Liquid Staking and LSDfi Landscape: Which Protocols Have Growth Potential?

TechFlow Selected TechFlow Selected

Liquid Staking and LSDfi Landscape: Which Protocols Have Growth Potential?

Why are liquid staking and LSDFi so popular?

Written by: Stacy Muur

Compiled by: TechFlow

Before we dive in, let me explain liquid staking and its derivatives.

• PoS chains use staking as their consensus mechanism.

• To enhance security, these chains incentivize more token staking by offering staking rewards.

• However, staking rewards alone may not be enough. To address this, liquid staking was introduced to increase capital efficiency of staked assets.

• When you stake XYZ, you receive staked ZYX, which can be used like a regular token across various protocols.

Now that you’ve got the basics down, let’s go deeper. Why are liquid staking and LSDFi so hot right now?

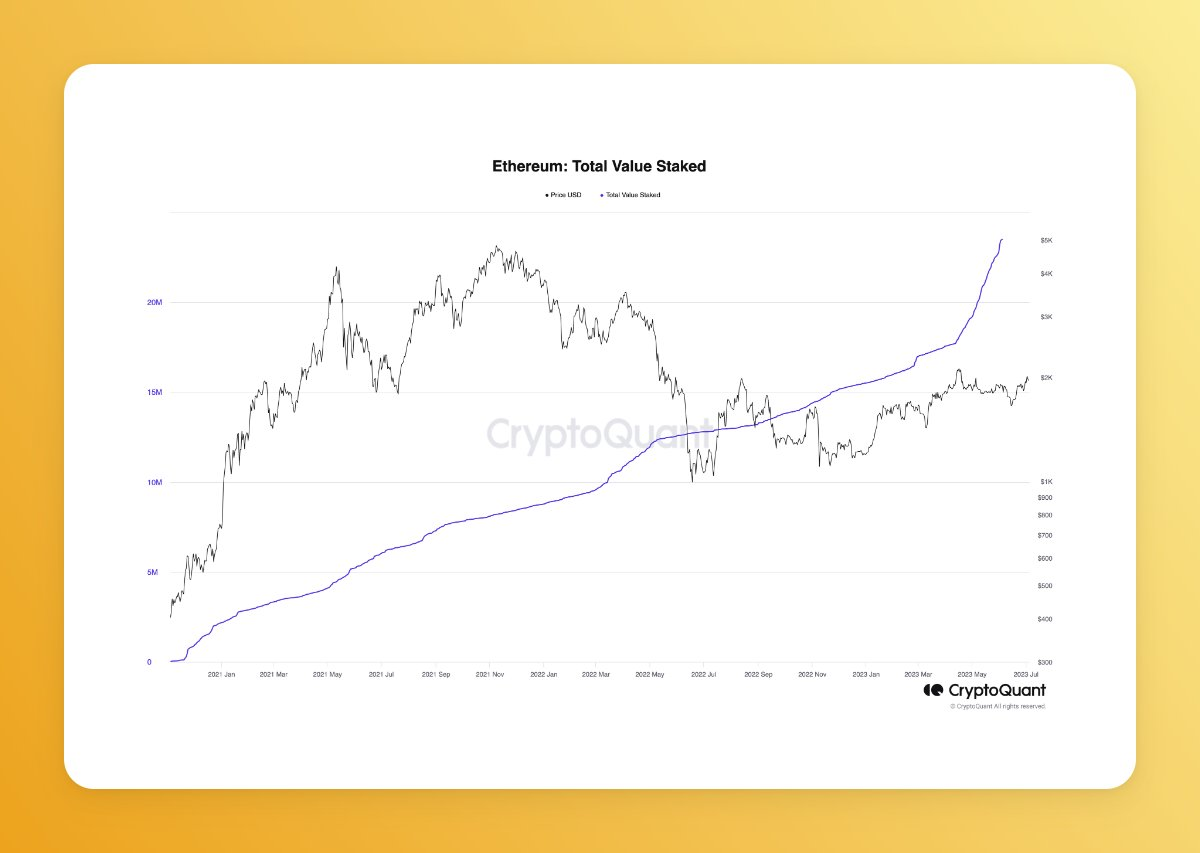

With Ethereum’s Shapella upgrade, users have gained greater confidence in staking because withdrawals are now possible—unlocking new yield opportunities.

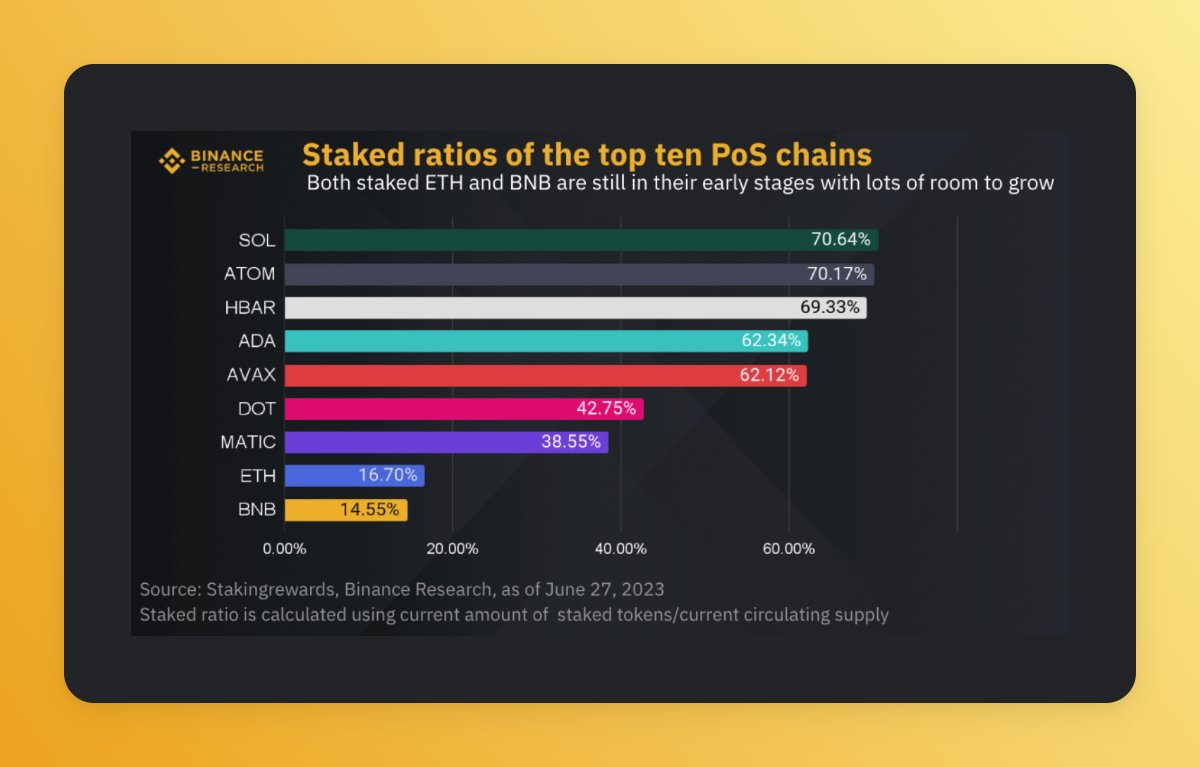

Interestingly, the ratio of staked ETH to circulating supply on Ethereum is currently 16.70%.

This suggests significant room for further growth on Ethereum. In contrast, the average staking ratio among other top-10 PoS chains stands at 49.67%.

There are four ways to stake Ethereum:

• Staking pools (Lido, Rocket Pool, Frax, etc.);

• Centralized exchange staking (Coinbase, Binance, etc.);

• Staking-as-a-service (minimum 32 ETH);

• Solo staking (minimum 32 ETH).

Currently, Lido leads the liquid staking market with approximately 32% share. However, Lido’s dominance also poses significant risks. If it exceeds key consensus thresholds—such as 1/3, 1/2, or 2/3—Ethereum could become vulnerable to manipulation or attacks.

Among the top five staking pool protocols, Fraxfinance appears to be making the most progress toward decentralization.

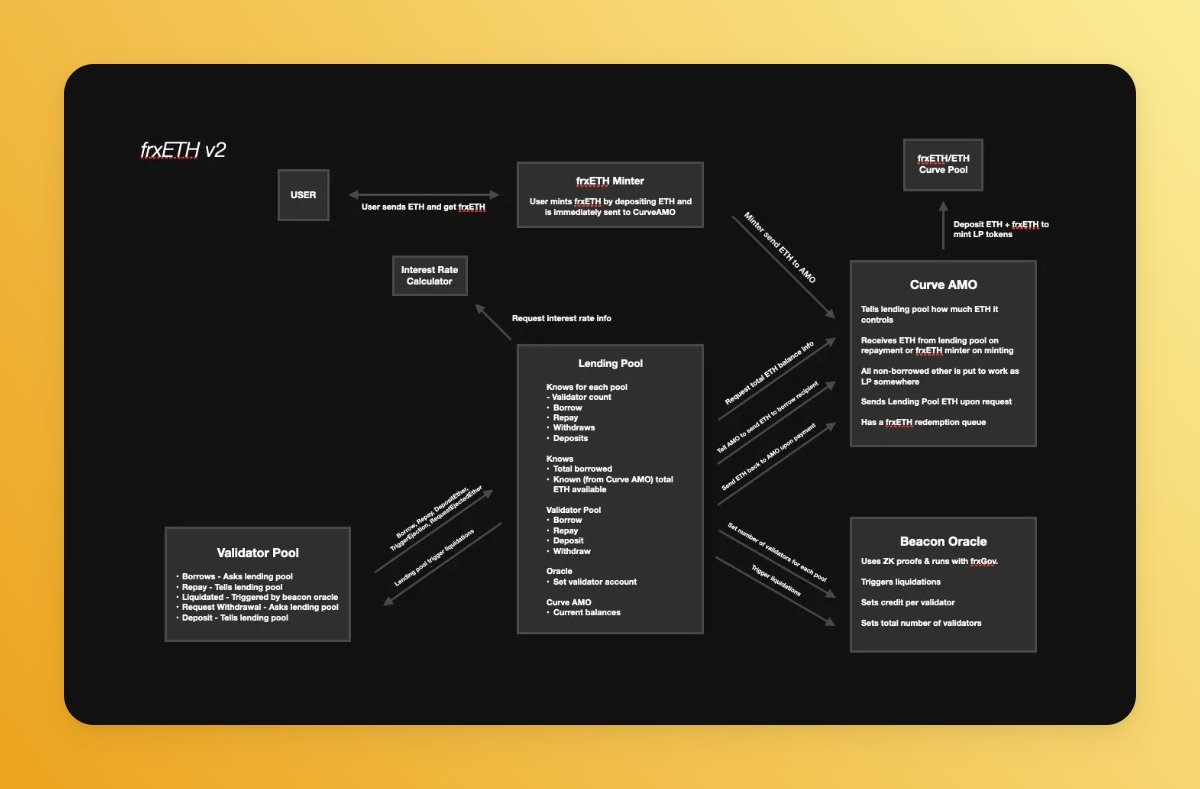

This is evident from the introduction of frxETH V2, which will function as a decentralized and permissionless Ethereum lending market for node operators.

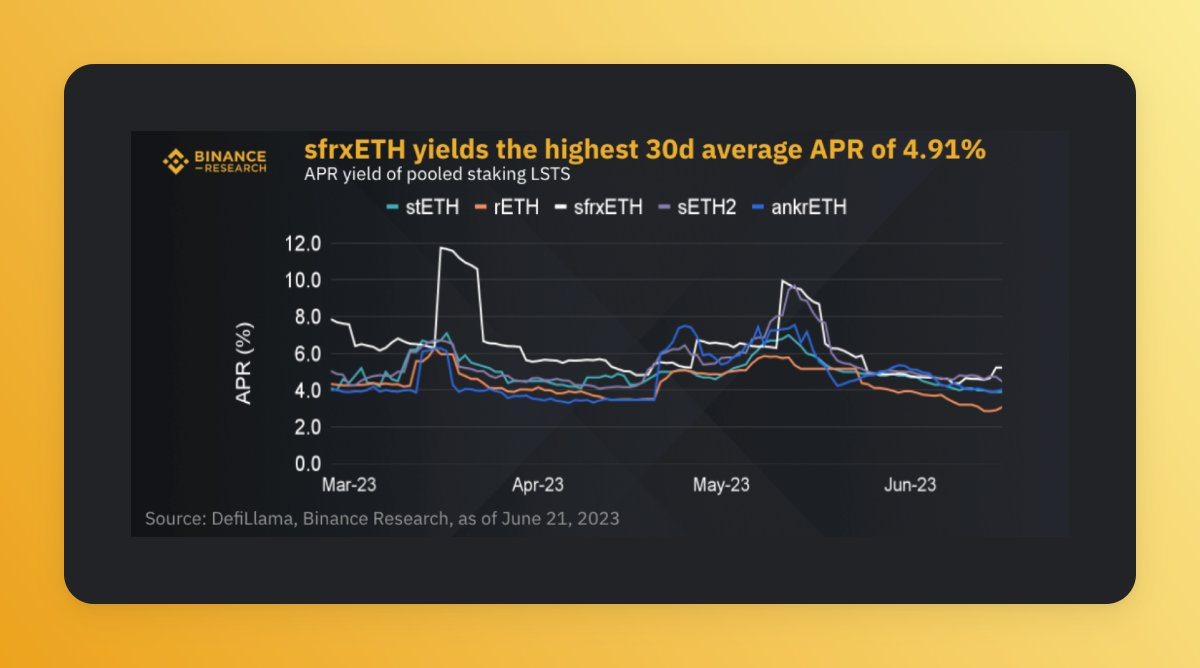

In terms of staking pool yields, Frax leads with the highest 30-day average annual percentage rate (APR) of 4.91%.

Therefore, considering recent developments, I personally believe $FRAX may be the asset with the greatest growth potential (not investment advice).

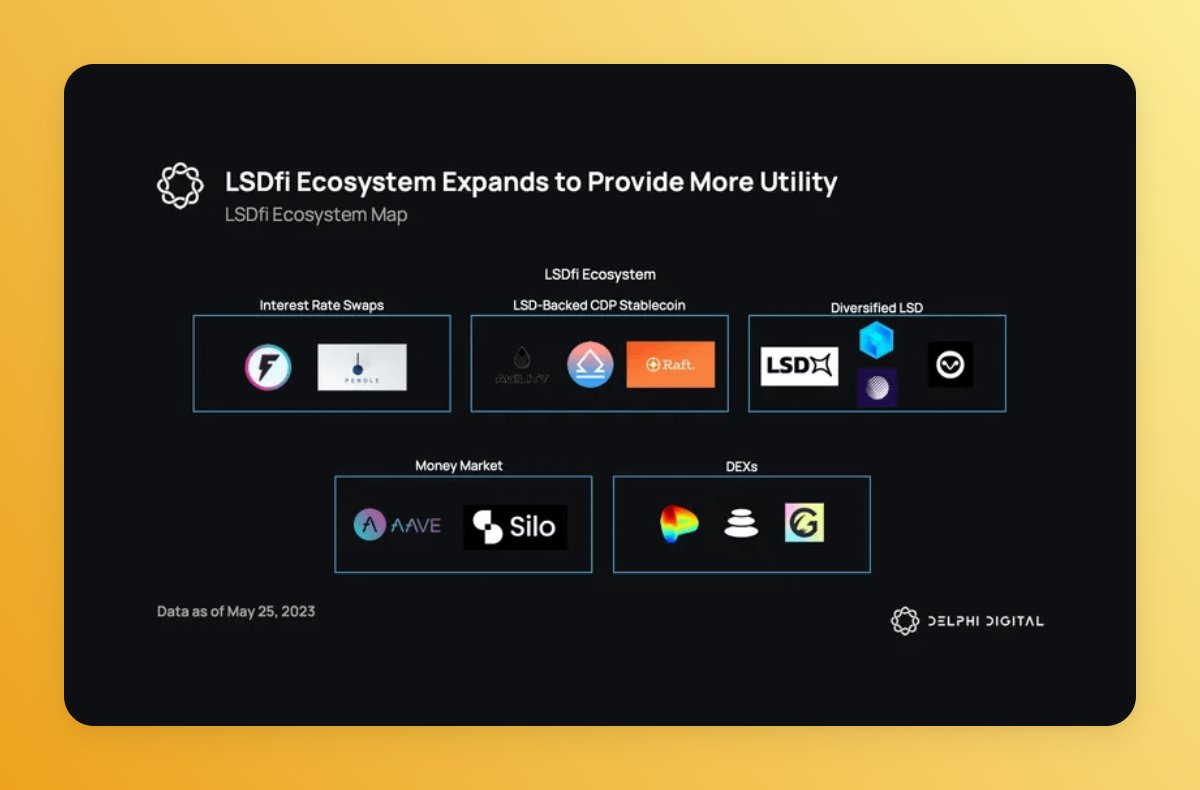

Now, let’s explore the LSDfi landscape.

In short, LSDfi (sometimes called LSTfi) refers to any mechanism that enables you to earn additional yield on staked assets such as sfrxETH, stETH, etc.

Tenet, EigenLayer, Pendle, Curve, and others are all examples of LSDfi protocols.

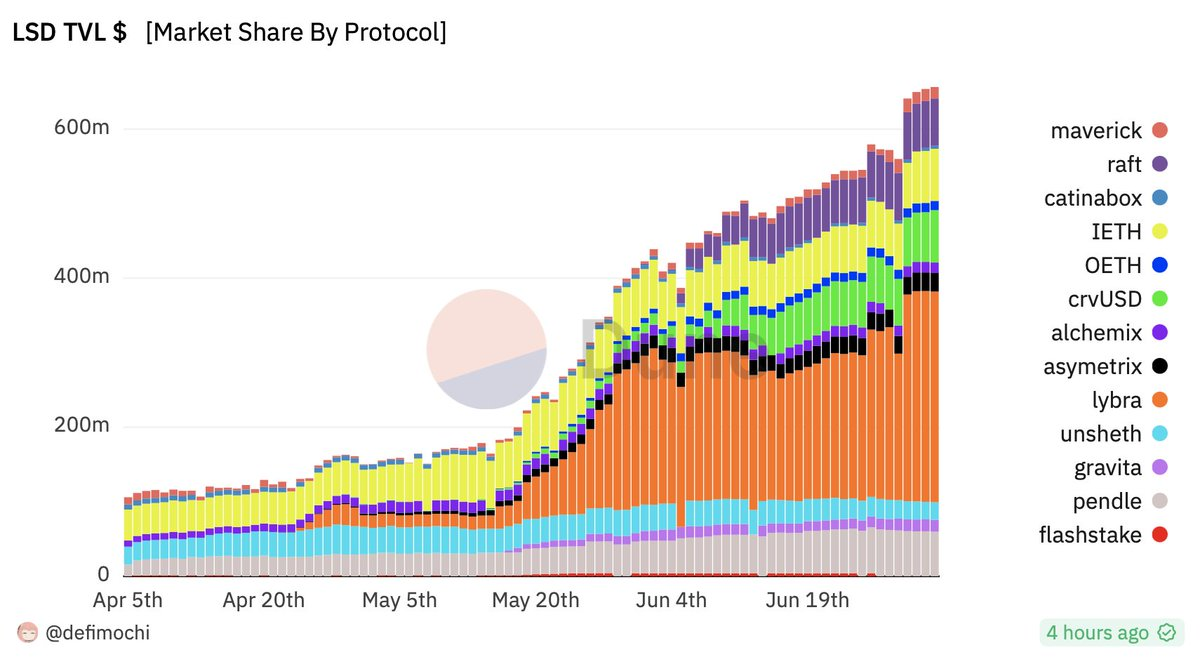

We can identify several fast growers from the past few months:

• LybraFinance;

• Raft;

• Asymetrix.

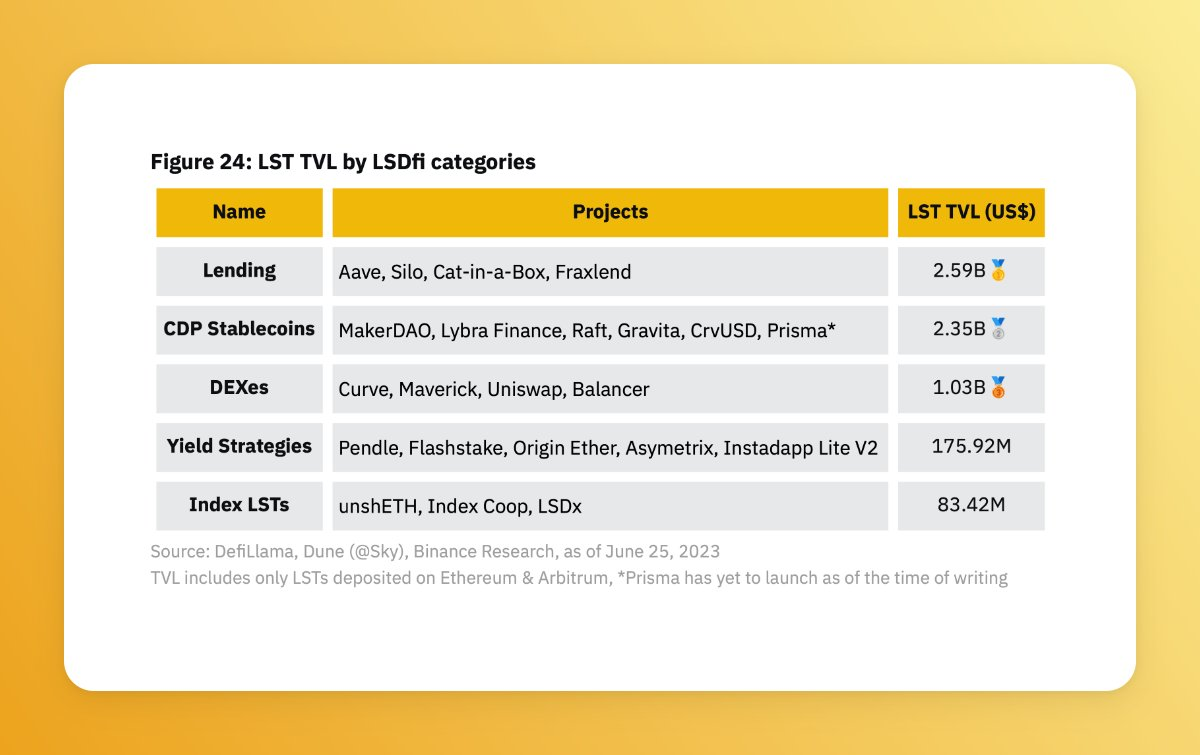

By category, the LSDfi market includes:

Lending: Aave, Catinabox, SiloFinance;

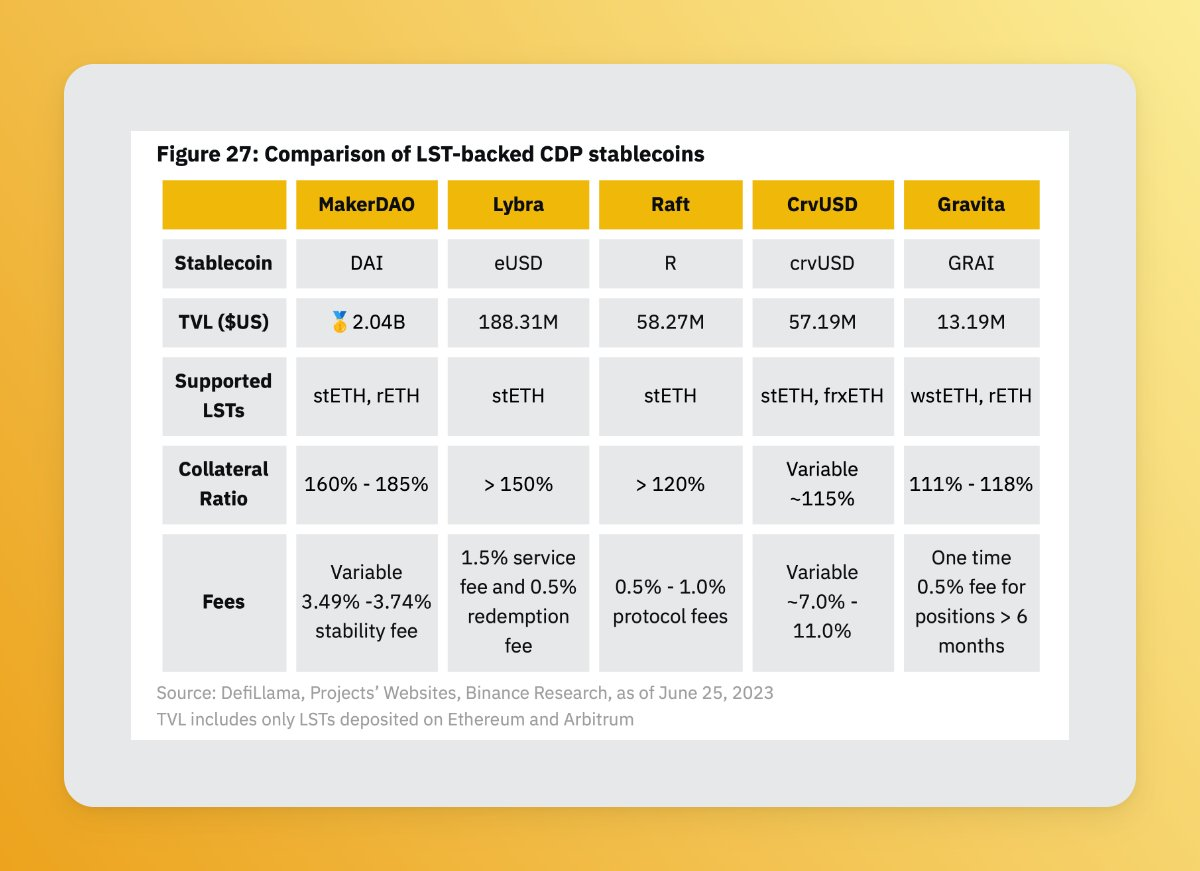

CDP: MakerDAO, CurveFinance, Gravitaprotocol

Decentralized Exchanges (DEX): CurveFinance, Maverick Protocol

Yield Strategies: Pendle, Instadapp

Index LST: Index Coop, etc.

Looking ahead? Watch these standout highlights:

• Maverick Protocol dominates the DEX category with an impressive average capital efficiency of 106.78%, followed by Uniswap at 38.64%.

• $crvUSD offers one of the highest interest rates for borrowers, exceeding 7.5%.

• Lybra introduced an innovative concept: redistributing staking rewards to stablecoin holders.

Below are also some LSDfi yields from leading protocols:

-

stETH: Pendle stETH LP (30-day average APR of 11.74%).

-

rETH: PancakeSwap V3: RETH-WETH (30-day average APR of 26.13%).

-

frxETH: ConvexFinance frxETH-CVX (30-day average APR of 27.75%).

In conclusion, the LSDfi space is rapidly evolving, with many compelling projects and protocols emerging. From liquid staking to lending, DEXs, and yield strategies, each category features its own leaders and innovators.

Degens may focus on assets and protocols offering the highest yields, but should also remember the importance of risk management and investment strategy.

As for the future of the LSDfi market, we look forward to even more exciting developments and opportunities. In the meantime, stay close to industry trends and project updates to seize potential growth opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News