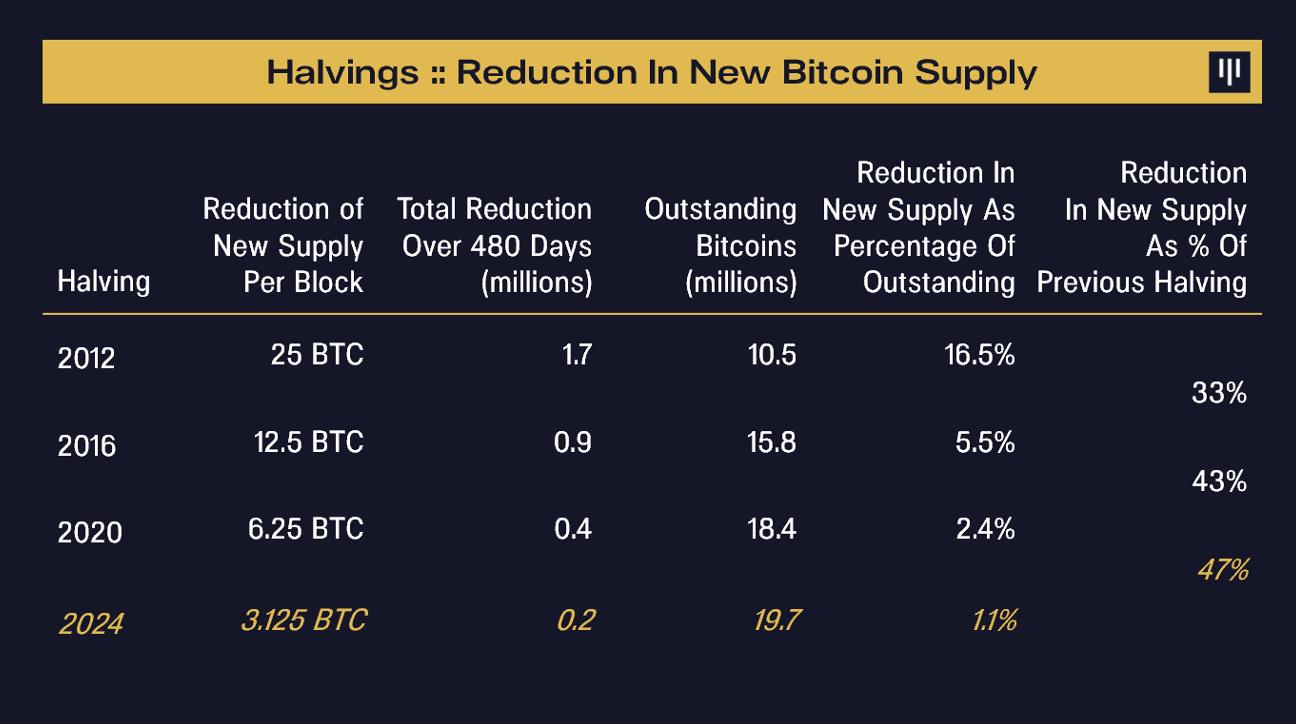

The framework we use to analyze the halving’s impact examines changes in the stock-to-flow ratio at each halving. The first halving reduced the supply of new bitcoins by 17% of the total circulating Bitcoin. This had a massive impact on new supply—and consequently, on price.

As each subsequent halving reduces the rate of supply decline compared to the prior one, the price impact of each halving may gradually diminish. The chart below shows the percentage reduction in new Bitcoin supply relative to total circulating supply at past halvings.

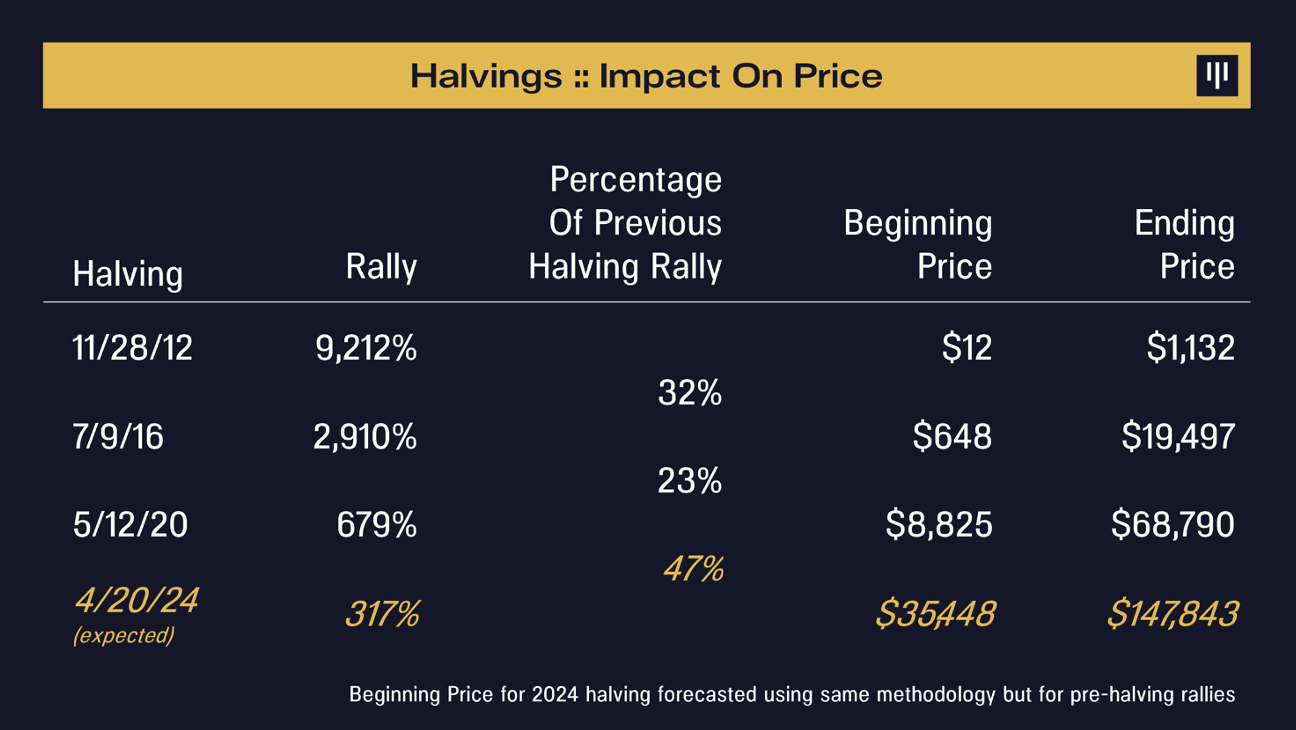

The 2016 halving reduced new Bitcoin supply by only one-third compared to the first halving. Interestingly, its price impact was also roughly one-third.

The 2020 halving reduced new Bitcoin supply by 43% relative to the previous halving. Its price impact reached up to 23%.

The next halving is expected on April 20, 2024. Since most Bitcoins are already in circulation, each halving now nearly cuts the new supply rate in half. If history repeats, Bitcoin will rise to $35,000 before the halving and reach $148,000 afterward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News