What other LSDfi protocols are worth paying attention to?

TechFlow Selected TechFlow Selected

What other LSDfi protocols are worth paying attention to?

LSDfi is an interesting innovation that offers LSD holders a broader range of unique yield strategies. By catering to the needs of various LSD owners, it enhances the appeal of holding $ETH as an income-generating asset, thereby enriching the entire Ethereum ecosystem.

Written by: AN APE'S PROLOGUE

Compiled by: TechFlow

With $ETH staking infrastructure maturing and users increasingly willing to hold $ETH in staked form to earn yield, it's time to look ahead to the next phase of DeFi composability—LSDfi.

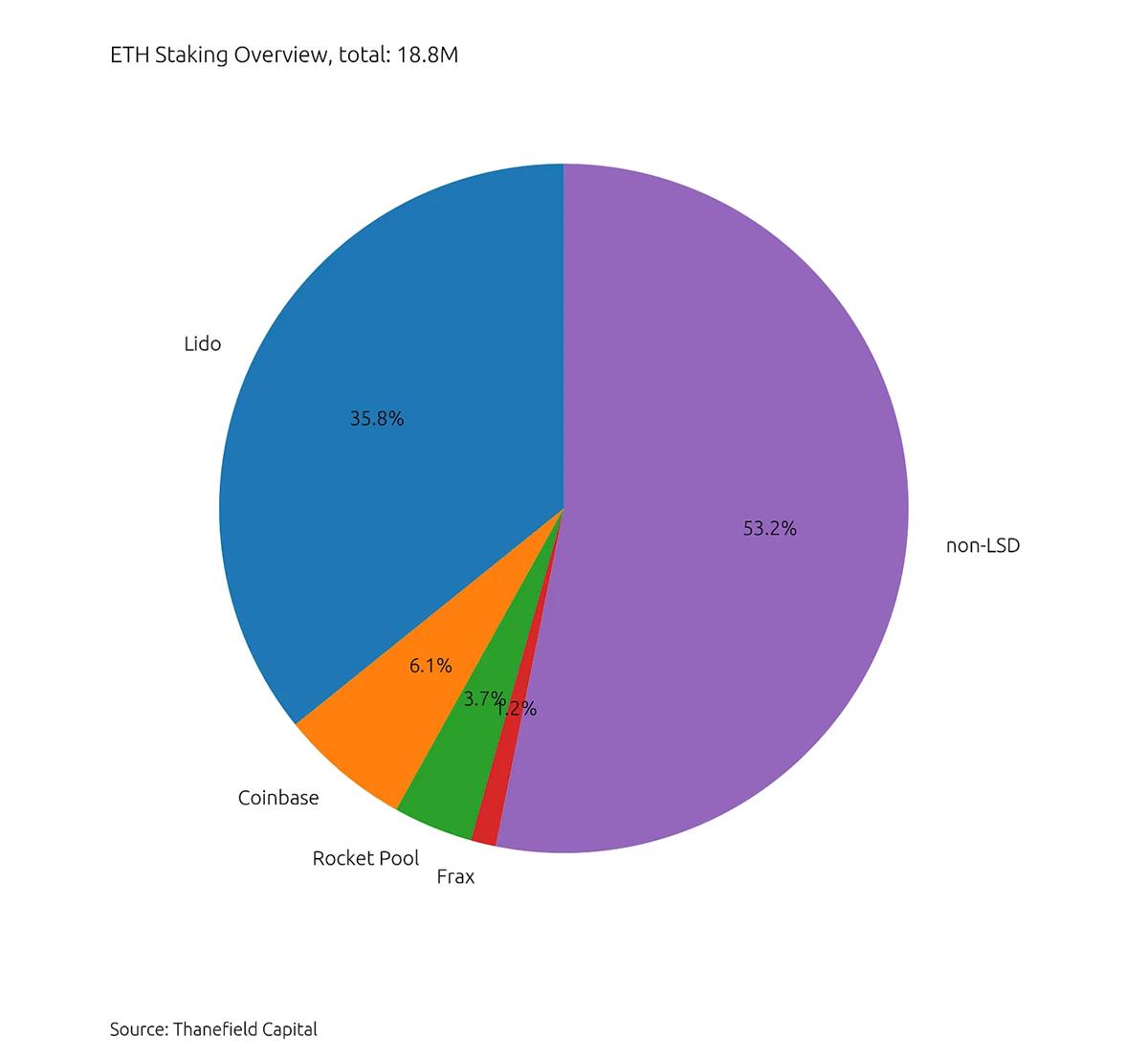

Following Lido V2, interest in staking $ETH remains strong. Currently, LSDs account for nearly 48% of the total 18.8 million $ETH staked to date.

Given continued expectations for growth in $ETH staking, various protocols have emerged to serve capital pools seeking greater utility and yield.

While not exhaustive, below are the protocols we currently consider noteworthy within the LSDfi category.

LSDfi protocols allow LSD holders to efficiently manage the yield from their staked assets, simplifying technical complexity and reducing gas costs. Examples include "selling" yield via Lybra’s $eUSD or enhancing base yield through $unshETH.

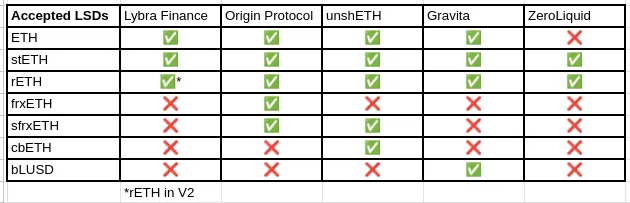

Thanks to Lido’s dominant market share of over 70% in the LSD market, $stETH has become the most widely accepted LSD among LSDfi protocols. Origin Protocol’s $OETH and $unshETH are among the products with the broadest LSD acceptance today.

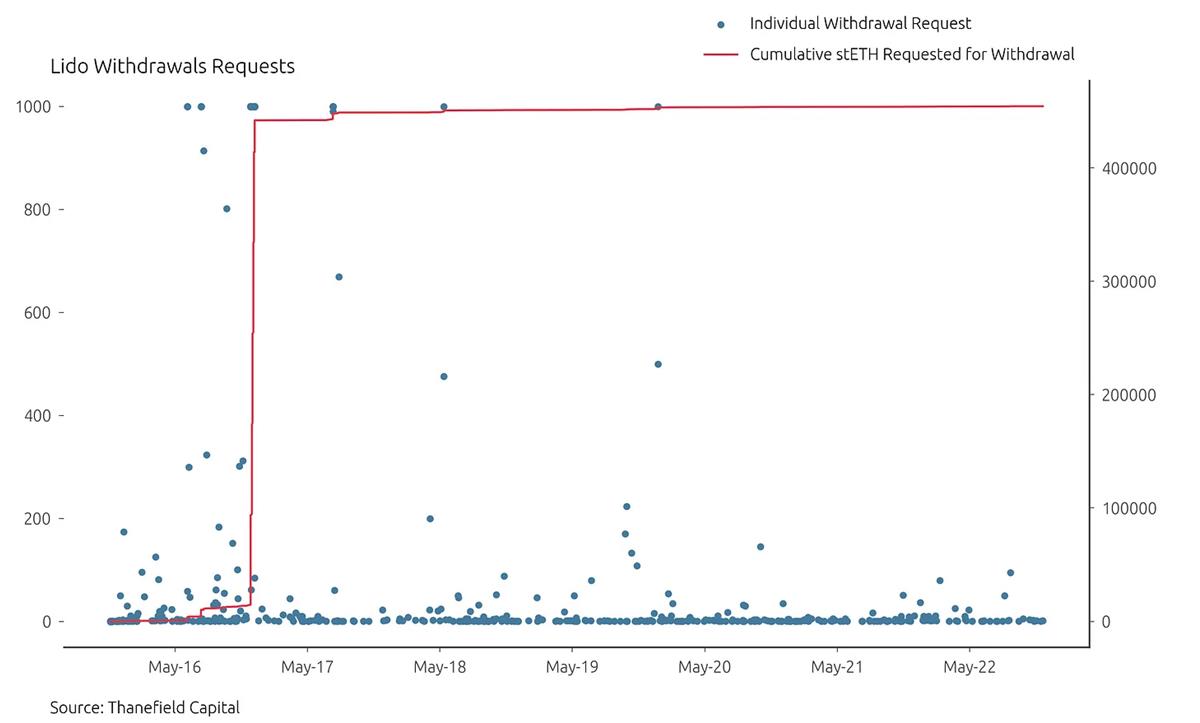

Although outflows from Lido have been limited post-$stETH withdrawals enabled in V2—excluding Celsius—it must remain vigilant to maintain its market leadership position.

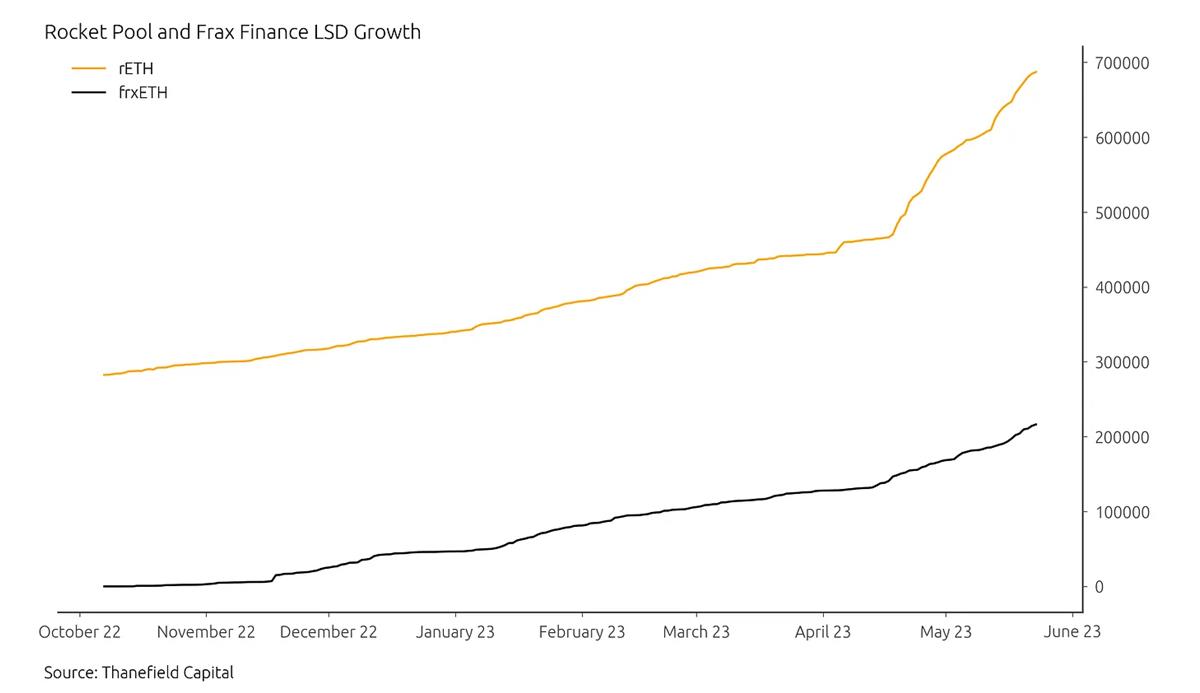

With the surge of $rETH and $frxETH, competition for LSD market share is intensifying. Both $rETH and $frxETH have steadily gained market share this year—a factor LSDfi protocols may consider when developing products.

LSDfi products generally fall into two main categories: lending and yield optimizers:

1) Lending – offsetting yield on loans or disproportionately rewarding lenders;

2) Yield Optimizers – delivering enhanced returns for liquidity providers.

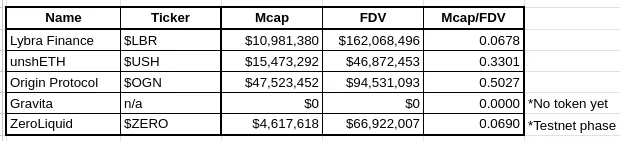

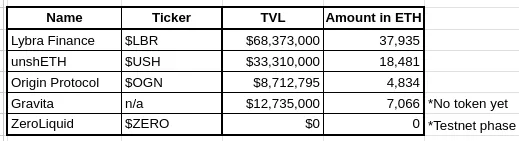

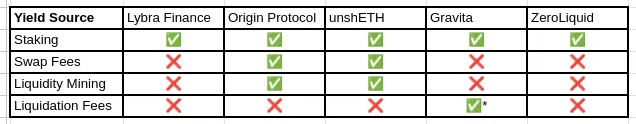

First, Lybra Finance stands out with its LSD-backed stablecoin $eUSD. $eUSD adjusts based on the yield earned by LSD collateral within the protocol. Over the past week, TVL grew by 400%, and $LBR has drawn the most attention in the LSDfi category.

unshETH and its derivative token $unshETH generate optimal risk-adjusted returns through a basket of staked ETH assets.

LSDs held within the protocol also earn additional yield through vdAMM swap fees, as they make the protocol a liquidity hub for $ETH LSDs.

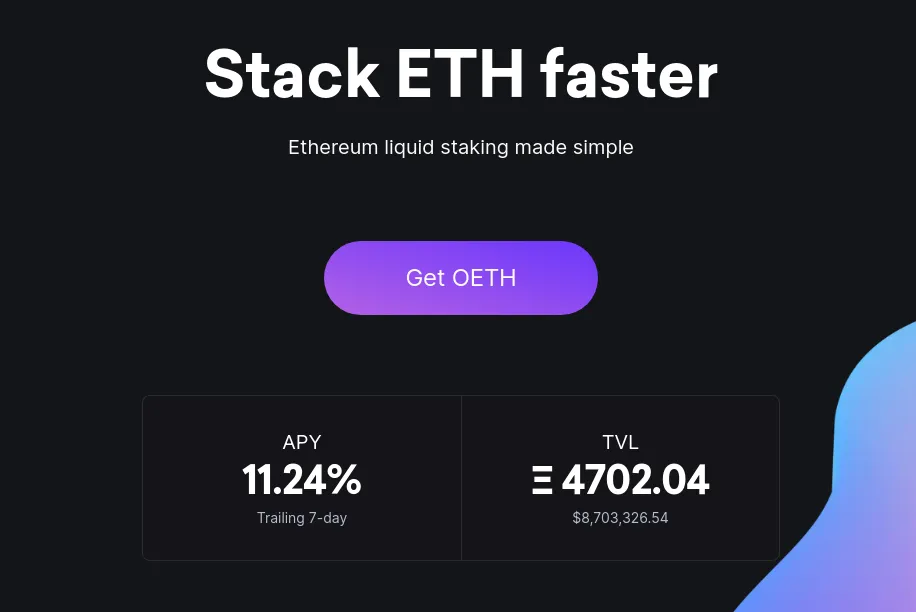

Origin Protocol, though not new, launched a new product $OETH on May 17. It aggregates various LSDs and generates enhanced yield by providing liquidity on top of standard staking rewards.

Gravita Protocol issues $GRAI, a 0% interest loan token with a natural price ceiling of $1.10 and a hard price floor of $0.97.

Backed by a mixed basket of LSDs and bLUSD (an enhanced version of LUSD provided by Liquity), interest continues to accrue during the loan period.

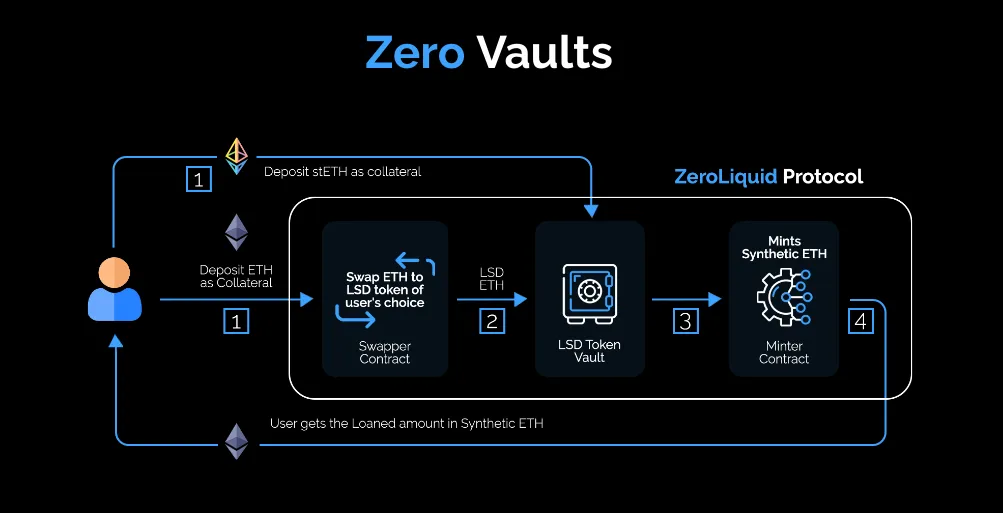

Bringing Alchemix’s self-repaying loan concept to LSDs, Zero Liquid allows users to mint $zETH using LSD collateral without liquidation risk.

The protocol then periodically harvests the user’s staking yield to reduce debt.

LSDfi is an intriguing innovation, offering LSD holders a broader range of unique yield strategies. By catering to diverse LSD owner needs, it enhances the appeal of holding $ETH as an income-generating asset, thereby enriching the entire Ethereum ecosystem.

Nonetheless, investors speculating on these protocols should consider established players like Frax Finance, Pendle, and Alchemix, which have the capacity to build similar products if they choose to allocate resources accordingly.

Regardless, the overall LSDfi sector is likely here to stay in the long term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News