LSDfi Evolution History: From Staking Protocols to Collateral Diversification – Which Projects Are Worth Watching?

TechFlow Selected TechFlow Selected

LSDfi Evolution History: From Staking Protocols to Collateral Diversification – Which Projects Are Worth Watching?

In this article, author ValHolla will divide the development of LSDfi into three phases and introduce some projects that have made breakthroughs in the LSDs space.

Written by: ValHolla

Translated by: TechFlow

It's widely known that Ethereum's Merge would have a positive impact on decentralized finance (DeFi), but within less than a year, it has already exceeded even the most optimistic expectations. One of the clearest manifestations of this is in LSDfi—the DeFi ecosystem built atop liquid staking derivatives, which continues to evolve rapidly. This narrative has been around for some time, making it worthwhile to explore its origins and, more importantly, its future trajectory.

In this article, ValHolla breaks down the development of LSDfi into three phases and highlights several projects pioneering breakthroughs in the LSD space. One thing is certain: the outlook is bright, and what we’ve seen so far is just the beginning.

Phase One: Liquid Staking Protocols

Entering 2023, LSD providers like Lido and Rocket Pool became among the hottest projects in crypto. As you may know, these protocols allow users to lock their ETH into smart contracts and stake it to help secure the network. In return, users receive liquid tokens such as stETH or rETH—LSDs representing their staked ETH. The result is a tradable, lendable liquid token that continues to accrue staking rewards from ETH itself.

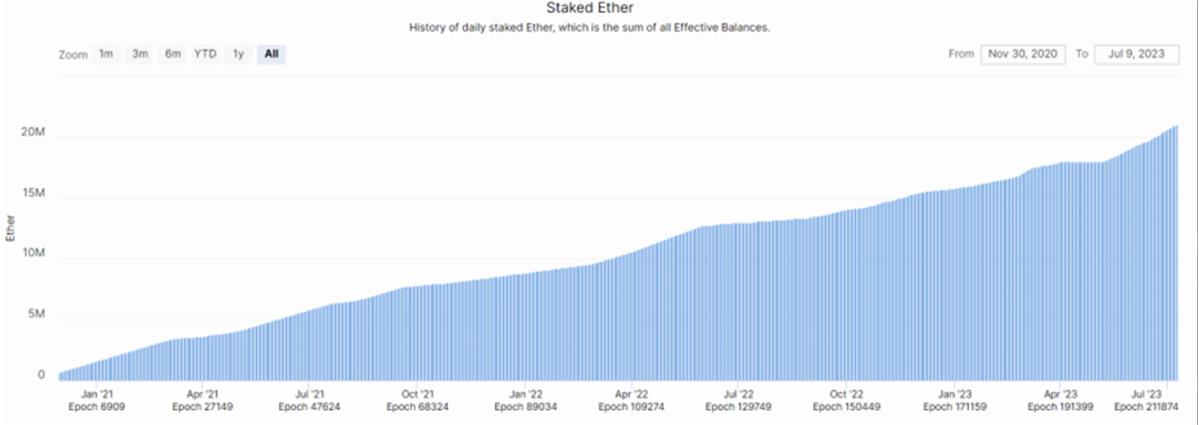

Earlier this year, many believed these protocols would benefit from rising staking demand, especially after withdrawal functionality was enabled. It’s safe to say this trend has played out in a strongly bullish manner. Just look at the increase in validator counts:

Likewise, the amount of staked ETH continues to climb rapidly:

By maintaining liquidity for staked tokens, LSD providers have played a crucial role in encouraging users to stake their Ether with confidence. However, these staking protocols are not the only beneficiaries. If we consider these protocols as first-level beneficiaries of LSDfi, we can dive deeper into subsequent layers.

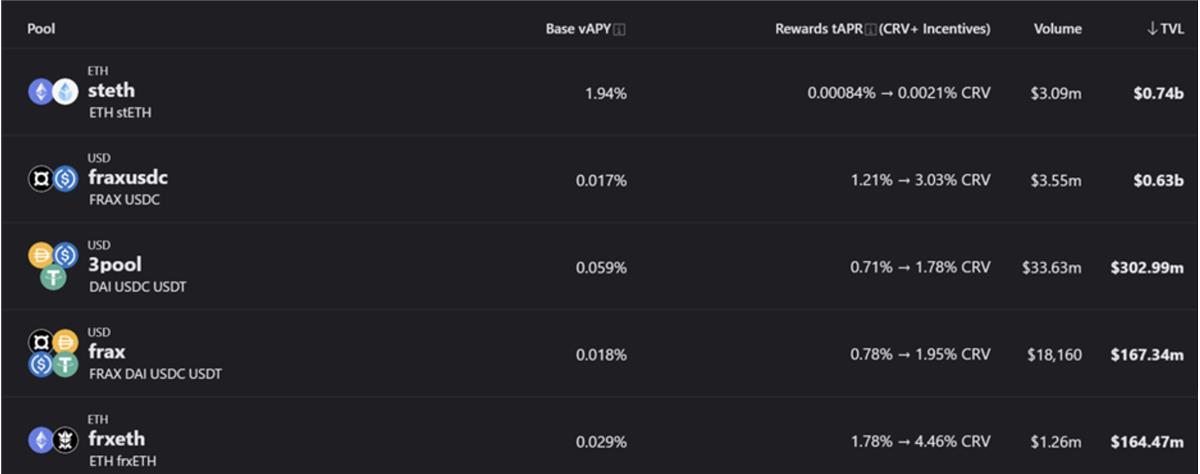

Once LSDs emerged, there was a logical need to find ways to keep them pegged to their underlying assets. The last thing we want is a repeat of what happened last summer, when stETH—the largest ETH LSD—depegged due to forced selling by institutions like 3AC. As a result, protocols like Curve and Balancer saw massive inflows into liquidity pools associated with ETH LSDs, significantly boosting their total value locked (TVL).

Currently, Curve’s stETH/ETH liquidity pool is the most significant LSD liquidity pool in DeFi, with approximately $740 million in TVL. Their frxETH/ETH pool also holds over $164 million, ranking as the fifth-largest liquidity pool on mainnet.

Balancer is another example—three of their top four liquidity pools on mainnet are LSD-related, collectively holding over $136 million in TVL, accounting for more than 13% of their total.

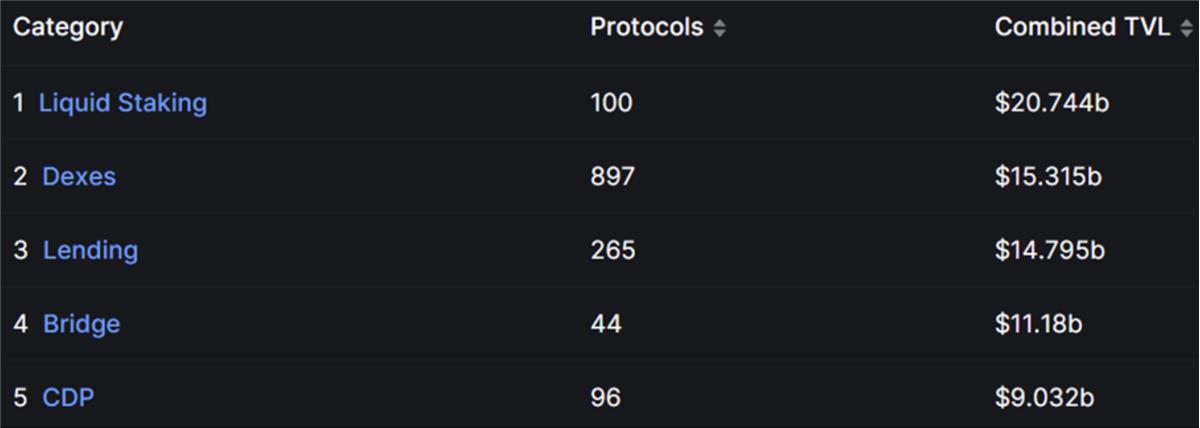

Looking across the landscape, LSDs have effectively become the largest source of TVL in DeFi:

Zooming out further makes the picture even more striking: currently, about 10 million ETH are deposited into liquid staking protocols—a figure that has grown over fivefold since early 2022!

During the same period, nearly every other project in DeFi and broader crypto collapsed. So if LSDfi experienced such growth, it clearly must be delivering real innovation.

With this context in mind, let’s move into phase two.

Phase Two: LSDs as Collateral

The second phase of LSDfi consists of a series of projects sharing a similar core concept: users lock LSDs into CDPs and then mint or borrow stablecoins against them.

You might be tired of hearing about new LSD-backed stablecoins, but don’t let the growing number of protocols using this model distract from its significance. Personally, I believe so many protocols are adopting this approach because it represents an incredibly compelling use case.

This not only further expands LSD utility but also brings much-needed decentralization to the existing stablecoin market. Moreover, by definition, LSDs earn yield from their underlying assets through performing tasks like securing PoS blockchains. Staking yields typically exceed what most money markets pay depositors (unless heavily incentivized), giving users an inherent advantage. Effectively, using yield-bearing tokens as collateral turns each CDP position into a self-repaying loan.

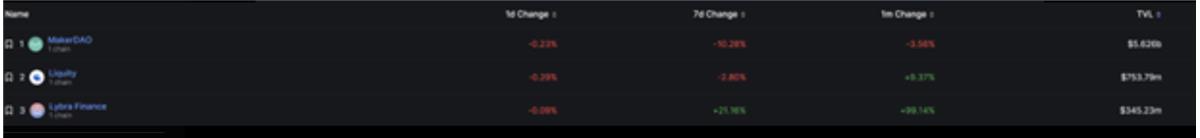

To date, the biggest beneficiaries of phase two include Lybra, Curve, and Raft.

Lybra

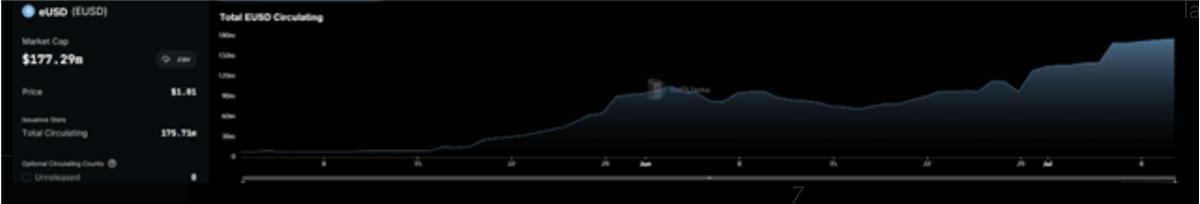

Lybra has generated considerable buzz on social media over recent months—and rightfully so. Its eUSD stablecoin, backed by ETH and stETH, has reached a market cap of $177 million. Among decentralized stablecoins, only DAI, FRAX, and LUSD rank higher.

In under three months, Lybra has accumulated $345 million in TVL, making it the third-largest CDP protocol on Ethereum, trailing only Maker and Liquity—a great company to be in!

Curve

Curve’s CRVUSD stablecoin is backed by wstETH, WBTC, sfrxETH, and ETH.

In total, over $120 million worth of these assets have been deposited as collateral, with more than 80% coming from the two LSDs on the list (wstETH and sfrxETH).

As a result, nearly $80 million in crvUSD is now in circulation—an increase of over 7x since June 7.

Raft

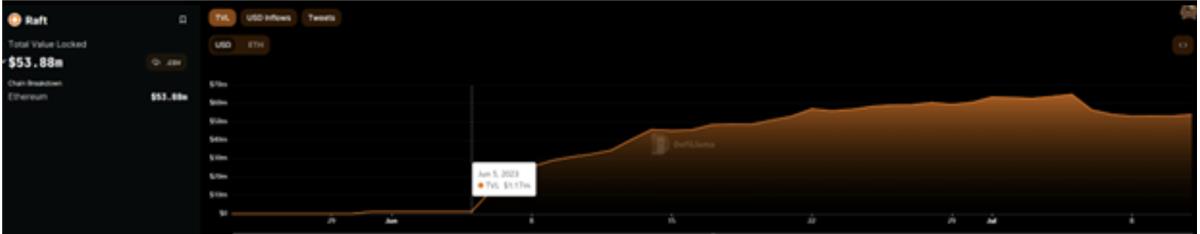

Compared to the previous two protocols, Raft and its LSD-backed stablecoin R have remained somewhat low-key, yet they’ve still made impressive progress. Within weeks, Raft’s TVL surged from $1 million to between $55 million and $60 million, currently sitting near $54 million.

So far, over 99% of R’s supported assets come from stETH as collateral. However, they also accept rETH from Rocket Pool, and additional collateral types may become available in the future.

Currently, Lido’s stETH dominates the collateral base of phase-two protocols. I see two ways this could change: one is that smaller LSDs will capture a larger share of the collateral market.

This would happen through CDP protocols offering diversified collateral options and DeFi users becoming more willing to purchase smaller LSDs and use them as collateral. We’ve recently seen some progress in this area (beyond crvUSD), such as Gravita, which accepts both stETH and rETH. So far, Gravita is an exception, as a significant portion of their stablecoin (GRAI) is issued against rETH rather than stETH.

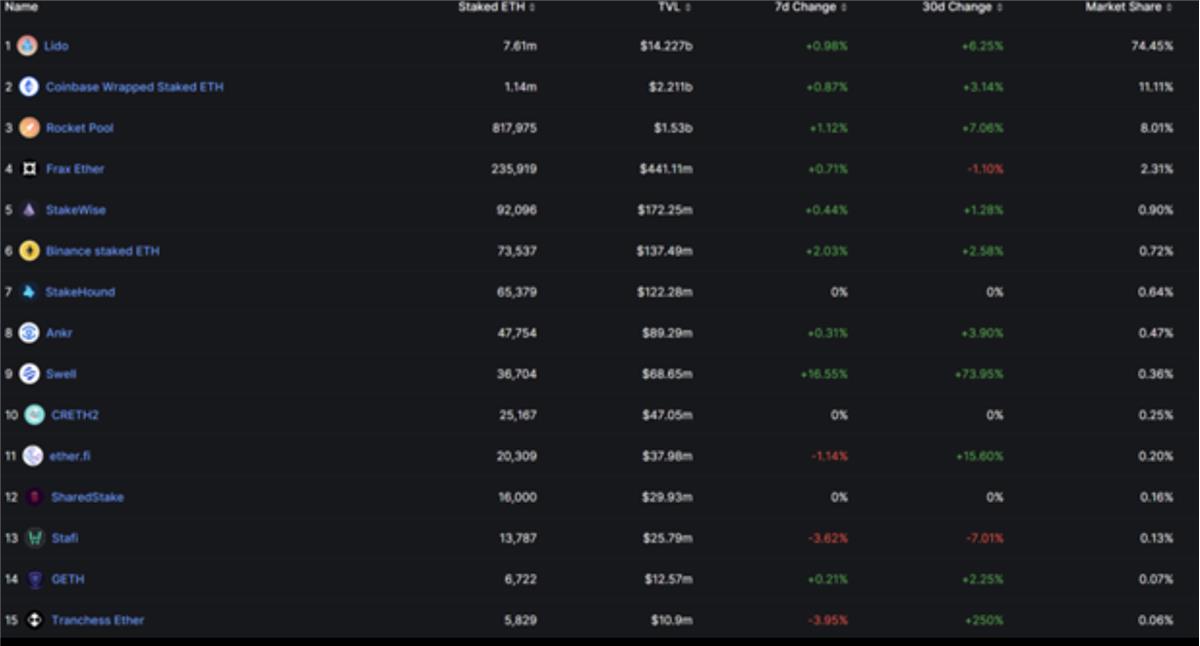

The other path follows the typical route taken by LSD providers. To date, Lido’s stETH accounts for nearly 75% of the market:

I believe that as LSDfi evolves, more LSDs will gain market share. In fact, I wouldn’t be surprised if stETH’s dominance drops below 50% by the end of 2024. After all, only about 17% of ETH supply is currently staked, and less than half of that goes through LSD providers. So this game is far from over.

Phase Three: Collateral Diversification

If phase one was about generating large amounts of LSDs, and phase two focused on lending against LSDs, what comes next in phase three?

Given that the foundational trend throughout this process has centered on LSDs based on Ethereum—the second-largest crypto asset—the natural progression is further expansion through other composable assets. This could be achieved using LP tokens, stablecoins, money market deposits (like Aave’s aUSDC), and more. Imagine being able to do everything that second-phase protocols like Lybra do with ETH, but using other tokens and positions instead.

Seneca is a prime example of an emerging DeFi project seeking to implement this strategy. While their product isn't public yet, they’re building a protocol designed to extend credit to various DeFi users.

While you can earn solid returns via LP tokens, LSDs, deposit receipts, etc., there’s always room to improve capital efficiency. Seneca aims to enable these tokens to serve as collateral for loans in their native stablecoin, senUSD. This releases liquidity while allowing collateral holders to continue earning yield on their assets.

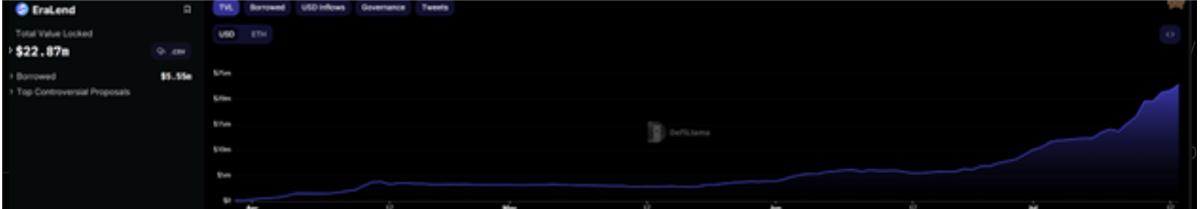

Another pioneer in this space is EraLend, a trailblazer in zkSync’s money market.

EraLend stands out for several reasons. First, they already accept SyncSwap’s USDC/WETH LP tokens as collateral. The catalyst for their expansion will be their upcoming P2P lending product. Details remain scarce, but I believe it will allow users to post various token types as collateral—LP tokens, LSDs, debt receipts, NFTs, and more.

In recent weeks, EraLend has gained significant traction, with its TVL surging from $3.9 million on June 1 to $22.9 million:

As zkSync grows, EraLend is definitely a project to watch. In fact, in terms of TVL, it has already become the third-largest project on zkSync.

Finally, another interesting feature of EraLend is that any token can be used to pay gas fees—a hint at potential account abstraction the young protocol may achieve in the future.

Even if you trust Tether and Circle to hold the assets they claim, it’s still preferable to see native DeFi stablecoins—backed by traceable on-chain collateral—eventually replace them. At this point, the most obvious path forward is creating models similar to Seneca’s.

Looking ahead, fractional reserve systems in DeFi are necessary, as they enable greater functionality with less capital. In practice, I believe DeFi can easily optimize for such systems. First, in DeFi, code is law—meaning parameters like collateral requirements are fixed and cannot be adjusted arbitrarily. Additionally, unlike traditional finance (TradFi), DeFi is inherently composable, making it easier to integrate new asset types and develop novel use cases. DeFi is also transparent by nature, making use cases like LSD- and LP-backed stablecoins far more attractive compared to traditional stablecoins like USDT and USDC.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News