Analysis of Top L2 Liquidity-Customized DEX Mechanisms: Trader Joe, Izumi, and Maverick

TechFlow Selected TechFlow Selected

Analysis of Top L2 Liquidity-Customized DEX Mechanisms: Trader Joe, Izumi, and Maverick

Compared to Uniswap V3, Trader Joe V2, Izumi, and Maverick are all upgrades to the concentrated liquidity (CLMM) model, with primary improvements focused on the LP market-making side.

Author: Yilan, LD Capital

Introduction

With the expiration of Uniswap V3's license, numerous forks based on concentrated liquidity AMMs (CLMMs) have emerged. "Uni v3-Fi" includes DEXs (either direct forks of V3 or customized pricing range strategies built upon V3), yield-enhancing protocols (e.g., Gammaswap), and options-based or other protocols designed to mitigate impermanent loss in V3. This article focuses on DEXs that optimize price ranges based on Uniswap V3—specifically Trader Joe v2, Izumi Finance, and Maverick Protocol.

Problems with Uniswap V3

In Uniswap V3, liquidity is concentrated within specific price ranges. This means that if the asset price moves outside this range, it results in so-called "impermanent loss" (IL). Impermanent loss refers to the loss suffered by liquidity providers (LPs) in an AMM compared to simply holding the assets. When the price deviates from the range selected by the LP, impermanent loss can significantly increase—even exceeding the potential gains from holding the underlying assets.

The concentrated liquidity model of Uniswap V3 further amplifies IL risk. This explanation involves the concept of gamma from options Greeks. Gamma measures how quickly the delta of an option changes relative to movements in the underlying asset’s price. A high gamma implies that delta is highly sensitive to price changes, requiring frequent rebalancing to avoid potential losses—this is known as Gamma risk. All else being equal, when volatility increases, the value of options also rises because higher volatility increases the probability of profitable outcomes, leading markets to demand higher prices for such options.

When asset volatility is high, gamma risk—and thus impermanent loss for LPs—increases accordingly. As a result, LPs require greater compensation for bearing this risk. In effect, AMMs can be viewed as embedding a perpetual options market, where LPs are exposed to gamma risk and bear impermanent loss in exchange for trading fees or mining rewards.

To address this challenge, LPs must closely monitor the prices of their assets and actively adjust positions—for example, withdrawing liquidity and reallocating funds into new price ranges—to reduce impermanent loss. However, this process is time-consuming, incurs gas fees, and carries the risk of incorrectly setting price ranges.

Additionally, Uniswap V3 faces other issues. Concentrating liquidity within narrow price bands may lead to fragmented liquidity, increasing trading costs. Moreover, due to frequent price fluctuations, LPs must constantly manage and rebalance their positions—a significant burden especially for large-scale or frequently trading providers.

Therefore, while Uniswap V3 offers higher fee income and annualized returns, LPs must carefully weigh these benefits against the associated risks and operational complexities. Solutions addressing Uniswap V3's limitations generally fall into three categories: mitigating impermanent loss, optimizing tools for LP market-making strategies (offering diverse methods tailored to different risk profiles), and enhancing yield-generation mechanisms embedded within LP NFTs.

This article primarily analyzes three DEX projects focused on improving LP market-making strategies: Trader Joe, Izumi, and Maverick.

Trader Joe v2

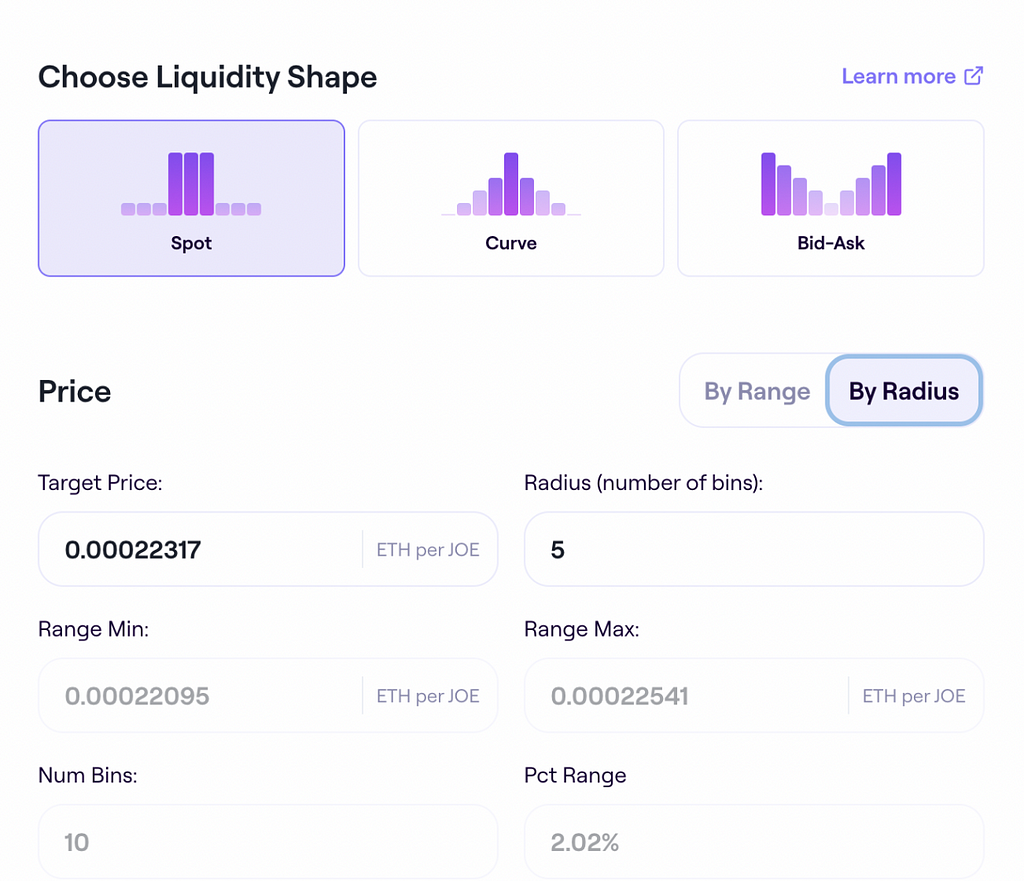

The key innovation of Trader Joe V2’s Liquidity Book (LB) over Uniswap V3 is the introduction of “Bins” and making liquidity distribution strategy-driven. A “Bin” represents a discrete price interval—the fundamental unit of liquidity distribution in the Liquidity Book. Within each bin, trades occur at a fixed exchange rate, enabling zero-slippage execution within that range and thereby improving trading efficiency and cost-effectiveness. Strategy-driven liquidity distribution means LB tokens possess semi-fungible characteristics and vertical liquidity allocation, allowing LPs to deploy capital strategically rather than uniformly across bins.

Trader Joe v2.1 launched its Auto Pool in June, with The General being the first auto-rebalancing pool deployed for AVAX-USDC (on Avalanche) and ETH-USDC (on Arbitrum). The General automatically rebalances liquidity positioning to maximize fee revenue, responding dynamically to market trends and asset imbalances, enabling adaptation across various market conditions. In the future, The General will expand to support additional liquidity pools.

Auto-Pools accumulate shares of trading fees generated by the liquidity pool. Tokens can be deposited into yield farms (to be released later). Auto-Pools may offer incentives through partner tokens (to be launched in the future). Each rebalancing incurs an automation fee equivalent to an annualized rate of 4.5%, used to cover operational costs such as gas fees. In the future, automation fees may be distributed to sJOE stakers.

By deploying liquidity under different strategic distributions, LPs who more accurately predict active price ranges—i.e., concentrate liquidity where price action occurs—earn higher rewards. Additionally, dynamic swap fees allow LPs to charge variable fees based on market volatility, enabling better risk and return management.

Izumi Finance

Izumi’s AMM uses the DL-AMM algorithm—a novel discrete concentrated liquidity mechanism that retains Uniswap V3’s core feature of concentrated liquidity provision but enables precise liquidity placement at any fixed price point instead of across a range. This grants iZiSwap greater control over liquidity management and supports advanced trading functionalities such as limit orders.

In addition to swaps, LiquidBox is another core product of Izumi Finance. LiquidBox is a liquidity mining solution built atop Uniswap V3 NFT LP tokens, leveraging various incentive models to attract liquidity. It allows project teams to efficiently configure trading pairs and liquidity pools while offering differentiated rewards across price ranges.

These liquidity reward models include:

1) Concentrated Liquidity Mining Model: Compared to standard xy=k models, capital efficiency within targeted intervals can exceed 50x. However, concentrated liquidity typically increases impermanent loss for non-stablecoin pairs, making it more suitable for stablecoin pairs due to their limited volatility.

2) One-Sided Non-Impermanent Loss Mining Model: For example, when an LP deposits 3,000 USDC and 3 ETH, Izumi manages 3,000 USDC placed within a (0, 3) price range on Uniswap V3 as buy orders during price dips. Meanwhile, the 3 ETH are locked in Izumi’s staking module (outside of Uniswap V3), preventing automatic sell-offs during price surges. This shields projects from impermanent loss and avoids forced selling pressure.

3) Dynamic Range Model: Designed to incentivize LPs to provide effective liquidity around the current market price.

When users stake their Uniswap V3 LP tokens into Izumi for farming, LiquidBox automatically checks whether the token’s value falls within the project owner-defined incentive range. This ensures LPs contribute liquidity precisely where needed.

This creates additional yield opportunities for Uniswap V3 LPs and functions similarly to a “bribe” mechanism for projects seeking to bootstrap liquidity. Users staking LP NFTs can manage their liquidity positions using features like fixed range, dynamic range, or one-sided models—potentially avoiding IL depending on market outlook and positioning choices.

Maverick Protocol

Maverick AMM’s Automatic Liquidity Placement (ALP) mechanism resembles Uniswap V3, but with a crucial distinction: ALP enables automatic dynamic rebalancing of concentrated liquidity. This results in lower slippage than non-concentrated AMMs while simultaneously reducing impermanent loss compared to traditional concentrated AMMs—especially under single-sided liquidity setups.

Its core mechanism relies on managing liquidity via “Bins”—the smallest usable price intervals. In Maverick, LPs can choose to allocate liquidity into specific bins. LPs can select among four distinct modes—Right, Left, Both, and Static—to determine how their liquidity responds to price movements.

When adding liquidity to a bin, LPs must deposit base and quote assets in the same ratio as existing holdings in that bin. They then receive corresponding LP tokens representing their share of liquidity in that bin.

In Maverick, non-static bins can shift left or right in response to price changes. When a moving bin overlaps with another of the same type, they merge, combining their total liquidity shares.

When an LP wishes to withdraw liquidity from a bin, they submit their LP tokens to claim their proportional share. If the bin has been merged, a recursive calculation routes the withdrawal request through the chain of merged bins, distributing assets proportionally from active bins in the sequence.

Summary

Trader Joe v2 and v2.1 achieve three main improvements:

1) Zero-slippage trading within individual bins.

2) The Liquidity Book introduces dynamic swap fee pricing, where fees apply to swap amounts within each bin and are proportionally distributed to LPs in that bin. This allows LPs to hedge against impermanent loss during periods of high volatility. From the perspective of AMMs as embedded perpetual options markets, this design is logical—using instantaneous volatility functions to price risk, akin to option premiums compensating sellers (LPs).

3) Auto Pools automatically rebalance liquidity positions to maximize fee income. Future upgrades will introduce farming strategies similar to Izumi’s LiquidBox and incentivization tools for project teams to bootstrap liquidity.

Izumi Finance achieves the following three advancements:

1) Precise value targeting: LiquidBox allows project owners to explicitly define incentive ranges for LP tokens, giving providers clearer visibility into where their liquidity is effective and enabling better risk management and reward optimization.

2) Enhanced liquidity management: By defining exact value zones, liquidity can be tightly concentrated at specific price points rather than spread across ranges. This improved control makes izumi easier to manage and supports advanced order types like limit orders.

3) Multiple liquidity reward models serve as powerful tools for project teams managing liquidity.

Maverick

Maverick enhances flexibility by offering multiple modes for adjusting how liquidity reacts to price movements. Bins can autonomously move and merge in response to price changes, maintaining optimal liquidity placement. This mechanism helps LPs better manage impermanent loss and improve returns amid price fluctuations. Features such as automatic native liquidity movement, customizable direction of concentration, automatic compounding of LP fees, and the ability for projects to incentivize specific price ranges make Maverick AMM a powerful tool for maximizing capital efficiency and enabling precise liquidity management for LPs, DAO treasuries, and DeFi development teams.

From performance metrics, Maverick recorded $164M in volume over the past week, Trader Joe $308M, and Izumi $54.16M; TVL stands at $27.83M for Maverick, $140M for Trader Joe, and $57M for Izumi. Notably, Maverick captures significantly higher volume relative to its lower TVL, indicating exceptional capital efficiency. Furthermore, most of its volume routed through 1inch suggests stronger price discovery capabilities.

Compared to Uniswap V3, Trader Joe V2, Izumi, and Maverick all represent upgrades to the concentrated liquidity (CLMM) model, with primary improvements centered on the LP market-making side.

In summary, the commonality among these protocols is the introduction of customizable price ranges, allowing LPs to select specific intervals for liquidity provisioning. This enables more precise control over capital deployment, facilitates strategic position-building, and supports optimized market-making strategies tailored to specific price points.

The differences lie in the degree of customization offered in liquidity management tools and the maturity stages of their respective ecosystems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News