Data Analysis: How Will the Pendle War Unfold?

TechFlow Selected TechFlow Selected

Data Analysis: How Will the Pendle War Unfold?

The risk lies in the ongoing emission of PENDLE tokens, making it difficult to consistently attract users to stake PENDLE.

1. Pendle Overview

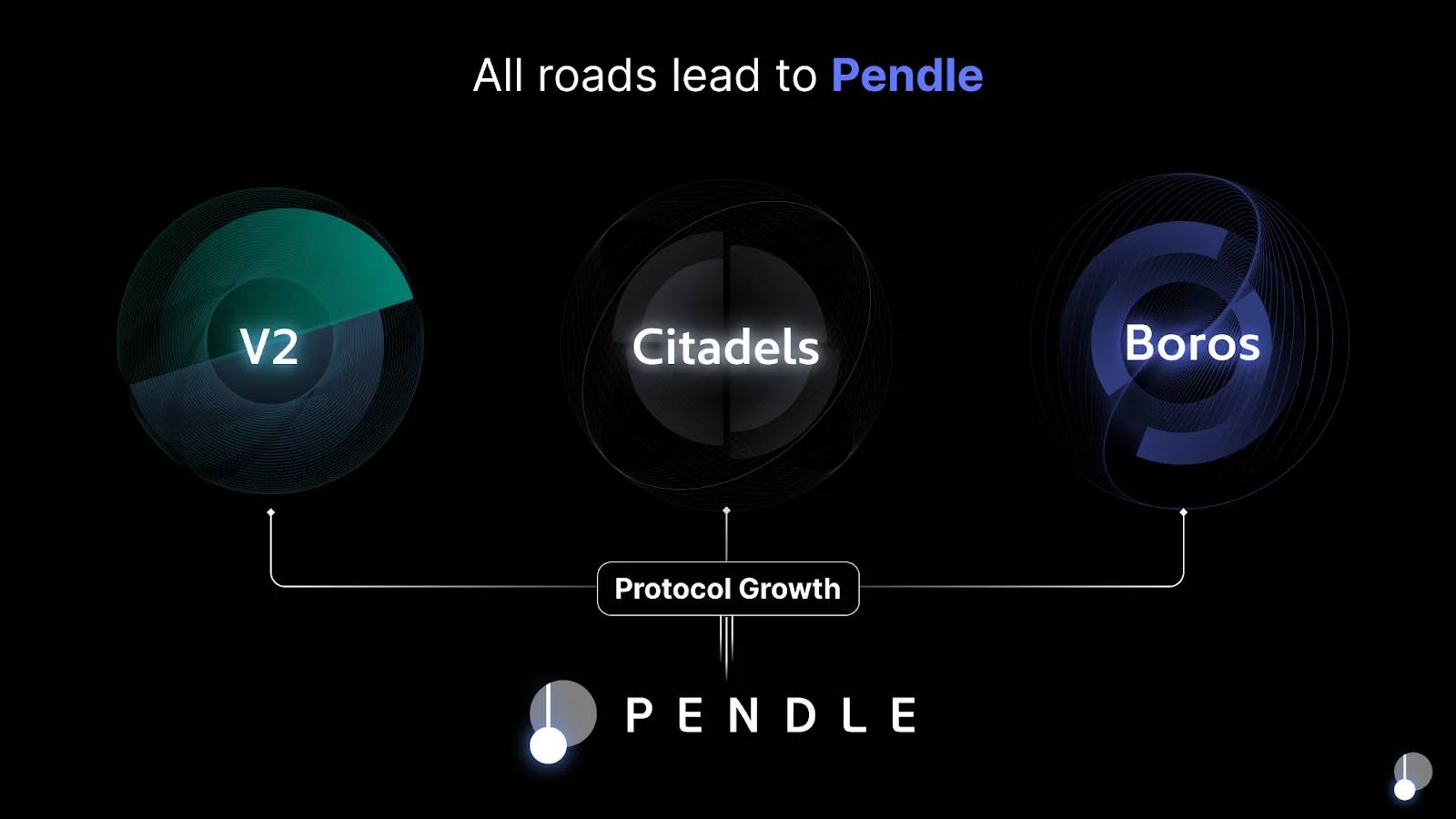

Pendle Finance is a yield strategy protocol deployed on Ethereum and Arbitrum. It launched its v2 version and revised its economic model at the end of 2022, later adding support for LST assets and launching on Arbitrum. For more fundamental information, refer to LD's historical report on Pendle.

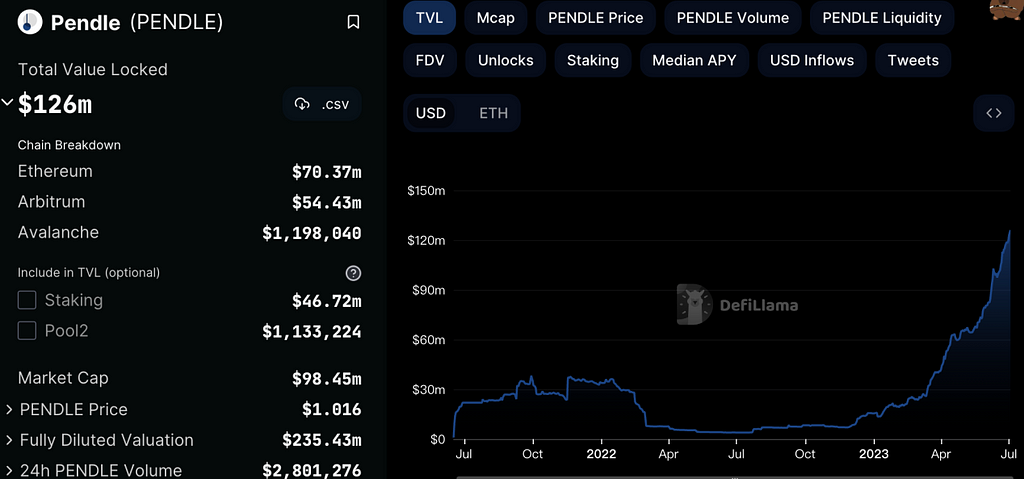

Figure: Pendle TVL

Its TVL has grown steadily since the end of 2022 and has now surpassed $126 million.

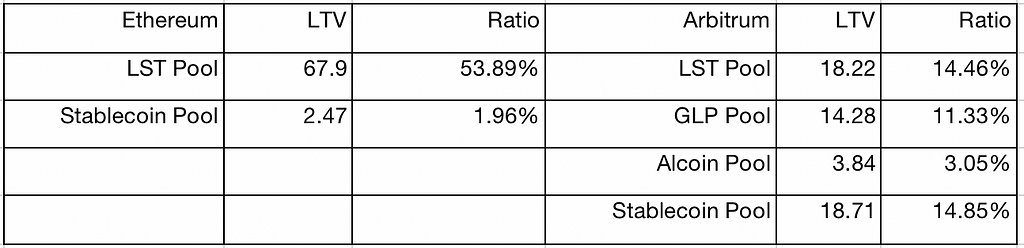

Figure: Liquidity Distribution (Million)

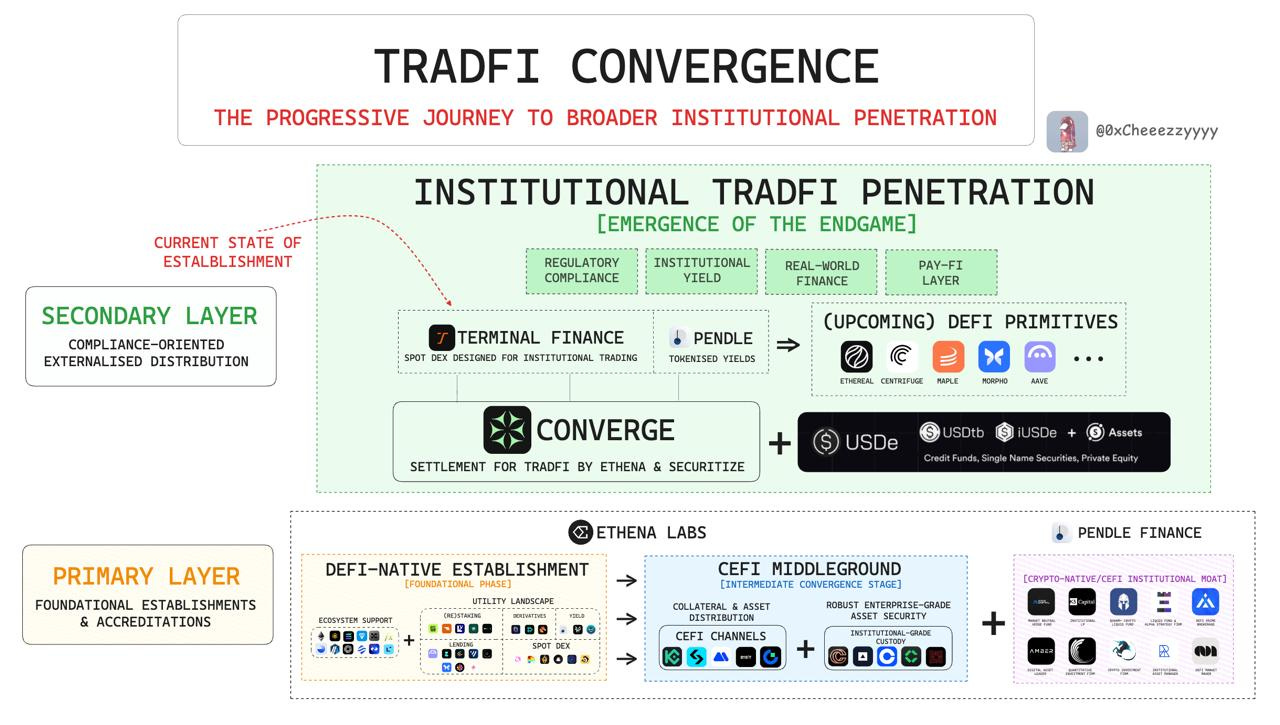

Liquidity within the Pendle protocol primarily comes from LST assets, while GLP, stablecoins, and other tokens account for only about 30% of its TVL. GLP’s revenue mainly derives from 70% of traders’ PnL and protocol fees. Both traders’ PnL and protocol fees fluctuate daily, resulting in higher volatility and greater tradability in GLP yields.

The initial yield of LST assets stems from ETH staking (PoS). Variations in staking amounts, LSD protocol mechanisms, and platform fees lead to slight differences in yields across LSD platforms, although these differences are generally small. Yields typically hover around 4%, with limited elasticity, which reduces the tradability of LST asset yields. The Pendle protocol employs a veToken and Gauge voting model for liquidity mining, enabling Pendle’s LST pools to achieve yields between 10% and 30%.

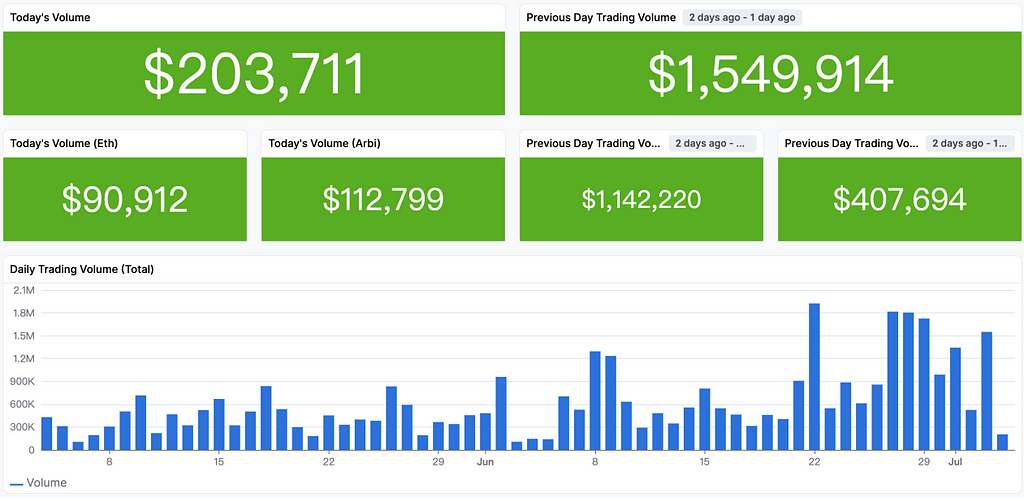

Figure: Pendle Protocol Trading Volume

Based on historical trading volume data, Pendle’s daily trading volume has mostly remained below $1 million. LSD asset trading accounts for 54.82% of total volume, while GLP accounts for 24.09%. GLP trading tends to increase during periods of high market activity; thus, GLP accounted for 51.29% of trading volume over the past 24 hours. Considering the proportion of each asset’s LTV within the protocol, GLP offers greater yield speculation opportunities.

2. Pendle Economic Model

Token Allocation

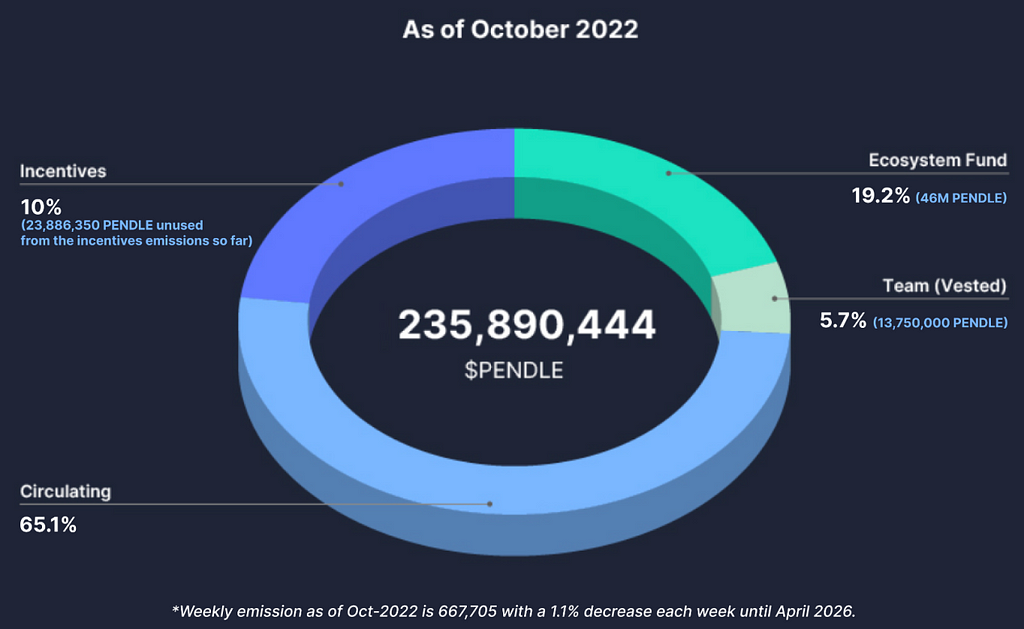

Figure: Token Distribution

The allocations for team, advisors, and investors have all been fully unlocked.

For liquidity incentives, 1.2 million tokens were distributed weekly for the first 26 weeks, after which the weekly amount decreases by 1.1% until week 260. After week 260, the annual inflation rate will stabilize at 2% based on circulating supply, with weekly liquidity emissions remaining relatively constant. According to the team, the weekly emission was 667,705 at week 79 (October 2022), and currently, we are roughly between weeks 113–117, with weekly emissions around 450,000 tokens. PENDLE will continue to be released long-term.

Figure: Weekly PENDLE Emission

Pendle introduced the veToken model in November 2022, primarily to enhance protocol liquidity. Lock-up durations for Pendle range from one week to two years. vePENDLE holders direct reward flows to different pools via voting, incentivizing liquidity in voted pools. Voting snapshots occur at the start of each cycle (Thursday 00:00 UTC), and incentive rates for each pool are adjusted accordingly.

Key Features of vePENDLE:

1) Issuers of LST assets have little incentive to bribe vePENDLE. As leading DEXs, asset issuers often provide token rewards and bribe veCRV voters to boost CRV-based liquidity mining for their assets on Curve. In contrast, demand for vePENDLE primarily comes from participating LPs, lacking strong demand from asset issuers.

2) Only vePENDLE lockers can participate in transaction fee distribution from pools they vote for.

3) vePENDLE holders receive 3% of fees generated from Yield Tokens (YT).

4) vePENDLE holders earn 80% of trading fees from the AMM pools they vote for.

Figure: PENDLE Staking Status

As of July 3, 37 million PENDLE tokens were locked, with an average lock-up duration of 392 days.

3. Penpie / Equilibria

Both Penpie and Equilibria are auxiliary protocols built atop Pendle’s veToken economic model designed to boost LP returns, allowing LPs to earn enhanced Pendle mining rewards without directly staking PENDLE. Their business models are largely similar.

Penpie

The protocol currently supports Ethereum and Arbitrum.

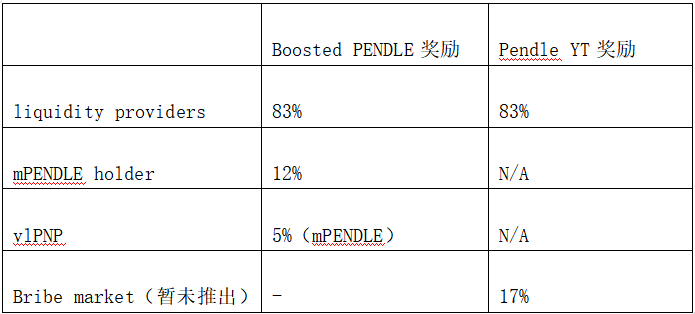

Users can convert PENDLE into mPENDLE via Penpie. The protocol aggregates deposited PENDLE and stakes it as vePENDLE to boost LP mining rewards. Boost income is distributed as follows: 83% to LPs, 12% to mPENDLE holders, and 5% to vlPNP. The team plans to allocate 17% of YT-related vePENDLE rewards to a bribe marketplace, but this feature has not yet launched.

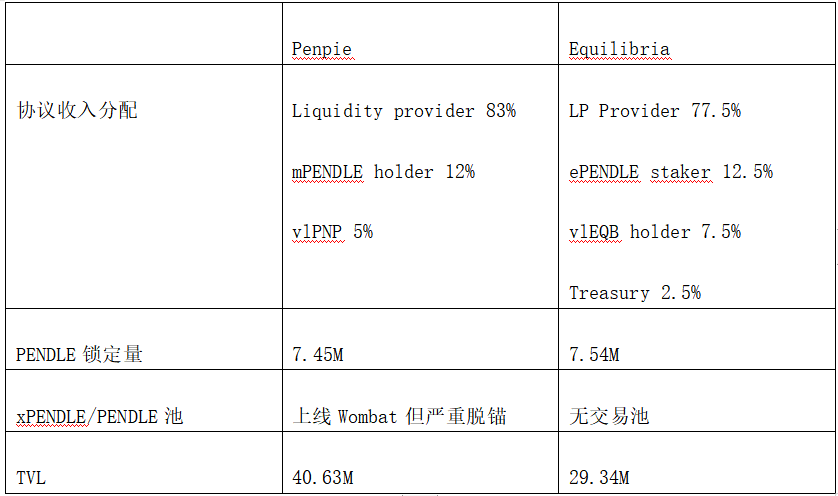

Table: Revenue Distribution

PNP is Penpie’s governance token. Users lock PNP to receive vlPNP at a 1:1 ratio. Holding vlPNP enables users to earn protocol revenue and participate in governance. Once PNP is locked into vlPNP, it enters a default locked state with no time limit. To begin unlocking, users must initiate a 60-day cooldown period. During this period, vlPNP holders continue earning passive income but cannot vote. After 60 days, users may fully unlock their vlPNP back into PNP. The penalty cost on the first day of cooldown equals 80% of the user’s total locked PNP, decreasing nonlinearly over time.

Equilibria

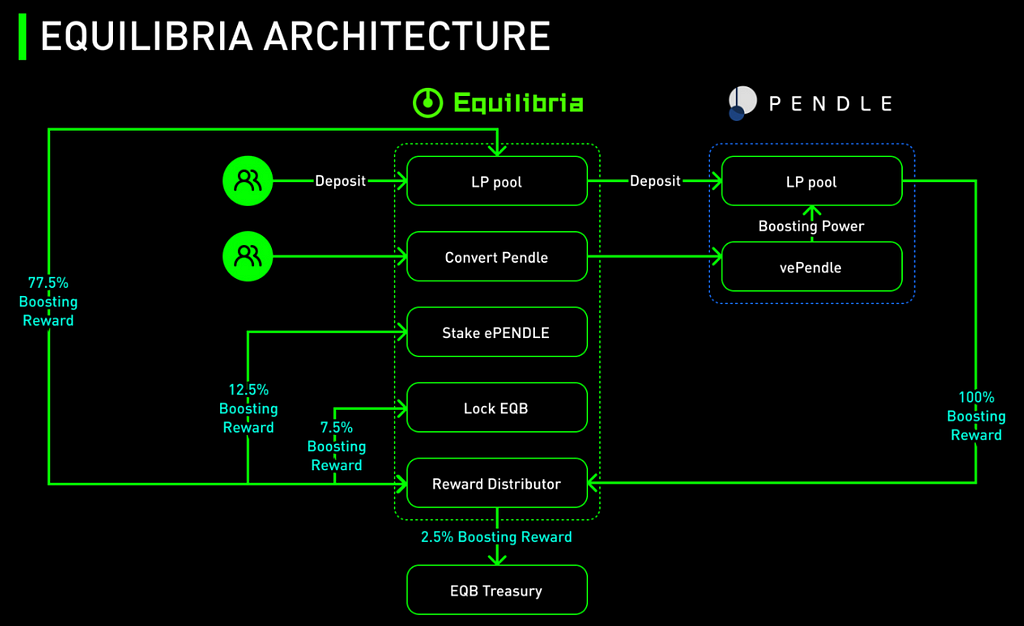

Equilibria operates similarly to Penpie, also helping Pendle LPs achieve mining boosts without directly staking PENDLE. Once PENDLE is staked as ePENDLE, the action is irreversible. Users must lock EQB/xEQB to obtain vlEQB, which grants access to protocol fees and voting rights. xEQB can be converted into vlEQB. The team intends to integrate xEQB into other protocols, though there are currently few practical use cases.

Figure: Equilibria Architecture

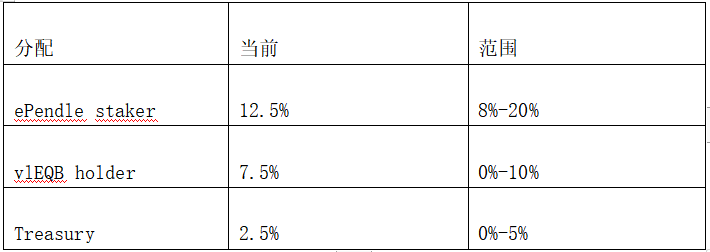

After achieving mining boosts through Equilibria, revenue is distributed as follows: 77.5% to LPs, 12.5% to ePENDLE holders, 7.5% to vlEQB holders, and 2.5% to the Treasury. Each role’s revenue share falls within predefined ranges.

Table: Revenue Distribution

Protocol Data

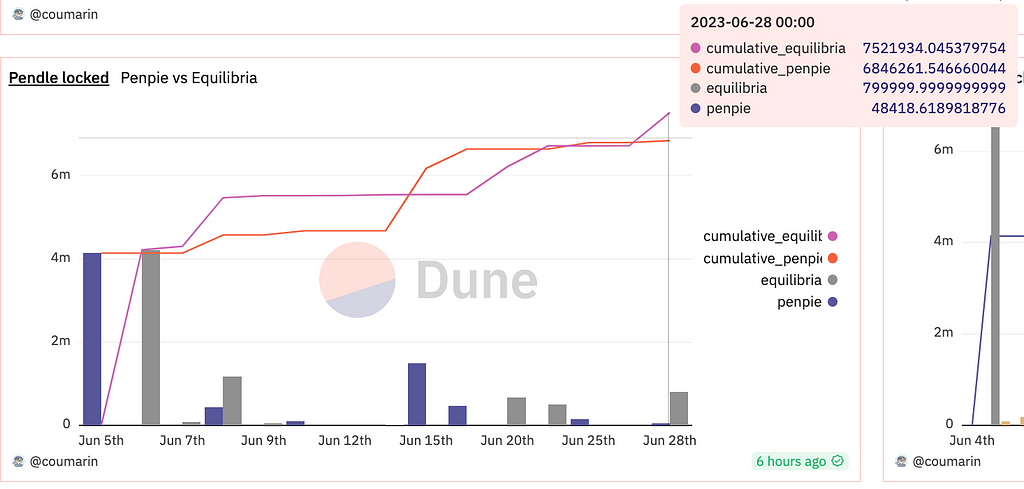

Figure: PENDLE Locked Data

*Dune data is for reference only (stale as of June 28) and may differ from current official website figures.

According to official data, as of July 4, Penpie had 7.45M PENDLE locked, while Equilibria had 7.54M locked. Although ePENDLE, mPENDLE, and PENDLE are all exchangeable at a 1:1 ratio, Equilibria announced on June 19 that it would suspend the ePENDLE/PENDLE liquidity pool, initially delayed for two weeks or longer. As of now, the community has not received a clear relaunch timeline. Meanwhile, mPendle has launched on Wombat, but the exchange rate is approximately 1:0.72, indicating significant slippage.

Table: Penpie vs Equilibria

Compared to Equilibria, Penpie allocates a larger portion of boost rewards to LPs, making it more LP-friendly and preserving more earnings for LPs. Under identical conditions, LPs would prefer Penpie.

From a data perspective, Pendle’s TVL continues to grow steadily, with fundamentals gradually strengthening. However, risks remain: PENDLE token emissions are ongoing, and neither Pendle nor Penpie or Equilibria can sustain high APRs indefinitely, making it difficult to continuously attract users to stake PENDLE. Additionally, large amounts of ePENDLE and mPENDLE currently lack liquidity pools or suffer from de-pegging, creating latent selling pressure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News