From trustless BTC to tokenized gold, who is the true "digital gold"?

TechFlow Selected TechFlow Selected

From trustless BTC to tokenized gold, who is the true "digital gold"?

Bitcoin relies on algorithmic consensus to achieve "trustlessness," while tokenized gold depends on institutional credit, representing a "re-trusting" model.

Have you noticed that more and more people around you are talking about "gold" recently?

Yes, I mean physical gold. With rising geopolitical risks and increasing global macroeconomic uncertainty, the total market capitalization of gold has (momentarily) reached $30 trillion, firmly securing its position as the top asset class globally.

Meanwhile, something quite interesting is happening in the crypto world: beyond Bitcoin, widely regarded as "digital gold," physical gold is rapidly moving on-chain. Tokenized gold, represented by Tether Gold (XAUT), has gained new capabilities through the RWA wave—divisibility, programmability, and even yield generation.

It is challenging a narrative long dominated by Bitcoin: "Who truly deserves to be called digital gold?"

01. BTC: A Decade-Long Evolution of Narrative

Is BTC currency or an asset? Is its core function payment or value storage? Or perhaps it's better categorized as a risk asset akin to tech stocks?

Since its inception in 2009, this question has run throughout nearly every phase of Bitcoin’s history.

Although Satoshi Nakamoto clearly defined BTC as "Electronic Cash" in the whitepaper, as BTC's scale evolved over the past decade, the narrative has repeatedly flipped, sparking endless debates within the community—from early payment tool, to "value storage," to "alternative asset."

Especially with the official approval of spot ETFs in 2024, a turning point emerged. Fewer people now believe Bitcoin will become a "global currency" for transactions and payments. Instead, an increasing number view Bitcoin as a consensus-backed store of value—namely, "digital gold":

Like gold, it has a fixed supply and predictable, steady issuance, while offering advantages gold cannot match: superior divisibility (1 satoshi = 0.00000001 BTC), portability (cross-border transfers in seconds), and liquidity (a 7×24 market).

As a result, Bitcoin is gradually becoming the third global store-of-value logic within the macro monetary system, after the US dollar and gold.

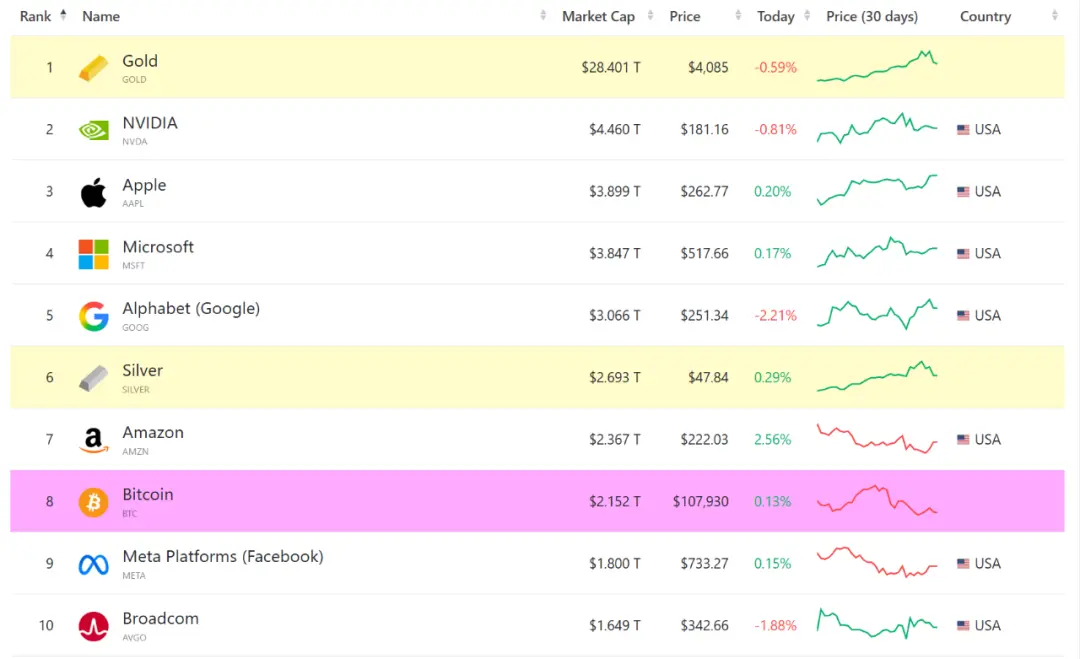

Source: companiesmarketcap.com

According to statistics from companiesmarketcap, gold currently holds an absolute lead among the world's Top 10 assets, with a total market cap ($28.4 trillion) far exceeding the combined value of the next nine ($26 trillion).

Keep in mind, even with BTC surpassing $100,000, its total market cap is only about $2 trillion—roughly 1/15th of gold’s. This gap is precisely the underlying motivation driving the BTC community to emphasize the "digital gold" narrative, aiming at the largest and oldest store of value in traditional finance.

Ironically, just as BTC strives to align itself with the "digital gold" narrative, gold itself is being "digitized."

The most direct catalyst is the repeated all-time highs of physical gold prices, coupled with this year's RWA surge, propelling tokenized gold products like Tether Gold (XAUT) and PAX Gold (PAXG) into rapid growth.

Backed by physical gold—each token issued corresponds to an equal amount of physical reserves—these "digital gold" products represent a new financial species for both the crypto and traditional finance (TradFi) worlds.

02. The Surging Wave of Gold RWA

Saying tokenized gold has "suddenly emerged" might not be entirely accurate.

Strictly speaking, neither XAUT—the largest by volume—nor PAXG, its close follower, are newly launched viral products. Rather, the current RWA wave and macro market conditions have elevated their strategic significance and attracted renewed attention.

Take XAUT, for example. Its origins trace back to late 2019, when Paolo Ardoino, CTO of Bitfinex and Tether, revealed plans for Tether to launch Tether Gold, a gold-backed stablecoin. The XAUT whitepaper was officially published on January 28, 2022.

The whitepaper explicitly states that each XAUT token represents ownership of one troy ounce of physical gold. Tether guarantees that physical gold reserves match the number of tokens issued, with all gold stored in "high-security Swiss vaults."

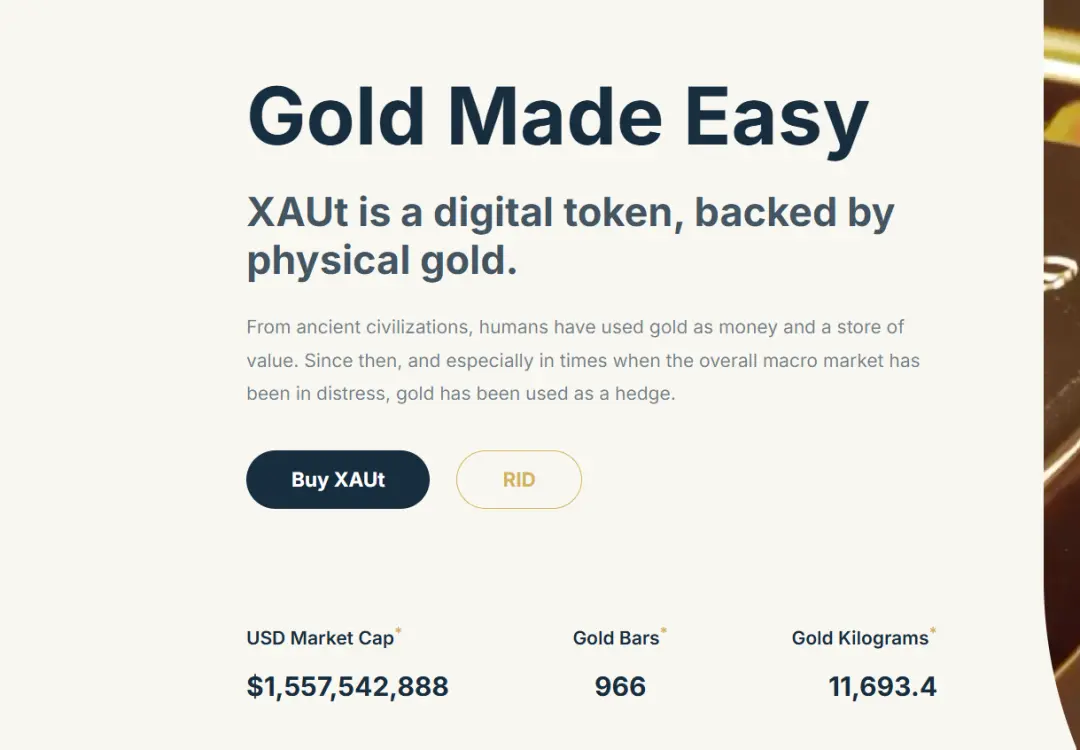

At the time of writing, XAUT’s total issuance exceeds $1.55 billion, representing approximately 966 gold bars (totaling 11,693.4 kilograms) in physical reserves.

Source: Tether

In the Tether Gold whitepaper, its competitive advantages are clearly outlined:

-

Compared to physical gold, "gold stablecoins" allow precious metals—which are hard to divide—into smaller denominations, making them easier to carry and transport, significantly lowering the barrier for individual investors;

-

Compared to gold ETFs, they enable 7×24 trading without custody fees, greatly improving transfer speed and efficiency;

-

In short, Tether Gold allows users to enjoy the benefits of underlying gold while gaining high liquidity and divisibility.

In other words, tokenization grants real gold the unique "digital attributes" previously exclusive to BTC, fully integrating it into the digital world as a freely movable, composable, and computable asset unit. This step transforms tokenized gold products like XAUT from mere "on-chain gold receipts" into assets with vast on-chain potential.

Naturally, this trend prompts the market to reconsider: when both gold and BTC become on-chain assets, is their relationship competitive or symbiotic?

03. Reflections on Tokenized Gold vs. Digital Gold

Overall, if BTC's core narrative is "scarce consensus in the digital world," then the key distinction of tokenized gold (XAUT/PAXG) lies in "bringing scarce consensus into the digital world."

This subtle yet fundamental difference reflects how BTC creates trust entirely from scratch, whereas tokenized gold digitizes traditional trust structures. As CZ recently tweeted:

"Tokenized gold isn't truly on-chain gold—it relies on trust in the issuer's ability to fulfill obligations. Even in extreme scenarios like management changes or war, users still depend on the continuity of this trust system."

This statement highlights the essential difference between tokenized gold and Bitcoin: Bitcoin's trust stems from algorithmic consensus, with no central issuer or custodian, while tokenized gold relies on institutional credit—requiring trust that Tether or Paxos will strictly adhere to their reserve commitments.

This means Bitcoin is a "trustless" product, whereas tokenized gold is an extension of "re-trusting."

Of course, from the perspective of added asset value, in traditional finance, gold’s core value lies in hedging and preservation. But within blockchain, tokenized gold gains programmability for the first time:

-

It can serve as collateral in DeFi protocols, allowing users to borrow stablecoins on platforms like Aave and Compound for leverage or yield management;

-

It can be integrated into smart contract logic, creating yield-bearing gold ("gold with interest");

-

It can freely circulate across different networks via cross-chain bridges, becoming a stable, liquid asset across multi-chain ecosystems;

The essence of this transformation is turning gold from a static store of value into a dynamic financial unit. Through tokenization, gold acquires Bitcoin-like digital attributes—verifiable, transferable, composable, and computable. This means gold is no longer merely a symbolic value sitting in vaults, but becomes a "living asset" on-chain capable of generating returns and credit.

Objectively speaking, amid tightening liquidity and weak alt assets, the rise of the RWA wave has brought traditional assets like gold, bonds, and stocks back into the crypto spotlight. The growing popularity of tokenized gold indicates that the market is seeking a more stable and certain on-chain value anchor.

From this perspective, the accelerated development of tokenized gold under the RWA wave does not aim to—and cannot—replace BTC. Instead, it perfectly complements BTC’s "digital gold" narrative, emerging as a new financial species combining the efficient liquidity of digital assets with the risk-hedging certainty of traditional gold.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News