Deconstructing Mori Finance: More Than Just LSDfi Stablecoins — Will Innovation in Perpetual Assets Gain Market Acceptance?

TechFlow Selected TechFlow Selected

Deconstructing Mori Finance: More Than Just LSDfi Stablecoins — Will Innovation in Perpetual Assets Gain Market Acceptance?

Due to its rapid time-to-market, ahead of other competitors (f(x)), Mori Finance is definitely worth paying attention to.

Author: arndxt

Translation: TechFlow

LSD perpetuals will be the next phase of LSDfi. This article introduces a product in this space—Mori Finance—which gives users options to create LSD assets.

LSD Perpetuals

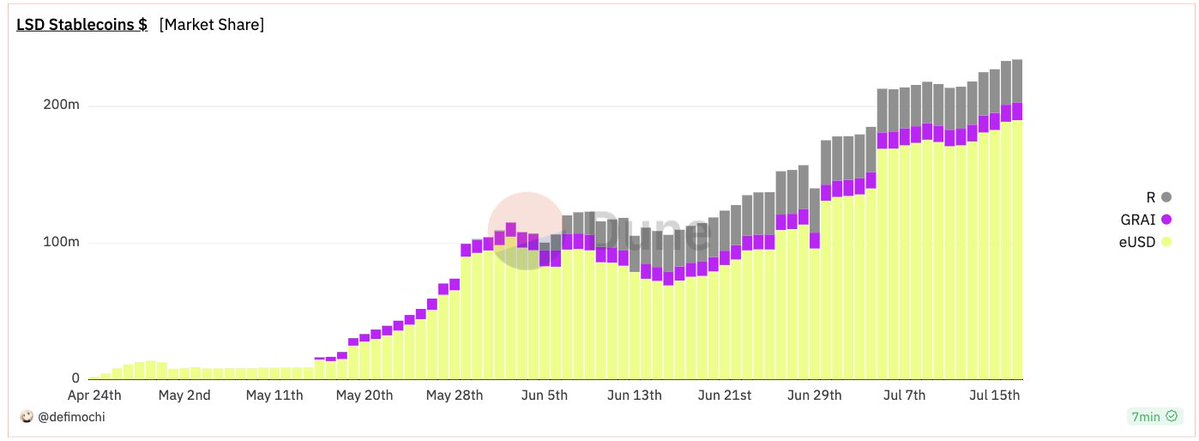

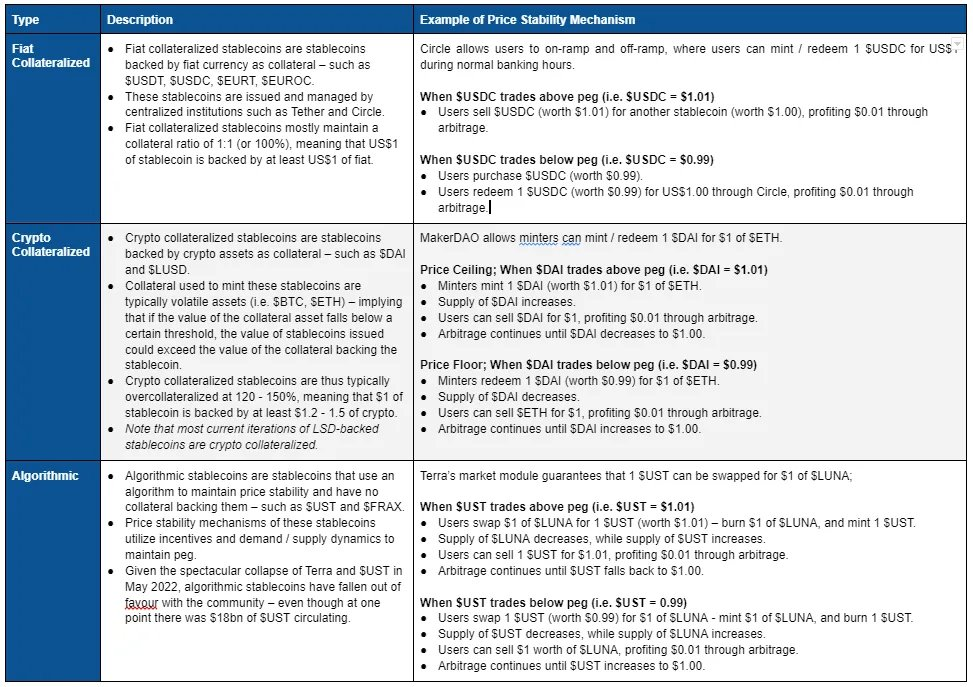

As is well known, LSD stablecoins were pioneered by Lybra Finance.

To date, it has attracted approximately $190 million in total value locked (TVL). Competitors such as Raft and Gravita Protocol are catching up.

$eUSD, $GRAI, and $R are all backed by over-collateralized LSDs. Overall, they follow the stablecoin framework. However, LSDfi is expected to evolve further through Mori Finance's LSD perpetual product.

About Mori

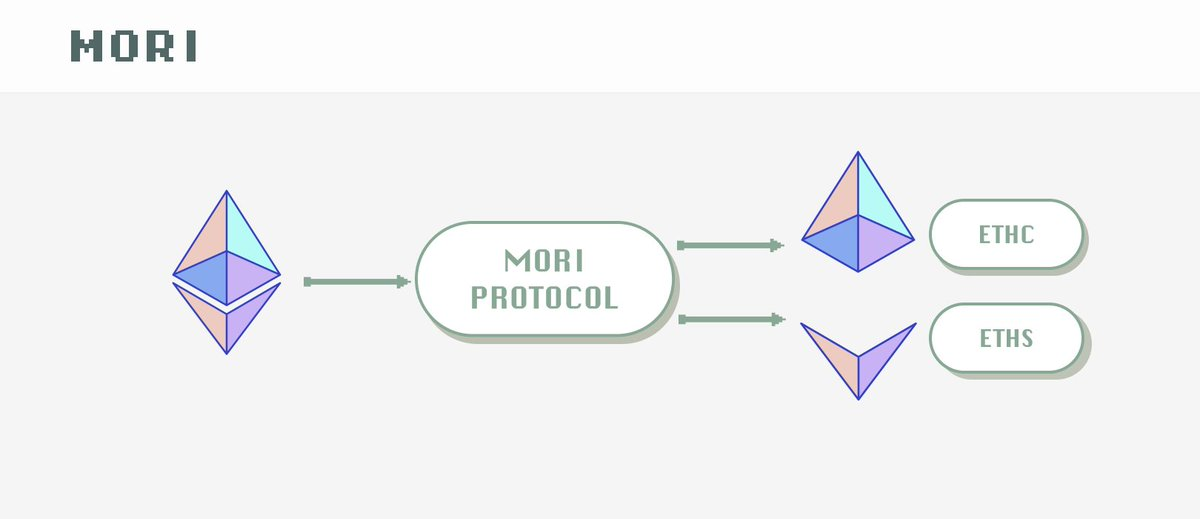

Mori Finance allows users to use LSD as collateral and split it into:

-

$ETHS stable asset;

-

$ETHC volatile leveraged long asset.

This provides users with a powerful hedge against ETH price volatility; zero-cost long positions with no liquidation risk.

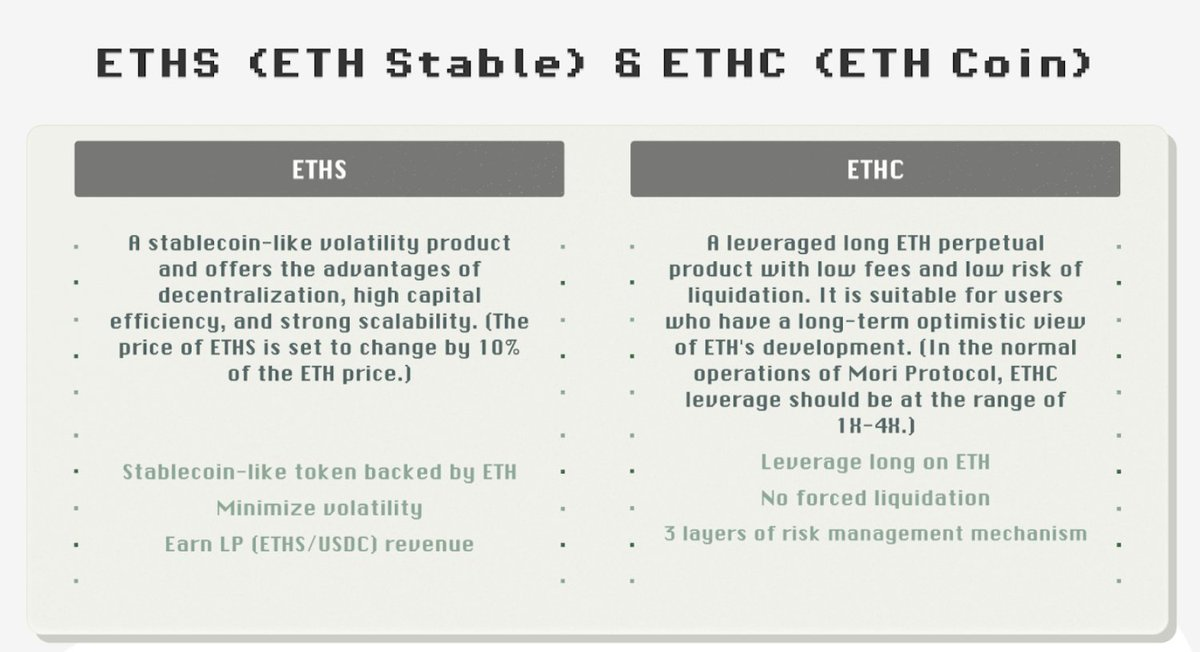

ETHS as a low-volatility token:

• A stable asset backed by ETH;

• Minimizes volatility;

• Earns additional liquidity provider (ETHS/USDC) yields.

ETHC as a leveraged long ETH perpetual token:

• Leveraged long on ETH;

• No liquidation risk;

• Emergency control mode reduces ETHC leverage.

These twin assets complement each other:

• ETHS is a stable asset that reflects only 10% of ETH price movements.

• ETHC absorbs most of the ETH price fluctuations.

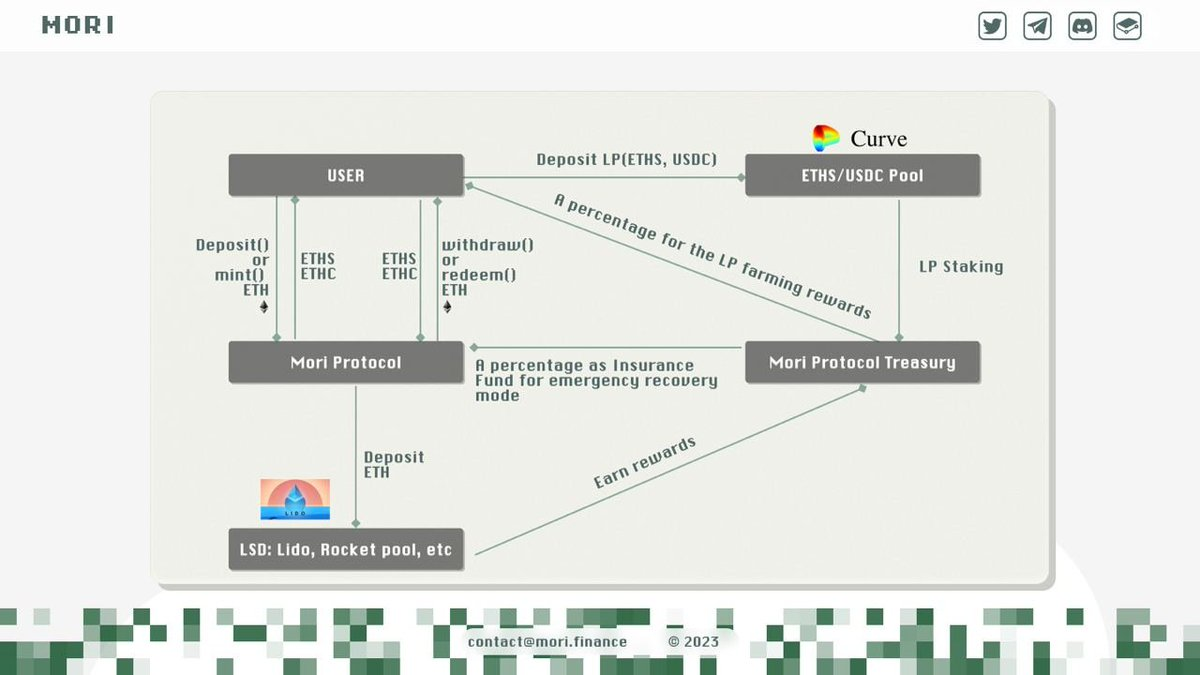

Depending on market conditions, users can choose to mint/redeem ETHS or ETHC based on their strategy. The process is as follows:

-

User deposits ETH;

-

Receives ETHS and/or ETHC;

-

Deposits ETHS-USDC LP;

-

Deposits ETHC-USDC LP;

-

User receives a share of liquidity provider mining rewards.

Risk Management

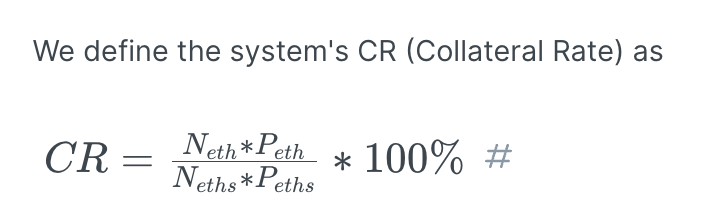

The risk management module exists to ensure ETHS stability and enable ETHC to absorb price impacts when ETH prices move. When the CR value is too low, it prevents ETHS from absorbing only 10% of ETH's value fluctuations.

When CR < 130%:

• Prohibit minting ETHS from ETH;

• Set ETHS redemption fee to zero;

• Set ETHC minting fee to zero;

• Increase ETHC redemption fee;

CR < 120%:

• Prohibit minting ETHS from ETH;

• Set ETHS redemption fee to zero;

• Set ETHC minting fee to zero;

• Increase ETHC redemption fee further;

• Use insurance fund to buy ETHS on secondary markets, then redeem for ETH.

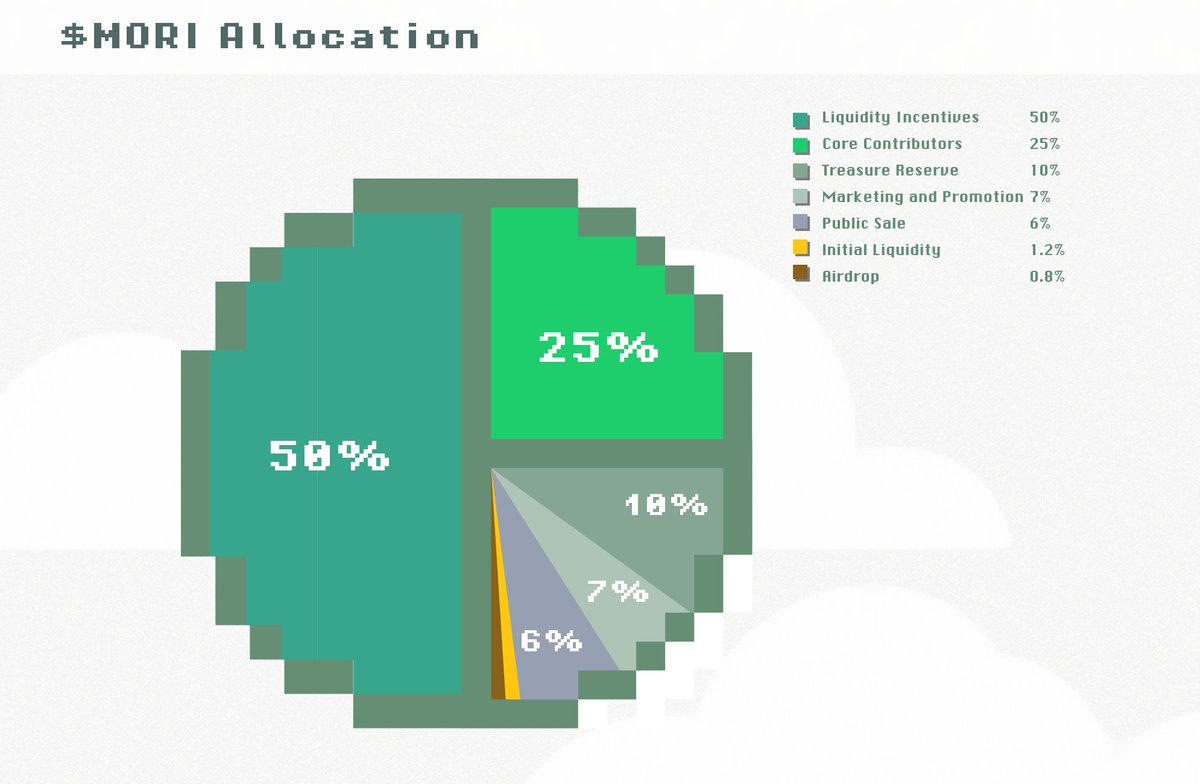

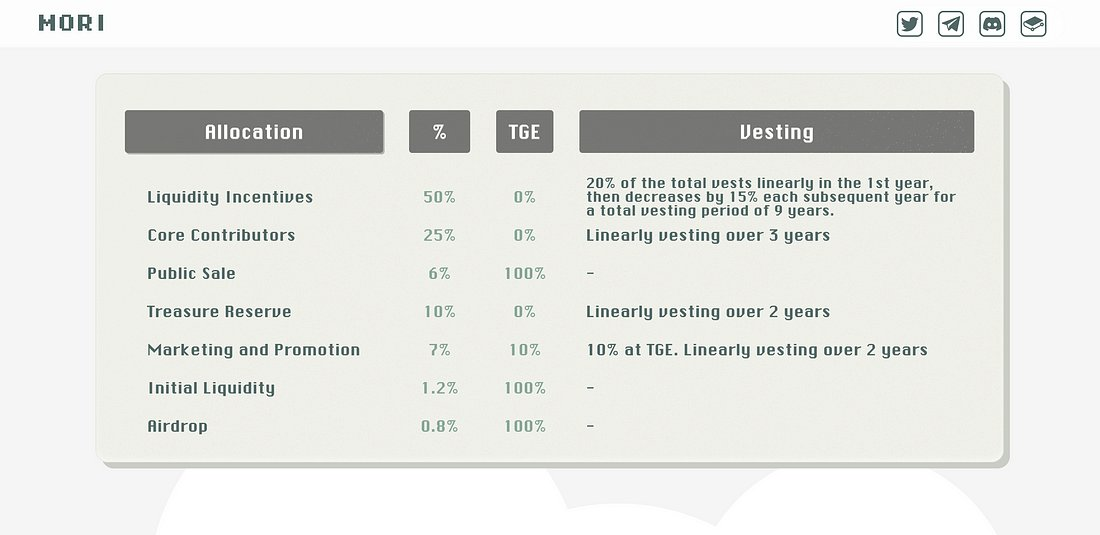

Tokenomics

Uses of $xMORI:

• Stake $MORI;

• Share in protocol revenue;

• Yield booster;

• Governance.

Its IDO will consist of two rounds. The first round will take place on July 20 at 1 PM UTC, open to early supporters, testers, and the public:

-

Whitelist 1%, public 2% = 30,000 $MORI;

-

Price: 1 MORI = 0.005 ETH;

-

FDV: $10 million;

-

Amount raised: ~$300,000.

The second round will occur upon Mori mainnet launch.

There is still time to join the testnet, as the snapshot will be taken on July 19, the day before the sale.

Here’s why I like Mori Finance:

-

No private sale;

-

No VCs;

-

No team allocation;

-

Audited by PeckShield prior to launch.

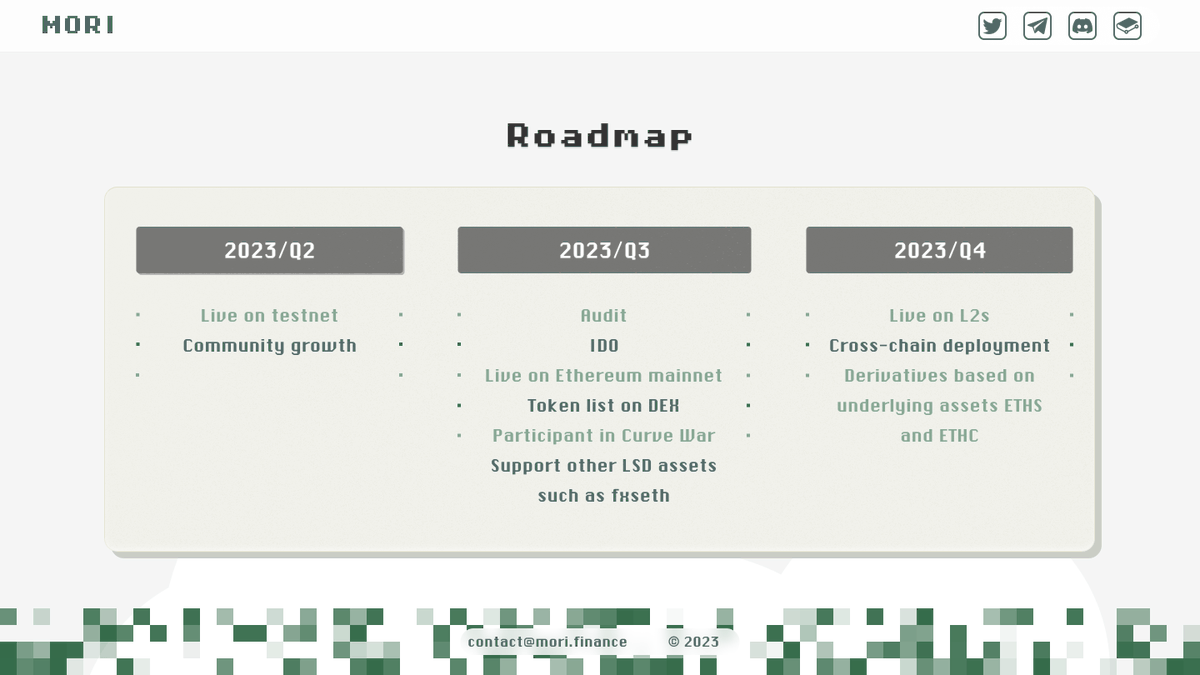

Roadmap / Team

They plan to launch on Ethereum in Q3 2023, followed by expansion to other Layer 2 networks in Q4.

Although the team is anonymous, the lead developer is highly experienced, evident from their development speed. Due to its rapid time-to-market, ahead of competitors (f(x)), Mori Finance is definitely worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News