Introducing the new protocol Asymetrix: Will more people participate when LSDfi adds a lottery gameplay?

TechFlow Selected TechFlow Selected

Introducing the new protocol Asymetrix: Will more people participate when LSDfi adds a lottery gameplay?

With the Asymetrix protocol, you can earn multiple times the annual interest rate on ETH staking, even with a small deposit.

Written by: VIKTOR DEFI

Compiled by: TechFlow

The allure of winning has always been key to fans' enduring loyalty toward sports events. The anticipation of those highlight moments creates and sustains passion for the game. This isn't limited to sports—it also applies to premium bonds.

A prime example is the UK’s premium bonds, which currently have over 23 million people investing more than £120 billion. Research shows that the success of UK premium bonds stems from two factors: first, investors don’t worry about losing their capital; second, the thrill of potentially winning.

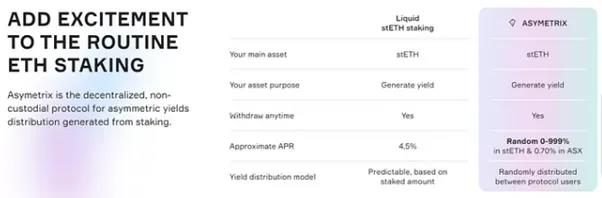

Similarly, in recent months, ETH staking has grown rapidly, attracting many developers and users. However, LSDs offer only an average annual yield of 4–5%, and the staking and reward distribution processes lack excitement. This is where Asymetrix Protocol comes in.

“Our team has invented a protocol that allows you to earn multiples of the standard annual interest rate through ETH staking—even with a small deposit—plus a bit of luck.” — Rostyslav Bortman, CTO of Asymetrix.

What is Asymetrix

Asymetrix is not your typical LSDfi project; it's an innovative staking protocol infused with excitement and chance. It is a decentralized, non-custodial protocol specifically designed to support asymmetric reward distribution. Built on Ethereum, Asymetrix enables users to earn high returns through ETH staking.

As mentioned earlier, Asymetrix was inspired by the success of UK premium bonds. By adapting this proven model, Asymetrix brings new opportunities to the crypto space, encouraging users to stake ETH for a chance to win substantial rewards. Within months of launch, the project quickly became the leading LSDfi protocol by TVL, clearly demonstrating strong product-market fit and the effectiveness of its bonding model.

Technology: How It Works

You might be wondering how Asymetrix works. Let’s use a real example: 200 users each deposit one stETH into the Asymetrix protocol, totaling 200 stETH. The pool then generates 10 stETH in staking rewards. Asymetrix collects these rewards and randomly allocates all 10 stETH to a single user. The lucky winner receives up to 500% APY in staking rewards, while the other 199 stakers retain their initial deposits despite earning no yield.

Step One: Deposit and Minting

Users first deposit stETH into the Asymetrix smart contract. The protocol mints Pool Share Tokens (PST) at a 1:1 ratio based on the user’s stETH deposit and sends them to their wallet. These PSTs confirm the user’s deposit, reflect their share in the pool, and are required for withdrawals. At the time of writing, the minimum deposit threshold for the Asymetrix protocol is 0.1 stETH.

Step Two: Reward Distribution

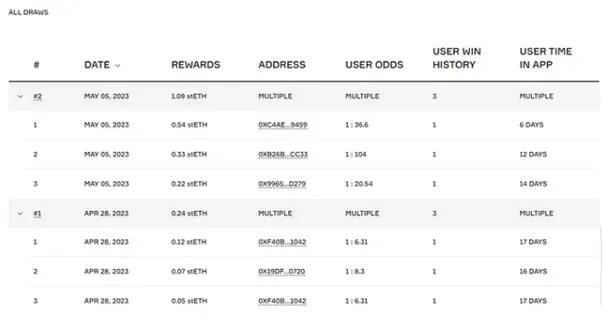

After some time, Asymetrix accumulates rewards from staked stETH and distributes them to winners. A random draw occurs every 604,800 seconds—approximately once per week. Then, an algorithm randomly selects and rewards a winner, facilitated by Chainlink VRF.

No one can influence the outcome—not even the DAO. Each user’s chance of winning is determined using the Time-Weighted Average Balance (TWAB) formula, which calculates both the user’s contribution to the pool and how long their deposit remains between draws. Then, Chainlink’s VRF generates a random number and matches it to select the winner.

Step Three: Winners

After the draw concludes, the winner automatically receives PST rewards equivalent to the stETH amount won. This increases the user’s balance and boosts their chances of winning future rewards. Users can withdraw their tokens anytime, maintaining full control over their funds.

To date, Asymetrix has distributed 87.95 stETH to 28 lucky stakers through weekly draws over 14 weeks. Compared to traditional staking, this gives participants a chance to achieve what amounts to extremely high annualized yields in a single draw.

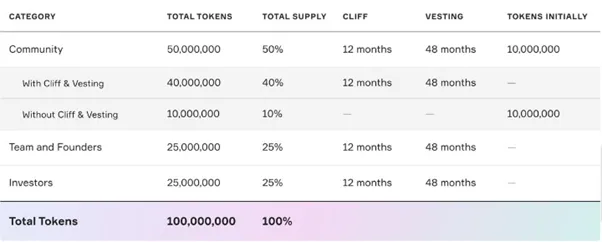

Tokenomics

ASX is Asymetrix’s governance and utility token. With a total supply of 100 million tokens, 50% is allocated to the community, 25% to investors, and 25% to core contributors. The team has reserved 10% of the community’s 50% allocation to incentivize early protocol users.

Hacken, a renowned crypto auditing firm, has audited Asymetrix. Additionally, they are running an ongoing bug bounty program to enhance platform security while rewarding bounty hunters.

Recently, the protocol announced the release of Asymetrix 2.0. While V1 was already impressive, V2 introduces comprehensive improvements to the ASX token design. Three upcoming features in V2 stand out: esASX, BOOST, and Mini Pools.

As the name suggests, esASX stands for escrowed ASX. Technically, it holds the same value as the governance token ASX. EsASX is a non-transferable token designed for long-term purposes and project sustainability. Users will need a 100-day vesting period to convert their esASX to ASX at a 1:1 ratio—this helps reduce sell pressure and prevent early dumping.

With V2, esASX becomes the default token for early user incentives and will be distributed in the next phase of incentive allocations. The second-phase incentive pool is split into two parts. 1,000,000 esASX/ASX will be distributed as before to all users who deposited into Asymetrix. The other portion, 3,000,000 esASX/ASX, is specifically designated for users who receive BOOST during the esASX/ASX distribution.

Asymetrix V2 introduces two novel boosting mechanisms: ODDS BOOST and esASX BOOST. Whenever users provide and lock liquidity on the Asymetrix smart contract, they receive ODDS BOOST, giving them higher chances of winning in weekly draws. On the other hand, esASX BOOST serves as an additional reward for liquidity providers, enhancing the distribution of esASX tokens.

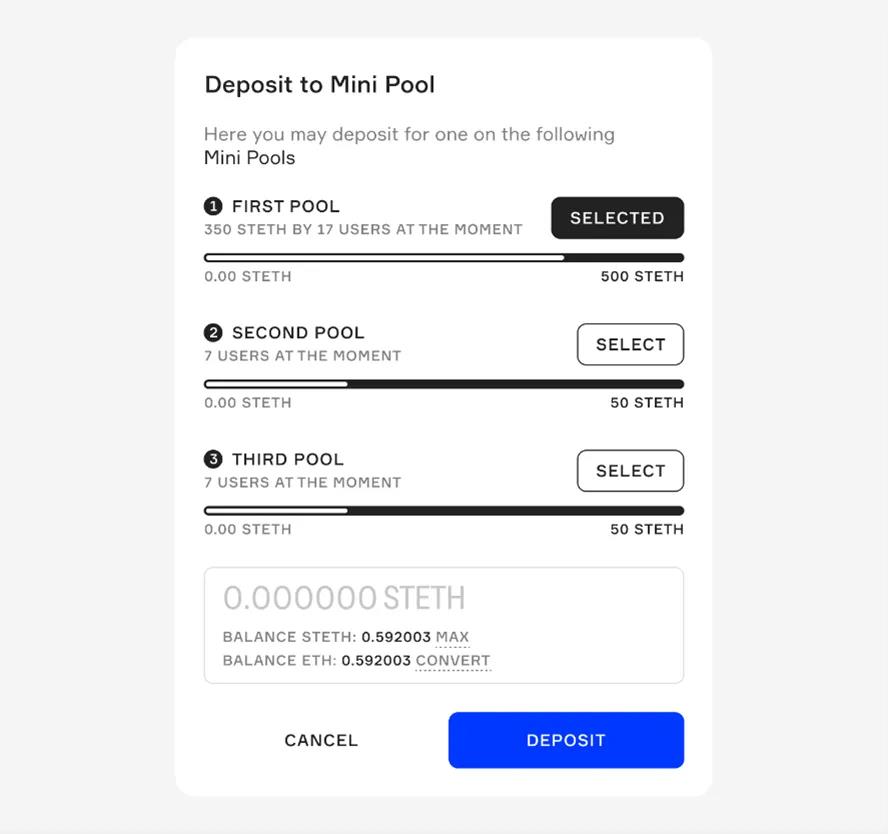

Think of mini pools as support groups enabling small depositors to fully participate in the Asymetrix ecosystem. In practice, mini pools are collectives of small depositors who pool their funds together to enter weekly draws. Furthermore, rewards earned are distributed among participants according to their share in the pool.

Conclusion

In the early days of decentralized finance, people joined primarily to experiment with a new and increasingly popular internet-based financial system. Now, they’re mainly drawn by better returns and the thrill of winning. Imagine earning massive 500% returns and the excitement that comes with it.

Even if you don’t win, you still get back your initial deposit along with some esASX/ASX rewards. In the long run, this model could achieve the same scale effects seen with UK premium bonds. With growing metrics and the upcoming V2 launch, it’s only a matter of time before Asymetrix leads the LSDfi narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News