Interpreting Binance Research's LSDfi Report: When Liquid Staking Meets DeFi

TechFlow Selected TechFlow Selected

Interpreting Binance Research's LSDfi Report: When Liquid Staking Meets DeFi

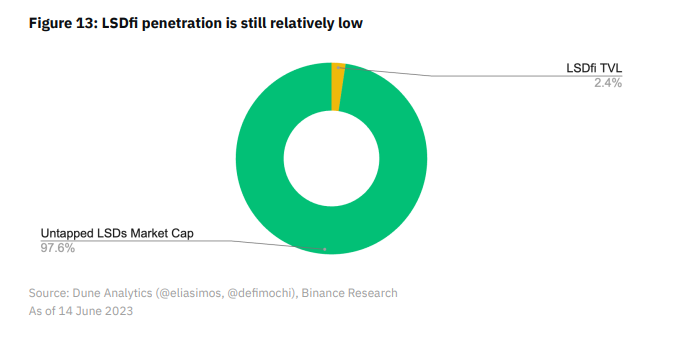

Although LSDfi is growing rapidly, its scale is still less than 3% of LSD itself, leaving room for further growth as an emerging sector.

Introduction

Recently, Binance Research released a report on LSDfi, covering the overall landscape, yield performance, and potential risks of the LSDfi sector. The report shows that while LSDfi is growing rapidly, its scale remains under 3% of the total LSD market, indicating significant room for future growth as an emerging sector.

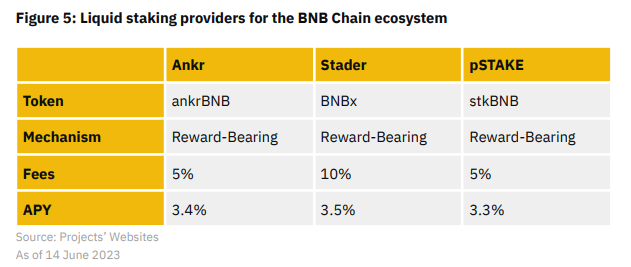

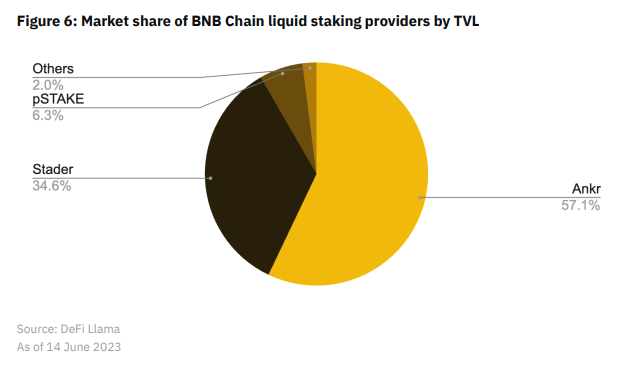

In addition, liquid staking and related strategies are also developing within the BNB chain ecosystem. Data indicates that LSD projects on this chain offer relatively lower fees, presenting viable participation opportunities.

Meanwhile, while LSDfi maximizes ETH staking yields, participants must remain cautious due to the sector’s early-stage nature, balancing returns against various risks and focusing on more certain opportunities.

TechFlow has selected and distilled the core insights from the report as follows:

Key Findings:

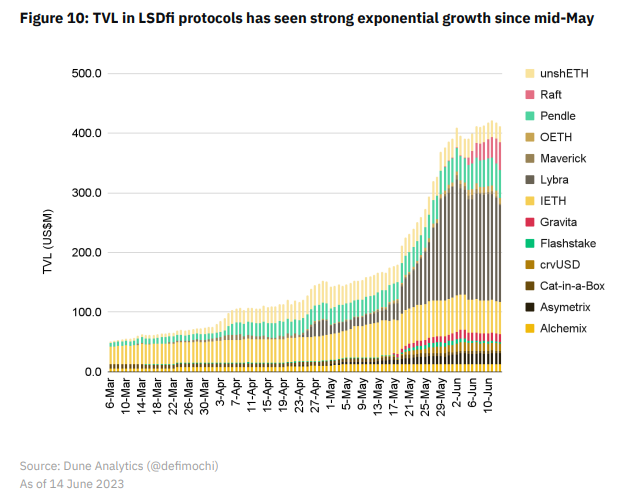

Over the past few months, TVL in LSDfi protocols has grown rapidly, driven by increased adoption of LSDs. The cumulative TVL of top LSDfi protocols has surpassed $400 million, more than doubling since just one month ago. Key drivers behind LSDfi growth include rising ETH staking volumes and the current low market penetration of LSDfi.

Currently, the TVL of LSDfi protocols accounts for less than 3% of the total addressable market. Although LSDfi offers attractive opportunities for LSD holders, users should be aware of associated risks, including but not limited to slashing risk, LSD price volatility, smart contract risk, and third-party risk.

Ethereum Staking and LSD Development

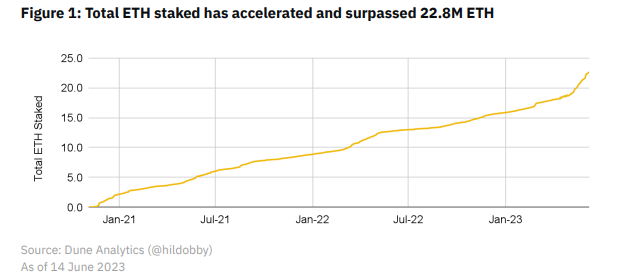

The ETH staking market is expanding rapidly. Following Ethereum's successful transition to the PoS consensus mechanism and enabling withdrawals after the Shapella upgrade, staked amounts have surged. Total staked ETH now exceeds 22.8 million ETH.

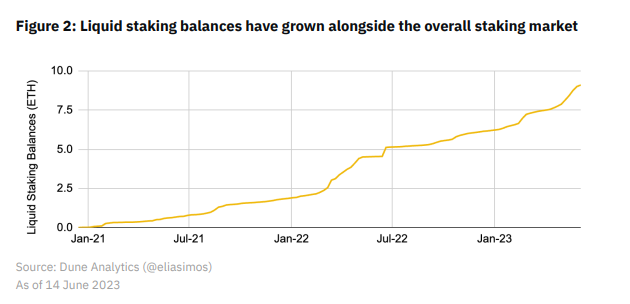

LSDs are also thriving. Running independent validator nodes involves technical complexity and high capital requirements, making it inaccessible to many. Liquid staking protocols lower these barriers while maintaining asset liquidity. Data also shows that the share of ETH staked via LSDs continues to grow relative to total staked ETH.

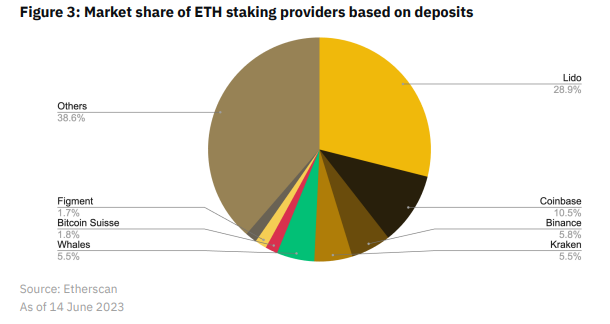

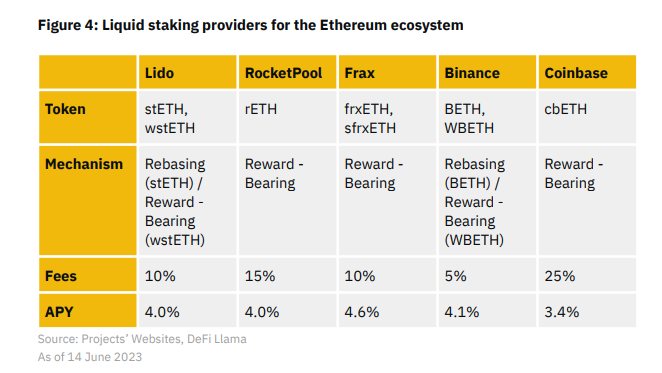

In terms of market structure, a "one dominant leader with multiple strong players"格局 has begun to emerge: Lido is the largest staking provider, holding 28.9% market share, followed by centralized exchanges such as Coinbase, Binance, and Kraken. There are also smaller liquid staking providers, though their staked ETH volumes are significantly lower.

Additionally, fee structures vary across providers, but annual yields are generally around 4%.

Liquid staking is also active in the BNB ecosystem, with a total staked value of approximately $150 million. Similar to ETH liquid staking, BNB stakers receive liquid staked BNB tokens (e.g., stkBNB), which can be used across DeFi to generate additional yields.

LSD-Based Financialization: LSDfi

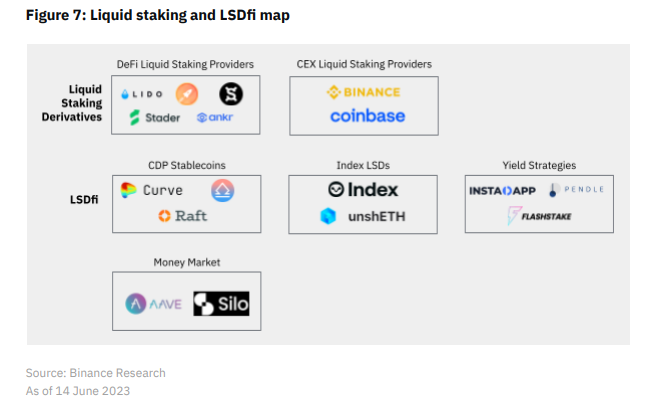

LSDfi protocols enable LSD holders to maximize their assets and earn additional yields. The main types and categories of LSDfi are as follows:

1. DeFi Liquid Staking Providers: DeFi platforms allowing users to stake and receive LSDs as rewards.

2. CEX Liquid Staking Providers: Centralized exchanges ("CEXs") offering liquid staking services.

3. CDP Stablecoins: Collateralized debt position ("CDP") protocols that allow users to mint stablecoins using LSDs as collateral.

4. Index LSDs: Tokens representing shares in a basket of multiple LSDs.

5. Yield Strategies: Protocols enabling users to capture additional yield opportunities.

6. Money Markets: Protocols facilitating lending and borrowing activities using LSDs.

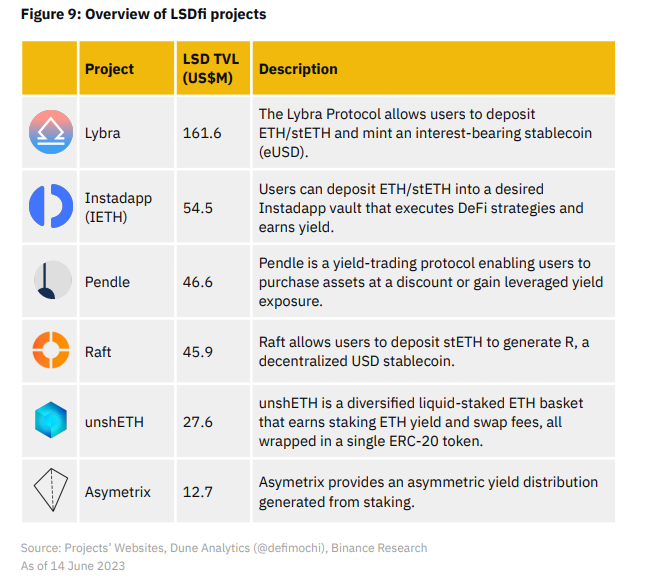

Based on the above classification, we can see the positioning and operations of different protocols:

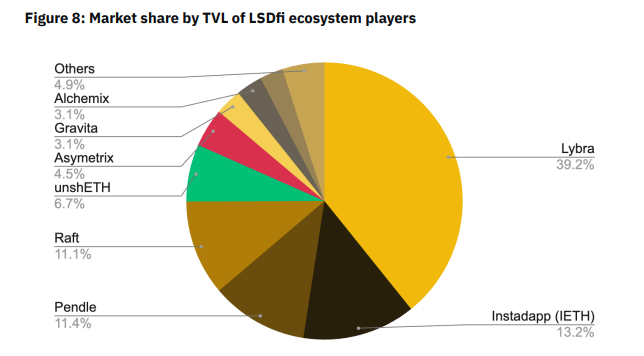

In terms of market structure, leading LSDfi providers hold a relatively concentrated share, with the top five controlling over 81% of total TVL. Lybra is the current market leader, having launched in April and rapidly growing to over $160 million in TVL.

In terms of growth momentum, LSDfi is expanding rapidly. Over recent months, TVL has surged, more than doubling in the past month alone to exceed $400 million. This growth is primarily driven by LSD holders seeking to maximize their returns.

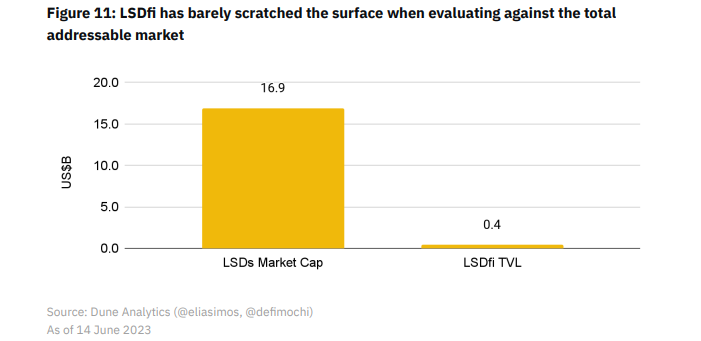

However, the road ahead remains long. Despite impressive growth, the LSD sector’s market cap exceeds $16.9 billion, while total TVL across LSDfi protocols stands at only $412 million—less than 3% penetration, indicating substantial headroom for expansion.

Finally, LSDfi is an emerging market where risks and opportunities coexist. Participants must carefully consider staking penalties, price volatility, smart contract vulnerabilities, and third-party dependencies.

Slashing Risk: Validators who fail to meet specific staking requirements (e.g., going offline) may face penalties, which LSD holders could indirectly bear.

LSD Price Risk: Due to market dynamics, LSD token prices may fluctuate independently from their underlying assets, exposing users to volatility and potential liquidation risk—especially when used as collateral.

Smart Contract Risk: Every interaction with a smart contract introduces potential vulnerabilities or exploits.

Third-Party Risk: Some projects rely on other dApps as part of their operations (e.g., yield strategies), introducing additional counterparty risks.

Conclusion

Overall, the report concludes that LSDfi protocols open new opportunities for yield-seeking LSD holders. By creating additional use cases for LSDs, LSDfi incentivizes further staking participation and has the potential to accelerate LSD adoption. Given the sector is still in its early stages, ongoing innovation and adoption trends in LSDfi will be exciting to observe.

LSDfi is poised to become a flourishing ecosystem—we’ve only scratched the surface. Binance Research may release another report in the coming weeks, diving deeper into LSD from a data-driven perspective.

Full report available here:

https://research.binance.com/static/pdf/lsdfi-when-liquid-staking-meets-defi.pdf

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News