Rage Trade: Innovator in Perpetual Futures Contracts, Building Full-Chain Liquidity

TechFlow Selected TechFlow Selected

Rage Trade: Innovator in Perpetual Futures Contracts, Building Full-Chain Liquidity

Rage Trade is a fully cross-chain perpetual futures trading platform powered by LayerZero, designed to enhance capital efficiency through deep liquidity.

Executive Summary

(1) Rage Trade is a cross-chain perpetual futures trading platform powered by LayerZero, aiming to enhance capital efficiency through deep liquidity.

(2) Compared to other perpetual platforms, its competitiveness and sustainability stem from innovations such as recycled liquidity and 80/20 Vaults.

(3) The Delta Neutral Vaults strategy minimizes market risk for GLP stakers while generating returns for USDC stakers.

Background

Perpetual futures (perps) have become a cornerstone of cryptocurrency, enabling leveraged trading, hedging, and speculation. Since BitMEX pioneered perpetual futures in 2016, most trading volume has originated from centralized platforms like Binance and OKX. As DeFi continues to evolve, decentralized perpetual futures are gaining increasing attention. This trend is primarily driven by the following factors:

(1) Users want self-custody of their assets;

(2) Traders seek to bypass restrictions such as KYC, regulations, and geographical boundaries when engaging in leveraged trading;

(3) Users desire reliable and stable platform operations (more dependent on the underlying blockchain);

(4) Users aim to profit from arbitrage and delta-neutral strategies.

Liquidity depth and gas fees are the two most critical factors users consider when selecting a decentralized perpetual futures trading platform. Deep liquidity ensures minimal slippage during trades, allowing users to achieve optimal positions. Low gas fees enable high-frequency trading, as transaction costs become negligible relative to position size.

Why Do We Need Another Perpetual Futures Platform?

Simply put, the liquidity issue has not been adequately resolved. How does Rage Trade incentivize liquidity in a sustainable manner?

As mentioned above, deep liquidity is essential for a smooth trading experience. Let's examine current perpetual futures trading platforms on the market and identify their shortcomings.

Among various decentralized perpetual futures platforms, dYdX and GMX are undoubtedly the most popular, with annual trading volumes reaching $207.1 billion and $46.4 billion respectively. However, long-term sustainability concerns remain—dYdX relies on token rewards to incentivize liquidity, while GMX’s yields depend on traders’ losses.

dYdX uses a Central Limit Order Book (CLOB), requiring market makers to provide liquidity via limit orders. To incentivize them, 40% of the total token supply is allocated to reward traders and liquidity providers. After each epoch, traders earn dYdX tokens based on their trading fees and position sizes. Market makers can trade based on the liquidity they provide and hedge their positions on centralized exchanges to earn risk-free dYdX tokens. Ultimately, when prices fall, token buyers bear the brunt of selling pressure, while market makers begin profiting.

On the other hand, GMX pays GLP rewards based on trader fees and losses. GLP holders earn money from traders' losing positions, liquidated assets, and fees paid on every trade. Their entire revenue structure depends on traders losing, since trader profits are paid out of GLP funds. Liquidity providers also face risks—they may be drained if traders make large gains. The yield offered also depends on trading volume, which cannot be guaranteed unless traders actively use GMX daily.

Additionally, another popular platform, Perpetual Protocol launched version 2 of its protocol to mitigate various risks associated with insurance fund depletion in v1. This was due to paying funding rates from the insurance fund, where significant deviations in token prices led to high funding rate payments.

With the launch of v2, real liquidity was introduced, making liquidity providers the counterparty to trades instead of the insurance fund. However, providing liquidity to the v2 protocol results in losses when the price of the underlying token changes. Most liquidity is provided by the team itself, which must trade using its own liquidity to hedge against losses. In the end, their PnL becomes negative, forcing them to sell $PERP rewards to cover losses. But token emissions lead to issues similar to dYdX, where tokens essentially only incentivize liquidity providers.

As shown above, existing platforms such as GMX, dYdX, and Perpetual Protocol face challenges regarding long-term sustainability. Rage Trade aims to solve this problem by offering both traders and liquidity providers a seamless, capital-efficient platform with deep liquidity.

This article will discuss how Rage Trade innovates in deep liquidity provision by recycling underutilized LP tokens from various chains, and explain how its capital efficiency and fee collection mechanisms differentiate it from existing platforms.

How Does Rage Trade Work?

You can refer to Rage Trade’s official documentation, as well as Twitter threads by BizYugo, 0xjager, and 0x_d24.eth for detailed mechanics. The diagram below illustrates the protocol workflow:

In short, Rage Trade has two main components designed to optimize spot LP liquidity and increase capital efficiency of its $ETH futures contracts by up to 10x leverage:

(1) Omni-chain Recycled Liquidity

(2) 80-20 Vaults

Omni-Chain Recycled Liquidity

Rage Trade has the potential to connect all ETH/USD yield-generating pools such as GMX, Sushiswap, etc., and leverage LayerZero to provide recycled liquidity. But how can an LP token from another protocol—held on other chains like Polygon, Avalanche, or Solana—serve as liquidity on Arbitrum-based Rage Trade?

The answer lies in LayerZero.

LayerZero is essentially a message-passing protocol that enables messages to be sent from Chain A to Chain B. Taking the 3CRV vault as an example, when a 3CRV LP token is used as collateral on Chain A, we can mint virtual liquidity into Rage Trade on Chain B.

80-20 Vault

This is a system pioneered by the Rage Trade team. Essentially, at least 80% of the LP tokens continue generating yield on the original protocol. The remaining 20% is used as virtual liquidity on Rage Trade.

This mechanism is akin to enjoying UNI V2 yields while still benefiting from concentrated liquidity advantages on UNI V3.

This 80-20 vault operates in dynamic equilibrium and does not remain fixed at an 80-20 ratio. You can learn more about its detailed operation here.

Additional Product: Delta Neutral Vault

GMX has remained a popular perpetual trading platform, with over $384 million in liquidity within its GLP pool as of January 2023.

GLP is a liquidity pool similar to Uniswap’s LP, containing a basket of tokens. The chart below shows the composition of tokens within the pool.

Source: GMX

GLP consists of 39% USDC and 61% other cryptocurrencies. Due to the volatility of assets like BTC and ETH, GLP is exposed to direct market risk, leading to value fluctuations. Users are incentivized to stake GLP to profit from traders’ losses and receive rewards in the form of esGMX and 70% of platform fees. However, despite earning rewards, GLP stakers may still incur losses due to market risk.

The chart below compares GLP returns versus rewards. Since inception, GLP has delivered a -13% return due to market risk.

Source: Ape/rture

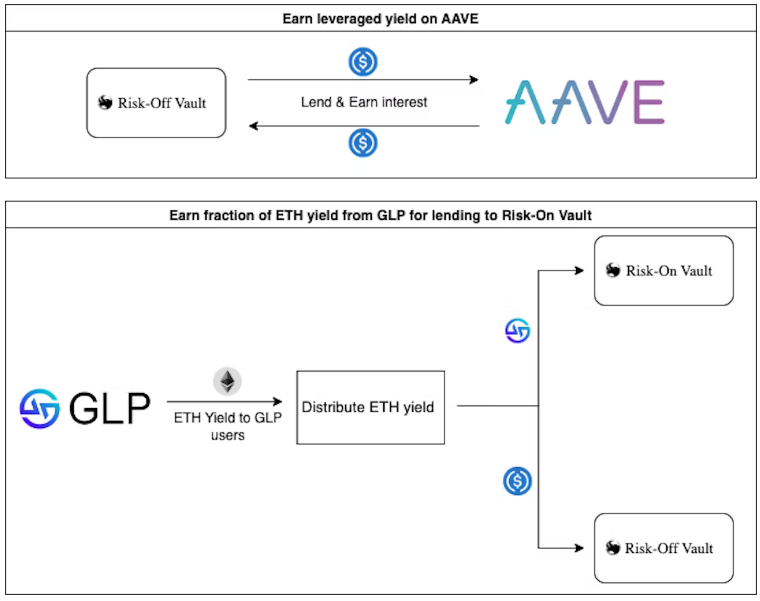

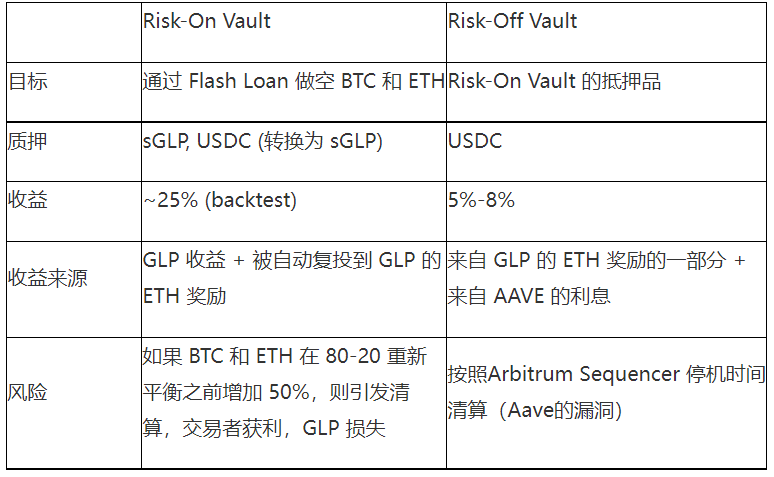

Rage Trade aims to address this issue by reducing market risk to ensure positive returns for GLP stakers. This is achieved through the Delta Neutral Vaults product, specifically by shorting BTC and ETH on Aave and Uniswap to minimize exposure. They operate two complementary, independent vaults: Risk-Off Vault and Risk-On Vault.

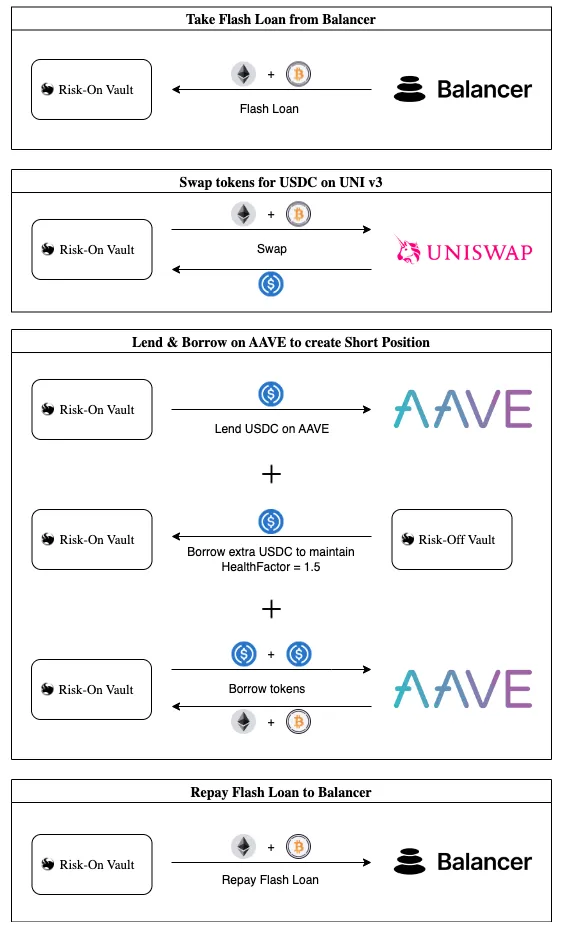

The Risk-On Vault uses Flash Loans on Balancer to obtain BTC and ETH, then sells them on Uniswap for USDC. These USDC proceeds, along with some USDC from the Risk-Off Vault, are used to borrow BTC and ETH, which are then repaid to Balancer. This effectively creates a short position on AAVE, as the Risk-On Vault borrows BTC and ETH. Every 12 hours, the position is rebalanced to collect fees, balance PnL between AAVE and GLP collateral shorts, and adjust hedging according to the composition of GLP deposits.

Source: Rage Trade

The Risk-Off Vault is key in providing collateral to the Risk-On Vault, maintaining a healthy factor (1.5) for AAVE borrowing.

Source: Rage Trade

Below is a comparison between Risk-On Vault and Risk-Off Vault:

How has the market responded to Delta Neutral Vaults?

At launch, both vaults were immediately filled within minutes, indicating strong user demand for the vault products.

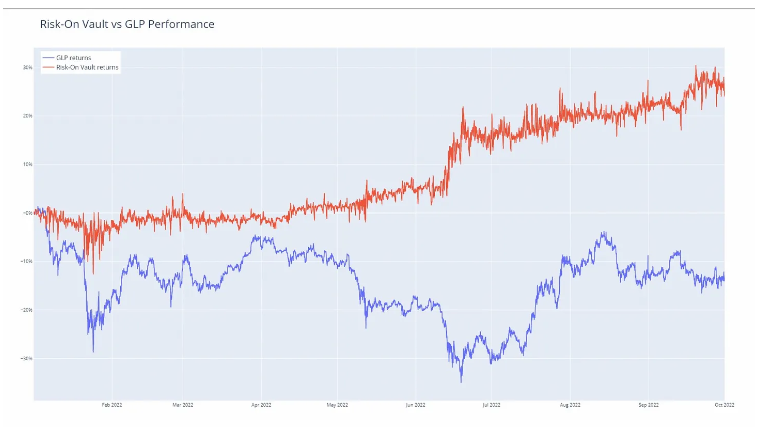

In terms of performance relative to GLP, Risk-On Vault has delivered a profit return of approximately 25%, compared to GLP’s -13%, clearly outperforming GLP.

Source: Ape/rture

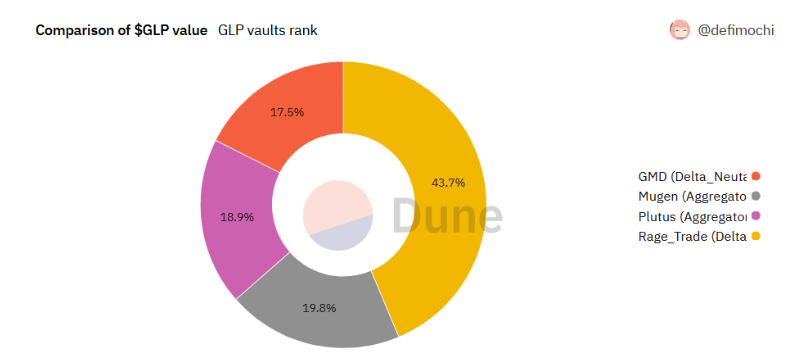

Currently, compared to other protocols built atop GLP, Rage Trade dominates in terms of GLP value, holding approximately $6.5 million worth of GLP.

Source: Dune

Why We Believe Rage Trade Will Perform Exceptionally

Potential of the Arbitrum Ecosystem

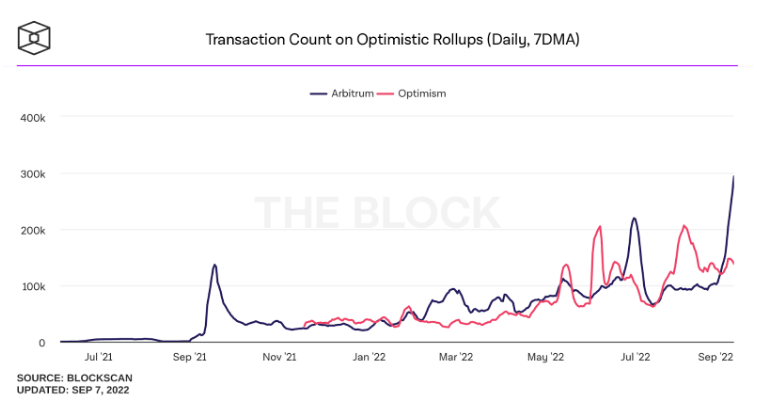

With Arbitrum’s successful rollout of its Nitro upgrade and the ongoing Arbitrum Odyssey, projects within the Arbitrum ecosystem have drawn significant attention.

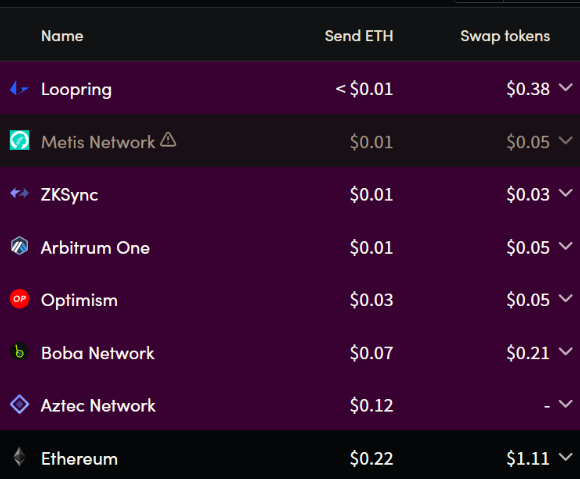

The Arbitrum ecosystem is thriving, setting new records in daily trading volume. Moreover, Arbitrum boasts among the lowest fees on L2s while inheriting Ethereum’s security, making it an ideal environment for protocol development.

Source: The Block

Source: L2fees

Unified Cross-Chain Liquidity

We firmly believe the future lies in a multi-chain landscape, which is why we invested in LayerZero and now in Rage Trade.

Most liquidity is scattered across different chains, isolated and fragmented. This is precisely where LayerZero helps protocols like Rage Trade aggregate liquidity.

Rage Trade can leverage not only Arbitrum-based protocol liquidity but also liquidity from Ethereum (Compound, Sushi, etc.), Avalanche (Trader Joe, Benqi, etc.), BNB Chain (PancakeSwap, etc.), Polygon (Quickswap, Aave, etc.), and many others.

Innovation in Recycled Liquidity

Rage Trade innovatively incentivizes liquidity in a sustainable way. Drawing from the success of protocols like GMX and Tri-Crypto, users can deposit their LP tokens to provide liquidity to Rage Trade.

Most notably, this encourages users to deposit their yield-generating LP tokens for additional returns without excessive token emissions.

Secondly, this demonstrates DeFi’s composability advantage over traditional finance—these LP tokens are reused, with liquidity provision being just one example.

Optimal Arbitrage Platform

Most GMX traders are arbitrageurs seeking to profit from price differences between GMX and CEXs. Similarly, Rage attracts arbitrageurs whenever prices deviate from oracle prices.

However, compared to GMX—which uses GLP pools and oracles—Rage, which employs vAMM pricing, may be more attractive to arbitrageurs because the vAMM model does not tie prices directly to asset values via oracles.

vAMMs represent independent markets, allowing arbitrageurs to hedge their positions on CEXs and profit from price discrepancies.

Significant Growth Opportunity

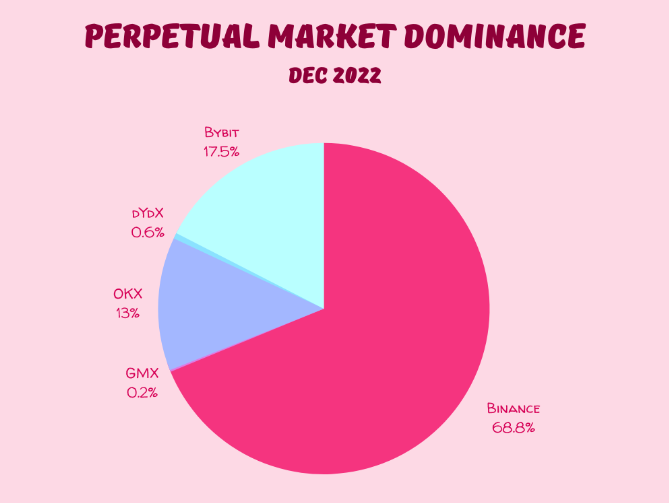

Compared to traditional centralized exchanges, the decentralized perpetual futures sector is still in its early stages. Data from The Block, TokenTerminal, and Dune Analytics show that as of December 2022, the perpetual futures market size was $389 billion. Decentralized perpetual futures account for only about $2.5 billion—just 0.8%. This indicates substantial growth potential for decentralized perpetual futures relative to centralized spot exchanges.

Source: The Block, TokenTerminal, Dune Analytics

Looking Ahead

The rapid uptake of the initial CRV vault demonstrated strong demand for LP token recycling. We look forward to seeing vaults utilizing protocols on Polygon, Avalanche, Solana, Aptos, Sui, and other chains in the future. Currently, Rage Trade only offers the ETH-USDC trading pair; we believe more trading pairs will be introduced soon, giving users greater choice.

Rage’s protocol code is open-source, allowing partners to integrate, compose, and build financial products on top of the most liquid ETH perp using their SDK. Other potential products could include Delta Neutral stablecoins and various structured products, delta-hedging your options positions, or using bots to earn fees and become system operators. Partners such as Abracadabra, UXD Protocol, and Sentiment offer leveraged yields to Delta Neutral Vault stakeholders; Sushiswap allows users to deploy idle LP into Rage to earn returns; Resonate provides fixed income from Delta Neutral Vaults; Sperax allocates 10% of its dollar-denominated collateral into the Risk-Off Vault.

The trust these partners place in using and building upon its products proves that Rage Trade is sufficiently secure. Since launch, Rage Trade has purchased insurance against smart contract vulnerabilities and ensured protocol stability through initial deposits.

Rage Trade features several key innovations, including recycled liquidity and 80-20 Vaults that enhance user trading experiences, and Delta Neutral Vaults that generate returns for stakers. Given the team’s emphasis on sustainability and security, we are confident in Rage Trade’s success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News