ARB Trades Shine, Unveiling Trade Joe V2

TechFlow Selected TechFlow Selected

ARB Trades Shine, Unveiling Trade Joe V2

Recently, Trade Joe V2 has gained significant attention by capturing a large portion of Arb trading volume from Uniswap, causing its token price to quickly double.

Recently, Trade Joe V2 has surged in popularity by capturing a significant share of $ARB trading volume from Uniswap, causing its token price to double rapidly. But how exactly did it achieve this? And what should you consider when providing liquidity?

This article will guide you through the mechanics of Joe V2, analyze why it gained such a large share in $ARB trading, and examine its strengths and weaknesses—helping you better understand modern DEX design.

In short, Trade Joe V2:

Uses an AMM model similar to an order book with non-continuous liquidity;

Employs minimum price precision based on ratios rather than fixed values;

Features vertically aggregated liquidity for improved composability;

Distributes liquidity incentives based on LPs’ earned trading fees and effective TVL.

AMM Mechanism

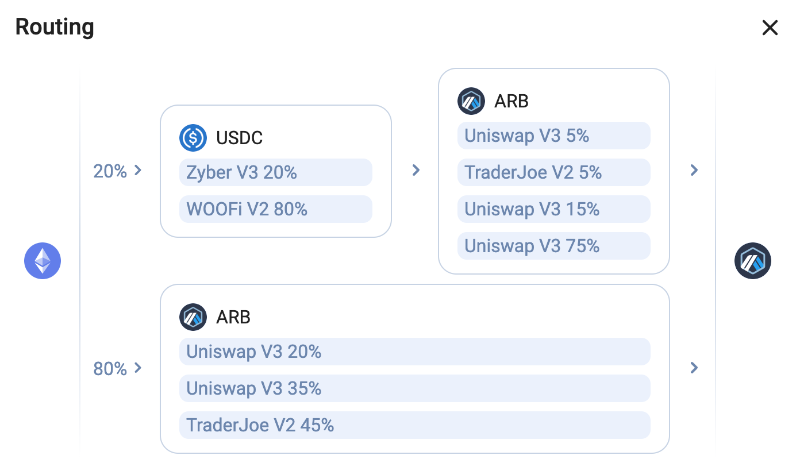

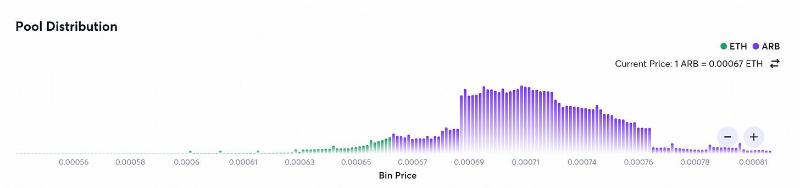

Let’s take the ARB/ETH 20 bps pool on Joe V2 as an example. First, observe the liquidity distribution—it looks quite similar to Uniswap V3 at first glance.

So where lies the fundamental difference?

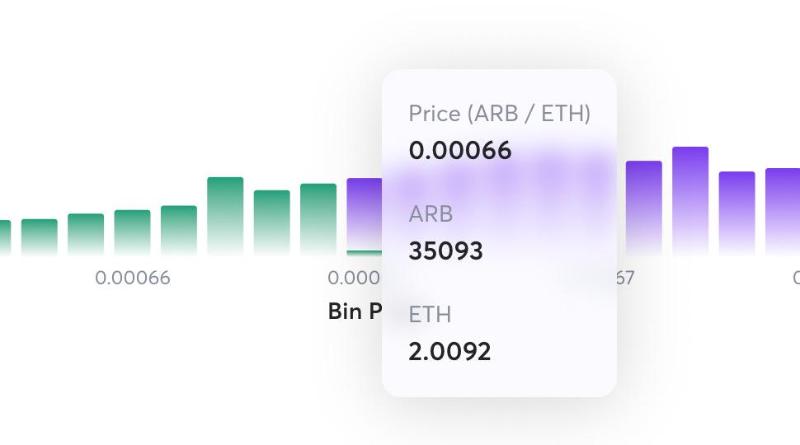

Each bar (or “bin”) in Joe V2 corresponds to a single price point. This means the price won’t change unless all liquidity within that bin is exhausted. For instance, in the image below, the bin contains approximately 35k ARB and 2 ETH. If someone sells 2 ETH worth of ARB at 0.00066, the trade shifts to the next bin to the left, and only then does the price move.

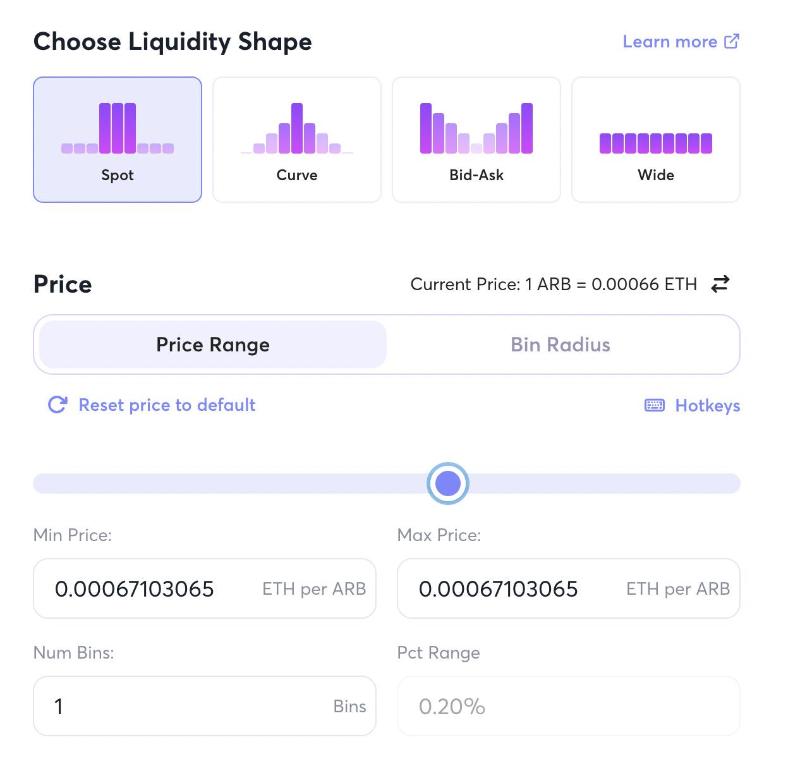

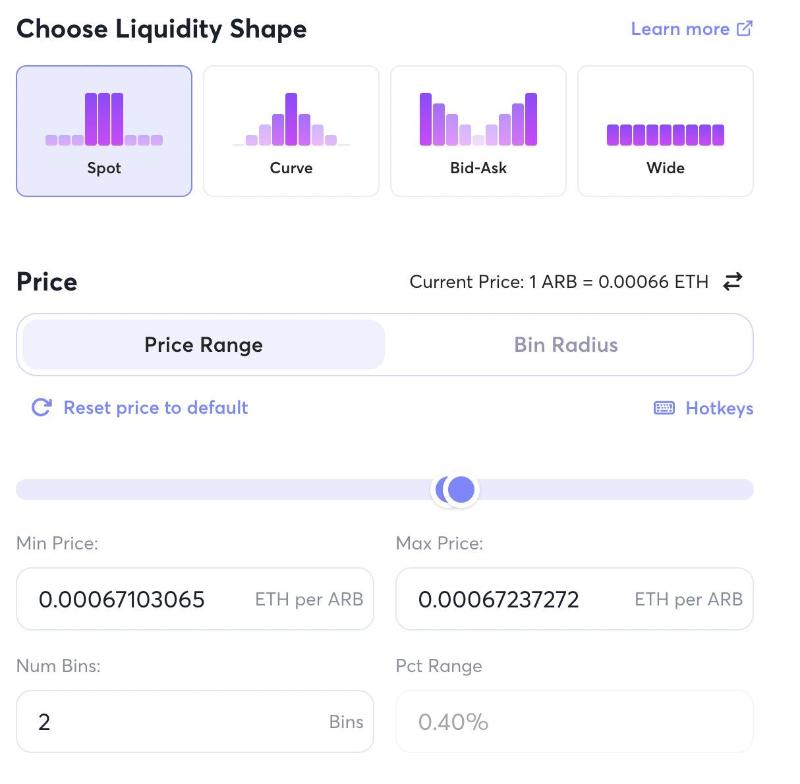

When adding liquidity to this pool, we find that we can provide liquidity at a single price point—meaning your liquidity sits at one exact price. This is effectively equivalent to placing a maker order in an order book. Then what about the "Pct Range = 0.20%" shown nearby?

Let’s slightly adjust the right slider to expand the range to 2 bins, then calculate the relative difference between the two prices:

(0.00067237272 - 0.00067103065) / 0.00067103065 = 0.20%

Thus, 0.20% represents the minimum price precision.

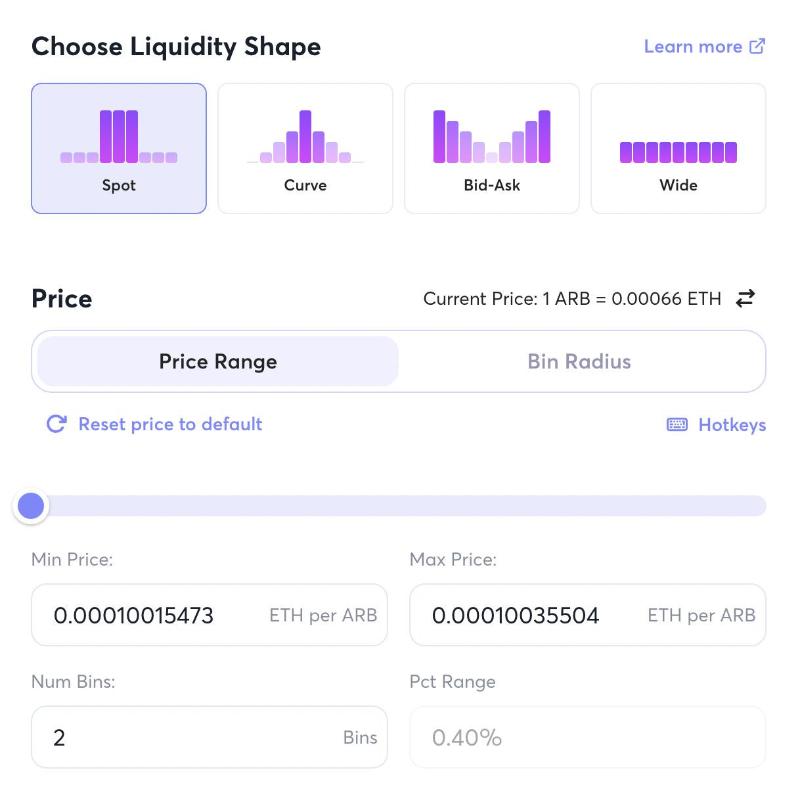

Now let's check a location further from the current price, say ARB/ETH = 0.0001. We get:

(0.00010035504 - 0.00010015473) / 0.00010015473 = 0.20%

Exactly—the price difference between adjacent bins is always 0.2%, proportional rather than fixed. This differs significantly from traditional order books, which typically use fixed minimum increments like 0.01 USDT.

Joe’s UI offers four methods for adding liquidity. Clicking “learn more” in the top-right corner explains each in detail. However, except for “Spot,” the other options use predefined parameters set by the protocol and are not customizable. Therefore, I recommend using the Spot option—its deposit method resembles Uniswap V3; if needed, simply deposit across multiple price ranges. Also, keep in mind that Joe V2 currently offers liquidity incentives, which must be factored into your yield calculations.

Liquidity Incentives

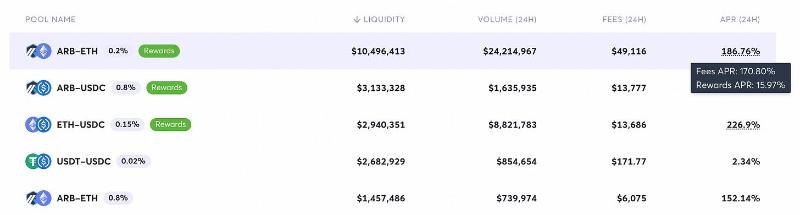

Currently, pools labeled with “Rewards” offer liquidity mining incentives.

Joe V2’s liquidity mining incentive distribution works as follows:

Scores are calculated based on actual trading fees earned by LPs and MakerTVL (see diagram below);

MakerTVL currently only counts liquidity within ±5 bins of the current price. For example, with a 0.2% bin width for ARB/ETH, only TVL within ±1% of the current price is counted;

At the end of each epoch, scores are tallied and rewards are distributed proportionally in a lump sum.

Therefore, to maximize incentive earnings, liquidity providers need to concentrate their positions around the current price.

For more details, refer to this document.

Why Did It Capture So Much $ARB Trading Volume?

Suppose the market is consistently buying ARB, and Uniswap shows ARB/USDC = 1.005. Assume Joe V2 has a 1% price precision with bin distribution [0.99, 1.00, 1.01...].

In this case, Joe’s current bin would be 1.00—0.5% cheaper than Uniswap. As long as the fee difference is less than this spread, arbitrageurs and aggregators like 1inch will naturally route buy orders through Joe. Conversely, when selling ARB, Joe holds no advantage. Thus, Joe performs well during high-volatility, one-sided market moves but appears mediocre in low-volatility, ranging markets.

Additionally, Joe set a 0.2% fee for the ARB/ETH pair. At the time, due to high volatility expectations, Uniswap V3 could only choose among 0.01%, 0.05%, 0.3%, or 1%. Most LPs opted for 0.3% or higher, putting Uniswap at a disadvantage compared to Joe’s lower 0.2% fee.

Frequent exchange rate advantages under high volatility + relatively lower fees enabled Joe V2 to capture massive share during ARB’s initial trading phase. Now, as volatility declines, Joe no longer maintains consistent pricing advantages. Meanwhile, Uniswap V3 LPs have shifted back to 0.05% fee tiers, eroding Joe’s fee competitiveness. Fortunately, Joe has already built strong brand recognition, and its effective incentive mechanism gives the team room for future growth strategies.

Product Strengths and Weaknesses

As discussed above, the AMM mechanism inherently brings both pros and cons. Here we explore additional aspects:

Strengths:

Vertical liquidity aggregation enables superior composability;

High capital efficiency combined with incentive support opens opportunities for partnerships (e.g., potential benefits from the LSD war).

Weaknesses:

Lacks mature token utility mechanisms like bribe systems, limiting returns for JOE holders;

Relatively higher impermanent loss.

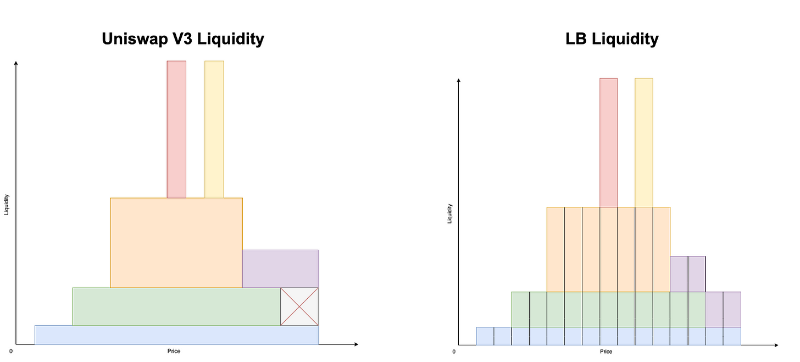

Advantage: Composability

In Joe V2, liquidity is vertically aggregated across bins, whereas in Uniswap V3, it is horizontally aggregated. The key benefit of vertical aggregation is that it makes liquidity interchangeable.

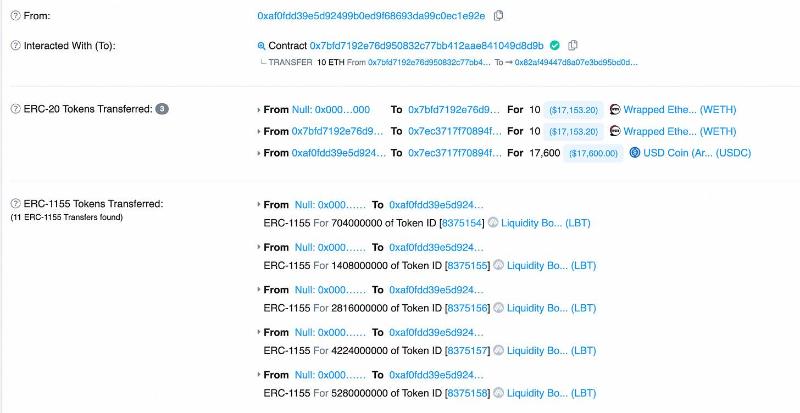

Looking at a specific liquidity addition transaction, after depositing ETH/USDC, Joe returns multiple ERC-1155 LBT tokens with different Token IDs, representing the user’s liquidity distribution across various price levels.

This differs significantly from Uniswap V3, which returns a single NFT. Since identical Token IDs indicate liquidity within the same bin/price level, they are fungible and offer greater composability.

Advantage: Partner Incentive Potential

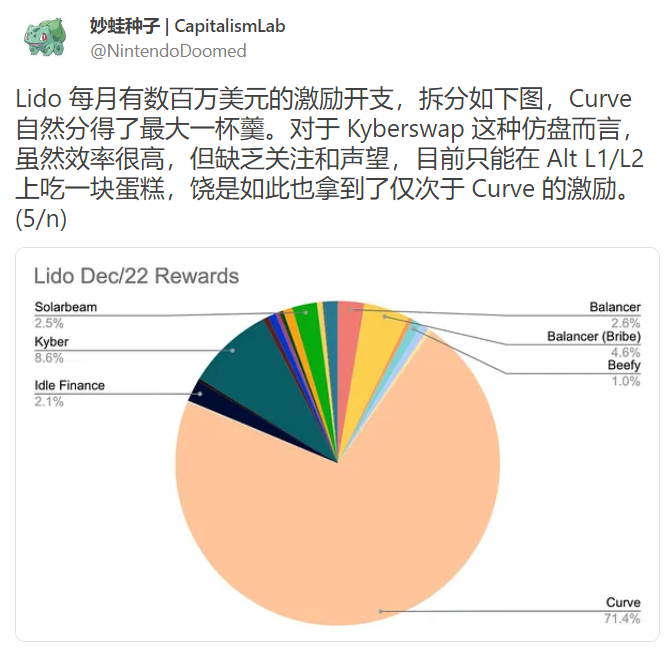

With highly efficient concentrated liquidity and built-in incentive support, Joe V2 is well-positioned to attract partners with liquidity needs—such as LSD protocols—who may fund additional rewards. For example, KyberSwap’s Dynamic Market Maker (DMM), working with UNI V3-style incentives, secured the second-largest reward allocation from Lido after Curve and captured a dominant share of LSD trading volume on alternative L1/L2 chains (see tweet below).

Joe V2, offering comparable value, theoretically has a similar opportunity to boost its TVL and trading volume through strategic partnerships.

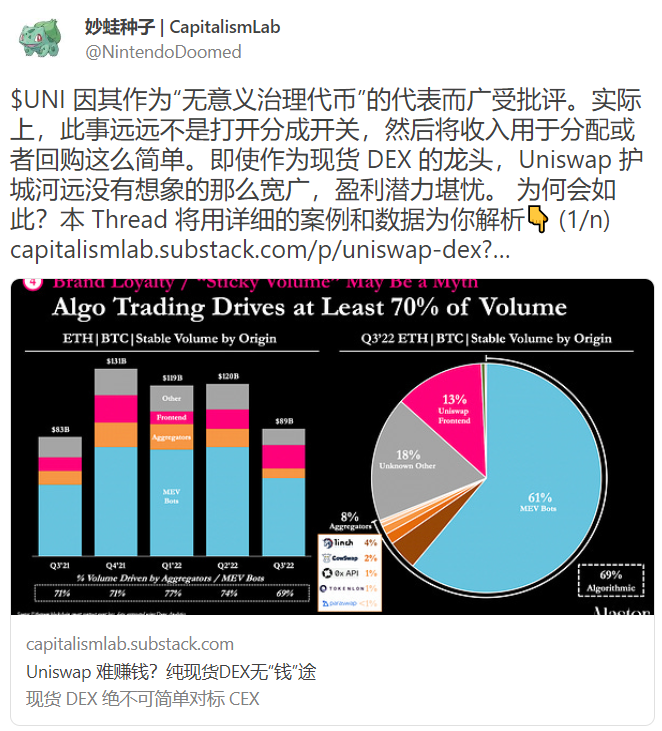

Weakness: Token Utility Issues

As mentioned in my tweet below, pure spot DEXs without additional utility mechanisms like bribes struggle to convert high TVL and trading volume into meaningful returns for token holders.

Currently, Joe generates revenue via fee sharing, but taking too large a cut risks losing trading volume. While Joe does have veJOE, it hasn't followed Curve’s bribe-based path, and so far this model hasn’t proven highly successful. Hence, token utility remains a challenge.

Weakness: Higher Impermanent Loss

As previously noted, Joe V2 enjoys frequent exchange rate advantages during one-sided moves, but for LPs, this translates into higher impermanent loss—essentially selling assets at a cheaper price.

Joe mitigates this through carefully calibrated fees—for example, 0.8% for ARB/USDC with 1% bin width, and 0.2% for ARB/ETH with 0.2% bin width. Since this risk isn't immediately obvious, the impact is somewhat acceptable.

Summary

Trade Joe V2 achieves differentiation over Uniswap V3 primarily through scenario-specific efficiency advantages. Its superior composability depends heavily on achieving sufficient scale. Going forward, watch closely for business development efforts—particularly whether Joe can secure enough partner-funded incentives to create a sustainable growth flywheel.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News